|

시장보고서

상품코드

1838152

항공기용 씰 시장 : 씰 유형별, 재료별, 항공기 유형별, 용도별, 최종 용도별 예측(-2030년)Aircraft Seals Market by Seal Type (Dynamic, Static) Material (Composites, Polymers, Metals), Aircraft Type (Commercial, Business & General Aviation, Military Aircraft, AAM, UAV), Application, End Use - Global Forecast to 2030 |

||||||

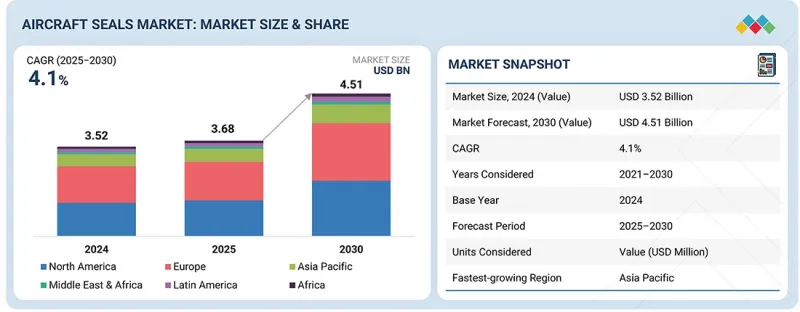

세계의 항공기 씰 시장 규모는 2025년 36억 8,000만 달러에서 2030년까지 45억 1,000만 달러에 이를 것으로 예측되며, CAGR 4.1%의 성장이 예상됩니다.

시장은 항공기 확대, MRO 사이클 성장, 차세대 플랫폼으로 첨단 씰링 솔루션에 대한 수요가 증가함에 따라 안정적으로 성장할 것으로 보입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 씰 유형, 재료, 용도, 항공기 유형, 최종 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

기내 소음의 저감, 연비 효율의 향상, 중요 시스템 전체의 안전성 확보에 대한 주목이 높아지는 가운데, 제조업체는 실리콘, FKM, PTFE 등의 고성능 재료에의 시프트를 진행하고 있습니다. 게다가 지속가능성에 대한 압력과 화학 규제의 강화로 내구성을 손상시키지 않고 컴플라이언스를 충족시키기 위한 엘라스토머의 조성 변경이 가속화되고 있습니다.

"용도별로는 엔진 시스템 부문이 2025년 최대 시장 점유율을 차지할 것으로 추정됩니다."

엔진 시스템은 주로 고온 및 고압 환경에서 안전성, 효율성, 신뢰성을 유지하는데 있어서 씰이 수행하는 중요한 역할에 의해 2030년에 걸쳐 항공기용 씰 시장을 선도할 것으로 추정됩니다. 최신 항공기 엔진은 전반적인 압력비와 터빈 입구 온도가 현저히 높은 상태에서 작동하므로 극단적인 열 사이클과 부식성이 강한 유체를 견딜 수 있는 첨단 밀봉 솔루션이 필요합니다. GE, Rolls-Royce, Pratt & Whitney 등의 엔진 OEM이 성능 향상과 연료 효율 목표를 추구하는 가운데, 첨단 엘라스토머, 메탈 씰, 스프링식 PTFE 컴포넌트의 채용이 가속화되고 있습니다.

엔진 부문은 애프터마켓에서 높은 교환률의 혜택을 누리고 있습니다. 연소기, 나셀, 블리드 에어 덕트 및 윤활 시스템의 씰은 항상 마모되어 유지 보수 사이클 중에 자주 점검하고 교체해야합니다. 이 때문에 특히 하루의 가동률이 높은 협폭동체 플릿에서는 정기적인 수요가 발생합니다. 전 세계적으로 연료 소비와 배출량 감소가 중시되고 있기 때문에 엔진 씰 누출을 최소화하는 중요성이 높아졌으며 씰 성능은 항공사의 운항 비용과 직접 연결됩니다.

"최종 응용 분야에서는 OEM 부문이 예측 기간에 가장 높은 성장률을 나타내는 것으로 추정됩니다."

항공기 씰 시장은 주요 민간 항공기 및 지역 항공기 프로그램의 실질적인 재고 제품으로 OEM 부문이 가장 높은 성장률을 보일 것으로 예측됩니다. Airbus, Boeing 및 신흥 지역 제트기 제조업체와 터보프롭 기계 제조업체는 모두 다년간의 주문 파이프라인을 갖추고 있으며 공장에 장착 된 씰 구성 요소의 안정적인 수요를 보장합니다. 새로운 항공기는 각각 나셀, 도어, 창문, 연료 탱크 및 비행 제어 시스템에 걸쳐 수천 개의 씰이 필요하기 때문에 OEM 납품이 주요 수익원이되었습니다.

주요 촉진요인은 조립 단계에서 경량화와 전자 설계의 통합이 진행되고 있다는 것입니다. 항공기 제조업체는 설치 단순화, 공차 유연성, 차세대 복합재료 및 금속 합금과의 호환성을 지원하는 씰을 선호합니다. 애프터마켓 대체품과는 달리, OEM 수요는 장기적인 설계 파트너십의 혜택을 누리며, 공급업체는 수십년동안 플랫폼 프로그램에 구속됩니다.

"아시아태평양이 예측 기간에 가장 빠르게 성장할 전망입니다."

아시아태평양이 2030년까지 항공기 씰 시장에서 가장 높은 성장률을 나타낼 것으로 예측되고 있습니다. 이는 신흥경제권에 있어서 항공기의 급속한 확대, 인프라 개발, 항공 수요 증가에 의해 지원되고 있습니다. 중국과 인도는 민간 항공기 인수 선진을 끊고 있으며, Airbus와 Boeing의 대량 주문은 호조로 여객 증가에 대응하는 것을 목표로 하고 있습니다. 인도네시아, 베트남, 필리핀을 포함한 동남아시아 국가들도 항공기 함대를 확대하여 내로우 바디 및 지역 항공기의 OEM 씰 수요를 추진하고 있습니다.

이 보고서는 세계 항공기 씰 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 항공기용 씰 시장의 기업에게 매력적인 기회

- 항공기용 씰 시장 : 다이나믹 씰별

- 항공기용 씰 시장 : 군용 항공기별

- 항공기용 씰 시장 : 복합재료별

- 항공기용 씰 시장 : 민간 항공기별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 원재료

- 연구개발

- 제조

- 유통

- 최종 사용자

- 애프터 서비스

- 에코시스템 매핑

- 제조업체

- 시스템 통합자

- MRO

- 고객사업에 영향을 주는 동향/혼란

- 무역 데이터

- 수입 시나리오(HS 코드 401693)

- 수출 시나리오(HS 코드 401693)

- 주요 컨퍼런스 및 이벤트(2025-2027년)

- 관세 및 규제 상황

- 관세 데이터

- 규제기관, 정부기관, 기타 조직

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 투자 및 자금조달 시나리오

- 가격 설정 분석

- 총소유비용

- 기술 로드맵

- 비즈니스 모델

- AI의 영향

- 소개

- 민간항공의 AI 채용 : 주요 국가별

- 항공기용 씰 시장에 대한 AI의 영향

- 거시경제 전망

- 북미

- 유럽

- 아시아태평양

- 중동

- 라틴아메리카

- 아프리카

제6장 항공기용 씰 시장 : 재료별

- 소개

- 복합재료

- 폴리머

- 금속

제7장 항공기용 씰 시장 : 유형별

- 소개

- 다이내믹 씰

- 스태틱 씰

- 기타

제8장 항공기용 씰 시장 : 항공기 유형별

- 소개

- 민간 항공기

- 비즈니스 및 일반 항공

- 군용 항공기

- 차세대 항공 교통

- 무인 항공기

제9장 항공기용 씰 시장 : 용도별

- 소개

- 엔진 시스템

- 항공기 구조

- 아비오닉스 및 전기 시스템

- 비행제어 및 유압 시스템

- 착륙장치 시스템

- 연료 시스템

- 기타

제10장 항공기용 씰 시장 : 최종 용도별

- 소개

- OEM

- 애프터마켓

제11장 항공기용 씰 시장 : 지역별

- 소개

- 북미

- PESTLE 분석

- 미국

- 캐나다

- 유럽

- PESTLE 분석

- 영국

- 프랑스

- 독일

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- PESTLE 분석

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 중동

- PESTLE 분석

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 카타르

- 라틴아메리카

- PESTLE 분석

- 브라질

- 멕시코

- 기타 라틴아메리카

- 아프리카

- PESTLE 분석

- 남아프리카

- 나이지리아

제12장 경쟁 구도

- 소개

- 시장 점유율 분석(2024년)

- 상장 기업의 수익 분석(2021-2024년)

- 브랜드/제품 비교

- 기업 평가 및 재무 지표

- 기업의 평가 매트릭스

- 스타트업/중소기업 평가 매트릭스

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- SKF

- PARKER HANNIFIN CORP

- TRELLEBORG SEALING SOLUTIONS

- EATON CORPORATION PLC

- SAINT-GOBAIN

- SEAL SCIENCE, INC.

- DP SEALS

- REXNORD CORPORATION

- GREENE TWEED

- WL GORE & ASSOCIATES, INC.

- PERFORMANCE SEALING INC.

- BROWN AIRCRAFT SUPPLY

- PRECISION POLYMER ENGINEERING LTD.

- STACEM

- NICHOLSONS SEALING TECHNOLOGIES LTD.

- ICON AEROSPACE TECHNOLOGY

- FREUDENBURG SEALING TECHNOLOGIES

- HUTCHINSON

- 기타 기업

- PPG AEROSPACE

- KIRKHILL, INC.

- DUPONT

- JACOTTET INDUSTRIE

- TECHNETICS GROUP

- NORTHWEST RUBBER EXTRUDERS, INC.

- STEIN SEAL COMPANY

- EMI SEALS & GASKETS

제14장 부록

JHS 25.10.22The aircraft seals market is expected to reach USD 4.51 billion by 2030, from USD 3.68 billion in 2025, at a CAGR of 4.1%. The aircraft seals market is set to grow steadily as fleet expansion, rising MRO cycles, and new-generation platforms drive higher demand for advanced sealing solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Seal Type, Material, Application, Aircraft Type, End Use and Region |

| Regions covered | North America, Europe, APAC, RoW |

With increased focus on reducing cabin noise, enhancing fuel efficiency, and ensuring safety across critical systems, manufacturers are shifting toward high-performance materials such as silicone, FKM, and PTFE. Additionally, sustainability pressures and stricter chemical regulations are accelerating the reformulation of elastomers to meet compliance without compromising durability.

"Based on application, the engine systems segment is estimated to account for the largest market share in 2025."

Engine systems are estimated to lead the aircraft seals market through 2030, primarily due to the critical role seals play in maintaining safety, efficiency, and reliability in high-temperature and high-pressure environments. Modern aircraft engines operate at significantly higher overall pressure ratios and turbine inlet temperatures, which demand advanced sealing solutions capable of withstanding extreme thermal cycles and aggressive fluids. As engine OEMs such as GE, Rolls-Royce, and Pratt & Whitney pursue performance gains and fuel efficiency targets, the adoption of advanced elastomers, metal seals, and spring-energized PTFE components is accelerating.

The engine segment benefits from higher replacement rates in the aftermarket. Seals within combustors, nacelles, bleed-air ducts, and lubrication systems are subject to constant wear and require frequent inspection and replacement during maintenance cycles. This drives recurring demand, particularly in narrowbody fleets with high daily utilization. The global emphasis on reducing fuel burn and emissions intensifies the importance of minimizing leakage in engine seals, linking sealing performance directly to airline operating costs.

"Based on end use, the OEM segment is estimated to grow at the highest rate during the forecast period."

The OEM segment is projected to grow at the highest rate in the aircraft seals market, driven by substantial production backlogs across major commercial and regional aircraft programs. Airbus, Boeing, and emerging regional jet and turboprop manufacturers collectively hold multi-year order pipelines, ensuring consistent demand for factory-installed sealing components. Each new aircraft requires thousands of seals across nacelles, doors, windows, fuel tanks, and flight control systems, making OEM deliveries a primary revenue generator.

A key growth driver is the increasing integration of lightweight and more-electric designs at the assembly stage. Aircraft manufacturers are prioritizing seals that support simplified installation, tolerance flexibility, and compatibility with next-generation composites and metallic alloys. Unlike aftermarket replacements, OEM demand benefits from long-term design partnerships, where suppliers are locked into platform programs for decades.

"The Asia Pacific region is estimated to grow at the highest rate during the forecast period."

Asia-Pacific is projected to register the highest growth rate in the aircraft seals market through 2030, supported by rapid fleet expansion, infrastructure development, and rising air travel demand across emerging economies. China and India are spearheading commercial aircraft acquisitions, with large orders from Airbus and Boeing aimed at meeting strong passenger growth. Southeast Asian nations, including Indonesia, Vietnam, and the Philippines, are also expanding fleets, driving OEM seal demand for narrowbody and regional jets.

On the defense side, governments in Asia Pacific invest heavily in indigenous aircraft programs and modernization efforts. India's Tejas, South Korea's KF-21, and Japan's next-generation fighter programs all integrate advanced sealing technologies in engines, avionics, and airframes, creating opportunities for both local and global seal suppliers. The region also exhibits strong aftermarket potential. Harsh climatic conditions-ranging from tropical humidity to desert heat-accelerate wear in door, window, and nacelle seals, boosting replacement cycles. Rapid MRO expansion in Singapore, Malaysia, and China supports localized seal manufacturing and supply-chain presence.

Combined with government policies encouraging domestic aerospace production, APAC's scale of fleet growth and operational intensity will fuel the highest CAGR for aircraft seals, positioning the region as the fastest-growing market globally.

The breakdown of the profile of primary participants in the aircraft seals market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East - 10%, Rest of the World (RoW) - 5%

Research Coverage

This market study covers the aircraft seals market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on the region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall aircraft seals market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The aircraft seals market experiences growth and evolution driven by various factors. The report provides insights into the following pointers:

- Market drivers (fleet modernization & expansion. stringent safety & efficiency standards, growth in MRO activities), restraints (high material & certification costs, long qualification & replacement cycles, supply chain volatility), opportunities (next-generation aircraft programs, sustainability focus, regional demand growth), challenges (extreme operating conditions, intense competition, customization needs) several factors could contribute to an increase in the Aircraft Seals Market.

- Market Penetration: Comprehensive information on aircraft seals offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the aircraft seals market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the aircraft seals market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the aircraft seals market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the aircraft seals market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 AIRCRAFT SEALS MARKET SEGMENTATION & REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interview details

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Increase in global aircraft fleet size to boost demand for seals from OEMs and aftermarket

- 2.2.2.2 Frequent replacement of aircraft seals

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.2.3.1 Technological advancements and material innovations in seal manufacturing

- 2.3 MARKET SIZE ESTIMATION AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Aircraft seals market for OEMs

- 2.3.1.2 Aircraft seals aftermarket

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.4.1 DATA TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT SEALS MARKET

- 4.2 AIRCRAFT SEALS MARKET, BY DYNAMIC SEALS

- 4.3 AIRCRAFT SEALS MARKET, BY MILITARY AIRCRAFT

- 4.4 AIRCRAFT SEALS MARKET, BY COMPOSITES

- 4.5 AIRCRAFT SEALS MARKET, BY COMMERCIAL AIRCRAFT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Fleet modernization and expansion

- 5.2.1.2 Growth in aircraft MRO

- 5.2.1.3 Material advancements

- 5.2.2 RESTRAINTS

- 5.2.2.1 High material and certification costs

- 5.2.2.2 Long qualification and replacement cycles

- 5.2.2.3 Volatile supply chain

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Next-generation aircraft programs

- 5.2.3.2 Focus on sustainability

- 5.2.3.3 Regional demand growth

- 5.2.4 CHALLENGES

- 5.2.4.1 Extreme operating conditions

- 5.2.4.2 Intense competition

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIALS

- 5.3.2 R&D

- 5.3.3 MANUFACTURING

- 5.3.4 DISTRIBUTION

- 5.3.5 END USERS

- 5.3.6 AFTER-SALES SERVICES

- 5.4 ECOSYSTEM MAPPING

- 5.4.1 MANUFACTURERS

- 5.4.2 SYSTEM INTEGRATORS

- 5.4.3 MRO

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TRADE DATA

- 5.6.1 IMPORT SCENARIO (HS CODE 401693)

- 5.6.2 EXPORT SCENARIO (HS CODE 401693)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.8 TARIFF & REGULATORY LANDSCAPE

- 5.8.1 TARIFF DATA

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ROLLS-ROYCE TRENT XWB ENGINE SEALS FOR WIDE-BODY AIRCRAFT

- 5.10.2 COMPOSITE AIRFRAME SEALING FOR BOEING 787 DREAMLINER

- 5.10.3 MAINTENANCE-FRIENDLY SEALS FOR EMBRAER E2 JETS

- 5.10.4 HYDRAULIC & FUEL SYSTEM SEALS FOR LOCKHEED MARTIN F-35 LIGHTNING II

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 High temperature- and pressure-resistant seal architectures

- 5.11.1.2 Dynamic sealing solutions

- 5.11.1.3 Advanced manufacturing methods

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Coating and surface engineering

- 5.11.2.2 MRO process automation

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Electric & hybrid propulsion systems

- 5.11.3.2 Lightweight aircraft structures

- 5.11.1 KEY TECHNOLOGIES

- 5.12 PATENT ANALYSIS

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 PRICING ANALYSIS

- 5.15 TOTAL COST OF OWNERSHIP

- 5.16 TECHNOLOGY ROADMAP

- 5.17 BUSINESS MODELS

- 5.18 IMPACT OF AI

- 5.18.1 INTRODUCTION

- 5.18.2 ADOPTION OF AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- 5.18.3 IMPACT OF AI ON AIRCRAFT SEALS MARKET

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 NORTH AMERICA

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.19.4 MIDDLE EAST

- 5.19.5 LATIN AMERICA

- 5.19.6 AFRICA

6 AIRCRAFT SEALS MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- 6.2 COMPOSITES

- 6.2.1 THERMAL ADAPTABILITY AND RESISTANCE TO DEFORMATION TO DRIVE DEMAND

- 6.2.2 CARBON FIBER COMPOSITES

- 6.2.3 GLASS FIBER COMPOSITES

- 6.3 POLYMERS

- 6.3.1 WIDE VERSATILITY AND ADAPTABILITY TO DRIVE DEMAND

- 6.3.2 FLUOROELASTOMER (FKM)

- 6.3.3 PERFLUOROELASTOMER (FFKM)

- 6.3.4 POLYTETRAFLUOROETHYLENE (PTFE)

- 6.3.5 ETHYLENE PROPYLENE DIENE MONOMER (EPDM)

- 6.3.6 POLYURETHANE

- 6.4 METALS

- 6.4.1 HIGH DURABILITY AND STRUCTURAL INTEGRITY TO DRIVE DEMAND

- 6.4.2 STAINLESS STEEL & ALLOYS

- 6.4.3 NICKEL & ALLOYS

- 6.4.4 OTHERS

7 AIRCRAFT SEALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DYNAMIC SEALS

- 7.2.1 REDUCED FRICTION AND EXTENDED LIFE TO DRIVE DEMAND

- 7.2.2 CONTACT SEALS

- 7.2.3 CLEARANCE SEALS

- 7.3 STATIC SEALS

- 7.3.1 INCREASING DEMAND FOR LIGHTWEIGHT MATERIALS AND FLEET MAINTENANCE TO DRIVE GROWTH

- 7.3.2 O-RINGS & GASKETS

- 7.3.3 OTHER STATIC SEALS

- 7.4 OTHERS

- 7.4.1 MECHANICAL SEALS

- 7.4.2 THERMAL/FIRE SEALS

- 7.4.3 ELECTRICAL SEALS

- 7.4.4 ENVIRONMENTAL & STRUCTURAL SEALS

8 AIRCRAFT SEALS MARKET, BY AIRCRAFT TYPE

- 8.1 INTRODUCTION

- 8.2 COMMERCIAL AIRCRAFT

- 8.2.1 INCREASING DEMAND IN NARROW-BODY AIRCRAFT TO DRIVE MARKET

- 8.2.2 NARROW-BODY AIRCRAFT

- 8.2.3 WIDE-BODY AIRCRAFT

- 8.2.4 REGIONAL TRANSPORT AIRCRAFT

- 8.3 BUSINESS & GENERAL AVIATION

- 8.3.1 GROWING FOCUS ON PASSENGER COMFORT AND UTILITY SOLUTIONS TO DRIVE MARKET

- 8.3.2 BUSINESS JETS

- 8.3.3 LIGHT AIRCRAFT

- 8.3.4 ELECTRIC AIRCRAFT

- 8.3.5 COMMERCIAL HELICOPTERS

- 8.4 MILITARY AIRCRAFT

- 8.4.1 HIGH OEM AND AFTERMARKET DEMAND TO DRIVE GROWTH

- 8.4.2 FIGHTER JETS

- 8.4.3 SPECIAL MISSION AIRCRAFT

- 8.4.4 TRANSPORT AIRCRAFT

- 8.4.5 MILITARY HELICOPTERS

- 8.5 ADVANCED AIR MOBILITY

- 8.5.1 FUTURE APPLICATIONS AND INNOVATIONS IN SEALS TECHNOLOGY TO DRIVE MARKET

- 8.5.2 EVTOL AIRCRAFT

- 8.5.3 HYBRID ELECTRIC AIRCRAFT

- 8.6 UNMANNED AERIAL VEHICLES

- 8.6.1 RISING ADOPTION IN DEFENSE APPLICATIONS TO DRIVE MARKET

9 AIRCRAFT SEALS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ENGINE SYSTEMS

- 9.2.1 FLEET MODERNIZATION PROGRAM AND MRO TO DRIVE MARKET

- 9.3 AEROSTRUCTURES

- 9.3.1 APPLICATIONS IN STRUCTURAL INTEGRITY AND CABIN PRESSURIZATION TO DRIVE MARKET

- 9.4 AVIONICS & ELECTRICAL SYSTEMS

- 9.4.1 RISING PASSENGER TRAFFIC TO DRIVE MARKET

- 9.5 FLIGHT CONTROL & HYDRAULIC SYSTEMS

- 9.5.1 INCREASING DEMAND IN HIGH-PRESSURE APPLICATIONS TO DRIVE MARKET

- 9.6 LANDING GEAR SYSTEMS

- 9.6.1 SHOCK ABSORBANCE AND REDUCED STRESS CAPABILITIES TO DRIVE DEMAND

- 9.7 FUEL SYSTEMS

- 9.7.1 INCREASE IN GLOBAL JET FUEL CONSUMPTION TO DRIVE DEMAND

- 9.8 OTHERS

10 AIRCRAFT SEALS MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 OEM

- 10.2.1 RISING AIRCRAFT PRODUCTION AND DELIVERIES TO DRIVE MARKET

- 10.3 AFTERMARKET

- 10.3.1 RISING REGULATORY MANDATES FOR REPLACEMENT AND MRO TO DRIVE MARKET

11 AIRCRAFT SEALS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Presence of major aircraft OEMs to govern market growth

- 11.2.3 CANADA

- 11.2.3.1 Domestic defense upgrades and civil aviation to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Defense modernization program to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Commitment to aviation decarbonization to drive market

- 11.3.4 GERMANY

- 11.3.4.1 Presence of major independent MRO providers to drive market

- 11.3.5 ITALY

- 11.3.5.1 Ongoing fleet modernization to drive market

- 11.3.6 SPAIN

- 11.3.6.1 Rising OEM partnerships and defense programs to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Large-scale domestic manufacturing to boost market

- 11.4.3 INDIA

- 11.4.3.1 Increased investment in MRO to propel market

- 11.4.4 JAPAN

- 11.4.4.1 Shift toward carbon-neutral aviation to support market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increasing demand from airlines to boost market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Heavy investment in aviation infrastructure to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 UAE

- 11.5.2.1 Rising traffic levels to drive market

- 11.5.3 SAUDI ARABIA

- 11.5.3.1 Large-scale aviation infrastructure projects to drive market

- 11.5.4 TURKEY

- 11.5.4.1 Expansion of aerospace industrial base to drive market

- 11.5.5 QATAR

- 11.5.5.1 Push toward aerospace industrialization to drive market

- 11.6 LATIN AMERICA

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 BRAZIL

- 11.6.2.1 Presence of major aircraft OEMs to drive market

- 11.6.3 MEXICO

- 11.6.3.1 Presence of strong manufacturing hub to fuel market

- 11.6.4 REST OF LATIN AMERICA

- 11.7 AFRICA

- 11.7.1 PESTLE ANALYSIS

- 11.7.2 SOUTH AFRICA

- 11.7.2.1 Recovery of aviation industry to be beneficial for market growth

- 11.7.3 NIGERIA

- 11.7.3.1 Expansion of aviation industry to influence market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS, 2024

- 12.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021-2024

- 12.4 BRAND/PRODUCT COMPARISON

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 COMPANY EVALUATION MATRIX

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Material footprint

- 12.6.5.4 Aircraft type footprint

- 12.7 STARTUP/SME EVALUATION MATRIX

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.7.5.1 List of startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 DEALS

- 12.8.2 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SKF

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 PARKER HANNIFIN CORP

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 TRELLEBORG SEALING SOLUTIONS

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 EATON CORPORATION PLC

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SAINT-GOBAIN

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SEAL SCIENCE, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 DP SEALS

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 REXNORD CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 GREENE TWEED

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 W. L. GORE & ASSOCIATES, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 PERFORMANCE SEALING INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 BROWN AIRCRAFT SUPPLY

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 PRECISION POLYMER ENGINEERING LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 STACEM

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 NICHOLSONS SEALING TECHNOLOGIES LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.16 ICON AEROSPACE TECHNOLOGY

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.17 FREUDENBURG SEALING TECHNOLOGIES

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.18 HUTCHINSON

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.1 SKF

- 13.2 OTHER PLAYERS

- 13.2.1 PPG AEROSPACE

- 13.2.2 KIRKHILL, INC.

- 13.2.3 DUPONT

- 13.2.4 JACOTTET INDUSTRIE

- 13.2.5 TECHNETICS GROUP

- 13.2.6 NORTHWEST RUBBER EXTRUDERS, INC.

- 13.2.7 STEIN SEAL COMPANY

- 13.2.8 EMI SEALS & GASKETS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS