|

시장보고서

상품코드

1859660

고순도 가스 시장 : 유형별, 기능별, 제조 공정별, 저장, 유통, 운송별, 최종 이용 산업별, 지역별 - 예측(-2030년)High Purity Gas Market by Type (High Atmospheric Gas, Noble Gas, Carbon Gas, Other Gases), Storage & Distribution and Transportation, Function, Manufacturing Process, End-use Industry, and Region - Global Forecast to 2030 |

||||||

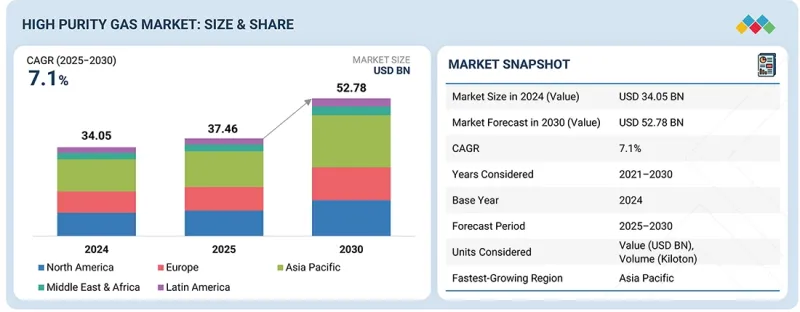

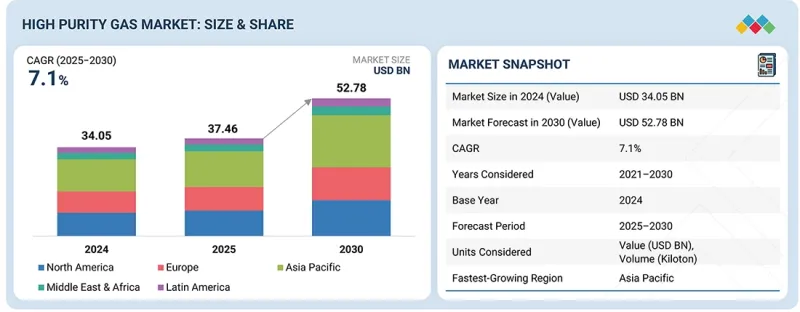

고순도 가스 시장 규모는 2025년에 374억 6,000만 달러로 추정되며, 2025년부터 2030년까지 CAGR은 7.1%로 전망되고, 2030년에는 527억 8,000만 달러에 달할 것으로 예측됩니다.

고순도 가스 시장은 반도체, 전자, 헬스케어 분야의 수요 증가에 힘입어 성장하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액, 킬로톤 |

| 부문별 | 유형별, 기능별, 제조 공정별, 저장, 유통, 운송별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 라틴아메리카, 중동 및 아프리카 |

AI 칩, 전기자동차, 5G 인프라의 발전으로 인한 반도체 제조 제조 부문의 성장은 질소, 아르곤, 수소 등 초순수 가스의 수요를 크게 증가시키고 있습니다. 또한, 제약, 생명공학 분야, 연구소의 분석 기기 사용 증가도 고순도 가스 시장의 성장에 기여하고 있습니다. 또한, 산업 자동화 및 태양광발전과 같은 재생에너지 솔루션에 대한 투자 증가로 인해 전 세계적으로 고순도 가스 솔루션에 대한 수요가 증가하고 있습니다.

저장·유통·운송별로 보면, 2024년 고순도 가스 시장 전체에서 머천트 리퀴드 부문이 2위 점유율을 차지했습니다. 이 부문의 시장은 비용 효율성과 물류 및 조건의 균형에 의해 주도되고 있습니다. 머천트 리퀴드 공급은 경제성이 낮은 벌크 파이프라인 배송과 고비용의 실린더 배송 사이의 상식적인 중간 지점 역할을 하며, 일관된 순도 수준에서 중-대량의 가스를 필요로 하는 산업 분야에 서비스를 제공합니다. 최근 극저온 탱크 구성과 단열 운송 시스템의 발전으로 장거리 액체 가스 운송의 안전성과 효율성이 향상되고 있습니다. 확장 가능한 배송 능력은 전용 파이프라인에 대한 투자 없이도 반도체, 화학, 헬스케어 분야의 여러 고객에게 가스를 배송할 수 있다는 분명한 이점을 공급업체에 제공합니다. 따라서 상업용 액체 가스는 모든 지역과 분산형 접근 방식에 적합한 선택이 될 수 있습니다.

반도체, 평판 디스플레이, 제약 등 환원 분위기 및 캐리어 가스 용도로 초순수소를 필요로 하는 다양한 산업에서 초순수소를 대규모로 사용함에 따라 2024년에는 수소 제조 공정이 고순도 가스 시장에서 두 번째로 큰 부문을 차지할 것으로 전망하고 있습니다. 친환경 수소와 청정 정제 공정에 대한 투자가 증가함에 따라 필요한 전자제품용 수소를 생산하는 정제 기술에 대한 수요도 증가하고 있습니다. 연료전지나 에너지 저장과 같은 새로운 용도의 수소 활용 확대도 PSA와 멤브레인을 통한 고순도 수소 생산 수요에 기여했습니다. 수소의 확립된 산업적 활용과 현재의 새로운 에너지 기반 기회는 수소에 강력한 시장 지위를 부여하고 있습니다.

2024년 북미는 세계 고순도 가스 시장에서 두 번째 점유율을 차지했습니다. 이 지역의 시장은 강력한 반도체 제조, 첨단 의료 시스템의 존재, 정교한 연구 생태계에 의해 주도되고 있습니다. 최근 미국의 CHIPS 및 과학법으로 대표되는 칩 제조에 대한 투자가 증가하면서 질소, 아르곤, 수소 등 초순수 가스에 대한 수요가 증가하고 있습니다. 또한, 많은 대형 제약회사와 생명공학 회사들은 이 지역의 고순도 가스 제조회사들의 존재로부터 혜택을 받고 있으며, 생명과학 및 재료 설계 분야에서도 연구개발의 중요성이 커지고 있습니다. 북미의 강력한 고순도 가스 시장 점유율은 잘 구축된 유통망, 정제 시스템의 발전, 엄격한 품질 기준에 의해 뒷받침됩니다.

세계의 고순도 가스 시장에 대해 조사했으며, 종류별, 기능별, 제조 공정별, 저장, 유통, 운송별, 최종 이용 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 기술 분석

- AI/생성형 AI가 고순도 가스 시장에 미치는 영향

- 특허 분석

- 규제 상황

- 주요 회의와 이벤트

- 사례 연구 분석

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 투자와 자금 조달 시나리오

- 2025년 미국 관세의 영향 - 고순도 가스 시장

제6장 고순도 가스 시장(유형별)

- 소개

- 고기압 가스

- 희가스

- 탄소 가스

- 기타

제7장 고순도 가스 시장(기능별)

- 소개

- 절연

- 조명

- 냉각제

제8장 고순도 가스 시장(제조 공정별)

- 소개

- 공기 분리

- 수소 제조

제9장 고순도 가스 시장(저장, 유통, 운송별)

- 소개

- 봄베/패키지 가스

- 머천트 리퀴드

- 톤수

제10장 고순도 가스 시장(최종 이용 산업별)

- 소개

- 일렉트로닉스

- 금속 생산

- 화학제품

- 석유 및 가스

- 의료·헬스케어

- 식품 및 음료

- 기타

제11장 고순도 가스 시장(지역별)

- 소개

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제12장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제13장 기업 개요

- 주요 진출 기업

- LINDE PLC

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- MESSER SE & CO. KGAA

- NIPPON SANSO HOLDINGS CORPORATION

- IWATANI CORPORATION

- DAIGAS GROUP

- SOL SPA

- INGAS

- GRUPPO SIAD

- RESONAC HOLDINGS CORPORATION

- AKELA-N

- 기타 기업

- ALCHEMIE GASES & CHEMICALS PVT. LTD.

- BHURUKA GASES LIMITED

- CHEMIX SPECIALTY GASES AND EQUIPMENT

- ULTRA PURE GASES(I) PVT. LTD.

- COREGAS

- SERALGAZ

- PURITYPLUS

- WOIKOSKI OY

- SPECIALTY GASES COMPANY LIMITED

- MESA SPECIALTY GASES & EQUIPMENT

- QINGDAO BAIGONG INDUSTRIAL AND TRADING CO., LTD.

