|

시장보고서

상품코드

1915208

소아용 혈관 접근 시장 : 유형별, 용도별, 최종사용자별 - 세계 예측(-2030년)Pediatric Vascular Access Market by Type (Catheters (CVC, PIVC, PICC), Ports, IV Sets, Infusion Pumps), Application (Drug Administration, Blood Transfusion, Diagnostics & Testing), End User (Hospitals, ASCs) - Global Forecast to 2030 |

||||||

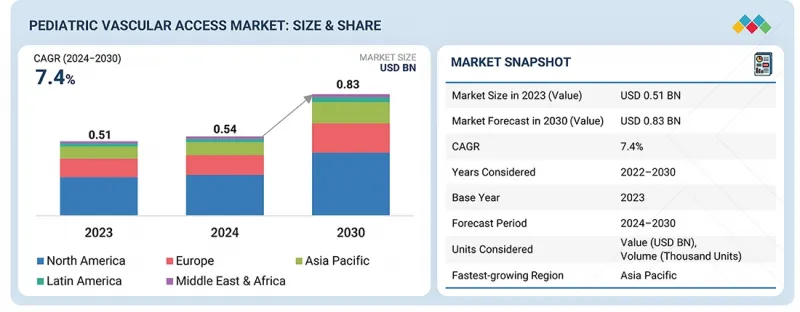

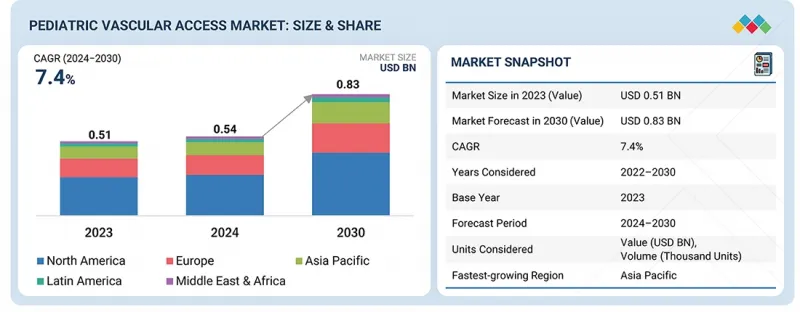

세계의 소아용 혈관 접근 시장 규모는 2024년 5억 4,300만 달러에서 2030년까지 8억 3,310만 달러에 달할 것으로 예측되며, 예측 기간 동안 CAGR로 7.4%의 성장이 전망됩니다. 미숙아 증가, 카테터 재료의 안전성 및 쾌적성 향상, 신생아 집중치료실(NICU) 입원 환자 수 증가 등 다양한 요인으로 인해 소아용 혈관 접근 시장은 꾸준한 성장을 보이고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2023-2030년 |

| 기준 연도 | 2023년 |

| 예측 기간 | 2024-2030년 |

| 단위 | 100만 달러 |

| 부문 | 유형, 용도, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

특히 북미, 유럽, 아시아태평양에서는 입원 환자 수가 증가함에 따라 스마트 혈관 접근 디바이스로의 전환이 진행되고 있습니다. 전반적으로 개발도상국 시장의 의료비 증가는 시장 성장에 새로운 기회를 제공하고 있습니다.

카테터 유형별로는 소아용 혈관 접근 시장의 말초 정맥 카테터(PIVC) 부문이 예측 기간 동안 가장 높은 CAGR을 유지할 것으로 예상됩니다.

소아용 혈관 접근 시장에서 말초 정맥 카테터(PIVC) 부문은 고위험군 신생아에게 안전하고 효율적인 혈관 접근을 가능하게 하는 중요한 역할을 하고 있어 예측 기간 동안 가장 높은 CAGR을 보일 것으로 예상됩니다. PIVC는 단기간 사용을 목적으로 설계되었으며, 일반적으로 24-96시간 동안 지속됩니다. 잦은 중재가 필요한 신생아 중환자실(NICU)에서 약물, 수액, 혈액제제 투여에 주로 사용됩니다.

최종사용자별로는 소아용 혈관 접근 시장의 외래 수술 센터(ASC) 부문이 두 번째로 높은 성장률을 보일 것으로 예상됩니다.

ASC는 비용 효율성, 편의성, 환자 중심적 치료에 중점을 두기 때문에 특정 신생아 중재에서 전통적인 병원 환경을 대체할 수 있는 대안으로 점점 더 많이 선택되고 있습니다. ASC는 말초정맥카테터(PIVC), 말초삽입형 중심정맥 카테터(PICC), 미드라인 카테터 등 첨단 혈관 접근 기기를 필요로 하는 시술을 전문으로 하는 경우가 많습니다. 이러한 장치는 통제된 최소침습적 환경에서 선천성 기형, 조산 합병증, 수술 후 회복과 같은 증상을 관리하는 데 필수적입니다. 병원 밖에서 이러한 시술을 할 수 있는 능력은 높은 의료 수준을 유지하면서 비용을 절감할 수 있어 의료 제공자와 환자 모두에게 매력적인 선택이 될 수 있습니다.

아시아태평양이 예측 기간 동안 소아용 혈관 접근 기기 시장에서 가장 높은 CAGR로 성장할 것으로 예상됩니다.

아시아태평양의 소아용 혈관 접근 시장은 인구통계학적, 경제적, 의료 인프라의 역학으로 인해 빠르게 성장하고 있습니다. 특히 중국과 인도에서는 인구 급증과 조산아 발병률 상승에 따라 신생아에 특화된 전문 바스큘러 디바이스에 대한 수요가 급증하고 있습니다. 이 지역 각국 정부는 신생아 의료의 개선을 우선순위에 두고 선진화된 신생아 집중치료실(NICU)에 대한 투자와 국제 표준에 부합하는 의료시설의 개선을 추진하고 있습니다. 예를 들어, 중국 국가위생건강위원회(National Health Commission)는 혈관 접근 기술을 포함한 신생아를 위한 중요한 치료에 대한 접근성을 개선하기 위한 노력을 시작했습니다. 일본의 선진 의료 생태계에서는 AI 통합 모니터링 시스템, 초소형 카테터와 같은 첨단 기술 도입이 진행되고 있습니다. 아시아태평양의 경제 성장으로 인해 가처분 소득이 증가하고 중산층이 증가함에 따라 고급 의료 솔루션에 대한 접근성이 확대되어 시장 성장을 더욱 가속화하고 있습니다. 한국과 싱가포르의 경우, 의료 분야의 기술 통합 문화에 힘입어 스마트 바스큘러 디바이스의 도입이 활발하게 이루어지고 있습니다.

세계의 소아용 혈관 접근 시장에 대해 조사 분석했으며, 주요 촉진요인 및 저해요인, 제품 개발 및 혁신, 경쟁 구도에 대한 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 소아용 혈관 접근 시장의 기업에서 매력적인 기회

- 소아용 혈관 접근 시장 : 지역별

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 업계 동향

- 최소침습 혈관 접근 수술

- 카테터 재료·코팅 혁신

- 밸류체인 분석

- 생태계 분석

- 공급망 분석

- 무역 분석

- 수입 시나리오(HS 코드 901839)

- 수출 시나리오(HS 코드 901839)

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 규제 상황

- 규제 프레임워크

- 규제기관, 정부기관, 기타 조직

- 특허 분석

- 가격 책정 분석

- 평균판매가격 동향 : 주요 기업별

- 평균판매가격 동향 : 지역별

- 주요 회의와 이벤트(2025-2026년)

- 인접 시장 분석

- 미충족 수요/최종사용자 기대

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 투자와 자금 조달 시나리오

- AI/생성형 AI의 영향

- 미국의 2025년 관세

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 이용 산업에 대한 영향

제6장 소아용 혈관 접근 시장 : 유형별

- 카테터

- 카테터 고정·안정화

- 이식형 포트

- 포트 바늘

- 주입 펌프

- IV 커넥터

- 주사기·바늘

- 혈관 폐쇄 기기

- 점적 세트·액세서리

- 마취 주사기

- 가이드 디바이스

- 카테터 뚜껑 및 마개

- 골수내 주입 디바이스

- 기타 유형

제7장 소아용 혈관 접근 시장 : 용도별

- 수분·영양 투여

- 투약

- 진단·검사

- 수혈

제8장 소아용 혈관 접근 시장 : 최종사용자별

- 병원

- 외래 수술 센터·진료소

- 재택 케어 환경

- 기타 최종사용자

제9장 소아용 혈관 접근 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 아시아태평양

- 거시경제 전망

- 일본

- 중국

- 기타 아시아태평양

제10장 경쟁 구도

- 주요 진출 기업의 전략/강점(2022-2024년)

- 매출 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품의 비교

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- BECTON, DICKINSON AND COMPANY

- TELEFLEX INCORPORATED

- ICU MEDICAL, INC.

