|

시장보고서

상품코드

1859656

GLP-1 작용제 시장 : 제품별, 분자별, 유형별, 적응증별, 제형별, 투여 경로별, 최종사용자별, 지역별 - 예측(-2033년)GLP-1 Agonists Market by Product (Ozempic, Wegovy, Mounjaro), Molecule (semaglutide, tirzepatide), Type (Patented, Biosimilars), Format (Single dose, Multi-dose, Tablets), ROA (SC, Oral), Indication (Diabetes, Obesity) - Global Forecast to 2033 |

||||||

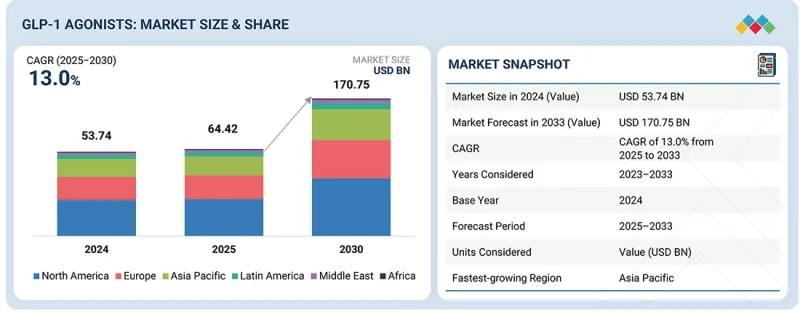

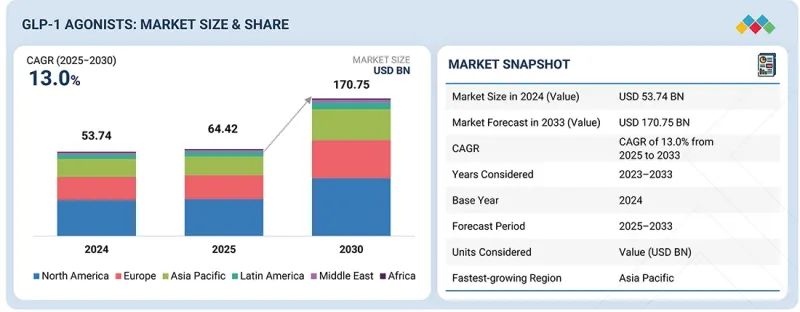

GLP-1 작용제 시장 규모는 예측 기간 동안 CAGR이 13.0%로, 2025년 644억 2,000만 달러에서 2033년에는 1,707억 5,000만 달러에 달할 것으로 예측됩니다.

GLP-1 작용제 시장은 몇 가지 주요 촉진요인에 의해 빠르게 성장하고 있습니다. 눈에 띄는 요인 중 하나는 규제 당국의 GLP-1 의약품에 대한 새로운 적응증 승인 증가입니다. 이번 승인으로 GLP-1 작용제의 적응증이 확대되어 심혈관질환, 알츠하이머병, 폐쇄성 수면무호흡증, 비만 등 새로운 적응증을 포함해 보다 광범위한 환자군을 대상으로 치료할 수 있게 됐습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2033년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2033년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 분자별, 유형별, 적응증별, 제형별, 투여 경로별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

당뇨병과 비만에 대한 효과적인 치료법을 필요로 하는 환자가 증가함에 따라 이러한 만성질환의 전 세계 유병률이 증가함에 따라 시장의 강력한 성장을 더욱 촉진하고 있습니다. 이와 함께 GLP-1 작용제는 혈당 조절 개선 및 체중 감소와 같은 임상적 이점이 입증되어 의료 서비스 제공자들 사이에서 채택률이 증가하고 있습니다.

유형별로 살펴보면, GLP-1 작용제 시장은 특허 제품과 바이오시밀러로 구분됩니다. 2024년에는 특허제품이 시장에서 가장 큰 점유율을 차지했습니다. 바이오시밀러는 2026년 이후 도입이 확대될 것으로 예상되기 때문에 현재로서는 특허 제품이 전체 시장을 점유하고 있습니다. 그러나 세마글루티드의 특허가 2026년 이후 만료되기 때문에 이후 바이오시밀러 시장은 크게 성장할 것으로 예상됩니다. 특허 받은 GLP-1 작용제는 탄탄한 임상 데이터, 광범위한 안전성 프로파일, 높은 마케팅 투자로 인해 처방 패턴을 지배하고 있습니다. 또한, 오리지널 GLP-1 제조사들은 높은 약가에도 불구하고 폭넓은 보험 적용을 통해 환자의 접근성을 보장하고 있습니다. 이러한 요인들이 시장 성장을 뒷받침할 것으로 예상됩니다.

최종사용자별로 GLP-1 작용제 시장은 홈케어 환경 및 피트니스/체중 관리 시설, 장기요양시설, 병원 및 전문 클리닉으로 구분됩니다. 2024년에는 재택 요양 시설 및 피트니스/체중 관리 시설 부문이 GLP-1 작용제 시장에서 가장 큰 점유율을 차지했습니다. 이 최종사용자 부문의 큰 점유율은 진화하는 환자 니즈와 비만 및 당뇨병 관리의 광범위한 트렌드에 기인합니다. 특히, 대부분의 GLP-1 치료제가 피하 또는 경구 투여가 용이한 피하 또는 경구제로 제공되기 때문입니다. 이는 환자의 복약 순응도를 향상시키고, 특히 비만과 제2형 당뇨병을 대상으로 한 장기 치료에서 많은 환자들이 자가 투약을 선호하게 됩니다. 비만의 급격한 증가와 예방 의료의 주류화로 인해 가정 환경에서의 GLP-1 사용이 더욱 보편화되어 이 부문 점유율 확대를 주도하고 있습니다.

2024년 미국은 인구통계학적, 의료, 규제, 상업적 요인의 수렴으로 인해 GLP-1 작용제 시장을 장악했습니다. 미국은 전 세계적으로 비만과 제2형 당뇨병 유병률이 가장 높은 국가 중 하나이며, GLP-1 치료 대상 환자층이 크게 확대되고 있습니다. 선진적인 의료 인프라와 의사들의 높은 인식은 새로운 치료법의 신속한 도입을 보장하고, 보험 적용과 보험 상환이 잘 되어 있어 환자들에게 폭넓은 접근성을 보장합니다.

세계의 GLP-1 작용제 시장을 조사했으며, 제품별, 분자별, 유형별, 적응증별, 제형별, 투여 경로별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

- 세계의 GLP-1 작용제 시장 현황

- 북미 : GLP-1 작용제 시장(적응증별·국가별, 2024년)

- GLP-1 작용제 시장(포맷별, 2024년)

- GLP-1 작용제 시장(최종사용자별, 2024년)

- GLP-1 작용제 시장 : 지리적 성장 기회

- 미충족 수요와 화이트 스페이스

- 성장 기회 전략적 분석

- 새로운 비즈니스 모델과 생태계의 변화

- 상호 접속된 시장과 분야 횡단적인 기회

- GLP-1 작용제 생산능력 하이라이트

- 2025-2033년의 주요 의약품 출시 예상

- 지속가능성에 대한 영향과 규제 정책의 대처

제5장 시장 개요

- 소개

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/디스럽션

- 가격 분석

- 업계 동향

- 기술 분석

- 파이프라인 분석

- 테크놀러지/제품 로드맵

- 밸류체인 분석

- 생태계 분석

- Porter's Five Forces 분석

- 규제 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객 상황과 구매 행동

- 투자/자금 조달 시나리오

- 상환 시나리오

- AI/생성형 AI GLP-1 작용제 시장에 대한 영향

- 2025년 트럼프 관세가 GLP-1 작용제 시장에 미치는 영향

제6장 GLP-1 작용제 시장(제품별)

- 소개

- GLP-1 작용제 시장 규모 추정

- 오젠픽

- 톨리시티

- 마운자로

- 위고비

- 리벨서스

- 제프바운드

- 올포그리프론

- 카그리세마

- 사보듀타이드

- 레타톨치드

- 세마글루타이드 바이오시밀러

- 기타 GLP-1 바이오시밀러

- 기타 제품

제7장 GLP-1 작용제 시장(분자별)

- 소개

- 세마글루타이드

- 티르제파타이드

- 듀라글루타이드

- 카글릴린타이드와 세마글루타이드의 복합제

- 올포르글리프론

- 사보듀타이드

- 레타톨타이드

- 기타

제8장 GLP-1 작용제 시장(유형별)

- 소개

- 특허 취득 제품

- 바이오시밀러

제9장 GLP-1 작용제 시장(적응증별)

- 소개

- 당뇨병

- 비만

- 기타

제10장 GLP-1 작용제 시장(제형별)

- 소개

- 일회 투여 형식

- 멀티 도스 포맷

- 오토인젝터

제11장 GLP-1 작용제 시장(투여 경로별)

- 소개

- 피하 투여

- 경구 투여

제12장 GLP-1 작용제 시장(최종사용자별)

- 소개

- 재택 케어 시설 및 피트니스/체중 관리 시설

- 장기간병 시설

- 병원과 전문 클리닉

제13장 GLP-1 작용제 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 중동의 거시경제 전망

- GCC 국가

- 기타

- 아프리카

- 성장을 지지하는 헬스케어와 생명과학 산업의 성장

- 아프리카의 거시경제 전망

제14장 경쟁 구도

- 소개

- 주요 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 주요 기업(파이프라인 제품 있음), 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제15장 기업 개요

- 소개

- 주요 진출 기업

- NOVO NORDISK A/S

- ELI LILLY AND COMPANY

- SANOFI

- HANSOH PHARMACEUTICAL GROUP COMPANY LIMITED

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- INNOVENT

- PEGBIO CO., LTD.

- SCIWIND BIOSCIENCES CO., LTD.

- ZEALAND PHARMA

- STRUCTURE THERAPEUTICS, INC.

- VIKING THERAPEUTICS

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- VTV THERAPEUTICS

- ALTIMMUNE

- AMGEN INC.

- GLENMARK PHARMACEUTICALS LTD.

- BIOCON

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- F. HOFFMANN-LA ROCHE LTD.

- 기타 기업

- TERNS PHARMACEUTICALS, INC.

- METAVIA

- SCOHIA PHARMA, INC.

- REGOR THERAPEUTICS GROUP

- NEURALY INC.

- I2O THERAPEUTICS, INC.

- PFIZER INC.

- HANMI PHARM CO.,LTD.

- JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

- BIOMED INDUSTRIES, INC.

제16장 부록

KSM 25.11.17The GLP-1 agonists market is expected to reach USD 170.75 billion in 2033 from USD 64.42 billion in 2025 at a CAGR of 13.0% during the forecast period. The GLP-1 agonists market has expanded rapidly due to several key drivers. One prominent factor is the growing number of new indication approvals for GLP-1 drugs by regulatory agencies. These approvals extend the uses of GLP-1 agonists beyond initial indications, allowing for treatments in broader patient populations, including newer indications such as cardiovascular conditions, Alzheimer's disease, obstructive sleep apnea, and obesity.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Units Considered | Value (USD billion) |

| Segments | Product, Molecule, Type, Format, Route of administration, Indication, End user |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

The rising prevalence of these chronic conditions globally further supports strong market growth, as more patients require effective therapies for diabetes and obesity. In parallel, GLP-1 agonists offer proven clinical benefits such as improved glycemic control and significant weight reduction, increasing their adoption rates among healthcare providers.

The patented products segment accounted for the largest share of the GLP-1 agonists market by type in 2024.

Based on type, the GLP-1 agonists market is segmented into patented products and biosimilars. In 2024, the patented products accounted for the largest share of the market. As biosimilars are expected to gain adoption post-2026, patented products currently account for the complete market. However, with the semaglutide patent expiring in 2026 onwards, the market for biosimilars is expected to grow significantly thereafter. Patented GLP-1 agonists dominate prescribing patterns due to their robust clinical data, extensive safety profiles, and premium marketing investments. Additionally, the original GLP-1 makers have established broad insurance coverage, ensuring patient access despite high list prices. These factors are expected to support market growth.

By end user, the home-care settings and fitness/ weight management facilities accounted for the largest share in the GLP-1 agonists market in 2024.

Based on end user, the GLP-1 agonists market is segmented into home-care settings and fitness/ weight management facilities, long-term care facilities, and hospitals & specialty clinics. In 2024, the home-care settings and fitness/weight management facilities segment accounted for the largest share of the GLP-1 agonists market. The large share of this end-user segment can be attributed to the evolving patient needs and broader trends in obesity and diabetes management. Home care settings offer convenience and flexible dosing schedules for patients, especially as most GLP-1 therapies are available in easy-to-administer, subcutaneous or oral formats. This increases patient adherence, with many preferring to self-administer medications, particularly for long-term therapies targeting obesity and type 2 diabetes. The spike in obesity prevalence and the mainstreaming of preventive health have also made GLP-1 usage in home environments much more common, driving share growth in this segment.

The US dominated the GLP-1 agonists market in 2024.

In 2024, the US dominated the GLP-1 agonists market due to a convergence of demographic, healthcare, regulatory, and commercial factors. The US has one of the highest prevalence rates globally for both obesity and type 2 diabetes, which significantly expands the patient pool eligible for GLP-1 treatment. Advanced healthcare infrastructure and widespread physician awareness ensure swift adoption of new therapies, while robust insurance coverage and reimbursement help broad patient access.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply-side- 70% and Demand-side 30%

- By Designation: Managers - 45%, CXOs & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe -25%, Asia Pacific -25%, Latin America -5% and the Middle East & Africa- 5%

List of Companies Profiled in the Report:

- Novo Nordisk A/S (Denmark)

- Eli Lilly and Company (US)

- Sanofi (France)

- Hansoh Pharmaceutical Group Co., Ltd. (China)

- Boehringer Ingelheim International GmbH (Germany)

- Innovent (China)

- Sun Pharmaceutical Industries Ltd. (India)

- Pegbio Co. Ltd (China)

- Structure Therapeutics (US)

- Viking Therapeutics (US)

- Amgen Inc. (Switzerland)

- Altimmune (US)

- Glenmark (India)

- Biocon (India)

- Teva Pharmaceuticals (Israel)

- Terns Pharmaceuticals, Inc. (US)

- VTV Therapeutics (US)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Hanmi Pharm Co., Ltd. (South Korea)

- Jiangsu Hengrui Pharmaceuticals Co., Ltd. (China)

- Pfizer Inc. (US)

- MetaVia Inc (US)

- SCOHIA PHARMA, Inc. (Japan)

- Sciwind Biosciences Co., Ltd. (China)

- i2o Therapeutics, Inc. (US)

- Biomed Industries, Inc. (US)

- Neuraly Inc. (US)

Research Coverage

This research report categorizes the GLP-1 agonists market by product (ozempic, wegovy, mounjaro, zepbound, rybelsus, trulicity, orforglipron, cagrisema, survodutide, retatrutide, semaglutide biosimilars, other GLP-1 biosimilars, other products), molecule (Semaglutide, Tirzepatide, Dulaglutide, Cagrilintide semaglutide combination, Orforglipron, Survodutide, Retatrutide, Other molecules), type (patented, biosimilars), format (single-dose, multi-dose, tablets), indication (diabetes, obesity, other indications), route of administration (subcutaneous, oral), end user (home-care settings and fitness/ weight management facilities, long-term care facilities, and hospitals and specialty clinics) and region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa). The report's scope covers detailed information regarding the leading factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the GLP-1 agonists market. A thorough analysis of the key industry players has provided insights into their business overview, products offered, key strategies, collaborations, partnerships, and agreements. Product launches & approvals, expansions, acquisitions, partnerships, product pipelines, collaborations, and agreements are the recent developments associated with the GLP-1 agonists market.

Key Benefits of Buying the Report

The report will help market leaders/new entrants by providing the closest approximations of the revenue numbers for the overall GLP-1 agonists market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business better and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (expanding manufacturing capacity, shift of GLP-1 drugs from diabetes specialty to broader treatment option, growing prevalence of obesity and type 2 diabetes), restraints (stringent cost and payer controls), opportunities (increasing studies on oral GLP-1), and challenges (counterfeits and compounded GLP-1 gray market, safety, tolerability, persistence issues) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on newly approved and launched products of the GLP-1 agonists market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the GLP-1 agonists market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of key players, including Novo Nordisk (Denmark), Eli Lilly (US), and Sanofi (France), among other players. A detailed analysis of the key industry players has been conducted to provide insights into their key strategies, product approvals and launches, acquisitions, partnerships, agreements, collaborations, expansions, recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the GLP-1 agonists market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 SECONDARY DATA & PRIMARY INTERVIEWS

- 2.2.3 SEGMENTAL MARKET SIZE ASSESSMENT

- 2.3 MARKET GROWTH FORECAST

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS

- 3.3 DISRUPTIVE TRENDS SHAPING GLP-1 AGONISTS MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

4 PREMIUM INSIGHTS

- 4.1 GLOBAL GLP-1 AGONISTS MARKET SNAPSHOT

- 4.2 NORTH AMERICA: GLP-1 AGONISTS MARKET, BY INDICATION AND COUNTRY, 2024

- 4.3 GLP-1 AGONISTS MARKET, BY FORMAT, 2024

- 4.4 GLP-1 AGONISTS MARKET, BY END USER, 2024

- 4.5 GLP-1 AGONISTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.6 UNMET NEEDS & WHITE SPACES

- 4.7 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 4.7.1 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 4.8 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFTS

- 4.9 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.10 GLP-1 AGONISTS PRODUCTION CAPACITY HIGHLIGHTS

- 4.11 KEY DRUG LAUNCHES EXPECTED, 2025-2033

- 4.12 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding manufacturing capacities of large pharmaceutical companies

- 5.2.1.2 Shift of GLP-1 drugs from diabetes specialty to broader treatment options

- 5.2.1.3 Rising prevalence of obesity and type-2 diabetes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent cost and payer controls

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing studies on oral GLP-1

- 5.2.4 CHALLENGES

- 5.2.4.1 Counterfeits and compounded GLP-1 gray market

- 5.2.4.2 Safety, tolerability, and persistence issues

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 KEY GLP-1 AGONISTS PIPELINE & EXPECTED LAUNCHES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF GLP-1 AGONIST PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF GLP-1 AGONIST PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF GLP-1 AGONIST PRODUCTS, BY REGION, 2022-2024

- 5.4.4 FACTORS IMPACTING GLP-1 AGONISTS PRICING

- 5.5 INDUSTRY TRENDS

- 5.5.1 SHIFT OF WEEKLY INJECTABLES TOWARD ORALS AND MULTI-AGONISTS

- 5.5.2 VERTICAL INTEGRATION AND CAPACITY SCALE-UP TO MEET DEMAND

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Chemical synthesis

- 5.6.1.2 Recombinant DNA technology

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Peptelligence

- 5.6.2.2 PEGylation and polymer encapsulation

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Hydrogel depot technologies

- 5.6.3.2 Technologies for oral delivery of GLP-1 analogues

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PIPELINE ANALYSIS

- 5.8 TECHNOLOGY/PRODUCT ROADMAP

- 5.9 VALUE CHAIN ANALYSIS

- 5.10 ECOSYSTEM ANALYSIS

- 5.10.1 ROLE IN ECOSYSTEM

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 REGULATORY ANALYSIS

- 5.12.1 REGULATORY LANDSCAPE

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.14.3 ADOPTION BARRIER & INTERNAL FRICTION

- 5.15 INVESTMENT/FUNDING SCENARIO

- 5.16 REIMBURSEMENT SCENARIO

- 5.17 IMPACT OF AI/GEN AI ON GLP-1 AGONISTS MARKET

- 5.17.1 IMPACT AT DEVELOPMENT AND MANUFACTURING STAGES

- 5.17.2 AI USE CASES

- 5.17.3 KEY COMPANIES IMPLEMENTING AI

- 5.17.4 FUTURE OF AI/GEN AI IN GLP-1 AGONIST DRUG DEVELOPMENT ECOSYSTEM

- 5.18 IMPACT OF 2025 TRUMP TARIFF ON GLP-1 AGONISTS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Hospitals & specialty centers

- 5.18.5.2 Long-term care facilities

6 GLP-1 AGONISTS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 GLP-1 AGONISTS VOLUME MARKET ESTIMATION

- 6.3 OZEMPIC

- 6.3.1 ANTICIPATED PATENT EXPIRY OF SEMAGLUTIDE STARTING IN 2026 AND EXPECTED NEW DRUG LAUNCHES TO NEGATIVELY IMPACT MARKET

- 6.4 TRULICITY

- 6.4.1 LOSS OF PATENT EXCLUSIVITY AND HIGH COMPETITIVE PRESSURE TO DISRUPT MARKET GROWTH

- 6.5 MOUNJARO

- 6.5.1 DUAL MECHANISM AS BOTH GIP AND GLP-1 RECEPTOR AGONIST TO PROPEL ADOPTION

- 6.6 WEGOVY

- 6.6.1 INCREASING USE FOR WEIGHT MANAGEMENT TO SUPPORT MARKET GROWTH

- 6.7 RYBELSUS

- 6.7.1 EASE OF ADMINISTRATION TO FUEL ADOPTION AMONG PATIENTS

- 6.8 ZEPBOUND

- 6.8.1 INCREASED FOCUS ON OBESITY MANAGEMENT TO INDICATE HUGE GROWTH POTENTIAL

- 6.9 ORFORGLIPRON

- 6.9.1 ORFORGLIPRON TO GAIN HIGH POTENTIAL DUE TO DEVICE-FREE LOGISTICS AND NO FASTING WINDOW

- 6.10 CAGRISEMA

- 6.10.1 FOCUS ON CHRONIC WEIGHT MANAGEMENT AND TYPE 2 DIABETES TREATMENT TO SPUR MARKET GROWTH

- 6.11 SURVODUTIDE

- 6.11.1 STRONG CLINICAL EFFICACY IN OBESITY AND METABOLIC DISEASE MANAGEMENT TO AID MARKET GROWTH

- 6.12 RETATRUTIDE

- 6.12.1 STRONG WEIGHT-LOSS SIGNALS IN PHASE-2 DIABETES AND GLOBAL PHASE-3 CLINICAL PIPELINE TO DRIVE MARKET

- 6.13 SEMAGLUTIDE BIOSIMILARS

- 6.13.1 HIGH DEMAND FOR AFFORDABLE DIABETES AND OBESITY TREATMENTS TO AID GROWTH

- 6.14 OTHER GLP-1 BIOSIMILARS

- 6.15 OTHER PRODUCTS

7 GLP-1 AGONISTS MARKET, BY MOLECULE

- 7.1 INTRODUCTION

- 7.2 SEMAGLUTIDE

- 7.2.1 PROVEN EFFICACY IN SIGNIFICANT WEIGHT LOSS AND GLYCEMIC CONTROL TO SUPPORT GROWTH

- 7.3 TIRZEPATIDE

- 7.3.1 STRONG EFFECTIVENESS IN OBESITY TREATMENT TO ENHANCE PHYSICIAN CONFIDENCE AND PAYER INTEREST

- 7.4 DULAGLUTIDE

- 7.4.1 USAGE IN PEDIATRIC TYPE 2 DIABETES FOR PATIENTS OVER 10 YEARS OLD TO ENHANCE USAGE IN SPECIALTY SETTINGS

- 7.5 CAGRILINTIDE SEMAGLUTIDE COMBINATION

- 7.5.1 SIGNIFICANT CLINICAL OUTCOMES IN WEIGHT MANAGEMENT TO DRIVE MARKET GROWTH

- 7.6 ORFORGLIPRON

- 7.6.1 NEEDLE-FREE ALTERNATIVE TO INCREASE CONVENIENCE AND SUPPORT ADOPTION AMONG PATIENTS

- 7.7 SURVODUTIDE

- 7.7.1 DUAL GCG/GLP-1 RECEPTOR AGONISM AND FAVORABLE CLINICAL EVIDENCE TO AID GROWTH

- 7.8 RETATRUTIDE

- 7.8.1 TRIPLE-AGONIST APPROACH AND BEST-IN-CLASS WEIGHT MANAGEMENT FOR OBESITY TO SHOW HIGH GROWTH POTENTIAL

- 7.9 OTHER MOLECULES

8 GLP-1 AGONISTS MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 PATENTED PRODUCTS

- 8.2.1 PATENTED GLP-1 BRANDS TO SHIFT FROM WEIGHT LOSS DRUGS TO CARDIOMETABOLIC THERAPIES FOR BETTER ACCESS AND DURABILITY

- 8.3 BIOSIMILARS

- 8.3.1 SEMAGLUTIDE BIOSIMILARS

- 8.3.1.1 Upcoming patent expiry for major drugs in key markets to increase biosimilar adoption

- 8.3.2 OTHER BIOSIMILARS

- 8.3.1 SEMAGLUTIDE BIOSIMILARS

9 GLP-1 AGONISTS MARKET, BY INDICATION

- 9.1 INTRODUCTIONS

- 9.2 DIABETES

- 9.2.1 HIGH DIABETES PREVALENCE TO FUEL MARKET ADOPTION

- 9.3 OBESITY

- 9.3.1 STRONG PIPELINE OF ANTI-OBESITY GLP-1 DRUGS TO DRIVE MARKET

- 9.4 OTHER INDICATIONS

10 GLP-1 AGONISTS MARKET, BY FORMAT

- 10.1 INTRODUCTION

- 10.2 SINGLE-DOSE FORMATS

- 10.2.1 EASE OF ADMINISTRATION, DOSING AMOUNT PRECISION, AND LOW CONTAMINATION RISK TO SUPPORT MARKET GROWTH

- 10.3 MULTI-DOSE FORMATS

- 10.3.1 COST-EFFECTIVENESS AND LOW MEDICAL WASTE GENERATION TO AUGMENT ADOPTION IN HEALTHCARE SETTINGS

- 10.4 AUTOINJECTORS

- 10.4.1 SIMPLIFIED INJECTION PROCESS WITH LOWER HUMAN ERRORS TO SUPPORT ADOPTION

11 GLP-1 AGONISTS MARKET, BY ROUTE OF ADMINISTRATION

- 11.1 INTRODUCTION

- 11.2 SUBCUTANEOUS ADMINISTRATION

- 11.2.1 PEN INJECTORS

- 11.2.1.1 Easy monitoring of volume and dosage strength to support adoption

- 11.2.2 AUTOINJECTORS

- 11.2.2.1 Simplified injection process with lower human errors to support adoption

- 11.2.1 PEN INJECTORS

- 11.3 ORAL ADMINISTRATION

- 11.3.1 ELIMINATION OF NEEDLEPHOBIA AND EASE OF USE TO DRIVE COMPLIANCE

12 GLP-1 AGONISTS MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 HOME CARE SETTINGS AND FITNESS/ WEIGHT MANAGEMENT FACILITIES

- 12.2.1 RISING NUMBER OF TELEHEALTH COMPANIES AND CONVENIENCE OF HOME CARE TO SUPPORT MARKET GROWTH

- 12.3 LONG-TERM CARE FACILITIES

- 12.3.1 GROWING GERIATRIC POPULATION WITH CHRONIC DISEASES TO SUPPORT SEGMENT GROWTH

- 12.4 HOSPITALS & SPECIALTY CLINICS

- 12.4.1 ORGANIZED ENVIRONMENT, PROFESSIONAL OVERSIGHT, AND ABILITY TO HANDLE COMPLEX PATIENT NEEDS TO DRIVE MARKET

13 GLP-1 AGONISTS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 US to dominate North American GLP-1 agonists market during forecast period

- 13.2.3 CANADA

- 13.2.3.1 Favorable funding scenario and presence of strong research infrastructure to support market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Expertise in biotechnology and reputation as leading pharmaceutical manufacturing hub to expedite market growth

- 13.3.3 UK

- 13.3.3.1 Growing R&D initiatives for development of GLP-1 agonists drugs to support market growth

- 13.3.4 FRANCE

- 13.3.4.1 Favorable regulatory scenario and strong research infrastructure to propel market growth

- 13.3.5 ITALY

- 13.3.5.1 Presence of key pharmaceutical & biotechnology companies to boost market growth

- 13.3.6 SPAIN

- 13.3.6.1 High incidence of diabetes and obesity to augment market adoption of GLP-1 therapeutic drugs

- 13.3.7 NETHERLANDS

- 13.3.7.1 Strong focus on pharmaceutical R&D to support market growth

- 13.3.8 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Increasing endorsements of anti-obesity drugs by celebrities to drive market adoption

- 13.4.3 JAPAN

- 13.4.3.1 High diabetic population and favorable regulatory scenario to aid market growth

- 13.4.4 INDIA

- 13.4.4.1 Growing demand for cost-effective and accessible anti-obesity medications to aid market growth

- 13.4.5 AUSTRALIA

- 13.4.5.1 Significant government investment in obesity prevention to fuel market growth

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Increasing strategic collaborations in obesity drugs to propel market growth

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 13.5.2 BRAZIL

- 13.5.2.1 Increasing partnerships with global pharmaceutical companies and rising diabetes cases to drive Brazilian market

- 13.5.3 MEXICO

- 13.5.3.1 Growing diabetes and obesity prevalence to support market growth

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST

- 13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 13.6.2 GCC COUNTRIES

- 13.6.2.1 Kingdom of Saudi Arabia

- 13.6.2.1.1 Pricing oversight of Saudi Food and Drug Authority and strong sales from leading industry players to drive market

- 13.6.2.2 UAE

- 13.6.2.2.1 Growing regulatory approvals for GLP-1 drugs to spur market growth

- 13.6.2.3 Rest of GCC Countries

- 13.6.2.1 Kingdom of Saudi Arabia

- 13.6.3 REST OF MIDDLE EAST

- 13.7 AFRICA

- 13.7.1 GROWING HEALTHCARE AND LIFE SCIENCE INDUSTRY TO SUPPORT GROWTH

- 13.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN GLP-1 AGONISTS MARKET

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS (WITH PRODUCTS IN PIPELINE), 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Format footprint

- 14.6.5.4 Route of administration footprint

- 14.6.5.5 Indication footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Competitive benchmarking of key startups/SMEs

- 14.8 COMPANY VALUATION & FINANCIAL METRICS

- 14.8.1 FINANCIAL METRICS

- 14.8.2 COMPANY VALUATION

- 14.9 BRAND/PRODUCT COMPARISON

- 14.10 COMPETITIVE SCENARIO

- 14.10.1 PRODUCT APPROVALS

- 14.10.2 DEALS

- 14.10.3 EXPANSIONS

- 14.10.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 NOVO NORDISK A/S

- 15.2.1.1 Business overview

- 15.2.1.2 Products offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product approvals

- 15.2.1.3.2 Deals

- 15.2.1.3.3 Expansions

- 15.2.1.3.4 Other developments

- 15.2.1.4 MnM view

- 15.2.1.4.1 Right to win

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses & competitive threats

- 15.2.2 ELI LILLY AND COMPANY

- 15.2.2.1 Business overview

- 15.2.2.2 Products offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Product approvals

- 15.2.2.3.2 Deals

- 15.2.2.3.3 Expansions

- 15.2.2.4 MnM view

- 15.2.2.4.1 Right to win

- 15.2.2.4.2 Strategic choices

- 15.2.2.4.3 Weaknesses & competitive threats

- 15.2.3 SANOFI

- 15.2.3.1 Business overview

- 15.2.3.2 Products offered

- 15.2.3.3 MnM view

- 15.2.3.3.1 Key strengths

- 15.2.3.3.2 Strategic choices

- 15.2.3.3.3 Weaknesses & competitive threats

- 15.2.4 HANSOH PHARMACEUTICAL GROUP COMPANY LIMITED

- 15.2.4.1 Business overview

- 15.2.4.2 Products offered

- 15.2.5 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 15.2.5.1 Business overview

- 15.2.5.2 Products offered (in pipeline)

- 15.2.5.3 Recent developments

- 15.2.5.3.1 Other developments

- 15.2.6 INNOVENT

- 15.2.6.1 Business overview

- 15.2.6.2 Products offered (in pipeline)

- 15.2.6.3 Recent developments

- 15.2.6.3.1 Product approvals

- 15.2.6.3.2 Other developments

- 15.2.7 PEGBIO CO., LTD.

- 15.2.7.1 Business overview

- 15.2.7.2 Products offered (in pipeline)

- 15.2.8 SCIWIND BIOSCIENCES CO., LTD.

- 15.2.8.1 Business overview

- 15.2.8.2 Products offered (in pipeline)

- 15.2.8.3 Recent developments

- 15.2.8.3.1 Deals

- 15.2.8.3.2 Other developments

- 15.2.9 ZEALAND PHARMA

- 15.2.9.1 Business overview

- 15.2.9.2 Products offered (in pipeline)

- 15.2.9.3 Recent developments

- 15.2.9.3.1 Deals

- 15.2.9.3.2 Other developments

- 15.2.10 STRUCTURE THERAPEUTICS, INC.

- 15.2.10.1 Business overview

- 15.2.10.2 Products offered (in pipeline)

- 15.2.10.3 Recent developments

- 15.2.10.3.1 Other developments

- 15.2.11 VIKING THERAPEUTICS

- 15.2.11.1 Business overview

- 15.2.11.2 Products offered (in pipeline)

- 15.2.11.3 Recent developments

- 15.2.11.3.1 Deals

- 15.2.12 SUN PHARMACEUTICAL INDUSTRIES LTD.

- 15.2.12.1 Business overview

- 15.2.12.2 Products offered (in pipeline)

- 15.2.13 VTV THERAPEUTICS

- 15.2.13.1 Business overview

- 15.2.13.2 Products offered (in pipeline)

- 15.2.14 ALTIMMUNE

- 15.2.14.1 Business overview

- 15.2.14.2 Products offered (in pipeline)

- 15.2.14.3 Recent developments

- 15.2.14.3.1 Other developments

- 15.2.15 AMGEN INC.

- 15.2.15.1 Business overview

- 15.2.15.2 Products offered (in pipeline)

- 15.2.16 GLENMARK PHARMACEUTICALS LTD.

- 15.2.16.1 Business overview

- 15.2.16.2 Products offered (in pipeline)

- 15.2.16.3 Recent developments

- 15.2.16.3.1 Product launches

- 15.2.17 BIOCON

- 15.2.17.1 Business overview

- 15.2.17.2 Products offered (in pipeline)

- 15.2.17.3 Recent developments

- 15.2.17.3.1 Product launches and approvals

- 15.2.17.3.2 Deals

- 15.2.18 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 15.2.18.1 Business overview

- 15.2.18.2 Products offered (in pipeline)

- 15.2.18.3 Recent developments

- 15.2.18.3.1 Product launches

- 15.2.19 F. HOFFMANN-LA ROCHE LTD.

- 15.2.19.1 Business overview

- 15.2.19.2 Products offered (in pipeline)

- 15.2.19.3 Recent developments

- 15.2.19.3.1 Deals

- 15.2.1 NOVO NORDISK A/S

- 15.3 OTHER PLAYERS

- 15.3.1 TERNS PHARMACEUTICALS, INC.

- 15.3.2 METAVIA

- 15.3.3 SCOHIA PHARMA, INC.

- 15.3.4 REGOR THERAPEUTICS GROUP

- 15.3.5 NEURALY INC.

- 15.3.6 I2O THERAPEUTICS, INC.

- 15.3.7 PFIZER INC.

- 15.3.8 HANMI PHARM CO.,LTD.

- 15.3.9 JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

- 15.3.10 BIOMED INDUSTRIES, INC.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS