|

시장보고서

상품코드

1861049

알루미늄 납땜 시장 : 제품 태국별, 제품 형태별, 최종 이용 산업별, 지역별 - 예측(-2032년)Aluminum Brazing Market by Product Type, Product Form, End-use Industry, and Region - Global Forecast to 2032 |

||||||

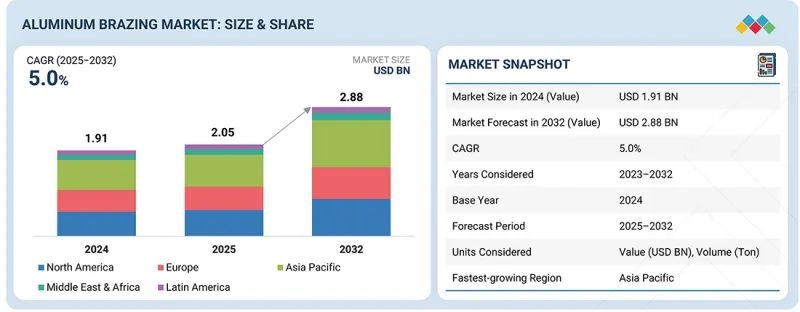

알루미늄 납땜 시장 규모는 2025년에 20억 5,000만 달러에서 2025년부터 2032년까지 연평균 복합 성장률(CAGR) 5.0%로 성장하여 2032년에는 28억 8,000만 달러에 이를 것으로 예측됩니다.

제품 유형별로는 알루미늄-아연 합금 부문이 전체 알루미늄 브레이징 시장에서 3번째로 높은 점유율을 차지하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2023-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 검토 단위 | 금액(100만 달러) 및 톤(Ton) |

| 부문 | 제품 태국별, 제품 형태별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

이 합금은 우수한 습윤성, 낮은 융점, 우수한 내식성을 제공하여 HVACR, 자동차 열교환기, 전자 응용 분야에서 고강도, 누수 없는 접합부를 제조하는 데 중요한 역할을 합니다. 또한, 알루미늄 기판과의 상용성은 갈바닉 부식을 최소화하여 CAB 방식과 같은 대량 생산 공정에 이상적입니다. 이 합금은 효율적인 유동성과 강력한 접합 일체성으로 비용 효율적인 제조를 지원합니다.

알루미늄 브레이징 시장의 와이어 부문은 효율성과 열 관리가 중요한 경량 자동차 및 HVAC 응용 분야에서 사용이 증가함에 따라 두 번째로 높은 CAGR을 보일 것으로 예측됩니다. 자동차 업계에서는 연비 향상과 배기가스 배출량 감소를 위한 경량 차량으로의 전환이 알루미늄 브레이징 와이어에 대한 수요를 견인하고 있습니다. 정밀 브레이징 제어를 위한 자동화 및 AI를 포함한 제조 기술의 발전은 생산 효율과 접합 품질을 향상시켜 성장을 더욱 촉진하고 있습니다. 또한, 지속가능성과 에너지 효율성이 높은 시스템에 대한 관심이 높아지면서 알루미늄 브레이징 와이어가 여러 산업 분야에서 선호되는 접합 재료로 채택되고 있습니다.

전기 및 전자 분야의 알루미늄 브레이징 시장은 예측 기간 동안 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 이 최종 용도 분야 시장을 주도하는 것은 전자 어셈블리에서 가볍고 내구성이 뛰어나며 부식에 강한 부품에 대한 수요가 증가하고 있기 때문입니다. 전자기기의 소형화와 냉각 시스템 및 회로 부품의 정밀하고 신뢰할 수 있는 조인트에 대한 요구가 이러한 성장을 가속하고 있습니다. 알루미늄 브레이징 기술의 발전은 전자제품 제조에서 브레이징의 품질과 효율성을 향상시켜 시장 확대를 더욱 촉진할 것으로 예측됩니다. 이 분야의 지속적인 기술 혁신과 가전 및 통신 분야의 생산량 증가도 수요 증가에 기여하고 있습니다.

유럽은 자동차, 산업, 항공우주 및 방위 분야의 큰 수요로 인해 알루미늄 브레이징 시장에서 세 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 시장 성장을 뒷받침하는 것은 이산화탄소 배출량을 줄이기 위해 에너지 효율이 높은 경량 소재를 장려하는 유럽 그린딜 등 EU의 엄격한 환경 규제입니다. 전기자동차, 재생에너지 프로젝트, 첨단 제조기술에 대한 투자는 수요를 더욱 자극할 것입니다. 독일, 프랑스, 이탈리아, 영국 및 기타 국가에서는 정부의 장려책과 지속 가능한 생산 방식에 대한 관심이 다양한 산업 분야에서 알루미늄 브레이징 합금 및 플럭스 채택을 촉진하고 있습니다.

세계의 알루미늄 브레이징 시장에 대해 조사했으며, 제품 유형별, 제품 형태별, 최종 이용 산업별, 지역별 동향, 시장 진출 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 가격 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 무역 분석

- 기술 분석

- 특허 분석

- 규제 상황

- 2025-2027년 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 생성형 AI/AI가 알루미늄 납땜 시장에 미치는 영향

- 투자 및 자금조달 시나리오

- 미국 관세의 영향 - 알루미늄 납땜 시장

제6장 알루미늄 납땜 시장(제품 유형별)

- 서론

- 알루미늄 실리콘 합금

- 알루미늄 아연 합금

- 알루미늄 구리 합금

- 알루미늄 마그네슘 합금

- 기타

제7장 알루미늄 납땜 시장(제품 형태별)

- 서론

- 시트

- 페이스트

- 와이어

- 로드

- 기타

제8장 알루미늄 납땜 시장(최종 이용 산업별)

- 서론

- 자동차

- 항공우주 및 방위

- 산업용

- 전기 및 전자 공학

- 기타

제9장 알루미늄 납땜 시장(지역별)

- 서론

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

- 라틴아메리카

제10장 경쟁 구도

- 도입

- 주요 시장 진출기업의 전략/강점, 2020년-2025년

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제11장 기업 개요

- 주요 시장 진출기업

- SOLVAY

- HONEYWELL INTERNATIONAL INC.

- LUCAS-MILHAUPT LLC

- HARRIS PRODUCTS GROUP(THE LINCOLN ELECTRIC COMPANY)

- SUNKWANG AMPA

- PRINCE & IZANT COMPANY

- NIHON SUPERIOR CO., LTD.

- AIMTEK, INC.

- ZHEJIANG YATONG NEW MATERIALS CO., LTD.

- VBC GROUP

- INDIAN SOLDER AND BRAZE ALLOYS PVT. LTD.

- SENTES-BIR A.S.

- STELLA S.R.L.

- PIETRO GALLIANI BRAZING S.P.A.

- HANGZHOU HUAGUANG ADVANCED WELDING MATERIALS CO., LTD.

- HEBEI YUGUANG WELDING CO., LTD

- CASTOLIN EUTECTIC

- 기타 기업

- ZHONGSHAN HUALE WEIDING COMPOUND CO., LTD.

- MATHURE METAL WORKS PVT. LTD.

- KINZOKU YOUZAI CO., LTD.

- NAVIKA SILVER BRAZING ALLOYS

- BRAZING TECHNOLOGIES, INC.

- LINBRAZE S.R.L.

- SELECTARC GROUP

- SALDFLUX SRL

- SANHUAN MATERIALS

- SALDOBRASE SRL

제12장 부록

LSH 25.11.18The aluminum brazing market is estimated to be USD 2.05 billion in 2025 and is projected to reach USD 2.88 billion by 2032, at a CAGR of 5.0% from 2025 to 2032. Based on product type, the aluminum-zinc alloys segment accounted for the third-largest share of the overall aluminum brazing market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | Product Type, Product Form, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

These alloys offer superior wettability, lower melting points, and excellent corrosion resistance, which are critical for producing high-strength, leak-proof joints in HVACR, automotive heat exchangers, and electronics applications. Their compatibility with aluminum base materials also minimizes galvanic corrosion, making them ideal for large-volume production processes such as controlled atmosphere brazing (CAB). These alloys support cost-effective manufacturing due to their efficient flow and strong joint integrity.

"The wires segment is projected to be the second-fastest-growing segment during the forecast period."

The wires segment of the aluminum brazing market is projected to witness the second-highest CAGR due to their increasing use in lightweight automotive and HVAC applications, where efficiency and thermal management are critical. The automotive industry's shift toward lightweight vehicles to improve fuel efficiency and reduce emissions drives strong demand for aluminum brazing wires. Advancements in manufacturing technologies, including automation and AI for precise brazing control, enhance production efficiency and joint quality, further propelling growth. The growing emphasis on sustainability and energy-efficient systems also supports the adoption of aluminum brazing wires as preferred joining materials in multiple industrial sectors.

"The electrical & electronics segment is projected to register the second-highest growth rate during the forecast period."

The aluminum brazing market in the electrical & electronics segment is projected to register the second-highest CAGR during the forecast period. The market in this end-use segment is driven by the rising demand for lightweight, durable, and corrosion-resistant components in electronic assemblies. The miniaturization of electronic devices and the need for precise, reliable joints in cooling systems and circuit components drive this growth. Growing advancements in aluminum brazing technologies are projected to enhance the quality and efficiency of brazing in electronics manufacturing, further propelling market expansion. The sector's continuous innovation and increasing production volumes in consumer electronics and telecommunications also contribute to the strong demand.

"Europe is projected to register the third-highest CAGR in the aluminum brazing market during the forecast period."

Europe is projected to register the third-highest CAGR in the aluminum brazing market due to the significant demand from the automotive, industrial, and aerospace & defense sectors. The market growth is supported by stringent environmental regulations in the EU, such as the European Green Deal, which promotes energy-efficient and lightweight materials to reduce carbon emissions. Investments in electric vehicles, renewable energy projects, and advanced manufacturing technologies further stimulate demand. Government incentives and a focus on sustainable production methods drive the adoption of aluminum brazing alloys and flux across various industries in countries like Germany, France, Italy, and the UK.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 50%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Solvay (Belgium), Honeywell International Inc. (US), Lucas-Milhaupt LLC (US), Harris Products Group (The Lincoln Electric Company) (US), Sunkwang AMPA (South Korea), Prince & Izant Company (US), Nihon Superior Co., Ltd. (Japan), Aimtek, Inc. (US), Zhejiang Yatong New Materials Co., Ltd. (China), VBC Group (UK), Indian Solder and Braze Alloys Pvt. Ltd. (India), Sentes-BIR A.S. (Turkey), Stella S.r.l. (Italy), Pietro Galliani Brazing S.p.A. (Italy), Hangzhou Huaguang Advanced Welding Materials Co., Ltd. (China), Hebei Yuguang Welding Co., Ltd. (China), and Castolin Eutectic (Germany).

Research Coverage

This research report categorizes the aluminum brazing market by product type (aluminum-silicon alloys, aluminum-zinc alloys, aluminum-copper alloys, aluminum-magnesium alloys, other aluminum alloys), product form (sheet, paste, wires, rods, other product forms), end-use industry (automotive, aerospace & defense, industrial, electrical & electronics, other end-use industries), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the aluminum brazing market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the aluminum brazing market. This report includes a competitive analysis of upcoming startups in the aluminum brazing market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aluminum brazing market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for aluminum brazing in electric vehicles), restraints (Oxide layer barrier in aluminum brazing), opportunities (Growing adoption in renewable energy projects), and challenges (Volatility in raw material prices) influencing the growth of the aluminum brazing market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the aluminum brazing market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the aluminum brazing market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the aluminum brazing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Solvay (Belgium), Honeywell International Inc. (US), Lucas-Milhaupt LLC (US), Harris Products Group (The Lincoln Electric Company) (US), Sunkwang AMPA (South Korea), Prince & Izant Company (US), Nihon Superior Co., Ltd. (Japan), Aimtek, Inc. (US), Zhejiang Yatong New Materials Co., Ltd. (China), VBC Group (UK), Indian Solder and Braze Alloys Pvt. Ltd. (India), Sentes-BIR A.S. (Turkey), Stella S.r.l. (Italy), Pietro Galliani Brazing S.p.A. (Italy), Hangzhou Huaguang Advanced Welding Materials Co., Ltd. (China), Hebei Yuguang Welding Co., Ltd. (China), and Castolin Eutectic (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: DEMAND-SIDE ANALYSIS

- 2.3.2 APPROACH 2: SUPPLY-SIDE ANALYSIS

- 2.4 FORECAST NUMBER CALCULATION

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM BRAZING MARKET

- 4.2 ALUMINUM BRAZING MARKET, BY PRODUCT FORM AND REGION

- 4.3 ALUMINUM BRAZING MARKET, BY PRODUCT TYPE

- 4.4 ALUMINUM BRAZING MARKET, BY END-USE INDUSTRY

- 4.5 ALUMINUM BRAZING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for aluminum brazing in electric vehicles

- 5.2.1.2 Growing use in HVACR applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Oxide layer barrier in aluminum brazing

- 5.2.2.2 Dissolution and erosion of base metals during brazing

- 5.2.2.3 Availability of alternative methods

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption in renewable energy projects

- 5.2.3.2 Next-gen aluminum brazing technology for space exploration

- 5.2.3.3 Rising shift toward sustainable solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility in raw material prices

- 5.2.4.2 Environmental and regulatory compliance

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2024

- 5.6 MACROECONOMIC OUTLOOK

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECAST

- 5.6.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (HS CODE 8311)

- 5.9.2 IMPORT SCENARIO (HS CODE 8311)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Torch brazing

- 5.10.1.2 Dip brazing

- 5.10.1.3 Furnace brazing

- 5.10.1.4 Vacuum and controlled atmosphere brazing

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Induction brazing

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPES

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 TOP APPLICANTS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 HONEYWELL'S JETFLUX TECHNOLOGY REVOLUTIONIZES ALUMINUM BRAZING FOR RENEWABLE ENERGY

- 5.14.2 BRAZING HIGH-MAGNESIUM AA6082 TO AA1050 USING NOCOLOK CS FLUX

- 5.14.3 BREAKING OXIDE BARRIER: MAGNESIUM-DRIVEN FLUX-FREE BRAZING FOR ALUMINUM SHEETS

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 IMPACT OF GEN AI/AI ON ALUMINUM BRAZING MARKET

- 5.16.1 TOP USE CASES AND MARKET POTENTIAL

- 5.16.2 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM BRAZING MARKET

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 US TARIFF IMPACT - ALUMINUM BRAZING MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON MAJOR COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 ALUMINUM BRAZING MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 ALUMINUM-SILICON ALLOYS

- 6.2.1 EXCELLENT WETTING BEHAVIOR AND STRENGTH TO DRIVE MARKET

- 6.3 ALUMINUM-ZINC ALLOYS

- 6.3.1 HIGH-STRENGTH JOINTS FOR INDUSTRIAL APPLICATIONS TO FUEL DEMAND

- 6.4 ALUMINUM-COPPER ALLOYS

- 6.4.1 ENHANCED STRENGTH AND CORROSION RESISTANCE TO PROPEL DEMAND

- 6.5 ALUMINUM-MAGNESIUM ALLOYS

- 6.5.1 POST-BRAZE STRENGTH AND MACHINABILITY IMPROVEMENTS TO FUEL ADOPTION

- 6.6 OTHER ALUMINUM ALLOYS

7 ALUMINUM BRAZING MARKET, BY PRODUCT FORM

- 7.1 INTRODUCTION

- 7.2 SHEETS

- 7.2.1 IMPROVED STRUCTURAL STRENGTH AND EXCELLENT FORMABILITY TO DRIVE DEMAND

- 7.3 PASTE

- 7.3.1 CONSISTENT AND HIGH-QUALITY JOINTS IN ALUMINUM ALLOYS TO FUEL ADOPTION

- 7.4 WIRES

- 7.4.1 EFFECTIVE HANDLING AND SUPERIOR CORROSION RESISTANCE TO FUEL DEMAND

- 7.5 RODS

- 7.5.1 LOW TEMPERATURE AND FLUX-CORE RODS TO PROPEL DEMAND

- 7.6 OTHER PRODUCT FORMS

8 ALUMINUM BRAZING MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 AUTOMOTIVE

- 8.2.1 DEMAND FOR LIGHTWEIGHT AUTOMOTIVE STRUCTURES TO DRIVE MARKET

- 8.3 AEROSPACE & DEFENSE

- 8.3.1 SUPERIOR THERMAL & ELECTRICAL CONDUCTIVITY TO FUEL DEMAND

- 8.4 INDUSTRIAL

- 8.4.1 DURABLE AND LIGHTWEIGHT INDUSTRIAL EQUIPMENT TO PROPEL DEMAND

- 8.5 ELECTRICAL & ELECTRONICS

- 8.5.1 ENHANCED THERMAL AND ELECTRICAL PERFORMANCE TO BOOST DEMAND

- 8.6 OTHER END-USE INDUSTRIES

9 ALUMINUM BRAZING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: ALUMINUM BRAZING MARKET, BY PRODUCT TYPE

- 9.2.2 NORTH AMERICA: ALUMINUM BRAZING MARKET, BY PRODUCT FORM

- 9.2.3 NORTH AMERICA: ALUMINUM BRAZING MARKET, BY END-USE INDUSTRY

- 9.2.4 NORTH AMERICA: ALUMINUM BRAZING MARKET, BY COUNTRY

- 9.2.4.1 US

- 9.2.4.1.1 Presence of major aluminum brazing material manufacturers to drive market

- 9.2.4.2 Canada

- 9.2.4.2.1 Government initiatives and investments to propel market

- 9.2.4.1 US

- 9.3 EUROPE

- 9.3.1 EUROPE: ALUMINUM BRAZING MARKET, BY PRODUCT TYPE

- 9.3.2 EUROPE: ALUMINUM BRAZING MARKET, BY PRODUCT FORM

- 9.3.3 EUROPE: ALUMINUM BRAZING MARKET, BY END-USE INDUSTRY

- 9.3.4 EUROPE: ALUMINUM BRAZING MARKET, BY COUNTRY

- 9.3.4.1 Germany

- 9.3.4.1.1 Presence of major automotive manufacturers to drive market

- 9.3.4.2 France

- 9.3.4.2.1 Strategic partnership for innovative brazing solutions to fuel demand

- 9.3.4.3 UK

- 9.3.4.3.1 Increasing demand for lightweight and high-performance materials to drive market

- 9.3.4.4 Italy

- 9.3.4.4.1 Technological innovations to drive market

- 9.3.4.5 Spain

- 9.3.4.5.1 Growing adoption of aluminum brazing alloys in automotive components to drive market

- 9.3.4.6 Rest of Europe

- 9.3.4.1 Germany

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: ALUMINUM BRAZING MARKET, BY PRODUCT TYPE

- 9.4.2 ASIA PACIFIC: ALUMINUM BRAZING MARKET, BY PRODUCT FORM

- 9.4.3 ASIA PACIFIC: ALUMINUM BRAZING MARKET, BY END-USE INDUSTRY

- 9.4.4 ASIA PACIFIC: ALUMINUM BRAZING MARKET, BY COUNTRY

- 9.4.4.1 China

- 9.4.4.1.1 Large number of domestic manufacturers to drive market

- 9.4.4.2 Japan

- 9.4.4.2.1 Growing demand from electronics industry to drive market

- 9.4.4.3 India

- 9.4.4.3.1 Rapid industrialization and urbanization to drive market

- 9.4.4.4 South Korea

- 9.4.4.4.1 Ongoing research & development of aluminum brazing materials to accelerate demand

- 9.4.4.5 Rest of Asia Pacific

- 9.4.4.1 China

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: ALUMINUM BRAZING MARKET, BY PRODUCT TYPE

- 9.5.2 MIDDLE EAST & AFRICA: ALUMINUM BRAZING MARKET, BY PRODUCT FORM

- 9.5.3 MIDDLE EAST & AFRICA: ALUMINUM BRAZING MARKET, BY END-USE INDUSTRY

- 9.5.4 MIDDLE EAST & AFRICA: ALUMINUM BRAZING MARKET, BY COUNTRY

- 9.5.4.1 GCC Countries

- 9.5.4.1.1 UAE

- 9.5.4.1.1.1 Increasing infrastructure development projects to propel market

- 9.5.4.1.2 Saudi Arabia

- 9.5.4.1.2.1 Government initiatives focusing on industrial diversification to fuel demand

- 9.5.4.1.3 Rest of GCC Countries

- 9.5.4.1.1 UAE

- 9.5.4.2 South Africa

- 9.5.4.2.1 Growing construction & infrastructure sector to drive market

- 9.5.4.3 Rest of Middle East & Africa

- 9.5.4.1 GCC Countries

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: ALUMINUM BRAZING MARKET, BY PRODUCT TYPE

- 9.6.2 LATIN AMERICA: ALUMINUM BRAZING MARKET, BY PRODUCT FORM

- 9.6.3 LATIN AMERICA: ALUMINUM BRAZING MARKET, BY END-USE INDUSTRY

- 9.6.4 LATIN AMERICA: ALUMINUM BRAZING MARKET, BY COUNTRY

- 9.6.4.1 Brazil

- 9.6.4.1.1 High-value construction projects to drive demand

- 9.6.4.2 Mexico

- 9.6.4.2.1 Ongoing investment and technological innovations to drive market

- 9.6.4.3 Rest of Latin America

- 9.6.4.1 Brazil

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2020-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Product type footprint

- 10.6.5.4 Product form footprint

- 10.6.5.5 End-use industry footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SOLVAY

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses and competitive threats

- 11.1.2 HONEYWELL INTERNATIONAL INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 LUCAS-MILHAUPT LLC

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 HARRIS PRODUCTS GROUP (THE LINCOLN ELECTRIC COMPANY)

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 SUNKWANG AMPA

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 PRINCE & IZANT COMPANY

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 NIHON SUPERIOR CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 AIMTEK, INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 ZHEJIANG YATONG NEW MATERIALS CO., LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 VBC GROUP

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 INDIAN SOLDER AND BRAZE ALLOYS PVT. LTD.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 SENTES-BIR A.S.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 STELLA S.R.L.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 PIETRO GALLIANI BRAZING S.P.A.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 HANGZHOU HUAGUANG ADVANCED WELDING MATERIALS CO., LTD.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.16 HEBEI YUGUANG WELDING CO., LTD

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.17 CASTOLIN EUTECTIC

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.1 SOLVAY

- 11.2 OTHER PLAYERS

- 11.2.1 ZHONGSHAN HUALE WEIDING COMPOUND CO., LTD.

- 11.2.2 MATHURE METAL WORKS PVT. LTD.

- 11.2.3 KINZOKU YOUZAI CO., LTD.

- 11.2.4 NAVIKA SILVER BRAZING ALLOYS

- 11.2.5 BRAZING TECHNOLOGIES, INC.

- 11.2.6 LINBRAZE S.R.L.

- 11.2.7 SELECTARC GROUP

- 11.2.8 SALDFLUX SRL

- 11.2.9 SANHUAN MATERIALS

- 11.2.10 SALDOBRASE SRL

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS