|

시장보고서

상품코드

1766251

자동차용 음향 합성 기술 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Vehicle Sound Synthesis Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

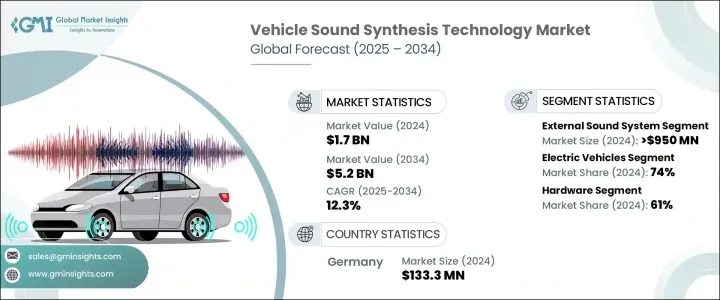

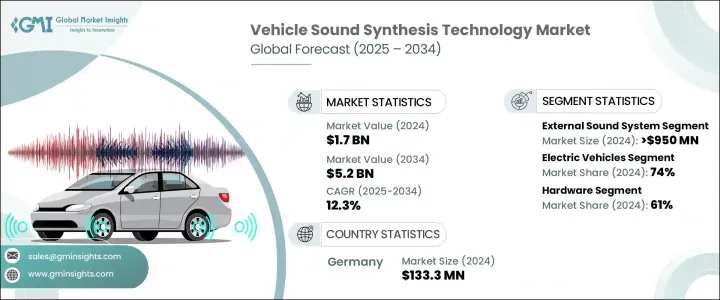

세계의 자동차용 음향 합성 기술 시장 규모는 2024년 17억 달러에 달하고, CAGR 12.3%로 성장해 2034년까지 52억 달러에 이를 것으로 예측되고 있습니다.

전기자동차와 하이브리드 자동차의 보급이 시장 성장을 견인하는 중요한 역할을 수행하고 있습니다. 전기자동차(EV)는 전기 모터를 탑재하고 있기 때문에 놀라울 정도로 조용하고, 차내의 쾌적성에 우위성이 있습니다. 그러나 이 고요함은 보행자, 특히 노인과 장애인에게 차량이 다가오는 것을 들을 수 없다는 위험을 초래합니다. 따라서 미국, EU, 일본, 중국 등 일부 지역에서는 인공음을 발생시키고 보행자에게 EV의 존재를 알리는 음향 차량 경보 시스템(AVAS)이 의무화되고 있습니다. 세계 EV 생산의 급증은 이러한 자동차용 음향 합성 시스템 수요를 더욱 밀어 올리고 있습니다.

또한 자동차 제조업체는 브랜드의 정체성을 높이고 고객과의 감정적인 연결을 만들기 위해 사운드 디자인을 활용합니다. 자동차용 음향 합성은 안전성을 넘어 진화해 지금은 전기자동차의 브랜딩과 감각적인 체험을 풍요롭게 하는데 중요한 역할을 하고 있습니다. 많은 자동차 제조업체들이 사운드 디자이너와 협력하여 엔진과 같은 포효에서 차분한 멜로디에 이르기까지 자체 오디오 프로파일을 개발하고 있습니다. 이 동향은 자동차 음향 합성 기술의 범위를 확대하는 데 도움이 됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 17억 달러 |

| 예측 금액 | 52억 달러 |

| CAGR | 12.3% |

차외 사운드 시스템 분야의 2024년 시장 규모는 9억 5,000만 달러였습니다. 자동 운전 차량과 같은 운전자가 없는 차량은 보행자에게 주의를 촉구하기 위해 기존의 균열을 합성음으로 대체한 음향 합성을 사용하는 경우가 많습니다. 이러한 요구에 따라 외부 사운드 시스템은 자동차의 수익을 창출하는 중요한 기능이 되고 있어, 제조업체는 규제 기준에 준거하기 위해서 대규모 연구개발 및 법적 자원을 소비하고 있습니다.

2024년 시장 점유율은 전기자동차 분야가 74%를 차지했고 압도적이며, 예측 기간 동안도 대폭적인 성장이 예상됩니다. BEV는 인공적인 엔진음을 발생시키는 AVAS 기술에 크게 의존하고 있으며, 보행자에게 보다 안전한 운전환경을 확보하고 있습니다.

독일의 자동차용 음향 합성 기술 2024년의 점유율은 21%, 매출액은 1억 3,330만 달러. 자동차를 더욱 효과적으로 판매하기 위해 사운드 디자인을 활용하고 있습니다. Bosch, Continental, HELLA 등 주요 기업을 보유한 독일의 강력한 자동차 산업은 유럽 전역에서 AVAS 시스템의 보급을 가속화하고 단기간에 표준화와 확장성을 실현했습니다.

자동차용 음향합성기술 시장의 주요 기업으로는 Aptiv, General Motors, Tesla, Harman International, Denso, Continental, Hyundai Motor Company, Volkswagen, Delphi Technologies, BMW 그룹 등이 있습니다. 자동차용 음향 합성 시장에서 각사는 안전성, 브랜드, 고객과의 감정적인 연결을 강화하는 선진적인 사운드 디자인과 음향 솔루션의 개발에 주력하고 있습니다. 또한, 진화하는 규제에 준거를 확실히 하기 위해, 연구개발에 대한 투자를 늘리고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 전기자동차와 하이브리드 자동차의 보급 증가

- 보행자의 안전에 관한 정부의 규제

- 디지털 사운드 디자인의 기술적 진보

- 차내 음향 체험에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- 레거시 플랫폼과 EV 전환과의 통합

- 중소규모 OEM이나 Tier 2 시장에서는 인지도가 낮음

- 시장 기회

- 전기차와 하이브리드차의 확대

- 보행자의 안전에 관한 규제 의무

- 맞춤형 브랜드 사운드 시그니처 수요

- 첨단 차량 아키텍처와의 통합

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 제품별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출과 수입

- 코스트 내역 분석

- 특허 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 친환경적인 노력

- 탄소발자국의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 제품별, 2021-2034년

- 주요 동향

- 내부 사운드 시스템

- 외부 사운드 시스템

제6장 시장 추계 및 예측 : 추진력별, 2021-2034년

- 주요 동향

- 내연기관(ICE)

- 전기자동차(EV)

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드 전기자동차(PHEV)

- 하이브리드 전기자동차(HEV)

제7장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 하드웨어

- 사운드 제너레이터 및 모듈

- 스피커 및 트랜스듀서

- 앰프

- 컨트롤러 및 ECU

- 소프트웨어

- 사운드 디자인 및 프로파일 소프트웨어

- 음성 합성 알고리즘

- 차량 통합 소프트웨어

- 음향 시뮬레이션 및 튜닝 툴

- 서비스

- 전개 및 통합

- 컨설팅

- 지원 및 유지 보수

제8장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제9장 시장 추계 및 예측 : 판매 채널별, 2021-2034년

- 주요 동향

- OEM

- 애프터마켓

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 말레이시아

- 싱가포르

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Aptiv

- Audi

- BMW 그룹

- Brigade Electronics

- BYD Auto Co.

- Continental

- Delphi Technologies

- Denso Corporation

- ECCO Safety Group

- Ford Motor Company

- General Motors Company

- Harman International

- Honda Motor Co.

- Hyundai Motor Company

- KUFATEC

- Mando Hella Electronics Corp

- Nissan Motor Corporation

- STMicroelectronics

- Tesla

- Volkswagen

The Global Vehicle Sound Synthesis Technology Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 5.2 billion by 2034. The widespread adoption of electric and hybrid vehicles plays a major role in driving market growth. Electric vehicles (EVs) are incredibly quiet due to their electric motor, which provides an advantage in cabin comfort. However, this silence also poses a risk to pedestrians, particularly the elderly and disabled, as they may not hear the vehicle approaching. As a result, Acoustic Vehicle Alerting Systems (AVAS) are now mandatory in several regions, including the US, EU, Japan, and China, to generate artificial sounds at low speeds and alert pedestrians of an EV's presence. The surge in global EV production further boosts the demand for these vehicle sound synthesis systems.

Automotive manufacturers are also using sound design to enhance brand identity and create emotional connections with customers. Vehicle sound synthesis has evolved beyond safety and now plays a key role in branding and enriching the sensory experience of electric vehicles. Many car manufacturers are working with sound designers to develop unique audio profiles for their vehicles, ranging from engine-like roars to calming melodies, which also serve to strengthen brand association. This trend is helping expand the scope of vehicle sound synthesis technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 12.3% |

The external sound system segment was valued at USD 950 million in 2024. As autonomous driving systems progress and the shared economy model gains ground, the need for exterior sounds is becoming more critical for human-machine interactions. Vehicles that lack a driver, such as self-driving cars, often rely on sound synthesis to alert pedestrians, replacing the traditional horn with synthetic sounds. This necessity has made external sound systems a crucial, revenue-generating feature in vehicles, with manufacturers dedicating significant research, development, and legal resources to comply with regulatory standards. Since these systems are legally required, automakers are increasingly investing in mass production, making them more affordable and widely available.

The electric vehicle segment dominated the market in 2024, capturing a 74% share, and it is expected to grow significantly during the forecast period. Battery Electric Vehicles (BEVs) operate without an internal combustion engine and are therefore silent by nature, posing a safety concern for pedestrians. To mitigate this risk, BEVs rely heavily on AVAS technology to produce artificial engine sounds, ensuring safer driving conditions for pedestrians. This market segment, which is the most advanced adopter of vehicle sound synthesis, is expected to see continued growth as the demand for EVs expands worldwide.

Germany Vehicle Sound Synthesis Technology Market held a 21% share in 2024 and generated USD 133.3 million. The country has been at the forefront of adopting sound synthesis systems for electric vehicles, with many manufacturers leading the charge. Not only do these companies comply with safety standards, but they also use sound design to market their electric vehicles more effectively. Germany's strong automotive industry, with key players such as Bosch, Continental, and HELLA, has accelerated the widespread adoption of AVAS systems across Europe, making them standardized and scalable within a short period.

Major companies in the Vehicle Sound Synthesis Technology Market include Aptiv, General Motors, Tesla, Harman International, Denso, Continental, Hyundai Motor Company, Volkswagen, Delphi Technologies, and BMW Group. In the vehicle sound synthesis market, companies are focusing on developing advanced sound design and acoustic solutions that enhance the safety, branding, and emotional connection with customers. Many manufacturers have adopted strategic collaborations with sound designers and composers to create bespoke audio profiles for their vehicles. Additionally, they are increasing investments in research and development to ensure compliance with evolving regulations. Partnerships with key Tier 1 suppliers for hardware and control system development are also helping companies expand their capabilities. Furthermore, mass production strategies are being employed to make sound synthesis systems more affordable and widely accessible to consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Component

- 2.2.5 Application

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric and hybrid vehicles

- 3.2.1.2 Regulations by the government for pedestrian safety

- 3.2.1.3 Technological advancements in digital sound design

- 3.2.1.4 Increasing demands for in-car acoustic experiences

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Integration with legacy platforms and EV conversions

- 3.2.2.2 Limited awareness among smaller OEMs and tier-2 markets

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric and hybrid vehicles

- 3.2.3.2 Regulatory mandates for pedestrian safety

- 3.2.3.3 Demand for customizable brand sound signatures

- 3.2.3.4 Integration with advanced vehicle architectures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD, Million, Units)

- 5.1 Key trends

- 5.2 Internal sound system

- 5.3 External sound system

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD, Million, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EV)

- 6.3.1 Battery electric vehicles (BEV)

- 6.3.2 Plug-in hybrid electric vehicles (PHEV)

- 6.3.3 Hybrid electric vehicles (HEV)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 (USD, Million, Units)

- 7.1 Key trends

- 7.2 Hardware

- 7.2.1 Sound generators/modules

- 7.2.2 Speakers/transducers

- 7.2.3 Amplifiers

- 7.2.4 Controllers / ECUs

- 7.3 Software

- 7.3.1 Sound design & profile software

- 7.3.2 Sound synthesis algorithms

- 7.3.3 Vehicle integration software

- 7.3.4 Acoustic simulation & tuning tools

- 7.4 Services

- 7.4.1 Deployment & integration

- 7.4.2 Consulting

- 7.4.3 Support & maintenance

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD, Million, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchbacks

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Sales channel, 2021 - 2034 (USD, Million, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Audi

- 11.3 BMW Group

- 11.4 Brigade Electronics

- 11.5 BYD Auto Co.

- 11.6 Continental

- 11.7 Delphi Technologies

- 11.8 Denso Corporation

- 11.9 ECCO Safety Group

- 11.10 Ford Motor Company

- 11.11 General Motors Company

- 11.12 Harman International

- 11.13 Honda Motor Co.

- 11.14 Hyundai Motor Company

- 11.15 KUFATEC

- 11.16 Mando Hella Electronics Corp

- 11.17 Nissan Motor Corporation

- 11.18 STMicroelectronics

- 11.19 Tesla

- 11.20 Volkswagen