|

시장보고서

상품코드

1830066

세포독성 의약품 및 HPAPI 제조 시장 : 업계 동향과 세계 예측(-2035년) - 제품 유형별, 기업 규모별, 사업 규모별, 분자 유형별, 고활성 최종제형 유형별, 주요 지역별Cytotoxic Drugs & HPAPI Manufacturing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Product, Company Size, Scale of Operation, Type of Molecule, Type of Highly Potent Finished Dosage Form, and Key Geographies |

||||||

세포독성 의약품과 HPAPI 제조 시장 : 개요

세계 세포독성 의약품 및 HPAPI 제조 시장 규모는 현재 139억 8,000만 달러에서 2035년까지 464억 1,000만 달러에 이르고, 2035년까지 예측 기간 동안 12.75%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다.

세포독성 의약품 및 HPAPI 제조 시장 시장 기회는 다음과 같은 부문에 분포되어 있습니다.

제품 유형

- HPAPI

- 고활성 완제품 형태

사업 규모

- 전임상

- 임상시험

- 상업

분자 유형

- 저분자

- 생물학적 제제

고활성 최종 제형 유형

- 주사제

- 경구용 고형제

- 크림

- 기타

주요 지역

- 북미(미국, 캐나다, 멕시코)

- 유럽(영국, 이탈리아, 독일, 프랑스, 스페인, 기타)

- 아시아태평양(중국, 인도, 기타)

- 기타 지역

세포독성 의약품 및 HPAPI 제조 시장 : 성장 및 동향

임상약리학 및 종양학의 발전과 더불어 표적치료에 대한 관심이 높아짐에 따라 전 세계 연구자들과 제약회사들은 고활성 의약품 성분(HPAPI)과 세포독성 의약품에 점점 더 많은 관심을 기울이고 있습니다. 전 세계 의약품의 45%가 고활성이며, HPAPI의 전문적인 제조가 필요하다는 것이 중요합니다. 그러나 HPAPI의 제조에는 복잡한 공정이 수반되어 여러 가지 어려움이 있습니다. 첫 번째 과제는 제조 중 교차 오염을 방지하는 것이며, 그 다음으로는 공급망과 관련된 환경과 근로자의 안전을 확보하는 것입니다. 또한, 장비, 절차, 개인보호장비(PPE) 등 적절한 격리 및 보호 수단을 선택하는 것이 매우 중요합니다. HPAPI를 취급하려면 일반적으로 안전한 취급 방법에 대한 지속적인 투자와 고도의 기술 전문 지식이 필요하며, 이는 현장을 더욱 복잡하게 만듭니다. 그 결과, 의약품 개발 기업들은 제조 공정의 아웃소싱에 점점 더 많은 관심을 기울이고 있습니다.

수탁 제조 부문의 큰 잠재력과 좋은 성장 전망으로 인해 대부분의 주요 기업들은 기존 제조 시설의 확장 및 강화에 투자하려고 합니다. 일부 위탁생산(CMO)은 일본, 중국, 인도, 브라질 등 신흥 시장에 새로운 시설을 설립하여 이들 지역의 낮은 제조 비용, 숙련된 노동력, 유리한 규제 환경의 혜택을 누리기 위해 노력하고 있습니다. 전체 시장 확대, 최근 기술 혁신, 아웃소싱 추세 증가에 힘입어 이 분야는 향후 10년간 지속적인 성장을 이룰 것으로 예측됩니다.

세포독성 의약품과 HPAPI 제조 시장 : 주요 인사이트

이 보고서는 세포독성 의약품 및 HPAPI 제조 시장의 현황을 조사하고 업계 내 잠재적인 성장 기회를 파악합니다. 주요 조사 결과는 다음과 같습니다.

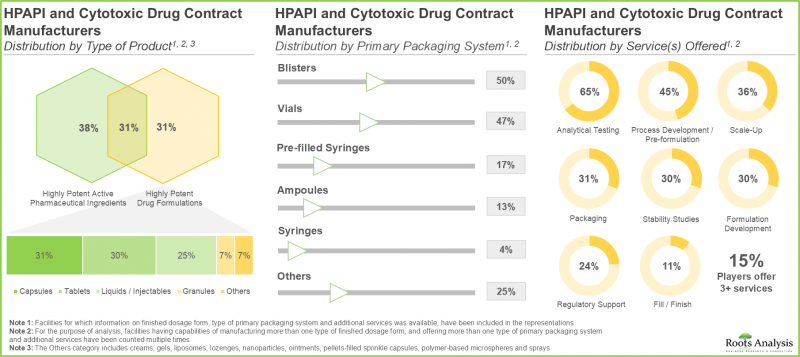

- 현재 140개 이상의 기업이 다양한 규모의 고활성 화합물 수탁 제조 서비스를 제공하는 데 필요한 전문 지식을 보유하고 있다고 주장하고 있습니다.

- 현재 시장 상황은 매우 세분화되어 있으며, 주요 지역에 걸쳐 신규 진출기업과 기존 기업이 모두 존재합니다.

- 이해관계자들은 전문지식을 활용하여 무수히 많은 고활성 화합물의 수탁 제조 서비스를 제공합니다. 약 70%의 서비스 제공업체는 HPAPI의 분석 테스트 역량을 보유하고 있습니다.

- 이 분야에 대한 관심이 높아지고 있는 것은 제휴 활동이 활발해지고 있는 것에서도 알 수 있습니다. 사실 HPAPI와 세포독성 의약품 제조 관련 제휴는 최근 들어 가장 많이 맺어지고 있습니다.

- CMO는 고활성 화합물에 대한 수요 증가에 대응하기 위해 시설 및 용량 확대를 위한 투자를 아끼지 않고 있습니다. 이러한 추세는 미국, 스위스, 영국에서 두드러지게 나타나고 있습니다.

- HPAPI의 전 세계 위탁생산 능력은 다양한 지역에 분산되어 있으며, 현재 생산능력의 80%는 대기업이 소유한 시설에 설치되어 있습니다.

- 항체 의약품 접합체는 고활성 화합물의 가장 인기 있는 클래스 중 하나이며, 현재 30개 이상의 기업이 이러한 바이오 의약품의 수탁 제조 및 접합 서비스를 제공하고 있다고 주장하고 있습니다.

- 고활성 의약품 개발 기업은 제조 업무를 아웃소싱할 가능성이 높으며, 서비스 기반 매출은 연간 12.75%의 성장률을 보일 것으로 예측됩니다.

세포독성 의약품 및 HPAPI 제조 시장 : 주요 부문

HPAPI 부문이 세포독성 의약품 및 HPAPI 제조 시장에서 가장 큰 점유율을 차지하고 있습니다.

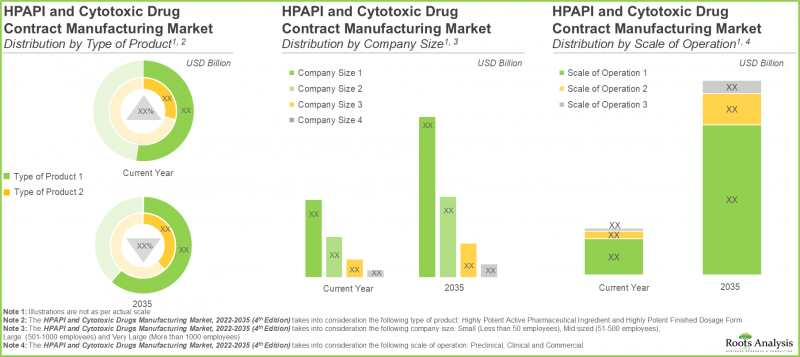

제품 유형에 따라 시장은 HPAPI와 고활성 최종 제형으로 구분됩니다. 현재 세포독성 의약품 및 HPAPI 제조 시장에서 HPAPI 부문이 가장 큰 점유율을 차지하고 있습니다. 이러한 추세는 가까운 미래에도 변하지 않을 것으로 보입니다.

예측 기간 동안 초대형 기업이 세포독성 의약품 및 HPAPI 제조 시장을 독점할 가능성이 높음.

기업 규모별로 시장은 중소기업, 중견기업, 대기업, 대기업, 초대형 기업으로 구분됩니다. 현재 세포독성 의약품 및 HPAPI 제조 시장에서는 초대형 기업들이 가장 큰 점유율을 차지하고 있습니다. 이러한 추세는 향후 10년 동안 변하지 않을 것으로 보입니다.

사업 규모별로는 상업적 규모가 세포독성 의약품 및 HPAPI 제조 시장을 독점할 가능성이 높음.

사업 규모에 따라 시장은 전임상, 임상, 상업적 규모로 구분됩니다. 현재 세포독성 의약품 및 HPAPI 제조 시장에서 상업적 규모가 큰 비중을 차지하고 있다는 점은 주목할 만합니다. 이러한 추세는 향후 몇 년 동안 변하지 않을 것으로 보입니다.

예측 기간 동안 세포독성 의약품 및 HPAPI 제조 시장에서 가장 빠르게 성장하는 분야는 생물학적 제제입니다.

시장은 분자의 유형에 따라 저분자와 생물학적 제제로 구분됩니다. 현재 저분자가 세포독성 의약품 및 HPAPI 제조 시장을 독점하고 있는 것은 주목할 만합니다. 이는 주로 CMO가 고활성 저분자를 위해 투자하고 그 역량을 확장해 왔기 때문입니다. 고활성 의약품에 대한 수요가 증가 추세에 있기 때문에 향후 10년간 생물학적 제제 시장은 더 빠른 속도로 성장할 것으로 예측됩니다.

예측 기간 동안 경구용 FDF가 세포 독성 약물 및 HPAPI 제조 시장을 독점 할 가능성이 높습니다.

고활성 최종 제형 유형별로 시장은 주사제, 경구용 고형제, 크림제, 기타 FDF로 구분됩니다. 현재 경구용 FDF가 세포독성 의약품 및 HPAPI 제조 시장에서 가장 높은 점유율을 차지하고 있다는 점은 주목할 만합니다. 이러한 추세는 제조업체의 비용 효율성, 환자의 편의성, 사용 편의성 등 경구용 제제의 장점으로 인해 향후 10년간 지속될 것으로 예측됩니다.

유럽이 가장 큰 시장 점유율을 차지

주요 지역별로 시장은 북미, 유럽, 아시아태평양, 기타 아시아태평양으로 구분됩니다. 점유율의 대부분을 차지하는 것은 유럽에 기반을 둔 기업들입니다. 이는 이 지역에는 상당한 설비 용량과 능력을 갖춘 전통 있는 기업들이 존재하기 때문입니다. 주목할 만한 점은 아시아태평양 시장이 향후 몇 년 동안 더 높은 CAGR로 성장할 것으로 예상된다는 점입니다.

세포독성 의약품과 HPAPI 제조 시장 진출기업 사례

- AbbVie

- Cambrex

- Catalent

- Pfizer CentreOne

- Piramal Pharma Solutions

- Abzena

- Aenova

- CARBOGEN AMCIS

- Hovione

- Lonza

- Intas Pharmaceuticals

- Scinopharm

- STA Pharmaceutical(WuXi AppTec company)

- Syngene

- Teva API

1차 조사 개요

본 조사에서 제시된 의견과 통찰력은 여러 이해관계자와의 논의를 통해 영향을 받았습니다. 본 조사 보고서에는 다음과 같은 업계 이해관계자들과의 인터뷰 내용을 상세하게 수록했습니다.

- A사 오너 겸 이사

- B사 부사장 겸 최고운영책임자 겸 사업본부장

- ILC Dover, C사 부사장

- D사 전 그룹 제품 매니저 겸 전 사업 개발 이사

- E사 사업개발 이사

- F사 매니징 디렉터

- G사 전 제제 및 최종제품 사업부장

- H사 전 현장소장

- I사 전 사업개발 시니어 매니저

- J사 제약부 마케팅 및 영업 매니저

- K사 전 사업개발 기술자

세포독성 의약품 및 HPAPI 제조 시장 : 조사 대상

- 시장 규모 및 기회 분석 : 이 보고서는 세포독성 의약품 및 HPAPI 제조 시장을(A) 제품 유형,(B) 기업 규모,(C) 사업 규모,(D) 분자 유형,(E) 고활성 완제품 유형,(F) 주요 지역 등 주요 시장 부문에 초점을 맞추어 상세하게 분석합니다.

- 시장현황: A)설립연도, B)기업규모(직원수), C)본사 소재지, D)제조시설 소재지, E)제조시설 면적 등 다양한 파라미터를 고려하여 HPAPI 및 세포독성 의약품 위탁생산에 종사하는 기업을 종합적으로 평가, F)사업 규모, G)제조되는 제품의 유형, H) 고활성 최종 제형 유형,(G) 직업적 노출 한계치,(H) 생산되는 분자의 유형,(H) 1차 포장 시스템 유형,(i) 획득한 규제 인증/인정,(J) 제공하는 서비스 유형.

- 경쟁 분석 : A) 공급업체의 강점,(B) 서비스 강점 등의 요인을 검토하여 HPAPI 및 세포독성 의약품 위탁 생산업체에 대한 종합적인 경쟁 분석을 실시합니다.

- 기업 프로파일:(A) 기업 개요,(B) HPAPI 및 세포독성 의약품 관련 서비스 포트폴리오,(C) 전용 시설,(D) 최근 동향,(E) 정보에 입각한 미래 전망에 초점을 맞추어 HPAPI 및 세포독성 의약품 수탁 제조 서비스를 제공하는 주요 기업 프로파일을 상세하게 제공합니다.

- 파트너십 및 협업: A) 파트너십 체결 연도, B) 파트너십 유형, C) 사업 규모, D) 제품 유형, E) 가장 활발한 진출 기업(계약 체결 수), F) 세포독성 의약품 및 HPAPI 제조 시장에서 수행된 파트너십 활동의 지역적 분포 등 관련 매개변수를 바탕으로 이 분야에서 구축된 파트너십을 분석합니다.

- 최근 사업 확장: HPAPI 및 세포독성 의약품 위탁생산 기업들이 이 분야에서 제조 역량을 강화하기 위해 기울인 다양한 확장 노력을 살펴봅니다. 이 분석에서는(A) 확장 연도,(B) 확장 유형,(C) 기업 규모,(D) 본사 소재지,(E) 사업 규모,(F) 제품 유형,(G) 확장 시설 위치,(H) 확장 시설 면적,(i) 확장 투자 금액,(J) 가장 활발하게 진출한 기업(최근 확장 횟수),(K) 지역 분포 등 다양한 요인을 고려하여 합니다.

- 생산능력 분석 : 다양한 이해관계자들이 발표한 데이터를 통해 전 세계 HPAPI 생산능력을 추정합니다. 이 분석은(A) 기업 규모(소형, 중형, 대형),(B) 사업 규모(전임상, 임상, 상업),(C) 주요 지역(북미, 유럽, 아태지역)에 따른 가용 생산능력의 분포에 중점을 두었습니다.

- 지역별 역량 평가 분석 : A) HPAPI 및 세포독성 의약품 수탁 제조업체 수, B) HPAPI 및 세포독성 의약품 제조 시설 수, C) 시설 확장 수, D) 특정 지역의 HPAPI 설치 능력 등 여러 매개 변수를 기반으로 주요 지역의 HPAPI 및 세포독성 의약품 제조 능력을 비교하는 지역 역량 평가 프레임워크.

- SWOT 분석 : 산업 발전에 영향을 미칠 수 있는 주요 촉진요인과 과제에 초점을 맞춘 SWOT 분석.

- 사례 연구 항체 약물 복합체(ADC) 제조 서비스를 제공하는 기업의 사례 연구. 또한, ADC의 주요 구성 요소와 이들 제품의 제조와 관련된 주요 과제를 강조하고 있습니다. 또한, 본 장에서는 ADC의 위탁생산 서비스를 제공하는 기업 리스트를 제시합니다.

목차

제1장 서문

제2장 주요 요약

제3장 서론

- 본 장의 개요

- 고활성 API

제4장 시장 구도

- 본 장의 개요

- HPAPI 및 세포 상해성 의약품 제조 수탁 기관 : 시장 구도

제5장 기업 경쟁력 분석

- 본 장의 개요

- 전제와 주요 파라미터

- 조사 방법

- HPAPI 제조 수탁 기관 : 기업 경쟁력 분석

- 고활성 FDF 수탁 제조업체 : 기업 경쟁력 분석

- HPAPI 및 고활성 FDF 제조 수탁 기관 : 기업 경쟁력 분석

제6장 기업 개요 : 북미의 HPAPI 및 세포 상해성 의약품 제조업체

- 본 장의 개요

- AbbVie

- Cambrex

- Catalent

- Pfizer CentreOne

- Piramal Pharma Solutions

제7장 기업 개요 : 유럽의 HPAPI 및 세포 상해성 의약품 제조업체

- 본 장의 개요

- Abzena

- Aenova

- CARBOGEN AMCIS

- Hovione

- Lonza

제8장 기업 개요 : 아시아태평양 및 기타 지역의 HPAPI 및 세포 상해성 의약품 제조업체

- 본 장의 개요

- Intas Pharmaceuticals

- Scinopharm

- STA Pharmaceutical(WuXi AppTec 산하)

- Syngene

- Teva API

제9장 파트너십 및 협업

- 본 장의 개요

- 파트너십 모델

- HPAPI와 세포독성 의약품 : 파트너십 및 협업 리스트

제10장 최근 확장

- 본 장의 개요

- HPAPI 및 세포독성 의약품 : 최근 확대 리스트

제11장 용량 분석

제12장 지역 능력 평가 분석

제13장 제조 vs. 구입 의사 의사결정 프레임워크

- 본 장의 개요

- 전제와 주요 파라미터

- 결론

제14장 시장 규모 평가와 기회 분석

- 본 장의 개요

- 예측 조사 방법과 주요 전제조건

- 2035년까지 세계의 고활성 API 및 세포독성 의약품 계약 제조 시장

제15장 SWOT 분석

제16장 사례 : 항체 약물 결합체 수탁 제조

- 본 장의 개요

- 항체 약물 결합체의 주요 성분

- ADC 제조 개요

- 공급망과 방법 이전에 수반하는 과제

- CMO 파트너를 선택할 때에 고려해야 할 중요 사항

- ADC 계약 제조 서비스 제공업체 : 시장 구도

- 결론

제17장 결론

제18장 경영진 인사이트

제19장 부록 1 : 표 형식 데이터

제20장 부록 2 : 기업 및 단체 리스트

LSH 25.10.16Cytotoxic Drugs and HPAPI Manufacturing Market: Overview

As per Roots Analysis, the global cytotoxic drugs and HPAPI manufacturing market is estimated to grow from USD 13.98 billion in the current year to USD 46.41 billion by 2035, at a CAGR of 12.75% during the forecast period, till 2035.

The market opportunity for cytotoxic drugs and HPAPI manufacturing market has been distributed across the following segments:

Type of Product

- HPAPIs

- Highly Potent Finished Dosage Forms

Scale of Operation

- Preclinical

- Clinical

- Commercial

Type of Molecule

- Small Molecules

- Biologics

Type of Highly Potent Finished Dosage Form

- Injectables

- Oral Solids

- Creams

- Others

Key Geographies

- North America (US, Canada and Mexico)

- Europe (UK, Italy, Germany, France, Spain, and Rest of Europe)

- Asia-Pacific (China, India, and Rest of Asia-Pacific)

- Rest of the World

Cytotoxic Drugs and HPAPI Manufacturing Market: Growth and Trends

Due to the progress in clinical pharmacology and oncology, along with rising interest of players in targeted therapies, researchers and drug manufacturers worldwide are increasingly focusing on high potency active pharmaceutical ingredients (HPAPIs) and cytotoxic drugs. It is important to note that 45% of drugs worldwide are highly potent, necessitating the need for specialized production of HPAPIs. However, the manufacturing of HPAPIs involves a complicated process, leading to various challenges. The primary challenge is preventing cross-contamination during production, followed by ensuring the safety of the environment and workers involved in the supply chain. Additionally, selecting the appropriate containment and protective measures, including equipment, procedures, and personal protective equipment (PPE), is crucial. Handling HPAPIs typically requires ongoing investment in safe handling practices, and advanced technical expertise, which further complicates the field. As a result, drug developers are increasingly turning to outsourcing their manufacturing processes.

Owing to the significant potential and favorable growth prospects of the contract manufacturing sector, most of the leading pharmaceutical companies are seeking to invest in the expansion or enhancement of their existing manufacturing facilities. Several contract manufacturing organizations (CMOs) are establishing new facilities in emerging markets such as Japan, China, India, and Brazil to benefit from lower production costs, skilled labor, and favorable regulatory environments in these regions. Driven by the overall expansion of the market, recent technological innovations, and a rising trend towards outsourcing, the sector is expected to experience consistent growth in the next decade.

Cytotoxic Drugs and HPAPI Manufacturing Market: Key Insights

The report delves into the current state of the cytotoxic drugs & HPAPI manufacturing market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Presently, more than 140 players claim to have the required expertise to offer contract manufacturing services for highly potent compounds, across different scales of operation.

- The current market landscape is highly fragmented, featuring the presence of both new entrants and established players across key geographical regions.

- Leveraging their expertise, stakeholders are offering contract manufacturing services for a myriad of highly potent compounds; around 70% of the service providers possess analytical testing capability for HPAPIs.

- The growing interest in this domain is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to HPAPI and cytotoxic drug manufacturing were inked in the recent past.

- In order to meet the rising demand for high potency compounds, CMOs have made elaborate investments to expand their facilities and capacities; this trend is most pronounced in the US, Switzerland and the UK.

- The installed global contract manufacturing capacity for HPAPIs is well distributed across different geographies; 80% of the present capacity is installed in facilities owned by very large players.

- Antibody Drug Conjugates are one of the most popular classes of highly potent compounds; more than 30 players currently claim to offer contract manufacturing / conjugation services for such biopharmaceuticals.

- It is anticipated that the highly potent drug developers are likely to outsource their manufacturing operations, enabling the service based revenues to grow at an annualized rate of 12.75%.

Cytotoxic Drugs & HPAPI Manufacturing Market: Key Segments

HPAPI Segment Occupies the Largest Share of the Cytotoxic Drugs and HPAPI Manufacturing Market

Based on the type of product, the market is segmented into HPAPI and highly potent finished dosage forms. At present, HPAPI segment holds the maximum share of the cytotoxic drugs & HPAPI manufacturing market. This trend is unlikely to change in the near future.

Very Large Players are Likely to Dominate the Cytotoxic Drugs & HPAPI Manufacturing Market During the Forecast Period

Based on the company size, the market is segmented into small, mid-sized, large and very large companies. At present, very large companies hold the maximum share of the cytotoxic drugs & HPAPI manufacturing market. This trend is likely to remain the same in the coming decade.

By Scale of Operation, Commercial Scale is Likely to Dominate the Cytotoxic Drugs and HPAPI Manufacturing Market

Based on scales of operation, the market is segmented into preclinical, clinical and commercial scales. It is worth highlighting that, at present, commercial scale holds a larger share of the cytotoxic drugs and HPAPI manufacturing market. This trend is likely to remain the same in the forthcoming years.

Biologics is the Fastest Growing Segment of the Cytotoxic Drugs and HPAPI Manufacturing Market During the Forecast Period

Based on the type of molecule, the market is segmented into small molecules and biologics. It is worth highlighting that, at present, small molecules dominate the cytotoxic drugs and HPAPI manufacturing market. This is primarily due to the fact the CMOs have invested and expanded their capabilities for highly potent small molecules. It is important to note the demand for highly potent drugs is on the rise, therefore the market for biologics is expected to grow at a faster pace in the coming decade.

Oral FDFs are Likely to Dominate the Cytotoxic Drugs and HPAPI Manufacturing Market During the Forecast Period

Based on the type of highly potent finished dosage forms, the market is segmented into injectables, oral solids, creams and other FDFs. It is worth highlighting that, at present, oral FDFs capture the highest share of the cytotoxic drugs and HPAPI manufacturing market. This trend is likely to remain the same in the coming decade owing to the benefits offered by oral formulations, such as cost-efficiency for manufacturers, comfort and ease of use for patients.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the world. The majority of the share is expected to be captured by players based in Europe. This is due to the fact that there are well-established players in this region with considerable installed capacities and capabilities. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Cytotoxic Drugs & HPAPI Manufacturing Market

- AbbVie

- Cambrex

- Catalent

- Pfizer CentreOne

- Piramal Pharma Solutions

- Abzena

- Aenova

- CARBOGEN AMCIS

- Hovione

- Lonza

- Intas Pharmaceuticals

- Scinopharm

- STA Pharmaceutical (a WuXi AppTec company)

- Syngene

- Teva API

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Owner and Director, Company A

- Vice President and Chief Operating Officer and Business Director, Company B

- ILC Dover, Vice President, Company C

- Ex-Group Product Manager and Ex-Director-Business Development, Company D

- Business Development Director, Company E

- Managing Director, Company F

- Ex-Business Head, Formulations and Finished Products, Company G

- Ex-Site Head, Company H

- Ex-Senior Manager, Business Development, Company I

- Marketing and Sales Manager, Pharma, Company J

- Ex-Business Development Technician, Company K

Cytotoxic Drugs and HPAPI Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the cytotoxic drugs and HPAPI manufacturing market, focusing on key market segments, including [A] type of product, [B] company size, [C] scale of operation, [D] type of molecule, [E] type of highly potent finished dosage form and [F] key geographical regions.

- Market Landscape: A comprehensive evaluation of companies involved in the contract manufacturing of HPAPI and cytotoxic drugs, considering various parameters, such as [A] year of establishment, [B] company size (in terms of number of employees), [C] location of headquarters, [D] location of manufacturing facility, [E] area of manufacturing facility, [F] scale of operation, [G] type of product manufactured, [H] type of highly potent finished dosage form, [G] Occupational Exposure Limit, [H] type of molecule manufactured, [H] type of primary packaging system, [I] regulatory certifications / accreditations received and [J] type of service(s) offered.

- Company Competitiveness Analysis: A comprehensive competitive analysis of HPAPI and cytotoxic drug contract manufacturers, examining factors, such as [A] supplier strength and [B] service strength.

- Company Profiles: In-depth profiles of key industry players offering contract manufacturing services for HPAPI and cytotoxic drugs, focusing on [A] company overviews, [B] HPAPI and cytotoxic drug-related service portfolio, [C] dedicated facilities, [D] recent developments and [E] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector based on relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] scale of operation, [D] type of product, [E] most active players (in terms of number of deals inked) and [F] regional distribution of partnership activity that have been undertaken in cytotoxic drugs and HPAPI manufacturing market.

- Recent Expansions: An examination of the different expansion efforts made by the HPAPI and cytotoxic drug contract manufacturers in this field to enhance their manufacturing capabilities. This analysis considers various factors, including the [A] year of expansion, [B] type of expansion, [C] company size, [D] location of headquarters, [E] scale of operation, [F] type of product, [G] location of expanded facility, [H] area of expanded facility, [I] amount invested in expansions, [J] most active players (in terms of number of recent expansions) and [K] geographical distribution.

- Capacity Analysis: Estimation of global HPAPI manufacturing capacity, derived from data provided by various stakeholders in the public domain. This analysis emphasizes the distribution of the available capacity on the basis of [A] company size (small, mid-sized and large), [B] scale of operation (preclinical, clinical and commercial) and [C] key geographical regions (North America, Europe and Asia-Pacific).

- Regional Capability Assessment Analysis: A regional capability assessment framework that compares the HPAPI and cytotoxic drug manufacturing capabilities across key geographies, based on several parameters, such as [A] the number of HPAPI and cytotoxic drug contract manufacturers, [B] number of HPAPI and cytotoxic drug manufacturing facilities, [C] number of facility expansions and [D] installed HPAPI capacity in that particular geographical region.

- SWOT Analysis: A SWOT analysis, focusing on key drivers and challenges that are likely to impact the industry's evolution.

- Case Study: A case study on companies offering manufacturing services for antibody drug conjugate (ADCs). The chapter also highlights the key components of ADCs and the key challenges associated with the manufacturing of these products. Further, the chapter presents a list of players that provide contract manufacturing services for ADCs.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What are the factors that are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. High Potency Active Pharmaceutical Ingredients

- 3.2.1. Classification by Potency

- 3.2.1.1. Classification of HPAPIs

- 3.2.2. Different Types of HPAPIs

- 3.2.2.1. Antibody Drug Conjugates

- 3.2.2.2. Cytotoxic Drugs

- 3.2.2.3. Peptides

- 3.2.2.4. Hormones

- 3.2.2.5. Beta-Lactam Compounds

- 3.2.2.6. Prostaglandins

- 3.2.2.7. Cytostatics

- 3.2.2.8. Steroids

- 3.2.3. Considerations for Handling HPAPIs

- 3.2.4. Contract Manufacturing of HPAPIs and Cytotoxic Drugs

- 3.2.4.1. Key Considerations While Selecting a Contract Manufacturing Partner

- 3.2.5. Regulatory Considerations for Manufacturing HPAPIs

- 3.2.6. Concluding Remarks

- 3.2.1. Classification by Potency

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. HPAPI and Cytotoxic Drug Contract Manufacturers: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters

- 4.2.5. Analysis by Location of Manufacturing Facility

- 4.2.6. Analysis by Area of Manufacturing Facility

- 4.2.7. Analysis by Scale of Operation

- 4.2.8. Analysis by Type of Product Manufactured

- 4.2.9. Analysis by Location of Manufacturing Facility and Type of Product Manufactured

- 4.2.10. Analysis by Type of Finished Dosage Form

- 4.2.11. Analysis by Occupational Exposure Limit (OEL)

- 4.2.12. Analysis by Type of Molecule Manufactured

- 4.2.13. Analysis by Type of Primary Packaging System

- 4.2.14. Analysis by Regulatory Certification / Accreditation Received

- 4.2.15. Analysis by Type of Service(s) Offered

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Key Parameters

- 5.3. Methodology

- 5.4. HPAPI Contract Manufacturers: Company Competitiveness Analysis

- 5.4.1. HPAPI Contract Manufacturers based in North America

- 5.4.2. HPAPI Contract Manufacturers based in Europe

- 5.4.3. HPAPI Contract Manufacturers based in Asia-Pacific and Rest of the World

- 5.5. Highly Potent FDF Contract Manufacturers: Company Competitiveness Analysis

- 5.5.1. Highly Potent FDF Contract Manufacturers based in North America

- 5.5.2. Highly Potent FDF Contract Manufacturers based in Europe

- 5.5.3. Highly Potent FDF Contract Manufacturers based in Asia-Pacific and Rest of the World

- 5.6. HPAPI and Highly Potent FDF Contract Manufacturers: Company Competitiveness Analysis

- 5.6.1. HPAPI and Highly Potent FDF Contract Manufacturers based in North America

- 5.6.2. HPAPI and Highly Potent FDF Contract Manufacturers based in Europe

- 5.6.3. HPAPI and Highly Potent FDF Contract Manufacturers based in Asia-Pacific and Rest of the World

6. COMPANY PROFILES: HPAPI AND CYTOTOXIC DRUG MANUFACTURERS IN NORTH AMERICA

- 6.1. Chapter Overview

- 6.2. AbbVie

- 6.2.1. Company Overview

- 6.2.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.2.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Cambrex

- 6.3.1. Company Overview

- 6.3.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.3.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.3.4. Recent Developments and Future Outlook

- 6.4. Catalent

- 6.4.1. Company Overview

- 6.4.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.4.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Pfizer CentreOne

- 6.5.1. Company Overview

- 6.5.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.5.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.5.4. Recent Developments and Future Outlook

- 6.6. Piramal Pharma Solutions

- 6.6.1. Company Overview

- 6.6.2. HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- 6.6.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.6.4. Recent Developments and Future Outlook

7. COMPANY PROFILES: HPAPI AND CYTOTOXIC DRUG MANUFACTURERS IN EUROPE

- 7.1. Chapter Overview

- 7.2. Abzena

- 7.2.1. Company Overview

- 7.2.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.2.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.2.4. Recent Developments and Future Outlook

- 7.3. Aenova

- 7.3.1. Company Overview

- 7.3.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.3.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.3.4. Recent Developments and Future Outlook

- 7.4. CARBOGEN AMCIS

- 7.4.1. Company Overview

- 7.4.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.4.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.4.4. Recent Developments and Future Outlook

- 7.5. Hovione

- 7.5.1. Company Overview

- 7.5.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.5.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.5.4. Recent Developments and Future Outlook

- 7.6. Lonza

- 7.6.1. Company Overview

- 7.6.2. HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- 7.6.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.6.4. Recent Developments and Future Outlook

8. COMPANY PROFILES: HPAPI AND CYTOTOXIC DRUG MANUFACTURERS IN ASIA-PACIFIC AND REST OF

THE WORLD

- 8.1. Chapter Overview

- 8.2. Intas Pharmaceuticals

- 8.2.1. Company Overview

- 8.2.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.2.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.2.4. Recent Developments and Future Outlook

- 8.3. Scinopharm

- 8.3.1. Company Overview

- 8.3.2. HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- 8.3.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.3.4. Recent Developments and Future Outlook

- 8.4. STA Pharmaceutical (a WuXi AppTec company)

- 8.4.1. Company Overview

- 8.4.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.4.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Syngene

- 8.5.1. Company Overview

- 8.5.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.5.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.5.4. Recent Developments and Future Outlook

- 8.6. Teva API

- 8.6.1. Company Overview

- 8.6.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.6.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.6.4. Recent Developments and Future Outlook

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. HPAPI and Cytotoxic Drugs: List of Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Analysis by Scale of Operation

- 9.3.5. Analysis by Type of Product

- 9.3.6. Analysis by Type of Partnership and Type of Product

- 9.3.7. Analysis of Amount Invested Via Acquisitions

- 9.3.8. Analysis by Type of Partner

- 9.3.9. Most Active Players: Analysis by Number of Partnerships

- 9.3.10. Analysis by Geography

- 9.3.10.1. Intracontinental and Intercontinental Deals

- 9.3.10.2. International and Local Deals

10. RECENT EXPANSIONS

- 10.1. Chapter Overview

- 10.2. HPAPI and Cytotoxic Drugs: List of Recent Expansions

- 10.2.1. Analysis by Year of Expansion

- 10.2.2. Analysis by Type of Expansion

- 10.2.3. Analysis by Year and Type of Expansion

- 10.2.4. Analysis by Company Size and Location of Headquarters

- 10.2.5. Analysis by Scale of Operation

- 10.2.6. Analysis by Type of Expansion and Scale of Operation

- 10.2.7. Analysis by Type of Product

- 10.2.8. Analysis by Type of Expansion and Type of Product

- 10.2.9. Analysis by Location of Expanded Facility

- 10.2.10. Analysis by Type of Expansion and Location of Expanded Facility

- 10.2.11. Analysis by Expanded Facility Area

- 10.2.12. Analysis by Amount Invested on Expansions

- 10.2.13. Most Active Players: Analysis by Number of Recent Expansions

- 10.2.14. Geographical Analysis

- 10.2.14.1. Analysis by Continent

- 10.2.14.2. Analysis by Country

11. CAPACITY ANALYSIS

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. HPAPI Contract Manufacturers: Global Installed Capacity

- 11.3.1. Analysis by Range of Installed Capacity

- 11.3.2. Analysis by Company Size

- 11.3.3. Analysis by Scale of Operation

- 11.3.4. Analysis by Location of Manufacturing Facility

- 11.3.4.1. Analysis of HPAPI Contract Manufacturing Capacity Installed in North America

- 11.3.4.2. Analysis of HPAPI Contract Manufacturing Capacity Installed in Europe

- 11.3.4.3. Analysis of HPAPI Contract Manufacturing Capacity Installed in Asia-Pacific and Rest of the World

- 11.3.5. Concluding Remarks

12. REGIONAL CAPABILITY ASSESSMENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Assumptions and Key Parameters

- 12.3. HPAPI and Cytotoxic Drug Manufacturing Capabilities in North America

- 12.4. HPAPI and Cytotoxic Drug Manufacturing Capabilities in Europe

- 12.5. HPAPI and Cytotoxic Drug Manufacturing Capabilities in Asia-Pacific

- 12.6. HPAPI and Cytotoxic Drug Manufacturing Capabilities in Rest of the World

- 12.7. Concluding Remarks

13. MAKE VERSUS BUY DECISION MAKING FRAMEWORK

- 13.1. Chapter Overview

- 13.2. Assumptions and Key Parameters

- 12.2.1. Scenario 1

- 12.2.1. Scenario 2

- 12.2.1. Scenario 3

- 12.2.1. Scenario 4

- 13.3. Concluding Remarks

14. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Forecast Methodology and Key Assumptions

- 14.3. Global HPAPI and Cytotoxic Drug Contract Manufacturing Market, till 2035

- 14.3.1. HPAPI and Cytotoxic Drug Contract Manufacturing Market: Analysis by Type of Product, till 2035

- 14.3.2. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Company Size, till 2035

- 14.3.3. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Scale of Operation, till 2035

- 14.3.4. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Type of Molecule, till 2035

- 14.3.5. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Type of Highly Potent Finished Dosage Forms, till 2035

- 14.3.6 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Geography, till 2035

- 14.3.7. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in North America, till 2035

- 14.3.7.1. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the US, till 2035

- 14.3.7.2. HPAPI and Cytotoxic Drug Contract Manufacturing Market in Canada, till 2035

- 14.3.7.3. HPAPI and Cytotoxic Drug Contract Manufacturing Market in Mexico, till 2035

- 14.3.8. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Europe, till 2035

- 14.3.8.1. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the UK, till 2035

- 14.3.8.2. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Italy, till 2035

- 14.3.8.3. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Germany, till 2035

- 14.3.8.4. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in France, till 2035

- 14.3.8.5. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Spain, till 2035

- 14.3.8.6. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of Europe, till 2035

- 14.3.9. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Asia-Pacific, till 2035

- 14.3.9.1. HPAPI and Cytotoxic Drug Contract Manufacturing Market in China, till 2035

- 14.3.9.2. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in India, till 2035

- 14.3.9.3. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of Asia-Pacific, till 2035

- 14.3.10. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the Rest of the World, till 2035

15. SWOT ANALYSIS

- 15.1. Chapter Overview

- 15.2. Strengths

- 15.3. Weaknesses

- 15.4. Opportunities

- 15.5. Threats

- 15.6. Concluding Remarks

16. CASE-IN-POINT: CONTRACT MANUFACTURING OF ANTIBODY DRUG CONJUGATES

- 16.1. Chapter Overview

- 16.2. Key Components of Antibody Drug Conjugates

- 16.2.1. Antibody

- 16.2.2. Cytotoxin

- 16.2.3. Linker

- 16.3. Overview of ADC Manufacturing

- 16.3.1. Key Process Steps

- 16.3.2. Challenges Associated with ADC Manufacturing

- 16.3.3. Growing Trend of Outsourcing in ADC Manufacturing

- 16.4. Challenges Associated with Supply Chain and Method Transfer

- 16.4.1. Growing Demand for One-Stop-Shops and Integrated Service Providers

- 16.5. Key Considerations for Selecting a CMO Partner

- 16.6. ADC Contract Manufacturing Service Providers: Overall Market Landscape

- 16.6.1. Analysis by Year of Establishment

- 16.6.2. Analysis by Company Size

- 16.6.3. Analysis by Location of Headquarters

- 16.6.4. Analysis by Service(s) Offered

- 16.7. Concluding Remarks

17. CONCLUDING REMARKS

18. EXECUTIVE INSIGHTS

- 18.1. Chapter Overview

- 18.2. Company A

- 18.2.1. Company Snapshot

- 18.2.2. Interview Transcript: Vice President and Chief Operating Officer and Business Director

- 18.3. Company B

- 18.3.1. Company Snapshot

- 18.3.2. Interview Transcript: Ex-Group Product Manager and Ex-Director-Business Development

- 18.3.3. Interview Transcript: Business Development Associate

- 18.4. Company C

- 18.4.1. Company Snapshot

- 18.4.2. Interview Transcript: Business Development Director

- 18.5. Company D

- 18.5.1. Company Snapshot

- 18.5.2. Interview Transcript: Managing Director

- 18.6. Company E

- 18.6.1. Company Snapshot

- 18.6.2. Interview Transcript: Ex-Business Head, Formulations and Finished Products

- 18.7. Company F

- 18.7.1. Company Snapshot

- 18.7.2. Interview Transcript: Ex-Site Head, Grangemouth

- 18.8. Company G

- 18.8.1. Company Snapshot

- 18.8.2. Interview Transcript: Ex-Senior Manager, Business Development

- 18.9. Company H

- 18.9.1. Company Snapshot

- 18.9.2. Interview Transcript: Marketing and Sales Manager, Pharma

- 18.10. Company I

- 18.10.1. Company Snapshot

- 18.10.2. Interview Transcript: Ex-Business Development Technician