|

시장보고서

상품코드

1881289

레크리에이션 보트 시장 : 보트 유형, 보트 사이즈, 엔진 배치, 엔진 유형, 재질, 액티비티 유형, 동력원, 출력 범위, 유통 채널, 지역별(-2032년)Recreational Boat Market by Boat Type (Yachts, Sailboats, Personal Watercrafts, Inflatables), Boat Size, Engine Location, Engine Type, Material, Activity Type, Power Source, Power Range, Distribution Channel, Region - Global Forecast to 2032 |

||||||

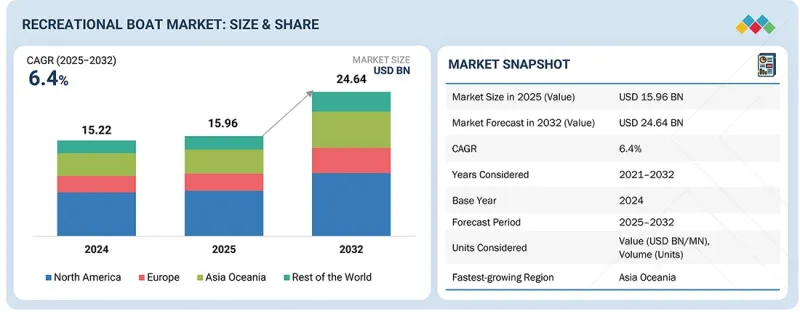

레크리에이션 보트 시장 규모는 예측 기간 동안 CAGR 6.4%로 성장하고 2025년 159억 6,000만 달러, 2032년에는 246억 4,000만 달러에 이를 것으로 전망됩니다.

가처분 소득 증가는 세계적인 레크리에이션 보트 시장의 성장을 뒷받침하고 있으며, 특히 해양 인프라와 수상 관광이 확립되고 급속히 확대되고 있는 북미와 유럽 연안 지역에서는 더 많은 사람들이 고급 레저 활동을 즐길 수 있게 되었습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 금액 및 단위 |

| 부문 | 보트 유형, 보트 사이즈, 엔진 배치, 엔진 유형, 출력 범위, 재질 유형, 액티비티 유형, 전원, 유통 채널, 지역 |

| 대상 지역 | 북미, 아시아, 오세아니아, 유럽 및 기타 지역 |

Brunswick Corporation과 Groupe Beneteau와 같은 기업이 전기 및 하이브리드 모델을 도입하여 소유 비용과 운영 비용을 줄이면서 환경 의식이 높은 구매자층에 호소 할 기회가 탄생했습니다. 자율항행, 디지털 플랫폼, 모듈러 인테리어 등의 기술의 진보가 시장의 변혁을 형성해, 보트 이용을 보다 안전하게, 보다 가까이에, 보다 폭넓은 층에 매력적으로 하고 있습니다. 다양한 렌탈모델과 분양소유모델은 진입장벽을 낮추고 도시의 젊은 구매층과 고급관광지의 퇴직자층에 대응하고 있습니다. 제품 혁신과 가격 전략을 특정 지역 동향과 소비자 부문에 맞추면 업계가 성장하고 지속 가능한 보트 이용이 기세를 늘리고 있습니다.

"예측 기간 동안 외부 엔진 보트가 가장 큰 부문이 될 전망"

외부 엔진 보트는 설치의 신속성, 유지 보수 용이성, 실내 공간의 효율적인 활용, 업그레이드의 간편성 등의 이점으로부터 레크리에이션 보트 시장에서 최대의 점유율을 유지할 것으로 예측되고 있습니다. 이러한 특성은 해안 및 내수 지역에서 낚시 및 레저 활동에 인기있는 소형에서 중형 보트에 적합합니다. 게다가, 외부엔진은 휴대성이 높고, 흡수가 얕고 끝나고, 부담스러운 보트 놀이를 향하고 있기 때문에 수요가 높아지고 있습니다. 국제무역센터(ITC)의 선박 수출 데이터에 따르면 2024년에는 외부 엔진이 수출액의 80% 이상을 차지하고 있습니다. 북미는 광대한 호수 망과 높은 선박 소유율로 이 시장의 최전선에 위치하고 있습니다. 아시아 및 오세아니아 지역도 관광업과 상업 어업의 견인에 의해 급속한 확대를 경험하고 있습니다. 예를 들어 Yamaha Motor Company는 2024년 11월 외장식 추진 시스템에 대한 수요 증가에 대응하기 위해 HARMO 2.0 전동 외장식 추진 시스템을 발표했습니다. 외장형 엔진이 장착된 보트는 사용자 친화적인 설계, 적응성이 높은 성능, 첨단 추진 동향과의 강한 무결성으로 인해 예측 기간 동안 계속해서 큰 시장 점유율을 유지할 것으로 예측됩니다.

"예측 기간 동안 전동 보트가 가장 빠르게 성장하는 부문이 될 전망"

환경규제와 지속가능한 레저활동에 대한 소비자의 관심이 높아짐에 따라 전동보트는 레크리에이션 보트 시장에서 급속히 보급되고 있습니다. 유럽과 북미는 이러한 전환을 주도하고 있으며, 정부의 인센티브, 엄격한 배출가스 규제, 충전 인프라에 대한 투자 확대가 뒷받침되고 있습니다. 전동 추진 시스템은 운영 비용 절감, 최소 유지 보수, 정숙성, 직접 배출 제로, 태양광 패널과 같은 재생에너지원의 가용성 등 여러 가지 큰 장점이 있습니다. 정부의 리베이트, 보조금, 충전 네트워크에 대한 인프라 투자 등 지속적인 지원책이 전동 보트의 보급 확대를 가능하게 하고 있습니다. 미국 연방교통국(Federal Transit Administration)에 의한 3억 1,600만 달러의 조성금과, EU의 Horizon Europe에 의한 909만 달러 규모의 STEESMAT 프로젝트 등의 공적 이니셔티브가 클린 에너지 도입을 더욱 가속화하고 있습니다. Yamaha, Brunswick Corporation, Malibu Boats 등의 제조업체들은 대용량 배터리와 통합형 태양광 시스템에 의한 전동 추진 기술을 추진하고 있습니다. 예를 들어, 독일의 ABT Marian M 800-R은 121.5kWh 배터리를 탑재하여 최고 속도 85km/h·항속 거리 80km를 실현하고 있습니다. 반면, Navalt의 Marsel 5 태양 전기 뗏목은 24명 승선 가능하며 배출 가스는 거의 0입니다.

본 보고서에서는 세계 레크리에이션 보트 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술·특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

제6장 업계 동향

- 가격 분석

- 보트 유형별 가격 분석

- 유리 섬유 및 알루미늄 보트의 기업별 가격 분석

- 존 보트와 다목적 보트의 기업별 가격 분석

- 폰툰 보트의 기업별 가격 분석

- 카누의 기업별 가격 분석

- 생태계 분석

- 공급망 분석

- 사례 연구 분석

- 무역 분석

- 2025-2026년의 주된 회의와 이벤트

- 고객의 사업에 영향을 주는 동향/혁신

- 투자 및 자금조달 시나리오

제7장 기술, 특허, 디지털, AI 도입에 의한 전략적 도입

- AI/생성형 AI의 영향

- 주요 신기술

- 보완적 기술

- 미래 기술

- 특허 분석

제8장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 각국의 규제

- 아시아 및 오세아니아 : 규제기관, 정부기관, 기타 조직

- 유럽 : 규제기관, 정부기관, 기타 조직

- 북미 : 규제기관, 정부기관, 기타 조직

- 기타 지역 : 규제기관, 정부기관, 기타 조직

제9장 고객정세와 구매행동

- 주요 이해관계자와 구매 기준

제10장 레크리에이션 보트 시장 : 액티비티 유형별

- 보트 브랜드

- 크루징과 수상 스포츠

- 낚시

- 주요 산업 인사이트

제11장 레크리에이션 보트 시장 : 보트 유형별

- 인기 레크리에이션 보트 프로바이더

- 요트

- 세일보트

- 개인용 수상 오토바이

- 고무 보트

- 기타

- 주요 산업 인사이트

제12장 레크리에이션 보트 시장 : 보트 사이즈별

- 보트의 분류와 톱 브랜드

- 30피트 미만

- 30-50피트

- 50피트 이상

- 주요 산업 인사이트

제13장 레크리에이션 보트 시장 : 유통 채널별

- 보트 딜러

- 보트쇼

- 온라인 보트 판매

제14장 레크리에이션 보트 시장 : 엔진 배치별

- 세계에서 인기 있는 레크리에이션 보트 프로바이더

- 아웃보드

- 인보드

- 기타

- 주요 산업 인사이트

제15장 레크리에이션 보트 시장 : 엔진별

- 보트의 분류와 톱 브랜드

- 내연기관(IC)

- 전기

- 주요 산업 인사이트

제16장 레크리에이션 보트 시장 : 재질별

- 세계의 소재를 고집한 레크리에이션 보트 프로바이더

- 알루미늄

- 강철

- 유리 섬유

- 기타

- 주요 산업 인사이트

제17장 레크리에이션 보트 시장 : 출력 범위별

- 전동 레크리에이션 보트의 출력 범위 분류

- 최대 100kW

- 100kW-200kW

- 200kW 초과

- 주요 산업 인사이트

제18장 레크리에이션 보트 시장 : 동력원별

- 엔진 구동

- 범선 동력

- 인력

- 주요 산업 인사이트

제19장 레크리에이션 보트 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 거시경제 전망

- 독일

- 프랑스

- 스페인

- 영국

- 이탈리아

- 아시아 및 오세아니아

- 거시경제 전망

- 인도

- 일본

- 중국

- 한국

- 호주

- 뉴질랜드

- 기타 지역

- 거시경제 전망

- 브라질

- 러시아

제20장 경쟁 구도

- 개요

- 시장 점유율 분석,

- 톱/리스트 기업의 수익 분석

- 기업평가와 재무지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업

- 스타트업/중소기업용 기업평가 매트릭스

- 경쟁 시나리오

제21장 기업 프로파일

- 주요 기업

- BRUNSWICK CORPORATION

- YAMAHA MOTOR COMPANY

- GROUPE BENETEAU

- MALIBU BOATS

- FERRETTI GROUP

- POLARIS INC.

- MASTERCRAFT BOAT COMPANY

- BOMBARDIER RECREATIONAL PRODUCTS

- MARINE PRODUCTS CORPORATION

- AZIMUT BENETTI GROUP

- SUNSEEKER INTERNATIONAL

- BASS PRO GROUP

- BRYTON MARINE GROUP

- 기타 기업

- MAHINDRA & MAHINDRA

- CATALINA YACHTS

- ZODIAC MARINE

- ISLAND PACKET YACHTS

- HALLBERG-RASSY

- OYSTER YACHTS

- WINNEBAGO INDUSTRIES

- MONTEREY BOATS

- S2 YACHTS

- SMOKER CRAFT

- OCEAN ALEXANDER

제22장 제안

- 예측기간 중, 북미는 레크리에이션 보트 시장에서 가장 성장이 빠른 지역이 될 전망

- 예측 기간 중 전동 엔진 보트는 내연 기관(ICE) 보트보다 높은 성장률을 나타낼 전망

- 결론

제23장 부록

SHW 25.12.11The recreational boat market is expected to grow from USD 15.96 billion in 2025 to USD 24.64 billion by 2032, at a compound annual growth rate (CAGR) of 6.4% during the forecast period. Rising disposable incomes are fueling the global recreational boat market, as more people can now afford luxury and leisure activities, particularly in North America and coastal Europe, where marine infrastructure and water tourism are well-established and expanding rapidly.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD BN/MN) and Volume (Units) |

| Segments | Boat Type, Boat Size, Engine Placement, Engine Type, Power Range, Material Type, Activity Type, Power Source, Distribution Channel, and Region |

| Regions covered | North America, Asia, Oceania, Europe, and Rest of the World |

Opportunities will arise as companies such as Brunswick Corporation and Groupe Beneteau introduce electric and hybrid models, reducing ownership and operation costs while appealing to environmentally conscious buyers. Technological advances, such as autonomous navigation, digital platforms, and modular interiors, are shaping the market's transformation, making boating safer, more accessible, and more attractive to a broader demographic. Diverse rental and fractional ownership models lower entry barriers, addressing younger buyers in urban centers and retirees in premium tourist regions. As a result, the industry grows by aligning product innovations and pricing strategies to specific regional trends and consumer segments, with sustainable boating gaining momentum.

"Outboard engine boats are expected to be the largest segment during the forecast period."

Outboard engine boats are expected to hold the highest share in the recreational boat market due to their advantages, such as quicker installation, easier maintenance, more usable interior space, and simpler upgrades, all of which suit small to mid-sized boats popular for fishing and leisure activities in coastal and inland waters. The demand for these boats is also driven by their portability, lower draft requirements, and better suitability for casual boating activities. International Trade Center data on marine exports show outboard making up over 80% of export value in 2024. North America is at the forefront of this market due to its extensive lake networks and high rates of boat ownership. Asia Oceania is also experiencing rapid expansion driven by the tourism and commercial fishing sectors. For instance, Yamaha Motor Company launched HARMO 2.0 electric outboard propulsion system in November 2024 to cater to the rising demand for outboard propulsion systems. Outboard position engine boats will thus continue to hold a substantial market share during the forecast period, attributed to their strong alignment with user-friendly design, adaptable performance, and forward-looking propulsion trends.

"Electric boats are expected to be the fastest-growing segment during the forecast period."

Electric boats are rapidly gaining traction in the recreational boat market, propelled by environmental regulations and consumer interest in sustainable leisure activities. Europe and North America lead this transition, supported by government incentives, rigorous emission laws, and increased investments in charging infrastructure. Electric propulsion offers several significant advantages, including lower operating costs, minimal maintenance, quieter operation, zero direct emissions, and the ability to utilize renewable power sources, such as solar panels. Ongoing government support initiatives through rebates, subsidies, and infrastructure investments in charging networks, enabling broader adoption of electric boats. Public initiatives, including the US Federal Transit Administration's USD 316 million grant (2024) and the EU Horizon Europe's USD 9.09 million STEESMAT project (2025), further accelerate the adoption of clean energy. Manufacturers like Yamaha, Brunswick Corporation, and Malibu Boats are advancing electric propulsion with high-capacity batteries and integrated solar systems. For instance, Germany's ABT Marian M 800-R features a 121.5 kWh battery, reaching 85 km/h and an 80 km range, while Navalt's Marsel 5 solar-electric catamaran accommodates 24 passengers with near-zero emissions.

"Asia Oceania is expected to exhibit the highest growth rate, with personal watercraft boats experiencing the fastest growth during the forecast period."

China's recreational boat market is expected to grow at a CAGR of 5.5% CAGR during the forecast period due to the rapid development of marina infrastructure in coastal areas like Hainan and increased demand from the rising middle class for tourism and family outings, which boosts sales of small luxury crafts. India's growth is expected to be slightly higher than China's, driven by rapid growth in local tourism activity and a government push through multiple policy initiatives, such as the River Cruise tourism project. Japan is also expected to see a growth rate close to China's. This growth is enabled by better engines, which have reduced fuel costs and comply with local noise regulations. In Asia Oceania, the personal watercraft boat segment is expected to grow at the fastest rate because these boats are less expensive, require minimal storage space, and are popular among the young generation of customers. For instance, Kawasaki's Ultra 310 LX/LXS and the STX 160X 2025 jet ski model with quiet electric options sells in large numbers in Japan's urban areas for city escapes, while Yamaha's compact PWC line, which includes FX SVHO and FX Cruise HO, is popular in India's local tourism industry.

In-depth interviews were conducted with managers, marketing directors, other innovation & technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEM - 50%, Tier I - 16%, Tier II - 13%, and Tourism/Rental Platforms - 21%

- By Designation: Managers - 30%, Directors - 15%, and Others - 55%

- By Region: North America - 30%, Europe - 20%, Asia Oceania - 40%, and Rest of the World - 10%

The recreational boat market is dominated by established players, including Brunswick Corporation (US), Yamaha Motor Corporation (Japan), Groupe Beneteau (France), Ferretti Group, and Malibu Boats (US). These companies have been developing new products, adopting expansion strategies, and undertaking collaborations, partnerships, and mergers & acquisitions to gain traction in the recreational boat market.

Research Coverage:

The report covers the recreational boat market, by boat type (yachts, sailboats, personal watercraft boats, inflatable boats), activity type (cruising & watersports, fishing), boat size (<30 feet, 30-50 feet, >50 feet), material type (aluminum, steel, fiberglass), engine location (outboard, inboard), engine type (ICE, electric), power source (engine-powered, sail-powered, human-powered), power range (<100 kW, 100-200 kW, >200 kW), distribution channel (boat dealership, boat shows, online boat sales), and Region (Asia Oceania, Europe, North America, and Rest of the World). It also covers the competitive landscape and company profiles of the major players in the recreational boat ecosystem.

Key Benefits of Buying Report:

- The report will help market leaders and new entrants in this market by providing information on the closest approximations of revenue numbers for the overall recreational boat market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 BY BOAT TYPE

- 1.2.2 BY ENGINE TYPE

- 1.2.3 BY POWER SOURCE

- 1.2.4 BY ENGINE LOCATION

- 1.2.5 BY ACTIVITY TYPE

- 1.2.6 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RECREATIONAL BOAT MARKET: FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RISK ASSESSMENT AND ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RECREATIONAL BOAT MARKET

- 4.2 RECREATIONAL BOAT MARKET, BY BOAT TYPE

- 4.3 RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE

- 4.4 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION

- 4.5 RECREATIONAL BOAT MARKET, BY POWER SOURCE

- 4.6 RECREATIONAL BOAT MARKET, BY BOAT SIZE

- 4.7 RECREATIONAL BOAT MARKET, BY ENGINE TYPE

- 4.8 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE

- 4.9 RECREATIONAL BOAT MARKET, BY POWER RANGE

- 4.10 RECREATIONAL BOAT MARKET GROWTH RATE, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of disposable incomes and tourism industry

- 5.2.1.2 Shifting trend of boat buyers

- 5.2.1.3 Adoption of electric and hybrid propulsion systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Strict pollution norms for recreational boats

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for higher horsepower engines

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of boat ownership

- 5.2.4.2 Limited electric charging and docking infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PRICING ANALYSIS

- 6.2 RECREATIONAL BOAT MARKET: PRICING ANALYSIS, BY BOAT TYPE (2024)

- 6.3 RECREATIONAL BOAT MARKET: BY COMPANY-WISE PRICING ANALYSIS (USD) FOR FIBERGLASS AND ALUMINUM BOATS

- 6.4 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR JON AND UTILITY BOATS (2024)

- 6.5 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR PONTOONS (2024)

- 6.6 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR CANOE (2024)

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 COMPONENT MANUFACTURERS

- 6.7.2 ENGINE MANUFACTURERS

- 6.7.3 OEMS

- 6.7.4 DISTRIBUTORS, DEALERS, AND SERVICE PROVIDERS

- 6.8 SUPPLY CHAIN ANALYSIS

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 MALIBU BOATS RECOVERED FROM SERVER OUTAGE IN MINUTES USING CLOUDENDURE DISASTER RECOVERY ON AWS

- 6.9.2 BRUNSWICK PARTNERED WITH MESH SYSTEMS FOR CZONE CLOUD ENABLEMENT AND PLATFORM MIGRATION

- 6.9.3 GROUPE BENETEAU ADOPTED KEEPER FOR SECURE ENTERPRISE PASSWORD MANAGEMENT

- 6.9.4 BALLARD'S FUEL CELL-BASED PROPULSION FOR SHIPS

- 6.9.5 FULL CARBON FIBER-BASED BOATS BY CARBON MARINE

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT DATA

- 6.10.2 EXPORT DATA

- 6.11 KEY CONFERENCES AND EVENTS IN 2025-2026

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.13 INVESTMENT AND FUNDING SCENARIO

7 STRATEGIC ADOPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 IMPACT OF AI/GEN AI

- 7.2 KEY EMERGING TECHNOLOGIES

- 7.2.1 CARBON FIBER AND GRAPHENE

- 7.2.2 AUTONOMOUS DOCKING

- 7.2.3 IOT-BASED NAVIGATION SYSTEM

- 7.3 COMPLEMENTARY TECHNOLOGIES

- 7.3.1 COMMUNICATIONS INFRASTRUCTURE

- 7.3.2 BATTERY AND ENERGY STORAGE TECHNOLOGIES

- 7.4 FUTURE TECHNOLOGIES

- 7.4.1 AUTONOMOUS RECREATIONAL BOATS

- 7.4.2 HYBRID MARINE PROPULSION

- 7.5 PATENT ANALYSIS

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.2 RECREATIONAL BOAT MARKET: COUNTRY-WISE REGULATIONS

- 8.3 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.6 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

9 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 9.1 KEY STAKEHOLDERS AND BUYING CRITERIA

- 9.1.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.1.2 BUYING CRITERIA

- 9.1.2.1 Yacht

- 9.1.2.2 Sailboat

- 9.1.2.3 Personal watercraft

10 RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE

- 10.1 INTRODUCTION

- 10.2 BOAT BRANDS

- 10.3 CRUISING AND WATERSPORTS

- 10.3.1 RISING INTEREST IN SAILING, YACHTING, KAYAKING, AND JET SKIING TO DRIVE MARKET

- 10.4 FISHING

- 10.4.1 EXPANDING RECREATIONAL AND COMMERCIAL FISHING ACTIVITIES TO DRIVE MARKET

- 10.5 KEY INDUSTRY INSIGHTS

11 RECREATIONAL BOAT MARKET, BY BOAT TYPE

- 11.1 INTRODUCTION

- 11.2 POPULAR RECREATIONAL BOAT PROVIDERS

- 11.3 YACHT

- 11.3.1 USED IN LARGE-SCALE TOURISM OPERATIONS

- 11.4 SAILBOAT

- 11.4.1 DEVOID OF ENGINE REPAIRS AND MAINTENANCE COSTS

- 11.5 PERSONAL WATERCRAFT

- 11.5.1 ELECTRIFICATION TREND TO GAIN TRACTION IN THIS SEGMENT

- 11.6 INFLATABLE BOAT

- 11.6.1 USED FOR RESCUE, RECREATIONAL, AND EMERGENCY OPERATIONS

- 11.7 OTHERS

- 11.8 KEY INDUSTRY INSIGHTS

12 RECREATIONAL BOAT MARKET, BY BOAT SIZE

- 12.1 INTRODUCTION

- 12.2 BOAT CATEGORIZATION AND TOP BRANDS

- 12.3 <30 FEET

- 12.3.1 LARGEST SEGMENT IN TERMS OF VOLUME

- 12.4 30-50 FEET

- 12.4.1 IDEAL FOR WATER SPORTS AND GROUP TOURISM

- 12.5 >50 FEET

- 12.5.1 GROWTH IN SALES DUE TO STATE-SPONSORED TOURISM INITIATIVES

- 12.6 KEY INDUSTRY INSIGHTS

13 RECREATIONAL BOAT MARKET, BY DISTRIBUTION CHANNEL

- 13.1 INTRODUCTION

- 13.2 BOAT DEALERSHIPS

- 13.3 BOAT SHOWS

- 13.4 ONLINE BOAT SALES

14 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION

- 14.1 INTRODUCTION

- 14.2 POPULAR RECREATIONAL BOAT PROVIDERS WORLDWIDE

- 14.3 OUTBOARD

- 14.3.1 EASY INSTALLATION AND MAINTENANCE TO DRIVE DEMAND

- 14.4 INBOARD

- 14.4.1 HIGH PERFORMANCE FOR LARGER LUXURY AND MOTOR YACHTS

- 14.5 OTHERS

- 14.6 KEY INDUSTRY INSIGHTS

15 RECREATIONAL BOAT MARKET, BY ENGINE TYPE

- 15.1 INTRODUCTION

- 15.2 BOAT CATEGORIZATION AND TOP BRANDS

- 15.3 INTERNAL COMBUSTION (IC)

- 15.3.1 MOST COMMONLY USED BOATS WORLDWIDE

- 15.4 ELECTRIC

- 15.4.1 LIMITS EMISSION AND CARBON FOOTPRINTS

- 15.5 KEY INDUSTRY INSIGHTS

16 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE

- 16.1 INTRODUCTION

- 16.2 MATERIAL-WISE RECREATIONAL BOAT PROVIDERS WORLDWIDE

- 16.3 ALUMINUM

- 16.3.1 LESS MAINTENANCE AND COST-EFFECTIVENESS TO DRIVE DEMAND

- 16.4 STEEL

- 16.4.1 DURABILITY AND ABRASION RESISTANCE TO DRIVE DEMAND

- 16.5 FIBERGLASS

- 16.5.1 ABILITY TO BE MOLDED INTO ANY DESIRED SHAPE OR SIZE TO DRIVE DEMAND

- 16.6 OTHERS

- 16.7 KEY INDUSTRY INSIGHTS

17 RECREATIONAL BOAT MARKET, BY POWER RANGE

- 17.1 INTRODUCTION

- 17.2 ELECTRIC RECREATIONAL BOAT POWER RANGE CATEGORIZATION

- 17.3 UP TO 100 KW

- 17.3.1 LIGHTWEIGHT WITH SLOW TO MODERATE SPEED

- 17.4 100 KW-200 KW

- 17.4.1 SUITABLE FOR DAY CRUISING AND WATERSPORTS

- 17.5 ABOVE 200 KW

- 17.5.1 FASTEST-GROWING SEGMENT DRIVEN BY MULTI-MOTOR BATTERY ADVANCEMENTS

- 17.6 KEY INDUSTRY INSIGHTS

18 RECREATIONAL BOAT MARKET, BY POWER SOURCE

- 18.1 INTRODUCTION

- 18.1.1 POPULAR RECREATIONAL BOAT PROVIDERS WORLDWIDE

- 18.2 ENGINE POWERED

- 18.2.1 HIGHEST-SELLING BOATS IN NORTH AMERICA AND EUROPE

- 18.3 SAIL POWERED

- 18.3.1 ENVIRONMENT-FRIENDLY AND REQUIRE MANUAL LABOR

- 18.4 HUMAN POWERED

- 18.4.1 HIGH DEMAND IN WATERSPORTS TO DRIVE GROWTH

- 18.5 KEY INDUSTRY INSIGHTS

19 RECREATIONAL BOAT MARKET, BY REGION

- 19.1 INTRODUCTION

- 19.2 NORTH AMERICA

- 19.2.1 MACROECONOMIC OUTLOOK

- 19.2.2 US

- 19.2.2.1 Presence of top recreational boating destinations to drive market

- 19.2.3 CANADA

- 19.2.3.1 Second-largest recreational boat market in North America

- 19.2.4 MEXICO

- 19.2.4.1 Growing influence from US and Canadian markets to drive market

- 19.3 EUROPE

- 19.3.1 MACROECONOMIC OUTLOOK

- 19.3.2 GERMANY

- 19.3.2.1 Increasing emission norms to regulate market

- 19.3.3 FRANCE

- 19.3.3.1 Largest market in Europe and top exporter

- 19.3.4 SPAIN

- 19.3.4.1 Growth in imports to drive market

- 19.3.5 UK

- 19.3.5.1 Presence of top European cruising operators to drive market

- 19.3.6 ITALY

- 19.3.6.1 Strong demand during summer season to drive market

- 19.4 ASIA OCEANIA

- 19.4.1 MACROECONOMIC OUTLOOK

- 19.4.2 INDIA

- 19.4.2.1 Growth of marine tourism to drive market

- 19.4.3 JAPAN

- 19.4.3.1 Presence of top outboard engine producers to drive market

- 19.4.4 CHINA

- 19.4.4.1 Expanding population of high-net-worth individuals to drive market

- 19.4.5 SOUTH KOREA

- 19.4.5.1 Rising income of upper middle-class to drive demand

- 19.4.6 AUSTRALIA

- 19.4.6.1 Increasing registrations of personal watercraft to drive market

- 19.4.7 NEW ZEALAND

- 19.4.7.1 Government policies for boater safety to drive market

- 19.5 REST OF THE WORLD

- 19.5.1 MACROECONOMIC OUTLOOK

- 19.5.2 BRAZIL

- 19.5.2.1 Growth of watersports tourism to drive market

- 19.5.3 RUSSIA

- 19.5.3.1 Fast-growing demand for cruising and recreational fishing to drive market

20 COMPETITIVE LANDSCAPE

- 20.1 OVERVIEW

- 20.2 MARKET SHARE ANALYSIS, 2024

- 20.3 REVENUE ANALYSIS OF TOP/LISTED PLAYERS

- 20.4 COMPANY VALUATION AND FINANCIAL METRICS

- 20.4.1 COMPANY VALUATION

- 20.4.2 FINANCIAL METRICS

- 20.5 BRAND COMPARISON

- 20.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 20.6.1 STARS

- 20.6.2 EMERGING LEADERS

- 20.6.3 PERVASIVE PLAYERS

- 20.6.4 PARTICIPANTS

- 20.6.5 COMPANY FOOTPRINT

- 20.7 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- 20.7.1 PROGRESSIVE COMPANIES

- 20.7.2 RESPONSIVE COMPANIES

- 20.7.3 DYNAMIC COMPANIES

- 20.7.4 STARTING BLOCKS

- 20.7.5 COMPETITIVE BENCHMARKING

- 20.8 COMPETITIVE SCENARIO

- 20.8.1 PRODUCT LAUNCHES

- 20.8.2 DEALS

- 20.8.3 EXPANSIONS

21 COMPANY PROFILES

- 21.1 KEY PLAYERS

- 21.1.1 BRUNSWICK CORPORATION

- 21.1.1.1 Business overview

- 21.1.1.2 Products offered

- 21.1.1.3 Recent developments

- 21.1.1.3.1 Product launches

- 21.1.1.3.2 Deals

- 21.1.1.3.3 Expansions

- 21.1.1.4 MnM view

- 21.1.1.4.1 Right to win

- 21.1.1.4.2 Strategic choices

- 21.1.1.4.3 Weaknesses and competitive threats

- 21.1.2 YAMAHA MOTOR COMPANY

- 21.1.2.1 Business overview

- 21.1.2.2 Products offered

- 21.1.2.3 Recent developments

- 21.1.2.3.1 Product launches

- 21.1.2.3.2 Deals

- 21.1.2.4 MnM view

- 21.1.2.4.1 Right to win

- 21.1.2.4.2 Strategic choices

- 21.1.2.4.3 Weaknesses and competitive threats

- 21.1.3 GROUPE BENETEAU

- 21.1.3.1 Business overview

- 21.1.3.2 Products offered

- 21.1.3.3 Recent developments

- 21.1.3.3.1 Product launches

- 21.1.3.3.2 Deals

- 21.1.3.4 MnM view

- 21.1.3.4.1 Right to win

- 21.1.3.4.2 Strategic choices

- 21.1.3.4.3 Weaknesses and competitive threats

- 21.1.4 MALIBU BOATS

- 21.1.4.1 Business overview

- 21.1.4.2 Products offered

- 21.1.4.3 Recent developments

- 21.1.4.3.1 Product launches

- 21.1.4.3.2 Deals

- 21.1.4.4 MnM view

- 21.1.4.4.1 Right to win

- 21.1.4.4.2 Strategic choices

- 21.1.4.4.3 Weaknesses and competitive threats

- 21.1.5 FERRETTI GROUP

- 21.1.5.1 Business overview

- 21.1.5.2 Products offered

- 21.1.5.3 Recent developments

- 21.1.5.3.1 Product launches

- 21.1.5.3.2 Deals

- 21.1.5.3.3 Expansions

- 21.1.5.4 MnM view

- 21.1.5.4.1 Right to win

- 21.1.5.4.2 Strategic choices

- 21.1.5.4.3 Weaknesses and competitive threats

- 21.1.6 POLARIS INC.

- 21.1.6.1 Business overview

- 21.1.6.2 Products offered

- 21.1.6.3 Recent developments

- 21.1.6.3.1 Product launches

- 21.1.7 MASTERCRAFT BOAT COMPANY

- 21.1.7.1 Business overview

- 21.1.7.2 Products offered

- 21.1.7.3 Recent developments

- 21.1.7.3.1 Product launches

- 21.1.7.3.2 Deals

- 21.1.7.3.3 Expansions

- 21.1.8 BOMBARDIER RECREATIONAL PRODUCTS

- 21.1.8.1 Business overview

- 21.1.8.2 Products offered

- 21.1.8.3 Recent developments

- 21.1.8.3.1 Product launches

- 21.1.8.3.2 Expansions

- 21.1.8.3.3 Others

- 21.1.9 MARINE PRODUCTS CORPORATION

- 21.1.9.1 Business overview

- 21.1.9.2 Products offered

- 21.1.9.3 Recent developments

- 21.1.9.3.1 Product launches

- 21.1.10 AZIMUT BENETTI GROUP

- 21.1.10.1 Business overview

- 21.1.10.2 Products offered

- 21.1.10.3 Recent developments

- 21.1.10.3.1 Product launches

- 21.1.10.3.2 Deals

- 21.1.11 SUNSEEKER INTERNATIONAL

- 21.1.11.1 Business overview

- 21.1.11.2 Products offered

- 21.1.11.3 Recent developments

- 21.1.11.3.1 Product launches

- 21.1.11.3.2 Deals

- 21.1.11.3.3 Others

- 21.1.12 BASS PRO GROUP

- 21.1.12.1 Business overview

- 21.1.12.2 Products offered

- 21.1.12.3 Recent developments

- 21.1.12.3.1 Product launches

- 21.1.12.3.2 Deals

- 21.1.12.3.3 Expansions

- 21.1.13 BRYTON MARINE GROUP

- 21.1.13.1 Business overview

- 21.1.13.2 Products offered

- 21.1.13.3 Recent developments

- 21.1.13.3.1 Product launches

- 21.1.13.3.2 Deals

- 21.1.1 BRUNSWICK CORPORATION

- 21.2 OTHER PLAYERS

- 21.2.1 MAHINDRA & MAHINDRA

- 21.2.2 CATALINA YACHTS

- 21.2.3 ZODIAC MARINE

- 21.2.4 ISLAND PACKET YACHTS

- 21.2.5 HALLBERG-RASSY

- 21.2.6 OYSTER YACHTS

- 21.2.7 WINNEBAGO INDUSTRIES

- 21.2.8 MONTEREY BOATS

- 21.2.9 S2 YACHTS

- 21.2.10 SMOKER CRAFT

- 21.2.11 OCEAN ALEXANDER

22 RECOMMENDATIONS

- 22.1 NORTH AMERICA TO BE FASTEST-GROWING REGION IN RECREATIONAL BOAT MARKET DURING FORECAST PERIOD

- 22.2 ELECTRIC ENGINE BOATS TO WITNESS HIGHER GROWTH RATE THAN ICE BOATS DURING FORECAST PERIOD

- 22.3 CONCLUSION

23 APPENDIX

- 23.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 23.2 DISCUSSION GUIDE

- 23.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 23.4 CUSTOMIZATION OPTIONS

- 23.5 RELATED REPORTS

- 23.6 AUTHOR DETAILS