|

시장보고서

상품코드

1755304

자율주행 차량 시뮬레이션 솔루션 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Autonomous Vehicle Simulation Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

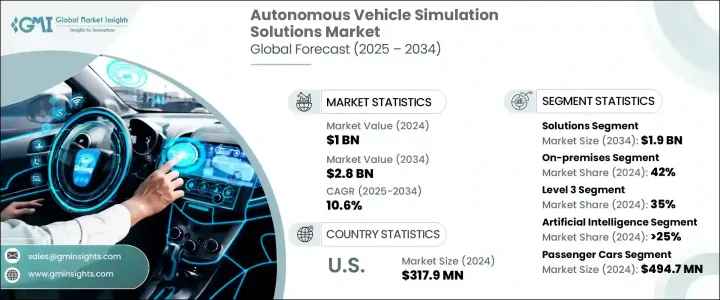

세계의 자율주행 차량 시뮬레이션 솔루션 시장 규모는 2024년에 10억 달러로 평가되었고, 2034년에는 28억 달러에 이를 것으로 예측되며, CAGR 10.6%로 성장할 전망입니다.

이 시장은 자율주행 시스템의 발전, 평가 및 배포를 지원하는 데 중요한 역할을 합니다. 시뮬레이션 플랫폼은 이제 개발 프로세스의 필수적인 부분으로, 자동차 제조업체와 기술 공급업체가 제어되고 반복 가능한 가상 환경에서 복잡한 자동 운전 기능을 테스트하고 검증할 수 있게 해줍니다. 이러한 플랫폼은 실제 운전 상황을 재현하여 엔지니어들이 차량이 도로에 출시되기 훨씬 전에 중요한 문제를 파악하고 해결할 수 있게 해줍니다. 자율 시스템이 점점 더 발전하고 미묘해짐에 따라 설계, 개발 및 안전 검증의 모든 단계에서 시뮬레이션 도구가 필요하게 되었습니다.

도로 안전이 여전히 주요 과제인 세상에서 시뮬레이션 기술은 교통사고로 인한 엄청난 인명 피해와 사망을 줄이는 실용적인 해결책으로 주목받고 있습니다. 전통적인 테스트 방법은 위험한 또는 드문 시나리오를 재현할 때 시간 소모적, 비용이 많이 들고 위험합니다. 시뮬레이션은 물리적 테스트의 대안으로, 수천 개의 경계 사례를 분석하면서도 인간 생명을 위험에 빠뜨리지 않는 비용 효율적이고 확장 가능한 방법을 제공합니다. 인간 오류가 교통 사고의 대부분을 차지함에 따라, 인간 운전사보다 더 안전하고 예측 가능하게 운영할 수 있는 자동화 시스템 개발의 필요성이 급증하고 있습니다. 시뮬레이션 기반 도구는 실제 세계에서 재현하기 너무 위험하거나 드문 조건을 포함해 무한한 조건 하에서 이러한 시스템을 테스트할 수 있도록 합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 10억 달러 |

| 예측 금액 | 28억 달러 |

| CAGR | 10.6% |

인공지능, 머신러닝, 고성능 컴퓨팅 기술이 계속 발전함에 따라 시뮬레이션 플랫폼은 더 고급화되고 정확하며 확장 가능해졌습니다. 현재의 솔루션은 기본적인 환경 모델링을 넘어 실시간 드라이버-인-더-루프 테스트와 클라우드 기반 시뮬레이션을 지원하여 자율주행 차량 개발의 전체 라이프사이클을 지원합니다. 복잡한 시나리오 생성부터 의사 결정 알고리즘 검증에 이르기까지, 이러한 도구는 업계가 안전한 자율 주행 시스템을 구축하고 테스트하는 방식을 변화시키고 있습니다.

컴포넌트별로 시장은 솔루션과 서비스로 구분됩니다. 2024년에 솔루션 부문은 전 세계 시장의 68%를 차지했으며, 2034년에는 19억 달러의 매출을 올릴 것으로 예상됩니다. 이 부문에서 고급 소프트웨어에 대한 수요는 주로 동적인 가상 환경을 제공할 수 있는 능력 덕분에 빠르게 증가하고 있습니다. 이러한 소프트웨어 플랫폼을 통해 엔지니어들은 다양한 환경 조건에서 교통 시나리오부터 시스템 반응에 이르기까지 모든 것을 시뮬레이션할 수 있습니다. 개발자들은 이러한 도구를 사용하여 실제 문제를 재현하고, 시스템 성능을 최적화하며, 물리적 위험이나 제한 없이 규정 준수를 보장합니다.

전개별로 시장은 온프레미스, 클라우드 기반 및 하이브리드 모델로 나뉩니다. 온프레미스 솔루션은 2024년에 42%의 시장 점유율로 이 부문을 지배했습니다. 높은 데이터 기밀성, 저지연 컴퓨팅 및 시뮬레이션 매개 변수에 대한 완전한 제어를 필요로 하는 기업들은 이러한 설정을 선호합니다. 이는 실시간 시뮬레이션을 수행하거나 민감한 독점 기술을 테스트하는 기업에 특히 해당됩니다.

자율성 수준 측면에서 시장은 레벨 1부터 레벨 5 이상까지로 분류됩니다. 레벨 3 부문인 조건부 자동화는 2024년에 시장 점유율 35%를 차지했습니다. 이 레벨에서는 차량이 특정 조건에서 대부분의 주행 기능을 처리해야 하지만, 요청이 있을 경우 여전히 사람의 개입이 필요합니다. 레벨 3 시스템은 수동 제어와 자동 제어 사이의 더 복잡한 전환 시나리오를 도입하기 때문에, 시뮬레이션은 시스템 간의 안전한 전환을 보장하기 위해 이러한 수명 주기 전환을 테스트하는 데 중요한 역할을 합니다. 이러한 시스템을 지원하는 서비스 부문은 예측 기간 동안 약 9.5%의 CAGR로 성장할 것으로 예상됩니다.

기술별로 보면, 시장은 인공 지능, 기계 학습, AR/VR, 빅 데이터 분석 등을 포함합니다. 인공 지능 부문은 2024년에 25% 이상의 점유율로 시장을 주도했습니다. AI는 지능형 시나리오 생성 및 예측 모델링을 통해 시뮬레이션 환경을 개선합니다. 시뮬레이션의 반응성이 향상되고 현실감이 높아지며 차량, 보행자 및 환경 간의 복잡한 상호 작용을 표현할 수 있게 됩니다. 또한 AI는 시뮬레이션을 효율적으로 확장할 수 있도록 지원하여 개발자가 더 다양한 조건에서 시스템을 훈련하고 검증할 수 있게 합니다.

차량 유형에 따라 시장은 승용차, 상용차, 이륜차 및 배달 로봇으로 분류됩니다. 승용차 부문은 2024년에 4억 9,470만 달러를 기록하며 가장 큰 규모를 차지했습니다. 소비자 차량에 반자율 주행 기능이 점점 더 통합됨에 따라, 적응형 크루즈 컨트롤, 차선 유지, 자율 주차와 같은 운전 보조 기능을 검증하는 시뮬레이션 솔루션은 필수적입니다. 이러한 솔루션은 제조사가 실제 환경 배포 전에 시스템의 신뢰성과 안전성을 확보하는 데 도움을 줍니다.

지역별로 미국은 북미 시장을 선도했으며 2024년 매출은 3억 1,790만 달러였습니다. 이러한 성장은 자율주행 차량의 테스트 및 배포를 지원하는 강력한 혁신 생태계와 유리한 정책에 의해 촉진되고 있습니다. 국내 주요 기업들은 개발 일정을 단축하고 실제 테스트와 관련된 위험을 줄이기 위해 시뮬레이션 기술에 적극적으로 투자하고 있습니다. 또한 미국의 규제 프레임워크는 시뮬레이션 기반의 검증을 촉진하여 미국을 전 세계의 미래를 선도하는 국가로 자리매김하고 있습니다.

주요 시장 참여자들은 시뮬레이션 역량을 강화하기 위해 파트너십, 합병, 인수, R&D 투자 등 전략적 이니셔티브를 추진하고 있습니다. 이러한 노력은 테스트 범위, 확장성 및 정확성을 개선하기 위해 AI, 기계 학습 및 디지털 트윈 기술을 결합한 최신기술 플랫폼을 개발하는 데 집중되어 있습니다. 또한 기업들은 OEM 및 규제 기관과 긴밀히 협력하여 자사의 솔루션을 진화하는 산업 표준에 부합시키고 자율주행차의 상용화를 가속화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 클라우드 플랫폼 공급업체

- 시나리오 생성 및 관리 서비스 제공업체

- 하드웨어 인더 루프(HiL) 및 소프트웨어 인더 루프(SiL) 테스트 제공업체

- 디지털 트윈 및 가상 차량 서비스 제공업체

- 검증 및 안전성 준수 서비스 제공업체

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 공급자의 상황

- 기술과 혁신의 상황

- 현재의 기술 동향

- AI 기반 시나리오 생성 및 테스트

- 실시간 센서 융합 시뮬레이션

- 클라우드 기반 시뮬레이션과 확장성

- 디지털 트윈과 가상 프로토타이핑

- 신흥기술

- 물리 기반 및 데이터 기반 하이브리드 시뮬레이션 모델

- 차량 내 실시간 검증을 위한 엣지 AI

- 생성형 AI를 이용한 합성 데이터 생성

- 데이터 무결성 및 시뮬레이션 추적성을 위한 블록체인

- 첨단 재료 과학

- 현재의 기술 동향

- 가격 동향

- 이용 사례

- 최상의 시나리오

- 주요 뉴스와 대처

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 영향요인

- 성장 촉진요인

- AI 및 머신 러닝 알고리즘의 발전

- ADAS 및 자율 시스템의 복잡성 증가

- 고충실도 센서 모델링 및 환경 현실성 요구

- 가상 테스트의 확장성과 비용 효과

- 업계의 잠재적 위험 및 과제

- 실제 세계의 복잡성과 특수 사례 재현의 어려움

- 고충실도 시뮬레이션에 필요한 높은 계산 자원 요구사항

- 시장 기회

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 생산에 있어서의 에너지 효율

- 환경 친화적 인 노력

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 소프트웨어

- 시나리오 생성 툴

- 센서 시뮬레이션 소프트웨어

- 3D 모델링과 시각화

- 물리 기반 시뮬레이터

- AI 및 ML 시뮬레이션 플랫폼

- 서비스

- 컨설팅 및 통합 서비스

- 지원 및 유지 보수

- 서비스형 시뮬레이션(SaaS)

제6장 시장 추계 및 예측 : 자율성 수준별(2021-2034년)

- 주요 동향

- 레벨 1

- 레벨 2

- 레벨 3

- 레벨 4

- 레벨 5 이상

제7장 시장 추계 및 예측 : 기술별(2021-2034년)

- 주요 동향

- 인공지능

- 머신러닝

- 증강현실/가상현실(AR/VR)

- 빅데이터 분석

- 기타

제8장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 사단

- 해치백

- SUV

- 상용차

- 경상용차

- 대형 상용차

- 버스와 장거리 버스

- 이륜차와 배달 로봇

제9장 시장 추계 및 예측 : 전개별(2021-2034년)

- 주요 동향

- 온프레미스

- 클라우드 기반

- 하이브리드

제10장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 테스트 및 검증

- 트레이닝 및 교육

- 시스템 통합

- 데이터 주석 및 라벨링

- 성능 최적화

제11장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 자동차 OEM

- 1단계 및 2단계 공급업체

- 기술기업

- 정부 및 규제기관

제12장 시장 추계 및 예측 : 지역별(2021-2034년)

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 벨기에

- 스웨덴

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 싱가포르

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제13장 기업 프로파일

- aiMotive

- Altair

- Ansys

- Applied Intuition

- Aptiv

- AVL List

- Cambridge Systematics

- Cognata

- Dassault

- dSPACE

- Foretellix

- Green Hills

- Hexagon

- IPG Automotive

- LG

- LHP Engineering

- MathWorks

- Mechanical Simulation

- rFpro

- Siemens

- Synopsys

The Global Autonomous Vehicle Simulation Solutions Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 2.8 billion by 2034. This market plays a pivotal role in supporting the evolution, evaluation, and deployment of autonomous driving systems. Simulation platforms are now an essential part of the development process, allowing automotive manufacturers and technology providers to test and validate complex automated driving functions in controlled and repeatable virtual environments. These platforms replicate real-world driving scenarios, enabling engineers to identify and resolve critical challenges long before vehicles hit the road. As autonomous systems become increasingly advanced and nuanced, simulation tools are needed across all phases of design, development, and safety validation.

In a world where road safety remains a major concern, simulation technologies are seen as a practical solution to reduce the staggering toll of traffic-related injuries and fatalities. Traditional testing methods are often time-consuming, expensive, and risky, especially when recreating dangerous or uncommon scenarios. Simulations bridge this gap by offering a cost-effective and scalable alternative to physical testing, where thousands of edge cases can be analyzed without endangering human life. With human error accounting for the majority of traffic incidents, there is a growing urgency to develop automated systems that can operate more safely and predictably than human drivers. Simulation-based tools make it possible to test these systems under an infinite variety of conditions, including those that are too hazardous or rare to replicate in the real world.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 10.6% |

As artificial intelligence, machine learning, and high-performance computing technologies continue to progress, simulation platforms have become more advanced, accurate, and scalable. Today's solutions go far beyond basic environmental modeling; they enable real-time, driver-in-the-loop testing and cloud-powered simulations that support the full lifecycle of autonomous vehicle development. From generating complex scenarios to validating decision-making algorithms, these tools are transforming how the industry builds and tests safe autonomous systems.

By component, the market is segmented into solutions and services. In 2024, the solutions segment accounted for 68% of the global market and is expected to generate USD 1.9 billion in revenue by 2034. The demand for advanced software in this segment is growing rapidly, primarily due to its ability to offer dynamic virtual environments. These software platforms allow engineers to simulate everything from traffic scenarios to system responses under various environmental conditions. Developers use these tools to replicate real-world challenges, optimize system performance, and ensure regulatory compliance without physical risks or limitations.

Deployment-wise, the market is divided into on-premises, cloud-based, and hybrid models. On-premises solutions dominated the segment with a 42% market share in 2024. Companies requiring high data confidentiality, low-latency computing, and full control over simulation parameters prefer these setups. This is especially true for firms conducting real-time simulations or testing sensitive, proprietary technologies.

In terms of autonomy level, the market includes level 1 through more than level 5 classifications. The level 3 segment-conditional automation-held 35% of the market in 2024. This level requires the vehicle to handle most driving functions under specific conditions but still relies on human intervention when prompted. As level 3 systems introduce more complex transition scenarios between manual and automated control, simulation plays a critical role in testing these life-cycle transitions to ensure safe handoffs between systems. The services segment supporting these systems is expected to expand at a CAGR of around 9.5% over the forecast period.

By technology, the market covers Artificial Intelligence, Machine Learning, AR/VR, Big Data Analytics, and others. The Artificial Intelligence segment led the market with over 25% share in 2024. AI enhances simulation environments by enabling intelligent scenario generation and predictive modeling. It makes simulations more responsive, realistic, and capable of representing complex interactions among vehicles, pedestrians, and the environment. AI also helps scale simulations efficiently, allowing developers to train and validate systems on a wider range of conditions.

Based on vehicle type, the market is categorized into passenger cars, commercial vehicles, and two-wheelers & delivery bots. The passenger cars segment was the largest in 2024, generating USD 494.7 million. With the rising integration of semi-autonomous features in consumer vehicles, simulation solutions are essential for validating driver-assistance functions like adaptive cruise control, lane keeping, and autonomous parking. These solutions help manufacturers ensure the reliability and safety of these systems before real-world deployment.

Regionally, the U.S. led the North American market with revenue of USD 317.9 million in 2024. This growth is fueled by a robust ecosystem of innovation and favorable policies supporting autonomous vehicle testing and deployment. Leading domestic companies are actively investing in simulation technologies to accelerate their development timelines and reduce risks associated with physical testing. Regulatory frameworks in the U.S. also promote simulation-based validation, positioning the country as a front-runner in the global landscape.

Key market players are pursuing strategic initiatives such as partnerships, mergers, acquisitions, and R&D investments to enhance their simulation capabilities. These efforts are focused on developing cutting-edge platforms that combine AI, machine learning, and digital twin technologies to improve test coverage, scalability, and accuracy. Companies are also working closely with OEMs and regulatory bodies to align their solutions with evolving industry standards and accelerate the commercialization of autonomous vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model.

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Autonomy level

- 2.2.4 Technology

- 2.2.5 Vehicle

- 2.2.6 Deployment

- 2.2.7 Application

- 2.2.8 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Cloud platform providers

- 3.1.1.2 Scenario generation & management service providers

- 3.1.1.3 Hardware-in-the-loop (HiL) & software-in-the-loop (SiL) testing providers

- 3.1.1.4 Digital twin & virtual vehicle service providers

- 3.1.1.5 Validation & safety compliance service providers

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.2.1 Current technological trends

- 3.2.1.1 AI-driven scenario generation and testing

- 3.2.1.2 Real-time sensor fusion simulation

- 3.2.1.3 Cloud-based simulation and scalability

- 3.2.1.4 Digital twin and virtual prototyping

- 3.2.2 Emerging Technologies

- 3.2.2.1 Physics-based and data-driven hybrid simulation models

- 3.2.2.2 Edge AI for in-vehicle real-time validation

- 3.2.2.3 Synthetic data generation using generative AI

- 3.2.2.4 Blockchain for data integrity and simulation traceability

- 3.2.3 Advanced material sciences

- 3.2.1 Current technological trends

- 3.3 Pricing trend

- 3.4 Use cases

- 3.5 Best-case scenario

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East & Africa

- 3.8 Impact on forces

- 3.8.1 Growth drivers

- 3.8.1.1 Advancements in AI and machine learning algorithms

- 3.8.1.2 Growing complexity of ADAS and autonomous systems

- 3.8.1.3 Need for high-fidelity sensor modeling and environmental realism

- 3.8.1.4 Scalability and cost-effectiveness of virtual testing

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Challenges in replicating real-world complexity and edge cases

- 3.8.2.2 High computational requirements for high-fidelity simulations

- 3.8.3 Market opportunity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Energy efficiency in production

- 3.12.3 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Scenario generation tools

- 5.2.2 Sensor simulation software

- 5.2.3 3D modeling and visualization

- 5.2.4 Physics-based simulators

- 5.2.5 AI & ML simulation platforms

- 5.3 Services

- 5.3.1 Consulting & integration services

- 5.3.2 Support & maintenance

- 5.3.3 Simulation-as-a-Service (SaaS)

Chapter 6 Market Estimates & Forecast, By Autonomy level, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Level 1

- 6.3 Level 2

- 6.4 Level 3

- 6.5 Level 4

- 6.6 Level 5 and above

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Artificial intelligence

- 7.3 Machine learning

- 7.4 Augmented reality / virtual reality (AR/VR)

- 7.5 Big data analytics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sadan

- 8.2.2 Hatchback

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicle

- 8.3.2 Heavy commercial vehicle

- 8.3.3 Buses & coaches

- 8.4 Two-wheelers & delivery bots

Chapter 9 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 On-premises

- 9.3 Cloud-based

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Testing & validation

- 10.3 Training & education

- 10.4 System integration

- 10.5 Data annotation & labeling

- 10.6 Performance optimization

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 Automotive OEMs

- 11.3 Tier 1 & tier 2 suppliers

- 11.4 Tech companies

- 11.5 Government & regulatory bodies

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 12.1 North America

- 12.1.1 U.S.

- 12.1.2 Canada

- 12.2 Europe

- 12.2.1 UK

- 12.2.2 Germany

- 12.2.3 France

- 12.2.4 Italy

- 12.2.5 Spain

- 12.2.6 Belgium

- 12.2.7 Sweden

- 12.3 Asia Pacific

- 12.3.1 China

- 12.3.2 India

- 12.3.3 Japan

- 12.3.4 Australia

- 12.3.5 Singapore

- 12.3.6 South Korea

- 12.3.7 Southeast Asia

- 12.4 Latin America

- 12.4.1 Brazil

- 12.4.2 Mexico

- 12.4.3 Argentina

- 12.5 MEA

- 12.5.1 South Africa

- 12.5.2 Saudi Arabia

- 12.5.3 UAE

Chapter 13 Company Profiles

- 13.1 aiMotive

- 13.2 Altair

- 13.3 Ansys

- 13.4 Applied Intuition

- 13.5 Aptiv

- 13.6 AVL List

- 13.7 Cambridge Systematics

- 13.8 Cognata

- 13.9 Dassault

- 13.10 dSPACE

- 13.11 Foretellix

- 13.12 Green Hills

- 13.13 Hexagon

- 13.14 IPG Automotive

- 13.15 LG

- 13.16 LHP Engineering

- 13.17 MathWorks

- 13.18 Mechanical Simulation

- 13.19 rFpro

- 13.20 Siemens

- 13.21 Synopsys