|

시장보고서

상품코드

1858521

ECMO 기기 시장 예측(-2030년) : 제품 유형별, 모달리티별, 환자 유형별, 용도별, 최종사용자별ECMO Machines Market by Product (ECMO Machines, Components ), Modality, Patient Type, Application, End User - Global Forecast to 2030 |

||||||

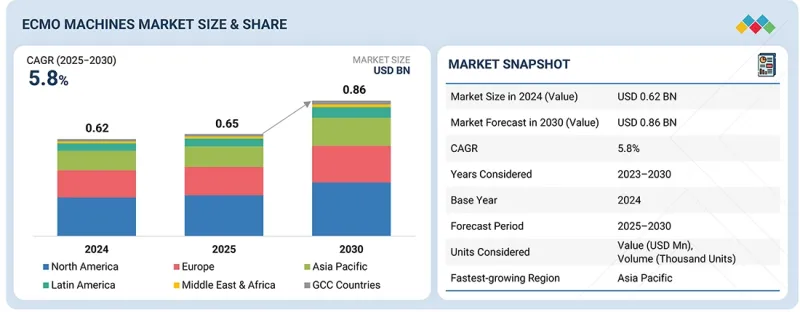

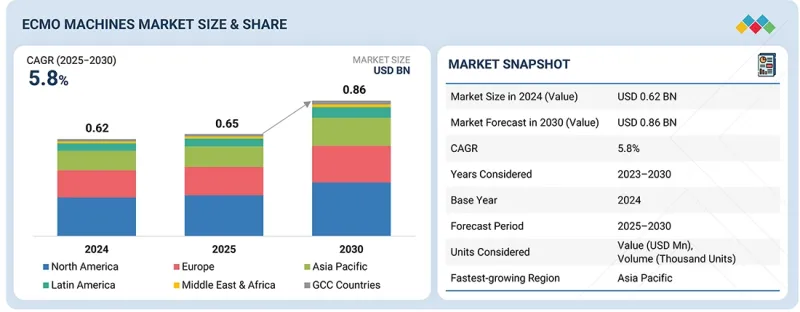

세계의 ECMO 기기 시장 규모는 2025년 6억 5,000만 달러에서 2030년까지 8억 6,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 5.8%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품 유형, 모달리티, 환자 유형, 용도, 최종사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

최근 수년간 ECMO 장비는 다루기 힘들고 수작업이 많은 시스템에서 컴팩트하고 자동화된 고효율 플랫폼으로 진화하고 있습니다. 차세대 ECMO는 실시간 모니터링, 자동 유량 조절, AI를 통한 산소화 제어를 통합하여 상시 수동 개입의 필요성을 줄입니다. Getinge AB, Medtronic과 같은 주요 기업은 휴대용 ECMO의 기술 혁신을 주도하고 있으며, 병원 간 및 병원내 환자 이송을 보다 원활하게 할 수 있도록 돕고 있습니다. 최근에는 무선 연결과 클라우드 기반 모니터링 기능을 갖춘 시스템도 등장해 전문의가 원격지의 환자 데이터를 추적할 수 있게 되었습니다. 개선된 원심 펌프와 폴리메틸펜텐(PMP) 산소 공급기는 내구성을 높이고 용혈 및 혈전 형성 등의 합병증을 감소시킵니다.

또한 항응고 관리의 혁신으로 에크모 환자의 역사적 과제였던 출혈의 위험을 줄였습니다. 이러한 기술적 도약은 환자의 생존율을 향상시키고, 인력이 부족한 병원에서도 ECMO를 보다 쉽게 사용할 수 있게 하여 선진국과 신흥 국가 의료 시장 전반에 걸쳐 폭넓은 채택을 촉진하고 있습니다.

제품별로 ECMO 기기 시장은 부품과 ECMO 기기로 나뉩니다. 2024년, 부품 부문은 ECMO 장비 세계 시장에서 가장 큰 점유율을 차지했습니다. 급성호흡곤란증후군(ARDS), 심정지, 다발성 장기부전 발생률이 증가함에 따라 전 세계에서 3차 병원 전체에서 에크모 사용이 확대되고 있습니다. 각 ECMO 시술은 산소공급기, 펌프, 튜브 세트, 컨트롤러, 캐뉼라를 소모합니다. 단기간의 ECMO라 할지라도 산소 공급기, 캐뉼라 등의 구성품은 일회용이며, 펌프는 정확한 적합성을 필요로 하고, 시술할 때마다 업그레이드해야 하는 경우가 많습니다. 전염병 후 준비는 ECMO의 사용 빈도를 높이고 구성 요소의 안정적인 회전을 보장합니다. 장비 자체는 변하지 않지만, 시술 횟수 증가는 부품 부문의 비약적인 성장을 가속합니다.

ECMO 시장은 환자 유형에 따라 성인, 소아, 신생아로 분류됩니다. 2024년, 성인이 ECMO 장비 시장에서 가장 큰 시장 점유율을 차지했습니다. COVID-19 팬데믹은 성인의 중증 호흡부전 치료에 있으며, 에크모의 역할이 매우 중요하다는 것을 보여주었습니다. 최고조에 이르렀을 때, 에크모를 지원받은 환자의 대부분은 중증 ARDS를 앓고 있는 성인이었습니다. 급성기가 끝난 후에도 많은 생존자들이 장기적인 폐 손상, 섬유증 및 기타 호흡기 합병증을 경험하고, 중증 환자에서 에크모 사용이 증가했습니다. COVID-19 이후 심근염, 바이러스 후 폐렴 등의 합병증도 주로 성인에서 발생하므로 이 연령층에서 에크모에 대한 수요가 증가하고 있습니다. 팬데믹 기간 중 전 세계 병원은 성인 중환자실을 중심으로 ECMO 인프라를 확장하여 장비 채택에 장기적인 영향을 미쳤습니다. 이러한 유산 효과로 인해 2024년 ECMO 시장 점유율은 성인이 가장 큰 시장 점유율을 차지할 것으로 예측됩니다.

북미는 예측 기간 중 ECMO 장비 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 북미, 특히 미국과 캐나다는 일류 병원, 중환자실, 전문 의료 센터를 갖춘 고도로 발달한 의료 생태계의 혜택을 누리고 있습니다. 이러한 시설은 ECMO와 같은 정교하고 자원 집약적인 기술을 지원할 수 있습니다. 대형 3차 병원이나 대학병원은 ECMO 시술의 거점인 경우가 많으며, 첨단 ICU와 훈련된 다학제 팀을 통해 효과적인 환자 관리를 실현하고 있습니다. 신흥 지역과 달리 북미의 병원들은 고가의 ECMO 장비에 투자하고 이를 효율적으로 유지할 수 있는 재정적 인프라를 갖추고 있습니다. 또한 첨단 모니터링 툴을 포함한 디지털 헬스 시스템과의 강력한 통합을 통해 안전한 에크모 관리를 보장합니다. 이러한 인프라의 즉각적인 대응 능력으로 ECMO를 대규모로 채택할 수 있게 되었고, 접근성이 향상되어 생존 결과가 증가하고 있습니다. 그 결과, 발달된 의료 네트워크가 북미 에크모 장비 시장에서 북미의 리더십을 강화하는 데 핵심적인 역할을 하고 있습니다.

세계의 ECMO 기기 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- ECMO 기기 시장의 개요

- 아시아태평양의 ECMO 머신 시장 : 제품별, 국가별(2024년)

- ECMO 기기 시장 : 지역적 성장 기회

- ECMO 기기 시장, 지역의 구성(2023-2030년)

- ECMO 기기 시장 : 신흥 국가 vs. 선진국

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 고객 비즈니스에 영향을 미치는 동향/파괴적 변화

- 가격결정 분석

- 주요 기업의 평균 판매 가격 : 유형별

- 평균 판매 가격 동향 : 지역별

- 밸류체인 분석

- 공급망 분석

- 에코시스템 분석

- 투자와 자금조달 시나리오

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 산업 동향

- 비전통 케어 환경에서 ECMO의 채택 확대

- 소아과와 신생아 케어에서 ECMO의 사용 증가

- ECMO 센터 오브 엑설런스와 지역화로의 이동

- ECMO 시뮬레이션 트레이닝과 원격 ECMO 프로그램의 성장

- 특허 분석

- 무역 분석

- HS 코드 901890의 수입 데이터

- HS 코드 901890의 수출 데이터

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 사례 연구 분석

- 규제 상황

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 미충족 요구/최종사용자 기대

- 인접 시장 분석

- ECMO 기기 시장에 대한 AI/생성형 AI의 영향

- 서론

- ECMO 기기 시장에서 생성형 AI의 시장 잠재력

- AI 사용 사례

- AI를 도입하고 있는 주요 기업

- ECMO 기기 시장에서 생성형 AI의 미래

- ECMO 기기 시장에 대한 2025년 미국 관세의 영향

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 주요 영향

- 최종 용도 산업에 대한 영향

제6장 ECMO 기기 시장 : 제품별

- 서론

- 컴포넌트

- 산소 발생기

- 펌프

- 컨트롤러

- 캐뉼라

- 액세서리

- 기기

제7장 ECMO 기기 시장 : 모달리티별

- 서론

- 정정맥 ECMO

- 정동맥 ECMO

- 동정맥ECMO

제8장 ECMO 기기 시장 : 환자 유형별

- 서론

- 성인 환자

- 소아 환자

- 신생아

제9장 ECMO 기기 시장 : 용도별

- 서론

- 호흡기 용도

- 심장 용도

- 체외순환식 심폐 소생

제10장 ECMO 기기 시장 : 최종사용자별

- 서론

- 병원

- 학술연구기관

- 전문 클리닉

제11장 ECMO 기기 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- GCC 국가

제12장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- GETINGE

- MEDTRONIC

- TERUMO CORPORATION

- FRESENIUS MEDICAL CARE AG

- LIVANOVA PLC

- NIPRO

- WEIGAO GROUP CO., LTD.

- ABBOTT

- MICROPORT SCIENTIFIC CORPORATION

- EUROSETS

- 기타 기업

- SPECTRUM MEDICAL

- SENKO MEDICAL INSTRUMENT MFG. CO., LTD.

- CHALICE MEDICAL LTD.

- MAGASSIST CO., LTD.

- BRAILE BIOMEDICA

- GIZMOMED PRIVATE LIMITED

- ORIGEN BIOMEDICAL, INC.

- ABIOMED

- ANDOCOR

- JIANGSU STMED TECHNOLOGY CO., LTD.

- CARDIOQUIP

- CBM LIFEMOTION

- CHANGZHOU KANGXIN MEDICAL INSTRUMENTS

- GENTHERM

제14장 부록

KSA 25.11.14The ECMO machines market is projected to reach USD 0.86 billion by 2030 from USD 0.65 billion in 2025, at a CAGR of 5.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Global ECMO Machines Market, by Product, Modality, Patient Type, Application, End User |

| Regions covered | North America, Europe, APAC, RoW |

In recent years, ECMO machines have evolved from bulky, manual-intensive systems to compact, automated, and highly efficient platforms. Next-generation ECMO integrates real-time monitoring, automated flow adjustments, and artificial intelligence (AI)-driven oxygenation control to reduce the need for constant manual intervention. Companies such as Getinge AB and Medtronic are leading in portable ECMO innovations, enabling smoother inter-hospital and intra-hospital patient transfers. Some systems now feature wireless connectivity and cloud-based monitoring, allowing specialists to track remote patient data. Improved centrifugal pumps and polymethyl pentene (PMP) oxygenators enhance durability and reduce complications such as hemolysis or clot formation.

Moreover, innovations in anticoagulation management reduce the risks of bleeding, a historical challenge for ECMO patients. These technological leaps improve patient survival and make ECMO more user-friendly for hospitals with limited staff, driving wider adoption across developed and emerging healthcare markets.

Based on product, the market of ECMO machines is divided into components and ECMO machines. In 2024, the components segment held the largest share of the global ECMO machines market. With the rising incidence of acute respiratory distress syndrome (ARDS), cardiac arrest, and multi-organ failure, ECMO usage has expanded globally across tertiary hospitals. Each ECMO procedure consumes oxygenators, pumps, tubing sets, controllers, and cannulas. Even in short-term ECMO, components like oxygenators and cannulas are single-use, while pumps require precise compatibility and often get upgraded with each procedure. Post-pandemic preparedness further contributes to higher ECMO use, ensuring steady turnover of components. Unlike the machine itself, which remains constant, the increasing number of procedures fuels exponential growth in the component segment.

Based on patient type, the ECMO market has been categorized into adults, pediatrics and neonates. In 2024, adults held the largest market share in the ECMO machines market. The COVID-19 pandemic highlighted ECMO's role in treating severe respiratory failure in adults. During the peak, most ECMO-supported cases were adults with severe ARDS. Even after the acute pandemic phase, many survivors experienced long-term pulmonary damage, fibrosis, and other respiratory complications that increased ECMO utilization in critical cases. Post-COVID-19 complications like myocarditis and post-viral pneumonia also primarily affect adults, contributing to higher demand for ECMO in this age group. Hospitals worldwide expanded ECMO infrastructure during the pandemic, with a focus on adult ICUs, leaving a long-term impact on equipment adoption. This legacy effect ensured that adults continued to account for the largest ECMO market share in 2024.

North America is expected to account for the largest share of the ECMO machines market during the forecast period. North America, particularly the US and Canada, benefits from a highly advanced healthcare ecosystem equipped with top-tier hospitals, critical care units, and specialized medical centers. These facilities can support sophisticated and resource-intensive technologies such as ECMO. Large tertiary hospitals and academic medical centers often serve as hubs for ECMO procedures, offering advanced ICUs and trained multidisciplinary teams that ensure effective patient management. In contrast to emerging regions, North American hospitals possess the financial and infrastructural capacity to invest in expensive ECMO equipment and maintain it efficiently. Furthermore, strong integration of digital health systems, including advanced monitoring tools, ensures safe ECMO management. This infrastructure readiness makes it feasible for ECMO adoption at scale, enhancing accessibility and increasing survival outcomes. As a result, the well-developed healthcare network plays a central role in reinforcing North America's leadership in the ECMO machines market.

A breakdown of the primary participants (supply-side) for the ECMO machines market referred to in this report is provided below:

- By Company Type: Tier 1: 34%, Tier 2: 38%, and Tier 3: 28%

- By Designation: C Level: 26%, Director Level: 35%, and Others: 39%

- By Region: North America: 17%, Europe: 39%, Asia Pacific: 28%, Latin America: 8%, Middle East & Africa: 3%, GCC Countries: 5%

Prominent players in the ECMO machines market are Fresenius Medical Care AG & Co. KGaA (Germany), Getinge AB (Sweden), Medtronic (Ireland), Terumo Corporation (Japan), and LivaNova PLC (UK).

Research Coverage

The report evaluates the ECMO machines market and estimates the market size and future growth potential based on various segments, including product, modality, patient type, application, end user, and region. The report also includes a competitive analysis of the major players in this market, along with company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will assist the market leader/new entrants with data on the nearest approximations of the revenue numbers for the overall ECMO machines market and the subsegments. The report will assist stakeholders in understanding the competitive landscape and gain further insights into better positioning their businesses and making appropriate go-to-market strategies. The report assists the stakeholders in understanding the market pulse and gives them data on influential drivers, hindrances, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (Increasing prevalence of cardiovascular and respiratory diseases, Growing adoption of ECMO in lung transplantation procedures), restraints (Complications associated with ECMO, High cost of ECMO procedures), opportunities (Increasing survival rates with ECMO), and challenges (Shortage of skilled professionals, Eligibility issues for ECMO)

- Product Launches/Innovations: Comprehensive details about product launches and anticipated trends in the global ECMO machines market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, modality, patient type, application, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global ECMO machines market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global ECMO machines market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ECMO MACHINES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: ECMO MACHINES MARKET, BY PRODUCT AND COUNTRY (2024)

- 4.3 ECMO MACHINES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 ECMO MACHINES MARKET, REGIONAL MIX, 2023-2030

- 4.5 ECMO MACHINES MARKET: EMERGING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of cardiovascular and respiratory diseases

- 5.2.1.2 Growing adoption of ECMO in lung transplantation procedures

- 5.2.1.3 Rise in ECMO centers worldwide

- 5.2.1.4 Technological advancements in ECMO machines

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complications associated with ECMO

- 5.2.2.2 High cost of ECMO procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing survival rates with ECMO

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Advanced oxygenator design

- 5.9.1.2 High-efficiency blood pumps

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Advanced hemodynamic monitoring systems

- 5.9.2.2 Ventilators

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Wearable Artificial Lungs (WALs)

- 5.9.3.2 Perfusion systems

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 GROWING ADOPTION OF ECMO IN NON-TRADITIONAL CARE SETTINGS

- 5.10.2 INCREASING USE OF ECMO IN PEDIATRIC AND NEONATAL CARE

- 5.10.3 SHIFT TOWARD ECMO CENTERS OF EXCELLENCE AND REGIONALIZATION

- 5.10.4 GROWTH OF ECMO SIMULATION TRAINING AND TELE-ECMO PROGRAMS

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 901890

- 5.12.2 EXPORT DATA FOR HS CODE 901890

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: IMPROVED SURVIVAL RATES IN US USING ECMO

