|

시장보고서

상품코드

1863602

정밀 임업 시장 예측(-2030년) : 오퍼링별, 기술별, 용도별, 시스템 아키텍처별, 소유권 유형별, 최종사용자별, 지역별Precision Forestry Market by Offering, by Technology, Application, End User and Region - Global Forecast to 2030 |

||||||

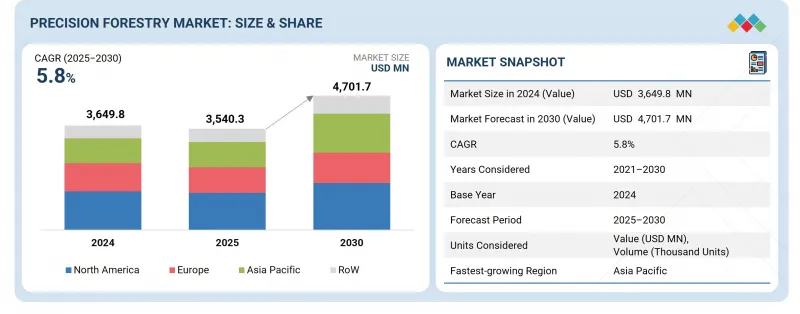

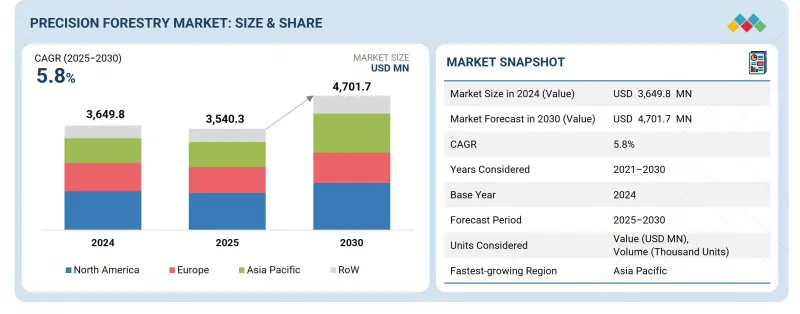

정밀 임업 시장 규모는 2025년 35억 4,030만 달러에서 2030년까지 47억 107만 달러에 달할 것으로 예측되고 있으며, CAGR은 5.8%로 전망되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 오퍼링별, 기술별, 용도별, 시스템 아키텍처별, 소유권 유형별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

정밀 임업 시장의 성장은 효율성, 생산성 및 탄소 관리를 향상시키는 첨단 기술, 지속가능한 임업 관행, AI를 활용한 솔루션의 도입 확대에 의해 촉진되고 있습니다.

세계 정밀 임업 시장은 산업 임업 기업, 정부 기관, 환경 및 보존 단체, 상업용 산림 소유자의 정밀 임업 기술 채택 증가에 힘입어 예측 기간 중 상당한 성장을 보일 것으로 예측됩니다. 산업 임업 기업은 실시간 데이터와 분석을 통해 벌채 활동의 효율성, 수확량 극대화, 공급망 효율성 강화를 위해 정밀 임업 솔루션의 도입을 확대하고 있습니다. 정부 기관은 디지털 매핑, 원격 감지 및 분석 플랫폼을 활용하여 산림 보전, 화재 감지 및 재조림 프로그램을 강화하고 있습니다. 환경 및 보전 분야에서는 탄소 모니터링, 생물다양성 평가, 지속가능한 토지 이용 계획을 위한 정밀 임업 툴을 도입하고 있습니다. 한편, 상업용 산림 소유주들은 생산성을 극대화하기 위해 나무 건강 모니터링, 병해충 관리, 토양 분석에 정밀 기술을 활용한 접근 방식을 채택하고 있습니다. 이러한 분야는 정밀 임업 기술이 다양한 용도로 통합되고 있음을 보여주며, 전 세계에서 지속가능하고 효율적인 데이터베이스 산림 관리를 실현하는 중요한 기반 기술로 자리매김하고 있습니다.

벌목 및 작업 부문은 GPS/GNSS, LiDAR, 차량용 센서 등 첨단 기술의 보급으로 2024년 가장 큰 시장 점유율을 차지했습니다. 이러한 기술은 벌목 및 현장 작업의 정확성, 생산성, 지속가능성을 향상시킵니다. 임업 기업은 스마트 수확기, 포워더, 텔레매틱스 지원 장비를 적극적으로 활용하여 기계 성능 최적화, 목재 폐기물 감소, 지속가능한 산림 관리 확보를 추진하고 있습니다. 또한 환경 규제 준수와 업무 효율화에 대한 관심이 높아지면서 지형 매핑, 기계 경로 계획, 실시간 모니터링을 위한 데이터베이스 툴이 통합되어 벌채 및 작업 분야는 정밀 임업에서 가장 성숙하고 광범위하게 도입이 진행되고 있는 용도입니다.

정밀 임업 시장에서 고정식/고정식 시스템 부문은 예측 기간 중 높은 CAGR을 나타낼 것으로 예측됩니다. 이는 산림 지역 전체에 영구적인 모니터링 및 센싱 데이터 수집 인프라의 도입 증가가 주요 요인으로 작용하고 있습니다. 지상 설치형 LiDAR 스캐너, 환경 센서, 고정형 카메라 네트워크 등을 포함한 이러한 시스템은 산림 건강 평가, 바이오매스 추정, 화재 감지를 위한 지속적이고 정확한 데이터 수집을 가능하게 합니다. 실시간 환경 모니터링을 위한 IoT 지원 고정형 시스템 도입 확대와 클라우드 기반 데이터 분석 및 자동화의 발전이 결합되어 이러한 시스템에 대한 수요를 견인하고 있습니다. 또한 정부 및 임업 기관이 장기적인 생태계 관리 및 삼림 벌채 추적을 위해 고정형 시스템에 투자하고 있는 것도 이동형 및 휴대용 시스템에 비해 이 부문의 성장을 가속화하고 있습니다.

북미는 첨단 산림관리 기술의 조기 도입과 Deere & Company(미국), Trimble Inc(미국), Caterpillar(미국), Tigercat International Inc(캐나다) 등 주요 정밀 임업 솔루션 프로바이더들의 강력한 입지를 바탕으로 2024년 정밀 임업 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 등 정밀 임업 솔루션을 제공하는 주요 기업의 강력한 존재감으로 2024년 정밀 임업 시장에서 가장 큰 점유율을 확보했습니다. 이 지역의 잘 구축된 디지털 인프라와 높은 투자 능력은 GPS/GNSS, GIS, 드론, LiDAR, 고급 데이터 분석과 같은 기술의 임업 업무에 대한 통합을 가속화하고 있습니다. 또한 미국과 캐나다의 정부 정책에 힘입어 지속가능한 산림 관리에 대한 관심이 높아지면서 벌채 최적화, 폐기물 감소, 산림 건강성 향상을 위한 정밀 임업 툴의 도입이 촉진되고 있습니다. 주요 임업 기계 제조업체와 기술 프로바이더의 존재는 이 시장에서 북미의 우위를 더욱 공고히 하고 있습니다.

주요 기업 분석

세계의 정밀 임업 시장에 대해 조사했으며, 오퍼링별, 기술별, 용도별, 시스템 아키텍처별, 소유권 유형별, 최종사용자별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 공급망 분석

- 에코시스템 분석

- 투자와 자금조달 시나리오

- 기술 분석

- 무역 분석

- 특허 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 사례 연구 분석

- 관세와 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- AI/생성형 AI의 영향

- 2025년 미국 관세가 정밀 임업 시장에 미치는 영향

제6장 정밀 임업 시장(오퍼링별)

- 서론

- 하드웨어

- 소프트웨어

- 서비스

제7장 정밀 임업 시장(기술별)

- 서론

- 스마트 하베스팅/CTL

- 재고 및 수율 모니터링

- 화재 감지

- 지리공간

- IoT

- 로봇 공학과 센서

- 기타

제8장 정밀 임업 시장(용도별)

- 서론

- 삼림 관리와 계획

- 수확과 작업

- 임업

- 화재 관리와 탐지

- 재고·물류 관리

- 환경과 보전

- 삼림 재생과 식림

- 해충·질병 관리

- 토양 검사

- 야생 생물 생식지 관리

- 유전학

- 기타

제9장 정밀 임업 시장(시스템 아키텍처별)

- 서론

- 고정식/고정형 시스템

- 모바일/핸드헬드 시스템

제10장 정밀 임업 시장(소유권 유형별)

- 서론

- 산업 임업 회사

- 상업림 소유주

- 소규모 토지 소유주/사유림 소유주

제11장 정밀 임업 시장(최종사용자별)

- 서론

- 정부기관

- 임업 회사

- 농업 협동 조합

- 비영리단체

- 기타

제12장 정밀 임업 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 북유럽

- 러시아

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타

- 기타 지역

- 기타 지역의 거시경제 전망

- 중동

- 아프리카

- 남미

제13장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점, 2021-2025년

- 매출 분석, 2021-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제14장 기업 개요

- 주요 참여 기업

- DEERE & COMPANY

- PONSSE OYJ

- KOMATSU LTD.

- TRIMBLE INC.

- CATERPILLAR

- TIGERCAT INTERNATIONAL INC.

- ROTTNE

- ECO LOG

- TOPCON

- SAMPO ROSENLEW OY

- 기타 기업

- TREEMETRICS

- HITACHI CONSTRUCTION MACHINERY CO., LTD.

- INSIGHT ROBOTICS

- KESLA

- HUSQVARNA GROUP

- ASTEC INDUSTRIES, INC.

- NV5GLOBAL, INC.

- BOBCAT COMPANY

- OREGON TOOL, INC.

- ARBORPRO

- FIELD TRUTH INC

- SATPALDA

- TREEVIA FOREST TECHNOLOGIES

- AB VOLVO

- STORA ENSO

제15장 부록

KSA 25.11.20The precision forestry market is projected to reach USD 4,701.07 million by 2030 from USD 3,540.3 million in 2025, at a CAGR of 5.8%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Technology, Application, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth of the precision forestry market is driven by increasing adoption of advanced technologies, sustainable forestry practices, and AI-enabled solutions that enhance efficiency, productivity, and carbon management.

" Widespread application of precision forestry solutions across stakeholder group to drive market"

The global precision forestry market is projected to grow significantly during the forecast period, supported by the increasing adoption of precision forestry technologies by industrial forestry companies, government agencies, environmental & conservation organizations, and commercial forest owners. Industrial forestry companies are increasingly adopting precision forestry solutions to streamline harvesting activities, maximize yield, and strengthen supply chain efficiency through real-time data and analytics. Government agencies are leveraging digital mapping, remote sensing, and analytics platforms to strengthen forest conservation, fire detection, and reforestation programs. The environmental and conservation sector is deploying precision forestry tools for carbon monitoring, biodiversity assessment, and sustainable land-use planning. Meanwhile, commercial forest owners are utilizing precision-driven approaches for tree health monitoring, pest and disease management, and soil analysis to maximize productivity. Together, these segments highlight the growing integration of precision forestry technologies across diverse applications, positioning them as key enablers of sustainable, efficient, and data-driven forest management worldwide.

"Harvesting & operations segment accounted for largest market share in 2024"

The harvesting & operations segment captured the largest market share in 2024 due to the widespread adoption of advanced technologies, such as GPS/GNSS, LiDAR, and onboard sensors, which enhance precision, productivity, and sustainability in timber extraction and field operations. Forestry companies are increasingly leveraging smart harvesters, forwarders, and telematics-enabled equipment to optimize machine performance, reduce wood waste, and ensure sustainable forest management. Additionally, growing emphasis on environmental compliance and operational efficiency has led to the integration of data-driven tools for terrain mapping, machine routing, and real-time monitoring, making harvesting and operations the most mature and extensively implemented application segment in precision forestry.

"Fixed/stationary systems segment to record higher CAGR during forecast period"

The fixed/stationary systems segment is expected to register a higher CAGR during the forecast period in the precision forestry market, driven by the increasing deployment of permanent monitoring, sensing, and data collection infrastructures across forested areas. These systems, which include ground-based LiDAR scanners, environmental sensors, and fixed camera networks, enable continuous and high-accuracy data gathering for forest health assessment, biomass estimation, and fire detection. The increasing adoption of IoT-enabled fixed systems for real-time environmental monitoring, combined with advancements in cloud-based data analytics and automation, is driving demand for these systems. Furthermore, government and forestry agencies are investing in fixed systems for long-term ecosystem management and deforestation tracking, further supporting the segment's accelerated growth compared to mobile or portable systems.

"North America accounted for largest market share in 2024"

North America secured the largest share of the precision forestry market in 2024 due to the early adoption of advanced forestry management technologies and the strong presence of leading companies offering precision forestry solutions, such as Deere & Company (US), Trimble Inc. (US), Caterpillar (US), and Tigercat International Inc. (Canada). The region's well-established digital infrastructure and high investment capacity have accelerated the integration of technologies such as GPS/GNSS, GIS, drones, LiDAR, and advanced data analytics in forestry operations. Additionally, the growing emphasis on sustainable forest management, supported by government initiatives in the US and Canada, has increased the adoption of precision forestry tools for optimizing harvesting, reducing waste, and improving forest health. The presence of major forestry equipment manufacturers and technology providers further strengthens North America's dominance in this market.

Breakdown of Primaries

A variety of executives from key organizations operating in the precision forestry market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-35%, Tier 2- 40%, and Tier 3-25%

- By Designation: C-level Executives-30%, Directors-40%, and Others-30%

- By Region: North America-40%, Europe-32%, Asia Pacific-23%, and RoW-5%

Note: Other designations include sales, marketing, and product managers.

Tier 1 companies include market players with revenues above USD 500 million; tier 2 companies earn revenues between USD 100 million and USD 500 million; and tier 3 companies earn revenues up to USD 100 million.

The precision forestry market is dominated by globally established players such as Deere & Company (US), Ponsse Oyj (Finland), Trimble Inc. (US), Komatsu Ltd. (Japan), Caterpillar (US), Topcon (US), Rottne (Sweden), Tigercat International Inc. (Canada), and Eco Log (Sweden). The study includes an in-depth competitive analysis of these key players in the precision forestry market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the precision forestry market and forecasts its size by offering, technology, application, system architecture, ownership type, end user, and region. It also discusses the market's drivers, restraints, opportunities, and challenges, and gives a detailed view of the market across four main regions: North America, Europe, Asia Pacific, and RoW. The report includes a supply chain analysis and the key players and their competitive analysis in the precision forestry ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (Growing adoption of remote sensing and GIS technologies, rising requirement for sustainable forestry practices, elevating demand for timber and wood-based products, and escalating need to adopt sustainable forest management techniques), restraints (High initial investment and operational costs, and geographical and environmental limitations), opportunities (Inclination toward AI-driven predictive analytics for forest management, integration of blockchain technology to ensure transparency in wood supply chain, and implementation of carbon credit and carbon offset programs), and challenges (Limited awareness of benefits offered by precision forestry solutions, and delayed ROI in precision forestry technologies) influencing the growth of the precision forestry market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product/solution/service launches in the precision forestry market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the precision forestry market across varied regions

- Market Diversification: Exhaustive information about new products/solutions/services, untapped geographies, recent developments, and investments in the precision forestry market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Deere & Company (US), Ponsse Oyj (Finland), Trimble Inc. (US), Komatsu Ltd. (Japan), and Caterpillar (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION FORESTRY MARKET

- 4.2 PRECISION FORESTRY MARKET, BY END USER

- 4.3 PRECISION FORESTRY MARKET, BY TECHNOLOGY

- 4.4 PRECISION FORESTRY MARKET, BY APPLICATION

- 4.5 PRECISION FORESTRY MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of remote sensing and GIS technologies

- 5.2.1.2 Rising requirement for sustainable forestry practices

- 5.2.1.3 Elevating demand for timber and wood-based products

- 5.2.1.4 Escalating need to adopt sustainable forest management techniques

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment and operational costs

- 5.2.2.2 Geographical and environmental limitations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Inclination toward AI-driven predictive analytics for forest management

- 5.2.3.2 Integration of blockchain technology to ensure transparency in wood supply chain

- 5.2.3.3 Implementation of carbon credit and carbon offset programs

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness of benefits offered by precision forestry solutions

- 5.2.4.2 Delayed ROI in precision forestry technologies

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF HARDWARE OFFERINGS, BY KEY PLAYER, 2020-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF HARVESTERS, BY REGION, 2020-2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Forest management information systems (FMIS)

- 5.8.1.2 Yield mapping

- 5.8.1.3 Forest inventory management software

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Geographic information systems (GIS)

- 5.8.2.2 Artificial intelligence (AI) & machine learning (ML)

- 5.8.2.3 IoT sensors

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Autonomous vehicles & robotics

- 5.8.3.2 Augmented reality (AR) & virtual reality (VR)

- 5.8.3.3 Digital twin technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8432)

- 5.9.2 EXPORT SCENARIO (HS CODE 8432)

- 5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 STORA ENSO IMPLEMENTS PRECISION FORESTRY SOLUTION TO ENHANCE FOREST MANAGEMENT EFFICIENCY

- 5.12.2 HOLMEN DEPLOYS PRECISION FORESTRY PLATFORM TO IMPROVE BIODIVERSITY CONSERVATION AND REGENERATION EFFORTS

- 5.12.3 EMERSON & SONS LOGGING ADOPTS PRECISION FORESTRY SOLUTION TO ENHANCE EFFICIENCY AND SUSTAINABILITY

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8432)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI

- 5.17 IMPACT OF 2025 US TARIFF ON PRECISION FORESTRY MARKET

- 5.17.1 INTRODUCTION

- 5.17.1.1 Key tariff rates

- 5.17.2 PRICE IMPACT ANALYSIS

- 5.17.3 IMPACT ON COUNTRIES/REGIONS

- 5.17.3.1 US

- 5.17.3.2 Europe

- 5.17.3.3 Asia Pacific

- 5.17.4 IMPACT ON END USERS

- 5.17.1 INTRODUCTION

6 PRECISION FORESTRY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 HARVESTERS & FORWARDERS

- 6.2.1.1 Heightened focus on enhancing forest productivity and adhering to regulatory policies to drive market

- 6.2.2 UAVS/DRONES

- 6.2.2.1 Potential to support faster assessments and precise resource monitoring to boost adoption

- 6.2.3 GPS/GNSS DEVICES

- 6.2.3.1 Growing focus on optimizing forest mapping, inventory, and operational planning to facilitate implementation

- 6.2.4 CAMERAS

- 6.2.4.1 Versatility in capturing high-resolution visual imagery and multispectral data to boost demand

- 6.2.5 RFID SOLUTIONS & SENSORS

- 6.2.5.1 Proficiency in offering real-time information on forest conditions and timber locations to accelerate demand

- 6.2.6 VARIABLE RATE CONTROLLERS

- 6.2.6.1 Capacity to reduce waste and ensure sustainable resource management to spur deployment

- 6.2.7 OTHER HARDWARE PRODUCTS

- 6.2.1 HARVESTERS & FORWARDERS

- 6.3 SOFTWARE

- 6.3.1 ON-PREMISES

- 6.3.1.1 Requirement for data security and real-time control to fuel segmental growth

- 6.3.2 CLOUD-BASED

- 6.3.2.1 Flexibility, remote accessibility, and seamless data integration features to boost demand

- 6.3.3 HYBRID

- 6.3.3.1 Rising focus on optimizing resource utilization and enhancing forest management accuracy to spike demand

- 6.3.1 ON-PREMISES

- 6.4 SERVICES

- 6.4.1 GREATER EMPHASIS ON MINIMAL DOWNTIME AND SUSTAINED OPERATIONAL PERFORMANCE TO CREATE OPPORTUNITIES

7 PRECISION FORESTRY MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 SMART HARVESTING/CTL

- 7.2.1 NEED TO MAINTAIN HIGH STANDARDS OF FOREST STEWARDSHIP TO FACILITATE ADOPTION

- 7.3 INVENTORY & YIELD MONITORING

- 7.3.1 AFFINITY FOR REAL-TIME AND SITE-SPECIFIC DATA FOR EFFECTIVE REFORESTATION PLANNING TO PROPEL DEPLOYMENT

- 7.4 FIRE DETECTION

- 7.4.1 NECESSITY TO SAFEGUARD FOREST ASSETS AND ENSURE ENVIRONMENTAL CONSERVATION TO FUEL DEMAND

- 7.5 GEOSPATIAL

- 7.5.1 GPS/GNSS

- 7.5.1.1 Proficiency in collecting precise spatial data across large and remote forest areas to drive implementation

- 7.5.2 GIS & MAPPING

- 7.5.2.1 Ability to provide actionable insights for resource optimization and sustainable forest management to augment deployment

- 7.5.3 REMOTE SENSING

- 7.5.3.1 Excellence in detecting early signs of pest infestations, drought stress, and illegal logging to facilitate adoption

- 7.5.4 UNMANNED AERIAL VEHICLES

- 7.5.4.1 Increasing focus on efficient forest restoration and management activities to create opportunities

- 7.5.5 DATA MANAGEMENT & ANALYTICS

- 7.5.5.1 Rising use of AI/ML-powered analytics in predictive forest management to support segmental growth

- 7.5.6 LIDAR

- 7.5.6.1 Potential to assess forest growth patterns and monitor ecological conditions to stimulate demand

- 7.5.1 GPS/GNSS

- 7.6 IOT

- 7.6.1 NEED FOR REAL-TIME TRACKING OF FOREST CONDITIONS, TIMBER MOVEMENT, AND MACHINERY PERFORMANCE TO SPIKE DEMAND

- 7.7 ROBOTICS & SENSORS

- 7.7.1 EMPHASIS ON REDUCING MANUAL LABOR AND IMPROVING SAFETY IN CHALLENGING FOREST ENVIRONMENTS TO BOOST ADOPTION

- 7.8 OTHER TECHNOLOGIES

8 PRECISION FORESTRY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FOREST MANAGEMENT & PLANNING

- 8.2.1 PRESSING NEED TO STREAMLINE WORKFLOWS AND ADHERE TO ENVIRONMENTAL REGULATIONS TO FUEL SEGMENTAL GROWTH

- 8.3 HARVESTING & OPERATIONS

- 8.3.1 INCREASING FOCUS ON OPTIMIZING CUTTING PATTERNS AND TRACK OPERATIONAL PROGRESS IN REAL TIME TO BOOST DEMAND

- 8.4 SILVICULTURE

- 8.4.1 GROWING EMPHASIS ON ENHANCING FOREST QUALITY AND PRODUCTIVITY TO FOSTER SEGMENTAL GROWTH

- 8.5 FIRE MANAGEMENT & DETECTION

- 8.5.1 NECESSITY TO ASSESS FIRE-PRONE ZONES AND IMPROVE SITUATIONAL AWARENESS TO ACCELERATE DEMAND

- 8.6 INVENTORY & LOGISTICS MANAGEMENT

- 8.6.1 RISING USE OF IOT AND BLOCKCHAIN TECHNOLOGIES FOR INVENTORY & LOGISTICS OPTIMIZATION TO PROPEL MARKET

- 8.7 ENVIRONMENTAL & CONSERVATION

- 8.7.1 STRONG FOCUS ON PROMOTING SUSTAINABLE AND RESILIENT FOREST LANDSCAPES TO DRIVE MARKET

- 8.8 REFORESTATION & AFFORESTATION

- 8.8.1 SURGING USE OF DIGITAL AND GEOSPATIAL TOOLS TO OPTIMIZE REFORESTATION PROCESS TO SUPPORT MARKET GROWTH

- 8.9 PEST & DISEASE MANAGEMENT

- 8.9.1 NECESSITY TO SAFEGUARD FOREST THROUGH PREDICTIVE MODELING TO CONTRIBUTE TO MARKET GROWTH

- 8.10 SOIL TESTING

- 8.10.1 RISING DEPLOYMENT OF SOIL SENSORS AND IOT DEVICES FOR REAL-TIME SOIL HEALTH MONITORING TO PROPEL MARKET

- 8.11 WILDLIFE HABITAT MANAGEMENT

- 8.11.1 URGENT NEED TO DETECT ILLEGAL POACHING ACTIVITIES IN REAL TIME TO CREATE OPPORTUNITIES

- 8.12 GENETICS

- 8.12.1 EXPANDING STRATEGIC FOCUS ON IDENTIFYING PLANT GROWTH RATE, WOOD QUALITY, AND PEST RESISTANCE TO SPIKE DEMAND

- 8.13 OTHER APPLICATIONS

9 PRECISION FORESTRY MARKET, BY SYSTEM ARCHITECTURE

- 9.1 INTRODUCTION

- 9.2 FIXED/STATIONARY SYSTEMS

- 9.2.1 HIGH RELIABILITY, LONG-TERM OPERATIONAL CAPABILITY, AND COST EFFICIENCY BENEFITS TO DRIVE SEGMENTAL GROWTH

- 9.3 MOBILE/HANDHELD SYSTEMS

- 9.3.1 NEED TO COLLECT REAL-TIME DATA ACROSS DIVERSE TERRAINS AND CONDUCT SITE-SPECIFIC ASSESSMENTS TO SPUR DEMAND

10 PRECISION FORESTRY MARKET, BY OWNERSHIP TYPE

- 10.1 INTRODUCTION

- 10.2 INDUSTRIAL FORESTRY COMPANIES

- 10.2.1 FOCUS ON ENHANCING DECISION-MAKING THROUGH GEOSPATIAL AND REMOTE SENSING TOOLS TO ACCELERATE MARKET GROWTH

- 10.3 COMMERCIAL FOREST OWNERS

- 10.3.1 INCLINATION TOWARD IMPROVING PROFITABILITY AND COMPETITIVENESS TO SPIKE DEMAND

- 10.4 SMALL LANDOWNERS/PRIVATE FOREST OWNERS

- 10.4.1 EMPHASIS ON STRENGTHENING FOREST HEALTH MONITORING THROUGH AFFORDABLE TECHNOLOGIES TO SPUR DEMAND

11 PRECISION FORESTRY MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 GOVERNMENT AGENCIES

- 11.2.1 STRINGENT CARBON EMISSION TARGETS TO FOSTER MARKET GROWTH

- 11.3 FORESTRY COMPANIES

- 11.3.1 INCLINATION TOWARD MINIMIZING WASTE AND ADHERING TO SUSTAINABLE FOREST MANAGEMENT STANDARDS TO DRIVE MARKET

- 11.4 AGRICULTURE & FARMING COOPERATIVES

- 11.4.1 FOCUS ON MAXIMIZING PRODUCTIVITY AND MAINTAINING ENVIRONMENTAL INTEGRITY TO SPUR ADOPTION

- 11.5 NON-PROFIT ORGANIZATIONS

- 11.5.1 FOREST RESTORATION, BIODIVERSITY PRESERVATION, WILDLIFE HABITAT PROTECTION INITIATIVES TO CREATE OPPORTUNITIES

- 11.6 OTHER END USERS

12 PRECISION FORESTRY MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Government initiatives promoting sustainable forest management to boost demand

- 12.2.3 CANADA

- 12.2.3.1 Emphasis on environmental stewardship, carbon management, and biodiversity conservation to fuel demand

- 12.2.4 MEXICO

- 12.2.4.1 Government support for reforestation and conservation programs to propel market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 UK

- 12.3.2.1 Rising focus on habitat restoration and sustainable timber operations to accelerate market growth

- 12.3.3 GERMANY

- 12.3.3.1 Widespread deployment of smart harvesting/CTL and complementary technologies to support market growth

- 12.3.4 FRANCE

- 12.3.4.1 Sustainable forest management programs to contribute to market growth

- 12.3.5 ITALY

- 12.3.5.1 Efforts toward habitat restoration, carbon credit tracking, and sustainable timber operations to foster market growth

- 12.3.6 SPAIN

- 12.3.6.1 Frequent wildfires in Mediterranean regions to facilitate adoption

- 12.3.7 POLAND

- 12.3.7.1 Reforestation initiatives and environmental monitoring programs to create growth opportunities

- 12.3.8 NORDICS

- 12.3.8.1 Elevating demand for advanced digital precision forestry technologies to stimulate market growth

- 12.3.9 RUSSIA

- 12.3.9.1 Sustainable harvesting and environmental conservation initiatives to promote market growth

- 12.3.10 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Strong focus on industrial-scale timber production and sustainable resource management to facilitate adoption

- 12.4.3 JAPAN

- 12.4.3.1 Emphasis on reducing labor intensity and adopting sustainable forestry practices to contribute to market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Necessity to capture real-time soil and environmental information to spike demand

- 12.4.5 INDIA

- 12.4.5.1 Government-led sustainable forest management programs to stimulate demand

- 12.4.6 AUSTRALIA

- 12.4.6.1 Active forest conservation efforts and structured government efforts to create opportunities

- 12.4.7 INDONESIA

- 12.4.7.1 Need to monitor illegal logging, track forest health, and implement reforestation projects to support market growth

- 12.4.8 MALAYSIA

- 12.4.8.1 Extensive forest land and strong focus on wildfire prevention to foster demand

- 12.4.9 THAILAND

- 12.4.9.1 Rising adoption of IoT sensors for real-time monitoring of soil health, tree growth, and environmental conditions to drive market

- 12.4.10 VIETNAM

- 12.4.10.1 Adoption of smart harvesting/CTL and geospatial technologies to propel market

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Government-led afforestation and AI-enabled initiatives to boost adoption

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Afforestation campaigns and urban greening initiatives to drive market

- 12.5.2.3 Oman

- 12.5.2.3.1 National tree-planting programs and technological interventions to create opportunities

- 12.5.2.4 Saudi Arabia

- 12.5.2.4.1 Smart green city projects to spur demand

- 12.5.2.5 UAE

- 12.5.2.5.1 Coastal afforestation and drone-assisted planting initiatives to drive market

- 12.5.2.6 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Environmental sustainability, economic development, and climate change mitigation goals to accelerate demand

- 12.5.3.2 Rest of Africa

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Brazil

- 12.5.4.1.1 Focus on environmental conservation to drive demand

- 12.5.4.2 Rest of South America

- 12.5.4.1 Brazil

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Offering footprint

- 13.7.5.4 Technology footprint

- 13.7.5.5 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 DEERE & COMPANY

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 PONSSE OYJ

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 KOMATSU LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 TRIMBLE INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 CATERPILLAR

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 TIGERCAT INTERNATIONAL INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Expansions

- 14.1.7 ROTTNE

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 ECO LOG

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 TOPCON

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Expansions

- 14.1.10 SAMPO ROSENLEW OY

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 DEERE & COMPANY

- 14.2 OTHER PLAYERS

- 14.2.1 TREEMETRICS

- 14.2.2 HITACHI CONSTRUCTION MACHINERY CO., LTD.

- 14.2.3 INSIGHT ROBOTICS

- 14.2.4 KESLA

- 14.2.5 HUSQVARNA GROUP

- 14.2.6 ASTEC INDUSTRIES, INC.

- 14.2.7 NV5 GLOBAL, INC.

- 14.2.8 BOBCAT COMPANY

- 14.2.9 OREGON TOOL, INC.

- 14.2.10 ARBORPRO

- 14.2.11 FIELD TRUTH INC

- 14.2.12 SATPALDA

- 14.2.13 TREEVIA FOREST TECHNOLOGIES

- 14.2.14 AB VOLVO

- 14.2.15 STORA ENSO

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS