|

시장보고서

상품코드

1895185

Drug Discovery용 AI 시장 : 업계 동향과 세계 예측(-2040년) - 응용 분야별, 처리 영상 유형별, 주요 지역별AI In Drug Discovery Market, till 2040: Distribution by Drug Discovery Steps, Therapeutic Area, and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

Drug Discovery용 AI 시장 전망

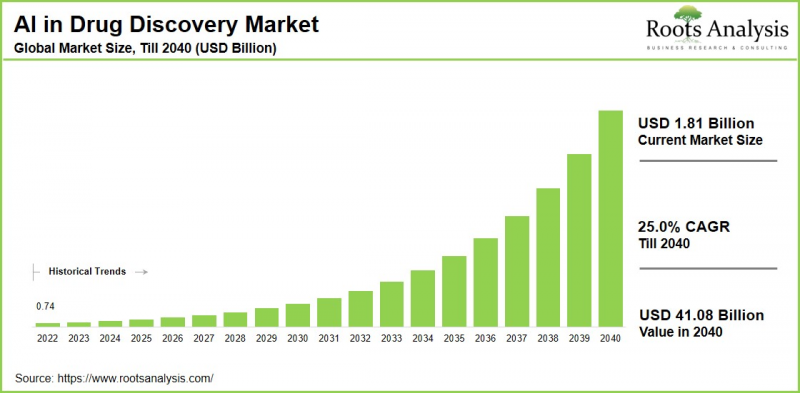

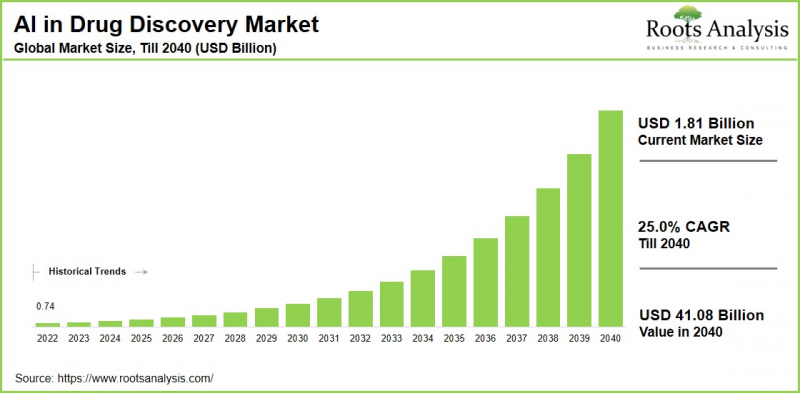

세계의 Drug Discovery용 AI 시장 규모는 현재 18억 1,000만 달러에서 2040년까지 410억 8,000만 달러로 성장할 것으로 예측됩니다. 예측 기간(-2040년)의 CAGR은 25%로 전망되고 있습니다. 본 조사에서는 시장 규모, 성장 시나리오, 업계 동향, 예측을 제공하고 있습니다.

인공지능(AI)은 가상 스크리닝, 유효성 및 독성 예측 모델링, 신약 설계 등의 기법을 통해 프로세스를 가속화하고 비용을 절감하며 성공률을 높이는 등 Drug Discovery에 혁명을 일으키고 있습니다. 머신러닝과 딥러닝 기술은 대규모 데이터세트를 평가하여 유망한 약물 후보를 식별하고, 체내에서의 거동을 예측하며, 심지어 완전히 새로운 분자를 생성할 수도 있습니다. 또한 기존 의약품의 새로운 용도를 발견하거나 환자 개개인의 특정 데이터를 기반으로 치료를 맞춤화함으로써 약물의 재사용 및 개인 맞춤형 치료에도 AI가 적용되고 있습니다.

다양한 질환을 대상으로 한 첨단 치료제에 대한 수요가 증가함에 따라 Drug Discovery용 AI 시장의 괄목할 만한 성장이 예상됩니다. 전 세계에서 만성질환의 유병률이 증가함에 따라 제약사들은 새로운 의약품에 대한 지속적인 수요에 대응하기 위해 연구개발에 대한 투자를 강화하고 있습니다.

경영진을 위한 전략적 인사이트

Drug Discovery용 AI 시장 성장을 촉진하는 주요 요인들

Drug Discovery 분야에서 AI 시장의 성장을 이끄는 주요 요인으로는 대규모 데이터세트의 신속한 분석, 분자 특성 및 독성 예측, 신규 약물 표적 발굴, 기존 의약품의 전환 프로세스 가속화 등 AI의 능력을 꼽을 수 있습니다. AI는 머신러닝을 활용하여 후보물질의 유효성, 안전성, 약동학적 특성을 보다 정확하게 예측함으로써 Drug Discovery 프로세스를 강화하고, 결과적으로 비용 절감과 개발 기간 단축을 실현합니다. 기타 중요한 성장 요인으로는 민간 및 공공 부문의 투자 및 자금 조달 증가, 표적 식별, 리드 최적화, 독성 예측 및 안전성 프로파일링을 위한 AI 기반 플랫폼의 채택 확대 등을 들 수 있습니다.

맞춤형 의료에서 AI의 역할

인공지능은 대규모 데이터세트를 분석하여 개인 맞춤형 치료 촉진, 진단 정확도 향상, 신약 개발 프로세스 가속화에 기여하며 맞춤형 의료에 크게 기여하고 있습니다. 유전체 정보, 전자 건강 기록, 웨어러블 기술의 정보를 통합하여 질병 위험 예측, 치료 계획의 최적화, 새로운 치료 표적의 발견을 실현합니다. 이를 통해 보다 정밀한 진단, 환자 결과 개선, 보다 효과적인 의료 시스템 구축이 가능합니다.

Drug Discovery용 AI 시장 : 업계 기업간 경쟁 구도

Drug Discovery용 AI 시장 경쟁 구도은 대기업과 중소기업이 모두 참여하는 치열한 경쟁이 특징입니다. 이 분야의 주요 시장 진출기업으로는 NVIDIA, Insilico Medicine, Exscientia, BenevolentAI, Google DeepMind, IBM, Microsoft 등이 있으며, 이들은 표적 식별, 창발화학, 임상시험 최적화를 위한 고급 AI 시스템을 개발하고 있습니다. AstraZeneca, Pfizer, Roche, Novartis, Bayer 등 주요 제약사들은 머신러닝을 활용한 신속하고 경제적인 의약품 개발 프로세스를 실현하기 위해 AI 기업과의 협업을 적극적으로 추진하고 있습니다.

Atomwise, Recursion Pharmaceuticals, BenchSci 등의 스타트업 기업은 독자적인 AI 특화 조사 방식으로 혁신을 가져오고 있습니다. 한편, 정밀의료와 새로운 치료법에 대한 수요 증가에 대응하기 위해 투자와 제휴가 빠르게 증가하고 있습니다. AI가 복잡한 생물학적 데이터를 처리하고, 연구개발 기간을 단축하고, 전 세계 신약 후보물질의 성공률을 향상시키는 능력에 힘입어 이 시장은 큰 폭의 성장이 예상되며, 견고한 모멘텀을 보이고 있습니다.

신약 개발에서의 AI의 진화 - 업계의 새로운 동향

이 분야의 새로운 동향으로는 생성형 AI를 활용한 신규 분자 생성, 질병에 대한 종합적인 이해를 위한 멀티오믹스 데이터 통합, 과학 문헌 분석에 거대 언어 모델(LLM) 활용 등을 들 수 있습니다. 또한 계산 효율을 향상시키는 상태공간모델(SSM)을 채택하고, AI를 통합하여 개별 환자 데이터를 평가하고 맞춤형 치료 계획을 수립하는 맞춤형 의료의 발전도 볼 수 있습니다.

주요 시장 과제

Drug Discovery용 AI 시장은 데이터 및 기술적 제약, 규제 및 윤리적 문제, 운영상의 장벽 등 심각한 문제에 직면해 있습니다. 데이터의 품질과 가용성은 매우 중요한 문제이며, 의약품 데이터세트는 단편화, 불일치, 불완전성, 불충분한 주석으로 인해 종종 어려움을 겪습니다. 이로 인해 AI 시스템의 예측에 편향성이 생겨 신뢰도가 낮은 결과를 초래할 수 있습니다.

또한 생물학적 시스템의 복잡한 특성은 종합적인 계산 모델링을 어렵게 만들고, 소규모 조직에 부담이 되는 높은 계산 비용으로 인해 더욱 복잡해집니다. 또한 FDA와 EMA의 가이드라인 변경이 AI의 반복적 특성과 일치하지 않아 발생하는 규제적 불확실성, HIPAA/GDPR(EU 개인정보보호규정)에 따른 데이터 프라이버시 문제 등 윤리적 딜레마, AI가 개발한 의약품의 특허 취득과 관련한 지적재산권 분쟁 등이 발생하고 있습니다.

Drug Discovery용 AI 시장 : 주요 시장 세분화

Drug Discovery 단계

- 표적 분자 식별/검증

- 히트 창출/리드 화합물 식별

- 리드 최적화

치료 영역

- 종양 질환

- 중추신경계 질환

- 감염성 질환

- 호흡기 질환

- 순환기 질환

- 내분비 질환

- 소화기 질환

- 근골격계 질환

- 면역계 질환

- 피부질환

- 기타

지역적 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미 국가

- 유럽

- 오스트리아

- 벨기에

- 덴마크

- 프랑스

- 독일

- 아일랜드

- 이탈리아

- 네덜란드

- 노르웨이

- 러시아

- 스페인

- 스웨덴

- 스위스

- 영국

- 기타 유럽 국가

- 아시아

- 중국

- 인도

- 일본

- 싱가포르

- 한국

- 기타 아시아 국가

- 라틴아메리카

- 브라질

- 칠레

- 콜롬비아

- 베네수엘라

- 기타 라틴아메리카 국가

- 중동 및 북아프리카

- 이집트

- 이란

- 이라크

- 이스라엘

- 쿠웨이트

- 사우디아라비아

- 아랍에미리트

- 기타 중동 및 북아프리카 국가

- 세계 기타 지역

- 호주

- 뉴질랜드

- 기타 국가

Drug Discovery용 AI 시장 : 주요 시장 점유율에 대한 인사이트

Drug Discovery 프로세스 단계별 시장 점유율

Drug Discovery 단계별로 세계 시장은 타겟 발굴 및 검증, 히트 창출 및 리드 화합물 발굴, 리드 화합물 최적화로 구분됩니다. 당사의 추정에 따르면 현재 납 화합물의 최적화가 시장의 대부분을 차지하고 있습니다. Drug Discovery의 초기 단계, 특히 리드 화합물 최적화에 AI를 적용하는 것은 약물의 효능, 가용성, 안전성 프로파일을 개선하는 데 매우 중요합니다. 또한 용해도, 세포투과성, 안정성을 높이기 위해서도 리드 화합물의 최적화가 필수적입니다.

지역별 시장 점유율

당사의 추정에 따르면 북미는 현재 Drug Discovery용 AI 시장에서 가장 큰 비중을 차지하고 있습니다. 이는 제약사들이 신약 개발 목적으로 AI 기반 툴을 활용하는 사례가 증가하고, 북미에서의 제품 제공을 개선하기 위한 제휴 계약이 증가했기 때문입니다. 또한 아시아태평양의 Drug Discovery용 AI 시장은 예측 기간 중 더 높은 CAGR로 성장할 것으로 예상된다는 점도 중요합니다.

Drug Discovery용 AI 시장의 대표적인 진출기업

- Aiforia Technologies

- Atomwise

- BioSyntagma

- Chemalive

- Collaborations Pharmaceuticals

- Cyclica

- DeepMatter

- Recursion

- InveniAI

- MAbSilico

- Optibrium

- Recursion Pharmaceuticals

- Sensyne Health

- Valo Health

Drug Discovery용 AI 시장 : 보고서의 범위

이 보고서에서는 Drug Discovery용 AI 시장에 대한 세부적인 분석을 다음과 같은 섹션별로 제공하고 있습니다.

- 시장 규모 및 기회 분석 : 신약 개발 분야의 AI 시장에 대한 심층 분석. 주요 시장 세분화인(A) 응용 분야,(B) 처리 대상 이미지 유형,(C) 주요 지역에 초점을 맞추었습니다.

- 경쟁 구도: Drug Discovery용 AI 시장에 진출한 기업에 대해(A) 설립 연도,(B) 기업 규모,(C) 본사 소재지,(D) 소유 구조 등 여러 관련 파라미터를 기반으로 한 종합적인 분석.

- 기업 개요: Drug Discovery용 AI 시장에 진출한 주요 기업의 상세한 프로파일을 제공합니다. 내용은(A) 본사 소재지,(B) 기업 규모,(C) 기업 이념,(D) 사업 전개 지역,(E) 경영진,(F) 연락처,(G) 재무 정보,(H) 사업 부문,(I) 제품 포트폴리오,(J) 최근 동향 및 미래 전망 등을 포함하고 있습니다.

- 메가트렌드: Drug Discovery 분야에서 AI 산업의 지속적인 메가트렌드를 평가합니다.

- 특허 분석 : Drug Discovery용 AI 관련 특허 출원 및 등록 현황을(A) 특허 유형,(B) 특허 공개 연도,(C) 특허 경과 기간,(D) 주요 진출기업 등 관련 파라미터를 기반으로 인사이트 분석을 수행합니다.

- 최근 동향 : Drug Discovery용 AI 시장의 최근 동향에 대한 개요와(A) 연간 활동,(B) 활동 유형,(C) 지역적 분포,(D) 가장 활발하게 활동하는 기업 등 관련 파라미터에 따른 분석을 제공합니다.

- Portre's Five Forces 분석 : Drug Discovery용 AI 시장에 존재하는 5가지 경쟁 요인(신규 시장 진출기업의 위협, 구매자의 협상력, 공급업체의 협상력, 대체품의 위협, 기존 경쟁사 간 경쟁)에 대한 분석.

- SWOT 분석 : 해당 분야의 강점, 약점, 기회, 위협을 명시하는 인사이트 있는 SWOT 프레임워크입니다. 또한 하비볼 분석을 제공하여 각 SWOT 매개변수의 상대적 영향력을 강조합니다.

- 밸류체인 분석 : 밸류체인에 대한 종합적인 분석을 통해 Drug Discovery의 AI 시장과 관련된 다양한 단계와 이해관계자에 대한 정보를 제공합니다.

목차

제1장 서문

제2장 개요

제3장 서론

- 챕터 개요

- 인공지능

- AI의 서브세트

- 기계학습

- 데이터 사이언스

- 헬스케어에서 AI의 응용

- Drug Discovery

- 질병 예측, 진단, 치료

- 제조 및 공급망 업무

- 마케팅

- 임상시험

- Drug Discovery용 AI

- 경로와 표적의 식별

- 히트 또는 리드의 식별

- 리드 최적화

- 약물 유사 화합물의 합성

- Drug Discovery 프로세스에서 AI 활용의 이점

- AI 도입에 수반하는 과제

- 결론

제4장 경쟁 구도

- 챕터 개요

- AI 기반 Drug Discovery : 전체 시장 현황

제5장 기업 개요 : 북미에 기반을 둔 AI 기반 Drug Discovery 프로바이더

- 챕터 개요

- Atomwise

- BioSyntagma

- Collaborations Pharmaceuticals

- Cyclica

- InveniAI

- Recursion Pharmaceuticals

- Valo Health

제6장 기업 개요 : 유럽에 기반을 둔 AI 기반 Drug Discovery 서비스 프로바이더

- 챕터 개요

- Aiforia Technologies

- Chemalive

- DeepMatter

- Exscientia

- MAbSilico

- Optibrium

- Sensyne Health

제7장 기업 개요 : 아시아태평양에 기반을 둔 AI 기반 Drug Discovery 서비스 프로바이더

- 챕터 개요

- 3BIGS

- Gero

- Insilico Medicine

- KeenEye

제8장 파트너십과 협업

- 챕터 개요

- 파트너십 모델

- AI 기반 Drug Discovery : 파트너십과 협업

제9장 자금조달과 투자 분석

- 챕터 개요

- 자금조달의 유형

- AI 기반 Drug Discovery : 자금조달과 투자

제10장 특허 분석

- 챕터 개요

- 범위와 조사 방법

- AI 기반 Drug Discovery : 특허 분석

- AI 기반 Drug Discovery : 특허 벤치마킹

- AI 기반 Drug Discovery : 특허 평가

- 주요 특허 : 인용수별 분석

제11장 Porter's Five Forces 분석

제12장 기업 가치 평가 분석

제13장 테크놀러지 대기업의 AI 기반 헬스케어 구상

- 챕터 개요

- Amazon Web Services

- Microsoft

- Intel

- Alibaba Cloud

- Siemens

- IBM

제14장 비용 삭감 분석

- 챕터 개요

- 주요 전제와 조사 방법

- Drug Discovery용 AI 기반 솔루션의 이용에 수반하는 전체적인 비용 삭감의 가능성

제15장 시장 예측

- 챕터 개요

- 주요 전제와 조사 방법

- 세계의 AI 기반 Drug Discovery 시장

제16장 결론

제17장 이그제큐티브 인사이트

- 챕터 개요

- Aigenpulse

- Cloud Pharmaceuticals

- DEARGEN

- Intelligent Omics

- Pepticom

- Sage-N Research

제18장 부록 I : 표 데이터

제19장 부록 II : 기업 및 조직 리스트

KSA 26.01.06AI in Drug Discovery Market Outlook

As per Roots Analysis, the global AI in drug discovery market size is estimated to grow from USD 1.81 billion in the current year to USD 41.08 billion by 2040, at a CAGR of 25% during the forecast period, till 2040. The new study provides market size, growth scenarios, industry trend and future forecast.

Artificial intelligence (AI) is revolutionizing drug discovery by speeding up the process, lowering costs, and enhancing success rates through methods, such as virtual screening, predictive modeling for efficacy and toxicity, and de novo drug design. Machine learning and deep learning techniques evaluate large datasets to pinpoint promising drug candidates, anticipate their behavior within the body, and even create completely new molecules. AI is also applied in drug repurposing and personalizing therapies by discovering new applications for existing medications or customizing treatments for individual patients based on their specific data.

The market for AI in drug discovery is expected to grow significantly due to the increasing need for advanced therapeutic medications aimed at a wide array of medical conditions. With the rising prevalence of chronic illnesses worldwide, pharmaceutical companies are enhancing their investment in research and development to fulfill the persistent demand for new medications.

Strategic Insights for Senior Leaders

Key Drivers Propelling Growth of AI in Drug Discovery Market

The primary factors propelling the AI in drug discovery market include the use of AI in drug discovery are its capability to quickly analyze large datasets, forecast molecular characteristics and toxicity, discover new drug targets, and speed up the process of repurposing existing medications. AI enhances the drug development process by employing machine learning to better predict a drug candidate's effectiveness, safety, and pharmacokinetic traits, ultimately resulting in lower expenses and shorter timelines. Other significant growth drivers, include the increasing investments and funding from private and public sectors, rising adoption of AI-driven platforms for target identification, lead optimization, toxicity prediction, and safety profiling.

Role of AI in Personalized Medicine

Artificial intelligence significantly contributes to personalized medicine by examining large datasets to facilitate tailored treatments, enhance diagnostics, and speed up the process of drug discovery. It combines information from genomics, electronic health records, and wearable technology to forecast disease risk, refine medication plans, and discover new therapeutic targets. This results in more precise diagnostics, improved patient outcomes, and more effective healthcare systems.

AI in Drug Discovery Market: Competitive Landscape of Companies in this Industry

The competitive landscape of AI in drug discovery market is characterized by intense competition, featuring a combination of large and smaller firms. Key players in this field include NVIDIA, Insilico Medicine, Exscientia, BenevolentAI, Google DeepMind, IBM, and Microsoft, which have created sophisticated AI systems for target identification, generative chemistry, and optimizing clinical trials. Major pharmaceutical organizations, such as AstraZeneca, Pfizer, Roche, Novartis, and Bayer are actively collaborating with AI firms to utilize machine learning for more rapid and economical drug development processes.

Startups such as Atomwise, Recursion Pharmaceuticals, and BenchSci bring innovation with their distinct AI-focused methodologies, while investments and partnerships are rapidly rising to meet the growing demand for precision medicine and new therapeutics. The market, which is projected for substantial growth, shows robust momentum driven by the capability of AI capability to process intricate biological data, shorten R&D timelines, and improve the success rates of drug candidates worldwide.

AI in Drug Discovery Evolution: Emerging Trends in the Industry

Emerging trends in this domain include the utilization of generative AI to create new molecules, the incorporation of multi-omics data for a comprehensive understanding of diseases, and the use of Large Language Models (LLMs) to examine scientific literature. Additional advancements include the employment of State Space Models (SSMs), which provide enhanced computational efficiency, and the integration of AI in personalized medicine, where AI develops customized treatment plans by evaluating individual patient data.

Key Market Challenges

The market for AI in drug discovery faces significant challenges, including data and technical limitations, as well as regulatory and ethical issues, and operational obstacles. The quality and availability of data are pivotal concerns, as pharmaceutical datasets frequently suffer from fragmentation, inconsistencies, incompleteness, or poor annotations. This can result in biased predictions and unreliable outcomes from AI systems.

Further, the intricate nature of biological systems makes comprehensive computational modeling difficult and is further complicated by the high computational expenses that can be burdensome for smaller organizations. Additionally, regulatory uncertainties arise from changing FDA and EMA guidelines that do not align well with the iterative characteristics of AI, ethical dilemmas such as data privacy issues under HIPAA/GDPR, and intellectual property disputes concerning the patenting of drugs developed by AI.

AI in Drug Discovery Market: Key Market Segmentation

Drug Discovery Steps

- Target identification / validation

- Hit generation / lead identification

- Lead optimization

Therapeutic Area

- Oncological disorders

- CNS disorders

- Infectious diseases

- Respiratory disorders

- Cardiovascular disorders

- Endocrine disorders

- Gastrointestinal disorders

- Musculoskeletal disorders

- Immunological disorders

- Dermatological disorders

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

AI in Drug Discovery Market: Key Market Share Insights

Market Share by Drug Discovery Step

Based on the drug discovery step, the global market is segmented into target identification / validation, hit generation / lead identification and lead optimization. According to our estimates, currently, lead optimization captures majority share of the market. The application of AI in the initial phases of drug discovery, particularly in lead optimization, is crucial for improving the drug's efficacy, accessibility, and safety profile. Additionally, lead optimization is vital for enhancing solubility, cellular permeability, and stability.

Market Share by Geography

According to our estimates North America currently captures a significant share of the AI in drug discovery market. This is due to the increasing utilization of AI-based tools by pharmaceutical companies for drug discovery and the rise in partnership agreements aimed at improving product offerings in North America. It is also important to note that the AI in drug discovery market in the Asia-Pacific region is expected to grow at a higher CAGR over the forecast period.

Example Players in AI in Drug Discovery Market

- Aiforia Technologies

- Atomwise

- BioSyntagma

- Chemalive

- Collaborations Pharmaceuticals

- Cyclica

- DeepMatter

- Recursion

- InveniAI

- MAbSilico

- Optibrium

- Recursion Pharmaceuticals

- Sensyne Health

- Valo Health

AI in Drug Discovery Market: Report Coverage

The report on the AI in drug discovery market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the AI in drug discovery market, focusing on key market segments, including [A] drug discovery steps, [B] therapeutic area, and [C] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the AI in drug discovery market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the AI in drug discovery market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the AI in drug discovery industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the AI in drug discovery domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the AI in drug discovery market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the AI in drug discovery market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the AI in drug discovery market.

Key Questions Answered in this Report

- What is the current and future market size?

- Who are the leading companies in this market?

- What are the growth drivers that are likely to influence the evolution of this market?

- What are the key partnership and funding trends shaping this industry?

- Which region is likely to grow at higher CAGR till 2040?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- Detailed Market Analysis: The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- In-depth Analysis of Trends: Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. Each report maps ecosystem activity across partnerships, funding, and patent landscapes to reveal growth hotspots and white spaces in the industry.

- Opinion of Industry Experts: The report features extensive interviews and surveys with key opinion leaders and industry experts to validate market trends mentioned in the report.

- Decision-ready Deliverables: The report offers stakeholders with strategic frameworks (Porter's Five Forces, value chain, SWOT), and complimentary Excel / slide packs with customization support.

Additional Benefits

- Complimentary Dynamic Excel Dashboards for Analytical Modules

- Exclusive 15% Free Content Customization

- Personalized Interactive Report Walkthrough with Our Expert Research Team

- Free Report Updates for Versions Older than 6-12 Months

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Artificial Intelligence

- 3.3. Subsets of AI

- 3.3.1. Machine Learning

- 3.3.1.1. Supervised Learning

- 3.3.1.2. Unsupervised Learning

- 3.3.1.3. Reinforced / Reinforcement Learning

- 3.3.1.4. Deep Learning

- 3.3.1.5. Natural Language Processing (NLP)

- 3.3.1. Machine Learning

- 3.4. Data Science

- 3.5. Applications of AI in Healthcare

- 3.5.1. Drug Discovery

- 3.5.2. Disease Prediction, Diagnosis and Treatment

- 3.5.3. Manufacturing and Supply Chain Operations

- 3.5.4. Marketing

- 3.5.5. Clinical Trials

- 3.6. AI in Drug Discovery

- 3.6.1. Identification of Pathway and Target

- 3.6.2. Identification of Hit or Lead

- 3.6.3. Lead Optimization

- 3.6.4. Synthesis of Drug-Like Compounds

- 3.7. Advantages of Using AI in the Drug Discovery Process

- 3.8. Challenges Associated with the Adoption of AI

- 3.9. Concluding Remarks

4. COMPETITIVE LANDSCAPE

- 4.1. Chapter Overview

- 4.2. AI-based Drug Discovery: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Type of Company

- 4.2.5. Analysis by Type of Technology

- 4.2.6. Analysis by Drug Discovery Steps

- 4.2.7. Analysis by Type of Drug Molecule

- 4.2.8. Analysis by Drug Development Initiatives

- 4.2.9. Analysis by Technology Licensing Option

- 4.2.10. Analysis by Target Therapeutic Area

- 4.2.11. Key Players: Analysis by Number of Platforms / Tools Available

5. COMPANY PROFILES: AI-BASED DRUG DISCOVERY PROVIDERS IN NORTH AMERICA

- 5.1. Chapter Overview

- 5.2. Atomwise

- 5.2.1. Company Overview

- 5.2.2. AI-based Drug Discovery Technology Portfolio

- 5.2.3. Recent Developments and Future Outlook

- 5.3. BioSyntagma

- 5.3.1. Company Overview

- 5.3.2. AI-based Drug Discovery Technology Portfolio

- 5.3.3. Recent Developments and Future Outlook

- 5.4. Collaborations Pharmaceuticals

- 5.4.1. Company Overview

- 5.4.2. AI-based Drug Discovery Technology Portfolio

- 5.4.3. Recent Developments and Future Outlook

- 5.5. Cyclica

- 5.5.1. Company Overview

- 5.5.2. AI-based Drug Discovery Technology Portfolio

- 5.5.3. Recent Developments and Future Outlook

- 5.6. InveniAI

- 5.6.1. Company Overview

- 5.6.2. AI-based Drug Discovery Technology Portfolio

- 5.6.3. Recent Developments and Future Outlook

- 5.7. Recursion Pharmaceuticals

- 5.7.1. Company Overview

- 5.7.2. AI-based Drug Discovery Technology Portfolio

- 5.7.3. Recent Developments and Future Outlook

- 5.8. Valo Health

- 5.8.1. Company Overview

- 5.8.2. AI-based Drug Discovery Technology Portfolio

- 5.8.3. Recent Developments and Future Outlook

6. COMPANY PROFILES: AI-BASED DRUG DISOCVERY SERVICE PROVIDERS IN EUROPE

- 6.1. Chapter Overview

- 6.2. Aiforia Technologies

- 6.2.1. Company Overview

- 6.2.2. AI-based Drug Discovery Technology Portfolio

- 6.2.3. Recent Developments and Future Outlook

- 6.3. Chemalive

- 6.3.1. Company Overview

- 6.3.2. AI-based Drug Discovery Technology Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. DeepMatter

- 6.4.1. Company Overview

- 6.4.2. AI-based Drug Discovery Technology Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. Exscientia

- 6.5.1. Company Overview

- 6.5.2. AI-based Drug Discovery Technology Portfolio

- 6.5.3. Recent Developments and Future Outlook

- 6.6. MAbSilico

- 6.6.1. Company Overview

- 6.6.2. AI-based Drug Discovery Technology Portfolio

- 6.6.3. Recent Developments and Future Outlook

- 6.7. Optibrium

- 6.7.1. Company Overview

- 6.7.2. AI-based Drug Discovery Technology Portfolio

- 6.7.3. Recent Developments and Future Outlook

- 6.8. Sensyne Health

- 6.8.1. Company Overview

- 6.8.2. AI-based Drug Discovery Technology Portfolio

- 6.8.3. Recent Developments and Future Outlook

7. COMPANY PROFILES: AI-BASED DRUG DISOCVERY SERVICE PROVIDERS IN ASIA PACIFIC

- 7.1. Chapter Overview

- 7.2. 3BIGS

- 7.2.1. Company Overview

- 7.2.2. AI-based Drug Discovery Technology Portfolio

- 7.2.3. Recent Developments and Future Outlook

- 7.3. Gero

- 7.3.1. Company Overview

- 7.3.2. AI-based Drug Discovery Technology Portfolio

- 7.3.3. Recent Developments and Future Outlook

- 7.4. Insilico Medicine

- 7.4.1. Company Overview

- 7.4.2. AI-based Drug Discovery Technology Portfolio

- 7.4.3. Recent Developments and Future Outlook

- 7.5. KeenEye

- 7.5.1. Company Overview

- 7.5.2. AI-based Drug Discovery Technology Portfolio

- 7.5.3. Recent Developments and Future Outlook

8. PARTNERSHIPS AND COLLABORATIONS

- 8.1. Chapter Overview

- 8.2. Partnership Models

- 8.3. AI-based Drug Discovery: Partnerships and Collaborations

- 8.3.1. Analysis by Year of Partnership

- 8.3.2. Analysis by Type of Partnership

- 8.3.3. Analysis by Year and Type of Partnership

- 8.3.4. Analysis by Target Therapeutic Area

- 8.3.5. Analysis by Focus Area

- 8.3.6. Analysis by Year of Partnership and Focus Area

- 8.3.7. Analysis by Type of Partner Company

- 8.3.8. Analysis by Type of Partnership and Type of Partner Company

- 8.3.9. Most Active Players: Analysis by Number of Partnerships

- 8.3.10. Analysis by Region

- 8.3.11.1. Intercontinental and Intracontinental Deals

- 8.3.11.2. International and Local Deals

9. FUNDING AND INVESTMENT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Types of Funding

- 9.3. AI-based Drug Discovery: Funding and Investments

- 9.3.1. Analysis of Number of Funding Instances by Year

- 9.3.2. Analysis of Amount Invested by Year

- 9.3.3. Analysis by Type of Funding

- 9.3.4. Analysis of Amount Invested and Type of Funding

- 9.3.5. Analysis of Amount Invested by Company Size

- 9.3.6. Analysis by Type of Investor

- 9.3.7. Analysis of Amount Invested by Type of Investor

- 9.3.8. Most Active Players: Analysis by Number of Funding Instances

- 9.3.9. Most Active Players: Analysis by Amount Invested

- 9.3.10. Most Active Investors: Analysis by Number of Funding Instances

- 9.3.11. Analysis of Amount Invested by Geography

- 9.3.11.1. Analysis by Region

- 9.3.11.2. Analysis by Country

10. PATENT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. AI-based Drug Discovery: Patent Analysis

- 10.3.1 Analysis by Application Year

- 10.3.2. Analysis by Geography

- 10.3.3. Analysis by CPC Symbols

- 10.3.4. Analysis by Emerging Focus Areas

- 10.3.5. Analysis by Type of Applicant

- 10.3.6. Leading Players: Analysis by Number of Patents

- 10.4. AI-based Drug Discovery: Patent Benchmarking

- 10.4.1. Analysis by Patent Characteristics

- 10.5. AI-based Drug Discovery: Patent Valuation

- 10.6. Leading Patents: Analysis by Number of Citations

11. PORTER'S FIVE FORCES ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology and Assumptions

- 11.3. Key Parameters

- 11.3.1. Threats of New Entrants

- 11.3.2. Bargaining Power of Drug Developers

- 11.3.3. Bargaining Power of Companies Using AI for Drug Discovery

- 11.3.4. Threats of Substitute Technologies

- 11.3.5. Rivalry Among Existing Competitors

- 11.4. Concluding Remarks

12. COMPANY VALUATION ANALYSIS

- 12.1. Chapter Overview

- 12.2. Company Valuation Analysis: Key Parameters

- 12.3. Methodology

- 12.4. Company Valuation Analysis: Roots Analysis Proprietary Scores

13. AI-BASED HEALTHCARE INITIATIVES OF TECHNOLOGY GIANTS

- 13.1. Chapter Overview

- 13.1.1. Amazon Web Services

- 13.1.2. Microsoft

- 13.1.3. Intel

- 13.1.4. Alibaba Cloud

- 13.1.5. Siemens

- 13.1.6. Google

- 13.1.7. IBM

14. COST SAVING ANALYSIS

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Overall Cost Saving Potential Associated with Use of AI-based Solutions in Drug Discovery

- 14.3.1. Likely Cost Savings: Analysis by Drug Discovery Steps

- 14.3.1.1. Likely Cost Savings During Target Identification / Validation

- 14.3.1.2. Likely Cost Savings During Hit Generation / Lead Identification

- 14.3.1.3. Likely Cost Savings During Lead Optimization

- 14.3.2. Likely Cost Savings: Analysis by Target Therapeutic Area

- 14.3.2.1. Likely Cost Savings for Drugs Targeting Oncological Disorders

- 14.3.2.2. Likely Cost Savings for Drugs Targeting Neurological Disorders

- 14.3.2.3. Likely Cost Savings for Drugs Targeting Infectious Diseases

- 14.3.2.4. Likely Cost Savings for Drugs Targeting Respiratory Disorders

- 14.3.2.5. Likely Cost Savings for Drugs Targeting Cardiovascular Disorders

- 14.3.2.6. Likely Cost Savings for Drugs Targeting Endocrine Disorders

- 14.3.2.7. Likely Cost Savings for Drugs Targeting Gastrointestinal Disorders

- 14.3.2.8. Likely Cost Savings for Drugs Targeting Musculoskeletal Disorders

- 14.3.2.9. Likely Cost Savings for Drugs Targeting Immunological Disorders

- 14.3.2.10. Likely Cost Savings for Drugs Targeting Dermatological Disorders

- 14.3.2.11. Likely Cost Savings for Drugs Targeting Other Disorders

- 14.3.3. Likely Cost Savings: Analysis by Geography

- 14.3.3.1. Likely Cost Savings in North America

- 14.3.3.2. Likely Cost Savings in Europe

- 14.3.3.3. Likely Cost Savings in Asia Pacific

- 14.3.3.4. Likely Cost Savings in MENA

- 14.3.3.5. Likely Cost Savings in Latin America

- 14.3.3.6. Likely Cost Savings in Rest of the World

- 14.3.1. Likely Cost Savings: Analysis by Drug Discovery Steps

15. MARKET FORECAST

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Global AI-based Drug Discovery Market

- 15.3.1. AI-based Drug Discovery Market: Distribution by Drug Discovery Steps

- 15.3.1.1. AI-based Drug Discovery Market for Target Identification / Validation

- 15.3.1.2. AI-based Drug Discovery Market for Hit Generation / Lead Identification

- 15.3.1.3. AI-based Drug Discovery Market for Lead Optimization

- 15.3.2. AI-based Drug Discovery Market: Distribution by Target Therapeutic Area

- 15.3.2.1. AI-based Drug Discovery Market for Oncological Disorders

- 15.3.2.2. AI-based Drug Discovery Market for Neurological Disorders

- 15.3.2.3. AI-based Drug Discovery Market for Infectious Diseases

- 15.3.2.4. AI-based Drug Discovery Market for Respiratory Disorders

- 15.3.2.5. AI-based Drug Discovery Market for Cardiovascular Disorders

- 15.3.2.6. AI-based Drug Discovery Market for Endocrine Disorders

- 15.3.2.7. AI-based Drug Discovery Market for Gastrointestinal Disorders

- 15.3.2.8. AI-based Drug Discovery Market for Musculoskeletal Disorders

- 15.3.2.9. AI-based Drug Discovery Market for Immunological Disorders

- 15.3.2.10. AI-based Drug Discovery Market for Dermatological Disorders

- 15.3.2.11. AI-based Drug Discovery Market for Other Disorders

- 15.3.3. AI-based Drug Discovery Market: Distribution by Geography

- 15.3.3.1. AI-based Drug Discovery Market in North America

- 15.3.3.1.1. AI-based Drug Discovery Market in the US

- 15.3.3.1.2. AI-based Drug Discovery Market in Canada

- 15.3.3.2. AI-based Drug Discovery Market in Europe

- 15.3.3.2.1. AI-based Drug Discovery Market in the UK

- 15.3.3.2.2. AI-based Drug Discovery Market in France

- 15.3.3.2.3. AI-based Drug Discovery Market in Germany

- 15.3.3.2.4. AI-based Drug Discovery Market in Spain

- 15.3.3.2.5. AI-based Drug Discovery Market in Italy

- 15.3.3.2.6. AI-based Drug Discovery Market in Rest of Europe

- 15.3.3.3. AI-based Drug Discovery Market in Asia Pacific

- 15.3.3.3.1. AI-based Drug Discovery Market in China

- 15.3.3.3.2. AI-based Drug Discovery Market in India

- 15.3.3.3.3. AI-based Drug Discovery Market in Japan

- 15.3.3.3.4. AI-based Drug Discovery Market in Australia

- 15.3.3.3.5. AI-based Drug Discovery Market in South Korea

- 15.3.3.4. AI-based Drug Discovery Market in MENA

- 15.3.3.4.1. AI-based Drug Discovery Market in Saudi Arabia

- 15.3.3.4.2. AI-based Drug Discovery Market in UAE

- 15.3.3.4.3. AI-based Drug Discovery Market in Iran

- 15.3.3.5. AI-based Drug Discovery Market in Latin America

- 15.3.3.5.1. AI-based Drug Discovery Market in Argentina

- 15.3.3.6. AI-based Drug Discovery Market in Rest of the World

- 15.3.3.1. AI-based Drug Discovery Market in North America

- 15.3.1. AI-based Drug Discovery Market: Distribution by Drug Discovery Steps

16. CONCLUSION

17. EXECUTIVE INSIGHTS

- 17.1. Chapter Overview

- 17.2. Aigenpulse

- 17.2.1. Company Snapshot

- 17.2.2. Interview Transcript: Steve Yemm (Chief Commercial Officer) and Satnam Surae (Chief Product Officer)

- 17.3. Cloud Pharmaceuticals

- 17.3.1. Company Snapshot

- 17.3.2. Interview Transcript: Ed Addison (Co-founder, Chairman and Chief Executive Officer)

- 17.4. DEARGEN

- 17.4.1. Company Snapshot

- 17.4.2. Interview Transcript: Bo Ram Beck (Head Researcher)

- 17.5. Intelligent Omics

- 17.5.1. Company Snapshot

- 17.5.2. Interview Transcript: Simon Haworth (Chief Executive Officer)

- 17.6. Pepticom

- 17.6.1. Company Snapshot

- 17.6.2. Interview Transcript: Immanuel Lerner (Chief Executive Officer, Co-Founder)

- 17.7. Sage-N Research

- 17.7.1. Company Snapshot

- 17.7.2. Interview Transcript: David Chiang (Chairman)