|

시장보고서

상품코드

1740995

C-V2X(Cellular Vehicle-to-Everything) 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Cellular Vehicle-to-Everything (C-V2X) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

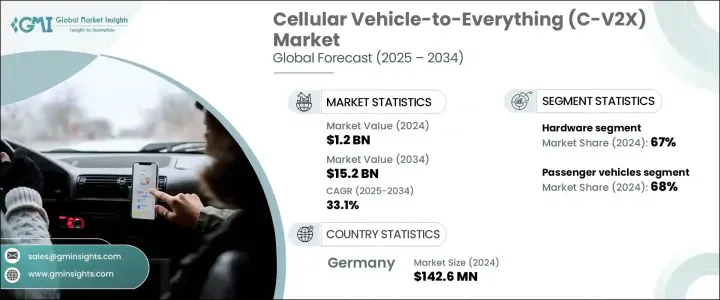

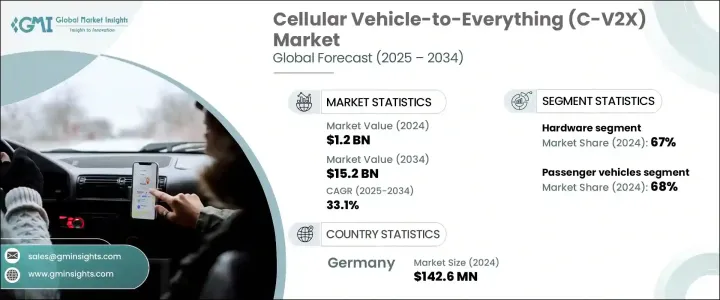

세계의 C-V2X 시장은 2024년 12억 달러로 평가되었고, CAGR 33.1%로 성장할 전망이며, 2034년에는 152억 달러에 이를 것으로 예측됩니다.

이 급증은 주로 고도의 교통안전 기술에 대한 수요가 높아지고 효율적이고 지능적인 교통관리 시스템에 대한 요구가 높아지기 때문입니다. 교통사고가 세계적으로 중대한 우려사항인 가운데, C-V2X 기술의 채용이 급증하고 있습니다. 이 기술 혁신은 차량, 인프라, 보행자 간 실시간 통신을 용이하게 하고 충돌 위험 감소 및 교통 흐름 합리화를 지원합니다. 도시 중심부가 보다 스마트하고 안전한 교통 솔루션으로 이동하는 가운데, C-V2X는 안전성과 편리성을 모두 높이는 커넥티드 교통 에코 시스템을 실현하는데 있어서 불가결한 것이 되고 있습니다. 또한 C-V2X는 자율주행차의 진화에서도 중요한 역할을 하며 복잡해지는 환경에서 안전하고 효율적인 주행을 실현합니다.

C-V2X는 자율주행차와 커넥티드카 모두에게 기본이 되는 것입니다. 차량이 위치, 속도, 의도에 대한 실시간 데이터를 교환할 수 있도록 함으로써 보다 안전하고 협조적인 운전 경험을 지원합니다. 이 지속적인 데이터 전송은 자율주행차의 안전 운행에 필수적이며 도로 상황, 위험, 시선을 훨씬 넘어선 주위 교통 상황에 대응하는 데 도움이 됩니다. 레이더나 카메라와 같은 기존 센서만으로는 이 수준의 환경 인식을 달성할 수 없습니다. C-V2X는 더 부드러운 차선 변경, 더 안전한 교차로 내비게이션, 최적화된 라우팅을 촉진합니다. 특히 복잡한 도시 지역과 고속도로에서의 정체를 완화할 수도 있습니다. C-V2X 시장의 급성장은 자동화를 추진하는 자동차 업계의 움직임과 자동차 안전성 향상에 대한 요구의 증가를 반영하고 있습니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 12억 달러 |

| 예측 금액 | 152억 달러 |

| CAGR | 33.1% |

컴포넌트의 관점에서 C-V2X 시장은 하드웨어와 소프트웨어로 나뉘어 2024년 시장 점유율은 하드웨어가 67%로 압도적이었습니다. 이 부문이 돌출하고 있는 것은 V2X 기능을 실현하는 데 있어서 하드웨어가 수행하는 역할이 불가결하기 때문입니다. 차량 유닛, 센서, 안테나, 도로변 인프라 등의 장치는 실시간 데이터 교환에 필수적입니다. 자동차 제조사들은 자동화, 내비게이션, 안전성을 향상시키기 위해 이러한 기술을 자동차에 탑재하는 경우가 늘고 있습니다. 관민 쌍방에 의한 커넥티드 인프라에 대한 계속적인 투자가, 하드웨어 부문의 성장을 뒷받침하고 있습니다.

승용차는 2024년 68% 점유율로 시장을 선도했으며, CAGR 33.5%를 보일 것으로 예측됩니다. 승용차에 ADAS(선진 운전 지원 시스템)가 널리 채용되고 있는 것이, C-V2X 기술 수요를 촉진하는 주된 요인이 되고 있습니다. 이들 시스템은 C-V2X에 의해 제공되는 추가 데이터를 활용해 위험 감지를 강화하고 상황 인식을 향상시키며 차량 전체의 안전성을 강화합니다.

독일에서 C-V2X 시장은 1억 4,260만 달러를 창출했으며, 2024년에는 27%의 점유율을 차지했습니다. 이 나라가 시장을 리드하고 있는 것은, 선진적인 자동차 에코 시스템, 5G의 광범위한 전개, 인텔리전트 교통 시스템을 추진하는 정부의 강력한 대처가 배경에 있습니다. 이러한 정책에 가세해 자동차와 통신의 양 분야에 있어서 공동 혁신이, 독일을 유럽에서 대규모 C-V2X 테스트의 일등지로 하고 있습니다.

이 시장의 주요 기업으로는 Intel, Robert Bosch, Qualcomm, ATandT, Huawei Technologies, Keysight Technologies, Infineon Technologies, Continental, ZTE, Denso 등이 있습니다. 경쟁력을 유지하기 위해 이러한 회사는 자동차 제조업체, 통신 제공업체, 인프라 기업과의 전략적 제휴에 주력하고 있습니다. 5G 통합, 스마트시티 시범 프로젝트, 표준화 이니셔티브 참가에 대한 투자는 C-V2X 시스템의 상용화를 가속화하는 열쇠가 됩니다. 나아가 지연, 커버리지, 상호운용성을 향상시키기 위한 RandD의 노력도 중요하며, 각사는 승용차와 상용차 양쪽 플랫폼에 대응하는 제품 라인업의 확충을 계속하고 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- C-V2X 하드웨어 공급업체

- C-V2X 소프트웨어 공급업체

- 자동차 OEM

- 통신 서비스 제공업체

- 최종 용도

- 이익률 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 타국에 의한 보복조치

- 업계에 미치는 영향

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 영향을 받는 주요 기업

- 자동차 OEM

- 통신 기기 프로바이더

- 반도체 및 모듈 공급자

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 전망 및 향후 검토 사항

- 무역에 미치는 영향

- 기술 및 혁신의 상황

- 특허 분석

- 주요 뉴스 및 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 세계에서 증가하는 교통사고

- 자율주행차 도입 확대

- 보다 안전한 도로 여행에 대한 수요 증가

- 차량 텔레매틱스의 인기 증가

- 업계의 잠재적 위험 및 과제

- 네트워크 보안 및 개인정보 보호 문제

- 휴대폰의 전파 미도달

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 커뮤니케이션별(2021-2034년)

- 주요 동향

- 차량 대인(V2P)

- 차량 대 인프라(V2I)

- 차량 대 네트워크(V2N)

- 차차간 통신(V2V)

제6장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 하드웨어

- 차재 유닛(OBU)

- 도로측 유닛(RSU)

- 안테나

- 통신 모듈

- 소프트웨어

- 교통 관리 소프트웨어

- 차량 관리 시스템

제7장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제8장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 차량 관리

- 자율 주행

- 충돌 회피

- 지능형 교통 시스템

- 주차장 관리 시스템

- 기타

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제10장 기업 프로파일

- AT&T

- Autotalks

- Cohda Wireless

- Commsignia

- Continental

- Denso

- Ficosa International

- Huawei Technologies

- Infineon Technologies

- Intel

- Keysight Technologies

- Nokia

- NTT DOCOMO

- Qualcomm

- Quectel Wireless Solutions

- Robert Bosch

- Rohde & Schwarz

- Savari

- Shenzhen Genvict Technologies

- ZTE Corporation

The Global Cellular Vehicle-To-Everything Market was valued at USD 1.2 billion in 2024 and is projected to grow at a CAGR of 33.1% to reach USD 15.2 billion by 2034. This rapid expansion is primarily driven by the increasing demand for advanced road safety technologies and the growing need for efficient, intelligent traffic management systems. With road accidents remaining a significant concern worldwide, the adoption of C-V2X technology has surged. This innovation facilitates real-time communication between vehicles, infrastructure, and pedestrians, helping to reduce collision risks and streamline traffic flow. As urban centers shift toward smarter, safer transportation solutions, C-V2X is becoming integral in enabling a connected transport ecosystem that enhances both safety and convenience. It also plays a critical role in the evolution of autonomous vehicles, ensuring they operate safely and efficiently within increasingly complex environments.

C-V2X is foundational for both autonomous and connected vehicles. By allowing vehicles to exchange real-time data regarding their position, speed, and intent, it supports safer and more coordinated driving experiences. This continuous data transmission is vital for the safe operation of autonomous vehicles, helping them respond to road conditions, hazards, and surrounding traffic far beyond the line of sight. Traditional sensors like radar and cameras alone can not achieve this level of environmental awareness. C-V2X facilitates smoother lane changes, safer intersection navigation, and optimized routing. It can even reduce congestion, particularly in complex urban or highway settings. The market's rapid growth reflects the broader automotive industry's push toward increased automation and the evolving need for enhanced vehicle safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $15.2 Billion |

| CAGR | 33.1% |

In terms of components, the C-V2X market is divided into hardware and software, with hardware holding a dominant 67% market share in 2024. This segment's prominence is due to the essential role that hardware plays in enabling V2X functionality. Devices such as on-board units, sensors, antennas, and roadside infrastructure are integral for real-time data exchange. Automotive manufacturers are increasingly incorporating these technologies into vehicles to improve automation, navigation, and safety. The continued investment in connected infrastructure by both public and private sectors is fueling the growth of the hardware segment.

Passenger vehicles led the market with a 68% share in 2024 and are expected to grow at a CAGR of 33.5%. The widespread adoption of advanced driver-assistance systems (ADAS) in passenger cars has been a key factor driving demand for C-V2X technology. These systems leverage the additional data provided by C-V2X to enhance hazard detection, improve situational awareness, and strengthen overall vehicle safety.

In Germany, the C-V2X market generated USD 142.6 million, holding a 27% share in 2024. The country's leadership in the market can be attributed to its advanced automotive ecosystem, widespread 5G deployment, and robust government initiatives promoting intelligent transportation systems. These policies, alongside collaborative innovation across the automotive and telecommunications sectors, make Germany a prime location for large-scale C-V2X testing in Europe.

Key players in the market include Intel, Robert Bosch, Qualcomm, ATandT, Huawei Technologies, Keysight Technologies, Infineon Technologies, Continental, ZTE, and Denso. To stay competitive, these companies focus on strategic partnerships with automakers, telecom providers, and infrastructure firms. Their investments in 5G integration, smart city pilot projects, and participation in standardization initiatives are key to accelerating the commercialization of C-V2X systems. Additionally, significant RandD efforts are being made to enhance latency, coverage, and interoperability while companies continue to expand their product offerings to cater to both passenger and commercial vehicle platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 C-V2X hardware suppliers

- 3.2.2 C-V2X software suppliers

- 3.2.3 Automotive OEMs

- 3.2.4 Telecom service providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.3.1 Automotive OEM

- 3.4.3.2 Telecom equipment providers

- 3.4.3.3 Semiconductor and module suppliers

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising number road accidents across the globe

- 3.9.1.2 Growing adoption of autonomous vehicles

- 3.9.1.3 Rising demand for safer road travel

- 3.9.1.4 Growing popularity of vehicle telematics

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Network security and privacy issues

- 3.9.2.2 Lack of cellular coverage

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Vehicle-to-Person (V2P)

- 5.3 Vehicle-to-Infrastructure (V2I)

- 5.4 Vehicle-to-Network (V2N)

- 5.5 Vehicle-to-Vehicle (V2V)

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 On-Board Units (OBUs)

- 6.2.2 Roadside Units (RSUs)

- 6.2.3 Antennas

- 6.2.4 Communication modules

- 6.3 Software

- 6.3.1 Traffic management software

- 6.3.2 Fleet management systems

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Fleet management

- 8.3 Autonomous driving

- 8.4 Collision avoidance

- 8.5 Intelligent traffic systems

- 8.6 Parking management systems

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 AT&T

- 10.2 Autotalks

- 10.3 Cohda Wireless

- 10.4 Commsignia

- 10.5 Continental

- 10.6 Denso

- 10.7 Ficosa International

- 10.8 Huawei Technologies

- 10.9 Infineon Technologies

- 10.10 Intel

- 10.11 Keysight Technologies

- 10.12 Nokia

- 10.13 NTT DOCOMO

- 10.14 Qualcomm

- 10.15 Quectel Wireless Solutions

- 10.16 Robert Bosch

- 10.17 Rohde & Schwarz

- 10.18 Savari

- 10.19 Shenzhen Genvict Technologies

- 10.20 ZTE Corporation