|

시장보고서

상품코드

1721576

주거용 회로 차단기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Residential Circuit Breaker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

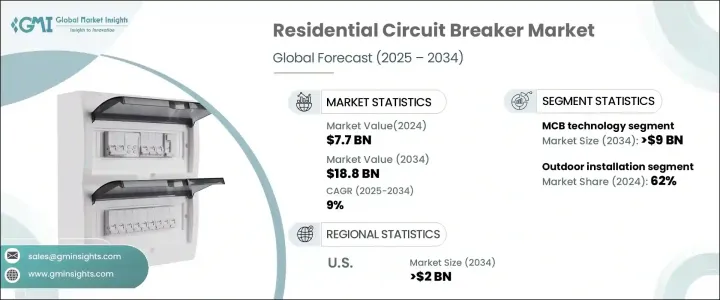

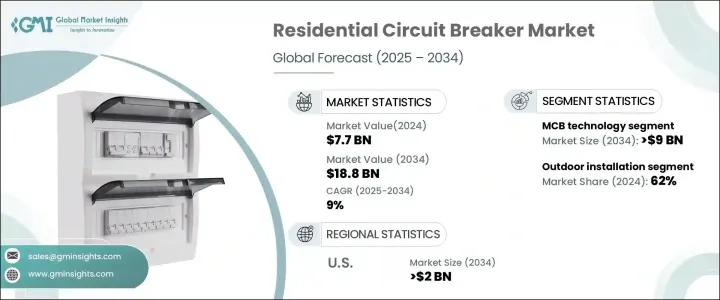

세계의 주거용 회로 차단기 시장은 2024년 77억 달러로 평가되었으며 CAGR 9%를 나타내 2034년에는 188억 달러에 이를 것으로 추정되고 있습니다. 보급에 의한 전력 소비량 증가는 주거용 회로 보호 시스템을 절대적인 필수품으로 하고 있습니다.

이 시장은 특히 소비자의 라이프 스타일의 진화, 전기 안전에 대한 높은 의식, 보다 스마트하고 안전한 거주 공간을 추진하는 정부의 정책에 의한 지원의 고조에 의해 변혁적인 변화를 목격하고 있습니다. 또한, 기후 변화에 대한 우려와 에너지 효율이 높은 주택 인프라에의 세계의 뒷받침이, 혁신적인 회로 브레이커 기술에 대한 수요를 촉진하고 있습니다. 솔라 패널과 가정용 EV 충전소의 통합도, 보다 신뢰성이 높고 디지털적으로 강화된 회로 보호 시스템의 요구를 높이는 데 있어 중요한 역할을 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 77억 달러 |

| 예측 금액 | 188억 달러 |

| CAGR | 9% |

급속한 도시화, 에너지 소비 증가, 전기 안전에 대한 우려 증가 등 여러 요인이 이 시장을 견인하고 있습니다. 건축 기준법과 안전 규제가 계속 주거용 회로 차단기에 대한 수요를 형성하고 있습니다.

게다가 재생가능 에너지 시스템과 홈 오토메이션 기술의 통합이 진행되고 있는 것도 시장을 지지하고 있습니다. 그럼에도 불구하고 세계 인프라와 주택 건설 프로젝트의 지속적인 성장으로 인해 주택의 안전하고 신뢰할 수있는 전기 시스템을 보장하는 회로 차단기의 중요성이 부각되고 있습니다.

미니어처 회로 차단기(MCB)는 합리적인 가격, 사용 편의성 및 고급 보호 기능으로 시장을 선도하고 있으며 2034년까지 90억 달러의 매출이 예상됩니다. 몰드 케이스 회로 차단기(MCCB)도 보호 기능의 추가와 내구성으로 주택 환경에서 지지를 모으고 있습니다. 산업 환경에서 일반적으로 사용되는 에어 회로 차단기(ACB)는 현재 하이 엔드 주택 및 스마트 홈 시스템에 내장되어 있습니다. 디지털 감시와 원격 제어 기능을 통합하여 안전과 운영 효율성을 높이고 이러한 제품의 매력을 높입니다.

실외 설치 부문은 2024년에 62%의 점유율을 차지했으며, 2034년까지 연평균 복합 성장률(CAGR)은 8.5%를 나타낼 것으로 예상됩니다. 실내용 회로 차단기는 공간 절약과 안전성의 특징으로 주거용 전기 패널로 주류가 되고 있지만, 주택 소유자가 전력 소비를 감시하고, 전기장해를 원격으로 특정할 수 있도록 하는 스마트 홈 기술 수요에 힘입어 옥외 설치의 인기가 높아지고 있습니다.

미국의 주거용 회로 차단기 시장은 2024년에 11억 6,000만 달러를 창출했습니다. 이 성장은 주택 건설 급증, 전기 안전 규제 강화, 스마트 홈 기술 채택 확대로 인한 것입니다. 신재생에너지발전시스템과 전기자동차 충전소을 중심으로 에너지 효율이 높은 IoT 대응 브레이커의 기술 혁신이 진행되어 2034년에는 20억 달러 시장 규모에 이를 것으로 예측되고 있습니다.

주거용 회로 차단기 업계에서 사업을 전개하고 있는 주요 기업에는 미쓰비시전기, GE, 히타치제작소, 슈나이더 일렉트릭, ABB, C& S 일렉트릭, L& T엘레 크토리컬 & 오토메이션, 이튼, 로크웰 오토메이션, 루그랑, 후지 전기, 지멘스, LS 일렉트릭, WEG, 친트 일렉트릭, 소코메크 등이 있습니다. 시장에서의 존재감을 높이기 위해 각 회사는 IoT 기능의 통합과 에너지 효율적인 솔루션의 강화 등 제품의 혁신에 주력하고 있습니다. 기술 기업과의 제휴를 통해 첨단 스마트 회로 차단기 개발이 가능합니다. 또한 각 회사는 수요 증가에 대응하기 위해 공급망의 합리화와 생산 효율성 향상을 위해 노력하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- PESTEL 분석

제4장 경쟁 구도

- 전략적 대시보드

- 혁신 및 지속가능성 전망

제5장 시장 규모와 예측 : 기술별(2021-2034년)

- 주요 동향

- ACB

- MCB

- MCCB

- 기타

제6장 시장 규모와 예측 : 설비별(2021-2034년)

- 주요 동향

- 실내

- 실외

제7장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 프랑스

- 독일

- 스페인

- 이탈리아

- 영국

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 남아프리카

- 라틴아메리카

- 브라질

- 아르헨티나

제8장 기업 프로파일

- ABB

- Chint Electric

- C&S Electric

- Eaton

- Fuji Electric

- GE

- Hitachi

- L&T Electrical &Automation

- Legrand

- LS Electric

- Mitsubishi Electric

- Rockwell Automation

- Schneider Electric

- Siemens

- Socomec

- WEG

The Global Residential Circuit Breaker Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 18.8 billion by 2034. Rapid growth in urban housing projects, along with expanding power distribution networks, is significantly fueling market demand worldwide. Rising electricity consumption driven by the widespread use of consumer electronics, home appliances, and HVAC systems is making residential circuit protection systems an absolute necessity. As modern homes grow increasingly dependent on stable and uninterrupted power supply, the importance of circuit breakers as key safety components continues to rise.

This market is witnessing transformative shifts, particularly due to evolving consumer lifestyles, increased awareness of electrical safety, and growing support from government policies promoting smarter and safer living spaces. Additionally, climate change concerns and the global push toward energy-efficient residential infrastructure are driving the demand for innovative circuit breaker technologies. The integration of solar panels and home EV charging stations is also playing a key role in elevating the need for more reliable and digitally enhanced circuit protection systems. These ongoing trends are expected to shape the competitive landscape, making residential circuit breakers an indispensable element of future-ready electrical grids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $18.8 Billion |

| CAGR | 9% |

Several factors drive this market, including rapid urbanization, increased energy consumption, and rising concerns over electrical safety. As electricity consumption increases with modern lifestyles, the need for effective circuit protection systems becomes essential. Additionally, building codes and safety regulations continue to shape the demand for residential circuit breakers. Increasing adoption of smart home technologies, such as IoT-enabled breakers, contributes to market growth as consumers seek enhanced monitoring and control of their electrical systems.

The market is further supported by the growing integration of renewable energy systems and home automation technologies. While this presents growth opportunities, challenges such as counterfeit products, supply chain disruptions, and fluctuating raw material costs can hinder market expansion. Despite these challenges, the ongoing growth in global infrastructure and residential construction projects underscores the importance of circuit breakers in ensuring safe and reliable electrical systems in homes. This positions the residential circuit breaker market as a vital segment within the broader electrical equipment industry.

Miniature circuit breakers (MCBs) lead the market due to their affordability, user-friendliness, and advanced protective features and are expected to generate USD 9 billion by 2034. Molded case circuit breakers (MCCBs) are also gaining traction in residential settings due to their added protection and durable features. Air circuit breakers (ACBs), commonly used in industrial environments, are now being integrated into high-end residential and smart home systems. The incorporation of digital monitoring and remote-control functionalities is boosting the appeal of these products by enhancing safety and operational efficiency.

The outdoor installation segment held a 62% share in 2024 and is expected to grow at a CAGR of 8.5% through 2034. While indoor circuit breakers dominate residential electrical panels due to space-saving and safety features, outdoor installations are becoming increasingly popular, driven by the demand for smart home technologies that allow homeowners to monitor power consumption and identify electrical faults remotely.

U.S. Residential Circuit Breaker Market generated USD 1.16 billion in 2024. This growth is attributed to a surge in housing construction, stricter electrical safety regulations, and greater adoption of smart home technologies. The market is projected to generate USD 2 billion by 2034, benefiting from innovations in energy-efficient and IoT-enabled breakers, especially for renewable energy systems and electric vehicle charging stations.

Major companies operating in the residential circuit breaker industry include Mitsubishi Electric, GE, Hitachi, Schneider Electric, ABB, C&S Electric, L&T Electrical & Automation, Eaton, Rockwell Automation, Legrand, Fuji Electric, Siemens, LS Electric, WEG, Chint Electric, and Socomec. To strengthen their market presence, companies focus on product innovation, such as integrating IoT capabilities and enhancing energy-efficient solutions. Partnerships with technology firms enable the development of advanced, smart circuit breakers. Companies are also working to streamline their supply chains and improve production efficiency to keep pace with growing demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, ’000 Units)

- 5.1 Key trends

- 5.2 ACB

- 5.3 MCB

- 5.4 MCCB

- 5.5 Others

Chapter 6 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Indoor

- 6.3 Outdoor

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 France

- 7.3.2 Germany

- 7.3.3 Spain

- 7.3.4 Italy

- 7.3.5 UK

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Chint Electric

- 8.3 C&S Electric

- 8.4 Eaton

- 8.5 Fuji Electric

- 8.6 GE

- 8.7 Hitachi

- 8.8 L&T Electrical & Automation

- 8.9 Legrand

- 8.10 LS Electric

- 8.11 Mitsubishi Electric

- 8.12 Rockwell Automation

- 8.13 Schneider Electric

- 8.14 Siemens

- 8.15 Socomec

- 8.16 WEG