|

시장보고서

상품코드

1464279

디지털 송금 시장(2024-2028년)Global Digital Money Transfer & Remittances: 2024-2028 |

||||||

| 주요 통계 | |

|---|---|

| 총 거래액(2024년): | 3조 9,000억 달러 |

| 총 거래액(2028년): | 6조 5,000억 달러 |

| 시장 성장률(2024-2028년): | 41% |

| 예측 기간 : | 2024-2028년 |

이 보고서는 세계의 디지털 송금 시장을 조사했으며, 디지털 송금 도입 및 발전을 형성하는 주요 추진 요인과 과제, 오픈 뱅킹, 스테이블 코인, CBDC, 모바일 머니 등 각종 금융 기술 동향, 사용자 수, 거래건수, 거래액의 추이 및 예측, 모바일, 온라인, 국내 및 국제, 인스턴트 페이먼트 등의 각종 구분 및 지역 및 주요 국가별 상세 분석, 주요 벤더의 경쟁 리더보드 등을 정리했습니다.

SAMPLE VIEW

시장 데이터 및 예측 보고서

시장 동향 및 전략 보고서

시장 데이터 및 예측 보고서

이 설문 조사 제품군에는 85개의 테이블과 40,000개가 넘는 데이터 포인트의 예측 데이터 세트에 대한 액세스가 포함되어 있습니다. 설문조사 스위트에는 다음 측정항목이 포함됩니다.

- 송금 유저수

- 송금거래 총건수

- 송금거래 총액

이 지표는 다음 주요 시장에 대해 제공됩니다.

- 모바일 국내 송금

- 온라인 국내 송금

- 모바일 국제송금

- 온라인 국제송금

- 소비자용 인스턴트 지불

주니퍼 리서치 인터랙티브 예측(Excel)에는 다음과 같은 기능이 있습니다.

- 통계 분석 : 데이터 기간 동안 모든 지역 및 국가에 대해 표시되는 특정 측정 항목을 검색할 수 있는 이점이 있습니다. 그래프는 쉽게 변경할 수 있으며 클립보드로 내보낼 수 있습니다.

- 국가별 데이터 도구 : 이 도구를 사용하면 예측 기간 동안 모든 지역 및 국가 측정 항목을 볼 수 있습니다. 검색창에 표시되는 측정 항목을 필터링할 수 있습니다.

- 국가별 비교 도구 : 특정 국가를 선택하고 비교할 수 있습니다. 이 도구에는 그래프를 내보내는 기능이 포함되어 있습니다.

- What-if 분석 : 5가지 대화형 시나리오를 통해 예측 지표를 고유한 전제조건과 비교할 수 있습니다.

목차

시장 동향 및 전략

제1장 중요 포인트 및 전략적 추천 사항

- 중요 포인트

- 전략적 권장 사항

제2장 국제 디지털 송금

- 국제 디지털 송금

- 블록체인 및 스테이블 코인

- 블록체인

- 스테이블 코인

- CBDC

- 국제 결제의 인스턴트 지불

- CBDC

- 디지털 송금의 AI

- 국제송금 시장에 혁신을 일으키는 요인

- 모바일 머니

- 네오뱅크

- 결제 게이트웨이

- 마이크로 파이낸스

- 시사 문제

- P2P 플랫폼별 디지털 송금 개선

제3장 국내 디지털 송금 및 모바일 머니

- 국내 디지털 송금 및 모바일 머니

- 현재 시장 상황 및 주목할만 한 동향

제4장 디지털 송금 : 주요 송금 경로 및 지역 분석

- 디지털 송금 : 주요 송금 경로 및 지역 분석

- 디지털 송금 : 지역 분석 및 미래 전망

- 북미

- 라틴아메리카

- 서유럽

- 중유럽 및 동유럽

- 인도 아대륙

- 극동 및 중국

- 기타 아시아태평양

- 아프리카 및 중동

- 디지털 송금에 관한 국가별 준비 상황 : 히트 맵 분석

경쟁 리더보드

제1장 디지털 송금 플랫폼 제공업체: Juniper Research 경쟁 리더보드

제2장 디지털 송금 플랫폼 제공업체의 기업 프로파일

- 디지털 송금 플랫폼 제공업체 공급업체 프로파일

- Amdocs

- Comviva

- Huawei

- Infosys EdgeVerve

- Interac

- Mastercard

- Nium

- OBOPAY

- PayPal

- RemitONE

- Ripple

- Seamless Distributions Systems

- Telepin Software

- Thunes

- Visa

- 주니퍼 리서치 리더보드 평가조사방법

제3장 디지털 송금 서비스 제공업체 : Juniper Research 경쟁 리더보드

- 송금업체 공급업체 프로파일

- Currencies Direct

- CurrencyFair

- FairFX

- Instarem

- Moneycorp

- MoneyGram

- OFX

- Remitly

- Ria

- Skrill

- Western Union

- Wise

- WorldRemit

- Xoom

- 주니퍼 리서치 리더보드 평가조사방법

데이터 및 예측

제1장 시장 개요

- 디지털 송금 : 서문

- 국내 디지털 송금 및 모바일 머니

제2장 조사 방법의 전제 및 요약

- 조사 방법 및 전제

- 즉시 지불

제3장 디지털 송금 : 예측 개요

- 디지털 송금의 이용 예측

- 모바일 및 온라인 디지털 송금 활성 사용자

- 모바일 및 온라인 송금의 총 거래 건수

- 모바일 및 온라인 송금의 총 거래액

제4장 국내 송금 : 시장 예측 및 중요 포인트

- 국내 송금 예측

- 국내 송금 활성 사용자

- 국내송금의 총거래건수

- 국내송금의 총거래액

제5장 국제송금 : 시장 예측 및 중요 포인트

- 국제송금 예측

- 국제 송금 활성 사용자

- 국제송금의 총거래건수

- 국제송금의 총거래액

제6장 소비자를 위한 즉각적인 결제 : 시장 예측 및 중요 포인트

- 소비자를 위한 즉각적인 결제 예측

- 거래액 : 국내 소비자

- 거래액 : 국외 소비자

- 거래액 : 소비자

| KEY STATISTICS | |

|---|---|

| Total transaction value in 2024: | $3.9tn |

| Total transaction value in 2028: | $6.5tn |

| 2024 to 2028 market growth: | 41% |

| Forecast period: | 2024-2028 |

Overview

Our "Digital Money Transfer & Remittances" research report provides a detailed evaluation and analysis of both the domestic and international markets, including the impact of instant payments, blockchain and CBDC and other initiatives disrupting the market such as mobile money, neobanks, mobile wallets and payment gateways. The research also considers the future challenges within digital money transfer and remittances, and emerging trends in the space.

In addition, this report covers market opportunities; providing strategic insights into the development of digital money transfer capabilities in line with new technologies, such as AI and machine learning.

It highlights future opportunities and technologies that are important for vendors, merchants and financial institutions to consider when adapting money transfer and digital remittances for the future, incorporating aspects such as Open Banking, instant transfers and CBDCs.

The report also positions 29 vendors across two Juniper Research Competitor Leaderboards, for digital money transfer and digital remittance; providing an invaluable resource for stakeholders seeking to understand the competitive landscape in the market.

The research suite contains a detailed dataset; providing forecasts for 61 countries across a wide range of different metrics, including total revenue from mobile domestic money transfer and online domestic money transfer to international mobile and online money transfer and instant transfers.

Key Features

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the digital money transfer and remittances space, including:

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Future strategic directions and market outlook for digital money transfer and remittances vendors.

- Key drivers and benefits of digital money transfer and remittances for vendors, including an increase in global digital acceptance, the implementation of AI and ML, the analysis of real-time data and the impact on the digital money transfer and remittance space, as well as how money transfer platforms can improve the digital money transfer space.

- Country Readiness Index: Comprehensive coverage featuring country-level market analysis on the future of the market in a select 61 countries split by 8 key regions; thoroughly analysing each country's potential success in the digital money transfer and remittance market, with insight into current and future trends, paired with supplementary 5-year forecast data.

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Benchmark Industry Forecasts: Includes forecasts for the total money transfer for both domestic and international money movement, as well as the total money sent through consumer instant payment. This data is split by our 8 key forecast regions and 61 countries.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment for 29 vendors in the digital money transfer and remittance space, via two Juniper Research Competitor Leaderboards.

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the digital money transfer and remittances space, including:

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Future strategic directions and market outlook for digital money transfer and remittances vendors.

- Key drivers and benefits of digital money transfer and remittances for vendors, including an increase in global digital acceptance, the implementation of AI and ML, the analysis of real-time data and the impact on the digital money transfer and remittance space, as well as how money transfer platforms can improve the digital money transfer space.

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Country Readiness Index: Comprehensive coverage featuring country-level market analysis on the future of the market in a select 61 countries split by 8 key regions; thoroughly analysing each country's potential success in the digital money transfer and remittance market, with insight into current and future trends, paired with supplementary 5-year forecast data.

- Benchmark Industry Forecasts: Includes forecasts for the total money transfer for both domestic and international money movement, as well as the total money sent through consumer instant payment. This data is split by our 8 key forecast regions and 61 countries.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment for 29 vendors in the digital money transfer and remittance space, via two Juniper Research Competitor Leaderboards.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the "Digital Money Transfer & Remittances" market includes access to the full set of forecast data of 85 tables and over 40,000 datapoints. Metrics in the research suite include:

- Total number of Money Transfer Users

- Total Number of Money Transfer Transactions

- Total Money Transfer Transaction Value

These metrics are provided for the following key market verticals:

- Mobile Domestic Money Transfer

- Online Domestic Money Transfer

- Mobile International Money Transfer

- Online International Money Transfer

- Consumer Instant Payments

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios

Market Trends & Strategies Report

Juniper Research's new report examines the "Digital Money Transfer & Remittances" market landscape in detail; assessing current trends and factors shaping the market such as the growing use and anticipation surrounding different financial technologies such as Open Banking, stablecoins, CBDCs and mobile money, and the use of AI and machine learning to improve the money transfer space. The report delivers comprehensive analysis of the strategic opportunities for digital money transfer and remittance providers within various markets; addressing key verticals and developing challenges, and how stakeholders should navigate these.

Competitor Leaderboard Report

Juniper Research's Competitor Leaderboards provide detailed evaluation and market positioning for 29 leading vendors in the "Digital Money Transfer & Remittances" space. The vendors are positioned either as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments. The vendors in the Digital Money Transfer Leaderboard include:

- Amdocs

- Comviva

- Huawei

- Infosys EdgeVerve

- Interac

- Mastercard

- Nium

- OBOPAY

- PayPal

- RemitONE

- Ripple

- Seamless Distribution Systems

- Telepin Software

- Thunes

- Visa

The vendors in the Digital Remittances Competitor Leaderboard include:

- Currencies Direct

- CurrencyFair

- FairFX

- InstaREM

- Moneycorp

- MoneyGram

- OFX

- Remitly

- Ria

- Skrill

- Western Union

- Wise

- WorldRemit

- Xoom

Backed by a robust and comprehensive scoring methodology, Juniper Research's Competitor Leaderboard allows readers to gain greater insight into leading market players; enabling them to view which companies have the highest market prospects and the strategies being implemented.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. International Digital Money Transfer & Remittances

- 2.1. International Digital Money Transfer & Remittances

- 2.1.1. Definition and Scope

- 2.2. Blockchain and Stablecoins

- 2.2.1. Blockchain

- i. Examples of Blockchain Use in International Digital Money Transfer

- ii. Advantages of Blockchain in International Digital Money Transfer

- Figure 2.1: Advantages of Blockchain in Digital Money Transfer

- 2.2.2. Stablecoins

- i. Benefits of Stablecoins in Cross-border Digital Money Transfer

- ii. Perceived Risks of Stablecoins in Cross-border Digital Money Transfer

- 2.2.3. CBDCs

- 2.2.1. Blockchain

- 2.3. Instant Payments within Cross-border Payments

- 2.4. CBDCs

- 2.4.1. Project mBridge

- 2.5. Artificial Intelligence in Digital Money Transfer

- 2.6. Players Disrupting the International Remittance Market

- 2.6.1. Mobile Money

- 2.6.2. Neobanks

- 2.6.3. Payment Gateways

- 2.6.4. Microfinance

- 2.6.5. Current Events

- 2.6.6. Improving Digital Money Transfer through P2P Platforms

- i. Additional Services

- ii. Partnerships and Open APIs

3. Domestic Digital Money Transfer & Mobile Money

- 3.1. Domestic Digital Money Transfer and Mobile Money

- 3.1.1. Definitions and Scope

- 3.2. Current Market Status and Trends to Watch

4. Digital Money Transfer: Key Remittance Corridors & Regional Analysis

- 4.1. Digital Money Transfer: Key Remittance Corridors & Regional Analysis

- Figure 4.1: Juniper Research's 8 Key Regions Definition

- Table 4.2: Juniper Research Digital Money Transfer Country Readiness Index: Scoring Criteria

- Figure 4.3: Juniper Research Country Readiness Index - Digital Money Transfer Remittances

- Figure 4.4: Juniper Research's Competitive Web: Digital Money Transfer Regional Opportunities

- 4.2. Digital Money Transfer: Regional Analysis & Future Outlook

- 4.2.1. North America

- i. US

- ii. Canada

- 4.2.2. Latin America

- i. Argentina

- ii. Brazil

- iii. Colombia

- iv. Mexico

- 4.2.3. West Europe

- i. Denmark

- ii. France

- iii. Germany

- iv. Italy

- v.Netherlands

- vi. Norway

- vii. Portugal

- viii. Spain

- ix. Sweden

- x. UK

- 4.2.4. Central & East Europe

- i. Poland

- ii. Russia

- iii. Turkey

- 4.2.5. Indian Subcontinent

- i. India

- 4.2.6. Far East & China

- i. China

- ii. Japan

- iii. South Korea

- 4.2.7. Rest of Asia Pacific

- i. Australia

- ii. Singapore

- 4.2.8. Africa & Middle East

- i. Saudi Arabia

- ii. South Africa

- 4.2.9. Digital Money Transfer & Remittances Country Readiness: Heatmap Analysis

- Table 4.5: Juniper Research's Country Readiness Index: North America

- Table 4.6: Juniper Research's Country Readiness Index: Latin America

- Table 4.7: Juniper Research's Country Readiness Index: West Europe

- Table 4.8: Juniper Research's Country Readiness Index: Far East & China

- Table 4.9: Juniper Research's Country Readiness Index: Indian Subcontinent

- Table 4.10: Juniper Research's Country Readiness Index: Rest of Asia Pacific

- Table 4.11: Juniper Research's Country Readiness Index: Africa & Middle East

- 4.2.1. North America

Competitor Leaderboard

1. Juniper Research Digital Money Transfer Platform Providers Competitor Leaderboard

- 1.1. Why Read This Report?

- Table 1.1: Juniper Research Competitor Leaderboard Vendors: Digital Money Transfer Platform Providers

- Figure 1.2: Juniper Research Competitor Leaderboard: Digital Money Transfer Platform Providers

- Table 1.3: Juniper Research Competitor Leaderboard: Digital Money Transfer Platform Providers

- Table 1.4: Juniper Research Competitor Leaderboard Digital Money Transfer Platform Providers - Heatmap

2. Digital Money Transfer Platform Providers Company Profiles

- 2.1. Digital Money Transfer Platform Providers Vendor Profiles

- 2.1.1. Amdocs

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.2. Comviva

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level Views of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.3. Huawei

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.4. Infosys EdgeVerve

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.5. Interac

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.6. Mastercard

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.1: Mastercard Send Platform

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.7. Nium

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.8. OBOPAY

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.9. PayPal

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Strategic Opportunities

- 2.1.10. RemitONE

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.11. Ripple

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Deevelopment Opportunities

- 2.1.12. Seamless Distributions Systems

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.13. Telepin Software

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.14. Thunes

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.15. Visa

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- Table 2.2: Juniper Research Digital Money Transfer Leaderboard Assessment Criteria

- 2.1.1. Amdocs

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

3. Juniper Research Competitor Leaderboard for Digital Money Transfer Remittance Providers

- Table 3.1: Juniper Research Competitor Leaderboard: Digital Remittance Providers

- Figure 3.2: Juniper Research Competitor Leaderboard - Digital Remittance Vendors

- Table 3.3: Juniper Research Competitor Leaderboard: Digital Remittance Vendor Ranking

- Table 3.4: Juniper Research Competitor Leaderboard: Digital Remittance Vendors - Heatmap

- 3.1. Money Transfer Remittance Providers Vendor Profiles

- 3.1.1. Currencies Direct

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.2. CurrencyFair

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.3. FairFX

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.4. Instarem

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.5. Moneycorp

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.6. MoneyGram

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.7. OFX

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research View: Strategic Recommendations & Key Development Opportunities

- 3.1.8. Remitly

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.9. Ria

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.10. Skrill

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.11. Western Union

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.12. Wise

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.13. WorldRemit

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.14. Xoom

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- Table 3.5: Juniper Research Digital Remittance Assessment Criteria

- 3.1.1. Currencies Direct

- 3.2. Juniper Research Leaderboard Assessment Methodology

- 3.2.1. Limitations & Interpretations

Data & Forecasting

1. Market Overview

- 1.1. Digital Money Transfer Introduction

- 1.1.1. Definition and Scope

- 1.2. Domestic Digital Money Transfer and Mobile Money

- 1.2.1. Definitions and Scope

2. Methodology Assumptions and Summary

- 2.1. Introduction

- 2.2. Methodology & Assumptions

- 2.2.1. Market Sizing: Introduction

- 2.2.2. Methodology

- 2.2.3. Indicators

- 2.3. Instant Payments

- 2.3.1. Introduction

- Figure 2.1: Digital Money Transfer & Remittances Market Forecast Methodology

- Figure 2.2: Consumer Instant Payments Methodology

- 2.3.1. Introduction

3. Digital Money Transfer & Remittances: Forecast Summary

- 3.1. Digital Money Transfer & Remittances Usage Forecasts

- 3.1.1. Mobile & Online Digital Money Transfer Active Users

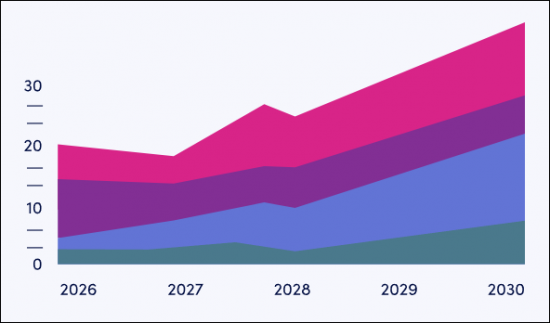

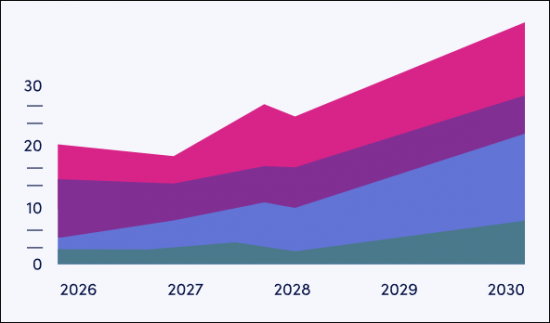

- Figure & Table 3.1: Total Number of Active Digital Money Transfer Users (m), Split by 8 Key Regions, 2023-2028

- 3.1.2. Mobile & Online Money Transfer & Remittances Total Transaction Volume

- Figure & Table 3.2: Total Digital Money Transfer & Remittance Transactions per annum (m), Split by 8 Regions, 2023-2028

- 3.1.3. Mobile & Online Money Transfer & Remittances Total Transaction Value

- Figure & Table 3.3: Total Value of Mobile & Online Money Transfer per annum ($m), Split by 8 Key Regions, 2023-2028

- 3.1.1. Mobile & Online Digital Money Transfer Active Users

4. Domestic Money Transfer: Market Forecasts & Key Takeaways

- 4.1. Domestic Money Transfer Forecasts

- 4.1.1. Domestic Money Transfer Active Users

- Figure & Table 4.1: Mobile & Online Domestic Money Transfer, Active Users (m), Split by 8 Key Regions, 2023-2028

- 4.1.2. Domestic Money Transfer Total Transactions Volumes

- Figure & Table 4.2: Total Number of Mobile & Online Domestic Money Transfer Transactions per annum (m), Split by 8 Key Regions, 2023-2028

- 4.1.3. Domestic Money Transfer Total Transaction Values

- Figure & Table 4.3: Total Value of Mobile & Online Domestic Transaction per annum ($m), Split by 8 Key Regions, 2023-2028

- 4.1.1. Domestic Money Transfer Active Users

5. International Money Transfer & Remittances: Market Forecasts & Key Takeaways

- 5.1. International Money Transfer & Remittances Forecasts

- 5.1.1. International Money Transfer Active Users

- Figure & Table 5.1: Mobile & Online International Money Transfer, Active Users (m), Split by 8 Key Regions, 2023-2028

- 5.1.2. International Money Transfer Total Transaction Volume

- Figure & Table 5.2: Total Number of Mobile & Online International Money Transfer Transactions per annum (m), Split by 8 Key Regions, 2023-2028

- 5.1.3. International Money Transfer Total Transaction Value

- Figure & Table 5.3: Total Value of Mobile & Online International Transactions per annum ($m), Split by 8 Key Regions, 2023-2028

- 5.1.1. International Money Transfer Active Users

6. Consumer Instant Payments: Market Forecasts & Key Takeaways

- 6.1. Consumer Instant Payments Forecast

- 6.1.1. Value of Domestic Consumer Instant Payments

- Figure & Table 6.1: Total Value of Instant Payments Domestic Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.2. Value of Cross-border Consumer Instant Payments

- Figure & Table 6.2: Total Value of Instant Payments Cross-border Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.3. Value of Consumer Instant Payments

- Figure & Table 6.3: Total Value of Instant Payments Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.1. Value of Domestic Consumer Instant Payments