|

시장보고서

상품코드

1794797

일렉트로닉스 분야 수요 개요(2025년)Overview of Global Electronics Sectors Demand in 2025 |

||||||

※ 본 상품은 영문 자료로 한글과 영문 목차에 불일치하는 내용이 있을 경우 영문을 우선합니다. 정확한 검토를 위해 영문 목차를 참고해주시기 바랍니다.

2025년 일렉트로닉스 산업 동향은 "AI 수요 호조, 소비자 기기 부진, 조기 수요 증가로 계절성 소멸, 향후 성장 둔화"로 나뉩니다.

인포그래픽

주요 하이라이트

- 2025년, AI 수요는 급증하는 반면, 가전제품(스마트폰, 노트북, TV)의 성장은 정체 또는 미미할 것으로 예상됩니다.

- 관세와 보조금의 영향으로 재고가 조기에 철수하고, 전통적인 판매 피크가 혼란스러워 하반기 리스크가 높아집니다.

- 클라우드 제공업체는 관세의 영향을 덜 받는 AI 서버에 대한 설비투자를 확대하여 일반 서버의 예산을 압박합니다. "AI는 단독으로 성공합니다."

- 엣지 AI는 모멘텀을 잃었고, 엔드 디바이스는 매력적인 AI 애플리케이션이 부족하여 업그레이드를 촉진하지 못했으며, 소비자의 관심도 높아지지 않을 것으로 보입니다.

- 2026년까지 업계는 저성장별 통합 단계에 진입하고, 대부분의 제품은 부진하고, AI 서버의 모멘텀은 약화될 것입니다.

- 관세의 불확실성은 PC OEM과 공급업체의 생산 전략에 영향을 미칩니다.

목차

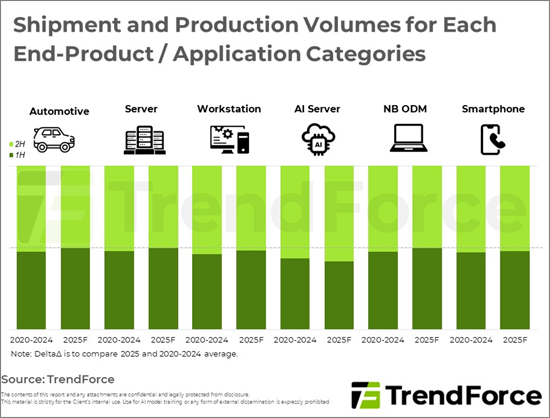

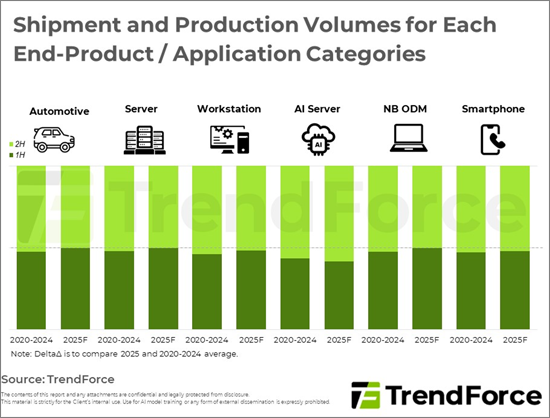

제1장 관세와 보조금으로 인해 수요가 앞당겨져 전통적인 성수기가 혼란에 빠졌습니다.

- 최종 제품 및 용도별 출하 및 생산량 - 2025년 상반기 및 하반기 연간 출하량 분포와 지난 5년 평균 대비 비교

제2장 AI 서버에 대한 수요는 꾸준히 증가하고 있습니다. 다른 애플리케이션에 비해 요금 관련 불확실성의 영향을 덜 받고, CSP의 설비투자 증가에 따른 수혜를 받고 있습니다.

제3장 엣지 AI의 화두는 가라앉고 있지만, 대체 물결은 아직 일어나지 않는 모양새입니다. 킬러 애플리케이션은 당분간 보류 중입니다.

제4장 2026년을 내다보며 - 성장 둔화 속, 업계는 저성장 및 통합으로 전환

KSM 25.08.27In 2025, the electronics industry sees diverging trends: strong AI demand, weak consumer devices, early pull-in erases seasonality, and future growth slows.

INFOGRAPHICS

Key Highlights:

- In 2025, AI demand surges while consumer electronics-smartphones, laptops, TVs-see stagnant or minimal growth.

- Tariff and subsidy impacts cause early inventory pull-in, disrupting traditional sales peaks and raising risks in the year's latter half.

- Cloud providers grow capital spending on AI servers, with less tariff impact, squeezing budgets for general servers. "AI alone thrives."

- Edge AI loses momentum; end devices lack compelling AI applications, failing to drive upgrades or noticeable consumer interest.

- By 2026, the industry enters a consolidation phase with slow growth, most products remain weak, and AI server momentum eases; breakthroughs needed for future cycles.

- Tariff uncertainty impacts PC OEMs' and suppliers' production strategies; DRAM supply-demand and other components merit close watch.

Table of Contents

1. Tariffs and Subsidies Have Caused Demand to Be Pulled Forward and Disrupts Traditional Peak Season

- Shipment and Production Volumes for Each End-Product / Application Categories - Distribution of Annual Shipments Between 1H25 and 2H25 vs. Averages of Previous Five Years

2. Demand Grows Steadily for AI Servers, Which Are Less Affected by Tariff-Related Uncertainties Compared with Other Applications and Have Benefited from CSPs' Increasing Capital Expenditure

3. Subsiding Topic of Edge AI Yet to Ignite Replacement Wave; Killer Applications Pending for the Time Being

4. Looking Ahead to 2026: Industry Enters Low-Speed Growth and Consolidation under Decelerating Increment

샘플 요청 목록