|

시장보고서

상품코드

1854901

환자 경험 기술 시장 : 제공 제품별, 기능별, 최종사용자별, 지역별 - 예측(-2030년)Patient Experience Technology Market by Offering, Function (Appointment (Online Booking), Registration (Intake), Virtual Care (Telehealth, RPM), Communication, Feedback), End User (Providers, Payers, Pharma & Biotech), Region - Global Forecast to 2030 |

||||||

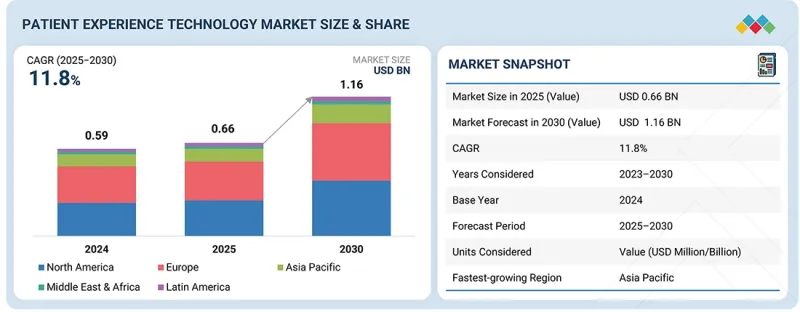

환자 경험 기술 시장 규모는 11.8%의 연평균 복합 성장률(CAGR)로 확대되어 2025년 6억 6,000만 달러에서 2030년에는 11억 6,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제공 제품별, 기능별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이러한 성장은 편의성과 개인화(예약 예약, 디지털 체크인, 원격 진료)에 대한 기대치 증가, 환자 접근성/상호운용성에 대한 규제 강화, 관리 업무 자동화, 환자 피드백 및 진료 데이터에서 실행 가능한 인사이트를 도출하는 AI, 앰비언트 분석, 대화형 인터페이스의 급속한 채택에 기인합니다. 주변 환경 분석, 대화형 인터페이스의 급속한 채택으로 인해 발생합니다.

벤더들은 환자 경험 플랫폼 전체에 AI를 통합하는 추세가 강화되고 있습니다. 예를 들어, 2023년 12월 Qualtrics는 Epic과의 제휴를 발표하고 환자 경험 데이터를 Epic의 종합 의료 기록(CHR) 시스템에 직접 통합한다고 발표했습니다. 이번 제휴는 Qualtrics의 AI와 자연어 처리를 활용하여 임상 데이터와 경험 데이터를 통합하여 의료진이 보다 개인화된 공감적 진료를 제공할 수 있도록 지원합니다. 이 통합을 통해 일선 직원들은 스케줄 관리에 대한 불만 등 환자의 감정을 실시간으로 감지하고 행동할 수 있게 되어 대응력과 치료 성과를 높일 수 있습니다.

이러한 개발은 임상 데이터와 경험 데이터를 결합하여 보다 신속하고 결과 중심의 환자 치료를 촉진할 수 있다는 것을 보여줍니다.

환자경험기술 시장은 제공 형태에 따라 소프트웨어/플랫폼과 서비스로 구분됩니다. 소프트웨어 부문은 On-Premise, 클라우드 기반, 하이브리드로 나뉩니다. 클라우드 기반 플랫폼은 확장성, 낮은 초기 비용, 빠른 업데이트 배포로 인해 예측 기간 동안 큰 시장 성장이 예상됩니다. 의료 서비스 제공업체들은 디지털 체크인, 원격 의료 분류, 환자 포털, AI 기반 개인화 등 클라우드 솔루션을 점점 더 선호하고 있습니다. Press Ganey, Qualtrics, Epic과 같은 벤더들은 클라우드 네이티브 분석, 대화형 AI, 앰비언트 리스닝 툴을 통합하여 유연성과 치료 접근성을 향상시키고 있습니다. 2025년 2월, Press Ganey는 마이크로소프트와 제휴하여 Press Ganey의 76억 건 이상의 환자 방문 데이터 세트와 마이크로소프트의 AI, 클라우드, 주변 청취 도구를 결합한 생성형 AI 기반 솔루션을 개발했습니다. 이번 협력을 통해 환자 안전을 위한 예측 분석, 의료 서비스 제공업체를 위한 실시간 실행 가능한 통찰력, Azure를 통한 안전한 데이터 공유, 클라우드 기반 PX 플랫폼이 개인화, 효율성, 환자 경험 개선을 촉진하고 있음을 입증했습니다. 입증되었습니다.

