|

시장보고서

상품코드

1693419

아시아태평양의 시아노아크릴레이트계 접착제 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Asia-Pacific Cyanoacrylate Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

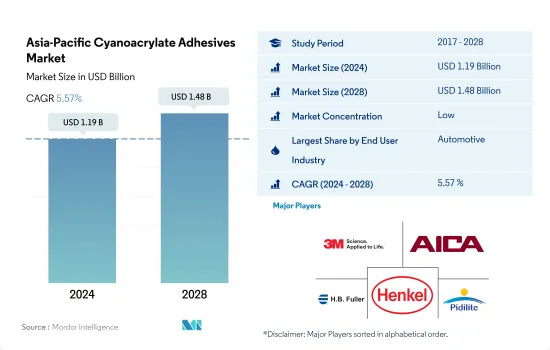

아시아태평양의 시아노아크릴레이트계 접착제 시장 규모는 2024년에 11억 9,000만 달러로 평가되었으며, 2028년에는 14억 8,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2024-2028년) CAGR은 5.57%를 나타낼 전망입니다.

항공우주산업과 의료산업에서 시아노아크릴레이트계 접착제의 용도와 수요 증가가 주요 성장요인입니다.

- 아시아태평양의 시아노아크릴레이트계 접착제 시장은 예측 기간 동안 DIY 및 전자 응용 분야 수요가 빠르게 증가하고 있기 때문에 다른 최종 사용자 산업에 의해 지배될 가능성이 높습니다. 노아크릴레이트는 목재, 금속, 플라스틱, 세라믹, 엘라스토머 등 다양한 기재와 단시간에 우수한 결합을 만드는 독특한 특성을 가지고 있으며, DIY 부문 전문가가 사용하기에 적합합니다.

- 시아노아크릴레이트계 접착제의 소비량은 산업 전체의 중요한 조립 작업의 응용에 기인하는 자동차 때문에 최근 증가하고 있습니다. 자동차는 안전성을 희생하지 않고 차량 전체의 무게를 줄이기 위해 경량 부품과 부품을 제조하기 위해 노력하고 있습니다.

- 항공우주 산업은 불연성, 빠른 경화 능력, 기계적 및 구조적 조작에서 번거로운 응용 분야로 인해 시아노아크릴레이트의 소비 측면에서 가장 빠르게 성장하는 섹터를 확인할 가능성이 높습니다. 또한, 시아노아크릴레이트의 경구용도는 최근 몇 년간 지속적인 개선을 보이고 있습니다.

인도네시아의 의료산업이 견인하는 시아노아크릴레이트계 접착제의 고성장 예측

- 아시아태평양은 세계 최대의 시아노아크릴레이트계 접착제 소비 지역으로, 2021년에는 시아노아크릴레이트계 접착제 총 소비량의 42.9%를 차지했습니다.

- 중국은 세계에서 시아노아크릴레이트계 접착제의 최대 소비국입니다. 자동차 생산 대수는 2021년의 2,620만대에서 2025년에는 3,420만대에 이를 것으로 예상되고 있습니다.

- 항공우주는 이 지역에서 시아노아크릴레이트계 접착제의 최종 사용자 산업으로서 가장 급성장하고 있으며, 예측기간 2022-2028년에는 수량 기준으로 CAGR은 6.26%를 보일 것으로 예측됩니다. 중국은 '메이드인 2025' 계획을 실시하고 있으며, 항공기 제조업체는 항공기의 100%를 중국에서 조달 및 제조할 것을 의무화해 외국기업의 진입을 제한하고 있습니다. 한편, 현지의 항공우주용 접착제 및 실란트 제조업체는 이 정부 계획으로부터 혜택을 받을 것으로 예측됩니다.

- 인도네시아는 이 지역과 세계 시장에서 가장 급성장하고 있는 국가이며, 의료산업의 성장으로 예측기간 2022-2028년의 CAGR은 7%를 보일 것으로 예측됩니다. 인도네시아의 의료 기기 시장은 2027년까지 28억 3,000만 달러에 이를 것으로 예측되고 있습니다.

아시아태평양 시아노아크릴레이트계 접착제 시장 동향

전기차의 보급이 산업을 견인

- 아시아태평양의 자동차 산업은 자동차 판매 대수가 대폭 증가하고 있기 때문에 시장을 견인하는 산업 중 하나가 되고 있습니다.

- 이 지역의 자동차 판매 대수는 생산 대수와 함께 크게 감소하고 있어 그 때문에 접착제의 이용이 영향을 받고 있습니다. COVID-19의 유행에 의해 전년대비 -10.2%를 기록했습니다. 제조시설의 조업정지와 공급체인의 혼란에 의한 자동차부품의 부족이 생산수준을 제약하였습니다.

- 아시아태평양의 EV 시장은 접착제 시장에 있어 또 하나의 성장 기회가 됩니다. 중국은 전 세계는 물론 전 지역에서 가장 큰 전기차 생산국입니다. 2016-2021년에 걸쳐, 상용 전기자동차의 대수는 562,603대에서 1,116,382대에 증가해, 약 98%의 성장률을 기록했습니다.

아시아태평양의 가구 제조업체의 높은 존재감이 산업을 견인할 것입니다.

- 아시아태평양에서는 중국이 가장 큰 가구 제조, 수출 및 소비국입니다.

- 미국과의 이해 갈등에도 불구하고 중국의 가구 시장은 2017년부터 19년에 걸쳐 약 18% 성장했습니다. 아시아 태평양 지역에서 가구 산업은 COVID-19 팬데믹으로 인한 운영, 무역 및 공급망 제한으로 인해 2020년에 약 7%의 감소를 나타냈습니다.

- 인도는 세계 제5위의 가구 생산국입니다. 인도의 가구 제조업은 대부분이 조직화되지 않았으며 인도 정부는 그 잠재력을 인정해, 챔피언 섹터라고 명명했습니다.

- 중국, 인도, 일본 등의 나라에서 목공 및 가구 제조 섹터의 현저한 성장으로 예측기간(2022-2028년) 중 이 시장은 수량 기준으로 약 4.2%의 연평균 복합 성장률(CAGR)로 성장할 것으로 예상됩니다.

아시아태평양 시아노아크릴레이트계 접착제 산업 개요

아시아태평양의 시아노아크릴레이트계 접착제 시장은 세분화되어 있으며 상위 5개 기업에서 31.95%를 차지하고 있습니다. 3M, Aica Kogyo Co.Ltd., H.B. Fuller Company, Henkel AG & Co. KGaA, Pidilite Industries Ltd. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 양말 피혁

- 목공 및 가구 제조

- 규제 프레임워크

- 호주

- 중국

- 인도

- 인도네시아

- 일본

- 말레이시아

- 싱가포르

- 한국

- 태국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 양말와 가죽

- 의료

- 목공 및 가구 제조

- 기타

- 기술

- 반응성

- UV 경화형 접착제

- 국가명

- 호주

- 중국

- 인도

- 인도네시아

- 일본

- 말레이시아

- 싱가포르

- 한국

- 태국

- 기타 아시아태평양

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- Aica Kogyo Co..Ltd.

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Kangda New Materials(Group) Co., Ltd.

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- ThreeBond Holdings Co., Ltd.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제 및 실란트 산업 개요

- 개요

- Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 억제요인, 기회

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Asia-Pacific Cyanoacrylate Adhesives Market size is estimated at 1.19 billion USD in 2024, and is expected to reach 1.48 billion USD by 2028, growing at a CAGR of 5.57% during the forecast period (2024-2028).

The rising applications and demand for cyanoacrylate adhesives across the aerospace and healthcare industries are the major growth factors

- Asia-Pacific's cyanoacrylate adhesives market is likely to dominate by other end-user industries owing to rapidly increasing demand from DIY and electronics applications throughout the projected timeframe. Cyanoacrylates have unique characteristics to create an exceptional bond in a shorter time period with different substrates such as wood, metal, plastics, ceramics, and elastomers, which make them suitable to be used by professionals in the DIY sector.

- Cyanoacrylate adhesive consumption has recently increased for automotive due to rising applications of critical assembly operations across the industry. Cyanoacrylates offer a permanent bond that can be stable under a wide range of heat and temperature. Moreover, automotive manufacturers are engaging themselves in producing lightweight parts and components to reduce the overall vehicle's weight without sacrificing safety. Thus, cyanoacrylate adhesives consumption in the automotive industry will showcase significant growth in the upcoming years.

- The aerospace industry is likely to witness a fastest-growing sector in terms of cyanoacrylate consumption owing to its non-flammable, fast-curing ability, and hassle-free applications in mechanical and structural operations. In addition, cyanoacrylates are rapidly adopted as a tissue adhesive for a variety of medical and surgical applications to replace traditional suturing processes. Furthermore, oral applications of cyanoacrylates have exhibited continuous improvements over the last few years. These factors collectively impetus the growth of cyanoacrylate adhesives across the Asia-Pacific region in the upcoming years.

High value growth forecasted for the cyanoacrylate adhesives led by the Indonesian healthcare industry

- Asia-Pacific is the world's largest regional consumer of cyanoacrylate adhesives, accounting for 42.9% of total cyanoacrylate adhesive consumption in 2021. Cyanoacrylate adhesives are instant adhesives consumed in the region's automotive, healthcare, DIY, and other industries.

- China is the largest consumer of cyanoacrylate adhesives in the region and the world. These adhesives are majorly used in the country's automotive and healthcare industries. The Chinese automotive industry consumes about 23,036 tons of cyanoacrylate adhesives. Automotive production is expected to reach 34.2 million units by 2025 from 26.2 million units in 2021. Such growing demand from the automotive industry is expected to drive the demand for cyanoacrylate adhesives in the country.

- Aerospace is the fastest-growing end-user industry of cyanoacrylate adhesives in the region and is expected to record a CAGR of 6.26% in volume terms during the forecast period 2022-2028. China is implementing the 'Made in 2025' plan, which requires aircraft manufacturers to source and manufacture 100% of aircraft in China, restricting foreign players' entry. On the other hand, the local aerospace adhesives and sealants manufacturers are expected to benefit from this government scheme. Similar policies being implemented by other countries in the region are expected to boost the aerospace industry in the region.

- Indonesia is the fastest-growing country in the region and globally for the market and is expected to record a CAGR of 7% during the forecast period 2022-2028, owing to its growing healthcare industry. The medical device market in Indonesia is expected to reach USD 2.83 billion by 2027. These factors are expected to boost the demand for cyanoacrylate adhesives in the Asia-Pacific region over the forecast period.

Asia-Pacific Cyanoacrylate Adhesives Market Trends

Increasing adoption of electric vehicles to drive the industry

- The Asia-Pacific automotive industry is one of the leading industries in the market, as the sales of automotive vehicles are largely increasing. Among all the countries, China is the largest automotive producer, accounting for about 57% of the regional production, followed by Japan with 17%, India with 10%, and South Korea with 8%.

- Vehicle sales in the region have majorly declined along with production, owing to which the utilization of adhesives has been impacted. While the Y-o-Y variation in 2017-18 was -1.8%, it fell further by -6.4% in 2018-19. In 2019-20, regional production was again impacted negatively and recorded a -10.2% decline from the previous year due to the COVID-19 pandemic. The shutdown of manufacturing facilities and the shortage of vehicle components due to disruptions in the supply chain constrained the production level. However, in 2021, the demand for automobiles rose again and is expected to continue, thereby increasing the utilization of adhesives across the region over the forecast period.

- The EV market in Asia-Pacific offers another opportunity for the adhesives market to grow. The rising production and adoption of EVs and hybrid vehicles are boosting the usage of adhesives for electronic component assembly in vehicles. China is the largest producer of EVs globally as well as across the region. From 2016 to 2021, the volume of commercial electric vehicles increased from 562,603 to 1,116,382 units, recording a growth rate of about 98%. These factors are expected to increase the demand for adhesives and result in the higher market growth over the forecast period.

High presence of furniture manufacturers in the Asia-Pacific region will propel the industry

- In Asia-Pacific, China is the largest furniture manufacturer, exporter, and consumer. China's high furniture consumption is due to its large population and the growing disposable income of urban households. More than 35% of the world's furniture trade originates from China, and 40% of the world's metal furniture exports and over 60% of upholstered wooden and metal seats are produced in China.

- The Chinese furniture market grew by around 18% during 2017-19 despite the conflict of interests with the United States. In Asia-Pacific, the furniture industry witnessed a decline of around 7% in 2020 due to the operational, trade, and supply chain restrictions resulting from the COVID-19 pandemic. However, the furniture industry has bounced back to its pre-pandemic levels in line with the rising demand from countries such as China, India, and Japan. In 2022, China exported USD 69 billion worth of furniture globally.

- India is the fifth largest producer of furniture in the world. The furniture manufacturing industry witnessed healthy growth from 2017 to 2019 because of factors like rising disposable income in Indian households, increasing middle-income families, and steady growth in urbanization. The Indian furniture manufacturing industry is largely unorganized, and the Indian government has recognized its potential and named it a champion sector. Efforts are being made to organize and regulate it in a structured way to ensure steady growth in domestic furniture production.

- Owing to the significant growth in the woodworking and joinery sector in countries like China, India, and Japan, the market is expected to register a CAGR of around 4.2% in terms of volume during the forecast period (2022-2028).

Asia-Pacific Cyanoacrylate Adhesives Industry Overview

The Asia-Pacific Cyanoacrylate Adhesives Market is fragmented, with the top five companies occupying 31.95%. The major players in this market are 3M, Aica Kogyo Co..Ltd., H.B. Fuller Company, Henkel AG & Co. KGaA and Pidilite Industries Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Woodworking and Joinery

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 UV Cured Adhesives

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema Group

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Hubei Huitian New Materials Co. Ltd

- 6.4.7 Kangda New Materials (Group) Co., Ltd.

- 6.4.8 NANPAO RESINS CHEMICAL GROUP

- 6.4.9 Pidilite Industries Ltd.

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms