|

시장보고서

상품코드

1773337

유기농 유아식 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Organic Baby Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

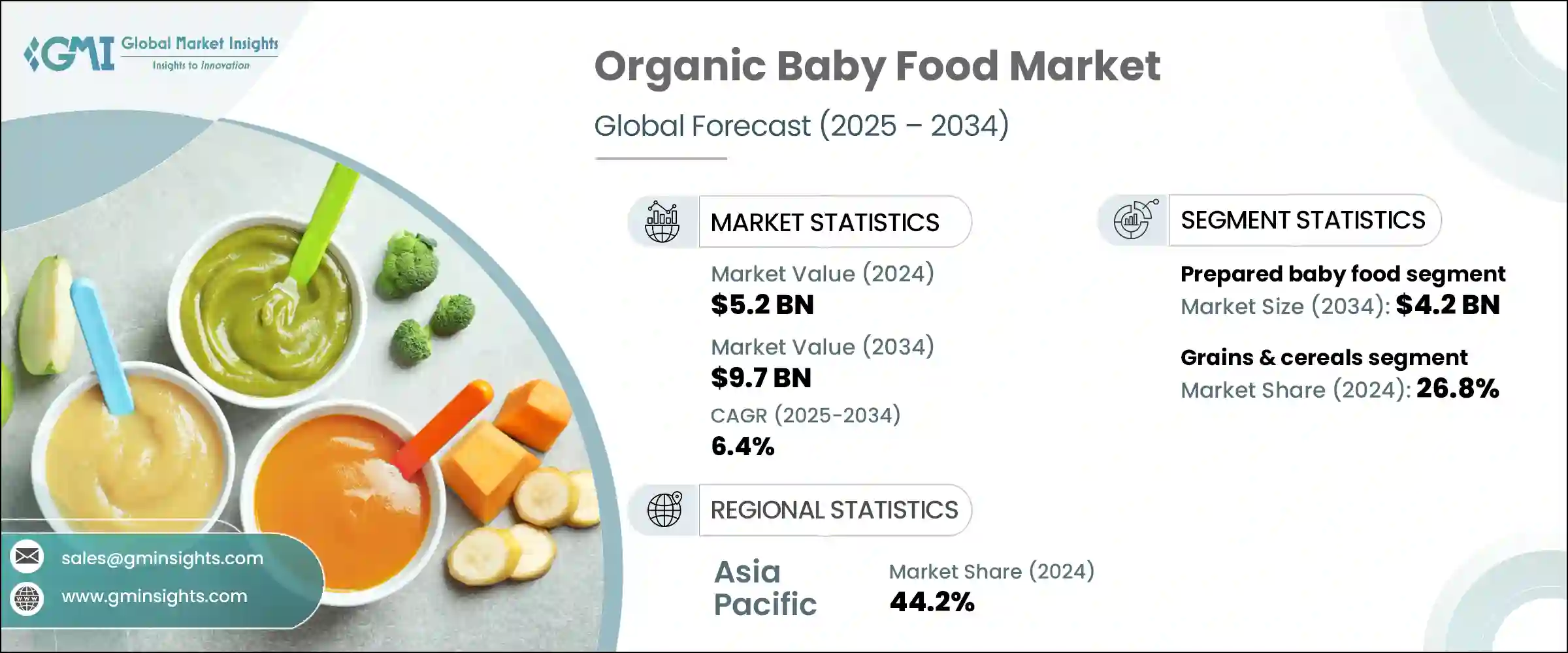

세계의 유기농 유아식 시장은 2024년에는 52억 달러로 평가되었고, 2034년에는 97억 달러에 이를 것으로 예측되며, CAGR 6.4%로 성장할 전망입니다.

이 시장은 주로 소비자 습관의 변화, 아동 영양에 대한 인식의 제고, 생활 방식의 변화에 따라 꾸준한 성장을 계속하고 있습니다. 최근의 부모들, 특히 밀레니얼 세대와 Z 세대의 부모들은 투명성, 클린 라벨 성분, 화학 물질이 함유되지 않은 제품을 우선으로 생각합니다. 유아에게 먹이는 음식에 대해 의식이 높은 육아자들이 늘어나면서 유기농 대체품에 대한 수요가 급증했습니다. 가족들이 아이들의 건강한 성장을 위해 관심을 기울이면서 GMO, 보존제, 인공 첨가물, 합성 농약이 함유되지 않은 제품이 큰 인기를 끌고 있습니다.

가공 식품과 잠재적인 장기적인 건강 영향에 대한 우려로 인해 유기농 유아식이 더 선호되고 있습니다. 소비자들은 안전하고 환경 친화적인 제품을 적극적으로 선택하고 있습니다. 알레르기 및 과민증을 겪는 유아의 수가 증가하는 것도 이러한 시장 동향에 영향을 미치고 있으며, 더 단순한 성분 구성을 요구하는 수요를 촉진하고 있습니다. 급변하는 도시 생활과 가족의 역학 관계의 변화와 함께, 품질을 저하시키지 않으면서도 편리함을 제공하는 영양가 높고 간편한 식품에 대한 수요가 증가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 52억 달러 |

| 예측 금액 | 97억 달러 |

| CAGR | 6.4% |

조리된 유기농 유아식은 가장 빠르게 성장하는 부문으로 부상하고 있으며, 2034년에는 42억 달러 규모로 연평균 6.6%의 성장률을 보일 것으로 예상됩니다. 이 부문은 파우치, 병, 퓨레 등 편리한 형태의 즉석 식사를 선호하는 오늘날의 바쁜 육아 부모들에게 큰 반향을 일으키고 있습니다. 이러한 제품은 특히 시간을 절약하고자 하는 일하는 부모들에게 영양과 편리함의 완벽한 균형을 제공합니다. 직장에 복귀하는 어머니들이 늘면서 이 부문의 수요도 증가했습니다. 재밀봉이 가능한 용기, 친환경 소재 등 포장의 혁신은 휴대성을 높이고 신선도를 유지하며 지속 가능성 가치에 부합함으로써 이 부문의 매력을 더욱 높였습니다.

곡물 및 시리얼 부문은 2024년에 26.8%의 점유율로 우위를 차지했으며, 2034년까지 연평균 6.1%의 성장률을 보일 것으로 예상됩니다. 이 부문은 영양 성분과 죽, 유아용 시리얼, 바, 젖니가 나는 아기를 위한 스낵 등 다양한 식사 형식으로 인해 계속 선두를 달리고 있습니다. 귀리, 기장, 퀴노아, 쌀로 만든 식품은 에너지가 높고 소화가 잘 되며 초기 발달에 적합합니다. 유연성과 유아 식단의 기본 역할을 하는 이러한 식품은 건강하고 천연 성분으로 아이들을 키우고자 하는 보호자들에게 꾸준히 사랑받고 있습니다.

2024년 44.2%의 시장 점유율을 차지했습니다. 인도네시아, 중국, 인도 등 국가에서는 출생률 증가와 중산층 인구 확대로 인해 시장이 성장하고 있습니다. 유아 영양에 대한 화학 첨가물의 위험성에 대한 인식이 높아지면서 도시와 준도시 지역에서 구매 패턴이 변화하고 있습니다. 해당 지역 정부들은 식품 안전 기준을 강화하고 유기농 인증 규정을 엄격히 적용해 소비자 신뢰를 높이고 있습니다. 또한 인터넷 접근성 향상과 전자상거래 확산으로 프리미엄 유기농 유아식이 원격 지역에서도 쉽게 구매 가능해지며 고객 기반이 확대되고 있습니다.