- AGT INTERNATIONAL

- AMERICAN WELDING AND GAS

제14장 부록

KSM 25.11.17The high purity gas market is estimated at USD 37.46 billion in 2025 and is projected to reach USD 52.78 billion by 2030, at a CAGR of 7.1% from 2025 to 2030. The market for high purity gas is propelled by the rising demand from the semiconductor, electronics, and healthcare sectors due to the critical need for precision and contamination-free environments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value, Volume (Kiloton) |

| Segments | By Type, Storage & Distribution and Transportation, Function, Manufacturing Process, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

The growth of the semiconductor production manufacturing sector, driven by advancements in AI chips, electric vehicles, and 5G infrastructure, is significantly boosting the demand for ultra-high purity gases such as nitrogen, argon, and hydrogen. The increasing use of analytical instruments in the pharmaceuticals, biotechnology sectors, and research laboratories is also contributing to the growth of the high purity gas market. Further, the increasing investments in industrial automation and renewable energy solutions like photovoltaics are also increasing the demand for high purity gas solutions globally.

"The merchant liquid segment accounted for the second-largest share of the overall high purity gas market in 2024."

Based on storage & transportation and distribution, the merchant liquid segment captured the second-largest share of the overall high purity gas market in 2024. The market in this segment is driven by its cost-effectiveness and logistical-conditional balance. Merchant liquid supply acts as a common-sense middle point between less economical bulk pipeline deliveries and high-cost cylinder deliverables, serving industries demanding medium to large gas volumes at consistent purity levels. Recent advancements in cryogenic tank configurations and insulated transportation systems have enhanced the safety and efficiency of long-distance liquid gas deliveries. Its scalable delivery capabilities offer suppliers distinct advantages of delivering gas to multiple customers across the semiconductors, chemicals, and healthcare sectors, all without the requirement for investment in a dedicated pipeline. As such, merchant liquid gas continues to be a suitable option for all regions and decentralized approaches.

"The hydrogen production manufacturing process accounted for the second-largest share of the high purity gas market in 2024."

In 2024, the hydrogen production process was the second-largest segment of the high purity gas market, owing to the continued large-scale use in a variety of industries, such as semiconductors, flat panel displays, and pharmaceuticals, that require ultra-high purity hydrogen for reducing atmospheres and carrier gas applications. Increasing investment in green hydrogen and a cleaner refining process has also created more demand for purification technologies to produce the necessary electronic-grade hydrogen. Hydrogen's growing utilization in new applications like fuel cells and energy storage also contributed to demand for high purity hydrogen production via PSA and membranes. Hydrogen's established industrial usage, and now new energy-based opportunities, have provided hydrogen with a strong market position.

"North America accounted for the second-largest share of the global high purity gas market in 2024."

In 2024, North America accounted for the second-largest share in the global high purity gas market. The market in the region is driven by the strong semiconductor manufacturing, presence of advanced healthcare system, and sophisticated research ecosystem. Recently, growing investments in chip fabrication, exemplified by the U.S. CHIPS and Science Act, have created increased demand for ultra-high purity gases such as nitrogen, argon, and hydrogen. Additionally, a number of major pharmaceutical and biotechnology companies benefit from the presence of high purity gas manufacturing companies in the region, where R&D is also becoming more important across the life sciences and materials design. North America's strong high purity gas market share is supported by established distribution networks, advancements in purification systems, and strict quality standards.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 15%, Europe - 50%, Asia Pacific - 20%, Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Linde Plc (Ireland), Air Liquide (France), Air Products and Chemicals, Inc. (US), Iwatani Corporation (Japan), Messer SE & Co. KGaA (Germany), Daigas Group (Japan), Nippon Sanso Holdings Corporation (Mitsubishi Chemical Group Corporation, Japan), SOL Spa (Italy), Ingas (Ukraine), Gruppo SIAD (Italy), and Resonac Holdings Corporation (Japan).

Research Coverage

This research report categorizes the high purity gas market by type (high atmospheric gas, noble gas, carbon gas and other gases), by storage & distribution and transportation (cylinders/packaged gas, merchant liquid, tonnage), by manufacturing process (air separation technology, hydrogen production), by function (insulation, illumination, coolant), end-use industry (electronics, metal production, chemicals, oil & gas, medical & healthcare, food & beverages, and other end-use industries), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the high purity gas market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the high purity gas market. This report includes a competitive analysis of upcoming startups in the high purity gas market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall high purity gas market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for solar photovoltaic panels, increasing demand from electronics industry), restraints (High cost of gas processing, Stringent regulatory environment), opportunities (Growing demand from chemical and automotive industries, rising applications in medical and pharmaceutical sectors), and challenges (Technological disruptions, production and supply chain complexities) influencing the growth of the high purity gas market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the high purity gas market