- 5.14.2 CASE STUDY 2: NEONATAL ECMO PROGRAM IN UK

- 5.14.3 CASE STUDY 3: MOBILE ECMO TRANSPORT SERVICE IN GERMANY

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY ANALYSIS

- 5.15.1.1 North America

- 5.15.1.1.1 US

- 5.15.1.1.2 Canada

- 5.15.1.2 Europe

- 5.15.1.2.1 Germany

- 5.15.1.2.2 France

- 5.15.1.2.3 UK

- 5.15.1.3 Asia Pacific

- 5.15.1.3.1 China

- 5.15.1.3.2 Japan

- 5.15.1.3.3 India

- 5.15.1.4 Latin America

- 5.15.1.4.1 Brazil

- 5.15.1.4.2 Mexico

- 5.15.1.5 Middle East & Africa

- 5.15.1.5.1 South Africa

- 5.15.1.5.2 GCC Countries

- 5.15.1.1 North America

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.1 REGULATORY ANALYSIS

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 ADJACENT MARKET ANALYSIS

- 5.20 IMPACT OF AI/GEN AI ON ECMO MACHINES MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 MARKET POTENTIAL OF GEN AI ON ECMO MACHINES MARKET

- 5.20.3 AI USE CASES

- 5.20.4 KEY COMPANIES IMPLEMENTING AI

- 5.20.5 FUTURE OF GEN AI IN ECMO MACHINES MARKET

- 5.21 IMPACT OF 2025 US TARIFF ON ECMO MACHINES MARKET

- 5.21.1 KEY TARIFF RATES

- 5.21.2 PRICE IMPACT ANALYSIS

- 5.21.3 KEY IMPACT ON COUNTRY/REGION

- 5.21.3.1 US

- 5.21.3.2 Europe

- 5.21.3.3 Asia Pacific

- 5.21.4 IMPACT ON END-USE INDUSTRIES

6 ECMO MACHINES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 COMPONENTS

- 6.2.1 OXYGENATORS

- 6.2.1.1 Significantly less priming volume associated with PMP oxygenators to boost demand

- 6.2.2 PUMPS

- 6.2.2.1 Pivotal role played by centrifugal blood pumps in adult extracorporeal life support to support market growth

- 6.2.3 CONTROLLERS

- 6.2.3.1 Ability of controllers to allow operators of ECMO circuits to adjust settings as needed to drive demand

- 6.2.4 CANNULAS

- 6.2.4.1 Importance of cannulas in optimizing ECMO flows to boost market

- 6.2.5 ACCESSORIES

- 6.2.1 OXYGENATORS

- 6.3 MACHINES

- 6.3.1 ADVANTAGES SUCH AS TIMELY INTERVENTION IN CASES OF RESPIRATORY AND CARDIAC EMERGENCIES TO FUEL GROWTH

7 ECMO MACHINES MARKET, BY MODALITY

- 7.1 INTRODUCTION

- 7.2 VENOVENOUS ECMO

- 7.2.1 LOWER INCIDENCE OF NEUROLOGIC COMPLICATIONS AND LACK OF ARTERIAL COMPROMISE TO BOOST GROWTH

- 7.3 VENOARTERIAL ECMO

- 7.3.1 INCREASING INCIDENCE OF HEART-LUNG FAILURE TO DRIVE GROWTH

- 7.4 ARTERIOVENOUS ECMO

- 7.4.1 PORTABILITY OF ARTERIOVENOUS ECMO MACHINES TO DRIVE DEMAND

8 ECMO MACHINES MARKET, BY PATIENT TYPE

- 8.1 INTRODUCTION

- 8.2 ADULT PATIENTS

- 8.2.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE USE OF ECMO IN ADULT PATIENTS

