|

시장보고서

상품코드

1687470

RF GaN - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)RF GaN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

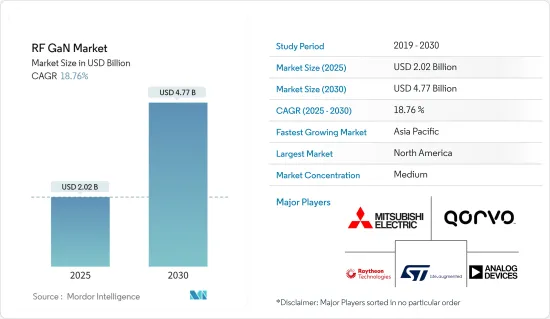

RF GaN 시장 규모는 2025년에 20억 2,000만 달러에 달할 것으로 추정됩니다. 2030년에는 47억 7,000만 달러에 이를 것으로 예상되며, 시장 추계·예측 기간(2025-2030년)의 CAGR은 18.76%를 나타낼 것으로 전망됩니다.

광범위한 실시간 연동 장치 및 용도에서 RF GaN 이용의 장점으로 인해 사물인터넷(IoT) 기술을 이용하는 산업이 늘어날 것으로 예상되며, 시장 성장의 원동력이 될 것으로 기대됩니다.

주요 하이라이트

- RF GaN은 무선 인프라에서 중요한 역할을 하고 효율을 향상시키고 대역폭을 확대함으로써 늘어나는 데이터 트랜스미션을 지원하고 있습니다.

- 전기차에 대한 RF GaN의 채용이 증가하고 있는 것도, 이 시장 수요를 촉진하는 주요인 중 하나입니다.

- 자율주행차와 드론 개발에 필요한 인프라도 RF GaN 기술 수요를 높이는 요인 중 하나입니다.

- GaN 고유의 재료 이점은 디바이스 가공 및 패키징 비용 및 최적화를 비롯한 여러 관련 과제를 수반합니다. RF용 GaN 기반 디바이스(성능과 수율)가 크게 개선되었지만, GaN-on-SiC(탄화규소상의 질화갈륨)가 주류 용도(ie 무선 통신 기지국이나 CATV)에 진입하는 것을 막는 장벽이 아직도 있습니다.

- COVID-19의 대유행은 공급라인과 전기통신업계에 영향을 주었습니다.

- 데이터 소비의 급격한 증가는 상용 네트워크의 성장을 가져와 네트워크 공급자에게 4G 및 5G와 같은 차세대 네트워크를 채택하도록 촉구하고 있습니다.

- 전 세계 조직이 신제품을 혁신하고 비즈니스를 확장하고 있습니다. GaN 기술을 미국과 유럽의 고객에게 출시하기 시작했다고 발표했습니다.

RF GaN 시장 동향

5G 구현의 진전에 견인되는 통신 인프라 분야의 강한 수요

- 세계의 디지털화의 주요 촉진요인이며 시장환경의 종합적인 변화하에 있는 업계로서, 통신업계는 디지털변혁기술의 주요사용자로 간주되고 있습니다.

- 5G 기술은 다양한 광대역 서비스의 영역을 변화시키고 다양한 최종 사용자의 수직 연결성을 강화할 것으로 기대되고 있습니다. 데오 컨텐츠 스트리밍, 5G 인프라, 5G를 활용한 다양한 IoT 용도입니다.

- 현재 5G 모바일 계약 수는 42만 건으로 평가되고 있으며, 2022년에는 4억 건에 이르렀습니다.

- 2022년 5월, ST 마이크로 일렉트로닉스(ST)와 통신, 산업, 방위, 데이터센터 산업용 반도체 제품공급업체인 MACOM Technology Solutions Holdings(MACOM)은 RF GaN on Silicon(RF건온실리콘) 시제품의 제조를 발표했습니다.

- Qorvo는 2G, 3G, 4G 기지국 제조업체에 RF 솔루션을 제공하는 공급업체 중 하나입니다. Qorvo는 주로 5G를 실현하기 위해 3.5, 4.8, 28, 39GHz 등 관련 5G 밴드를 커버하는 제품 솔루션에 투자하고 시장에 서비스를 제공합니다.

- 5G 인프라는 고밀도, 소규모 안테나 어레이가 필요하기 때문에 무선 주파수(RF) 시스템의 전력 및 열 관리와 관련된 중요한 과제가 발생합니다.

아시아태평양은 대폭적인 성장이 예상됩니다.

- 아시아태평양의 이산 반도체 산업은 중국, 일본, 대만, 한국이 견인하고 있으며, 세계 이산 반도체 시장의 약 65%를 차지하고 있습니다.

- 인도 일렉트로믹스 및 반도체 협회에 의하면, 인도의 반도체 부품 시장은 CAGR 10.1%(2018-2025년)를 나타내, 2025년에는 323억 5,000만 달러에 이를 것으로 추정됩니다. India '이니셔티브는 반도체 시장에 큰 투자를 가져올 것으로 예상됩니다.

- 2022년 2월, GaN 집적회로(IC)공급자인 나비타스 세미컨덕터는 China International Capital Corporation Limited(CICC)의 투자자 회의에 참가를 발표했습니다. 동사의 독자적인 GaN 파워 IC는 GaN 파워와 GaN 드라이브, 제어, 보호를 단일 SMT 패키지에 통합한 것입니다.

- 5G 기술을 지원하는 인프라 개발에 대한 투자자의 관심이 높아짐에 따라 APAC 지역 전체의 RF GaN에 대한 수요는 증가할 것으로 예상됩니다.

- 중국에서의 RF GaN 기업의 성장은 중국이 제조업 주도에서 기술 혁신 주도의 경제로 전환하는 가운데 보다 광범위한 경향의 일부가 되고 있습니다.

- 또한 2021년 12월 인도 IIT Kanpur의 연구자들은 알루미늄 GaN(AlGaN) 고전자 이동도 트랜지스터(HEMT)의 고성능 업계 표준 모델을 개발했습니다. GaN 시장 성장의 원동력이 될 것 같습니다.

고주파 질화 갈륨 산업 개요

RF GaN 시장의 경쟁 기업간 경쟁 관계는 다음과 같은 주요 기업의 존재로 인해 높습니다. 지속적인 혁신을 통해 이들은 타사에 대한 경쟁 우위를 확보하고 있습니다.

2022년 6월 세계를 연결하는 혁신적인 RF 솔루션의 유명한 공급자인 Qorvo는 미국 국방부(DoD)에 의해 국방 차관 연구 기술국(OUSD R&E)의 마이크로 일렉트로닉스 로드맵의 일환으로 STARRY NITE라고도 알려진 국산 최첨단(SOTA) RF GaN 프로그램 State-of-the-Art(SOTA) RF GaN program)의 추진 기업으로 선정되었습니다.

2022년 5월, ST 마이크로 일렉트로닉스와 산업, 통신, 방위 및 데이터센터 산업용 반도체 제품의 중요한 공급업체인 MACOM Technology Solutions Holdings Inc.는 RF Gan on Silicon(RF건온 Si) 프로토타입의 제조에 성공했다고 발표했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 기술 스냅샷

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 5G 구현의 발전으로 인한 통신 인프라 분야로부터의 강한 수요

- 고성능, 소형 폼 팩터 등의 유리한 특성

- 시장 성장 억제요인

- 비용과 운영상의 과제

제6장 시장 세분화

- 용도별

- 군사

- 통신 인프라(백홀, RRH, 매시브 MIMO, 스몰셀)

- 위성통신

- 유선 광대역

- 상업용 레이더 및 항공전자공학

- RF 에너지

- 재료 유형별

- GaN-on-Si

- GaN-on-SiC

- 기타 재료 유형(GaN-on-GaN, GaN-on-Diamond)

- 지역별

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Aethercomm Inc.

- Analog Devices Inc.

- Wolfspeed Inc.(Cree Inc.)

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Microsemi Corporation(Microchip Technology Incorporated)

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- Qorvo Inc.

- STMicroelectronics NV

- Sumitomo Electric Device Innovations Inc.

- HRL Laboratories

- Raytheon Technologies

- Mercury Systems, Inc

제8장 투자 분석

제9장 시장 기회와 앞으로의 동향

KTH 25.05.07The RF GaN Market size is estimated at USD 2.02 billion in 2025, and is expected to reach USD 4.77 billion by 2030, at a CAGR of 18.76% during the forecast period (2025-2030).

Due to the benefits of RF GaN usage across a wide range of real-time linked devices and applications, more industries are expected to use the Internet of Things (IoT) technology, which is expected to drive market growth. With the continuously evolving GaN technology, GaN enables higher frequencies in more complex applications, such as phased arrays, radar, and base transceiver stations for cable TV (CATV), very small aperture terminal (VSAT), and defense communications.

Key Highlights

- RF GaN plays a key role in wireless infrastructure, improving efficiency and expanding bandwidth to support ever-increasing data transmission speeds. The market for RF GaN is primarily driven by increasing 5G adoption and advances in wireless communications. Telecom operators could also benefit from increased use of GaN power transistors.

- The increasing adoption of RF GaN in electric automotive is also one of the major factors driving demand in this market. Silicon carbide devices are used in the onboard battery chargers of electric buses, taxis, lorries, and passenger cars. Further, increasing government laws favoring the electric vehicles market stimulates demand in the RF GaN market.

- The infrastructure needed to create autonomous vehicles and drones is another factor that increases demand for RF GaN technologies. Hence, growth in the adoption and development of autonomous vehicles and drones for various applications, especially military and defense, is expected to increase further the adoption of RF GaN devices over the forecast period.

- The inherent material advantages of GaN come with some associated manufacturing challenges that include the cost and optimization of device processing and packaging. Other issues include charge trapping and current collapse, which need to be resolved for increased adoption of these devices. Although significant improvements have been made in RF GaN-based devices (performance and yields), there are still some barriers preventing the gallium nitride on silicon carbide (GaN-on-SiC) from entering mainstream applications (i.e., in wireless telecom base-stations or CATV).

- The COVID-19 pandemic impacted supply lines and the telecoms industry. It considerably hindered the penetration of 5G in the telecommunications sector. In this critical situation, consumers are expected to continue using mobile phones, but most of them may not be able to invest more in a technology that is still in a nascent stage.

- Rapidly increasing data consumption has resulted in the growth of commercial networks and is encouraging network providers to adopt next-generation networks, such as 4G and 5G. According to the Cisco Visual Networking Index, global mobile data traffic is expected to register a CAGR of 46%, reaching 77.5 exabytes per month by 2022.

- Organizations across the world are innovating new products and expanding their business. For instance, in June 2022, Integra, a provider of innovative RF and microwave power solutions, announced that it had begun shipping its breakthrough 100V RF GaN technology to customers in the United States and Europe. The company also announced the expansion of its 100V RF GaN product portfolio with the launch of seven new products for the avionics, directed energy, electronic warfare, radar, and scientific market segments, delivering power levels of up to 5kW in a single transistor.

Radiofrequency Gallium Nitride Market Trends

Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- As a primary driver of global digitization and an industry undergoing comprehensive changes in the market environment, the telecommunications industry is regarded as a major user of digital transformation technologies. The telecommunications industry's investment in interoperability and technology has facilitated a paradigm shift in the flow of capital and information throughout the global economy, providing the building blocks for the emergence of entirely new business models across the industry.

- The 5G technology is expected to revolutionize the domain of various broadband services and empower connectivity across different end-user verticals. The major factors boosting the market share of GaN are increasing mobile subscriptions, streaming of online video content, 5G infrastructure, and various IoT applications using 5G. 5G is anticipated to support different services and associated service requirements across multiple scenarios.

- Currently, the number of 5G mobile subscriptions is valued at 0.42 million, and it is expected to reach 400 million subscriptions by 2022. With the substantial growth in the rollouts of 5G technology globally, the demand for RF GaN technology is expected to increase.

- In May 2022, STMicroelectronics (ST) and MACOM Technology Solutions Holdings (MACOM), a supplier of semiconductor products for the telecommunications, industrial, defense, and data center industries, announced the production of RF GaN on silicon (RF Gan-on-Si) prototypes. With this success, ST and MACOM will continue to work together and expand their relationship. GaN-on-Si technology under development by ST and MACOM is anticipated to offer competitive performance and significant economies of scale enabled by integration into standard semiconductor process flows.

- Qorvo is one of the suppliers of RF solutions to the 2G, 3G, and 4G base station manufacturers. It is uniquely positioned in the market to support the development of sub-6 GHz and cmWave/mmWave wireless infrastructure. Qorvo has been investing in product solutions covering relevant 5G bands, such as 3.5, 4.8 and 28, and 39GHz, to service the market, mainly to enable 5G.

- The need for dense, small-scale antenna arrays in 5G infrastructure results in key challenges with power and thermal management in radio frequency (RF) systems. With their improved wideband performance, efficiency, and power density, GaN devices offer the potential for more compact solutions that can address these challenges.

Asia-Pacific is Expected to Experience Significant Growth

- The Asia-Pacific region's discrete semiconductor industry is driven by China, Japan, Taiwan, and South Korea, constituting around 65% of the global discrete semiconductor market. In contrast, others, like Vietnam, Thailand, Malaysia, and Singapore, contribute to the region's dominance in the market.

- According to the Electronics and Semiconductors Association of India,the Indian market for semiconductor components would register a 10.1% CAGR (2018-2025) to reach USD 32.35 billion by 2025. The country is a vital destination for global research and development centers. Therefore, the ongoing 'Make in India' initiative by the Government of India is expected to result in significant investment in the semiconductor market. Such initiatives by the government of India will leverage the RF GaN market.

- In February 2022, Navitas Semiconductor, a provider of GaN integrated circuits (ICs), announced its participation in the China International Capital Corporation Limited (CICC) Investor Conference. The company's proprietary GaN power IC integrates GaN power and GaN drive, control, and protection in a single SMT package. Such participation will leverage the GaN market in the region.

- Demand for RF GaN across the APAC region is expected to increase due to growing investor interest in developing infrastructure to support 5G technology. For instance, according to the GSMA, the Asia-Pacific mobile operator is expected to spend more than USD 400 billion by 2025, of which USD 331 billion will be expended on 5G deployments.

- The growth of RF GaN companies in China is part of a broader trend as the nation shifts from a manufacturing- to an innovation-driven economy. The Chinese market is witnessing an exploding demand for commercial wireless telecom applications, and Chinese companies are already developing next-gen telecom networks.

- Moreover, in December 2021, researchers from IIT Kanpur in India developed a high-performance, industry-standard model of aluminum GaN (AlGaN) high electron mobility transistor (HEMT). This model provides a simple design method that can be used to manufacture high-power RF circuits. RF circuits include amplifiers and switches used in wireless transmissions and are useful in aerospace and defense applications. Constant innovations by researchers will drive the market growth of RF GaN in the region.

Radiofrequency Gallium Nitride Industry Overview

The competitive rivalry among the players in the RF GaN market is high owing to the presence of some key players such as Raytheon Technologies, STM microelectronics, amongst others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over other players. Through research and development, strategic partnerships, and mergers and acquisitions, these players have been able to gain a strong foothold in the market.

In June 2022, Qorvo, a prominent provider of innovative RF solutions that connect the world, was selected by the US Department of Defense (DoD) to proceed with the Advanced Integration Interconnection and Fabrication Growth for Domestic State-of-the-Art (SOTA) RF GaN program, also known as STARRY NITE, as part of the Office of Undersecretary of Defense Research & Engineering's (OUSD R&E) microelectronics roadmap. The program seeks to develop and mature domestic, open SOTA RF GaN foundries in alignment with the DoD's advanced packaging ecosystem.

In May 2022, STMicroelectronics and MACOM Technology Solutions Holdings Inc., a significant supplier of semiconductor products for the industrial, telecommunications, defense, and data center industries, announced the successful production of RF Gan on Silicon (RF Gan-on-Si) prototypes. With this achievement, ST and MACOM would continue to work together and enhance their relationship.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- 5.1.2 Favorable Attributes Such As High-performance and Small Form Factor to

- 5.2 Market Restraints

- 5.2.1 Cost & Operational Challenges

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Military

- 6.1.2 Telecom Infrastructure (Backhaul, RRH, Massive MIMO, Small Cells)

- 6.1.3 Satellite Communication

- 6.1.4 Wired Broadband

- 6.1.5 Commercial Radar and Avionics

- 6.1.6 RF Energy

- 6.2 By Material Type

- 6.2.1 GaN-on-Si

- 6.2.2 GaN-on-SiC

- 6.2.3 Other Material Types (GaN-on-GaN, GaN-on-Diamond)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aethercomm Inc.

- 7.1.2 Analog Devices Inc.

- 7.1.3 Wolfspeed Inc. (Cree Inc.)

- 7.1.4 Integra Technologies Inc.

- 7.1.5 MACOM Technology Solutions Holdings Inc.

- 7.1.6 Microsemi Corporation (Microchip Technology Incorporated)

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 NXP Semiconductors NV

- 7.1.9 Qorvo Inc.

- 7.1.10 STMicroelectronics NV

- 7.1.11 Sumitomo Electric Device Innovations Inc.

- 7.1.12 HRL Laboratories

- 7.1.13 Raytheon Technologies

- 7.1.14 Mercury Systems, Inc