전 세계 유기농 유아식 시장은 Hero Group, Danone S.A., The Hain Celestial Group, Abbott Laboratories, Nestle S.A. 등 주요 업체들이 통합된 상태로 유지되고 있습니다. 유기농 유아식 부문의 선도 기업들은 시장 지위를 강화하기 위해 식물성 제형, 알레르기 유발 성분이 없는 제품, 특정 발달 요구에 맞는 강화 혼합 제품 등 제품 포트폴리오를 확대하는 데 주력하고 있습니다. 많은 기업들이 클린 라벨에 대한 기대를 충족하고 브랜드 신뢰를 높이기 위해 지속 가능한 농업 파트너십 및 추적 기술에 투자하고 있습니다. 또한 기업들은 전자상거래의 붐을 활용하여 특히 신흥 시장에서 유통 범위를 확대하고 있습니다. 소아과 의사 및 영양사와의 협력은 제품의 신뢰성을 높이는 데 도움이 되며, 혁신적이고 친환경적인 포장 솔루션은 장기적인 지속 가능성 목표를 지원합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 부모의 건강 의식 증가

- 전통 식품 내 화학 잔류물에 대한 우려 증가

- 알레르기 및 식품 민감성 발생률 증가

- 여성 근로자 수 증가

- 업계의 잠재적 위험 및 과제

- 유기농 제품의 프리미엄 가격

- 보존제 부재로 인한 짧은 유통기한

- 유기농 원료 공급망의 과제

- 시장 기회

- 신흥 시장으로 확대

- 전자상거래 성장 및 소비자 직접 판매 모델

- 제품의 혁신과 다양화

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 세계의 유기 인증 기준

- 지역에 의한 규제의 차이

- 북미(USDA 유기농)

- 유럽(EU 유기 규제)

- 아시아태평양의 규제 틀

- 라벨 요건과 주장

- 안전 기준 및 시험 프로토콜

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 소비자 행동 분석

- 구입 패턴과 선호도

- 유기농 제품에 프리미엄을 지불하는 의욕

- 구매결정에 대한 인구통계학적 영향

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 조리된 유아식

- 건조 유아식

- 유아용 분유

- 기타

제6장 시장 추계 및 예측 : 식재별(2021-2034년)

- 주요 동향

- 곡물 및 시리얼

- 과일

- 야채

- 유제품

- 육류 및 닭고기

- 기타

제7장 시장 추계 및 예측 : 연령별(2021-2034년)

- 주요 동향

- 영아(0-6개월)

- 유아(6-12개월)

- 유아(12-24개월)

- 어린이(24개월 이상)

제8장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 슈퍼마켓 및 대형 슈퍼마켓

- 전문점

- 편의점

- 온라인 소매

- 약국 및 드럭스토어

- 기타

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제10장 기업 프로파일

- Abbott Laboratories

- Nestle SA

- Danone SA

- Hero Group

- The Hain Celestial Group, Inc.

- Kraft Heinz Company

- Plum Organics(Campbell Soup Company)

- Once Upon a Farm

- HiPP GmbH &Co. Vertrieb KG

- Amara Organic Foods

- Babylife Organics

- Little Spoon

- Serenity Kids

- Sprout Organic Foods, Inc.

- Tiny Organics

The Global Organic Baby Food Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 9.7 billion by 2034. The market continues to witness steady growth, largely due to shifting consumer habits, greater awareness about child nutrition, and evolving lifestyle dynamics. Modern-day parents, especially those from millennial and Gen Z demographics, are prioritizing transparency, clean-label ingredients, and chemical-free products. As more caregivers become conscious about the foods they give to their infants, the demand for organic alternatives has surged. Products free from GMOs, preservatives, artificial ingredients, and synthetic pesticides are gaining significant popularity as families focus on providing a healthier start in life.

Concerns over processed food and potential long-term health impacts have made organic baby food more desirable. Consumers are actively choosing options that are both safe and environmentally responsible. The increasing number of infants experiencing allergies and sensitivities has also played a role in this market trend, pushing demand for simpler ingredient profiles. Coupled with fast-paced urban living and changing family dynamics, there's a greater need for nutritious yet hassle-free feeding choices that cater to convenience without compromising quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $9.7 Billion |

| CAGR | 6.4% |

Prepared organic baby food is emerging as the fastest-growing category and is forecasted to be valued at USD 4.2 billion by 2034, growing at 6.6% CAGR. This segment resonates well with today's busy caregivers who prefer ready-to-serve meals in convenient formats like pouches, jars, and purees. These products offer the perfect balance of nutrition and ease, especially for working parents looking to save time. With more mothers rejoining the workforce, demand for this category has climbed. Innovations in packaging, such as resealable containers and eco-conscious materials, have further boosted its appeal by offering portability, preserving freshness, and aligning with sustainability values.

The grains and cereals segment held the dominant share in 2024 at 26.8% and is expected to grow at a CAGR of 6.1% through 2034. This segment continues to lead due to its nutritional profile and versatility in meal formats like porridge, infant cereals, bars, and teething snacks. Foods made with oats, millet, quinoa, and rice are high in energy, easily digestible, and suitable for early development. Their flexibility and foundational role in baby diets make them a consistent favorite for caregivers looking to nourish their children with wholesome, natural ingredients.

Asia Pacific Organic Baby Food Market held a 44.2% share in 2024. Countries such as Indonesia, China, and India are seeing a rise in birth rates alongside expanding middle-class populations. Heightened awareness about the risks of chemical additives in baby nutrition is influencing buying patterns across urban and semi-urban areas. Governments across the region are also raising food safety standards and enforcing stricter organic certification norms, which boost consumer trust. Moreover, increased internet access and e-commerce adoption are making premium organic baby food products available in more remote regions, helping grow the customer base.

The Global Organic Baby Food Market remains consolidated, with major players including Hero Group, Danone S.A., The Hain Celestial Group, Abbott Laboratories, and Nestle S.A. To enhance their market position, leading companies in the organic baby food sector are focusing on expanding product portfolios through plant-based formulations, allergen-free variants, and fortified blends for specific developmental needs. Many are investing in sustainable farming partnerships and traceability technologies to meet clean-label expectations and enhance brand trust. Businesses are also capitalizing on the e-commerce boom to widen their distribution footprint, especially in emerging markets. Collaborations with pediatricians and nutritionists help drive product credibility, while innovative, eco-friendly packaging solutions support long-term sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Ingredients type trends

- 2.2.3 Age group

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness among parents

- 3.2.1.2 Growing concerns over chemical residues in conventional food

- 3.2.1.3 Increasing incidence of allergies and food sensitivities

- 3.2.1.4 Rising number of working women

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Premium pricing of organic products

- 3.2.2.2 Limited shelf life due to absence of preservatives

- 3.2.2.3 Supply chain challenges for organic ingredients

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 E-commerce growth and direct-to-consumer models

- 3.2.3.3 Product innovation and diversification

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global organic certification standards

- 3.4.2 Regional Regulatory Variations

- 3.4.2.1 North America (USDA organic)

- 3.4.2.2 Europe (EU organic regulations)

- 3.4.2.3 Asia pacific regulatory framework

- 3.4.3 Labeling requirements and claims

- 3.4.4 Safety standards and testing protocols

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Consumer behavior analysis

- 3.13.1 Purchasing patterns and preferences

- 3.13.2 Willingness to pay premium for organic products

- 3.13.3 Demographic influences on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Prepared baby food

- 5.3 Dried baby food

- 5.4 Infant milk formula

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Ingredients Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Grains & cereals

- 6.3 Fruits

- 6.4 Vegetables

- 6.5 Dairy products

- 6.6 Meat & poultry

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Infants (0–6 months)

- 7.3 Babies (6–12 months)

- 7.4 Toddlers (12–24 months)

- 7.5 Children (24+ months)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets & hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies & drug stores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Nestle S.A.

- 10.3 Danone S.A.

- 10.4 Hero Group

- 10.5 The Hain Celestial Group, Inc.

- 10.6 Kraft Heinz Company

- 10.7 Plum Organics (Campbell Soup Company)

- 10.8 Once Upon a Farm

- 10.9 HiPP GmbH & Co. Vertrieb KG

- 10.10 Amara Organic Foods

- 10.11 Babylife Organics

- 10.12 Little Spoon

- 10.13 Serenity Kids

- 10.14 Sprout Organic Foods, Inc.

- 10.15 Tiny Organics