- Market Development: Comprehensive information about lucrative markets-the report analyses the high purity gas market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the high purity gas market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Linde Plc (Ireland), Air Liquide (France), Air Products and Chemicals, Inc. (US), Iwatani Corporation (Japan), Messer SE & Co. KGaA (Germany), Daigas Group (Japan), Nippon Sanso Holdings Corporation (Mitsubishi Chemical Group Corporation, Japan), SOL Spa (Italy), Ingas (Ukraine), Gruppo SIAD (Italy), Resonac Holdings Corporation (Japan), Alchemie Gases & Chemicals Pvt. Ltd. (India), Bhuruka Gases Limited (India), Chemix Specialty Gases and Equipment (India), Ultra Pure Gases (I) Pvt. Ltd. (India), Coregas (Australia), Seralgaz (Turkey), PurityPlus (US), Woikoski Oy (Finland), Specialty Gases Company Limited (Saudi Arabia), American Welding and Gas (US), and Qingdao Baigong Industrial and Trading Co., Ltd. (China)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HIGH PURITY GAS MARKET

- 4.2 HIGH PURITY GAS MARKET, BY TYPE AND REGION

- 4.3 HIGH PURITY GAS MARKET, BY STORAGE & DISTRIBUTION AND TRANSPORTATION

- 4.4 HIGH PURITY GAS MARKET, BY MANUFACTURING PROCESS

- 4.5 HIGH PURITY GAS MARKET, BY FUNCTION

- 4.6 HIGH PURITY GAS MARKET, BY END-USE INDUSTRY

- 4.7 HIGH PURITY GAS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for solar photovoltaic panels

- 5.2.1.2 Increasing demand from electronics industry

- 5.2.1.3 Urbanization and increased disposable income

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of gas processing

- 5.2.2.2 Stringent regulatory environment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand from chemical and automotive industries

- 5.2.3.2 Rising applications in medical and pharmaceutical sector

- 5.2.3.3 Focus on sustainability

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological disruptions

- 5.2.4.2 Production and supply chain complexities

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 INTRODUCTION

- 5.5.2 GDP TRENDS AND FORECAST

- 5.5.3 TRENDS IN GLOBAL ELECTRONICS INDUSTRY

- 5.5.4 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.5.5 TRENDS IN GLOBAL METAL PRODUCTION INDUSTRY

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- 5.8.2 AVERAGE SELLING PRICE, BY REGION

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 2804)

- 5.9.2 EXPORT SCENARIO (HS CODE 2804)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Air separation process

- 5.10.1.2 Hydrogen production

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Alkaline electrolysis

- 5.10.2.2 Proton exchange membrane electrolysis

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Demineralization

- 5.10.1 KEY TECHNOLOGIES

- 5.11 IMPACT OF AI/GEN AI ON HIGH PURITY GAS MARKET

- 5.11.1 TOP USE CASES AND MARKET POTENTIAL

- 5.11.2 BEST PRACTICES IN OIL & GAS MARKET

- 5.11.3 CASE STUDIES OF AI IMPLEMENTATION IN HIGH PURITY GAS MARKET

- 5.11.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.11.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN HIGH PURITY GAS MARKET

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPE

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS OF PATENTS

- 5.12.6 JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANTS

- 5.12.8 LIST OF PATENTS BY CHINA PETROCHEMICAL CORPORATION

- 5.12.9 LIST OF PATENTS BY INSTITUTE OF PROCESS ENGINEERING

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 IWATANI CORPORATION BEGAN STUDY ON GREEN HYDROGEN PRODUCTION

- 5.15.2 AIR LIQUIDE AND GROUPE ADP PARTNERED TO CREATE HYDROGEN AIRPORT

- 5.15.3 MESSER SE & CO KGAA EXPANDED PRODUCTION CAPACITY IN BRAZIL

- 5.16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF - HIGH PURITY GAS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 HIGH PURITY GAS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 HIGH ATMOSPHERIC GAS

- 6.2.1 INCREASING DEMAND FROM ELECTRONICS AND METAL PRODUCTION INDUSTRIES TO FUEL SEGMENT GROWTH

- 6.3 NOBLE GAS

- 6.3.1 INCREASED USE IN GAS CHROMATOGRAPHY & METAL PRODUCTION TO PROPEL MARKET

- 6.4 CARBON GAS

- 6.4.1 RAPIDLY GROWING FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

- 6.5 OTHER TYPES OF GAS

7 HIGH PURITY GAS MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- 7.2 INSULATION

- 7.2.1 INCREASING DEMAND FROM ELECTRONICS AND ELECTRICAL INDUSTRIES TO DRIVE MARKET

- 7.3 ILLUMINATION

- 7.3.1 GROWING DEMAND FOR LIGHTING TO PROPEL MARKET

- 7.4 COOLANT

- 7.4.1 RAPIDLY GROWING FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

8 HIGH PURITY GAS MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 AIR SEPARATION

- 8.2.1 AVAILABILITY OF UHP GASES TO DRIVE MARKET

- 8.3 HYDROGEN PRODUCTION

- 8.3.1 EFFICIENT ON-SITE PRODUCTION TO PROPEL DEMAND

9 HIGH PURITY GAS MARKET, BY STORAGE & DISTRIBUTION AND TRANSPORTATION

- 9.1 INTRODUCTION

- 9.2 CYLINDERS/PACKAGED GAS

- 9.2.1 INCREASING DOMESTIC DELIVERY OF HIGH PURITY GAS TO DRIVE GROWTH

- 9.3 MERCHANT LIQUID

- 9.3.1 DEMAND FROM METAL PRODUCTION INDUSTRY TO PROPEL MARKET

- 9.4 TONNAGE

- 9.4.1 RAPIDLY GROWING ELECTRONICS INDUSTRY TO SUPPORT MARKET GROWTH

10 HIGH PURITY GAS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 ELECTRONICS

- 10.2.1 TECHNOLOGICAL ADVANCEMENTS AND INTEGRATION OF AI TO DRIVE MARKET

- 10.3 METAL PRODUCTION

- 10.3.1 GROWING DEMAND FOR STEEL TO PROPEL MARKET

- 10.4 CHEMICALS

- 10.4.1 FAVORABLE GOVERNMENT POLICIES, INCENTIVES, & INITIATIVES TO PROPEL MARKET

- 10.5 OIL & GAS

- 10.5.1 INCREASING USE IN PETROCHEMICAL INDUSTRY TO DRIVE MARKET

- 10.6 MEDICAL & HEALTHCARE

- 10.6.1 ADVANCEMENTS IN PHARMACEUTICAL SECTOR TO SUPPORT MARKET GROWTH

- 10.7 FOOD & BEVERAGE

- 10.7.1 CHANGING CONSUMER PREFERENCES AND RISING DISPOSABLE INCOME TO DRIVE MARKET

- 10.8 OTHER END-USE INDUSTRIES

11 HIGH PURITY GAS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: HIGH PURITY GAS MARKET, BY TYPE

- 11.2.2 NORTH AMERICA: HIGH PURITY GAS MARKET, BY STORAGE & DISTRIBUTION AND TRANSPORTATION

- 11.2.3 NORTH AMERICA: HIGH PURITY GAS MARKET, BY MANUFACTURING PROCESS

- 11.2.4 NORTH AMERICA: HIGH PURITY GAS MARKET, BY FUNCTION

- 11.2.5 NORTH AMERICA: HIGH PURITY GAS MARKET, BY END-USE INDUSTRY

- 11.2.6 NORTH AMERICA: HIGH PURITY GAS MARKET, BY COUNTRY

- 11.2.7 US

- 11.2.7.1 Growing demand for purity gas in semiconductor industry to drive market

- 11.2.8 CANADA

- 11.2.8.1 Advancements in technologies to propel market

- 11.3 EUROPE

- 11.3.1 EUROPE: HIGH PURITY GAS MARKET, BY TYPE

- 11.3.2 EUROPE: HIGH PURITY GAS MARKET, BY STORAGE & DISTRIBUTION AND TRANSPORTATION

- 11.3.3 EUROPE: HIGH PURITY GAS MARKET, BY MANUFACTURING PROCESS

- 11.3.4 EUROPE: HIGH PURITY GAS MARKET, BY FUNCTION

- 11.3.5 EUROPE: HIGH PURITY GAS MARKET, BY END-USE INDUSTRY

- 11.3.6 ITALY

- 11.3.6.1 Heavy reliance on chemical manufacturing of high purity gas to drive market

- 11.3.7 GERMANY

- 11.3.7.1 Commitment to sustainability and energy policies to propel market growth

- 11.3.8 RUSSIA

- 11.3.8.1 Increasing research activities to support market growth

- 11.3.9 FRANCE

- 11.3.9.1 Investments in decarbonization initiatives to propel market

- 11.3.10 UKRAINE

- 11.3.10.1 World's largest supplier of noble gas-key factor driving market growth

- 11.3.11 UK

- 11.3.11.1 Presence of major players to support market growth

- 11.3.12 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: HIGH PURITY GAS MARKET, BY TYPE

- 11.4.2 ASIA PACIFIC: HIGH PURITY GAS MARKET, BY STORAGE & DISTRIBUTION AND TRANSPORTATION

- 11.4.3 ASIA PACIFIC: HIGH PURITY GAS MARKET, BY MANUFACTURING PROCESS

- 11.4.4 ASIA PACIFIC: HIGH PURITY GAS MARKET, BY FUNCTION

- 11.4.5 ASIA PACIFIC: HIGH PURITY GAS MARKET, BY END-USE INDUSTRY

- 11.4.6 CHINA

- 11.4.6.1 Presence of major electronics manufacturers to propel market

- 11.4.7 JAPAN

- 11.4.7.1 Presence of major automakers to drive growth

- 11.4.8 INDIA

- 11.4.8.1 Growing aging population and medical & healthcare sector to propel market

- 11.4.9 AUSTRALIA

- 11.4.9.1 Growing oil & gas sector to drive market

- 11.4.10 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MEXICO

- 11.5.1.1 Increasing government investments to support market growth

- 11.5.2 BRAZIL

- 11.5.2.1 Increasing government initiatives and regulatory frameworks to propel market

- 11.5.3 REST OF LATIN AMERICA

- 11.5.1 MEXICO

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MIDDLE EAST & AFRICA: HIGH PURITY GAS MARKET, BY TYPE

- 11.6.2 MIDDLE EAST & AFRICA: HIGH PURITY GAS MARKET, BY STORAGE & DISTRIBUTION AND TRANSPORTATION

- 11.6.3 MIDDLE EAST & AFRICA: HIGH PURITY GAS MARKET, BY MANUFACTURING PROCESS

- 11.6.4 MIDDLE EAST & AFRICA: HIGH PURITY GAS MARKET, BY FUNCTION

- 11.6.5 MIDDLE EAST & AFRICA: HIGH PURITY GAS MARKET, BY END-USE INDUSTRY

- 11.6.6 MIDDLE EAST & AFRICA: HIGH PURITY GAS MARKET, BY COUNTRY

- 11.6.7 GCC COUNTRIES

- 11.6.7.1 UAE

- 11.6.7.1.1 Promotion of clean technologies and reduction of carbon emissions to propel market

- 11.6.7.2 Saudi Arabia

- 11.6.7.2.1 Mega infrastructure projects to drive market

- 11.6.7.3 Rest of GCC Countries

- 11.6.7.1 UAE

- 11.6.8 SOUTH AFRICA

- 11.6.8.1 Gas infrastructure development to drive market

- 11.6.9 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.5.1 PURE GASES

- 12.5.2 ALPHAGAZ

- 12.5.3 ULTRA-HIGH PURITY GASES

- 12.5.4 HIGH PURITY GASES

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Type footprint

- 12.6.5.4 Storage & distribution and transportation footprint

- 12.6.5.5 Manufacturing process footprint

- 12.6.5.6 Function footprint

- 12.6.5.7 End-use industry footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMES

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 LINDE PLC

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 AIR LIQUIDE

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 AIR PRODUCTS AND CHEMICALS, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 MESSER SE & CO. KGAA

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 NIPPON SANSO HOLDINGS CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 IWATANI CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansions

- 13.1.7 DAIGAS GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 SOL SPA

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.9 INGAS

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 GRUPPO SIAD

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Expansions

- 13.1.11 RESONAC HOLDINGS CORPORATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 AKELA-N

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.1 LINDE PLC

- 13.2 OTHER PLAYERS

- 13.2.1 ALCHEMIE GASES & CHEMICALS PVT. LTD.

- 13.2.2 BHURUKA GASES LIMITED

- 13.2.3 CHEMIX SPECIALTY GASES AND EQUIPMENT

- 13.2.4 ULTRA PURE GASES (I) PVT. LTD.

- 13.2.5 COREGAS

- 13.2.6 SERALGAZ

- 13.2.7 PURITYPLUS

- 13.2.8 WOIKOSKI OY

- 13.2.9 SPECIALTY GASES COMPANY LIMITED

- 13.2.10 MESA SPECIALTY GASES & EQUIPMENT

- 13.2.11 QINGDAO BAIGONG INDUSTRIAL AND TRADING CO., LTD.

- 13.2.12 AGT INTERNATIONAL

- 13.2.13 AMERICAN WELDING AND GAS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS