|

시장보고서

상품코드

1873717

클라우드 AI의 전망(2026년) : GPU와 ASIC를 공략하는 북미의 하이퍼스케일러2026 Cloud AI Outlook: NA Hyperscalers Target GPU & ASICs |

||||||

※ 본 상품은 영문 자료로 한글과 영문 목차에 불일치하는 내용이 있을 경우 영문을 우선합니다. 정확한 검토를 위해 영문 목차를 참고해주시기 바랍니다.

북미의 클라우드 대기업은 설비투자를 대폭 확대하고 있으며, 향후 2년간 AI 인프라에 대한 투자가 최고치에 달할 것으로 나타났습니다. 대규모의 장기적인 전략으로 전환하는 가운데 하이엔드 GPU 랙에 주력하여 자사 개발의 AI 전용 ASIC 개발을 가속화함으로써 시장에서의 주도권 확보와 AI 서버의 급속한 성장을 추진하고 있습니다.

샘플 미리보기

주요 하이라이트 :

- AI 투자 가속 : 주요 북미 CSP(클라우드 서비스 제공업체)는 설비 투자를 크게 늘리고 대규모의 장기적인 AI 인프라 전략으로 전환하고 있습니다. 이 기세는 향후 수년간 지속될 것으로 예측됩니다.

- GPU 랙에 집중 투자 : 투자는 하이엔드 NVIDIA GPU 랙 솔루션(GB/VR 시리즈)에 집중하고 있으며, 북미 공급업체가 주도적인 점유율을 차지하고 있습니다. AMD도 경쟁 솔루션을 도입하고 있습니다.

- 커스텀 ASIC의 상승 : 의존도 감소와 비용 효율성 향상을 위해 Google, AWS, Meta 등 대기업은 자사 개발의 AI용 ASIC 개발을 가속화하고 기술적 자율성을 높이고 있습니다.

- 견조한 시장 전망 : GPU와 ASIC의 두 가지 투자 경로와 신흥 국가 주도형 AI 프로젝트에 견인되어 AI 서버의 출하 대수 증가는 상향 조정이 계속될 것으로 예측되고 있습니다.

목차

제1장 CSP의 설비투자 전망은 2025년을 향해 다시 상향 조정, 투자세는 2026년에도 견조하게 추이

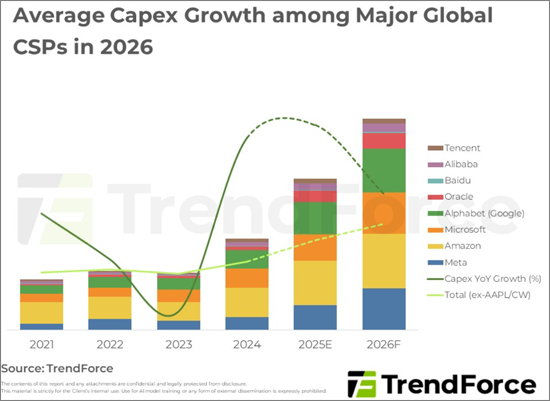

- 2026년 세계 주요 CSP의 평균 설비 투자액 증가율

제2장 2026년에 GB300 및 VR200 GPU 랙 출하의 성장을 견인하는 북미의 주요 CSP5사

- 북미 상위 5개 기업의 CSP가 2026년까지 GB 및 VR 랙의 총 출하량으로 우위를 차지할 것으로 예상되어 Oracle이 최대 점유율을 획득

제3장 AI 칩의 자급자족이 트렌드가 되어 미국의 CSP는 자사 ASIC 개발을 가속시켜 주요기술의 관리를 강화하고 있습니다.

- CSP는 컴퓨팅의 자립성과 차별화 경쟁력을 높이기 위해 AI ASIC의 개발을 강화

North American cloud giants are substantially increasing Capex, signaling an investment peak in AI infrastructure over the next two years. Shifting to large-scale, long-term strategies, they are focusing on high-end GPU Racks and accelerating in-house AI ASIC development to secure market leadership and drive rapid AI server growth.

Sample preview

Key Highlights:

- Accelerated AI Investment: Major North American CSPs are significantly raising Capex, shifting to large-scale, long-cycle AI infrastructure strategies with strong momentum expected to continue for years.

- Focus on GPU Racks: Investment is heavily concentrated on high-end NVIDIA GPU rack solutions (GB/VR series), with NA providers taking a dominant share; AMD is also introducing competing solutions.

- Rise of Custom ASICs: To reduce reliance and improve cost efficiency, giants like Google, AWS, and Meta are accelerating in-house AI ASIC development, enhancing their technological autonomy.

- Strong Market Outlook: AI server shipment growth is projected to continue its upward revision, driven by the dual investment tracks (GPU + ASIC) and emerging sovereign AI projects.

Table of Contents

1. CSPs' Outlook on Capex Upward Revised Once Again for 2025; Investment Momentum Remains Strong for 2026

- Average Capex Growth among Major Global CSPs in 2026

2. Five Major North American CSPs to Drive Growth of GB300 and VR200 GPU Rack Shipments in 2026

- North America's Top Five CSPs Expected to Dominate Total GB and VR Rack Shipments by 2026, with Oracle Having Largest Share

3. AI Chip Self-Sufficiency Is a Rising Trend, and US-Based CSPs Are Expediting In-House ASIC Development and Strengthen Control over Key Technologies

- CSPs Ramp Up AI ASIC Development to Achieve a Greater Degree of Computing Self-Sufficiency and Differentiation Competitiveness

샘플 요청 목록