|

시장보고서

상품코드

1880371

분자 세포 유전학 시장 : 제품별, 기법별, 용도별 - 예측(-2030년)Molecular Cytogenetics Market by Product (Kits, Reagents, Probes, Instrument, Software, Services), Technique (FISH, CISH, Comparative Genomic Hybridization [Array-based, Standard]), Application (Cancer, Personalized Medicine) - Global Forecast to 2030 |

||||||

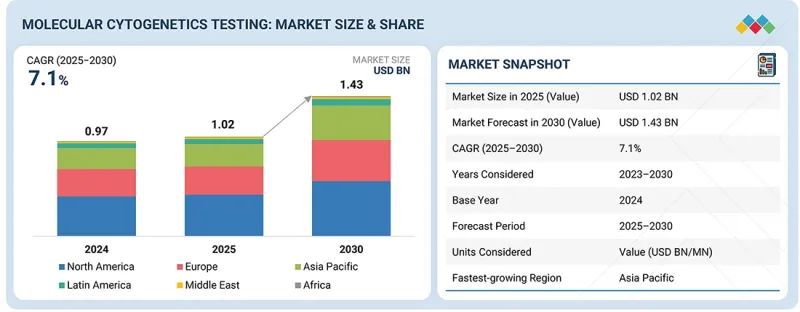

세계의 분자 세포 유전학 시장 규모는 2025년 10억 2,000만 달러에서 2030년에는 14억 3,000만 달러에 이를 것으로 예측되어 예측 기간에 CAGR` 7.1%의 성장이 전망됩니다.

이 시장의 성장은 주로 노인을 대상으로 한 암과 유전성 질환의 유병률 증가에 의해 주도되고 있습니다. 또한, 정확한 진단과 질병 관리를 위한 분자 세포유전학적 검사의 활용 확대도 중요한 역할을 하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품 및 서비스, 기법, 용도, 최종사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

또한, 표적 치료의 등장과 개인 맞춤형 의료로의 통합은 시장 성장을 더욱 촉진하고 있습니다. 그러나 첨단 분자세포유전학 기법에 따른 높은 비용과 숙련된 전문가의 필요성은 시장 확대에 큰 장벽으로 작용하고 있습니다.

"테스트 키트 부문은 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다. "

분자 세포 유전학 시장에서 테스트 키트 부문은 사용 편의성, 재현성, 신속하고 정확한 결과를 제공하는 능력으로 인해 가장 높은 CAGR로 성장하고 있습니다. CGH 어레이와 FISH 프로브 패널을 포함한 이들 키트는 임상 실험실 및 연구소에서 염색체 이상 및 유전자 변이를 표준화된 방식으로 검출할 수 있도록 합니다. 검증된 분석법과 통합 분석 툴을 활용하여, 검사 키트는 종양학, 산전 검사, 유전 질환 진단을 지원하는 신뢰할 수 있는 고처리량 솔루션을 제공합니다. 검사 키트는 편리성, 정확성, 확장성으로 인해 효율적인 세포유전학 검사에 필수적이며, 시장에서의 강력한 채택을 촉진하고 있습니다.

"암 분야가 시장에서 가장 큰 점유율을 차지하고 있습니다. "

분자세포유전학 시장에서 가장 큰 비중을 차지하는 분야는 암 응용 분야입니다. 이러한 성장은 주로 전 세계적으로 암 발병률 증가, 특히 악성종양에 취약한 노년층의 암 발병률 증가에 기인합니다. 유전적 변화와 염색체 이상은 종양 발생의 주요 원인으로, 종양학에서 분자 세포유전학적 검사에 대한 수요가 증가하고 있습니다. 형광 in situ hybridization(FISH), 비교유전체하이브리데이션(CGH) 등의 기법을 통해 이러한 이상을 정확하게 검출할 수 있어 정확한 진단, 종양 유형 분류, 질병 진행 모니터링이 용이해집니다. 또한, 암 연구에 대한 투자 증가, 의료 인프라 개선, 조기 발견 및 유전자 프로파일링의 이점에 대한 인식이 높아짐에 따라 전 세계 임상 및 연구 환경 전반에 걸쳐 이 부문의 강력한 성장에 기여하고 있습니다.