따라서 이러한 전략적 제휴는 헬스케어 환경 전반에 걸쳐 개인화되고, 효율적이며, 데이터 기반 치료를 제공하는 데 있어 클라우드 기반 AI 기반 환자 경험 플랫폼의 역할이 점점 더 중요해지고 있다는 것을 보여줍니다.

최종 사용자별로는 헬스케어 지불자 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 의료비 지불자는 회원 참여도 향상, 청구 및 관리 프로세스 간소화, 의료 플랜 서비스 전반의 만족도 향상을 위해 환자 경험(PX) 플랫폼에 대한 투자를 늘리고 있습니다. 가치 기반 치료와 결과 중심의 보상 모델에 대한 관심이 높아지면서 지불자는 AI, 분석, 환자 피드백 도구를 활용하여 서비스 품질을 모니터링하고, 회원의 요구를 예측하고, 예방 가능한 치료의 격차를 줄이고 있습니다.

회원 포털, 원격 심사, 자동화된 커뮤니케이션 도구와 같은 디지털 채널은 개인화된 실시간 지원을 제공하고, 예방 치료 순응도를 높이고, 환자 충성도를 강화하기 위해 채택되고 있습니다. 또한, 미국의 Cures Act, 유럽의 EHDS와 같은 상호운용성 및 환자 접근성 관련 규제 의무화로 인해 지불자의 환자 경험 기술 채택이 가속화되고 있습니다. 그 결과, 환자 경험과 결과를 중시하는 전략적 태도를 반영하여 지불자가 시장의 주요 성장 동력으로 부상하고 있습니다.

예측 기간 동안 유럽은 세계 환자 경험 기술 시장에서 큰 점유율을 차지할 것으로 예측됩니다. 이는 디지털 의료 기술의 확산, 환자 중심 진료에 대한 수요 증가, 데이터 프라이버시와 상호운용성을 우선시하는 강력한 규제 환경의 배경에 기인합니다. 큰 흐름은 개별화된 의료 서비스로의 전환으로, 환자 개개인의 필요에 따라 개입을 조정하고 순응도, 만족도, 임상 결과를 개선하기 위해 설계된 플랫폼과 도구가 활용되고 있습니다. 정부, 의료 당국, 민관 파트너십은 의료 생태계 전반에서 환자 참여를 촉진하는 데 있어 매우 중요한 역할을 하고 있습니다. 예를 들어, 2022년 3월, 24억 6,000만 달러의 예산을 가진 생명과학 분야의 주요 민관 협력 조직인 유럽 건강 이니셔티브(European Health Initiative)는 모든 연구 단계에 환자를 적극적으로 통합하고 실제 환자의 우선순위를 반영하는 헬스케어 솔루션에 실제 환자의 우선순위가 반영될 수 있도록 하는 과학 및 혁신 패널을 설립했습니다.

또한, 유럽연합(EU)의 'e-헬스 및 디지털의 10년' 이니셔티브는 전자건강기록(EHR), 환자 포털, 상호운용 가능한 의료시스템의 보급을 촉진하고 환자 참여형 기술을 위한 비옥한 환경을 조성하고 있습니다. 예를 들어, 2024년 7월 유럽연합 집행위원회는 '디지털의 10년 2024' 연구를 발표하며 2030년까지 EU 시민이 전자건강기록(EHR)에 보편적으로 접근할 수 있도록 하기 위한 진전을 강조했습니다. 보고서는 EU27의 e-헬스 성숙도 평균 종합 점수가 2023년 72%에서 79%로 상승했으며, 22개 회원국의 성과가 향상되었다고 지적했습니다.

모바일 건강 앱, 원격 건강 플랫폼, AI 기반 가상 비서, 원격 모니터링 기기 등 디지털 도구가 임상 워크플로우에 통합되어 커뮤니케이션을 개선하고, 치료 순응도를 모니터링하며, 예방적 의료를 지원하는 등 다양한 디지털 도구가 임상 워크플로우에 통합되고 있습니다. 통합되고 있습니다. Doctrin(스웨덴), Infermedica(폴란드), Cegedim(프랑스)과 같은 유럽의 주목할 만한 공급업체들은 병원, 진료소, 지불자가 환자 경험과 업무 효율성을 향상시킬 수 있도록 환자 참여 제공을 적극적으로 확장하고 있습니다. 클라우드 기반의 AI 기반 솔루션을 제공합니다.

이러한 추세를 종합하면, 유럽은 지속적인 정부 투자, 규제적 인센티브, 의료 서비스 제공에 있어 환자 권한 부여에 대한 우선순위가 높아짐에 따라 환자 참여 기술 도입의 주요 지역으로 남아있음을 알 수 있습니다.

세계의 환자 경험 기술(Patient Experience Technology) 시장에 대해 조사했으며, 제품별, 기능별, 최종사용자별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 2025년-2027년 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 최종사용자 분석

- 비즈니스 모델

- AI/생성형 AI가 환자 경험 기술 시장에 미치는 영향

- 2025년 미국 관세가 환자 경험 기술 시장에 미치는 영향

제6장 환자 경험 기술 시장, 제공 제품별

- 서론

- 소프트웨어

- 서비스

제7장 환자 경험 기술 시장, 기능별

- 서론

- 예약 스케줄

- 환자 등록

- 버추얼 케어

- 환자와의 커뮤니케이션

- 청구

- 피드백 관리

- 기타

제8장 환자 경험 기술 시장, 최종사용자별

- 서론

- 의료 제공자

- 의료비 지불자

- 제약 기업 및 바이오기술 기업

- 기타

제9장 환자 경험 기술 시장, 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 남아프리카공화국

- 기타

제10장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/소프트웨어 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제11장 기업 개요

- 주요 시장 진출기업

- PRESS GANEY

- NATIONAL RESEARCH CORPORATION

- MEDALLIA INC.

- PHREESIA

- NICE

- R1

- EPIC SYSTEMS CORPORATION

- IQVIA

- QUALTRICS

- RELIAS LLC

- GETWELLNETWORK, INC.

- CIPHERHEALTH INC.

- KYRUUS, INC.

- RELATIENT

- ALIDA

- TWILIO INC.

- AVAAMO

- CERTIFY HEALTH

- LUMA HEALTH INC.

- SOLUTIONREACH

- SALESFORCE, INC.

- 기타 기업

- VITAL

- NEXHEALTH

- COLLECTLY, INC.

- BUSINESS INTEGRITY SERVICES

- BAMBOO HEALTH

제12장 부록

LSH 25.11.07The patient experience technology market is projected to reach USD 1.16 billion by 2030 from USD 0.66 billion in 2025, at a CAGR of 11.8%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Offerings, Functions, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

This growth is driven by increasing expectations for convenience and personalization (appointment scheduling, digital check-in, teletriage), regulatory pushes for patient access/interoperability, and rapid adoption of AI, ambient analytics, and conversational interfaces that automate administrative tasks and surface actionable insights from patient feedback and encounter data.

Vendors are increasingly integrating AI across patient experience platforms. For instance, in December 2023, Qualtrics announced a collaboration with Epic to integrate patient experience data directly into Epic's comprehensive health record (CHR) system. The partnership leverages Qualtrics' AI and natural language processing to fuse clinical and experiential data, enabling providers to deliver more personalized, empathetic care. The integration allows frontline staff to detect and act on patient sentiment, such as frustrations with scheduling, in real time, enhancing responsiveness and care outcomes.

Thus, such developments demonstrate that combining clinical and experiential data can drive more responsive and outcomes-focused patient care.

The cloud-based segment is expected to witness significant market share during the forecast period.

Based on the offering, the patient experience technology market is segmented into software/platform and services. The software segment is divided into on-premise, cloud-based, and hybrid. The cloud-based platform is expected to witness significant market growth during the forecast period due to its scalability, lower upfront costs, and ability to rapidly deploy updates. Healthcare providers increasingly favor cloud solutions for digital check-ins, telehealth triage, patient portals, and AI-driven personalization. Vendors such as Press Ganey, Qualtrics, and Epic are embedding cloud-native analytics, conversational AI, and ambient listening tools that improve flexibility and care access. In February 2025, Press Ganey partnered with Microsoft to develop generative AI-powered solutions that combine Press Ganey's dataset of over 7.6 billion patient encounters with Microsoft's AI, cloud, and ambient listening tools. This collaboration enables predictive analytics for patient safety, real-time actionable insights for providers, and secure data sharing via Azure, demonstrating that cloud-based PX platforms are driving personalization, efficiency, and improved patient experience.

Hence, such strategic collaborations underscore the growing role of cloud-based, AI-enabled patient experience platforms in delivering personalized, efficient, and data-driven care across healthcare settings.

The healthcare payers segment is expected to grow at a considerable CAGR during the forecast period.

By end user, the healthcare payers segment is expected to register the highest CAGR during the forecast period. Payers are increasingly investing in patient experience (PX) platforms to improve member engagement, streamline claims and administrative processes, and enhance overall satisfaction with health plan services. The growing emphasis on value-based care and outcomes-driven reimbursement models is prompting payers to leverage AI, analytics, and patient feedback tools to monitor service quality, predict member needs, and reduce preventable gaps in care.

Digital channels, such as member portals, teletriage, and automated communication tools, are being adopted to provide personalized, real-time support, improve adherence to preventive care, and strengthen patient loyalty. Additionally, regulatory mandates for interoperability and patient access, such as the US Cures Act and Europe's EHDS, are accelerating payer adoption of patient experience technologies. As a result, payers are emerging as a key growth driver in the market, reflecting their strategic focus on member experience and outcomes.

Europe is expected to lead the patient experience technology market in 2025.

During the forecast period, Europe is projected to hold a substantial share of the global patient experience technology market, driven by the widespread adoption of digital health technologies, rising demand for patient-centered care, and a robust regulatory environment that prioritizes data privacy and interoperability. A major trend is the shift toward personalized healthcare, with platforms and tools designed to tailor interventions to individual patient needs, enhancing adherence, satisfaction, and clinical outcomes. Governments, healthcare authorities, and public-private partnerships are playing a pivotal role in promoting patient involvement across the healthcare ecosystem. For instance, in March 2022, the European Health Initiative, a flagship public-private collaboration in life sciences with a USD 2.46 billion budget, established a Science & Innovation Panel that actively integrates patients in every stage of research, ensuring that healthcare solutions reflect real-world patient priorities.

In addition, the European Union's eHealth and Digital Decade initiatives are driving widespread adoption of electronic health records (EHRs), patient portals, and interoperable health systems, creating a fertile environment for patient engagement technologies. For instance, in July 2024, the European Commission released the Digital Decade 2024 study, highlighting progress toward universal access to electronic health records (EHRs) for EU citizens by 2030. The report noted that the EU27-average composite score for eHealth maturity increased from 72% to 79% in 2023, with 22 member states improving their performance.

Digital tools such as mobile health apps, telehealth platforms, AI-driven virtual assistants, and remote monitoring devices are increasingly being integrated into clinical workflows to improve communication, monitor treatment adherence, and support preventive care. Notable European vendors such as Doctrin (Sweden), Infermedica (Poland), and Cegedim (France) are actively expanding their patient engagement offerings, providing cloud-based, AI-enabled solutions that enable hospitals, clinics, and payers to enhance patient experience and operational efficiency.

These trends collectively signal that Europe will continue to be a leading region for patient engagement technology adoption, supported by ongoing government investments, regulatory incentives, and the increasing prioritization of patient empowerment in healthcare delivery.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C Level: 42%, Director Level: 31%, and Others: 27%

- By Region - North America: 35%, Europe: 30%, Asia Pacific: 25%, Middle East & Africa: 5%, Latin America: 5%

Key Players

The key players functioning in the patient experience technology market include Press Ganey (US), National Research Corporation (NRC Health) (US), Medallia Inc. (US), Phreesia (US), NiCE (Israel), R1 (US), Epic Systems Corporation (US), IQVIA (US), Qualtrics (US), Relias LLC (US), GetWellNetwork (US), CipherHealth Inc. (US), Kyruus, Inc. (US), Twilio Inc. (US), Relatient (US), Alida (Canada), Certify Health (US), Avaamo (US), Luma Health Inc. (US), Solutionreach (US), and Salesforce, Inc. (US).

Research Coverage

The report analyzes the patient experience technology market. It aims to estimate the market size and future growth potential of various market segments based on component, use case, revenue model, end user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms and new entrants/smaller firms to gauge the market's pulse, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers: Drivers (rising demand for digital engagement platforms and personalized patient care, increasing adoption of telehealth, mobile health apps, and AI-powered analytics, government initiatives and funding for healthcare digital transformation, growing focus on improving patient satisfaction and long-term engagement, and expansion of cloud-based engagement platforms), Restraints (data privacy and cybersecurity concerns, high implementation and integration costs for healthcare providers, limited interoperability between patient engagement systems and existing EHRs), Opportunities (growth opportunities in emerging markets, adoption of AI-driven personalization and predictive analytics for patient care, strategic partnerships among technology platforms, pharma companies, and payers, and rising adoption of virtual reality and augmented reality) and Challenges (need to ensure accuracy and reliability of feedback data, rapid technological evolution) influencing the growth of the patient experience technology market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the patient experience technology market.

- Market Development: Comprehensive information on the lucrative emerging markets, by offerings, functions, end user, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the patient experience technology market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the patient experience technology market such as Press Ganey (US), National Research Corporation (NRC Health) (US), Medallia Inc. (US), Phreesia (US), NiCE (Israel), R1 (US), Epic Systems Corporation (US), IQVIA (US), Qualtrics (US), Relias LLC (US), GetWellNetwork (US), CipherHealth Inc. (US), Kyruus, Inc. (US), Twilio Inc. (US), Relatient (US), Alida (Canada), Certify Health (US), Avaamo (US), Luma Health Inc. (US), Solutionreach (US), Salesforce, Inc. (US), Vital (US), NexHealth (US), Collectly, Inc. (US), Business Integrity Services (US), and Bamboo Health (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary sources

- 2.1.1 SECONDARY DATA

- 2.2 RESEARCH METHODOLOGY

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.5.2 OVERALL STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PATIENT EXPERIENCE TECHNOLOGY MARKET OVERVIEW

- 4.2 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING AND REGION

- 4.3 PATIENT EXPERIENCE TECHNOLOGY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 PATIENT EXPERIENCE TECHNOLOGY MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for digital engagement platforms and personalized patient care

- 5.2.1.2 Increasing adoption of telehealth, mobile health apps, and AI-powered analytics

- 5.2.1.3 Government initiatives and funding for healthcare digital transformation

- 5.2.1.4 Growing focus on improving patient satisfaction and long-term engagement

- 5.2.1.5 Expansion of cloud-based engagement platforms

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and cybersecurity concerns

- 5.2.2.2 High implementation and integration costs for healthcare providers

- 5.2.2.3 Limited interoperability between patient engagement systems and existing electronic health record systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging market

- 5.2.3.2 Adoption of AI-driven personalization and predictive analytics for patient care

- 5.2.3.3 Strategic partnerships among technology providers, pharma companies, and payers

- 5.2.3.4 Rising adoption of virtual reality and augmented reality

- 5.2.4 CHALLENGES

- 5.2.4.1 Need to ensure accuracy and reliability of feedback data

- 5.2.4.2 Rapid technological evolution

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INVESTMENTS IN PATIENT ENGAGEMENT AND EXPERIENCE PLATFORMS

- 5.3.2 AI-DRIVEN PERSONALIZATION AND VIRTUAL ASSISTANTS

- 5.3.3 CLOUD-BASED PLATFORMS AND OMNICHANNEL ACCESS

- 5.3.4 TELEHEALTH AND HYBRID CARE MODELS

- 5.3.5 IMMERSIVE TECHNOLOGIES FOR EDUCATION AND ADHERENCE

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Voice-of-the-Patient (VoP) platforms

- 5.9.1.2 Telehealth and virtual care platforms

- 5.9.1.3 Patient portals and personal health records

- 5.9.1.4 Remote Patient Monitoring (RPM)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Interoperability/API and FHIR Infrastructure

- 5.9.2.2 Patient identity management and authentication systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Clinical Decision Support Systems (CDSS)

- 5.9.3.2 Population Health Management (PHM) platforms

- 5.9.3.3 Patient engagement solutions

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS

- 5.10.2 JURISDICTION ANALYSIS

- 5.10.3 MAJOR PATENTS IN PATIENT EXPERIENCE TECHNOLOGY MARKET

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.12 CASE STUDY ANALYSIS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 END-USER ANALYSIS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 BUSINESS MODELS

- 5.18 IMPACT OF AI/GEN AI ON PATIENT EXPERIENCE TECHNOLOGY MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN PATIENT EXPERIENCE TECHNOLOGY

- 5.18.3 AI USE CASES

- 5.18.4 CASE STUDY ON IMPLEMENTATION OF AI/GEN AI

- 5.18.5 INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.5.1 US healthcare technology market

- 5.18.5.2 Patient engagement technology market

- 5.18.6 USER READINESS AND IMPACT ASSESSMENT

- 5.18.6.1 User readiness

- 5.18.6.1.1 Hospitals & health systems

- 5.18.6.1.2 Outpatient & ambulatory care centers

- 5.18.6.1.3 Physician and group practices

- 5.18.6.1.4 Long-term care and post-acute facilities

- 5.18.6.1.5 Others

- 5.18.6.2 Impact assessment

- 5.18.6.2.1 Implementation

- 5.18.6.2.2 Impact

- 5.18.6.1 User readiness

- 5.19 IMPACT OF 2025 US TARIFFS ON PATIENT EXPERIENCE TECHNOLOGY MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 IMPACT ON COUNTRY/REGION

- 5.19.3.1 US

- 5.19.3.2 Europe

- 5.19.3.3 Asia Pacific

- 5.19.4 IMPACT ON END-USE INDUSTRIES

- 5.19.4.1 Healthcare providers

- 5.19.4.2 Healthcare payers

- 5.19.4.3 Pharma & biotech companies

- 5.19.4.4 Others

6 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 SOFTWARE

- 6.2.1 ON-PREMISE SOFTWARE

- 6.2.1.1 Data sovereignty and seamless workflow ability to drive market

- 6.2.2 CLOUD-BASED SOFTWARE

- 6.2.2.1 Lower upfront costs and seamless interoperability to aid growth

- 6.2.3 HYBRID SOFTWARE

- 6.2.3.1 Ability to ensure maximum compliance and control to boost market

- 6.2.1 ON-PREMISE SOFTWARE

- 6.3 SERVICES

- 6.3.1 MANAGED SERVICES

- 6.3.1.1 Rising demand for operational efficiency and risk mitigation to encourage growth

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Need for continuous patient engagement to contribute to growth

- 6.3.1 MANAGED SERVICES

7 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- 7.2 APPOINTMENT SCHEDULING

- 7.2.1 GROWING TREND TOWARD OMNICHANNEL, INTELLIGENT PATIENT EXPERIENCE SOLUTIONS TO FUEL MARKET

- 7.3 PATIENT REGISTRATION

- 7.3.1 NEED TO ENHANCE CLINICAL SAFETY AND OPERATIONAL PERFORMANCE TO AUGMENT GROWTH

- 7.4 VIRTUAL CARE

- 7.4.1 EXPANDING REMOTE ACCESS AND CONTINUITY OF CARE TO AID GROWTH

- 7.5 PATIENT COMMUNICATION

- 7.5.1 INCREASING LAUNCHES OF COMMUNICATION PLATFORMS TO BOLSTER GROWTH

- 7.6 BILLING

- 7.6.1 INCREASING PUSH FOR TRANSPARENT AND AUTOMATED FINANCIAL WORKFLOWS TO SPUR GROWTH

- 7.7 FEEDBACK MANAGEMENT

- 7.7.1 NEED FOR REAL-TIME INSIGHTS INTO PATIENT SATISFACTION, CARE QUALITY, AND SERVICE GAPS TO FACILITATE GROWTH

- 7.8 OTHER FUNCTIONS

8 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE PROVIDERS

- 8.2.1 HOSPITALS & HEALTH SYSTEMS

- 8.2.1.1 Growing adoption of advanced digital and AI-driven platforms to bolster market

- 8.2.2 OUTPATIENT & AMBULATORY CARE CENTERS

- 8.2.2.1 Rising demand for preventive care, chronic disease management, and same-day procedures to promote growth

- 8.2.3 PHYSICIANS & GROUP PRACTICES

- 8.2.3.1 Increasing use of predictive analytics and remote monitoring tools to augment growth

- 8.2.4 LONG-TERM CARE & POST-ACUTE FACILITIES

- 8.2.4.1 Growing burden of aging population and chronic diseases to boost market

- 8.2.5 OTHER HEALTHCARE PROVIDERS

- 8.2.1 HOSPITALS & HEALTH SYSTEMS

- 8.3 HEALTHCARE PAYERS

- 8.3.1 INCREASING ADVANCEMENTS IN ARTIFICIAL INTELLIGENCE AND VIRTUAL CARE MODELS TO FUEL MARKET

- 8.4 PHARMA & BIOTECH COMPANIES

- 8.4.1 RISING INTEGRATION OF PATIENT EXPERIENCE TECHNOLOGY TO AID GROWTH

- 8.5 OTHER END USERS

9 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Increasing adoption of digital solutions to contribute to growth

- 9.2.3 CANADA

- 9.2.3.1 Rising focus on healthcare delivery through digital innovation to expedite growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Growing focus on digital-first healthcare delivery and patient empowerment to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Aging population and rising prevalence of chronic diseases to spur growth

- 9.3.4 FRANCE

- 9.3.4.1 Favorable policies and commitment to digital transformation to aid growth

- 9.3.5 ITALY

- 9.3.5.1 Expanding regulatory and reimbursement support to fuel market

- 9.3.6 SPAIN

- 9.3.6.1 Growing adoption of telemedicine to boost market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Rapidly growing elderly population to accelerate growth

- 9.4.3 CHINA

- 9.4.3.1 Widespread integration of healthcare services into super-apps to accelerate growth

- 9.4.4 INDIA

- 9.4.4.1 Increasing burden of non-communicable diseases and use of mobile-first platforms to favor growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Booming medical tourism to speed up growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Matured healthcare system and digital infrastructure to promote growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increase utilization of digital ecosystems to spur growth