- B. BRAUN SE

- TERUMO CORPORATION

- MEDTRONIC

- VYGON

- NIPRO CORPORATION

- ANGIODYNAMICS

- COOK MEDICAL

- 기타 기업

- CANADIAN HOSPITAL SPECIALTIES LIMITED

- MERIT MEDICAL SYSTEMS, INC.

- MEDICAL COMPONENTS, INC.

- AMECATH

- ARGON MEDICAL DEVICES

- HEALTH LINE INTERNATIONAL CORPORATION

- DELTA MED

- ACCESS VASCULAR, INC.

- PAKUMEDMEDICAL PRODUCTS GMBH

- GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- PFM MEDICAL

- POLY MEDICURE LTD

- NEWTECH MEDICAL DEVICES PVT. LTD.

- SHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD.

- ANGIPLAST PRIVATE LIMITED

제12장 부록

KSM 26.02.05The global pediatric vascular access market is projected to reach USD 833.1 million by 2030 from USD 543.0 million in 2024, at a CAGR of 7.4% during the forecast period. The pediatric vascular access market is witnessing consistent growth due to various factors such as preterm births, advancement in catheter materials in terms of safety and comfort, and growing NICU admissions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific , Latin America, Middle East & Africa |

There has also been a shift towards smart vascular access devices, particularly in North America, Europe, and the Asia Pacific, where there is an increase in hospitalizations. Overall, increased healthcare expenditure in developing markets is bringing new opportunities to market growth.

The Peripheral Intravenous Catheters (PIVC) segment of the pediatric vascular access market, by the type of catheters, is expected to hold the highest CAGR during the forecast period.

The Peripheral Intravenous Catheters (PIVC) segment within the Pediatric Vascular Access market is anticipated to exhibit the highest CAGR during the forecast period due to its critical role in facilitating safe and efficient vascular access for high-risk newborns. PIVCs are designed for short-term use, typically lasting 24-96 hours. They are preferred for administering medications, fluids, and blood products in neonatal intensive care units (NICUs), where frequent interventions are required.

The Ambulatory Surgical Centers (ASCs) segment of the pediatric vascular access market, by end user, is expected to show the second-highest growth.

ASCs are increasingly becoming a preferred alternative to traditional hospital settings for certain neonatal interventions due to their cost-effectiveness, convenience, and focus on patient-centered care. ASCs often specialize in procedures that require advanced vascular access devices, such as peripheral intravenous catheters (PIVCs), peripherally inserted central catheters (PICCs), and midline catheters. These devices are essential for managing conditions such as congenital anomalies, preterm complications, or post-surgical recovery in a controlled, less intensive setting. The ability to perform these procedures outside of a full-scale hospital environment reduces costs while maintaining high standards of care, making ASCs an attractive option for providers and patients.

Asia Pacific is expected to grow at the highest CAGR during the forecast period in the pediatric vascular access market.

The pediatric vascular access market in the Asia Pacific region is growing rapidly due to demographic, economic, and healthcare infrastructure dynamics. With a rapidly growing population and rising incidence of preterm births, particularly in China and India, the demand for specialized vascular devices tailored to neonates is surging. Governments across the region are prioritizing improvements in neonatal care, investing in advanced NICUs, and upgrading healthcare facilities to align with global standards. For instance, China's National Health Commission has launched initiatives to enhance access to critical neonatal interventions, including vascular access technologies. Japan's sophisticated healthcare ecosystem continues to adopt cutting-edge technologies such as AI-integrated monitoring systems and ultra-miniaturized catheters. Economic expansion in the Asia Pacific is further fueling market growth as rising disposable incomes and expanding middle-class populations increase access to premium medical solutions. South Korea and Singapore are witnessing heightened adoption of smart vascular devices, driven by a culture of technological integration in healthcare.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 28%, Tier 2: 34%, and Tier 3: 38%

- By Designation: C-level: 40%, Director Level: 26%, and Others: 34%

- By Region: North America: 25%, Europe: 41%, Asia Pacific: 30%, Latin America: 3%, and Middle East & Africa: 1%

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the Pediatric Vascular Access market include BD (US), Teleflex Incorporated (US), ICU Medical, Inc. (US), B. Braun SE (Germany), Angiodynamics, Inc. (US), Terumo Corporation (Japan), Nipro Medical Corporation (Japan), and Medtronic Plc (Ireland)

Research Coverage

This report studies the pediatric vascular access market based on type, applications, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing prevalence of preterm births, advancements in catheter materials in terms of safety and comfort, and growing NICU admissions), restraints (high prices of vascular access devices), opportunities (technological advancements), challenges (balancing innovations with cost-effectiveness)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the pediatric vascular access market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the Pediatric Vascular Access market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the pediatric vascular access industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as BD, Teleflex Incorporated, ICU Medical, Inc., B. Braun SE, AngioDynamics, Inc., Terumo Corporation, Nipro Medical Corporation, and Medtronic Plc.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.5.1 METHODOLOGY-RELATED LIMITATIONS

- 2.5.2 SCOPE-RELATED LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PEDIATRIC VASCULAR ACCESS MARKET

- 4.2 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapidly growing pediatric population

- 5.2.1.2 Rise of pediatric cancer

- 5.2.1.3 Heightened use of vascular access devices in pediatric patients

- 5.2.2 RESTRAINTS

- 5.2.2.1 Costly placement and maintenance of Pediatric vascular access devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in vascular access devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled healthcare professionals

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Imaging and navigation

- 5.3.1.2 Catheter securement and stabilization

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Artificial intelligence and machine learning

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Infection control technologies

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 MINIMALLY INVASIVE VASCULAR ACCESS PROCEDURES

- 5.4.2 INNOVATIONS IN CATHETER MATERIALS AND COATINGS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 901839)

- 5.8.2 EXPORT SCENARIO (HS CODE 901839)

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY FRAMEWORK

- 5.11.1.1 North America

- 5.11.1.1.1 US

- 5.11.1.1.2 Canada

- 5.11.1.2 Europe

- 5.11.1.3 Asia Pacific

- 5.11.1.4 Latin America

- 5.11.1.5 Middle East & Africa

- 5.11.1.1 North America

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATORY FRAMEWORK

- 5.12 PATENT ANALYSIS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.13.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 VASCULAR ACCESS DEVICE MARKET

- 5.16 UNMET NEEDS/END USER EXPECTATIONS

- 5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 IMPACT OF AI/GEN AI

- 5.20 US 2025 TARIFF

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRY

6 PEDIATRIC VASCULAR ACCESS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CATHETERS

- 6.2.1 CENTRAL VENOUS CATHETERS

- 6.2.1.1 Increased prevalence of preterm births to drive market

- 6.2.2 PERIPHERAL INTRAVENOUS CATHETERS

- 6.2.2.1 Rapid adoption of minimally invasive procedures to drive market

- 6.2.3 PERIPHERALLY INSERTED CENTRAL CATHETERS

- 6.2.3.1 Need for long-term vascular access in premature neonates to drive market

- 6.2.4 MIDLINE CATHETERS

- 6.2.4.1 Advancements in catheter materials and insertion techniques to drive market

- 6.2.1 CENTRAL VENOUS CATHETERS

- 6.3 CATHETER SECUREMENT & STABILIZATION

- 6.3.1 IMPROVED AWARENESS ABOUT CATHETER STABILIZATION TO DRIVE MARKET

- 6.4 IMPLANTABLE PORTS

- 6.4.1 RISING INCIDENCES OF PEDIATRIC CANCER TO DRIVE MARKET

- 6.5 PORT NEEDLES

- 6.5.1 INCREASED USE OF IMPLANTABLE PORTS IN PEDIATRIC CARE TO DRIVE MARKET

- 6.6 INFUSION PUMPS

- 6.6.1 HEIGHTENED DEMAND FOR PRECISE DRUG DELIVERY IN PEDIATRIC CARE TO DRIVE MARKET

- 6.7 IV CONNECTORS

- 6.7.1 STRINGENT HOSPITAL PROTOCOLS TO DRIVE MARKET

- 6.8 SYRINGES & NEEDLES

- 6.8.1 NEED FOR SAFE DRUG ADMINISTRATION IN PEDIATRICS TO DRIVE MARKET

- 6.9 VASCULAR CLOSURE DEVICES

- 6.9.1 SURGE IN MINIMALLY INVASIVE PROCEDURES IN PEDIATRIC TO DRIVE MARKET

- 6.10 IV SETS & ACCESSORIES

- 6.10.1 RISE IN PEDIATRIC CONDITIONS REQUIRING INTRAVENOUS THERAPY TO DRIVE MARKET

- 6.11 ANESTHESIA INJECTION DEVICES

- 6.11.1 GROWING PEDIATRICS PROCEDURES TO DRIVE MARKET

- 6.12 GUIDANCE DEVICES

- 6.12.1 ESCALATING DEMAND FOR SAFER AND MORE EFFECTIVE VASCULAR ACCESS PROCEDURES TO DRIVE MARKET

- 6.13 CATHETER CAPS & CLOSURES

- 6.13.1 ADOPTION OF INFECTION PREVENTION PROTOCOLS BY PEDIATRIC CARE UNITS TO DRIVE MARKET

- 6.14 INTRAOSSEOUS INFUSION DEVICES

- 6.14.1 RISING PEDIATRIC EMERGENCIES AND SEPSIS CASES TO DRIVE MARKET

- 6.15 OTHER TYPES

7 PEDIATRIC VASCULAR ACCESS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FLUID & NUTRITION ADMINISTRATION

- 7.2.1 NEED FOR PRECISE, CONTINUOUS THERAPY IN PEDIATRIC POPULATION TO DRIVE MARKET

- 7.3 DRUG ADMINISTRATION

- 7.3.1 RISE IN PEDIATRIC HEALTH COMPLEXITIES TO DRIVE MARKET

- 7.4 DIAGNOSTICS & TESTING

- 7.4.1 ELEVATED DEMAND FOR EARLY DISEASE DETECTION, SEPSIS MANAGEMENT, AND MONITORING TO DRIVE MARKET

- 7.5 BLOOD TRANSFUSION

- 7.5.1 PREVALENCE OF PRETERM BIRTHS AND NEONATAL ANEMIA TO DRIVE MARKET

8 PEDIATRIC VASCULAR ACCESS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 GROWING NICU ADMISSIONS DUE TO PREMATURE BIRTHS AND CONGENITAL CONDITIONS TO DRIVE MARKET

- 8.3 AMBULATORY SURGICAL CENTERS & CLINICS

- 8.3.1 INCREASING PREFERENCE FOR OUTPATIENT CARE TO DRIVE MARKET

- 8.4 HOMECARE SETTINGS

- 8.4.1 EMERGING TREND OF EARLY HOSPITAL DISCHARGE TO DRIVE MARKET

- 8.5 OTHER END USERS

9 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Increasing burden of pediatric cancer to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising preterm births and NICU admissions to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK

- 9.4.2 JAPAN

- 9.4.2.1 Growing focus on pediatric care to drive market

- 9.4.3 CHINA

- 9.4.3.1 Substantial investments in healthcare infrastructure to drive market

- 9.4.4 REST OF ASIA PACIFIC

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End user footprint

- 10.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING

- 10.6.5.1 List of start-ups/SMEs

- 10.6.5.2 Competitive benchmarking of start-ups/SMEs

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BECTON, DICKINSON AND COMPANY

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses & competitive threats

- 11.1.2 TELEFLEX INCORPORATED

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 ICU MEDICAL, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 B. BRAUN SE

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 TERUMO CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choice

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 MEDTRONIC

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 VYGON

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 NIPRO CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 ANGIODYNAMICS

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.10 COOK MEDICAL

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.1 BECTON, DICKINSON AND COMPANY

- 11.2 OTHER PLAYERS

- 11.2.1 CANADIAN HOSPITAL SPECIALTIES LIMITED

- 11.2.2 MERIT MEDICAL SYSTEMS, INC.

- 11.2.3 MEDICAL COMPONENTS, INC.

- 11.2.4 AMECATH

- 11.2.5 ARGON MEDICAL DEVICES

- 11.2.6 HEALTH LINE INTERNATIONAL CORPORATION

- 11.2.7 DELTA MED

- 11.2.8 ACCESS VASCULAR, INC.

- 11.2.9 PAKUMEDMEDICAL PRODUCTS GMBH

- 11.2.10 GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- 11.2.11 PFM MEDICAL

- 11.2.12 POLY MEDICURE LTD

- 11.2.13 NEWTECH MEDICAL DEVICES PVT. LTD.

- 11.2.14 SHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD.

- 11.2.15 ANGIPLAST PRIVATE LIMITED

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS