|

시장보고서

상품코드

1687701

석유 및 가스 분야 AI : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)AI In Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

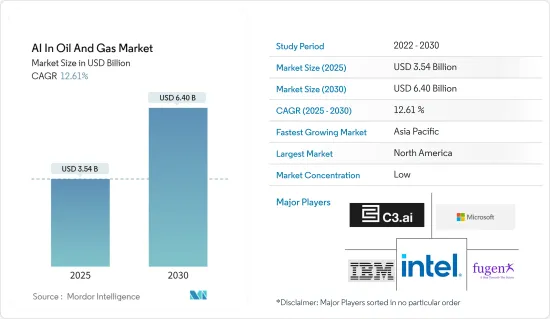

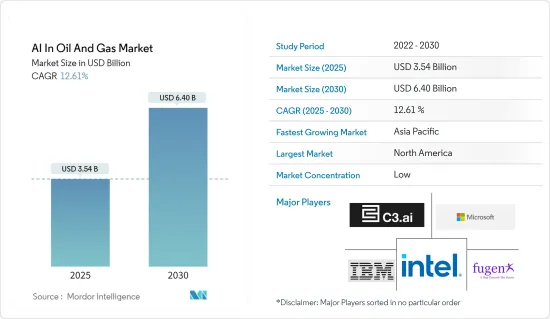

석유 및 가스 분야 AI 시장 규모는 2025년 35억 4,000만 달러로 추정되며, 2030년에는 64억 달러에 달할 것으로 예상되며, 시장 추정 및 예측 기간(2025-2030년) 동안 12.61%의 CAGR을 기록할 것으로 예상됩니다.

석유 및 가스 산업은 저류층 분석 및 시추 최적화에서 안전 모니터링 및 배출량 감소에 이르기까지 AI 활용이 급증하고 있습니다. 이러한 AI의 물결은 탐사, 생산, 환경의 지속가능성을 재구성하고 시장 성장을 촉진할 것입니다.

인공지능은 특히 예지보전의 형태로 석유 및 가스 산업의 자산 관리를 재구성하고 있습니다. 이러한 추세는 신뢰성을 강화하고 운영 리스크를 줄임으로써 시장 성장의 중요한 촉진제가 될 것으로 보입니다.

2023년 10월, 엔터프라이즈 AI 소프트웨어 선도기업 C3 AI는 쉘과의 협력을 발표하며 C3 AI 신뢰성 애플리케이션에 예지보전 소프트웨어를 통합한다고 밝혔습니다. 이 전략적 파트너십은 석유 및 가스 산업에서 AI 플랫폼의 채택을 확대하고 시장 확장을 뒷받침하는 것을 명확히 했습니다.

AI 기술은 석유 및 가스 산업에서 운영 효율성을 향상시키고, 기업이 패턴을 식별하고, 의사결정을 자동화하고, 센서와 기계에서 얻은 방대한 데이터세트를 분석할 수 있도록 도와주며, AI 기반 예지보전 솔루션은 장비의 고장을 사전에 예방할 수 있도록 도와줍니다. 예방할 수 있기 때문에 기업은 유지보수 계획을 수립하고, 다운타임을 최소화하며, 자산 활용도를 최적화할 수 있습니다.

이 시장을 주도하는 것은 주로 석유 및 가스 산업의 생산 비용 절감 요구입니다. 유가 변동에 직면한 기업들은 업무 간소화, 효율성 향상, 비용 절감을 위해 AI에 주목하고 있습니다.

특히 석유 및 가스 산업에서 AI 도입이 가속화되고 있으며, 기업들은 AI의 기능을 활용하여 데이터에서 더 깊은 인사이트를 도출하고 있습니다. 이러한 기업들은 업무 최적화를 통해 비용을 절감할 뿐만 아니라 생산성을 향상시키고 있습니다.

러시아는 우크라이나 침공 이후 유럽으로의 파이프라인 가스 공급이 800억 입방미터(BCM) 감축되면서 에너지 위기에 직면했습니다. 그 결과, 석유 및 가스 산업의 중-다운스트림 기업의 운영에 차질을 빚었고, 시장 성장이 정체되었습니다.

유럽연합(EU)의 재생에너지를 통한 에너지 자급자족 추진은 전통적인 석유 및 가스 산업에 도전이 되고 있습니다. 이러한 변화는 이 지역의 석유 및 가스 산업에서 AI 솔루션의 적용 범위를 간접적으로 억제하여 시장 성장에 영향을 미치고 있습니다.

이미 시장 역학을 극복한 세계 석유 및 가스 산업은 COVID-19 사태로 인해 심각한 후퇴를 겪었습니다. 이후 세계 각국의 조업 중단과 경제 활동 위축은 석유 수요를 크게 감소시켜 국제 유가를 급락시켰습니다. 그 결과, 석유 산업의 생산 및 탐사 활동은 저해되어 AI 기술 채택에 영향을 미쳤습니다.

석유 및 가스 분야 AI 시장 동향

업스트림 오퍼레이션 부문이 큰 성장을 이룰 것으로 예상

- 석유 및 가스 산업의 업스트림 사업은 지질 조사 및 토지 취득부터 육상 및 해상 시추에 이르기까지 탐사 활동을 포괄합니다. 이 단계에서 중요한 과제는 지질학자와 탐사팀이 새로운 석유 매장량 및 용출물을 발견하는 것입니다.

- 석유 및 가스, 특히 탐사 분야에서 AI의 통합은 점점 더 많은 견인력을 얻고 있습니다. 고급 AI 알고리즘은 지진 탐사, 지층, 유정 로그, 위성 이미지 등 방대한 데이터세트를 처리할 수 있습니다. 이를 통해 육지와 해양 모두에서 잠재적인 석유 매장량을 정확하게 파악할 수 있습니다.

- 저명한 기업인 엑손모빌(ExxonMobil)은 석유 탐사에 AI를 활용함으로써 이러한 추세를 잘 보여주고 있습니다. 엑손모빌은 AI 모델을 도입하여 실시간 지진 데이터와 과거 시추 기록을 분석하여 해양 환경의 천연 석유층을 탐지하는 능력을 향상시키고 있습니다.

- 세계 주요 석유 및 가스 회사들은 AI를 활용하여 탐사 활동의 효율성을 높이기 위해 AI 도구를 활용하여 기록을 디지털화하고 지질 데이터 분석을 자동화함으로써 파이프라인 부식, 장비 마모 증가와 같은 문제를 신속하게 파악할 수 있습니다.

- 예를 들어, 화웨이는 AI와 빅데이터를 활용하여 고객을 위해 10파운드에 달하는 방대한 과거 탐사 데이터를 재분석하여 새로운 가치를 창출하고 지진 데이터 수집에 혁명을 일으켰습니다.

- 클라우드 기반 분석의 발전과 디지털 트윈의 등장은 석유 및 가스 산업에서 예지보전의 형태를 바꾸고 있습니다. 특히 BP, ExxonMobil, Shell과 같은 업계 선두주자들은 예측 유지보수를 활용하여 장비의 상태를 평가하고 유지보수 필요성을 예측하고 있습니다.

- OPEC의 2024년 4월 데이터에 따르면, 원유 수요는 지속적인 성장 궤도에 있으며, 이는 석유 및 가스 산업의 생산 수요 증가를 반영합니다.

- 석유 및 가스 업계에서는 환경 친화적 노력에 대한 관심이 높아지면서 위험 요소를 조기에 발견하기 위해 AI를 활용하는 사례가 늘고 있습니다. 항공 사진, 위성 이미지, 원격 감지 데이터를 분석함으로써 기업은 기름 유출이나 파이프라인 누출을 신속하게 파악하여 환경 파괴를 억제하고 오염 물질의 확산을 방지할 수 있습니다. 이러한 요소들이 종합적으로 시장 성장 예측을 뒷받침하고 있습니다.

북미가 가장 큰 시장 점유율을 차지

- 북미는 AI에 있어 매우 중요한 거점이며, 특히 석유 및 가스 산업이 발달한 지역입니다. 이 지역의 경제력, 유전 사업체의 광범위한 AI 도입, 풍부한 AI 공급업체, 공공 및 민간 부문의 실질적인 공동 투자로 인해 석유 및 가스 분야 AI 수요를 촉진하고 있습니다. 석유 및 가스 생산과 투자가 증가함에 따라 시장 잠재력은 더욱 확대될 것으로 예상됩니다.

- 미국은 방대한 석유 및 가스 산업과 AI 통합이 눈에 띄게 증가함에 따라 북미 석유 및 가스 분야 AI 시장을 선도할 태세를 갖추고 있습니다. 미국 EIA의 데이터에 따르면 미국은 6년 연속 원유 생산량에서 다른 국가를 앞질렀으며, 2023년 미국은 하루 평균 1,290만 배럴의 원유를 생산하여 2019년에 기록한 1,230만 배럴을 넘어 사상 최고치를 기록할 것으로 예상됩니다. 이러한 풍부한 공급은 에너지 비용을 낮추고 민간 투자를 촉진하여 국가의 경제 상황을 더욱 강화했습니다.

- 석유 및 가스 밸류체인에서 AI의 역할은 특히 역동적인 에너지 생산이 특징인 이 산업에서 매우 중요하며, AI는 유전층 평가에서 시추 전략 조정, 유정 위험 평가에 이르기까지 기업의 업무를 재구성하고 있습니다. 북미의 선진적인 인프라를 고려할 때 북미가 세계 시장을 선도할 것으로 예상됩니다. 또한, 스타트업의 AI 투자 급증은 가까운 시일 내에 시장 성장을 증폭시킬 것으로 보입니다.

- 석유 및 가스 탐사에 AI를 도입함으로써 기업이 탄화수소 자원을 발견하고 추출하는 방식을 근본적으로 변화시켜 정확성과 효율성의 새로운 시대를 열었습니다. 그 결과, 석유 탐사 활동에 대한 투자가 증가함에 따라 업계에서 AI의 활용도 증가하고 있습니다.

- 엑손모빌(ExxonMobil)과 옥시덴탈 페트롤리엄(Occidental Petroleum)과 같은 미국 대기업들은 이러한 AI의 물결을 활용하고 있습니다. 이들은 다양한 석유 탐사 사업에 수십억 달러의 자금을 투입하고, 대규모 인수합병(M&A)을 통해 입지를 다지고 있습니다.

- 2024년 3월, Corva LLC가 개발한 고도의 AI 프로그램이 원격지에 위치한 Navers Industries의 굴착기에서 고삐를 잡았습니다. 이 AI는 위성통신을 활용하여 즉각적인 판단을 내리고, 시추 속도를 최소 30% 이상 향상시키고, 인간 작업자의 명령을 5000번 이상 줄일 수 있습니다. 이 기술의 주요 목적은 비용을 절감하고 석유를 최대한 추출하는 것. AI의 도입, 특히 석유 탐사 분야에서 이러한 대담한 돌파구를 통해 미국 기업들은 시장 전망을 재구성 할 준비가 되어 있습니다.

석유 및 가스 분야 AI 개요

석유 및 가스 분야 AI 시장은 단편화되어 있으며, 세계 대기업과 다수의 중소기업이 혼재되어 있습니다. 주목할 만한 기업으로는 IBM Corporation, Fugenx Technologies, C3.AI Inc., Microsoft Corporation, Intel Corporation 등이 있습니다. 이들 기업은 제품 포트폴리오를 강화하고 경쟁력을 확보하기 위해 전략적 제휴와 인수를 통해 제품 포트폴리오를 강화하는 경향이 강해지고 있습니다.

2023년 1월 AI 애플리케이션 소프트웨어 전문 기업 C3 AI는 C3 Generative AI 제품군(C3 Generative AI Product Suite)을 발표하고 C3 Generative AI for Enterprise Search로 첫 선을 보였습니다. C3 Generative AI 제품군은 다양한 가치사슬의 통합을 간소화하는 고급 트랜스포머 모델을 자랑하며, C3 Generative AI의 도입은 석유 및 가스를 포함한 다양한 산업 분야의 혁신 노력을 촉진할 것으로 기대됩니다.

2023년 8월 유럽 최대의 천연가스 및 석유 기업이자 석유 및 가스, 탄소 관리에 중점을 둔 빈터샤르 디아(Vintershall Dier)가 IBM 컨설팅과 손잡고 AI 역량 센터(CoC)를 설립했습니다. Microsoft를 공유 기술 파트너로 하는 이 전략적 제휴는 에너지 생산을 향상시키는 AI 애플리케이션을 촉진하는 것을 목표로 합니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- 시장에 미치는 거시경제 요인 평가

- 기술 현황 - 용도별

- 품질 관리

- 생산 계획

- 예지보전

- 기타 용도

제5장 시장 역학

- 시장 성장 촉진요인

- 빅데이터를 용이하게 처리하는 것에 대한 주목 상승

- 생산 비용 절감 동향 상승

- 시장 성장 억제요인

- 높은 초기 도입 비용

- 석유 및 가스 산업의 숙련된 전문가의 부족

- 주요 사용 사례

제6장 시장 세분화

- 오퍼레이션별

- 업스트림

- 미드스트림

- 다운스트림

- 유형별

- 플랫폼

- 서비스별

- 지역별

- 북미

- 유럽

- 아시아

- 호주·뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 개요

- IBM Corporation

- FuGenX Technologies

- C3.AI Inc.

- Microsoft Corporation

- Intel Corporation

- ABB Ltd

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- NVIDIA Corporation

- Infosys Limited

- oPRO.ai Inc.

제8장 투자 분석

제9장 시장 전망

ksm 25.05.12The AI In Oil And Gas Market size is estimated at USD 3.54 billion in 2025, and is expected to reach USD 6.40 billion by 2030, at a CAGR of 12.61% during the forecast period (2025-2030).

The oil and gas industry is witnessing a surge in AI applications, spanning reservoir analysis and drilling optimization to safety monitoring and emissions reduction. This AI wave is set to reshape exploration, production, and environmental sustainability, propelling market growth.

Artificial intelligence, particularly in the form of predictive maintenance, is reshaping asset management in the oil and gas industry. This trend is poised to be a key driver of market growth by bolstering reliability and mitigating operational risks.

In October 2023, C3 AI, a leading Enterprise AI software firm, announced a collaboration with Shell, integrating predictive maintenance software into the C3 AI reliability application. This strategic partnership underscored the increased adoption of AI platforms in the oil and gas industry, underpinning market expansion.

AI technologies promise heightened operational efficiency in oil and gas, enabling companies to identify patterns, automate decisions, and analyze vast datasets from sensors and machinery. Equipped with AI, predictive maintenance solutions can preempt equipment breakdowns, allowing businesses to plan maintenance, minimize downtime, and optimize asset utilization.

The market is primarily driven by the oil and gas industry's need to lower production costs. Faced with volatile oil prices, companies are turning to AI to streamline operations, enhance efficiency, and cut costs.

As AI adoption accelerates, especially in the oil and gas industry, companies are leveraging its capabilities to extract deeper insights from their data. By optimizing their operations, these firms are not only cutting costs but also boosting productivity.

Russia faced an energy crisis following the 80 billion cubic meters (BCM) cut in pipeline gas supplies to Europe after its Ukraine invasion. This, in turn, hampered the operations of midstream and downstream players in the oil and gas industry, stalling market growth.

The European Union's push for energy self-sufficiency through renewable sources poses a challenge to the traditional oil and gas industry. This shift indirectly curtails the scope for AI solutions in the region's oil and gas industry, impacting market growth.

The global oil and gas industry, already navigating market dynamics, faced a severe setback during the COVID-19 pandemic. The ensuing global shutdown and reduced economic activities led to a significant drop in oil demand, plummeting international crude oil prices. Consequently, production and exploration activities in the industry were hampered, affecting the adoption of AI technologies.

AI In Oil And Gas Market Trends

The Upstream Operations Segment is Expected to Witness Significant Growth

- Upstream operations in the oil and gas industry encompass exploration activities, from geological surveys and land acquisition to onshore and offshore drilling. A key challenge in this phase is the search for new oil reserves and seeps by geologists and exploration teams.

- The integration of AI in oil and gas, particularly in exploration, is gaining traction. Advanced AI algorithms can process vast datasets, including seismic surveys, geological formations, well logs, and satellite imagery. This enables precise identification of potential oil reservoirs, both on land and in the ocean.

- ExxonMobil, a prominent player, exemplifies this trend by harnessing AI for oil exploration. By deploying AI models, the company can analyze real-time seismic data and historical drilling records, enhancing its ability to detect natural oil seeps in oceanic settings.

- Major global oil and gas corporations are increasingly turning to AI to bolster the efficiency of their exploration endeavors. By leveraging AI tools to digitize records and automate geological data analysis, these companies can swiftly identify issues like pipeline corrosion or heightened equipment wear.

- Huawei, for instance, developed a specialized cloud for oil and gas exploration. By harnessing AI and Big Data, the company reanalyzed a massive 10 PB of historical exploration data for a customer, extracting new value and revolutionizing seismic data collection.

- Advancements in cloud-based analytics and the rise of digital twins are reshaping predictive maintenance in the oil and gas industry. Notably, industry giants like BP, ExxonMobil, and Shell are utilizing predictive maintenance to assess equipment conditions and anticipate maintenance needs.

- As per OPEC's April 2024 data, the demand for crude oil is on a consistent growth trajectory, reflecting the escalating production needs in the oil and gas industry, which bodes well for the market's future.

- With a heightened focus on environmentally friendly practices, the oil and gas industry is increasingly turning to AI for early hazard detection. By analyzing aerial photos, satellite imagery, and remote sensing data, companies can swiftly identify oil spills and pipeline leaks, curbing environmental damage and limiting pollutant spread. These factors collectively underpin the market's projected growth.

North America Holds the Largest Market Share

- North America is a pivotal hub for AI, particularly in terms of its robust oil and gas industry. The region's economic prowess, coupled with widespread AI adoption among oilfield entities, a rich landscape of top AI suppliers, and substantial joint investments from both public and private sectors, propels the demand for AI in oil and gas. With oil and gas production and investments increasing, the market's potential is expected to expand further.

- The United States is poised to lead North America's AI in oil and gas market, owing to its expansive oil and gas industry and a notable uptick in AI integration. According to data from the US EIA, the United States outpaced all other nations in crude oil production for six consecutive years. In 2023, the United States hit a record high, producing an average of 12.9 million barrels of crude oil daily, surpassing the previous record of 12.3 million set in 2019. This abundant supply lowered energy costs and catalyzed private investments, further bolstering the nation's economic landscape.

- The role of AI in the oil and gas value chain is profound, especially in an industry marked by dynamic energy production. Ai has reshaped companies' operations, ranging from reservoir valuation to tailoring drilling strategies and assessing well risks. Given North America's advanced infrastructure, it is expected to lead the global market. Moreover, the surge in AI investments among start-ups is set to amplify market growth in the near future.

- The infusion of AI in oil and gas exploration has ushered in a new era of precision and efficiency, fundamentally altering how companies locate and extract hydrocarbon resources. Consequently, as investments in oil exploration activities rise, the utilization of AI in the industry also increases.

- Major US players like ExxonMobil and Occidental Petroleum are making use of this AI wave. They are channeling billions into diverse oil exploration ventures and consolidating their positions through substantial mergers and acquisitions.

- In March 2024, an advanced AI program developed by Corva LLC took the reins at a remote Nabors Industries Ltd rig. Leveraging satellite communication, this AI made split-second decisions, enhancing drilling speed by at least 30% and potentially reducing human operator commands by 5,000. The primary aim behind this technology is to cut costs and maximize oil extraction. With such bold strides in AI adoption, especially in oil exploration, US companies are poised to reshape the market landscape.

AI In Oil And Gas Industry Overview

The AI in oil and gas market is fragmented, featuring a mix of global giants and numerous small and medium-sized enterprises. Noteworthy players include IBM Corporation, Fugenx Technologies, C3.AI Inc., Microsoft Corporation, and Intel Corporation. These companies are increasingly turning to strategic collaborations and acquisitions to bolster their product portfolios and secure a competitive edge.

January 2023: C3 AI, specializing in AI application software, unveiled its C3 Generative AI Product Suite, debuting with the C3 Generative AI for Enterprise Search. This suite boasts advanced transformer models, streamlining integration across diverse value chains. The introduction of C3 Generative AI is poised to boost transformative efforts in various industries, including oil and gas.

August 2023: Wintershall Dea, a leading European player in natural gas and oil, pivoting toward a focus on gas and carbon management, joined hands with IBM Consulting to establish an AI Center of Competence (CoC). This strategic alliance, with Microsoft as a shared technology partner, is geared toward driving forward AI applications that elevate energy production.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market

- 4.4 Technology Snapshot - By Application

- 4.4.1 Quality Control

- 4.4.2 Production Planning

- 4.4.3 Predictive Maintenance

- 4.4.4 Other Applications

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus to Easily Process Big Data

- 5.1.2 Rising Trend to Reduce Production Cost

- 5.2 Market Restraints

- 5.2.1 Initial High Cost of Adoption

- 5.2.2 Lack of Skilled Professionals in the Oil and Gas Industry

- 5.3 Key Use Cases

6 MARKET SEGMENTATION

- 6.1 By Operation

- 6.1.1 Upstream

- 6.1.2 Midstream

- 6.1.3 Downstream

- 6.2 By Type

- 6.2.1 Platform

- 6.2.2 Services

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 FuGenX Technologies

- 7.1.3 C3.AI Inc.

- 7.1.4 Microsoft Corporation

- 7.1.5 Intel Corporation

- 7.1.6 ABB Ltd

- 7.1.7 Honeywell International Inc.

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 NVIDIA Corporation

- 7.1.10 Infosys Limited

- 7.1.11 oPRO.ai Inc.