|

시장보고서

상품코드

1740854

자체 냉각 포장 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Self-cooling Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

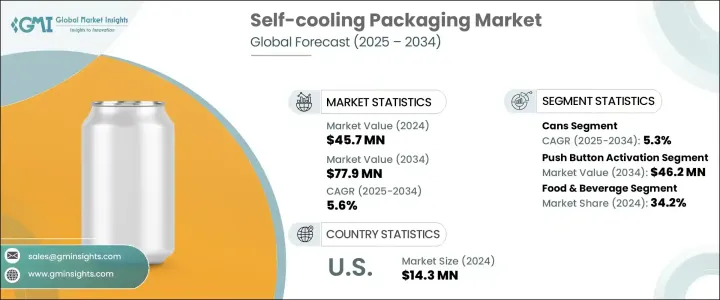

세계의 자체 냉각 포장 시장은 2024년에 4,570만 달러로 평가되었고 특히 편의성과 혁신성을 요구하는 젊은 소비자들 사이에서 기능성 음료와 에너지 음료에 대한 의욕이 높아지고 있는 것을 배경으로 CAGR 5.6%를 나타내 2034년에는 7,790만 달러에 달할 것으로 예측됩니다.

라이프 스타일이 더욱 빠르고 도시 중심이 됨에 따라 세계의 포장 업계는 큰 전환기를 맞이하고 있습니다. 즉각적인 냉각 기능을 내장한 자체 냉각 포장은 그 요구에 리얼타임으로 응하고 있습니다. 외부 냉장의 필요성을 없애고, 현대의 소비자 행동에 매치한 다음 레베 르의 편의성을 제공합니다. 이러한 기술을 구사한 패키지의 동향은 이동성, 건강 지향의 습관, 지속가능성이 중시되는 시장에서 특히 주목을 끌고 있습니다. 각 브랜드는 지금, 포화 상태의 음료나 조리 완료식 제품 중에서 두드러지기 위한 전략으로서 포장에 혁신을 도입하려고 경쟁하고 있습니다.

도시화가 진행됨에 따라 모바일 라이프 스타일에 대응하는 포장 솔루션 수요가 급증하고 있습니다.자가 냉각 포장은 신선도에 타협하지 않고 편리성과 속도를 우선하는 소비자에게 게임 체인저로 부상하고 있습니다. 경계 등으로, 번거로움 없이 신속하게 소비할 수 있는 제품에 관심을 갖고 있습니다. 셀프·틸드 기술의 통합은 선반의 매력과 기능적인 이점이 점점 구매 결정에 영향을 주게 되고 있는 소매 환경에 있어서, 갈망되고 있던 우위성을 제공합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 4,570만 달러 |

| 예측 금액 | 7,790만 달러 |

| CAGR | 5.6% |

미국의 역대 정권에 의해 시작된 무역 마찰과 수입 관세는 자체 냉각 포장 형식의 중요한 구성 요소인 알루미늄과 같은 원재료의 가용성과 가격에 큰 영향을 미쳤습니다. 많은 기업이 현지 조달 모델에 기울여, 연구개발에 대한 투자를 늘리고 있습니다.이 전략적인 축족은 원재료 가격의 변동을 완화할 뿐만 아니라, 공급 체인의 회복력을 높이는 것도 이어집니다.

다양한 제품 유형 중에서 자냉식 캔은 계속 우위를 차지하고 있으며, 2034년까지의 CAGR은 5.3%를 나타낼 것으로 예측됩니다. 냉각 성능을 높이 평가하고 여행, 야외 활동, 스포츠·이벤트 등, 냉장의 손이 닿지 않는 경우에 이상적인 것이 되고 있습니다. 성숙 시장에서 경쟁하고 있는 음료 브랜드에 있어서, 자체 냉각 캔은 보다 매력적이고 프리미엄인 유저 체험을 제공한다는 명확한 우위성을 제공합니다.

푸시버튼식 활성화 부문은 직관적이고 사용자 친화적인 디자인으로 2034년까지 4,620만 달러에 이를 것으로 예측되고 있습니다. 운반이 간단한 식사나 음료 수요가 높아짐에 따라, 제품 라인 전체로 이 활성화 방식을 채용하는 제조업체가 늘어나고 있습니다.

미국의 자체 냉각 포장 시장은 2024년에 1,430만 달러를 창출했습니다. 미국을 거점으로 하는 제조업체는 보다 일관되고 신뢰성이 높은 냉각 기능을 제공하기 위해(때문에), 열조정 기술을 진보시켜 화학 공학 프로세스를 세련시키는 것으로 기술 혁신을 추진하고 있습니다 시장의 기세는 액티브하고 아웃도어 지향의 라이프 스타일에 소비자의 관심이 변화하고 있는 것과도 관련되어 있습니다.

세계의 자체 냉각 포장 시장의 주요 기업은 Icetec, deltaH Innovations, Therapak, Tempra Technology, Gobi Technologies, Joseph Company International 등입니다. 이러한 기업은 전략적 제휴를 맺고, 속도와 신뢰성을 위해 활성화 기술을 개선하고, 맞춤형 솔루션에 투자함으로써 발자취를 확대하기 위해 적극적인 수단을 강구 진화하는 소비자의 기호와 제품 설계를 동기화하고 지속 가능하고 사용자 중심의 혁신에 주력함으로써 이러한 시장 리더는 새로운 기회를 이용하여 자체 냉각 분야에서 미래 성장의 무대를 갖추고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 업계에 미치는 영향요인

- 성장 촉진요인

- 기능성 음료 및 에너지 음료 시장의 성장

- 외출처에서 간편하게 사용할 수 있는 상품이나 편리한 상품에 수요 증가

- E-Commerce의 성장이 기능성 포장 수요를 견인

- 도시화의 진전과 라이프 스타일의 변화

- 의약품이나 콜드체인의 대체품에의 응용 확대

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용

- 한정된 재사용성

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 캔

- 파우치

- 상자 및 용기

- 기타

제6장 시장 추계·예측 : 메커니즘 유형별(2021-2034년)

- 주요 동향

- 푸시 버튼 활성화

- 트위스트 활성화

제7장 시장 추계·예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 식품 및 음료

- 의약품 및 헬스케어

- 화장품 및 퍼스널케어

- 기타

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- deltaH Innovations

- Gobi Technologies

- Icetec

- Joseph Company International

- Tempra Technology

- Therapak

The Global Self-Cooling Packaging Market was valued at USD 45.7 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 77.9 million by 2034, driven by the rising appetite for functional and energy beverages, especially among younger consumers who demand convenience and innovation. As lifestyles get faster and more urban-centric, the global packaging industry is undergoing a major shift. Consumers today expect more than just a container-they want packaging that enhances usability, matches their pace, and supports their on-the-go habits. Self-cooling packaging, with its built-in instant chill feature, is answering that demand in real time. It eliminates the need for external refrigeration, offering a next-level convenience that aligns well with modern consumer behavior. This tech-enabled packaging trend is especially gaining traction in markets where mobility, health-conscious habits, and sustainability take center stage. Brands are now racing to incorporate innovation in packaging as a strategy to stand out in a highly saturated beverage and ready-to-eat meal landscape. For companies in the beverage space, it's not just about what's inside the can-it's about how the entire consumption experience feels to the end user.

As urbanization continues to boom, the demand for packaging solutions that cater to mobile lifestyles has surged. Self-cooling packaging is emerging as a game-changer for consumers who prioritize convenience and speed without compromising freshness. With growing awareness around health and wellness, many buyers are leaning toward products that support quick, hassle-free consumption during travel, at events, or in outdoor environments. The integration of self-chilling technology provides a much-needed edge in retail environments, where shelf appeal and functional benefits are increasingly influencing purchase decisions. This format brings in a unique value proposition-instant refreshment anytime, anywhere.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.7 Million |

| Forecast Value | $77.9 Million |

| CAGR | 5.6% |

Trade tensions and import tariffs initiated by previous U.S. administrations have significantly impacted the availability and pricing of raw materials like aluminum, which is a critical component in self-cooling packaging formats. These policy shifts have triggered widespread disruptions across global supply chains, compelling manufacturers to rethink their procurement strategies. As a result, many companies are now leaning into local sourcing models and investing more heavily in R&D. This strategic pivot not only helps mitigate raw material price fluctuations but also enhances supply chain resilience. By reengineering their frameworks, brands are aiming for long-term operational sustainability while maintaining product quality.

Among various product types, self-cooling cans continue to dominate and are projected to grow at a CAGR of 5.3% through 2034. These cans are especially popular in the beverage industry due to their compatibility with pressure-based cooling systems and simple user functionality. Consumers appreciate their durable structure and reliable cooling performance, which make them ideal for travel, outdoor activities, and sporting events-scenarios where refrigeration is often out of reach. For beverage brands competing in mature markets, self-cooling cans offer a clear advantage in delivering a more engaging and premium user experience.

The push-button activation segment is projected to reach USD 46.2 million by 2034, gaining traction due to its intuitive and user-friendly design. This segment relies on a built-in chemical-based reaction that initiates the cooling function with a simple press, making it perfect for time-sensitive use cases. From busy commuters to adventure seekers, this mechanism fits seamlessly into active lifestyles. As demand rises for easy-to-carry meals and beverages, more manufacturers are embracing this activation method across product lines. It's also being explored in sectors like emergency preparedness and defense, where quick access to cooled products can add significant value.

The U.S. Self-Cooling Packaging Market generated USD 14.3 million in 2024. With increasing popularity of grab-and-go beverages, meal kits, and smart convenience food options, this market continues to expand rapidly. U.S.-based manufacturers are pushing innovation by advancing thermal regulation technologies and refining chemical engineering processes to deliver more consistent, reliable cooling features. The market's momentum is also tied to shifting consumer interests toward active, outdoor-oriented lifestyles. This change has driven increased demand from both the recreational and defense segments. As American consumers grow more environmentally and convenience conscious, local producers are stepping up with packaging solutions that align with both trends.

Key players in the Global Self-Cooling Packaging Market include Icetec, deltaH Innovations, Therapak, Tempra Technology, Gobi Technologies, and Joseph Company International. These companies are taking aggressive steps to expand their footprint by forming strategic alliances, refining activation technologies for speed and reliability, and investing in tailored solutions. By syncing product design with evolving consumer preferences and focusing on sustainable, user-centric innovations, these market leaders are tapping into emerging opportunities and setting the stage for future growth in the self-cooling space.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth of the functional and energy drinks market

- 3.3.1.2 Rising demand for on-the-go and convenience products

- 3.3.1.3 E-commerce growth driving demand for functional packaging

- 3.3.1.4 Increasing urbanization and lifestyle changes

- 3.3.1.5 Increased application in pharmaceuticals and cold chain alternatives

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of production

- 3.3.2.2 Limited reusability and single-use nature

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & kilo tons)

- 5.1 Key trends

- 5.2 Cans

- 5.3 Pouches

- 5.4 Boxes and containers

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Mechanism Type, 2021-2034 (USD Million & kilo tons)

- 6.1 Key trends

- 6.2 Push-button activation

- 6.3 Twist activation

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & kilo tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals & healthcare

- 7.4 Cosmetics & personal care

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 deltaH Innovations

- 9.2 Gobi Technologies

- 9.3 Icetec

- 9.4 Joseph Company International

- 9.5 Tempra Technology

- 9.6 Therapak