|

시장보고서

상품코드

1687347

윈도우 필름 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

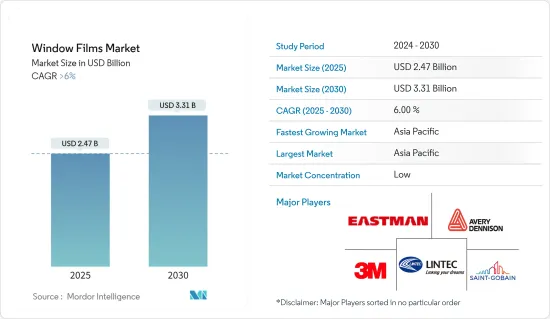

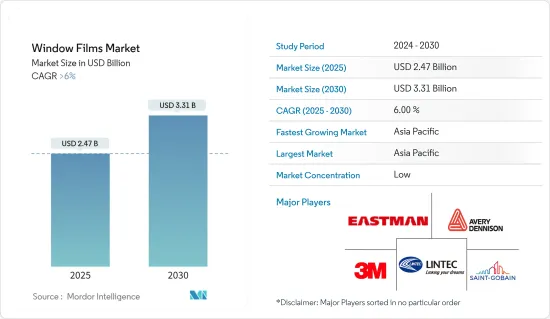

윈도우 필름 시장 규모는 2025년에 24억 7,000만 달러로 예측되며, 예측 기간 중(2025-2030년) CAGR은 6%를 넘어 2030년에는 33억 1,000만 달러에 달할 것으로 예측됩니다.

2020년 COVID-19 팬데믹은 건설 업계에 악영향을 끼쳤습니다. 업계는 물류 및 원자재 가용성 부족으로 인한 어려움에 직면했습니다. 이는 윈도우 필름 시장에도 부정적인 영향을 미쳤습니다. 그러나 대유행 이후 자동차 산업의 생산과 판매가 급증하면서 시장의 성장과 회복을 촉진했습니다.

주요 하이라이트

- 중기적으로는 탄소발자국 감소에 대한 중요성이 강조되고 소비자들 사이에서 안전과 보안에 대한 관심이 높아지는 것이 시장 성장의 주요 요인으로 작용할 것으로 보입니다.

- 그러나 윈도우 필름의 시공에는 어느 정도의 기술적 전문 지식이 필요하며, 윈도우 필름 시장의 성장을 확대하기 위해서는 기술적 문제나 시공상의 문제를 개선해야 합니다. 또한 스마트 유리 시장의 성장이 윈도우 필름 시장의 성장을 저해할 가능성도 있습니다.

- 또한 자외선(UV) 차단에 대한 관심이 높아짐에 따라 업계에 새로운 성장 기회를 제공할 것으로 예측됩니다.

- 아시아태평양이 시장을 장악하고 예측 기간 중 가장 높은 연간 성장률을 나타낼 것으로 예측됩니다.

윈도우 필름 시장 동향

시장을 독점하고 있는 건축 및 건설 부문

- 윈도우 필름은 일사량 조절을 위해 건축 산업에서 이용되고 있습니다. 일사량을 반사하여 건물내 온도를 쾌적하게 유지할 수 있습니다.

- 건설 분야에서는 장식용 필름, 자외선(UV) 차단 필름, 프라이버시 필름, 눈부심 방지 필름, 낙서 방지 필름, 단열 필름, 안전 및 방범 필름 등의 윈도우 필름이 사용되고 있습니다. 세계 건설 산업은 주로 인도, 중국, 미국 등의 국가들이 주도하고 있으며, 2030년까지 8조 달러에 달할 것으로 예측됩니다.

- 중국은 건설 붐이 일고 있습니다. 세계 최대 건설 시장이자 전 세계 건설 투자의 20%를 차지하는 중국은 2030년까지 약 13조 달러에 달하는 건설 투자를할 것으로 예측됩니다.

- 국가통계국(NBS)에 따르면 중국 건설업 경기활동지수(BASI)는 2023년 11월 55.9에서 12월 현재 56.9로 상승했으며, BASI 점수가 50을 넘으면 산업 성장을 의미하며, 2023년 10월의 BASI 점수는 53.5였습니다.

- 인도 산업 및 국내 무역 진흥부에 따르면 2022년 인도 건설 개발 부문에 대한 외국인 직접 투자(FDI) 주식 유입액은 1억 2,500만 달러에 달할 것으로 예측됩니다. 미국의 민간 건설 지출은 2022년에 증가하여 공공 부문 건설 지출의 약 4배에 달했습니다. 미국은 건설 산업에서 큰 비중을 차지하고 있으며, 2022년에는 연간 17억 9,300만 달러 이상의 지출을 기록했습니다.

- 미국 인구조사국(USCB)에 따르면 2023년 12월 건설 지출은 계절조정 연율로 2조 960억 달러로 11월 수정치인 2조 783억 달러보다 0.9% 증가했습니니다. 또한 2023년 건설액은 1조 9,787억 달러로 2022년 1조 8,487억 달러보다 7.0% 증가했습니다.

- 따라서 앞서 언급 한 개발은 향후 수년간 건설 산업에서 창 필름에 대한 수요를 촉진할 것으로 예측됩니다.

아시아태평양이 시장을 독점

- 아시아태평양이 시장을 독점하고 중국과 인도가 가장 큰 점유율을 차지할 것으로 예측됩니다. 중국은 이 지역에서 가장 큰 GDP를 자랑합니다. 중국은 가장 빠르게 성장하고 있는 경제 국가 중 하나이며, 현재 세계 최대 생산국 중 하나입니다. 중국의 제조업은 중국 경제에 크게 기여하고 있습니다. 중국은 아시아태평양에서도 건설업이 활발한 국가 중 하나이며, 산업과 건설업이 GDP의 약 50%를 차지하고 있습니다.

- 중국의 인구구조는 앞으로도 주택 건설의 성장에 박차를 가할 것으로 예측됩니다. 가계 소득 수준 상승과 농촌에서 도시로의 인구 이동이 결합하여 주택 건설 분야 수요를 지속적으로 견인할 것으로 예측됩니다. 공공 및 민간 부문의 저렴한 주택에 대한 관심이 높아지면서 주택 건설 분야의 성장을 가속할 것으로 예측됩니다.

- 인도는 건설 업계의 가장 큰 시장이며, 부동산 및 도시개발 부문이 증가하고 있습니다. 인도 브랜드 에쿼티 재단(IBEF)에 따르면 인도의 부동산 산업은 2030년까지 1조 달러에 달할 것으로 예상되며, 2025년까지 국내총생산(GDP)의 약 13%를 차지할 것으로 예측됩니다. 이에 따라 윈도우 필름 시장 수요가 증가하여 이 지역 시장이 활성화될 것으로 보입니다.

- 건축 수요는 강세를 보이고 있지만, 인도에서는 자동차 산업도 성장하고 있습니다. 예를 들어 인도자동차산업협회(SIAM)에 따르면 2023년 승용차 생산량은 458만 대에 달하고, 2022년 365만 대에서 25.5% 성장했습니다. 또한 2023년 인도에서 1,586만 대 이상의 오토바이가 판매되었습니다.

- 또한 OICA에 따르면 중국의 자동차 생산량은 2023년 3,016만 대에 달하고, 연간 10.6%의 성장률을 보일 것으로 예측했습니다.

- 또한 Oxford Economics는 2037년까지 중국, 미국, 인도가 전 세계 건설 공사의 51%를 차지할 것으로 예측했습니다. 이는 아시아태평양 두 국가에서 전 세계에서 막대한 건설 물량이 발생한다는 것을 의미하며, 예측 기간 중 윈도우 필름 수요를 크게 늘릴 수 있습니다.

- 이러한 요인으로 인해 이 지역의 윈도우 필름 시장은 예측 기간 중 안정적인 성장을 보일 것으로 예측됩니다.

윈도우 필름 산업 개요

세계 윈도우 필름 시장은 세분화되어 있으며, 상위 2개 기업이 세계 시장에서 큰 점유율을 차지하고 있습니다. 이 시장의 주요 기업(무순서)에는 Eastman Chemical Company, 3M, Avery Dennison Corporation, Saint-Gobain, Lintec Corporation 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 역학

- 촉진요인

- 안전·방범 윈도우 필름에 대한 수요의 증가

- 탄소발자국의 삭감에 대한 관심의 증가

- 억제요인

- 기술, 보증, 시공 문제

- 스마트 글래스 시장의 성장

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁의 정도

제5장 시장 세분화

- 유형별

- 일사 조정·UV 차단 필름

- 장식용 필름

- 안전·보안 필름

- 프라이버시 필름

- 단열 필름

- 기타

- 최종사용자 산업별

- 자동차

- 건축·건설

- 주택용

- 상용

- 인프라·시설

- 해양

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 베트남

- 말레이시아

- 인도네시아

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 러시아

- 튀르키예

- 노르딕

- 스페인

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 카타르

- 나이지리아

- 아랍에미리트

- 이집트

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합병사업, 제휴, 협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- 3M

- Armolan Greece

- Avery Dennison Corporation

- Eastman Chemical Company

- HYOSUNG CHEMICAL

- Johnson Window Films Inc.

- LINTEC Corporation

- NEXFIL

- Rayno Window Film

- Saint-Gobain

- TORAY INDUSTRIES INC.

제7장 시장 기회와 향후 동향

- 자외선 방지에 대한 관심의 증가

The Window Films Market size is estimated at USD 2.47 billion in 2025, and is expected to reach USD 3.31 billion by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The COVID-19 pandemic in 2020 adversely affected the construction industry. The industry faced challenges due to logistics and raw materials' unavailability. This also negatively impacted the window films market. However, the automotive industry's upsurge in production and sales post-pandemic propelled the market's growth and recovery.

Key Highlights

- Over the medium term, the major factors driving the market's growth are increasing emphasis on reducing carbon footprint and increasing safety and security concerns among consumers.

- However, some technical expertise is required to install window films, and the technicality and installation issues need to be improved to increase the growth of the window film market. Also, the growth in the smart glass market may cause hindrances to the window film market.

- Also, the growing concern for ultraviolet (UV) protection is projected to create new growth opportunities for the industry.

- Asia-Pacific is expected to dominate the market and will likely witness the highest annual growth rate during the forecast period.

Window Films Market Trends

The Building and Construction Segment to Dominate the Market

- Window films are utilized in the construction industry for solar control. They can reflect solar radiation heat and maintain a comfortable temperature inside buildings. Window films are used in the construction sector for solar control due to their ability to reflect the heat from solar radiation and maintain a comfortable ambiance in terms of the temperature inside the structure or building.

- In the construction segment, window films, such as decorative, ultraviolet (UV) block, privacy, anti-glare, anti-graffiti, insulating films, and safety and security films, are used. The global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by countries like India, China, and the United States.

- China is amid a construction mega-boom. The country has the largest building construction market in the world, making up 20% of all construction investment globally. The country is expected to spend nearly USD 13 trillion on buildings by 2030.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- According to the Department for Promotion of Industry and Internal Trade of India, the foreign direct investment (FDI) equity inflow for the construction development sector in India was worth USD 125 million in 2022. The United States' spending on private construction grew in 2022 and was nearly four times larger than construction spending in the public sector. The United States holds a significant share of the construction industry, which recorded an annual expenditure of over USD 1,793 million in 2022.

- According to the US Census Bureau (USCB), construction spending in December 2023 was estimated at a seasonally adjusted annual rate of USD 2,096.0 billion, 0.9% above the revised November estimate of USD 2,078.3 billion. Moreover, the construction value was USD 1,978.7 billion in 2023, 7.0%higher than the USD 1,848.7 billion spent in 2022.

- Therefore, the aforementioned developments are expected to drive the demand for window films in the construction industry through the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market, with China and India accounting for the largest share. China has the largest GDP in the region. China is one of the fastest emerging economies, and it has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the major contributors to the country's economy. China is one of the major countries in Asia-Pacific with ample construction activities, with the industrial and construction industries accounting for approximately 50% of the GDP.

- Demographics in the country are expected to continue to spur growth in residential construction. Rising household income levels combined with the population migrating from rural to urban areas are expected to continue to drive demand for the residential construction segment in the country. Increased focus on affordable housing by both the public and private sectors will drive growth in the residential construction segment.

- India is the largest market for the construction industry, with an increase in the real estate and urban development segment. According to the Indian Brand Equity Foundation (IBEF), the Indian real estate industry will likely reach USD 1 trillion by 2030 and contribute approximately 13% to the country's GDP by 2025. This will increase the demand for the window film market and propel its market in the region.

- Although the demand for construction is good, the automotive industry in India is also increasing. For instance, according to the Society of Indian Automobile Manufacturers (SIAM) India, the passenger vehicle production volume reached 4.58 million in 2023, registering a 25.5% growth over 3.65 million in 2022. Moreover, in 2023, over 15.86 million units of two-wheelers were sold domestically across the country.

- Also, according to OICA, automotive production in China reached 30.16 million in 2023, an annual increase of 10.6%.

- Also, Oxford Economics estimates that China, the United States, and India will account for 51% of all construction work done worldwide by 2037. This means a huge global construction volume will occur in the two Asia-Pacific countries and can significantly grow the demand for window films during the forecast period.

- Due to all such factors, the market for window films in the region is expected to grow steadily during the forecast period.

Window Films Industry Overview

The global window films market is fragmented, with the top two companies holding significant shares in the global market. Some of the major players in the market (not in any particular order) include Eastman Chemical Company, 3M, Avery Dennison Corporation, Saint-Gobain, and Lintec Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Safety and Security Window Films

- 4.1.2 Increasing Emphasis on Reducing Carbon Footprint

- 4.2 Restraints

- 4.2.1 Technical, Warranty, and Installation Issues

- 4.2.2 Growing Smart Glass Market

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Solar Control and UV Blocking Films

- 5.1.2 Decorative Films

- 5.1.3 Safety and Security Films

- 5.1.4 Privacy Films

- 5.1.5 Insulating Films

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.2.1 Residential

- 5.2.2.2 Commercial

- 5.2.2.3 Infrastructural and Institutional

- 5.2.3 Marine

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Malaysia

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 NORDIC

- 5.3.3.8 Spain

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Armolan Greece

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Eastman Chemical Company

- 6.4.5 HYOSUNG CHEMICAL

- 6.4.6 Johnson Window Films Inc.

- 6.4.7 LINTEC Corporation

- 6.4.8 NEXFIL

- 6.4.9 Rayno Window Film

- 6.4.10 Saint-Gobain

- 6.4.11 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Concerns Regarding UV Protection