- 9.5.3 MEXICO

- 9.5.3.1 Growing consumer-driven digital marketplaces to fuel market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Rising healthcare investments to contribute to growth

- 9.6.2.2 Saudi Arabia

- 9.6.2.2.1 Digital health transformation programs to support growth

- 9.6.2.3 UAE

- 9.6.2.3.1 Rising patient expectations and entry of innovative regional platforms to aid growth

- 9.6.2.4 Rest of GCC countries

- 9.6.3 SOUTH AFRICA

- 9.6.3.1 Growing smartphone penetration and supportive regulatory efforts to boost market

- 9.6.4 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PATIENT EXPERIENCE TECHNOLOGY MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/SOFTWARE COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Function footprint

- 10.7.5.5 End-user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 SOLUTION LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 PRESS GANEY

- 11.1.1.1 Business overview

- 11.1.1.2 Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Solution launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 NATIONAL RESEARCH CORPORATION

- 11.1.2.1 Business overview

- 11.1.2.2 Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Solution launches and enhancements

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 MEDALLIA INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Solution launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 PHREESIA

- 11.1.4.1 Business overview

- 11.1.4.2 Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Solution launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 NICE

- 11.1.5.1 Business overview

- 11.1.5.2 Solutions offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 R1

- 11.1.6.1 Business overview

- 11.1.6.2 Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Solution launches and enhancements

- 11.1.6.3.2 Deals

- 11.1.7 EPIC SYSTEMS CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Solution launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 IQVIA

- 11.1.8.1 Business overview

- 11.1.8.2 Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Solution launches and enhancements

- 11.1.9 QUALTRICS

- 11.1.9.1 Business overview

- 11.1.9.2 Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.9.3.3 Other developments

- 11.1.10 RELIAS LLC

- 11.1.10.1 Business overview

- 11.1.10.2 Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 GETWELLNETWORK, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Solutions offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Solution launches and enhancements

- 11.1.11.3.2 Deals

- 11.1.12 CIPHERHEALTH INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Solutions offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Solution launches and enhancements

- 11.1.12.3.2 Deals

- 11.1.13 KYRUUS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Solutions offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Solution launches and enhancements

- 11.1.13.3.2 Deals

- 11.1.14 RELATIENT

- 11.1.14.1 Business overview

- 11.1.14.2 Solutions offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Solution launches and enhancements

- 11.1.15 ALIDA

- 11.1.15.1 Business overview

- 11.1.15.2 Solutions offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Other developments

- 11.1.16 TWILIO INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Solutions offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Solution launches and enhancements

- 11.1.16.3.2 Deals

- 11.1.17 AVAAMO

- 11.1.17.1 Business overview

- 11.1.17.2 Solutions offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Solution launches and enhancements

- 11.1.18 CERTIFY HEALTH

- 11.1.18.1 Business overview

- 11.1.18.2 Solutions offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Other developments

- 11.1.19 LUMA HEALTH INC.

- 11.1.19.1 Business overview

- 11.1.19.2 Solutions offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Solution launches and enhancements

- 11.1.19.3.2 Deals

- 11.1.20 SOLUTIONREACH

- 11.1.20.1 Business overview

- 11.1.20.2 Solutions offered

- 11.1.20.3 Recent developments

- 11.1.20.3.1 Solution launches and enhancements

- 11.1.21 SALESFORCE, INC.

- 11.1.21.1 Business overview

- 11.1.21.2 Solutions offered

- 11.1.21.3 Recent developments

- 11.1.21.3.1 Solution launches and enhancements

- 11.1.1 PRESS GANEY

- 11.2 OTHER PLAYERS

- 11.2.1 VITAL

- 11.2.2 NEXHEALTH

- 11.2.3 COLLECTLY, INC.

- 11.2.4 BUSINESS INTEGRITY SERVICES

- 11.2.5 BAMBOO HEALTH

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS