|

시장보고서

상품코드

1797813

4D 이미징 레이더 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)4D Imaging Radar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

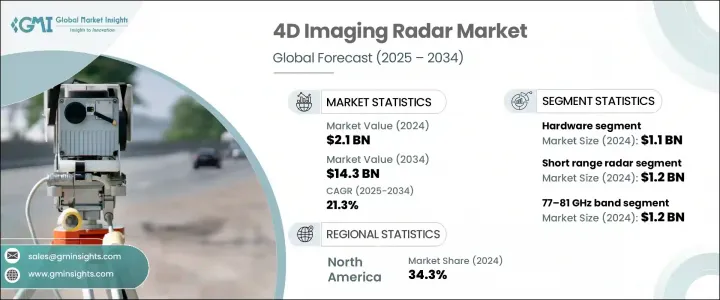

세계의 4D 이미징 레이더 시장 규모는 2024년 21억 달러에 달했고, CAGR 21.3%로 성장해 2034년까지 143억 달러에 이를 것으로 예측됩니다.

이 산업은 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 21.3%로 성장할 것으로 보입니다. 이러한 강력한 성장의 배경으로는 자율주행에 대한 관심 증가, 스마트 모빌리티 솔루션의 확대, ADAS 투자 확대, 군사 시스템, 무인 항공기(UAV), 산업 자동화 등의 이용 사례 확대가 있습니다. 4D 이미징 레이더는 거리, 앙각, 속도 및 방위각을 실시간으로 분석할 수 있으므로 안전하고 중요한 용도에서 높은 가치를 발휘합니다. 이 레이더는 고해상도 환경 매핑, 정확한 물체 추적, 안개, 연기, 어둠 등의 악조건에서 신뢰할 수 있는 성능을 제공합니다. BVLOS 운영에 대한 대응이 진행됨에 따라 UAV 및 드론으로의 이러한 시스템의 통합이 가속화되어 더욱 안전하고 자율적인 비행이 가능해지고 있습니다.

게다가 제조업과 물류로 자동화가 점차 추진되고 있기 때문에 특히 시각 기반 시스템이 고전하는 어려운 동적 환경에서는 로봇 공학에서 레이더 강화 지각 수요가 높아지고 있습니다. 기존의 광학 시스템은 저조도, 먼지, 안개, 연기가 가득 찬 조건 하에서 종종 한계에 직면하여 성능 저하 및 안전 위험을 초래합니다. 이에 비해 4D 이미징 레이더는 환경의 제약에 관계없이 고해상도 공간 매핑과 물체 추적으로 안정적인 성능을 발휘합니다. 이 기능은 자동 지게차, 창고 로봇, 자율 배송 시스템 등 정확성과 신뢰성이 필수적인 용도에서 매우 중요합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 21억 달러 |

| 예측 금액 | 143억 달러 |

| CAGR | 21.3% |

2024년 하드웨어 분야는 11억 달러의 평가액으로 세계 4D 이미징 레이더 시장을 선도했습니다. 이러한 이점은 안테나 아키텍처의 획기적인 발전, 특히 MIMO 시스템 및 위상 어레이 기술의 채택에 의해 지원됩니다. 레이더와 비전 시스템 및 라이더와 같은 보완적인 감지 기술을 통합해야 할 필요성이 높아짐에 따라 고급 모듈러 하드웨어 솔루션의 복잡성과 수요에 박차를 가하고 있습니다. 자동차 및 드론 기반 방어 용도의 진화하는 수요에 부응하기 위해 하드웨어 제조업체는 확장 가능한 MIMO 기반 아키텍처와 머신러닝 중심의 교정 방법에 주력하고 있습니다.

단거리 레이더 분야는 2024년에 12억 달러를 창출했습니다. 근거리 레이더가 선호되는 것은 근접 감지, 사각 감시, 차량 탑재 제스처 인식 등의 기능을 실현하는데 중요한 역할을 하기 때문입니다. 이 분야는 레이더 분해능과 목표 추적 능력의 최근 향상으로 이익을 얻었으며, 이러한 소형 모듈은 근거리에서 고정밀 작업에 이상적입니다. 또한 소형화 노력과 효율적인 전력 사용으로 폭넓은 소비자용 및 산업용 시스템에 쉽게 통합할 수 있는 비용 효율적인 레이더 유닛이 탄생하고 있습니다.

미국의 4D 이미징 레이더 시장은 2024년에 6억 4,620만 달러를 창출해 2034년까지 연평균 복합 성장률(CAGR) 21%로 강력한 기세를 유지할 것으로 예측됩니다. ADAS(첨단 운전 지원 시스템)의 급속한 전개와 대도시권에서의 자율주행차 테스트 프로그램의 진화가 이 성장에 기여하고 있습니다. 차세대 플랫폼에 저지연, 고정밀 레이더 시스템을 통합하는 것에 주목이 높아지고 있으며, 기술 제공업체는 시스템 레벨에서의 기술 혁신을 진행하고 있습니다. 도시 지역의 로봇 택시 프로그램과 함대 운영자는 요구되는 응답 시간과 높은 각도 정밀도를 충족할 수 있는 4D 레이더 솔루션을 선호합니다.

4D 이미징 레이더 산업경쟁 구도를 형성하는 주요 기업은 Renesas Electronics Corporation, Aptiv PLC, ZF Friedrichshafen AG, Mobileye, Robert Bosch GmbH, Infineon Technologies AG, Oculii, Texas Instruments Incorporated, Continental AG, Arbe Robotics Ltd., Hella Aglaia Mobile Vision GmbH, Metawave Corporation, NXP Semiconductors, Ainstein, Vayyar Imaging Ltd. 등이 있습니다. 이러한 주요 기업들은 다양한 이동성과 자동화 에코시스템에 걸쳐 혁신을 주도하고 레이더 통합을 위한 미래 표준을 형성하고 있습니다. 4D 이미징 레이더 시장의 주요 기업은 특히 인공지능 주도 신호 처리, 확장 가능한 하드웨어 모듈, 적응형 빔포밍 기술에 대한 전략적 R&D 투자를 통해 시스템 성능 향상에 주력하고 있습니다. 시장 침투를 강화하기 위해 기업은 자동차 OEM, UAV 제조업체, 로봇 기업과 업계를 가로 지르는 제휴를 맺고 레이더 솔루션을 새로운 모빌리티 플랫폼에 통합하려고합니다. 단거리 로봇 엔지니어링 및 장거리 방어 용도를 포함한 용도별 요구에 맞는 맞춤화는 공급업체의 차별화에 도움이 됩니다. IP 포트폴리오를 확대하고 시장 출시까지의 시간을 단축하기 위해 M&A도 활용되고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 미래의 전망

- 제조업자

- 리셀러

- 영향요인

- 성장 촉진요인

- 새로운 전자기기의 가격 상승

- 지속가능성과 전자폐기물에 대한 우려

- 가전제품 확대

- 산업기기 및 의료기기 사용 증가

- 타사 수리업체의 성장

- 업계의 잠재적 위험 및 과제

- 급속한 기술 진부화

- OEM 부품 및 툴에 대한 접근 제한

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTLE 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 새로운 비즈니스 모델

- 컴플라이언스 요건

- 지속가능성 대책

- 소비자 감정 분석

- 특허 및 지적재산 분석

- 지정학과 무역의 역학

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 시장 집중 분석

- 지역별

- 주요 기업의 경쟁 벤치마킹

- 재무실적의 비교

- 수익

- 이익률

- 연구개발

- 제품 포트폴리오 비교

- 제품 라인업의 넓이

- 기술

- 혁신

- 지리적 존재의 비교

- 세계 실적 분석

- 서비스 네트워크의 범위

- 지역별 시장 침투율

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 재무실적의 비교

- 주요 발전, 2021-2024년

- 합병 및 인수

- 파트너십 및 협업

- 기술적 진보

- 확대 및 투자 전략

- 지속가능성에 대한 노력

- 디지털 변혁의 대처

- 신흥기업/스타트업 기업경쟁 구도

제5장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 하드웨어

- 트랜시버 모듈

- 안테나 및 빔포밍 유닛

- 신호 프로세서

- 기타

- 소프트웨어

- 물체 검출 소프트웨어

- 센서 퓨전 소프트웨어

- 레이더 이미지 및 매핑 소프트웨어

- 기타

- 서비스

제6장 시장 추계 및 예측 : 레이더 거리별, 2021-2034년

- 주요 동향

- 단거리 레이더

- 중거리 레이더

- 장거리 레이더

제7장 시장 추계 및 예측 : 주파수 대역별, 2021-2034년

- 주요 동향

- 24GHz대

- 60GHz대

- 77-81GHz대

- 기타

제8장 시장 추계 및 예측 : 전개 플랫폼별, 2021-2034년

- 주요 동향

- 지상 차량

- 승용차

- 상용차

- 기타

- 고소 작업차

- 드론 및 무인 항공기

- 유인 항공기

- 해양 플랫폼

- 해군 함정

- 상선

- 기타

- 기타

제9장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- ADAS(첨단 운전 지원 시스템)

- 모니터링 및 보안

- 산업 자동화

- 스마트 인프라

- 헬스케어 모니터링

- 기타

제10장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 자동차

- 항공우주 및 방어

- 헬스케어

- 산업

- 기타

제11장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제12장 기업 프로파일

- 세계 주요 기업

- Aptiv PLC

- Continental AG

- NXP Semiconductors

- Texas Instruments Incorporated

- ZF Friedrichshafen AG

- 지역의 주요 기업

- 북미

- Mobileye(Intel)

- Uhnder

- Magna International

- 유럽

- Hella Aglaia Mobile Vision GmbH

- Robert Bosch GmbH

- Infineon Technologies AG

- 아시아태평양

- Renesas Electronics Corporation

- Huawei

- Smart Radar System

- 북미

- 디스랩터/틈새 기업

- Ainstein

- Arbe Robotics Ltd.

- Metawave Corporation

- Oculii

- Vayyar Imaging Ltd.

The Global 4D Imaging Radar Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 14.3 billion by 2034. The industry is set to grow at a CAGR of 21.3% between 2025 and 2034. This robust growth is fueled by rising interest in autonomous driving, increased deployment of smart mobility solutions, expanded investment in ADAS, and widening use cases in military systems, unmanned aerial vehicles (UAVs), and industrial automation. The ability of 4D imaging radar to deliver real-time analysis of range, elevation, velocity, and azimuth makes it highly valuable for safety-critical applications. These radars enable high-resolution environmental mapping, precise object tracking, and reliable performance in adverse visibility conditions like fog, smoke, or darkness. Increasing support for BVLOS operations is accelerating the integration of these systems in UAVs and drones, allowing for safer and more autonomous flights.

Moreover, the increasing push toward automation across manufacturing and logistics is driving demand for radar-enhanced perception in robotics, especially in challenging, dynamic environments where vision-based systems struggle. Traditional optical systems often face limitations in low-light, dusty, foggy, or smoke-filled conditions, leading to performance drops and safety risks. In contrast, 4D imaging radar delivers consistent performance with high-resolution spatial mapping and object tracking, regardless of environmental constraints. This capability is critical in applications such as automated forklifts, warehouse robots, and autonomous delivery systems, where precision and reliability are essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 billion |

| Forecast Value | $14.3 billion |

| CAGR | 21.3% |

In 2024, the hardware segment led the global 4D imaging radar market with a valuation of USD 1.1 billion. This dominance is supported by breakthroughs in antenna architecture, particularly the adoption of MIMO systems and phased array technologies, which significantly boost range, precision, and detection clarity. The growing need to integrate radar with complementary sensing technologies, such as vision systems and lidar, is adding to the complexity and demand for advanced modular hardware solutions. To cater to the evolving demands of automotive and drone-based defense applications, hardware manufacturers are focusing on scalable MIMO-based architectures and machine-learning-driven calibration methods.

The short-range radar segment generated USD 1.2 billion in 2024. The preference for short-range radar is driven by its critical role in enabling features such as proximity detection, blind spot monitoring, and in-vehicle gesture recognition. The segment benefits from recent improvements in radar resolution and target tracking capabilities, making these compact modules ideal for high-precision tasks at close distances. Additionally, miniaturization efforts and efficient power usage have resulted in cost-effective radar units that are easily embedded into a wide array of consumer and industrial systems.

U.S. 4D Imaging Radar Market generated USD 646.2 million in 2024 and is expected to maintain strong momentum at a CAGR of 21% throughout 2034. Rapid deployment of advanced driver-assistance systems and evolving autonomous vehicle testing programs across major metropolitan areas are contributing to this growth. The increasing focus on integrating low-latency and high-accuracy radar systems in next-generation platforms is pushing technology providers to innovate at the system level. Urban robotaxi programs and fleet operators are prioritizing 4D radar solutions capable of meeting demanding response times and high angular accuracy.

Major players shaping the competitive landscape of the 4D Imaging Radar Industry include Renesas Electronics Corporation, Aptiv PLC, ZF Friedrichshafen AG, Mobileye, Robert Bosch GmbH, Infineon Technologies AG, Oculii, Texas Instruments Incorporated, Continental AG, Arbe Robotics Ltd., Hella Aglaia Mobile Vision GmbH, Metawave Corporation, NXP Semiconductors, Ainstein, and Vayyar Imaging Ltd. These companies continue to lead innovation and shape future standards for radar integration across a variety of mobility and automation ecosystems. Leading companies in the 4D imaging radar market are focusing on advancing system capabilities through strategic R&D investments, especially in AI-driven signal processing, scalable hardware modules, and adaptive beamforming techniques. To enhance market penetration, firms are forming cross-industry alliances with automotive OEMs, UAV manufacturers, and robotics companies to integrate radar solutions into new mobility platforms. Customization for use-specific needs, such as short-range robotics or long-range defense applications, helps vendors differentiate. Mergers and acquisitions are also being leveraged to expand IP portfolios and accelerate time-to-market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Radar range trends

- 2.2.3 Frequency band trends

- 2.2.4 Deployment platform trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cost of new electronics

- 3.2.1.2 Sustainability and e-waste concerns

- 3.2.1.3 Expansion of consumer electronics

- 3.2.1.4 Increasing industrial and medical device usage

- 3.2.1.5 Growth of third-party repair providers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Rapid technological obsolescence

- 3.2.2.2 Limited access to OEM parts and tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Transceiver modules

- 5.2.2 Antenna & beamforming units

- 5.2.3 Signal processors

- 5.2.4 Others

- 5.3 Software

- 5.3.1 Object detection software

- 5.3.2 Sensor fusion software

- 5.3.3 Radar imaging & mapping software

- 5.3.4 Others

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Radar Range, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Short-range radar

- 6.3 Medium-range radar

- 6.4 Long-range radar

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 24 GHz band

- 7.3 60 GHz band

- 7.4 77-81 GHz band

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Deployment Platform, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Ground Vehicles

- 8.2.1 Passenger Vehicles

- 8.2.2 Commercial Vehicles

- 8.2.3 Others

- 8.3 Aerial Platforms

- 8.3.1 Drones & UAVs

- 8.3.2 Manned Aircraft

- 8.4 Marine Platforms

- 8.4.1 Naval Vessels

- 8.4.2 Commercial Ships

- 8.4.3 Others

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Advanced driver assistance systems (ADAS)

- 9.3 Surveillance & security

- 9.4 Industrial automation

- 9.5 Smart infrastructure

- 9.6 Healthcare monitoring

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Aerospace and Defense

- 10.4 Healthcare

- 10.5 Industrial

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Aptiv PLC

- 12.1.2 Continental AG

- 12.1.3 NXP Semiconductors

- 12.1.4 Texas Instruments Incorporated

- 12.1.5 ZF Friedrichshafen AG

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 Mobileye (Intel)

- 12.2.1.2 Uhnder

- 12.2.1.3 Magna International

- 12.2.2 Europe

- 12.2.2.1 Hella Aglaia Mobile Vision GmbH

- 12.2.2.2 Robert Bosch GmbH

- 12.2.2.3 Infineon Technologies AG

- 12.2.3 Asia-Pacific

- 12.2.3.1 Renesas Electronics Corporation

- 12.2.3.2 Huawei

- 12.2.3.3 Smart Radar System

- 12.2.1 North America

- 12.3 Disruptors / Niche Players

- 12.3.1 Ainstein

- 12.3.2 Arbe Robotics Ltd.

- 12.3.3 Metawave Corporation

- 12.3.4 Oculii

- 12.3.5 Vayyar Imaging Ltd.