"미국은 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다. "

여러 요인으로 인해 미국이 분자세포유전학 시장에서 가장 높은 성장률을 보이고 있습니다. 주요 세포유전학 기업의 존재, 선진화된 연구 인프라 및 대규모 환자 기반은 이 나라 시장 성장을 가속하는 주요 요인으로 작용하고 있습니다. 또한, 종양학, 산전 검사, 유전성 질환 진단에서 분자 세포 유전학 검사의 채택이 증가함에 따라 수요를 촉진하고 있습니다. 의료 규제 지원 체계, 유전체 연구 자금 지원 증가, 정밀의료에 대한 관심 증가도 미국 분자세포유전학 시장 확대에 기여하고 있습니다.

또한, 염색체 이상을 정확하게 검출하기 위한 FISH, CGH와 같은 분자세포유전학 기법의 광범위한 채택은 분자세포유전학의 성장을 가속하고 있습니다. 정부와 민간의 생물 의학 연구 및 종양학에 대한 막대한 자금 지원은 혁신을 가속화하고 최첨단 검사 플랫폼의 개발을 촉진하고 있습니다. 이 지역의 엄격한 규제 프레임워크는 제품의 품질과 신뢰성을 보장하고, 분자 세포 유전학 솔루션에 대한 신뢰를 더욱 강화하며, 북미의 세계 우위를 확고히 하고 있습니다.

세계의 분자세포유전학 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 북미 분자 세포 유전학 시장 : 용도별, 국가별

- 분자 세포 유전학 시장 점유율 : 최종사용자별(2024년)

- 분자 세포 유전학 시장 : 지역적 성장 기회

- 상호 접속된 시장과 부문의 횡단적인 기회

- Tier 1/2/3 기업의 전략적인 움직임

- VC/사모펀드 투자 동향

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

제6장 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 사례 연구 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 가격 결정 분석

- 분자 세포 유전학 제품 평균 판매 가격 동향 : 주요 기업별(2022년-2024년)

- 기구 평균 판매 가격 동향(2022년-2024년) : 지역별

- 특허 분석

- 조사 방법

- 특허 출원 건수 : 서류 유형별

- 주요 특허 리스트

- 무역 분석

- HS코드 3822.00 수입 데이터(2020년-2024년)

- HS코드 3822.00 수출 데이터(2020년-2024년)

- 밸류체인 분석

- 생태계 분석

- 에코시스템 역할

- 새로운 비즈니스 모델과 에코시스템 변화

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 관세 및 규제 분석

- HS코드 9027.50.80/3822.00 관세 데이터

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 지속가능성에 대한 영향과 규제 정책 대처

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 투자 및 자금조달 시나리오

- 분자 세포 유전학 시장에 대한 AI/생성형 AI의 영향

- 분자 세포 유전학 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 주요 영향

- 최종 이용 산업에 대한 영향

제7장 분자 세포 유전학 시장 : 제품 및 서비스별

- 서론

- 키트 및 시약

- 검사 키트

- 프로브

- 형광 친화성 시약

- 기타 키트 및 시약

- 소모품

- 기구

- 소프트웨어 및 서비스

제8장 분자 세포 유전학 시장 : 기법별

- 서론

- FLUORESCENCE IN SITU HYBRIDIZATION (FISH)

- ARRAY-BASED COMPARATIVE GENOMIC HYBRIDIZATION (ACGH)

- CHROMOGENIC IN SITU HYBRIDIZATION (CISH)

- 기타 기법

제9장 분자 세포 유전학 시장 : 용도별

- 서론

- 유전성 질환

- 암

- 맞춤형 의료

- 기타 용도

제10장 분자 세포 유전학 시장 : 최종사용자별

- 서론

- 임상 및 진단실험실

- 학술연구기관

- 제약 기업 및 바이오테크놀러지 기업

- 기타 최종사용자

제11장 분자 세포 유전학 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동

- 중동의 거시경제 전망

- GCC 국가

- 기타 중동

- 아프리카

제12장 경쟁 구도

- 서론

- 주요 기업이 채택한 전략 개요

- 매출 분석(2020년-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- F. HOFFMANN-LA ROCHE LTD.

- DANAHER CORPORATION

- AGILENT TECHNOLOGIES, INC.

- ABBOTT

- THERMO FISHER SCIENTIFIC INC.

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- F. HOFFMANN-LA ROCHE LTD.

- DANAHER CORPORATION

- AGILENT TECHNOLOGIES, INC.

- ABBOTT

- THERMO FISHER SCIENTIFIC INC.

- ILLUMINA, INC.

- REVVITY

- PACBIO

- BIO-RAD LABORATORIES, INC.

- BIO-TECHNE

- GENE DX, LLC

- INSIGHT MOLECULAR DIAGNOSTICS INC.

- BIOVIEW

- 기타 기업

- OXFORD GENE TECHNOLOGY IP LIMITED

- APPLIED SPECTRAL IMAGING

- CYTOTEST INC.

- KROMATID

- GENIAL GENETIC SOLUTIONS LTD.

- CYTOGNOMIX INC.

- METASYSTEMS

- SCIGENE CORPORATION

- BIOMODAL

- BIOCARE MEDICAL, LLC

- BIODOT

- ONCODNA

제14장 부록

LSH 25.12.10The molecular cytogenetics market is expected to reach USD 1.43 billion in 2030 from USD 1.02 billion in 2025, at a CAGR of 7.1% during the forecast period. The market is driven by a rising prevalence of cancer and genetic disorders, mainly among older adults. The growing application of molecular cytogenetic tests for accurate diagnosis and disease management also plays a crucial role.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product & Service, Technique, Applications, End User |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

Furthermore, the emergence of targeted therapies and their integration into personalized medicine are further driving market growth. Nonetheless, the high expenses associated with advanced molecular cytogenetic techniques and the requirement for skilled professionals continue to be major barriers to market expansion.

"Testing kits segment is expected to grow at the highest CAGR during the forecast period"

The testing kits segment is growing at the highest CAGR in the molecular cytogenetics market due to its ease of use, reproducibility, and ability to deliver rapid, accurate results. These kits, including CGH arrays and FISH probe panels, enable standardized detection of chromosomal abnormalities and genetic variations across clinical and research laboratories. By leveraging pre-validated assays and integrated analysis tools, testing kits offer reliable, high-throughput solutions that support oncology, prenatal testing, and genetic disorder diagnostics. Their convenience, accuracy, and scalability make them essential for efficient cytogenetic testing, driving their strong adoption in the market.

"Cancer application segment holds the largest share of the market"

The cancer applications segment accounts for the largest share of the molecular cytogenetics market. This growth is primarily driven by the rising incidence of cancer worldwide, particularly among the aging population, which is more susceptible to malignancies. Genetic changes and chromosomal abnormalities are major contributors to tumor development, increasing the demand for molecular cytogenetic testing in oncology. Techniques such as fluorescence in situ hybridization (FISH) and comparative genomic hybridization (CGH) enable the precise detection of these abnormalities, facilitating accurate diagnosis, classification of tumor types, and monitoring of disease progression. Furthermore, increasing investments in cancer research, improvements in healthcare infrastructure, and growing awareness of the benefits of early detection and genetic profiling are contributing to the robust growth of this segment across clinical and research settings globally.

"US is expected to grow at the highest CAGR during the forecast period"

The US is experiencing the highest growth rate in the molecular cytogenetics market due to several factors. The presence of leading cytogenetics companies, advanced research infrastructure, and a large patient base are major drivers of market growth in the country. Additionally, rising adoption of molecular cytogenetic testing in oncology, prenatal screening, and genetic disorder diagnostics is fueling demand. Supportive healthcare regulations, increased funding for genomic research, and the growing focus on precision medicine further contribute to the expansion of the molecular cytogenetics market in the US.

Additionally, the widespread adoption of molecular cytogenetic techniques, such as FISH and CGH, for the accurate detection of chromosomal abnormalities has further supported the growth of molecular cytogenetics. Extensive government and private funding for biomedical research and oncology accelerates innovation and the deployment of cutting-edge testing platforms. The region's stringent regulatory framework ensures product quality and reliability, further strengthening trust in molecular cytogenetic solutions and solidifying North America's dominant position globally.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Tier 1 - 25%, Tier 2 - 35%, and Tier 3 - 40%

- By Designation: Managers - 45%, CXOs and Directors - 30%, and Executives - 25%

- By Region: North America - 35%, Europe - 25%, Asia Pacific - 15%, Latin America - 10%, the Middle East - 10%, and Africa - 5%

F. Hoffmann-La Roche Ltd. (Switzerland), Danaher (US), Agilent Technologies, Inc. (US), Abbott (US), Thermo Fisher Scientific Inc. (US), Illumina, Inc. (US), Revvity (US), PacBio (US), Bio-Rad Laboratories, Inc. (US), Bio-Techne (US), GeneDx, LLC (US), Insight Molecular Diagnostics Inc. (US), BioView (Israel), Oxford Gene Technology IP Limited (UK), Applied Spectral Imaging, Inc. (US), CytoTest Inc. (US), KROMATID (US), Genial Genetic Solutions Ltd. (UK), Cytognomix Inc. (Canada), MetaSystems (Germany), SciGene Corporation (US), Biomodal (UK), Biocare Medical, LLC (US), BioDot (US), and OncoDNA (Belgium) are some of the key companies offering molecular cytogenetics products.

Research Coverage

This research report categorizes the molecular cytogenetics market by product & service (kits & reagents [testing kits, probes, fluorescent affinity reagents, other kits & reagents], instruments, consumables, software & services), technique (comparative genomic hybridization [array-based comparative genomic hybridization, standard comparative genomic hybridization], fluorescence in-situ hybridization, chromogenic in-situ hybridization, other techniques), application (cancer, genetic disorders, personalized medicine and other applications), end user (clinical & research laboratories, academic & research institutes, pharmaceutical & biotechnology companies, other end users), and region (North America, Europe, Asia Pacific, Latin America, Middle East, And Africa).

The report's scope encompasses detailed information about the primary factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the molecular cytogenetics market. A comprehensive analysis of key industry players has been performed to provide insights into their business overview, product portfolio, key strategies, new product launches, acquisitions, and recent developments related to the molecular cytogenetics market. This report also includes a competitive analysis of emerging startups in the molecular cytogenetics industry ecosystem.

Key Benefits of Buying the Report

The report will assist market leaders and new entrants by providing revenue estimates for the overall market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their businesses effectively and develop suitable go-to-market strategies. This report will enable stakeholders to grasp the market's pulse and offer information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing incidence of cancer and genetic disorders, growing focus on targeted cancer treatment, rapid growth in aging population and subsequent increase in prevalence of chronic diseases, and increasing penetration of molecular cytogenetics in clinical pathological testing), restraints (high cost of advanced instruments and unfavourable reimbursement scenario), opportunities (untapped emerging markets), and challenges (transition from FISH to array-based techniques) influencing the market growth

- Product Development/Innovation: Detailed insights into newly launched products and technological assessment of the molecular cytogenetics market

- Market Development: Comprehensive information about lucrative markets and analysis of the market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the molecular cytogenetics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including F. Hoffman-La Roche Ltd (Switzerland), Danaher (US), Agilent Technologies, Inc. (US), Abbott (US), Thermo Fisher Scientific Inc. (US), Illumina, Inc. (US), among others offering products and services for molecular cytogenetics market. Other companies include Applied Spectral Imaging Inc. (US), Biomodal (UK), Biocare Medical, LLC (US), OncoDNA (Belgium), among others, for the molecular cytogenetics market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GLOBAL MOLECULAR CYTOGENETICS MARKET SIZE ESTIMATION, 2024

- 2.2.1.1 Revenue share analysis (bottom-up approach)

- 2.2.1.2 Secondary data & primary interviews

- 2.2.1.2.1 Insights of primary experts

- 2.2.1.3 MnM repository analysis

- 2.2.2 SEGMENTAL MARKET ASSESSMENT: TOP-DOWN APPROACH

- 2.2.1 GLOBAL MOLECULAR CYTOGENETICS MARKET SIZE ESTIMATION, 2024

- 2.3 MARKET GROWTH RATE PROJECTION

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS

- 3.3 DISRUPTIVE TRENDS SHAPING MOLECULAR CYTOGENETICS MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 NORTH AMERICA: MOLECULAR CYTOGENETICS MARKET, BY APPLICATION AND COUNTRY

- 4.2 MOLECULAR CYTOGENETICS MARKET SHARE, BY END USER, 2024

- 4.3 MOLECULAR CYTOGENETICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVIES BY TIER-1/2/3 PLAYERS

- 4.6 VC/PRIVATE EQUITY INVESTMENT TRENDS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancement and adoption of high-resolution techniques

- 5.2.1.2 Growing focus on targeted cancer treatment

- 5.2.1.3 Increasing penetration of molecular cytogenetics in clinical pathological testing

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced instruments

- 5.2.2.2 Unfavorable reimbursement scenario for advanced diagnostic tests

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Untapped emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Transition from FISH to array-based molecular cytogenetic techniques in diagnostic and research communities

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS & WHITE SPACES

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.2 CASE STUDY ANALYSIS

- 6.2.1 MOSAIC TETRASOMY 9P TO BE DETECTED BY CNV-SEQ IN PRENATAL DIAGNOSIS

- 6.2.2 PRENATAL DETECTION OF 15Q21.3 AND 16P11.2 MICRODUPLICATION SYNDROMES USING CNV-SEQ AND WES

- 6.2.3 INTEGRATED CNV-SEQ AND KARYOTYPING IN LARGE PRENATAL COHORT FOR CHROMOSOMAL ABNORMALITY DETECTION

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 KEY TECHNOLOGIES

- 6.3.1.1 Optical genome mapping

- 6.3.1.2 Next-generation sequencing

- 6.3.2 COMPLEMENTARY TECHNOLOGIES

- 6.3.2.1 CRISPR-based editing

- 6.3.1 KEY TECHNOLOGIES

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND OF MOLECULAR CYTOGENETIC PRODUCTS, BY KEY PLAYER, 2022-2024

- 6.4.2 AVERAGE SELLING PRICE TREND OF INSTRUMENTS, BY REGION, 2022-2024

- 6.5 PATENT ANALYSIS

- 6.5.1 METHODOLOGY

- 6.5.2 NUMBER OF PATENTS FILED, BY DOCUMENT TYPE

- 6.5.3 LIST OF KEY PATENTS

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT DATA FOR HS CODE 3822.00, 2020-2024

- 6.6.2 EXPORT DATA FOR HS CODE 3822.00, 2020-2024

- 6.7 VALUE CHAIN ANALYSIS

- 6.8 ECOSYSTEM ANALYSIS

- 6.8.1 ROLE IN ECOSYSTEM

- 6.8.2 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFTS

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.9.2 BARGAINING POWER OF SUPPLIERS

- 6.9.3 BARGAINING POWER OF BUYERS

- 6.9.4 THREAT OF SUBSTITUTES

- 6.9.5 THREAT OF NEW ENTRANTS

- 6.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.10.2 KEY BUYING CRITERIA

- 6.11 TARIFF & REGULATORY ANALYSIS

- 6.11.1 TARIFF DATA FOR HS CODES 9027.50.80 AND 3822.00

- 6.11.1.1 US

- 6.11.1.2 European Union

- 6.11.1.3 Asia Pacific

- 6.11.2 REGULATORY LANDSCAPE

- 6.11.2.1 North America

- 6.11.2.1.1 US

- 6.11.2.1.2 Canada

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.11.2.3.1 Japan

- 6.11.2.3.2 China

- 6.11.2.3.3 India

- 6.11.2.4 Latin America

- 6.11.2.4.1 Brazil

- 6.11.2.1 North America

- 6.11.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.4 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES

- 6.11.1 TARIFF DATA FOR HS CODES 9027.50.80 AND 3822.00

- 6.12 KEY CONFERENCES & EVENTS, 2025-2026

- 6.13 INVESTMENT & FUNDING SCENARIO

- 6.14 IMPACT OF AI/GEN AI ON MOLECULAR CYTOGENETICS MARKET

- 6.15 IMPACT OF 2025 US TARIFF ON MOLECULAR CYTOGENETICS MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 PRICE IMPACT ANALYSIS

- 6.15.4 KEY IMPACT ON COUNTRIES/REGIONS

- 6.15.4.1 North America

- 6.15.4.1.1 US

- 6.15.4.2 Europe

- 6.15.4.3 Asia Pacific

- 6.15.4.1 North America

- 6.15.5 IMPACT OF END-USE INDUSTRIES

- 6.15.5.1 Clinical & diagnostic laboratories

- 6.15.5.2 Academic & research institutes

- 6.15.5.3 Pharmaceutical & biotechnology companies

7 MOLECULAR CYTOGENETICS MARKET, BY PRODUCT & SERVICE

- 7.1 INTRODUCTION

- 7.2 KITS & REAGENTS

- 7.2.1 TESTING KITS

- 7.2.1.1 Standardized and integrated kit workflows to propel market growth

- 7.2.2 PROBES

- 7.2.2.1 Advances in oligonucleotide probe chemistry, multiplexing, and regulatory-driven product modernization to boost market

- 7.2.3 FLUORESCENT AFFINITY REAGENTS

- 7.2.3.1 Improved fluorochrome chemistry and pre-validated conjugates paired with advanced spectral imaging to drive growth

- 7.2.4 OTHER KITS & REAGENTS

- 7.2.1 TESTING KITS

- 7.3 CONSUMABLES

- 7.3.1 STANDARDIZATION AND EXPANDING CLINICAL APPLICATIONS TO PROMOTE MARKET GROWTH

- 7.4 INSTRUMENTS

- 7.4.1 AUTOMATION, AI-ENABLED IMAGING, AND INTEGRATED PLATFORMS TO DRIVE MARKET

- 7.5 SOFTWARE & SERVICES

- 7.5.1 AI INTEGRATION, WORKFLOW STANDARDIZATION, AND CLOUD-ENABLED DATA MANAGEMENT TO DRIVE MARKET

8 MOLECULAR CYTOGENETICS MARKET, BY TECHNIQUE

- 8.1 INTRODUCTION

- 8.2 FLUORESCENCE IN SITU HYBRIDIZATION (FISH)

- 8.2.1 INTEGRATION OF FISH AND ADVANCED IMAGING TECHNOLOGIES TO DRIVE GROWTH

- 8.3 ARRAY-BASED COMPARATIVE GENOMIC HYBRIDIZATION (ACGH)

- 8.3.1 BETTER CLINICAL ACCEPTANCE AND IMPROVED TECHNOLOGICAL INTEGRATION TO PROPEL MARKET GROWTH

- 8.4 CHROMOGENIC IN SITU HYBRIDIZATION (CISH)

- 8.4.1 ENHANCED PROBE TECHNOLOGY AND BETTER WORKFLOW AUTOMATION TO BOOST MARKET GROWTH

- 8.5 OTHER TECHNIQUES

9 MOLECULAR CYTOGENETICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 GENETIC DISORDERS

- 9.2.1 EXPANDED CLINICAL GUIDELINES AND IMPROVED CMA/FISH TECHNOLOGIES TO PROPEL MARKET GROWTH

- 9.3 CANCER

- 9.3.1 RISING CANCER RESEARCH AND INCREASING USE OF AUTOMATED CYTOGENETIC PLATFORMS TO DRIVE MARKET

- 9.4 PERSONALIZED MEDICINE

- 9.4.1 STRATEGIC COLLABORATIONS AND BIOMARKER-DRIVEN CYTOGENETIC TESTING TO ACCELERATE MARKET GROWTH

- 9.5 OTHER APPLICATIONS

10 MOLECULAR CYTOGENETICS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 CLINICAL & DIAGNOSTIC LABORATORIES

- 10.2.1 INVESTMENT IN AUTOMATION AND INDUSTRY PARTNERSHIPS TO DRIVE MARKET GROWTH

- 10.3 ACADEMIC & RESEARCH INSTITUTES

- 10.3.1 STRATEGIC ACADEMIA-INDUSTRY COLLABORATIONS TO AUGMENT MARKET GROWTH

- 10.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.4.1 STRATEGIC ACQUISITIONS AND PRECISION MEDICINE INTEGRATION TO FUEL MARKET GROWTH

- 10.5 OTHER END USERS

11 MOLECULAR CYTOGENETICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to dominate North American molecular cytogenetics market during study period

- 11.2.3 CANADA

- 11.2.3.1 Increasing cancer burden and expanding application of cytogenetics technology in oncology to drive market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Dynamic convergence of research excellence, clinical adoption, and industry collaboration to augment market growth

- 11.3.3 UK

- 11.3.3.1 Strong governmental support for genomics research and advanced healthcare infrastructure to aid market growth

- 11.3.4 FRANCE

- 11.3.4.1 Increasing government investment in pharmaceutical industry to support market growth

- 11.3.5 ITALY

- 11.3.5.1 Rising research activities in pharma R&D to boost market growth

- 11.3.6 SPAIN

- 11.3.6.1 Well-established network of research centers and universities to boost clinical and diagnostic research

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Development of advanced healthcare infrastructure and government support for genomics research to propel growth

- 11.4.3 JAPAN

- 11.4.3.1 Technological adoption and increased clinical programs to favor market growth

- 11.4.4 INDIA

- 11.4.4.1 Rising awareness of cancer and genetic disorders to support market growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Progressive translational research, advanced diagnostic integration, and cross-institutional collaborations to fuel growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Technological innovation and high demand for precision medicines to aid market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Increased number of public-private collaborations to focus on strategic market expansions

- 11.5.3 MEXICO

- 11.5.3.1 Strengthening genomic infrastructure and technology integration to support market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Kingdom of Saudi Arabia

- 11.6.2.1.1 Growing healthcare expenditure to boost market growth

- 11.6.2.2 UAE

- 11.6.2.2.1 Rising government support and incorporation of ISH technologies by hospitals to aid market growth

- 11.6.2.3 Rest of GCC countries

- 11.6.2.1 Kingdom of Saudi Arabia

- 11.6.3 REST OF MIDDLE EAST

- 11.7 AFRICA

- 11.7.1 GROWING MARKET FOR PHARMACEUTICALS AND INCREASING DEMAND FOR GENETIC TESTING TO PROPEL GROWTH

- 11.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION & FINANCIAL METRICS

- 12.5.1 FINANCIAL METRICS

- 12.5.2 COMPANY VALUATION

- 12.6 BRAND/PRODUCT COMPARISON

- 12.6.1 F. HOFFMANN-LA ROCHE LTD.

- 12.6.2 DANAHER CORPORATION

- 12.6.3 AGILENT TECHNOLOGIES, INC.

- 12.6.4 ABBOTT

- 12.6.5 THERMO FISHER SCIENTIFIC INC.

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product & service footprint

- 12.7.5.4 Technique footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 F. HOFFMANN-LA ROCHE LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches & approvals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 DANAHER CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 AGILENT TECHNOLOGIES, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 ABBOTT

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses & competitive threats

- 13.1.5 THERMO FISHER SCIENTIFIC INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 ILLUMINA, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansions

- 13.1.7 REVVITY

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 PACBIO

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.9 BIO-RAD LABORATORIES, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services offered

- 13.1.10 BIO-TECHNE

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.11 GENE DX, LLC

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 INSIGHT MOLECULAR DIAGNOSTICS INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services offered

- 13.1.13 BIOVIEW

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services offered

- 13.1.1 F. HOFFMANN-LA ROCHE LTD.

- 13.2 OTHER PLAYERS

- 13.2.1 OXFORD GENE TECHNOLOGY IP LIMITED

- 13.2.2 APPLIED SPECTRAL IMAGING

- 13.2.3 CYTOTEST INC.

- 13.2.4 KROMATID

- 13.2.5 GENIAL GENETIC SOLUTIONS LTD.

- 13.2.6 CYTOGNOMIX INC.

- 13.2.7 METASYSTEMS

- 13.2.8 SCIGENE CORPORATION

- 13.2.9 BIOMODAL

- 13.2.10 BIOCARE MEDICAL, LLC

- 13.2.11 BIODOT

- 13.2.12 ONCODNA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS