|

시장보고서

상품코드

1742160

마이크로 LED 디스플레이 및 비디스플레이 응용 시장 분석(2025년)2025 Micro LED Display and Non-Display Application Market Analysis |

||||||

【인사이트】마이크로 LED는 디스플레이를 넘어 확대, 투명 및 비 디스플레이 응용으로 새로운 가능성을 개척할 것

디스플레이 분야에서 마이크로 LED 기술의 현재 개발은 설계 및 생산 개선을 통한 제조 비용 최적화와 독자적인 틈새 시장의 특정이라는 두 가지 주요 과제에 초점을 맞추고 있다고 보고되었습니다.

대형 디스플레이의 비용 개선 진행 중

현재 마이크로 LED 디스플레이 관련 시장의 대부분은 대형 디스플레이로 구성되어 있으며, Samsung이 이 분야에서 주도적 지위를 차지하고 있습니다.

또한, AI의 진전에 의해 헤드 마운트 디바이스의 이용 장면이 확대되고 있는 것이나, 스마트 드라이빙 에코시스템의 발전에 의해 선진적인 차재 디스플레이에 대한 수요가 높아지고 있기 때문에 이 2개의 분야는 향후 마이크로 LED 디스플레이 시장의 주요 기둥이 될 것으로 예측되고 있습니다.

TrendForce는 마이크로 LED 대형 디스플레이의 업계 표준으로 일반적으로 4K 이상의 해상도가 요구되고 있다고 지적하고 있지만, 현재 상업화되어 양산 가능한 픽셀 피치는 여전히 0.5mm에 그치고 있습니다.

비용 최적화 노력은 제조 공정을 간소화하여 수율을 개선하고 접합부를 줄임으로써 조립 공정을 삭감할 수 있는 백플레인측으로도 시프트하고 있습니다.

마이크로 LED의 두드러진 특성인 고휘도, 고콘트라스트, 고투명성은 계속 제조업자로부터의 투자를 모으고 있으며, 이러한 특성에 의해 마이크로 LED는 차재 윈도우용 투명 디스플레이나 AR-HUD, P-HUD 등의 시스템에 통합이 가능하게 됩니다. 실제 정보의 원활한 통합에 대한 수요에 부응할 수 있습니다. 또한 마이크로 LED를 실리콘 기판과 결합하여 AR 유리용 니어 아이 디스플레이에 강력한 솔루션을 제공할 수 있게 되어 마이크로 LED는 차세대 메타버스 대응 헤드 마운트 디바이스의 기준 기술로서의 지위를 구축하고 있습니다.

본 보고서에서는 마이크로 LED 디스플레이 및 비 디스플레이 응용 시장을 조사했으며, 마이크로 LED의 기술 개발 동향, 마이크로 LED 디스플레이 및 비디스플레이 응용 시장 규모 추이와 예측, 마이크로 LED 투명 디스플레이의 동향, 주요 제조자 프로파일 등을 정리했습니다.

목차

제1장 마이크로 LED 디스플레이 시장 분석

- 시장 규모 분석 : 대형 디스플레이

- 시장 규모 분석 : 웨어러블 디스플레이

- 시장 규모 분석 : 헤드 마운트 디바이스

- 시장 규모 분석 : 차량용 디스플레이

- 시장 규모 분석

- 웨이퍼 수요 분석

제2장 마이크로 LED 기술 개발

- 모듈의 대형화

- 마이크로 LED 모듈 대형화/타일화의 저감

- 마이크로 LED 모듈 대형화의 이점(1/2) - 타일화의 생략

- 마이크로 LED 모듈 대형화의 이점(2/2) - 비용 및 상업적 이점

- 모듈 사이즈와 타일 사이즈의 관계

- 경제적으로 최적인 모듈 사이즈의 결정

- 마이크로 LED 모듈 대형화에서 과제

- 마이크로 LED 타일화: 대형 모듈 vs 소형 모듈

- 타일형 디스플레이

- 타일 접합부의 기술적 과제

- 마이크로 LED 타일화의 상업 전략 : 픽셀 피치의 관점에서

- 마이크로 LED 타일형 디스플레이에 있어서 상업화 가능한 최소 사이즈 : UHD(초고화질)

- 마이크로 LED 타일형 디스플레이에서 상업화 가능한 최대 사이즈 : 경제적 타일화의 관점에서

- 상업화된 대형 마이크로 LED 디스플레이에 가장 적합한 크기

- 유리 : 사파이어 기반 COC의 잠재적 경쟁 소재

- 마이크로 LED의 방열에 관한 과제

- 마이크로 LED의 PPI에 관한 과제

- 고효율 마이크로 LED 실현에의 선언: 달성은 눈앞

- 마이크로 LED 업계 동향(1/2) : 전문용도 디스플레이에의 전개

- 마이크로 LED 업계 동향(2/2) : AR에 주력하는 마이크로 LED 기업

제3장 마이크로 LED 투명 디스플레이

- 투과형 디스플레이의 2개의 방식: 직접 뷰 방식과 마이크로 디스플레이 투영 방식

- 직접 뷰 방식과 투영 방식의 주된 차이(1/2) : 시야각

- 직접 뷰 방식과 투영 방식의 주된 차이(2/2) : 초점의 문제

- 투명 직접 뷰형 디스플레이의 과제 : 선명함과 실재감의 트레이드 오프 관계

- 2유형 투명 디스플레이의 벤치마크 비교

- 투명 직접 뷰형 디스플레이의 SWOT 분석

- 용도별로 본 투명 직접 뷰형 디스플레이의 SWOT 분석

- 투명 직접 뷰형 디스플레이의 개발 동향 분석

- 투명 디스플레이 용도를 선정할 때의 고려점

- 각종 투명 디스플레이에 의한 기술 원리의 차이

- JDI, LCD로 투명 디스플레이 시장에 재참전

- 투명 디스플레이의 응용 사례

- 투명 디스플레이에서 휘도와 투과율의 패러독스

- 마이크로 LED 투명 디스플레이

- 각종 투명 디스플레이 기술의 비교

- 양산된 투명 디스플레이의 가격 비교

제4장 마이크로 LED 제조업체의 동향

- 2025년 마이크로 LED 기업의 제조 능력 분석

- PlayNitride

- Ennostar

- HC Semitek

- AUO

- Innolux

- Extremely PQ

- Tianma

- BOE

- LGD

- Samsung

- Hisense

- Hongshi

- VueReal

- Aledia

부록

JHS 25.06.13[Insight] Micro LED Expands Beyond Displays, Unlocking New Opportunities in Transparent and Non-Display Applications

TrendForce's latest report, "2025 Micro LED Display and Non-Display Application Market Analysis", reveals that the current development of Micro LED technology in the display sector focuses on two key challenges: optimizing manufacturing costs through design and production improvements, and identifying unique niche markets.

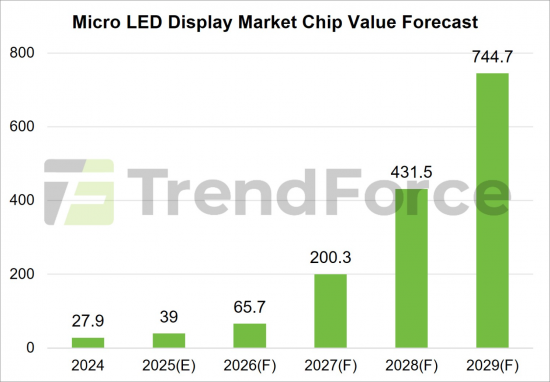

TrendForce forecasts that the chip market value for Micro LED display applications will reach US$740 million by 2029, with a CAGR of 93% from 2024 to 2029.

Cost improvements continue for large-sized displays

Presently, the bulk of Micro LED's display-related market value is driven by large-sized displays, where Samsung holds a leading position. Future growth will rely not only on breakthrough across several critical manufacturing processes but also on collaborations between Chinese chipmakers and brand manufacturers to push chip miniaturization. This will further enhance cost advantages for mass-produced Micro LED large-sized displays.

Additionally, as AI broadens the application scenarios for head-mounted devices and as smart driving ecosystems drive up demand for advanced automotive displays, these two sectors are expected to become major pillars of Micro LED display market value in the years ahead.

TrendForce notes that the industry standard for Micro LED large-sized displays is typically 4K resolution or higher; however, the currently commercialized, mass-producible pixel pitch remains at 0.5 mm. Continued efforts to reduce pixel pitch are essential to further differentiate Micro LED from Mini LED video wall , along with overcoming challenges like low yield rates in driver connections and issues with panel seams.

Cost optimization is also shifting toward the backplane, where simplifying the manufacturing process can improve yields, and reducing the number of seams can cut down assembly steps. This contributes to overall cost reductions.

Micro LED's standout characteristics-high brightness, high contrast, and high transparency-continue to attract investment from manufacturers. These features enable Micro LED to integrate into transparent displays for automotive windows or as part of AR-HUD or P-HUD systems, meeting the growing demand for seamless integration of virtual and real-world information for drivers and passengers. Additionally, combining Micro LED with silicon substrates offers a robust solution for near-eye displays in AR glasses, positioning Micro LED as a benchmark for next-generation metaverse-focused head-mounted devices.

Transparent displays hold great promise; non-display applications open new doors

Micro LED technology also shows strong potential in transparent display applications. These can be categorized into direct-view and micro-projection systems, with the key differences lying in viewing angels and focal distance management. In terms of use case, transparent direct-view displays are better suited for public environments where content is viewed by multiple people, and Micro LED's combination of high brightness and high transparency makes it an ideal technology.

Meanwhile, micro-projection systems hold greater promise in privacy-sensitive personal electronic devices, where Micro LED offers ultra-miniaturized light engine solutions and is seen as the best option for micro-display technology in AR applications. Overall, Micro LED has significant room for expansion across diverse transparent display segments by developing both TFT and CMOS backplane platforms.

TrendForce emphasizes that the immediate priority for the Micro LED industry is to scale up the market quickly in order to realize economic efficiencies. As a result, non-display sectors have increasingly become important avenues for growth in addition to focusing on display applications.

These non-display opportunities span a wide range, including optical communication applications accelerated by AI, biotechnology-related medical uses, and industrial production areas such as 3D printing and photopolymerization. Ongoing innovations in these areas are adding further momentum to Micro LED's market expansion.

Table of Contents

Chapter 1. Micro LED Display Market Analysis

- 2025-2029 Micro LED Market Value Analysis-Large-sized Displays

- 2025-2029 Micro LED Market Value Analysis-Wearable Displays

- 2025-2029 Micro LED Market Value Analysis-Head-mounted Devices

- 2025-2029 Micro LED Market Value Analysis-Automotive Displays

- 2025-2029 Micro LED Market Value Analysis

- 2025-2029 Micro LED Wafer Demand Analysis

Chapter 2. Micro LED Technology Development

- 2.1. Module Enlargement

- Micro LED Module Enlargement/Reduced Tiling

- Enlarging Micro LED Modules Advantages (1/2) - Tiling Omitted

- Enlarging Micro LED Modules Advantages (2/2) - Cost and Commercial Benefits

- Relationships between Module Size and Tiling Size

- Deciding Economic Module Size

- Micro LED Module Enlargement Challenges

- Micro LED Tiling: Large Modules vs. Small Modules

- 2.2. Tiling Display

- Tiling Seams Technical Challenges

- Micro LED Tiling Commercial Strategies : A Pixel Pitch Perspective

- Lower Limit of Commercialization Size for Micro LED-tiled Displays: UHD

- Upper Limit of Commercialization Size for Micro LED-tiled Displays: Economic Tiling

- Most Suitable Sizes for Commercialized Large-sized Micro LED Displays

- Glass: A Potential Competitor to Sapphire-based COC

- Micro LED Heat Dissipation Challenges

- Micro LED PPI Challenges

- Manifesto for Achieving High-Efficiency Micro LED is Within Reach

- Micro LED Industrial Trends (1/2): Towards Specialized Display

- Micro LED Industrial Trends (2/2): Micro LED Enterprises to Focus on AR

Chapter 3. Micro LED Transparent Display

- Two Systems for See-through Displays: Direct-view and Micro display Projection

- Key Differences between Direct-view and Projection Systems (1/2): Viewing Angle

- Key Differences between Direct-view and Projection Systems (2/2): Focus Issues

- Transparent Direct-View Displays Challenges : Mutually Exclusive Relationship between Vitality and Reality

- Benchmarks between the Two Types of Transparent Displays

- Transparent Direct-view Displays SWOT Analysis

- Transparent Direct-view Displays across Different Applications SWOT Analysis

- Transparent Direct-view Displays Development Trend Analysis

- Things to Consider When Selecting Transparent Display Applications

- Technology Principles by Different Transparent Displays

- JDI Brings LCD Back to Transparent Display Competition

- Transparent Display Application Cases

- The Brightness-Transmittance Paradox in Transparent Displays

- Micro LED Transparent Displays

- Comparison between Different Transparent Display Technologies

- Prices of Mass-produced Transparent Displays

Chapter 4. Micro LED Manufacturer Dynamic

- 2025 Micro LED Player Capacity Analysis.

- PlayNitride

- Ennostar

- HC Semitek

- AUO

- Innolux

- Extremely PQ

- Tianma

- BOE

- LGD

- Samsung

- Hisense

- Hongshi

- VueReal

- Aledia

Appendix

- Intel-Samsung Patent Sale

- Advancing non-display Micro LED Technology Development - Avicena