|

시장보고서

상품코드

1745943

레독스 플로우 배터리(RFB)에 의한 장기 에너지 저장 : 그리드·마이크로그리드·시장·기술(2025-2045년)Long Duration Energy Storage with Redox Flow Batteries: Grid, Microgrid, Markets, Technology 2025-2045 |

||||||

레독스 플로우 배터리(RFB)는 그리드 및 마이크로그리드용 장기 에너지 저장(LDES)의 역할을 점점 더 많이 담당하고 있습니다. 2025년부터 2045년까지 누적 사업 규모가 1,700억 달러 이상에 달할 것으로 예상되며, 그 수요는 전 세계적으로 다양화 및 분산화될 것으로 예측됩니다.

2024년 RFB의 매출은 약 10억 달러에 달하며, 대부분 단기간 사용자용으로 이루어졌습니다. 이 매출은 2045년에는 약 220억 달러에 달할 것으로 예상되며, 대부분 LDES(장기 에너지 저장)용으로 사용될 것으로 예측됩니다. 이는 시장의 요구와 RFB 기술의 발전에 따른 것입니다. 또한, 2045년경에는 마이크로그리드용 RFB를 통한 LDES의 판매가 주류가 될 가능성도 있습니다. 이러한 용도는 향후 등장할 RFB 기술의 특성과 매우 높은 친화력을 가지고 있기 때문입니다.

레독스 플로우 배터리(RFB)에 의한 LDES(장기 에너지 저장) 시장을 조사했으며, RFB 기술 개요와 로드맵, 시장 규모 예측, RFB 제조업체 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 주요 요약·결론

- 이 보고서의 목적, LDES, RFB 및 하이브리드 RFB

- 조사 방법

- 정의, 지연 전력의 필요성, 대체 기술

- 8개 주요 결론 : RFB 시장과 업계, 10개 인포그래픽

- 인포그래픽 : RFB 기업별/기술별 실적과 전망

- 인포그래픽 : 2025년 LDES 기술 지속 시간과 공급 전력

- RFB 2025-2045가 목표로 하는 그리드 LDES와 그리드 외 LDES에 대한 매우 다른 요구

- 인포그래픽 : 향후 RFB의 비욘드 그리드 적용 예시 : 6G 기지국

- RFB 성공과 시장에서의 격차

- 맥락에서의 RFB : 그리드 및 비그리드 용도를 위한 완전한 LDES 툴킷 인포그래픽

- LDES 2025-2045 RFB 기술 리더

- RFB 기술에 관한 19개 주요 결론

- RFB 로드맵 : 시장별/기술별

- 장기 에너지 저장(LDES) 로드맵

- 시장 예측 : 2025-2045년

제2장 LDES 요구, 설계 원칙, 2025년까지 상황

- 에너지 기초

- 급속한 비용 절감 별 재생에너지에의 참여 : 2025년 통계와 동향

- 태양광발전의 승리와 간헐성 과제

- LDES 대체 루트

- LDES의 정의와 선택사항 비교

- 그리드 LDES와 그리드 외 LDES에 대한 크게 다른 요구

- 2025년 주요 프로젝트

- LDES 장애, 대체안, 투자 환경

- LDES 툴킷

- 퍼포먼스에 관한 최신 독립 평가 : 기술별

- LDES용 RFB 파라미터 비교 표

제3장 레독스 플로우 배터리(RFB)에서 LDES로의 이동 : 요구, 비용, 화학, 멤브레인

- 개요

- 일반 : 그리드 및 마이크로그리드용 RFB

- 2030년 6G 통신을 포함한 마이크로그리드용으로 최적화된 RFB

- 양극액과 음극액 화학

- 보다 낮은 LCOS, 불연성, 하이브리드 폼, 보다 우수한 멤브레인 탐구(인포그래픽)

- 유기 및 수성 RFB 설계

- 대규모 RFB를 구현 가능

- 활기 있는 혁신 파이프라인

- 인포그래픽 : RFB의 상업적 성과와 전망

- RFB 연구는 LDES로 전환

- LDES용 RFB SWOT 평가

제4장 RFB 기술과 동향

- RFB 기술

- 일반 옵션과 하이브리드 옵션 SWOT 평가

- 재료별 구체적인 설계 : 바나듐, 철 및 그 변종, 할로겐 기반, 유기, 망간, 해수

제5장 RFB 제조업체 개요·분석

- 제조업체 수와 시장 규모 : 화학제품별

- 45개 RFB 기업을 8개 항목으로 비교 : 명칭, 브랜드, 기술, 기술 준비, 그리드 외에 대한 초점, LDES에 대한 초점, 코멘트

- RFB 제조업체 개요

Summary

Redox Flow Batteries RFB increasingly supply Long Duration Energy Storage LDES for grids and microgrids. From 2025-2045, that may total over $170 billion dollars of business cumulatively but fragmenting to serve increasingly varied needs and locations worldwide. It is time for an independent report on that large business opportunity, so we now have the Zhar Research 252-page report, "Long Duration Energy Storage with Redox Flow Batteries: Grid, microgrid, markets, technologies 2025-2045" . This is your detailed guidebook, whether you offer added value materials or complete devices.

Advances in 2025 are very important

Importantly, this new report includes PhD level analysis of the remarkable research and company advances in 2025. See 23 forecast lines 2025-2045, new roadmaps 2025-2045, SWOT reports, comparison tables, infograms and 45 manufacturer profiles with appraisals. Learn how the number of RFB manufacturers will grow up-to and after a future shakeout. Which formats, chemistries, materials and membranes win? What are your potential acquisitions, partners, competitors? What optimum strategies assist you to attain up to $5 billion in yearly RFB LDES sales?

Chapters and their findings

The "Executive summary and conclusions" (50 pages) is sufficient if your time is limited, for here are the basics, eight key conclusions on markets and companies and 19 on technologies. 45 RFB companies are compared in eight columns for each. Many pie charts, three SWOT appraisals and those 23 forecast lines and graphs with explanations make sense of it all. For example, RFB sales were around $1 billion in 2024, mainly for short duration, but sales could be around $22 billion in 2045, mostly as LDES, due to the needs and RFB technologies changing as explained here. RFB LDES value sales for microgrids could dominate by then, because these different requirements are an even better match for emerging RFB capabilities.

Chapter 2. "LDES needs, design principles, situation through 2025" takes 30 pages giving a balanced, independent view embracing the microgrid opportunity as well. You do not suffer figures from manufacturers and trade associations exaggerating the opportunity and concentrating only on grid applications. See why RFB has less competition for microgrid LDES and RFB may even lead that storage market. See escape routes from LDES such as grids widening over time and weather zones and new green generation modes each giving less intermittency. That reduces the need for grid LDES though it will still be substantial.

Chapter 3. "Redox flow batteries RFB pivoting to LDES: needs, costs, chemistries and membranes" (20 pages) gives the big picture on the costs, formats, liquid chemistries and membrane science involved. 2025 advances and potential for improvement are prioritised. The different grid and microgrid solutions are examined.

Chapter 4. "RFB technologies and trends" (37 pages) examines those all-important electrolytes and their matched formats in detail. It compares and interprets the flood of advances, particularly in 2025. The general picture is of most effort, and progress, being with vanadium, iron and zinc-based anolytes and catholytes, variants including combinations with several other metals but there is more. Eliminating flammability is now a given with the aqueous electrolytes and some organic ones. Progress is patchy in eliminating toxigens and toxigen intermediaries and zinc chemistries have considerable research but struggle with commercialisation. Such problems may be your opportunities.

The report closes with the longest chapter. Chapter 5. "RFB manufacturer profiles and analysis" (106 pages) appraises manufacturers and putative manufacturers of RFB including their profiles, technology focus and readiness, strategies, successes and failures. Conclusions are presented in tables, pie charts and forecasts.

Expert opinion

Primary author Dr Peter Harrop, CEO of Zhar Research, says, "As LDES becomes a very large market, pumped hydro and its variants and compressed air underground may serve most grid needs but special situations will favour RFB creating a lesser - but still large - grid opportunity. Green generation off-grid and capable-of-being-off-grid is an even bigger opportunity for RFB because it reads more strongly onto its strengths such as no major earthworks, small footprint when stacked and fast permitting and installation, even safely in cities. Overall, RFB can follow the demand as it moves to longer time of storage and longer duration of subsequent power delivery. It will provide ever larger capacity still with minimal fade and self-leakage, even offering repair and upgrading after deployment. Most alternatives cannot keep up with this, so we strongly urge you to assess these opportunities for both your added-value materials and your capability with structures and product integration".

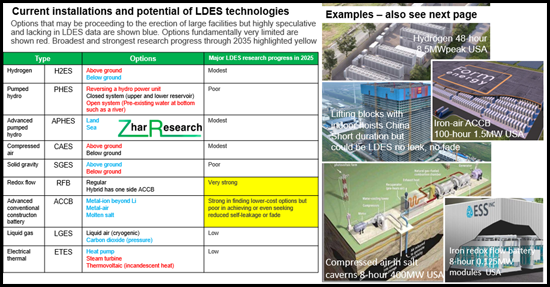

CAPTION: Current installations and potential of LDES technologies showing strong position of RFB. Source, Zhar Research report, "Long Duration Energy Storage with Redox Flow Batteries: Grid, microgrid, markets, technologies 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report, LDES, RFB and hybrid RFB

- 1.2. Methodology of this analysis

- 1.3. Definitions, need for delayed electricity, escape routes

- 1.4. Eight primary conclusions: RFB markets and industry with ten infograms

- 1.5. Infogram: RFB achievements and aspirations by company and technology 2025-2045

- 1.6. Infogram: Duration hours vs power delivered for LDES technologies in 2025

- 1.7. The very different needs for grid vs beyond-grid LDES targetted by RFB 2025-2045

- 1.8. Infogram: Example of future beyond-grid application of RFB: 6G base stations

- 1.9. RFB success and gaps in its markets

- 1.10. RFB in context: Infogram of complete LDES toolkit for grid and beyond-grid applications

- 1.11. RFB technology leaders for LDES 2025-2045

- 1.11.1. Vanadium RFB gets busy - examples

- 1.11.2. RFB projects without vanadium coming up fast - examples

- 1.11.3. Analysis of number of manufacturers by chemistry: vanadium lead reducing

- 1.11.4. Research pipeline analysis: 61 papers from 2024-2025: primary emphasis strongly beyond vanadium

- 1.12. 19 primary conclusions concerning RFB technologies

- 1.12.1. The 19 conclusions

- 1.12.2. Seven RFB key parameters driving volume sales, vanadium vs other 2025-2045

- 1.12.3. 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 1.12.4. SWOT appraisal of regular RFB

- 1.12.5. SWOT appraisal of hybrid RFB

- 1.12.6. SWOT appraisals of vanadium and all-iron RFB against alternatives

- 1.13. RFB roadmap by market and by technology 2025-2045

- 1.14. Long Duration Energy Storage LDES roadmap 2025-2045

- 1.15. Market forecasts 2025-2045 in 23 lines

- 1.15.1. RFB global value market grid vs beyond-grid 2025-2045 table, graph, explanation

- 1.15.2. RFB global value market short term and LDES $ billion 2025-2045 table, graph, explanation

- 1.15.3. Vanadium vs iron vs other RFB value market % 2025-2045 table, graph, explanation

- 1.15.4. Regional share of RFB value market % in four regions and manufacturer numbers 2025-2045

- 1.15.5. LDES total value market showing beyond-grid gaining share 2025-2045

- 1.15.6. LDES value market $ billion in 9 technology categories with explanation 2025-2045

2. LDES needs, design principles, situation through 2025

- 2.1. Energy fundamentals

- 2.2. Racing into renewables with rapid cost reduction: 2025 statistics and trends

- 2.3. Solar winning and the intermittency challenge

- 2.4. Escape routes from LDES

- 2.4.1. General situation

- 2.4.2. Reduction of LDES need by unrelated actions

- 2.4.3. Many options to deliberately reduce the need for LDES

- 2.5. LDES definitions and choices compared

- 2.6. The very different needs for grid vs beyond-grid LDES 2025-2045

- 2.7. Leading projects in 2025 showing leading technology subsets

- 2.7.1. Current LDES situation and trend in need: simplified version

- 2.7.2. Leading projects in 2025 showing detail and leading technology subsets, trend

- 2.8. LDES impediments, alternatives, and investment climate

- 2.9. LDES toolkit

- 2.9.1. Overview

- 2.9.2. LDES choices compared

- 2.9.3. Electrochemical LDES options explained

- 2.10. Latest independent assessments of performance by technology

- 2.11. Parameter comparison table of RFB for LDES

3. Redox flow batteries RFB pivoting to LDES: needs, costs, chemistries, and membranes

- 3.1. Overview

- 3.1.1. General: RFB for grids and microgrids

- 3.1.2. RFB optimised for microgrids including 6G Communications in 2030

- 3.1.3. Chemistries of anolyte and catholyte

- 3.1.4. Quest for lower LCOS, non-flammable, hybrid forms and better membranes (with infogram)

- 3.1.5. Organic and aqueous RFB design

- 3.1.6. Large RFB becoming viable

- 3.1.7. Vibrant pipeline of innovation

- 3.2. Infogram: RFB commercial achievements and aspirations 2025-2045

- 3.3. RFB research pivoting to LDES

- 3.3.1. Overview of RFB and its potential for LDES

- 3.3.2. Lessons from review papers

- 3.3. SWOT appraisal of RFB for LDES

4. RFB technologies and trends

- 4.1. RFB technologies

- 4.1.1. Regular or hybrid, their chemistries and the main ones being commercialised

- 4.1.2. Types of RFB and their design

- 4.1.3. Leading alternative chemistries compared for redox flow batteries RFB including hybrids

- 4.2. SWOT appraisals of regular vs hybrid options

- 4.2.1. SWOT appraisal of regular RFB geometry

- 4.2.2. SWOT appraisal of hybrid RFB

- 4.3. Specific designs by material: vanadium, iron and variants, halogen-based, organic, manganese, salt water 2025, research, 3 SWOT

- 4.3.1. Metal ligand RFB

- 4.3.2. Vanadium RFB design with 15 research advances in 2025 and SWOT

- 4.3.3. All-iron RFB design with research advances in 2025

- 4.3.4. Iron combinations for RFB with research advances in 2025

- 4.3.6. Salt-water to acid-plus-base and back

5. RFB manufacturer profiles and analysis

- 5.1. Number of manufacturers and value market by chemistry 2025-2045

- 5.2. 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment

- 5.3. Profiles of RFB manufacturers and putative manufacturers in 97 pages