|

시장보고서

상품코드

1766258

자동차 데이터 수익화 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Data Monetization Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

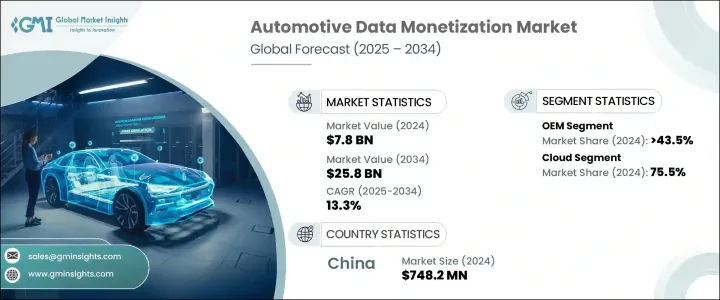

세계의 자동차 데이터 수익화 시장 규모는 2024년 78억 달러에 달했고, CAGR 13.3%로 성장해 2034년까지 258억 달러에 이를 것으로 추정됩니다.

시장의 성장은 주로 커넥티드카의 보급에 의해 초래됩니다. 이 자동차는 내장 센서, 텔레매틱스, 통신 시스템을 통해 방대한 양의 실시간 데이터를 생성합니다. 운전자의 건강 상태와 같은 커넥티드 자동차에서 수집된 데이터는 자동차 제조업체, 보험 제공업체, 차량 운행 회사, 서비스 제공업체에게 새로운 데이터 중심 비즈니스 모델을 개발할 수 있는 기회를 창출합니다.

클라우드 기반 플랫폼과 고급 분석을 활용하여 차량 데이터를 거의 실시간으로 처리, 분석 및 수익화할 수 있는 능력이 점점 더 중요해지고 있습니다. 시스템 통합에 대한 수요 증가에 기여하고 있으며, 예지 보전, 텔레매틱스 기반 보험, 인포테인먼트 서비스 등의 첨단 기술을 통해 기업은 자동차 데이터에서 새로운 수익원을 끌어낼 수 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 78억 달러 |

| 예측 금액 | 258억 달러 |

| CAGR | 13.3% |

2024년 시장 규모는 30억 달러, 점유율은 43.5%로 OEM(상대 브랜드 제조) 부문이 압도적인 지위를 차지하고 있습니다. 데이터 흐름을 제어 및 관리해, OEM은 구독 기반의 기능, 실시간 인포테인먼트, 예지보전 솔루션 등 개인화된 서비스를 제공할 수 있는 독자적인 입장에 있습니다. 또한, OEM은 클라우드 플랫폼에 대한 투자를 늘리고, 사내에서 데이터를 관리하거나, 다른 비즈니스와 협업함으로써 데이터 거버넌스를 엄격하게 관리하고 있습니다.

클라우드 분야는 2024년에 75.5%의 점유율을 차지했습니다. 클라우드 플랫폼은 OEM과 서비스 제공업체가 스토리지 및 처리 능력을 확장할 수 있도록 자동차 데이터 수익화 에코시스템에 도움이 되고 있습니다. 클라우드 인프라는 비용이 많이 드는 On-Premise IT 시스템의 필요성을 줄이고, 데이터 관리를 위한 보다 비용 효율적인 솔루션을 제공하며, 기업이 사용한 만큼만 지불할 수 있게 합니다.

아시아태평양의 자동차 데이터 수익화 산업은 35%의 점유율을 차지했으며, 2024년에는 7억 4,820만 달러를 창출했습니다. 인터넷(IoT) 생태계의 발전은 텔레매틱스 및 V2X(Vehicle-to-Everything) 통신을 포함한 커넥티드 차량 서비스 수요 촉진에 기여하고 있습니다. 중국의 국내 자동차 제조업체는 클라우드 서비스, 자동차 인공지능, 디지털 서비스 플랫폼에 많은 투자를 하고 있으며, 이것이 데이터 주도형 비즈니스 모델의 성장에 박차를 가하고 있습니다.

세계 자동차 데이터 수익화 업계의 주요 기업으로는 Bosch, IBM, Caruso GmbH, Continental, Airlinq Inc., Cox Automotive, Geotab, Harman International, Oracle, Urgent.ly Inc(Otonomo) 등이 있습니다. 시장 포지션을 강화하기 위해 자동차 데이터 수익화 분야의 기업은 OEM, 보험 회사 및 서비스 제공 업체와의 제휴 확대에 주력하고 있습니다. 엔지니어링 빌딩에 투자하고 확장성과 비용 효율적인 데이터 관리 서비스를 제공합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 영향요인

- 성장 촉진요인

- 커넥티드카의 보급

- 예지보전의 성장

- 함대 및 이동성 서비스 확대

- 정부의 규제와 스마트 인프라

- 업계의 잠재적 위험 및 과제

- 데이터 프라이버시 및 보안에 대한 우려

- 표준화의 부족

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 코스트 내역 분석

- 특허 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 친환경적인 노력

- 탄소발자국의 고려

- 이용 사례

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 직접 수익화

- 간접 수익화

제6장 시장 추계 및 예측 : 전개별, 2021-2034년

- 주요 동향

- On-Premise

- 클라우드

제7장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 보험

- 예측 유지보수

- 차량 관리

- 서비스형 모빌리티(MaaS)

- 정부 및 인프라

- 기타

제8장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- OEM

- 함대 오퍼레이터

- 타사 서비스 제공업체

- 기타

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Airlinq

- Bosch

- Caruso

- Continental

- Cox Automotive

- Geotab

- Harman

- High Mobility

- IBM

- INRIX

- Lear

- Masternaut

- Motorq

- Nexar

- Octo Telematics

- Oracle

- The Floow

- Urgent.ly(Otonomo)

- Vinchain

- Vinli

The Global Automotive Data Monetization Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 25.8 billion by 2034. The growth in the market is primarily driven by the widespread adoption of connected vehicles. These vehicles generate vast amounts of real-time data through embedded sensors, telematics, and communication systems. Data gathered from connected cars, including driving behavior, environmental conditions, location, and even driver health, creates opportunities for automotive manufacturers, insurance providers, fleet operators, and service providers to develop new data-driven business models.

By leveraging cloud-based platforms and advanced analytics, the ability to process, analyze, and monetize vehicle data in near real-time has become increasingly essential. Government regulations and infrastructure developments are also contributing to the increasing demand for data transparency and the integration of vehicles with public systems. Additionally, advanced technologies, such as predictive maintenance, telematics-based insurance, and infotainment services, are enabling companies to unlock new revenue streams from automotive data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $25.8 Billion |

| CAGR | 13.3% |

In 2024, the OEM (Original Equipment Manufacturer) segment held a dominant position in the market, valued at USD 3 billion and accounting for a 43.5% share. OEMs are key players in collecting and managing data from connected vehicles, as they integrate technologies that provide direct access to data on engine performance, user preferences, and vehicle diagnostics. By controlling and managing data flow, OEMs are in a unique position to offer personalized services such as subscription-based features, real-time infotainment, and predictive maintenance solutions. Additionally, OEMs are increasingly investing in their cloud platforms to manage data internally or collaborate with other businesses, maintaining strict control over data governance.

The cloud segment held a 75.5% share in 2024. Cloud platforms help in the automotive data monetization ecosystem, as they enable OEMs and service providers to scale storage and processing capabilities, crucial for managing massive volumes of real-time data generated by connected vehicles. These platforms support various services, including predictive maintenance, usage-based insurance (UBI), and mobility management, by enabling real-time analytics and machine learning models. The cloud infrastructure also reduces the need for expensive on-premises IT systems, offering a more cost-effective solution for data management and allowing companies to pay only for what they use. This has made the cloud an increasingly popular choice among businesses seeking efficient, scalable, and affordable solutions for data monetization.

Asia Pacific Automotive Data Monetization Industry held a 35% share and generated USD 748.2 million in 2024. China's rapid adoption of 5G networks and advancements in the Internet of Things (IoT) ecosystem have helped in driving the demand for connected vehicle services, including telematics and vehicle-to-everything (V2X) communication. Domestic vehicle manufacturers in China are investing heavily in cloud services, in-car artificial intelligence, and digital services platforms, which are fueling the growth of data-driven business models. Chinese consumers are more receptive to digital automotive products and services, enabling greater acceptance of connected car technologies and data monetization strategies.

Key players in the Global Automotive Data Monetization Industry include Bosch, IBM, Caruso GmbH, Continental, Airlinq Inc., Cox Automotive, Geotab, Harman International, Oracle, and Urgent.ly Inc (Otonomo). To strengthen their market position, companies in the automotive data monetization sector are focusing on expanding their partnerships with OEMs, insurance firms, and service providers. This approach enhances their ability to offer comprehensive, data-driven solutions. Additionally, many companies are investing in building robust cloud-based platforms to offer scalable and cost-efficient data management services. Emphasizing advanced analytics and machine learning capabilities, these firms aim to provide more valuable insights and predictive features to their clients. Furthermore, companies are developing tailored solutions for specific regions, leveraging local infrastructure, regulations, and customer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Deployment

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of connected vehicles

- 3.2.1.2 Growth in predictive maintenance

- 3.2.1.3 Expansion of fleet and mobility services

- 3.2.1.4 Government regulations and smart infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Direct monetization

- 5.3 Indirect monetization

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Insurance

- 7.3 Predictive maintenance

- 7.4 Fleet management

- 7.5 Mobility-as-a-service (MaaS)

- 7.6 Government & infrastructure

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet operators

- 8.4 Third-party service providers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airlinq

- 10.2 Bosch

- 10.3 Caruso

- 10.4 Continental

- 10.5 Cox Automotive

- 10.6 Geotab

- 10.7 Harman

- 10.8 High Mobility

- 10.9 IBM

- 10.10 INRIX

- 10.11 Lear

- 10.12 Masternaut

- 10.13 Motorq

- 10.14 Nexar

- 10.15 Octo Telematics

- 10.16 Oracle

- 10.17 The Floow

- 10.18 Urgent.ly (Otonomo)

- 10.19 Vinchain

- 10.20 Vinli