- 8.3 PEDIATRIC PATIENTS

- 8.3.1 RECENT ADVANCES IN ECMO TO BOOST MARKET GROWTH

- 8.4 NEONATES

- 8.4.1 INCREASING UTILIZATION OF ECMO TO MANAGE NEONATES WITH CARDIAC AND RESPIRATORY FAILURE TO SUPPORT GROWTH

9 ECMO MACHINES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 RESPIRATORY APPLICATIONS

- 9.2.1 INCREASING CASES OF ACUTE RESPIRATORY DISTRESS SYNDROME, PNEUMONIA, AND INFLUENZA TO SPUR GROWTH

- 9.3 CARDIAC APPLICATIONS

- 9.3.1 RISING PREVALENCE OF CARDIOVASCULAR DISEASES WORLDWIDE TO SUPPORT GROWTH

- 9.4 EXTRACORPOREAL CARDIOPULMONARY RESUSCITATION

- 9.4.1 GROWING CLINICAL EVIDENCE SUGGESTING IMPROVED SURVIVAL RATES AND NEUROLOGICAL OUTCOMES TO FUEL MARKET

10 ECMO MACHINES MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 GROWING USE OF ECMO FOR MANAGING CRITICAL CONDITIONS TO DRIVE MARKET

- 10.3 ACADEMIC & RESEARCH INSTITUTIONS

- 10.3.1 INCREASING MEDICAL COLLEGES AND RESEARCH FACILITIES INVESTING IN ECMO SYSTEMS TO FOSTER GROWTH

- 10.4 SPECIALTY CLINICS

- 10.4.1 RISING NEED FOR ADVANCED, LIFE-SAVING INTERVENTIONS TO AID GROWTH

11 ECMO MACHINES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to account for largest share of North American market

- 11.2.3 CANADA

- 11.2.3.1 Implementation of ABF model in Canadian hospitals to drive market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increasing volume of ECMO procedures to drive market growth in Germany

- 11.3.3 FRANCE

- 11.3.3.1 Rising healthcare spending to drive market growth in France

- 11.3.4 UK

- 11.3.4.1 Significant investment in healthcare to support adoption of advanced medical technologies like ECMO

- 11.3.5 ITALY

- 11.3.5.1 High burden of CVDs to contribute to growth of ECMO machines market in Italy

- 11.3.6 SPAIN

- 11.3.6.1 High adoption of advanced technologies to drive market growth in Spain

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Favorable healthcare infrastructure in Japan to drive market growth

- 11.4.3 CHINA

- 11.4.3.1 Large patient population and government-backed critical care infrastructure expansion to fuel growth

- 11.4.4 INDIA

- 11.4.4.1 Growing applications and rising adoption of ECMO to drive market growth in India

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Advanced healthcare infrastructure and early ECMO adoption to position South Korea as leading regional market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Rising respiratory and cardiac complications, coupled with aging population, to fuel ECMO adoption

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Rising adoption of ECMO as bridge to heart and lung transplantation to drive market growth in Brazil

- 11.5.3 MEXICO

- 11.5.3.1 High burden of CVDs in country to drive market growth in Mexico

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 INCREASING PREVALENCE OF TARGET DISEASES TO DRIVE MARKET GROWTH IN MIDDLE EAST & AFRICA

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.7 GCC COUNTRIES

- 11.7.1 RISING INVESTMENTS IN ADVANCED HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 11.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of startups/SMEs

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 GETINGE

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 MEDTRONIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses & competitive threats

- 13.1.3 TERUMO CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 FRESENIUS MEDICAL CARE AG

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 LIVANOVA PLC

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 NIPRO

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 WEIGAO GROUP CO., LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 ABBOTT

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product approvals

- 13.1.9 MICROPORT SCIENTIFIC CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 EUROSETS

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.1 GETINGE

- 13.2 OTHER PLAYERS

- 13.2.1 SPECTRUM MEDICAL

- 13.2.2 SENKO MEDICAL INSTRUMENT MFG. CO., LTD.

- 13.2.3 CHALICE MEDICAL LTD.

- 13.2.4 MAGASSIST CO., LTD.

- 13.2.5 BRAILE BIOMEDICA

- 13.2.6 GIZMOMED PRIVATE LIMITED

- 13.2.7 ORIGEN BIOMEDICAL, INC.

- 13.2.8 ABIOMED

- 13.2.9 ANDOCOR

- 13.2.10 JIANGSU STMED TECHNOLOGY CO., LTD.

- 13.2.11 CARDIOQUIP

- 13.2.12 CBM LIFEMOTION

- 13.2.13 CHANGZHOU KANGXIN MEDICAL INSTRUMENTS

- 13.2.14 GENTHERM

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS