|

시장보고서

상품코드

1740857

그래핀 주입 포장 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Graphene Infused Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

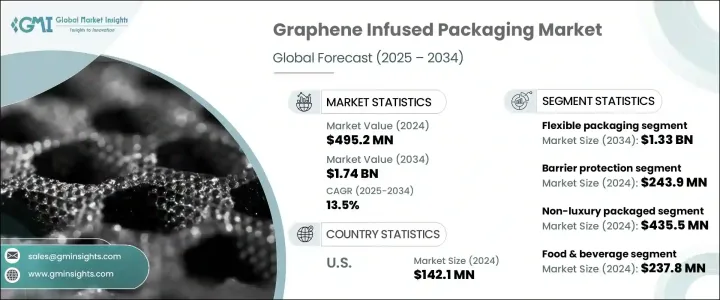

세계의 그래핀 주입 포장 시장 규모는 2024년에 4억 9,520만 달러로 평가되었고, CAGR 13.5%를 나타내 2034년에는 17억 4,000만 달러에 이를 것으로 예측됩니다.

그래핀은 포장 기술 혁신의 게임 체인저로 등장하여 신선품과 섬세한 전자 기기의 신선도와 무결성을 유지하는 경량이고 내구성이 뛰어난 고성능 솔루션을 제공합니다. 그래핀을 배합한 소재는 리사이클성과 생분해성의 높이로 각광을 받고 있습니다. 이러한 특성은 환경 친화적인 포장을 요구하는 소비자의 기호의 변화나, 환경 규제에 의한 압력 증가짐과 완전히 일치하고 있습니다.

각 브랜드는 그래핀을 연포장 필름, 라미네이트, 코팅제에 통합하여 유통 기한을 연장할 뿐만 아니라 이산화탄소 배출량과 플라스틱 폐기물을 줄임으로써 대응하고 있습니다. 순환형 경제에 대한 세계의 추진은 성능을 저하시키지 않고 녹색 목표를 따르는 포장 형태의 혁신을 제조업체에 촉구하고 있습니다. 또한, 그래핀의 탁월한 열적 및 기계적 강도는 포장의 안전성, 내구성 및 투명성이 필수적인 다양한 분야에서 부가가치를 가져옵니다. 식음료 기업은 부패 방지에 그래핀을 배합한 소재를 사용해, 일렉트로닉스 기업은 섬세한 부품의 보호에 그래핀의 정전기 방지와 보호 특성을 활용하고 있습니다. 제약 분야에서 그래핀은 섬세한 의약품의 무균성과 안정성을 유지하는 데 도움이 되며, 보다 안전하고 오래 지속되는 포장 형태를 제공합니다. 연구개발에 대한 투자가 증가하고, 파일럿 프로그램의 수도 늘어나고 있기 때문에 상업적인 채용도 기세를 늘리고 있습니다. 신흥기업과 재료과학기업은 대기업 포장 기업과 협력하여 그래핀의 용도를 확대하고 시장 수요를 충족하는 차세대 지속가능 포장 시스템을 개발하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 4억 9,520만 달러 |

| 예측 금액 | 17억 4,000만 달러 |

| CAGR | 13.5% |

국제 무역 역학의 발전은 특히 미국과 같은 신흥 경제 국가의 제조업체들에게 그래핀 주입 포장 시장의 성장 경로에 영향을 미치고 있습니다. 생산비용을 높이고 해외 공급에 의존하는 제조업체들에게 역풍이 되고 있습니다. 그러나 지속가능성과 성능에 대한 업계의 헌신이 이러한 기세를 유지하고 있습니다. 이것은 바이오 베이스 폴리머와의 일체화의 강화나, 화학 기상 성장법이나 롤·투·롤 제조법 등의 첨단 기술에 의한 생산 스케일러빌리티의 향상 등을 포함합니다.

연포장 분야는 2034년까지 13억 3,000만 달러에 이를 것으로 예상되고, 우위를 차지할 것으로 예상되고 있습니다. 능숙한 기술로 제조된 그래핀 기반 필름을 사용함으로써 소매, 식품배송, 전자상거래에서 널리 사용되는 기존 플라스틱 필름을 대체할 수 있는 지속가능한 대체품을 제공할 수 있게 됩니다.

기능성의 관점에서 장벽 보호는 여전히 그래핀 주입 포장의 중심 용도이며, 이 부문의 2024년 시장 규모는 2억 4,390만 달러였습니다. 그래핀은 초박형이면서도 침입을 허용하지 않는 장벽을 형성하는 비교할 수 없는 능력을 갖추고 있기 때문에 제품의 보존이 중요한 용도에 최적입니다. 의약품 포장에 있어서의 수분의 침입 방지, 식품 보존에 있어서의 산소와 빛의 차단 등, 그래핀을 강화한 소재는 알루미늄 포일이나 폴리에틸렌이라고 하는 종래의 소재를 능가하는 레벨의 성능을 발휘합니다. 고성능 폴리머와 결합하여 그래핀은 보다 안전하고 효과적일 뿐만 아니라 최신 재활용 시스템에도 적합한 하이브리드 소재를 생산합니다.

미국의 그래핀 주입 포장 시장은 2024년 1억 4,210만 달러에 이르렀으며, 식품, 제약, 일렉트로닉스 등 주요 산업에서 지속 가능한 고성능 포장에 대한 수요 증가가 이를 뒷받침하고 있습니다. 국내 시장 개척의 기업은 연구개발에 많은 투자를 하고, 신흥기업, 연구대학, 포장 기업 간의 콜라보레이션을 활성화시켜 국산 그래핀 솔루션을 개발하고 있습니다. 수입 그래핀에의 의존이나 무역 관세에 의한 비용에 대한 영향과 같은 과제는 남아 있는 것, 미국은 견고한 국내 공급 체인의 구축을 향해 적극적으로 임하고 있습니다. 이러한 노력은 원료 의존을 줄이고 다양한 포장 요구를 지원하는 선진 그래핀 복합재료의 현지 생산을 가능하게 하는 것을 목표로 하고 있습니다.

세계의 그래핀 주입 포장 시장에서 사업을 전개하는 주요 기업으로는 Tetra Pak International SA, GRAPHEN GreenTech SL, Black Swan Graphene 등이 있습니다. 이러한 기업들은 지속가능한 혁신에 전략적으로 투자하고 연구기관 및 기술 주도형 신흥기업과 제휴를 맺고 확장 가능하고 비용 효율적인 제조 공정를 진행함으로써 시장에서의 존재감을 높이고 있습니다. 이러한 기업들은 롤-투-롤 생산과 하이브리드 재료 합성 등의 기술을 채용함으로써 세계의 포장 밸류 체인 전체에서 그래핀 주입 솔루션이 폭넓게 채용되는 길을 열고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 업계에 미치는 영향요인

- 성장 촉진요인

- 그래핀의 뛰어난 배리어 특성

- 재활용 가능하고 생분해성의 특징을 지닌 그래핀 베이스 포장

- 식품·헬스케어 분야 수요 증가

- 스마트하고 액티브한 포장 통합

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용이 채용을 제한

- 규제상의 장애물이 상업화 지연

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 포장 형태별(2021-2034년)

- 주요 동향

- 연질 포장

- 경질 포장

제6장 시장 추계·예측 : 기능별(2021-2034년)

- 주요 동향

- 장벽 보호

- 정전기 방지

- 항균

- 열전도

제7장 시장 추계·예측 : 포장 제품 유형별(2021-2034년)

- 주요 동향

- 고급

- 비고급

제8장 시장 추계·예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 식품 및 음료

- 헬스케어 및 의약품

- 가전

- 항공우주 및 방위

- 기타

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Tetra Pak International SA

- Black Swan Graphene

- GRAPHENE GrennTech SL

- Haydale Graphene Industries plc

The Global Graphene Infused Packaging Market was valued at USD 495.2 million in 2024 and is estimated to grow at a 13.5% CAGR to reach USD 1.74 billion by 2034, driven by the material's superior barrier properties against moisture, oxygen, and UV radiation. Graphene has emerged as a game-changer in packaging innovation, offering lightweight, durable, and high-performance solutions that preserve the freshness and integrity of perishable goods and sensitive electronics. As the global packaging landscape moves toward smarter, more sustainable solutions, graphene-infused materials are gaining prominence for their recyclability and biodegradability. These qualities align perfectly with shifting consumer preferences for eco-friendly packaging and the rising pressure from environmental regulations.

Brands are responding by incorporating graphene into flexible packaging films, laminates, and coatings that not only extend shelf life but also reduce carbon footprint and plastic waste. The global push toward circular economies is encouraging manufacturers to innovate packaging formats that align with green goals without compromising performance. Moreover, graphene's exceptional thermal and mechanical strength adds value across various sectors where packaging safety, durability, and transparency are essential. Food and beverage companies are using graphene-infused materials to combat spoilage, while electronics firms leverage the material's anti-static and protective properties to shield delicate components. In the pharmaceutical space, graphene helps maintain the sterility and stability of sensitive drugs, creating safer and longer-lasting packaging formats. With increased investments in R&D and a growing number of pilot programs, commercial adoption is gaining momentum. Startups and material science companies are collaborating with large packaging firms to scale graphene applications and develop next-gen sustainable packaging systems that meet market demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $495.2 Million |

| Forecast Value | $1.74 Billion |

| CAGR | 13.5% |

The evolving dynamics of international trade have also influenced the growth path of the graphene-infused packaging market, especially for producers in developed economies such as the United States. Ongoing tariff policies on imported composite and specialty materials, including graphene, have raised production costs, creating headwinds for manufacturers that depend on foreign supplies. Sectors like aerospace, electronics, and premium food packaging have seen increased operational expenses due to these trade frictions, temporarily impacting demand in some verticals. However, the industry's commitment to sustainability and performance has kept the momentum alive. In response, companies are doubling down on research efforts to make graphene processing more efficient and cost-effective. This includes enhancing the material's integration with bio-based polymers and improving production scalability through advanced technologies like chemical vapor deposition and roll-to-roll manufacturing.

The flexible packaging segment is expected to dominate, projected to reach USD 1.33 billion by 2034. Flexible formats benefit the most from graphene's ultra-lightweight, strong, and flexible nature. These materials deliver superior barrier protection while allowing for cost-effective mass production. Using graphene-based films produced with scalable techniques enables businesses to offer sustainable alternatives to conventional plastic films widely used in retail, food delivery, and e-commerce. These advanced packaging formats not only reduce product waste but also optimize logistics through lower material weight and better product protection.

From a functionality standpoint, barrier protection remains the core application of graphene-infused packaging, with this segment valued at USD 243.9 million in 2024. Graphene's unmatched ability to create ultra-thin yet impenetrable barriers makes it ideal for applications where product preservation is critical. Whether it is preventing moisture intrusion in pharmaceutical packaging or blocking oxygen and light in food storage, graphene-enhanced materials deliver a level of performance that outclasses traditional materials like aluminum foil or polyethylene. When combined with high-performance polymers, graphene creates hybrid materials that are not only safer and more effective but also compatible with modern recycling systems.

The U.S. Graphene Infused Packaging Market reached USD 142.1 million in 2024, fueled by growing demand for sustainable, high-performance packaging in key industries such as food, pharma, and electronics. Domestic market players are investing heavily in R&D and ramping up collaborations between startups, research universities, and packaging companies to develop homegrown graphene solutions. Although challenges persist due to dependence on imported graphene and the cost implications of trade tariffs, the U.S. is actively working toward building a robust domestic supply chain. These efforts aim to reduce raw material dependency and enable localized production of advanced graphene composites to support diverse packaging needs.

Key players operating in the global graphene-infused packaging market include Tetra Pak International S.A., GRAPHENE GreenTech S.L., and Black Swan Graphene. These companies are bolstering their market presence by investing strategically in sustainable innovation, forming partnerships with research institutions and tech-driven startups, and advancing scalable, cost-efficient manufacturing processes. By adopting technologies such as roll-to-roll production and hybrid material synthesis, these players are paving the way for broader adoption of graphene-infused solutions across the global packaging value chain.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Superior barrier properties of graphene

- 3.3.1.2 Graphene-based packaging is recyclable and biodegradable

- 3.3.1.3 Rising demand in food & healthcare sectors

- 3.3.1.4 Smart and active packaging integration

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High production costs limit adoption

- 3.3.2.2 Regulatory hurdles delay commercialization

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Flexible packaging

- 5.3 Rigid packaging

Chapter 6 Market Estimates & Forecast, By Functionality, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Barrier protection

- 6.3 Antistatic

- 6.4 Antimicrobial

- 6.5 Thermal conduction

Chapter 7 Market Estimates & Forecast, By Packaged Product Type, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Luxury

- 7.3 Non-luxury

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Healthcare & pharmaceuticals

- 8.4 Consumer electronics

- 8.5 Aerospace & defense

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Tetra Pak International S.A.

- 10.2 Black Swan Graphene

- 10.3 GRAPHENE GrennTech S.L.

- 10.4 Haydale Graphene Industries plc