|

시장보고서

상품코드

1910708

유럽의 전기 자전거 시장 - 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Europe E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

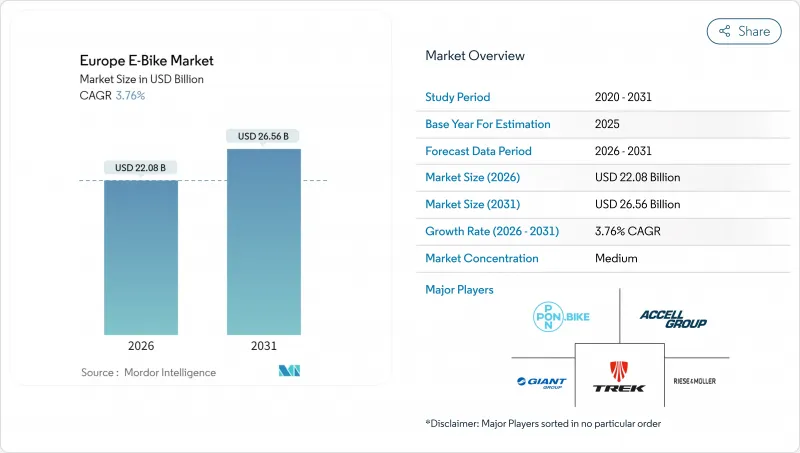

유럽의 전기 자전거 시장은 2025년의 212억 8,000만 달러에서 2026년에는 220억 8,000만 달러로 성장해 2026년부터 2031년에 걸쳐 CAGR 3.76%를 나타낼 전망입니다. 2031년까지 265억 6,000만 달러에 달할 것으로 예측됩니다.

기업용 차량 수요, 마지막 마일 물류, 통근 대체 수요 등 견조한 기반 수요가 유행 후 재고 조정을 상쇄하고 있습니다. 보호된 자전거 네트워크의 확대, 중국제 전기 자전거의 반덤핑 관세의 5년간 연장, 배터리 기술의 향상 등의 요소가 합쳐 가격 결정력을 유지해, 이익률을 보호하고 있습니다. 대규모 대량 구매를 예측 가능한 운영 비용으로 전환하는 임대 모델은 고용주층으로의 침투를 가속화하고 있습니다. 반면 EU 지역 내 현지 생산은 관세 위험을 줄이고 리드 타임을 단축합니다. 스피드 페델렉(고속 전기 자전거)에 관한 규제의 단계적인 통일과 고체 마이크로 배터리의 기술적 돌파구가 결합되어 고성능 모델을 위한 잠재 시장 규모의 확대가 기대됩니다.

유럽의 전기 자전거 시장 동향과 인사이트

기업용 자전거 임대 붐

세제 우대 조치가 있는 임대는 전기 자전거를 선택 구매품에서 직원 복리 후생으로 전환합니다. 급여 날인에 의해 실질 부담액이 30-50% 삭감되어 가격의 높이에 놀라지 않고 프리미엄 모델에의 길이 열립니다. 차량 관리를 통해 OEM 제조업체는 수요량을 가시화할 수 있어 Just-in-time 생산과 재고 위험 감소가 가능합니다. NAVIT와 같은 플랫폼은 국경을 넘은 인사규칙을 통일해 노동 시장이 희박한 프랑스와 네덜란드에서의 전개를 가속화하고 있습니다.

구매 보조금 및 세제 우대 조치

국가와 지자체의 까다로운 우대책으로 실질 가격이 압축되어 수요가 앞당겨지고 있습니다. 프랑스에서는 1대당 최대 4,000유로(약 464만 6천엔)의 보조가 계속중, 네덜란드에서는 고용주가 전기 자전거의 비용을 감가 상각 가능, 벨기에에서는 급여 공제와 리스를 조합하는 것으로 정가로부터 대폭적인 할인을 실현하고 있습니다. 갱신 시기가 예측 가능하기 때문에 제조업체는 보조 기간에 맞추어 생산 계획을 조정해, 재고를 평준화하는 것과 동시에 중가격대의 판매 대수를 보호. 이러한 조치는 성장을 지속하고 있습니다.

높은 초기 비용 대 일반 자전거

평균 가격은 기존 자전거보다 상당히 높으며 상당한 프리미엄이 부과됩니다. 독일에서 가격 인하 후에도 엔트리 모델이 하락하는 경우는 드뭅니다. 임금 중앙값이 낮은 동유럽 가구에서는 이 격차를 강하게 느끼고, 인프라가 정비되고 있음에도 불구하고 주류화가 늦어지고 있습니다. 대출 제도는 도움이 되지만, 소비자 신용에 대한 문화적 저항감 때문에 많은 구매자는 가격 하락이나 소득 증가를 기다리는 상황입니다.

부문 분석

유럽의 전기 자전거 시장 규모는 2025년에 77.35%의 점유율을 차지했습니다. 페달 어시스트는 규제의 간소함과 익숙한 주행 감각으로 지지되어 통근·레저 수요의 기반이 되고 있습니다. 스피드 페델렉은 모든 카테고리 중 가장 높은 3.88%의 연평균 복합 성장률(CAGR)을 나타내 통근자를 위한 시속 45km 성능과 배송 효율화를 요구하는 기업 수요를 견인했습니다.

규제의 통일은 여전히 결정적 요인입니다. 헬멧 착용 의무나 전용 레인 이용 규칙의 조화를 목표로 하는 EU 초안이 실현되면, 양산화와 단가 저하가 기대됩니다. 리제&뮐러사가 곧 발매 예정인 피니언 탑재 모델은 OEM 제조업체가 프리미엄 고속 전기 자전거의 확대에 주력하고 있는 증좌입니다. 보험 상품의 성숙과 인프라 정비가 진행됨에 따라, 구동 방식의 구성비는 고출력 클래스로 서서히 이행할 전망입니다.

2025년 시점에서 유럽 전기 자전거 시장의 73.62%를 도시 통근이 차지했습니다. 이것은 주차난이나 교통 체증 요금이 자동차 이용을 억제하는 10km 미만의 이동에 있어서, 전기 자전거가 특히 우위성을 발휘하기 때문입니다. 긴 랙과 박스를 갖춘 화물 및 실용형은 소매업체, 택배업자, 젊은 세대에 의한 세컨드카 대체 수요에 의해 CAGR 3.84%로 확대되고 있습니다. 듀얼 차일드 시트를 갖춘 패밀리 카고 유형은 배송업체 이외의 층에도 소구를 넓혀, 단거리의 자동차 이동을 대체해, 환경 의식이 높은 친층을 획득하고 있습니다. OEM 제조업체는 250W의 법적 제한을 초과하지 않고 200kg의 적재량을 실현하는 프레임을 재설계하여 개인 이용과 상용 이용의 경계를 더욱 모호하게 하고 있습니다.

트레킹 자전거와 산악 자전거는 견고한 프레임, 듀얼 배터리, 높은 토크 모터로 높은 가격대를 유지하지만, 계절적인 날씨와 예산 제약으로 인해 보급은 제한적입니다. 지자체의 기후 대책 계획이나 라스트 마일 배송 계약에 의해 연구 개발은 적재량 최적화, 회생 브레이크, 모듈식 액세서리에 주력되어, 자전거를 레저 용품으로부터 업무용 기기로 변모시키고 있습니다.

2025년 시점에서 유럽 전기 자전거 시장의 99.86%를 리튬 이온 전지가 차지해, 코스트 삭감과 에너지 밀도 향상에 의해 시장 규모를 지원했습니다. 화학 조성의 지속적인 개선, 비용 안정화를 위한 니켈 망간 코발트 혼합물과 LFP(인산철 리튬)로의 전환은 시장 전체와 마찬가지로 연평균 CAGR 3.76%의 점진적인 확대를 이끌어 낼 전망입니다.

납 축전지는 교체 시장과 초저가 수입품에만 존속합니다. 리튬 카본 또는 반고체 배터리 팩을 사용한 시험 운용 차량은 15-20%의 급속 충전과 저온 환경 하에서의 우수한 내구성을 약속합니다. 고체 전지의 기가팩토리가 규모 확대될 때까지는 케이스 설계·BMS 알고리즘·리사이클 함유 캐소드의 점진적 개량에 의해 보증 기간의 연장과 재판매 가치의 향상을 도모해, 예측 기간 중에는 리튬 이온 전지의 우위성이 흔들리지 않습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 서포트(3개월간)

자주 묻는 질문

목차

제1장 주요 요약 주요 조사 결과

제2장 보고서 제공

제3장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 연간 자전거 판매 대수

- 평균 판매 가격 및 가격대 구성

- 전기 자전거 및 부품의 국경 간 무역

- 전기 자전거의 총 판매 대수에 차지하는 비율

- 5-15km 통근 점유율

- 자전거 및 전기 자전거 렌탈 시장 규모

- 전기 자전거용 배터리 팩 가격

- 배터리 화학 성분별 가격 비교

- 라스트 마일 배송량

- 자전거 전용도로(km)

- 트레킹 및 아웃도어 활동 참가율

- 전기 자전거 배터리 용량(Wh)

- 도시 교통 혼잡도 지수

- 규제 프레임워크

- 형식 승인 및 인증

- 수출입 및 무역 규정

- 분류 및 도로 접근 규정

- 배터리 및 충전기 안전

제5장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 법인용 자전거 임대 붐

- 구입 보조금과 세제 우대 조치

- 라스트마일용 전동화물 차량의 성장

- 자전거 전용 레인의 확충

- 지역화된 EU 제조 거점의 이전

- 고체 마이크로 전지의 진보

- 시장 성장 억제요인

- 높은 초기 비용과 기존 자전거의 비교

- 판매점의 재고 평가 감소

- 스피드 페델렉 규제 회색지대

- 중국산 투입재에 대한 관세 변동

- 가치/공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 업계 간 경쟁

- 가격 분석

제6장 시장 세분화 분석

- 추진 유형별

- 페달 보조 방식

- 스피드 페델렉

- 스로틀 보조 방식

- 용도별

- 화물 및 유틸리티

- 도시형

- 트레킹 및 산악

- 배터리 유형별

- 납축전지

- 리튬 이온 배터리

- 기타

- 모터 설치 장소별

- 허브(전륜 및 후륜)

- 미드 드라이브

- 구동 시스템별

- 체인 구동

- 벨트 구동

- 모터 출력별

- 250W 미만

- 251-350W

- 351-500W

- 501-600W

- 600W 이상

- 가격대별

- 1,000USD 이하

- 1,000-1,499USD

- 1,500-2,499USD

- 2,500-3,499USD

- 3,500-5,999USD

- 6,000USD 이상

- 판매 채널별

- 온라인

- 오프라인

- 최종 용도별

- 상업 배송

- 소매 및 상품 배송

- 식품 및 음료 배달

- 서비스 제공업체

- 개인 및 가정용 이용

- 기관용

- 기타

- 상업 배송

- 국가별

- 독일

- 네덜란드

- 프랑스

- 이탈리아

- 스페인

- 영국

- 스위스

- 오스트리아

- 벨기에

- 덴마크

- 스웨덴

- 노르웨이

- 폴란드

- 체코 공화국

- 포르투갈

- 기타 유럽

제7장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 프로파일

- Accell Group

- Pon Holdings BV

- Giant Manufacturing Co. Ltd.

- Trek Bicycle Corporation

- Riese & Muller GmbH

- Brompton Bicycle Limited

- CUBE Bikes

- Yamaha Motor Co., Ltd.

- Merida Industry Co. Ltd.

- VanMoof BV

- Volt Electric Bikes

- Pedego Electric Bikes

- KTM Fahrrad GmbH

- Fritzmeier Systems GmbH & Co. KG(M1 Sporttechnik)

제8장 CEO에 대한 주요 전략적 질문

KTH 26.01.26The European e-bike market is expected to grow from USD 21.28 billion in 2025 to USD 22.08 billion in 2026 and is forecast to reach USD 26.56 billion by 2031 at 3.76% CAGR over 2026-2031.

Healthy underlying demand from corporate fleets, last-mile logistics, and commuter substitution offsets the post-pandemic inventory correction. Expansion of protected cycle networks, the five-year extension of anti-dumping duties on Chinese e-bikes, and battery technology upgrades collectively sustain pricing power and shield margins. Leasing models that convert large one-time purchases into predictable operating expenses accelerate penetration among employers, while localized EU manufacturing mitigates tariff risk and shortens lead times. Gradual regulatory alignment on speed-pedelecs, combined with solid-state micro-battery breakthroughs, is expected to widen the total addressable base for higher-performance models.

Europe E-Bike Market Trends and Insights

Corporate Bike-Leasing Boom

Tax-advantaged leasing turns e-bikes into employee benefits rather than discretionary buys. Payroll deductions cut effective outlay by 30-50% and open premium tiers without sticker shock. Fleets give OEMs volume visibility, enabling just-in-time production and lower inventory risk. Platforms like NAVIT unify cross-border HR rules, accelerating rollouts in France and the Netherlands under tight labor markets.

Purchase Subsidies and Tax Incentives

Generous national and municipal incentives compress effective prices and pull demand forward. France still grants up to EUR 4,000 (~USD 4,646) per unit, the Netherlands lets employers depreciate e-bike costs, and Belgium couples payroll credits with leases, slicing significant savings from sticker prices. Because renewals follow predictable cycles, manufacturers time production runs to subsidy windows, smoothing inventories and protecting mid-range volume tiers. These measures sustain growth.

High Upfront Cost vs Acoustic Bikes

Average prices are significantly higher, commanding a substantial premium over conventional bicycles. Even after a German price retreat, entry models rarely dip, while high battery replacements add lifetime expense. Eastern European households, with lower median wages, feel the gap most, slowing mainstream adoption despite better infrastructure. Financing helps, yet cultural resistance to consumer credit leaves many buyers waiting for price cuts or income growth.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Last-Mile E-Cargo Fleets

- Protected Bicycle-Lane Expansion

- Dealer Inventory Write-Downs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The European e-bike market size for pedal-assist propulsion accounted for 77.35% share in 2025. Pedal-assist thrives on regulatory simplicity and a familiar ride feel, anchoring commuter and leisure volumes. Speed-pedelecs outpaced all categories at 3.88% CAGR, leveraging commuter appetite for 45 km/h capability and fleet demand for quicker deliveries.

Regulatory convergence remains the swing factor: draft EU proposals aiming to synchronize helmet and path-access rules could unlock scale manufacturing and lower unit costs. Riese & Muller's forthcoming Pinion-equipped models reflect OEM bets on premium speed-pedelec expansion . As insurance products mature and infrastructure adapts, the propulsion mix is likely to tilt gradually toward higher-power classes.

City/urban commuting generated 73.62% of the European e-bike market share in 2025, because e-bikes excel on sub-10 km trips where parking scarcity and congestion charges penalize cars. Cargo/utility formats, purpose-built with long racks or boxes, expand at a 3.84% CAGR as retailers, couriers, and young families replace second cars. Family cargo variants with dual-child seating broaden the appeal beyond couriers, substituting short car trips and capturing sustainability-minded parents. OEMs redesign frames for 200 kg payloads without exceeding 250 W legal limits, further blurring lines between personal and commercial use.

Trekking and mountain bikes command premium ASPs through rugged frames, dual batteries, and high-torque motors, but remain limited by discretionary budgets and seasonal weather. Municipal climate plans and last-mile contracts tilt R&D toward payload optimization, regenerative braking, and modular accessories that transform bikes from leisure gear into professional equipment.

Lithium-ion holds 99.86% of the European e-bike market share in 2025, anchoring market size through cost erosion and energy-density gains. Continuous chemistry tweaks, shift toward nickel-manganese-cobalt blends or LFP for cost stability, drive incremental 3.76% CAGR, mirroring total market.

Lead-acid survives only in replacement sales and ultra-budget imports. Pilot fleets with lithium-carbon or semi-solid packs promise 15-20% faster charging and better low-temperature resilience. Until solid-state gigafactories scale, incremental gains in housing design, BMS algorithms, and recycled-content cathodes will lengthen warranties and lift resale values, keeping lithium-ion unchallenged during the forecast window.

The Europe E-Bike Market Report is Segmented by Propulsion Type (Pedal Assisted, Speed Pedelec, and More), Application Type (Cargo/Utility, City/Urban, and More), Battery Type (Lead-Acid Battery, Lithium-Ion Battery, and More), Motor Placement (Hub (Front/Rear), Mid-Drive), Drive Systems, Motor Power, Price Band, Sales Channel, End Use, and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Accell Group

- Pon Holdings B.V.

- Giant Manufacturing Co. Ltd.

- Trek Bicycle Corporation

- Riese & Muller GmbH

- Brompton Bicycle Limited

- CUBE Bikes

- Yamaha Motor Co., Ltd.

- Merida Industry Co. Ltd.

- VanMoof BV

- Volt Electric Bikes

- Pedego Electric Bikes

- KTM Fahrrad GmbH

- Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Report Offers

3 Introduction

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 Key Industry Trends

- 4.1 Annual Bicycle Sales

- 4.2 Average Selling Price & Price-Band Mix

- 4.3 Cross-Border Trade in E-Bikes & Parts

- 4.4 E-Bike Share of Total Bicycle Sales

- 4.5 5-15 km Commuter Share

- 4.6 Bicycle/E-Bike Rental Market Size

- 4.7 E-Bike Battery Pack Price

- 4.8 Battery Chemistry Price Comparison

- 4.9 Last-Mile Delivery Volume

- 4.10 Protected Bicycle Lanes (km)

- 4.11 Trekking/Outdoor Activity Participation

- 4.12 E-Bike Battery Capacity (Wh)

- 4.13 Urban Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.14.1 Homologation & Certification

- 4.14.2 Export-Import & Trade Rules

- 4.14.3 Classification & Road-Access Rules

- 4.14.4 Battery & Charger Safety

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Corporate Bike-Leasing Boom

- 5.2.2 Purchase Subsidies and Tax Incentives

- 5.2.3 Growth of Last-Mile E-Cargo Fleets

- 5.2.4 Protected Bicycle-Lane Expansion

- 5.2.5 Regionalized EU Manufacturing Shift

- 5.2.6 Solid-State Micro-Battery Advances

- 5.3 Market Restraints

- 5.3.1 High Upfront Cost vs Acoustic Bikes

- 5.3.2 Dealer Inventory Write-Downs

- 5.3.3 Speed-Pedelec Regulatory Grey-Zones

- 5.3.4 Tariff Volatility on Chinese Inputs

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

- 5.8 Pricing Analysis

6 Market Segmentation Analysis (Market Size & Growth Forecasts -Value (USD) and Volume (Units))

- 6.1 By Propulsion Type

- 6.1.1 Pedal Assisted

- 6.1.2 Speed Pedelec

- 6.1.3 Throttle Assisted

- 6.2 By Application Type

- 6.2.1 Cargo / Utility

- 6.2.2 City / Urban

- 6.2.3 Trekking / Mountain

- 6.3 By Battery Type

- 6.3.1 Lead-Acid Battery

- 6.3.2 Lithium-ion Battery

- 6.3.3 Others

- 6.4 By Motor Placement

- 6.4.1 Hub (Front / Rear)

- 6.4.2 Mid-Drive

- 6.5 By Drive Systems

- 6.5.1 Chain Drive

- 6.5.2 Belt Drive

- 6.6 By Motor Power

- 6.6.1 Below 250 W

- 6.6.2 251-350 W

- 6.6.3 351-500 W

- 6.6.4 501-600 W

- 6.6.5 Above 600 W

- 6.7 By Price Band

- 6.7.1 Less than/Equals USD 1,000

- 6.7.2 USD 1,000-1,499

- 6.7.3 USD 1,500-2,499

- 6.7.4 USD 2,500-3,499

- 6.7.5 USD 3,500-5,999

- 6.7.6 Greater than/Equals USD 6,000

- 6.8 By Sales Channel

- 6.8.1 Online

- 6.8.2 Offline

- 6.9 By End Use

- 6.9.1 Commercial Delivery

- 6.9.1.1 Retail and Goods Delivery

- 6.9.1.2 Food and Beverage Delivery

- 6.9.2 Service Providers

- 6.9.3 Personal and Family Use

- 6.9.4 Institutional

- 6.9.5 Others

- 6.9.1 Commercial Delivery

- 6.10 By Country

- 6.10.1 Germany

- 6.10.2 Netherlands

- 6.10.3 France

- 6.10.4 Italy

- 6.10.5 Spain

- 6.10.6 United Kingdom

- 6.10.7 Switzerland

- 6.10.8 Austria

- 6.10.9 Belgium

- 6.10.10 Denmark

- 6.10.11 Sweden

- 6.10.12 Norway

- 6.10.13 Poland

- 6.10.14 Czech Republic

- 6.10.15 Portugal

- 6.10.16 Rest of Europe

7 Competitive Landscape

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 7.3.1 Accell Group

- 7.3.2 Pon Holdings B.V.

- 7.3.3 Giant Manufacturing Co. Ltd.

- 7.3.4 Trek Bicycle Corporation

- 7.3.5 Riese & Muller GmbH

- 7.3.6 Brompton Bicycle Limited

- 7.3.7 CUBE Bikes

- 7.3.8 Yamaha Motor Co., Ltd.

- 7.3.9 Merida Industry Co. Ltd.

- 7.3.10 VanMoof BV

- 7.3.11 Volt Electric Bikes

- 7.3.12 Pedego Electric Bikes

- 7.3.13 KTM Fahrrad GmbH

- 7.3.14 Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)