|

시장보고서

상품코드

1692492

인도의 E-Commerce 물류 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)India E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

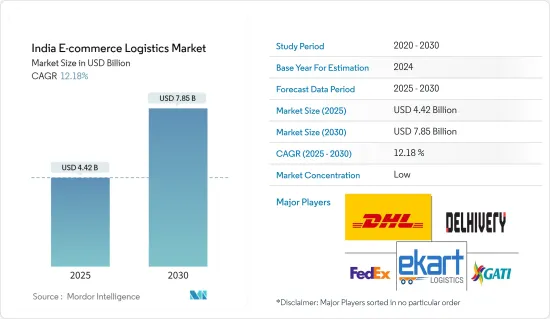

인도의 E-Commerce 물류 시장 규모는 2025년 44억 2,000만 달러로 추정되고, 2030년에는 78억 5,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR 12.18%로 확대될 것으로 예상됩니다.

COVID-19의 첫 번째 물결에서는 수익이 즉시 타격을 받았기 때문에 많은 소매업체가 점포를 폐쇄했습니다. 그러나 인도 정부의 수출 촉진 기관인 India Brand Equity Foundation에 따르면 소매업의 온라인 보급률은 2019년의 4.7%에 비해 2024년에는 10.7%를 보일 것으로 예측됐습니다.

인도를 거점으로 하는 비정부 산업단체이자 옹호단체인 인도상공회의소 연합회(FICCI)에 따르면 인도 소매 시장은 2026년까지 연간 성장률 10%, 1조6,000억 달러에 달할 것으로 예상되고 있습니다. 인도는 소매 업계에서 세계 5위의 세계적인 진출처이며, 복수의 신규 기업의 참가로 이어지고 있습니다.

온라인 소매업체는 3PL 서비스 제공업체에 대한 의존도가 높기 때문에 인도의 E-Commerce 물류 부문에 긍정적인 영향을 미칠 것으로 예측됩니다.

인도 E-Commerce 물류 시장 동향

전자상거래 매출 성장이 시장 확대를 견인

인도의 전자상거래 시장의 성장은 현저하고, 2034년에는 미국을 제치고 세계 2위의 전자상거래 시장이 된다고 India Brand Equity Foundation은 예측했습니다.

전자상거래 사업은 Facebook 및 Google에서 캠페인을 생성, 실행 및 분석하는 데 도움이 되는 마케팅 도구를 사용하여 판매자가 세계에 판매하고 비즈니스를 배포할 수 있도록 지원합니다. E-Commerce 스토어에서 소비자 체험의 향상은 당일 배송 프로세스나 유연한 옵션을 통해 분명합니다.

인터넷이나 스마트폰 유저의 보급이 전망되기 때문에 E-Commerce 업계에 참가하는 기업은 서서히 늘고 있습니다. 온라인 소매업체는 제3자 물류(3PL) 프로바이더와 제휴해, 재고, 포장, 배송, 창고 보관, 추적 등 배송에 관한 문제를 관리하고 있습니다. 이것은 물류 업계의 수익에 직접 공헌합니다.

인도의 인터넷 이용자 수 증가

Statista는 인터넷 사용자 수가 2027년까지 12억 3,233만 명에 이를 것으로 예측했습니다. Internet and Mobile Association of India(IAMAI)의 보고서에 따르면, 인도는 중국에 이어 세계 2위의 온라인 시장입니다.

인도 브랜드 에퀴티 재단의 데이터에 따르면 디지털 인디아 프로그램을 통해 인터넷 사용자 수는 2023년에 6억 9,200만 명으로 전망됐습니다. 인도의 스마트폰 이용자수는 2030년에는 8억 8,740만명에 달할 것으로 예상되고 있어 이용자 증가가 보여집니다.

인도 E-Commerce 물류 산업 개요

인도의 E-Commerce 물류 시장 경쟁 구도은 단편적입니다. 지역 전체에서 물류 및 서비스 수요가 급증하고 있기 때문에 각 회사는 거대한 기회를 포착하려고 경쟁력을 높이고 있습니다. E-Commerce에의 100% 직접 투자가 인정되어 최근의 디지털 리터러시의 향상에 의해 새로운 국제적 기업이 인도에 거점을 갖게 되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 현재의 시장 시나리오

- 업계의 기술 동향

- 정부의 대처와 규제

- 전자상거래에 대한 인사이트

- 밸류체인/공급망 분석

- 수요 및 공급 분석

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 인터넷과 스마트폰의 보급 확대

- 도시화와 라이프 스타일의 변화

- 정부의 대처

- 시장 성장 억제요인

- 빈약한 인프라와 라스트 마일 딜리버리

- 기회

- 물류 인프라 투자

- 크로스 보더 E-Commerce와 리버스 물류

- 전자상거래 기업과의 제휴

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자·소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제6장 시장 세분화

- 서비스별

- 수송

- 창고 및 재고 관리

- 부가가치 서비스(라벨링, 포장)

- 사업별

- B2B별

- B2C별

- 목적지별

- 국내

- 국제 및 크로스 보더

- 상품별

- 패션 및 의류

- 가전

- 가전제품

- 가구

- 미용 및 퍼스널케어 제품

- 기타 제품(완구, 식품 등)

제7장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- FedEx Corporation

- Delhivery Pvt. Ltd

- Ekart Logistics

- Blue Dart Express Ltd

- Shadowfax

- Xpress Bees

- DTDC

- Ecom Express Logistics

- Gati-Kintetsu Express Private Limited

- DHL

- Mahindra Logistics Ltd*

- 기타 기업

제8장 시장의 미래

제9장 부록

- 거시경제 지표(활동별 GDP 분포, 운수 및 창고 부문의 경제에의 기여도)

- 자본 이동에 관한 인사이트(운수 및 창고 섹터에 대한 투자)

- 전자상거래와 소비자 소비 관련 통계

- 대외무역 통계-수출과 수입, 제품별, 목적지/원산국별

The India E-commerce Logistics Market size is estimated at USD 4.42 billion in 2025, and is expected to reach USD 7.85 billion by 2030, at a CAGR of 12.18% during the forecast period (2025-2030).

During the first wave of COVID-19, many retailers shut down their stores as their revenue was hit instantly. However, it started to adapt gradually. As per the India Brand Equity Foundation, an Indian government export promotion agency, online penetration of retail is expected to reach 10.7% by 2024 compared to 4.7% in 2019, due to which many retailers started working on click-and-collect services and started partnering with logistics companies to keep their business moving forward. As the demand for door deliveries has increased, retailers are facilitating order deliveries with logistics companies to comfort companies and retailers.

India's retail market is expected to witness an annual growth rate of 10% with USD 1.6 trillion by 2026, as per the Federation of Indian Chambers of Commerce & Industry (FICCI), a non-governmental trade association and advocacy group based in India. The Indian retail market accounts for 10% of the country's gross domestic product (GDP) and around 8% of employment. India is the world's fifth-largest global destination in retail, leading to several new players' entries. In the next five years, online stores are expected to grow drastically and become equal to physical stores.

Since online retailers depend more on 3PL service providers, it is expected to influence the Indian e-commerce logistics sector positively.

India E-commerce Logistics Market Trends

The Growth of E-commerce Sales is Driving the Expansion of the Market

The Indian e-commerce market is growing predominantly and is expected to surpass the United States to become the second-largest e-commerce market in the world by 2034, as per the India Brand Equity Foundation. The Indian e-commerce market is expected to reach USD 197 billion by 2027 from USD 102.75 billion in 2023.

The e-commerce business helps the sellers sell globally and market the business using marketing tools that help create, execute, and analyze campaigns on Facebook and Google. The sellers can use a single dashboard to manage orders, shipping, and payments, which is highly flexible. The improvement of consumer experiences in e-commerce stores is evident through the same-day delivery process and flexible options. Due to these efficiencies, there is continuous growth in e-commerce sales across the existing and upcoming years.

The number of players entering the e-commerce industry is gradually increasing due to the expectation of increased penetration on the internet and smartphone users. Online retailers are partnering with third-party logistics (3PL) providers to manage issues related to delivery, such as inventory, packaging, shipping, warehousing, and tracking. This is directly contributing to the revenue of the logistics industry.

The Number of Internet Users in India is Increasing

Statista expects the number of internet users to reach 1,232.33 million by 2027. It is estimated to increase in urban and rural regions, indicating dynamic growth in access to the Internet. India is the second largest online market globally, ranking only behind China, according to a report by the Internet and Mobile Association of India (IAMAI). Due to the increase in mobile connectivity, growth in the purchasing behavior of women, and penetration in rural areas, the number of users has increased gradually.

The Digital India program drove the number of internet users to 692 million in 2023, per the India Brand Equity Foundation data. Of the total internet connections, 55% were in urban areas, 97% were wireless. The number of smartphone users in India is expected to reach 887.4 million by 2030, which shows an increase in users. India has the highest data consumption rate worldwide, at 14.1 GB of data per person a month.

India E-commerce Logistics Industry Overview

The competitive landscape of the Indian e-commerce logistics market is fragmented; as the demand for logistics services is growing rapidly across the region, companies are becoming more competitive to capture the huge opportunity. Policy support from the Indian government has allowed 100% FDI in B2B e-commerce, and the recent rise in digital literacy has led to new international players setting up their bases in India. This has, in turn, led the international logistics players to make strategic investments by establishing a regional logistics network, such as opening new distribution centers and smart warehouses. Some of the leading players include FedEx Corporation, DHL, and Aramex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends in the Industry

- 4.3 Government Initiatives and Regulations

- 4.4 Insights into the E-commerce

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Demand and Supply Analysis

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Internet and Smart Phone Penetration

- 5.1.2 Urbanization and Lifestyle Changes

- 5.1.3 Government Initiatives

- 5.2 Market Restraints

- 5.2.1 Poor Infrastructure and Last Mile Delivery

- 5.3 Opportunities

- 5.3.1 Investments in the Logistic Infrastructure

- 5.3.2 Cross-Border E-commerce and Reverse Logistics

- 5.3.3 Collaborations with E-commerce Companies

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services (Labeling, Packaging )

- 6.2 By Business

- 6.2.1 By B2B

- 6.2.2 By B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross Border

- 6.4 By Product

- 6.4.1 Fashion and Appareal

- 6.4.2 Consumer Electronics

- 6.4.3 Home Appliances

- 6.4.4 Furniture

- 6.4.5 Beauty and Personal Care Products

- 6.4.6 Other Products (Toys, Food Products, Etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 FedEx Corporation

- 7.2.2 Delhivery Pvt. Ltd

- 7.2.3 Ekart Logistics

- 7.2.4 Blue Dart Express Ltd

- 7.2.5 Shadowfax

- 7.2.6 Xpress Bees

- 7.2.7 DTDC

- 7.2.8 Ecom Express Logistics

- 7.2.9 Gati-Kintetsu Express Private Limited

- 7.2.10 DHL

- 7.2.11 Mahindra Logistics Ltd *

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport and Storage Sector to Economy)?

- 9.2 Insights on Capital Flows (Investments in the Transport and Storage Sector)

- 9.3 E-commerce and Consumer Spending-related Statistics

- 9.4 External Trade Statistics - Exports and Imports, by Product and by Country of Destination/Origin