|

시장보고서

상품코드

1700502

산업용 기계 상태 모니터링 : 기회 및 예측(-2029년)Industrial Machine Health Monitoring: Opportunities & Forecasts Through 2029 |

||||||

IIoT에 의해 가능해진 데이터 구동 전략의 도입이 진행됨에 따라, 많은 산업 사업자는 가동 기기의 건전성을 감시하는 솔루션에 대한 투자를 우선하고 있습니다. 성능을 지속적으로 모니터링함으로써 제조업체 및 기타 산업 운영자는 가동 시간과 생산량을 극대화하는 데 도움이 되는 유지 보수 전략을 수립하고 관리 할 수 있으므로 센싱 하드웨어, 실시간 모니터링 기능 및 고급 분석(예측 모델링 등)을 완벽한 엔드 투 엔드 솔루션으로 통합하는 산업용 기계 상태 모니터링 솔루션은 운영 효율성과 최적화를 추구하는 기업에게 매우 중요한 도구로 등장합니다.

이 보고서는 세계의 산업용 기계 상태 모니터링 솔루션 시장을 조사했으며, 지역, 판매 채널 및 산업별 분석 및 예측을 다룹니다.

어떤 질문에 대응합니까?

- 산업용 기계 상태 모니터링 솔루션 시장 규모는?

- 향후 5년간의 성장을 견인하는 지역과 산업은 어디인가?

- OT, IT, IoT의 융합은 이 시장을 어떻게 형성하고 있는가?

- 기계 상태 이니셔티브 지원에 가장 적극적인 산업 자동화 공급업체는?

- 사이버 보안 문제는 이러한 솔루션의 채택과 구현에 어떤 영향을 미치는가?

이 보고서에 게시된 공급업체

|

|

|

센싱 기술의 지속적인 성숙은 본 시장의 초기 단계에 있어서의 기본적인 성장 요인이 되어 왔습니다.

이 시장에는 기계의 건전성에 특화된 스타트업 기업, 기존의 산업용 기술 공급업체, 산업용 부품 공급업체, 세계적인 산업 오토메이션의 대기업 등 다양한 사업자가 참가하고 있습니다. 이 시장의 초기 단계부터 Augury, I-care, KCF Technologies와 같은 전문 머신헬스 제공업체는 이 분야에 집중하여 수요 창출에 가장 큰 성공을 거두었습니다. 솔루션 관점에서 이 시장의 경쟁업체는 일반적으로 센서를 판매하는 기업, 센서를 판매하고 서비스 계약을 통해 수동 진단 및 권장 사항을 제공하는 기업, 센서를 판매하고 AI를 활용하여 자동 진단 및 권장 사항을 제공하는 기업 등 여러 범주 중 하나에 속합니다.

2024년에는 식품 및 음료 업계가 시장에서 가장 큰 수익원이 되었습니다. 이것은 주로 이 업계의 시설 내에 다수의 기계가 존재하는 것이 큰 요인입니다. 시스템의 도입이 원활하고 비용 절감 효과도 알기 쉽게 나타내기 쉬운 특징이 있습니다. 한편, 에너지·발전 분야는 2029년까지 가장 급성장하는 산업 부문이 될 전망입니다. (ESG) 목표는 이산화탄소 배출 및 에너지 관리 요구사항에 대한 대응을 요구하기 때문입니다.

목차

어떤 질문을 다룰 수 있는가?

이 보고서를 읽을 사람은 누구입니까?

이 보고서에 게재된 공급업체

주요 요약

- 주요 조사 결과

세계 시장 개요

- 시장 요약

- 시장 성장 촉진요인과 전략

- 디지털 전환을 촉진하는 노동 과제

- 센서의 성숙도와 상호 운용성의 요건이 시장을 형성

경쟁 구도

- 개요

- 과제

- 인수로 시장 점유율 획득

- 최전선에서 일하는 직원의 바이인 강화

- 전개의 확장과 진화하는 고객 요구에의 적응

- 기회

- AI 퍼즐을 풀다

- OT 스택 전체에서의 통합 실현

- 새로운 시장 진출을 위한 제휴 추구

세계 시장 : 구분별

- 지역별 시장·예측

- 개요

- 산업화가 시장 기회를 창출

- 산업별 시장·예측

- 개요

- 업계의 사일로화가 시장의 성장을 억제

- 감시 기술별 시장·예측

- 개요

- 기계 지식의 한계에 의해 방해되는 대체 기술

- 채널별 시장·예측

- 개요

- 최종 사용자가 OEM 솔루션을 경계하는 이유

공급업체 하이라이트

- Advanced Technology Services(ATS)

- AssetWatch

- Augury

- I-care

- KCF Technologies

- 기타

- Bently Nevada

- Emerson

- MaintainX

- TRACTIAN

- Waites

저자 정보

KTH 25.04.28Inside this Report

As industrial organizations increasingly embrace the data-driven strategies enabled by the Industrial Internet of Things (IIoT), many have prioritized investments in solutions that monitor the health of their operational equipment. By continuously monitoring the status and performance of compressors, gear boxes, motors, pumps, and other industrial machinery, manufacturers and other industrial operators can develop and manage maintenance strategies that help maximize production uptime and output. As such, industrial machine health monitoring solutions - which combine sensing hardware, real-time monitoring capabilities, and advanced analytics (e.g., predictive modeling) within a complete, end-to-end solution - have emerged as critical tools in these organizations' pursuit of operational efficiency and optimization. This report covers the global market for industrial machine health monitoring solutions, including segmentations and forecasts by geographic region, channel, and industry.

What Questions are Addressed?

- How large is the market for industrial machine health solutions?

- Which regions and industries will drive growth over the next five years?

- How is the convergence of OT, IT, and IoT shaping this market?

- Which industrial automation suppliers have been most aggressive in supporting machine health initiatives?

- How have cybersecurity concerns affected the adoption and implementation of these solutions?

Who Should Read this Report?

This report is intended for those making critical decisions regarding product development, partnerships, go-to- market planning, and competitive strategy and tactics. It is written for executives, senior managers, and other decision-makers involved in the development, deployment, marketing, management, or sales of industrial machine health solutions, including those in the following roles:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Vendors Listed in this Report:

|

|

|

Executive Summary

The continued maturation of sensing technologies has been a foundational growth driver throughout the early stages of this market. Moving forward, the emergence and maturation of industrial artificial intelligence will be among the most critical technological drivers for this market.

This market is populated by a diverse mix of machine health startups, established industrial technology vendors, industrial component suppliers, and global industrial automation giants. Through the early stages of this market, dedicated machine health providers such as Augury, I-care, and KCF Technologies have been the most successful in generating demand due to their laser focus on this sector. From a solution perspective, competitors in this market generally fit into one of several categories: companies that sell sensors, companies that sell sensors and provide manual diagnostics and recommendations via service engagements, and companies that sell sensors and provide automated diagnostics and recommendations leveraging AI. Beyond the leading vendors, the competitive landscape is further populated by variety of niche competitors that serve select geographies, industries, or machine health monitoring applications.

The food and beverage industry was the leading sources of industrial machine health monitoring revenue in 2024 due, in large part, to the high volume of machinery present in facilities within this space. Operating environments within the food and beverage industry are generally less complex to monitor, allowing for straightforward deployments and easily demonstrable cost savings. The energy and power generation sector will be the fastest- growing industry segment through 2029 as corporate environmental, societal, and governance (ESG) goals drive operators to address mounting requirements such as those around carbon emissions or energy management. Automotive manufacturers and component suppliers will also drive significant growth through the end of the forecast period.

Key Findings:

- The maturation of industrial artificial intelligence will be a critical growth driver for this market.

- Requirements around openness and interoperability have intensified as industrial organizations continue gaining access to new operational data sources.

- Competitors whose deployments rely on professional services will find it increasingly difficult to scale their services capacity as their install base grows.

- The Asia-Pacific region will attain the highest growth rate through the end of the forecast period.

- Vendors overwhelmingly rely on direct sales to engage with customers.

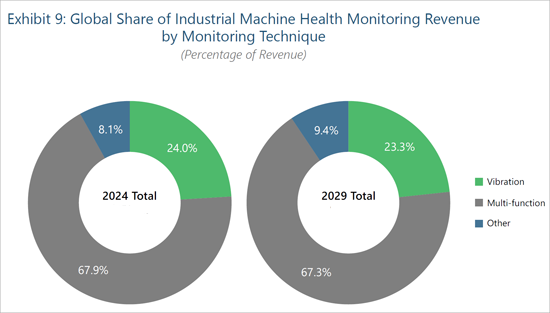

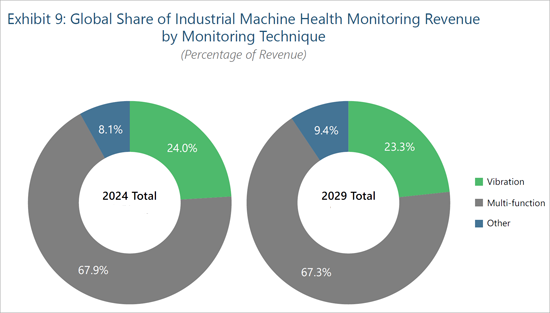

Monitoring Technique Segmentation and Forecast

Overview

Vibration monitoring - either via dedicated vibration sensors or multi-function sensors also including temperature and other measurements - generated the overwhelming majority of industrial machine health monitoring revenue in 2024. Due to its ability to identify abnormal behavior in common industrial equipment such as compressors, generators, fans, motors, pumps, and turbines, vibration monitoring is the de facto starting point for any industrial organization looking to prevent failures before they occur. The addition of temperature measurement allows multi-function sensors to provide a more comprehensive understanding of machine performance. Multi-function sensors from Augury, I-care, and other market leaders commonly include additional measurement parameters, such as impact and magnetic flux. The expanded coverage afforded by these additional measurement parameters will allow the growth rate of this segment to outpace that of the single- parameter vibration segment. Moving forward, vibration and multi-function sensors will continue to comprise the vast majority of this market through the end of the forecast period, however, alternative techniques such as corrosion monitoring, electrical monitoring, and oil analysis will grow at the greatest rate (nearly 16% per year through the end of the forecast period) as organizations begin to target non-rotating equipment such as drums, pipes, and tanks. Sensors measuring magnetic flux will become particularly attractive due to their ability to measure energy consumption and help organizations meet their ESG objectives.

Alternative Techniques Hindered by Limited Machine Knowledge

Even before the emergence of this IIoT-enabled market segment, vibration monitoring has long been at the forefront of industrial organizations' condition monitoring efforts. As such, solution providers have access to tremendous volumes of reference data detailing common failure points and fault conditions for most types of rotating industrial equipment. Used in conjunction with vendors' machine learning algorithms and AI capabilities, this reference data is a foundational element of the machine health market. Unfortunately, reference data for non- rotating, discrete machinery such as cranes and robots is comparatively scarce. Without a sufficient body of knowledge as to how these machines break and how they are fixed, vendors in this space have been hesitant to offer coverage in this area. To effectively cover assets with critical, non-rotating components, solution providers must amass not only sufficient reference data around each new class of machinery, but also sufficient in-house expertise to deliver value-adding advice to customers.

Table of Contents

What Questions are Addressed?

Who Should Read this Report?

Vendors Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

- Market Summary

- Market Drivers and Strategies

- Labor Challenges Prompting Digital Transformation

- Sensor Maturity, Interoperability Requirements Shaping Market

Competitive Landscape

- Overview

- Challenges

- Seizing Market Share via Acquisition

- Fostering Buy-In from Frontline Workers

- Scaling Deployments and Adapting to Evolving Customer Requests

- Opportunities

- Solving the AI Puzzle

- Enabling Integrations Throughout the OT Stack

- Pursuing Partnerships to Reach New Markets

Global Market Segmentations

- Regional Segmentation and Forecast

- Overview

- Industrialization Creates Market Opportunities

- Industry Segmentation and Forecast

- Overview

- Industry Silos Limit Market Growth

- Monitoring Technique Segmentation and Forecast

- Overview

- Alternative Techniques Hindered by Limited Machine Knowledge

- Channel Segmentation and Forecast

- Overview

- End Users Wary of OEM Solutions

Vendor Highlights

- Advanced Technology Services (ATS)

- AssetWatch

- Augury

- I-care

- KCF Technologies

- Others

- Bently Nevada

- Emerson

- MaintainX

- TRACTIAN

- Waites

About the Authors

List of Exhibits

- Exhibit 1: Global Revenue for Industrial Machine Health Monitoring

- Exhibit 2: Global Revenue for Industrial Machine Health Monitoring by Leading Vendors (2024)

- Exhibit 3: Global Revenue for Industrial Machine Health Monitoring by Region

- Exhibit 4: Global Share of Industrial Machine Health Monitoring Revenue by Region

- Exhibit 5: Global Revenue for Industrial Machine Health Monitoring by Industry

- Exhibit 6: Global Share of Industrial Machine Health Monitoring Revenue by Industry

- Exhibit 7: Global Revenue for Industrial Machine Health Monitoring by Monitoring Technique

- Exhibit 8: Global Share of Industrial Machine Health Monitoring Revenue by Monitoring Technique

- Exhibit 9: Global Revenue for Industrial Machine Health Monitoring by Channel

- Exhibit 10: Global Share of Industrial Machine Health Monitoring Revenue by Channel