|

시장보고서

상품코드

1784319

외과용 봉합사 시장 : 제품별, 유형별, 용도별, 최종 사용자별, 지역별 예측(-2030년)Surgical Sutures Market by Product (Suture Thread (Natural, Synthetic ), Automated Suturing Device), Type, Application, End User & Region - Global Forecast to 2030 |

||||||

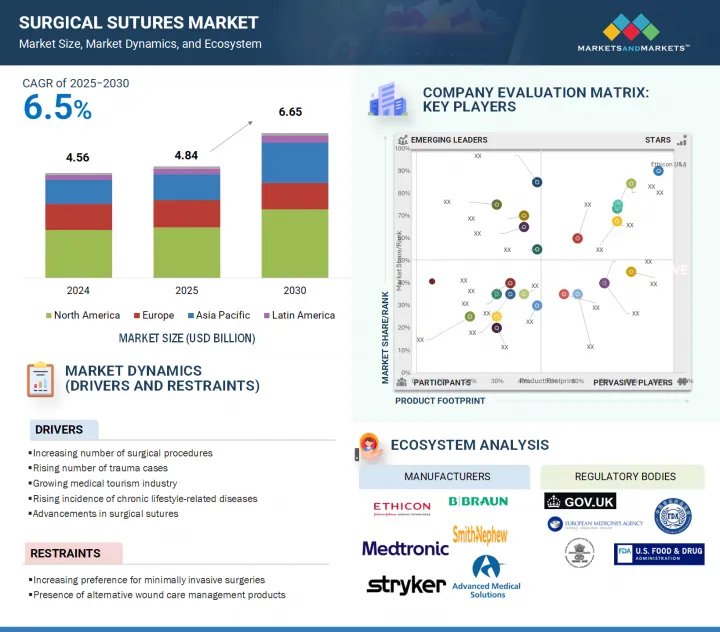

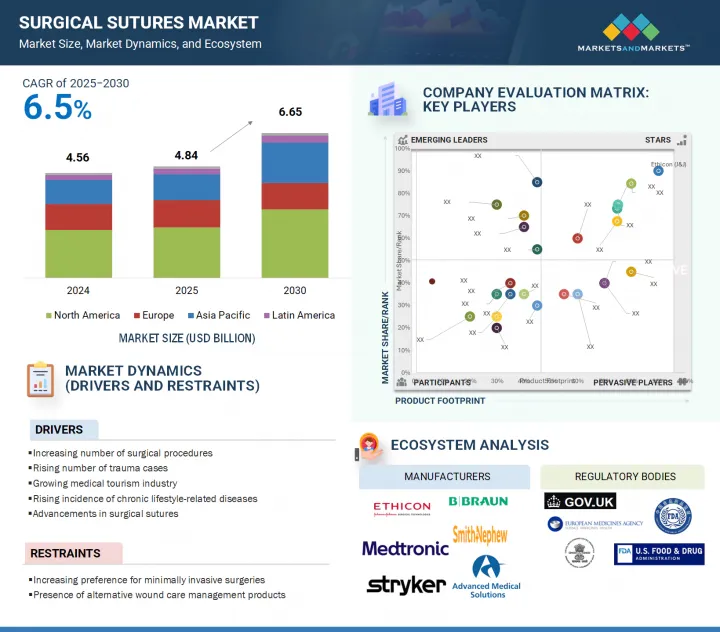

세계의 외과용 봉합사 시장 규모는 2025년 48억 4,000만 달러에서 2030년에는 66억 5,000만 달러에 이를 것으로 예측되며, 예측 기간 중 CAGR은 6.5%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 유형별, 용도별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

전 세계 수술 절차의 미래 성장은 주로 인구 고령화와 관련된 만성 질환, 특히 당뇨병, 심혈관 질환 및 근골격계 질환의 유병률 증가에 기인할 수 있으며, 이러한 질환은 모두 수술적 개입이 필요한 경우가 많습니다. 또한, 외상 및 사고의 발생률이 증가하면서 봉합사 수요도 증가하고 있습니다. 흡수성, 항균성, 가시 봉합사 등의 혁신은 수술 결과를 크게 개선하고 감염 위험을 완화하여 시장 성장을 촉진합니다. 또한, 고급 봉합 방법이 필요한 로봇 및 최소 침습 수술 기법의 부상은 상처 봉합에 대한 정밀성의 필요성을 강조하며 시장을 계속 발전시키고 있습니다.

봉합사는 다양한 수술 분야에서 상처 봉합에 필수적인 요소로, 봉합사 시장에서 상당한 점유율을 차지하고 있습니다. 봉합사는 기존 개복 수술과 최소 침습 수술에서 중요한 역할을 하며, 모든 봉합 시스템의 초석으로 사용됩니다. 봉합사의 우위는 다목적성, 다양한 재료 선택, 성능 및 효능을 향상시키기 위한 지속적인 혁신에 기인할 수 있습니다. 흡수성, 비흡수성, 항균 코팅, 바브형 등 고급 봉합사는 일반, 정형외과, 부인과, 심혈관 수술에서 적용 범위를 크게 넓혔습니다. 외과의는 높은 인장 강도, 최소한의 조직 반응성, 예측 가능한 흡수율을 가진 봉합사를 선호합니다. 이에 대응하여 주요 제조업체들은 진화하는 수술 분야의 요구를 충족하기 위해 이러한 특성을 지속적으로 개선하고 있습니다.

외과용 봉합사 시장은 우수한 취급 특성, 강화된 매듭 안정성 및 다양한 수술 분야에서의 적응성으로 인해 멀티 필라멘트 봉합사가 주를 이루고 있습니다. 여러 가닥이 엮이거나 꼬인 멀티 필라멘트 봉합사는 모노 필라멘트 봉합사보다 강도와 유연성이 뛰어나 정밀한 조직 접근 시술에 특히 적합합니다. 취급이 쉽고 매듭 유지력이 뛰어나 수술 시간을 최소화하는 데 매우 중요하며, 이는 수요가 많은 수술 환경에서 큰 장점입니다. 또한, 멀티 필라멘트 봉합사는 부드럽고 유연하기 때문에 조직 자극을 최소화하여 위장, 심혈관 및 부인과 수술을 포함한 복잡한 외과적 개입에 이상적입니다.

수술 건수의 증가는 주로 두 가지 중요한 요인에 기인할 수 있습니다: 인구 고령화 및 당뇨병, 비만, 심혈관 질환 등 만성 질환의 높은 유병률. 이러한 질환은 합병증을 관리하고 환자의 삶의 질을 개선하기 위해 종종 외과적 개입이 필요합니다. 고령 인구가 증가하면서 인구 통계학적 미래가 변화함에 따라 의료 시스템은 수술 솔루션에 대한 수요가 증가하고 있습니다. 이러한 인구 통계학적 동향 외에도 미국은 광범위한 병원 네트워크와 수술 치료에 대한 접근성 개선을 포함한 정교한 의료 인프라를 자랑합니다. 이러한 접근성으로 인해 수술 건수가 증가하여 적극적인 의료 관리로 전환하는 추세가 확대되고 있습니다. 또한, 미국은 Ethicon 및 Medtronic과 같은 선도적인 기업들이 위치하고 있어 의료 혁신의 허브로 인정받고 있습니다. 이러한 기업들은 환자의 치료 결과를 개선하기 위해 첨단 외과용 봉합사를 개발하는 데 앞장서고 있습니다. 이들이 제공하는 제품에는 제거할 필요가 없는 흡수성 봉합사, 매듭을 짓지 않고도 조직을 안전하게 봉합할 수 있어 수술 과정을 단순화하는 바브 봉합사, 수술 후 감염 위험을 줄이는 항균 코팅 봉합사 등 혁신적인 제품이 포함됩니다. 이러한 최신 봉합 기술의 지속적인 도입은 진화하는 수술 절차의 미래에 중요한 역할을 하고 있습니다. 이는 미국에서 수술 기술과 환자 치료의 개선에 대한 의지를 강조하는 것입니다.

본 보고서에서는 세계의 외과용 봉합사 시장에 대해 조사했으며, 제품별, 유형별, 용도별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 규제 상황

- 기술 분석

- 업계 동향

- 밸류체인 분석

- 공급망 분석

- 무역 분석

- 가격 분석

- Porter's Five Forces 분석

- 인접 시장 분석

- 특허 분석

- 생태계 분석

- 주된 회의 및 이벤트(2025-2026년)

- 사례 연구

- 고객의 비즈니스에 영향을 미치는 동향 및 혼란

- 주요 이해관계자와 구매 기준

- 투자 및 자금조달 시나리오

- 미충족 요구 및 최종 사용자의 기대

- 외과용 봉합사 시장에서의 AI의 영향

- 미국 관세의 영향(2025년) : 외과용 봉합사 시장

제6장 외과용 봉합사 시장(제품별)

- 소개

- 봉합사

- 자동 봉합 장치

제7장 외과용 봉합사 시장(유형별)

- 소개

- 멀티 필라멘트 봉합사

- 모노 필라멘트 봉합사

제8장 외과용 봉합사 시장(용도별)

- 소개

- 심장혈관 수술

- 일반 외과

- 부인과 수술

- 정형외과

- 안과 수술

- 미용 정형외과

- 기타

제9장 외과용 봉합사 시장(최종 사용자별)

- 소개

- 병원

- 외래수술센터(ASC)

- 클리닉 및 진료소

제10장 외과용 봉합사 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 거시경제 전망

- GCC 국가

- 기타

제11장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석(2022-2025년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- ETHICON, INC.

- MEDTRONIC

- B. BRAUN SE

- ADVANCED MEDICAL SOLUTIONS GROUP PLC(AMS GROUP)

- HEALTHIUM MEDTECH LIMITED

- BOSTON SCIENTIFIC CORPORATION

- ZIMMER BIOMET HOLDINGS, INC.

- STRYKER

- SMITH NEPHEW

- CONMED CORPORATION

- INTERNACIONAL FARMACEUTICA SA DE CV

- CORZA MEDICAL

- DEMETECH CORPORATION

- UNISUR LIFECARE PVT. LTD

- ASSUT EUROPE

- 기타 기업

- RESORBA MEDICAL GMBH

- KATSAN KATGUT SANAYI VE TIC. AS

- SUTUMED CORP.

- FUTURA SURGICARE PVT. LTD.

- GMD GROUP

- LOTUS SURGICALS PVT LTD

- BIOSINTEX

- MERIL LIFE SCIENCES PVT. LTD.

- MELLON MEDICAL

- AQMEN MEDTECH

- ANCHORA MEDICAL LTD.

제13장 부록

HBR 25.08.13The global surgical sutures market is projected to reach USD 6.65 billion by 2030 from USD 4.84 billion in 2025, at a CAGR of 6.5% during the forecast period."

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The growth in the global surgical procedures landscape can be attributed primarily to the increasing prevalence of chronic conditions associated with an aging demographic, notably diabetes, cardiovascular diseases, and musculoskeletal disorders, all of which frequently necessitate surgical intervention. Furthermore, the rising incidence of trauma and accidents contributes to an uptick in suture demand. Innovations such as absorbable, antibacterial, and barbed sutures significantly improve surgical outcomes and mitigate infection risks, thereby catalyzing market growth. Additionally, the ascent of robotic and minimally invasive surgical techniques, which require advanced suturing methodologies, continues to propel the market forward, highlighting the need for precision in wound closure.

"By product, the suture threads segment had the largest market share in the surgical sutures market in 2024."

Suture thread is a critical component for wound closure across various surgical disciplines, thereby securing a substantial share of the surgical sutures market. It plays a vital role in traditional open surgeries and minimally invasive techniques, serving as the cornerstone of any suturing system. The thread's dominance can be attributed to its versatility, the diverse selection of available materials, and ongoing innovations to enhance its performance and efficacy. Advanced suture threads-such as absorbable, non-absorbable, antibacterial-coated, and barbed varieties-have significantly broadened their applicability in general, orthopedic, gynecological, and cardiovascular surgery. Surgeons prefer threads that exhibit high tensile strength, minimal tissue reactivity, and predictable absorption rates. In response, leading manufacturers continually refine these properties to meet the evolving demands of the surgical landscape.

"By type, the multifilament sutures segment held the largest share in the surgical sutures market in 2024."

The surgical suture market is predominantly characterized by multifilament sutures, owing to their superior handling properties, enhanced knot security, and adaptability across various surgical domains. Comprising multiple braided or twisted strands, multifilament sutures exhibit greater strength and pliability than monofilament options, making them particularly well-suited for precise tissue approximation procedures. Their ease of manipulation and excellent knot retention are crucial in minimizing surgical time, a significant advantage in high-demand operating environments. Furthermore, the soft and flexible nature of multifilament sutures minimizes tissue irritation, rendering them ideal for intricate surgical interventions, including gastrointestinal, cardiovascular, and gynecological operations.

"The US is expected to grow at the highest CAGR in the North American surgical sutures market during the study period."

The increasing number of surgical procedures can be primarily attributed to two significant factors: an aging population and a high prevalence of chronic health conditions such as diabetes, obesity, and cardiovascular diseases. These conditions often necessitate surgical intervention to manage complications and improve patients' quality of life. As the demographic landscape shifts with a growing elderly population, healthcare systems face heightened demand for surgical solutions. In addition to these demographic trends, the US boasts a sophisticated healthcare infrastructure that includes extensive hospital networks and improved access to surgical care. This accessibility has led to a rise in the number of surgeries performed, reflecting a broader shift towards proactive healthcare management. Moreover, the US is recognized as a hub for medical innovation, largely due to the presence of leading companies like Ethicon and Medtronic. These firms are at the forefront of developing advanced surgical sutures to enhance patient outcomes. Their offerings include innovative products such as absorbable sutures, which eliminate the need for removal; barbed sutures, which simplify the surgical process by allowing for secure tissue closure without the need for knots; and antibacterial-coated sutures, which help reduce the risk of postoperative infections. The continuous introduction of these cutting-edge suture technologies plays a crucial role in the evolving landscape of surgical procedures. It underscores the commitment to improving surgical techniques and patient care in the US.

A breakdown of the primary participants (supply-side) for the surgical sutures market referred to in this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3-25%

- By Designation: C-level-45%, Director Level-35%, and Others-20%

- By Region: North America-27%, Europe-25%, Asia Pacific-30%, Latin America- 8%, Middle East & Africa-10% .

Prominent players in the surgical sutures market are Ethicon [Johnson & Johnson] (US), Medtronic (Ireland), B.Braun SE (Germany), Advanced Medical Solutions Group Plc (UK), Healthium MedTech Limited (India), Boston Scientific Corporation (US) Zimmer Biomet Holdings, Inc. (US), Stryker (US), Smith+Nephew (UK), Conmed Corporation (US), Internacional Farmaceutica S.A. de C.V. (Mexico), Corza Medical (US), DemeTECH Corporation (US), Unisur Lifecare Pvt. Ltd (India), Assut Europe (Italy), RESORBA Medical GmbH (Germany), KATSAN Katgut Sanayi ve Tic. A.S. (Turkey), Sutumed Corp. (US), Mellon Medical (Netherlands), Futura Surgicare Pvt. Ltd. (India), GMD Group (Turkey), Lotus Surgicals Pvt Ltd (India), BioSintex (Romania), Meril Life Sciences Pvt. Ltd. (India), and Aqmen Medtech (India).

Research Coverage:

The report analyzes the surgical sutures market and aims to estimate the market size and future growth potential based on various segments such as product, type, application, end user, and region. The report also includes a competitive analysis of the key players in this market, along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help market leaders and new entrants by providing information on the closest approximations of the revenue numbers for the surgical sutures market. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing number of surgical procedures, rising incidence of trauma-related cases, growing medical tourism industry, rising incidence of chronic lifestyle-related diseases, advancements in surgical sutures), restraints (increasing preference for minimally invasive surgeries, presence of alternative wound care management products), opportunities (growth opportunities in low- and middle-income countries) and challenges (market saturation and pricing pressure).

- Market Penetration: It includes extensive information on products the major players in the global surgical sutures market offers. The report includes various product, type, application, end user, and region segments.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global surgical sutures market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, type, application, end user, and region.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global surgical sutures market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products, and capacities of the major competitors in the global surgical sutures market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 ASSUMPTIONS & LIMITATIONS

- 2.5.1 STUDY ASSUMPTIONS

- 2.5.2 LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SURGICAL SUTURES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: SURGICAL SUTURES MARKET, BY PRODUCT & TYPE

- 4.3 GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 REGIONAL MIX: SURGICAL SUTURES MARKET

- 4.5 SURGICAL SUTURES MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of surgical procedures

- 5.2.1.2 Growing number of trauma cases

- 5.2.1.3 Growing medical tourism industry

- 5.2.1.4 Rising incidence of chronic lifestyle-related diseases

- 5.2.1.5 Advancements in surgical sutures

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing preference for minimally invasive surgeries

- 5.2.2.2 Presence of alternative wound care management products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in LMICs

- 5.2.4 CHALLENGES

- 5.2.4.1 Market saturation and pricing pressure

- 5.2.1 DRIVERS

- 5.3 REGULATORY LANDSCAPE

- 5.3.1 REGULATORY FRAMEWORK

- 5.3.1.1 North America

- 5.3.1.1.1 US

- 5.3.1.1.2 Canada

- 5.3.1.2 Europe

- 5.3.1.1 North America

- 5.3.2 ASIA PACIFIC

- 5.3.2.1 Japan

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.1 REGULATORY FRAMEWORK

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Sutures with integrated sensors for detecting infection

- 5.4.1.2 Drug-eluting sutures for local therapeutic delivery

- 5.4.1.3 Barbed sutures

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Surgical robots

- 5.4.2.2 Surgical staplers and clips

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Bioengineered suture materials

- 5.4.3.2 AI-driven surgical assistance

- 5.4.1 KEY TECHNOLOGIES

- 5.5 INDUSTRY TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 300610

- 5.8.2 EXPORT DATA FOR HS CODE 300610

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024

- 5.9.2 AVERAGE SELLING PRICE, BY REGION, 2024

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 ADJACENT MARKET ANALYSIS

- 5.12 PATENT ANALYSIS

- 5.13 ECOSYSTEM ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 CASE STUDIES

- 5.15.1 CASE STUDY 1: UNIVERSITY RESEARCHERS DEVELOP REAL-TIME NON-INVASIVE WOUND MONITORING

- 5.15.2 CASE STUDY 2: ORTHOPEDIC INNOVATION AND PATIENT OUTCOMES

- 5.15.3 CASE STUDY 3: REDUCING SURGICAL SITE INFECTIONS WITH VICRYL PLUS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 UNMET NEEDS/ END-USER EXPECTATIONS

- 5.20 IMPACT OF AI ON SURGICAL SUTURES MARKET

- 5.21 IMPACT OF 2025 US TARIFFS-SURGICAL SUTURES MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRIES/REGIONS

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USER INDUSTRIES

6 SURGICAL SUTURES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SUTURE THREADS

- 6.2.1 BY NATURE OF ABSORBENT

- 6.2.1.1 Absorbable sutures

- 6.2.1.1.1 Absorbable synthetic sutures

- 6.2.1.1.1.1 Polyglactin 910 sutures

- 6.2.1.1.1.1.1 High rigidity and knot strength of polyglactin 910 sutures to drive demand

- 6.2.1.1.1.2 Poliglecaprone 25 sutures

- 6.2.1.1.1.2.1 Smooth surface area and minimal tissue reaction to boost adoption

- 6.2.1.1.1.3 Polydioxanone sutures

- 6.2.1.1.1.3.1 Long-duration wound support and superior strength of polydioxanone sutures to drive growth

- 6.2.1.1.1.4 Polyglycolic acid sutures

- 6.2.1.1.1.4.1 Superior elasticity and strength compared to other braided structures to support market growth

- 6.2.1.1.1.5 Other absorbable synthetic sutures

- 6.2.1.1.1.1 Polyglactin 910 sutures

- 6.2.1.1.2 Absorbable natural sutures

- 6.2.1.1.2.1 Catgut plain sutures

- 6.2.1.1.2.1.1 Fast-absorbing properties to boost demand

- 6.2.1.1.2.2 Catgut chromic sutures

- 6.2.1.1.2.2.1 Ability to absorb more rapidly in affected tissues to boost adoption

- 6.2.1.1.2.1 Catgut plain sutures

- 6.2.1.1.1 Absorbable synthetic sutures

- 6.2.1.2 Non-absorbable sutures

- 6.2.1.2.1 Non-absorbable synthetic sutures

- 6.2.1.2.1.1 Nylon sutures

- 6.2.1.2.1.1.1 Growing use of nylon sutures in general soft tissue approximation to boost market

- 6.2.1.2.1.2 Polypropylene sutures

- 6.2.1.2.1.2.1 High tensile strength and flexibility of polypropylene sutures to fuel growth

- 6.2.1.2.1.3 Stainless steel sutures

- 6.2.1.2.1.3.1 Growing use of stainless steel sutures in hernia and tendon repair to support market growth

- 6.2.1.2.1.4 UHMWPE sutures

- 6.2.1.2.1.4.1 Non-reactive nature of UHMWPE sutures to boost demand

- 6.2.1.2.1.5 Other non-absorbable synthetic sutures

- 6.2.1.2.1.1 Nylon sutures

- 6.2.1.2.2 Non-absorbable natural sutures

- 6.2.1.2.2.1 Cotton sutures

- 6.2.1.2.2.1.1 Growing applications of cotton sutures in healthcare and cosmetic procedures to boost market

- 6.2.1.2.2.2 Silk sutures

- 6.2.1.2.2.2.1 Good tensile strength offered by silk sutures to support growth

- 6.2.1.2.2.3 Other non-absorbable natural sutures

- 6.2.1.2.2.1 Cotton sutures

- 6.2.1.2.1 Non-absorbable synthetic sutures

- 6.2.1.1 Absorbable sutures

- 6.2.2 BY COATING

- 6.2.2.1 Uncoated sutures

- 6.2.2.1.1 High risk of infection associated with uncoated sutures to restrict market growth

- 6.2.2.2 Antimicrobial-coated sutures

- 6.2.2.2.1 High burden of SSIs to drive adoption

- 6.2.2.3 Other coated sutures

- 6.2.2.1 Uncoated sutures

- 6.2.1 BY NATURE OF ABSORBENT

- 6.3 AUTOMATED SUTURING DEVICES

- 6.3.1 DISPOSABLE AUTOMATED SUTURING DEVICES

- 6.3.1.1 Lower cost compared to reusable devices to boost market

- 6.3.2 REUSABLE AUTOMATED SUTURING DEVICES

- 6.3.2.1 Customizability and lower overall expenses to support market growth

- 6.3.1 DISPOSABLE AUTOMATED SUTURING DEVICES

7 SURGICAL SUTURE THREADS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MULTIFILAMENT SUTURES

- 7.2.1 MULTIFILAMENT SUTURES TO ACCOUNT FOR LARGEST MARKET SHARE

- 7.3 MONOFILAMENT SUTURES

- 7.3.1 LOW KNOT SECURITY AND LESS FLEXIBILITY TO RESTRICT GROWTH

8 SURGICAL SUTURES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CARDIOVASCULAR SURGERY

- 8.2.1 GROWING ADOPTION OF POLYPROPYLENE SUTURES IN CARDIOVASCULAR PROCEDURES TO BOOST MARKET

- 8.3 GENERAL SURGERY

- 8.3.1 NEED TO PREVENT BLOOD LOSS IN GASTROINTESTINAL SURGERIES TO DRIVE ADOPTION

- 8.4 GYNECOLOGICAL SURGERY

- 8.4.1 HIGH PROCEDURAL VOLUME TO ENSURE STRONG DEMAND

- 8.5 ORTHOPEDIC SURGERY

- 8.5.1 INCREASING PREVALENCE OF SPORTS-RELATED INJURIES TO SUPPORT MARKET GROWTH

- 8.6 OPHTHALMIC SURGERY

- 8.6.1 HIGH NUMBER OF OPHTHALMIC PROCEDURES PERFORMED TO FAVOR MARKET GROWTH

- 8.7 COSMETIC & PLASTIC SURGERY

- 8.7.1 GROWING NUMBER OF COSMETIC & PLASTIC SURGERIES TO DRIVE ADOPTION OF SUTURES

- 8.8 OTHER APPLICATIONS

9 SURGICAL SUTURES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 INCREASING NUMBER OF SURGERIES AND TRAUMA CASES TO DRIVE ADOPTION OF SURGICAL SUTURES AMONG HOSPITALS

- 9.3 AMBULATORY SURGICAL CENTERS

- 9.3.1 GROWING NUMBER OF SURGICAL PROCEDURES PERFORMED IN ASCS TO FAVOR MARKET GROWTH

- 9.4 CLINICS & PHYSICIAN OFFICES

- 9.4.1 WIDE RANGE OF MEDICAL SERVICES TO SUPPORT GROWTH

10 SURGICAL SUTURES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate North American surgical sutures market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Improving healthcare quality and government support to aid market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Germany to dominate market for surgical sutures in Europe

- 10.3.3 UK

- 10.3.3.1 Rising incidence and prevalence of CVD to drive market

- 10.3.4 FRANCE

- 10.3.4.1 High healthcare spending by government to drive adoption of surgical sutures

- 10.3.5 ITALY

- 10.3.5.1 Improving quality of and accessibility to medical care and technologies to boost market

- 10.3.6 SPAIN

- 10.3.6.1 Increasing incidence of cardiovascular diseases to favor market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 China to dominate market for surgical sutures in APAC

- 10.4.3 INDIA

- 10.4.3.1 Large number of surgical procedures performed to drive market growth

- 10.4.4 JAPAN

- 10.4.4.1 Early adoption of technologically advanced products to drive market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing incidence of obesity and rising number of bariatric surgeries to aid market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 High geriatric population and increased surgical procedures to propel market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 High diabetes rates and focus on private-public partnerships for better healthcare facilities to favor market growth

- 10.5.3 MEXICO

- 10.5.3.1 Increased focus on medical tourism and developed private healthcare sector to drive market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Higher disposable income and increased government healthcare expenditure to propel market growth

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SURGICAL SUTURES MARKET

- 11.3 REVENUE ANALYSIS, 2022-2025

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Type footprint

- 11.5.5.5 Application footprint

- 11.5.5.6 End-user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 STARTING BLOCKS

- 11.6.4 RESPONSIVE COMPANIES

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ETHICON, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON)

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 MEDTRONIC

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 B. BRAUN SE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 ADVANCED MEDICAL SOLUTIONS GROUP PLC (AMS GROUP)

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 HEALTHIUM MEDTECH LIMITED

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 BOSTON SCIENTIFIC CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 ZIMMER BIOMET HOLDINGS, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 STRYKER

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 SMITH+NEPHEW

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 CONMED CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 INTERNACIONAL FARMACEUTICA S.A. DE C.V.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 CORZA MEDICAL

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.13 DEMETECH CORPORATION

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 UNISUR LIFECARE PVT. LTD

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 ASSUT EUROPE

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 ETHICON, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON)

- 12.2 OTHER PLAYERS

- 12.2.1 RESORBA MEDICAL GMBH

- 12.2.2 KATSAN KATGUT SANAYI VE TIC. A.S.

- 12.2.3 SUTUMED CORP.

- 12.2.4 FUTURA SURGICARE PVT. LTD.

- 12.2.5 GMD GROUP

- 12.2.6 LOTUS SURGICALS PVT LTD

- 12.2.7 BIOSINTEX

- 12.2.8 MERIL LIFE SCIENCES PVT. LTD.

- 12.2.9 MELLON MEDICAL

- 12.2.10 AQMEN MEDTECH

- 12.2.11 ANCHORA MEDICAL LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS