|

시장보고서

상품코드

1790688

데이터센터 냉각 시장(-2032년) : 솔루션별(공조, 냉각 유닛, 냉각탑, 이코노마이저 시스템, 액체 냉각 시스템, 제어 시스템), 서비스별, 냉각 유형별, 데이터센터 유형별, 최종 이용 산업별, 지역별Data Center Cooling Market by Solution (Air Conditioning, Chilling Unit, Cooling Tower, Economizer System, Liquid Cooling System, Control System), Service, Type of Cooling, Data Center Type, End-use Industry, and Region - Global Forecast to 2032 |

||||||

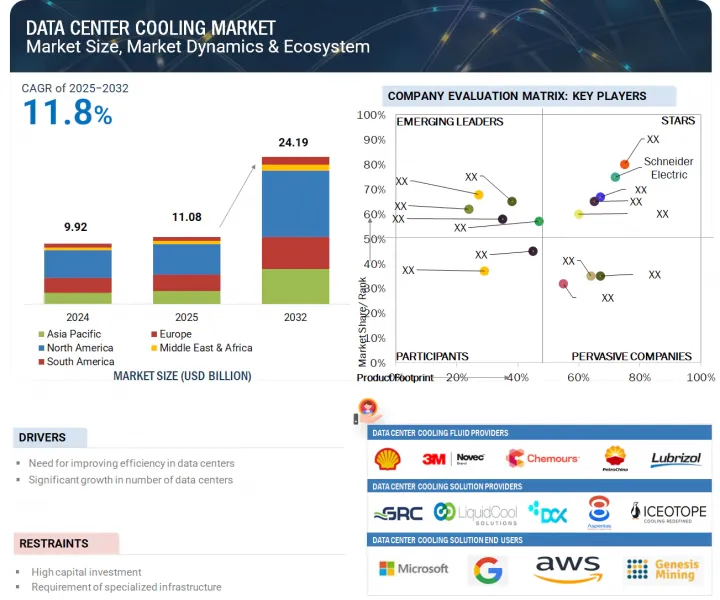

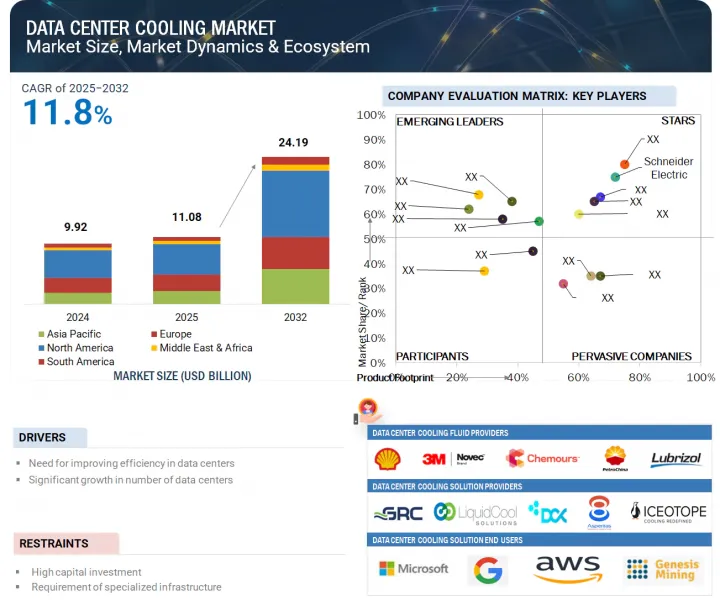

세계의 데이터센터 냉각 시장 규모는 2025년 110억 8,000만 달러에서 예측 기간 동안 CAGR 11.8%로 성장하여 2032년에는 241억 9,000만 달러로 성장할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 금액(달러) |

| 부문 | 구성요소, 서비스, 냉각 유형, 데이터센터 유형, 솔루션, 최종 이용 산업, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동 및 아프리카, 남미 |

이 시장은 데이터센터 효율성 개선의 필요성, IT 및 통신, 은행, 금융서비스 및 보험(BFSI), 정부 및 국방, 연구 및 학술, 의료, 제조, 제조, 소매, 에너지, 기타 산업을 포함한 다양한 최종사용자 산업에서 데이터센터 수 증가 등의 요인에 의해 주도되고 있습니다.

"서비스별로는 설치 및 도입 부문이 예측 기간 동안 시장에서 두 번째로 큰 점유율을 차지할 것으로 예측됩니다."

이러한 성장은 현대 데이터센터의 특정 레이아웃과 운영 요건에 맞는 맞춤형 에너지 절약형 냉각 시스템에 대한 수요 증가에 힘입어 성장세를 보이고 있습니다. 특히 하이퍼스케일, 코로케이션 시설 등 데이터센터의 규모와 복잡성이 증가함에 따라, 기업들은 액체 냉각, 칩 직접 냉각, 컨테이너 시스템과 같은 첨단 냉각 기술을 원활하게 통합하기 위해 전문 서비스 제공업체에 의존하는 경향이 증가하고 있습니다.

설치 및 도입 단계는 전체 냉각 인프라의 성능, 가동 시간, 에너지 절약 효율에 직접적인 영향을 미치기 때문에 매우 중요합니다. 이는 물리적 냉각 장치 설치뿐만 아니라 데이터센터 전력 시스템, 환경 모니터링 도구, 제어 시스템과의 통합을 포함합니다. 또한, 지속가능성 및 규제 준수에 대한 중요성이 높아지는 가운데, 전문적 도입을 통해 냉각 시스템이 그린 빌딩 인증 및 탄소 저감 목표를 충족할 수 있도록 보장합니다.

"솔루션별로는 액체 냉각 시스템이 예측 기간 동안 시장에서 두 번째로 큰 점유율을 차지할 것으로 예측됩니다."

이러한 성장은 열을 많이 발생시키는 고성능 컴퓨팅, AI, 고밀도 서버 아키텍처의 채택 확대에 의해 주도되고 있습니다. 이들은 기존 공랭식보다 더 효율적인 냉각 방식을 필요로 합니다. 액체 냉각은 우수한 열 관리, 에너지 절약, 공간 활용도를 향상시켜 현대의 고밀도 데이터센터에 가장 적합한 솔루션입니다. 운영자들이 지속가능하고 비용 효율적인 솔루션을 찾고 있는 가운데, 액체 냉각은 차세대 데이터센터 인프라의 핵심 요소로 부상하고 있습니다.

세계의 데이터센터 냉각 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 공급망 분석

- 규제 상황

- 특허 분석

- 사례 연구

- 주요 이해관계자와 구입 기준

- 생태계 분석

- 고객의 사업에 영향을 미치는 동향과 혼란

- 기술 분석

- 주요 기술

- 인접 기술

- 보완적인 기술

- 투자와 자금 조달 시나리오

- 2025-2026년의 주요 회의와 이벤트

- 데이터센터 냉각 시장에 대한 AI의 영향

- AI 기반 냉각 최적화

- 첨단 액체 냉각 기술 로의 전환

- 예측 보수와 시스템 신뢰성

- 지속가능성과 규제 준수

- 경제와 투자 기회

- 과제와 향후 전망

- 세계의 거시경제 전망

- 2025년 미국 관세가 데이터센터 냉각 시장에 미치는 영향

제6장 데이터센터 냉각 시장 : 구성요소별

제7장 데이터센터 냉각 시장 : 데이터센터 유형별

- 중규모 데이터센터

- 엔터프라이즈 데이터센터

- 대규모 데이터센터

제8장 데이터센터 냉각 시장 : 최종 이용 산업별

- BFSI

- IT·통신

- 연구·학술

- 정부·방위

- 소매

- 에너지

- 제조

- 헬스케어

- 기타

제9장 데이터센터 냉각 시장 : 서비스별

- 컨설팅

- 인스톨·전개

- 유지보수·지원

제10장 데이터센터 냉각 시장 : 솔루션별

- 공조

- 냉각 유닛

- 냉각탑

- 이코노마이저 시스템

- 액체 냉각 시스템

- 제어 시스템

- 기타

제11장 데이터센터 냉각 시장 : 냉각 유형별

- 룸 기반 냉각

- 열/랙 기반 냉각

제12장 데이터센터 냉각 시장 : 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 네덜란드

- 프랑스

- 이탈리아

- 기타

- 중동 및 아프리카

- 아랍에미리트

- 사우디아라비아

- GCC의 기타 국가

- 남아프리카공화국

- 기타

- 남미

- 브라질

- 기타

제13장 경쟁 구도

- 주요 기업의 채용 전략

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스 : Tier 1

- 스타트업/중소기업 평가 매트릭스

- 기업 평가와 재무 지표

- 경쟁 시나리오와 동향

제14장 기업 개요

- 주요 기업

- VERTIV GROUP CORP.

- GREEN REVOLUTION COOLING, INC.

- SUBMER

- ASPERITAS

- COOLIT SYSTEMS

- DCX LIQUID COOLING SYSTEMS

- ICEOTOPE PRECISION LIQUID COOLING

- SCHNEIDER ELECTRIC

- JOHNSON CONTROLS

- CARRIER

- DAIKIN INDUSTRIES, LTD.

- MITSUBISHI ELECTRIC CORPORATION

- RITTAL GMBH & CO. KG

- MIDAS IMMERSION COOLING

- TRANE TECHNOLOGIES PLC

- MUNTERS

- LIQUIDSTACK HOLDING B.V.

- CHILLDYNE, INC.

- DUG TECHNOLOGY

- LIQUIDCOOL SOLUTIONS

- STULZ GMBH

- DELTA POWER SOLUTIONS

- MODINE MANUFACTURING COMPANY

- BOYD

- SUPER MICRO COMPUTER, INC.

- FLEX LTD.

- BLACK BOX

- ALFA LAVAL

- 기타 기업

- COOLCENTRIC

- ASETEK

- GIGA-BYTE TECHNOLOGY CO., LTD.

- NVENT

- ACCELSIUS LLC

- KAORI HEAT TREATMENT CO., LTD.

- ZUTACORE, INC.

- NORTEK AIR SOLUTIONS, LLC.

제15장 인접 시장과 관련 시장

제16장 부록

KSM 25.08.22The global data center cooling market is projected to grow from USD 11.08 billion in 2025 to USD 24.19 billion by 2032, at a CAGR of 11.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Component, Service, Type of Cooling, Data Center Type, Solution, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

The market is driven by factors including the need for improving efficiency in data centers and an increase in the number of data centers across various end-use industries, including IT & telecom, BFSI, government & defense, research & academic, healthcare, manufacturing, retail, energy, and other industries.

"Installation and deployment segment, by service, is estimated to account for the second-largest share of the market during the forecast period."

The installation and deployment segment, by service, is projected to account for the second-largest share in the data center cooling market during the forecast period. This growth is driven by the rising demand for customized and energy-efficient cooling systems that are tailored to the specific layout and operational requirements of modern data centers. As data centers expand in size and complexity, especially hyperscale and colocation facilities, organizations increasingly rely on specialized service providers for the seamless integration of advanced cooling technologies such as liquid cooling, direct-to-chip cooling, and containment systems.

The installation and deployment phase is crucial as it directly impacts the overall performance, uptime, and energy efficiency of the cooling infrastructure. It involves not only setting up physical cooling units but also integrating them with the data center's power systems, environmental monitoring tools, and control systems. Additionally, with the growing emphasis on sustainability and regulatory compliance, professional deployment ensures that cooling systems meet green building certifications and carbon reduction goals.

"Liquid cooling systems, by solution, is estimated to account for the second-largest share of the market during the forecast period."

The liquid cooling systems segment, by solution, is projected to hold the second-largest share of the data center cooling market during the forecast period. This growth is fueled by the increasing adoption of high-performance computing, AI, and dense server architectures that generate significant heat, requiring more efficient cooling methods than traditional air systems. Liquid cooling offers superior thermal management, reduced energy consumption, and better space utilization, making it ideal for modern, high-density data centers. As operators seek sustainable and cost-effective solutions, liquid cooling is emerging as a critical component in next-generation data center infrastructure.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 16%, Tier 2 - 36%, and Tier 3 - 48%

- By Designation: C-level- 16%, Director Level- 24%, and Others - 60%

- By Region: North America - 36%, Europe - 24%, Asia Pacific - 20%, Middle East & Africa - 12%, and South America - 8%

Vertiv Group Corp. (US), Green Revolution Cooling, Inc. (US), Submer (Spain), Asperitas (Netherlands), and COOLIT Systems (Canada) are some of the major players operating in the data center cooling market. These players have adopted strategies such as acquisitions, expansions, partnerships, and agreements to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the data center cooling market based on data center type, type of cooling, service, solution, end-use industry, component, and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges. It strategically profiles data center cooling manufacturers and comprehensively analyzes their market shares and core competencies, as well as tracks and analyzes competitive developments, such as expansions, partnerships, and product launches, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the data center cooling market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (need for improving efficiency in data centers, significant growth in number of data centers), restraints (high capital investment, requirement of specialized infrastructure), opportunities (emergence of liquid cooling technology, growing requirement for modular data center cooling, and development of innovative cooling techniques), and challenges (cooling challenges during power outage and necessity of reducing carbon emissions) influencing the growth of the data center cooling market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the data center cooling market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the data center cooling market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the data center cooling market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Carrier (US), Trane Technologies PLC (Ireland), Alfa Laval (Sweden), Daikin Industries Ltd. (Japan), Super Micro Computer Inc. (US), DCX Liquid Cooling Systems (Poland), Johnson Controls, Inc. (US), Modine (US), BOYD (US), Schneider Electric (France), STULZ GMBH (Germany), Delta Power Solution (Taiwan), Vertiv group Corp (US), COOLIT Systems (Canada), Rittal GmbH & Co. KG (Germany), Green Revolution Cooling Inc. (US), Iceotope Precision Liquid Cooling (UK), DUG Technology (Australia), Submer (Spain), Midas Immersion Cooling (US), Chilldyne Inc. (US), Asperitas (Netherlands), Munters (Sweden), Black Box (US), LiquidStack Holdings B.V. (US), Liquid Cool Solutions (US), Mitsubishi Electric Corporation (Japan), Flex Ltd (US), and others in the data center cooling market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.3.1 DATA CENTER COOLING MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- 1.3.2 DATA CENTER COOLING MARKET, BY COMPONENT: INCLUSIONS & EXCLUSIONS

- 1.3.3 DATA CENTER COOLING MARKET, BY SOLUTION: INCLUSIONS & EXCLUSIONS

- 1.3.4 DATA CENTER COOLING MARKET, BY SERVICE: INCLUSIONS & EXCLUSIONS

- 1.3.5 DATA CENTER COOLING MARKET, BY TYPE OF COOLING: INCLUSIONS & EXCLUSIONS

- 1.3.6 DATA CENTER COOLING MARKET, BY DATA CENTER TYPE: INCLUSIONS & EXCLUSIONS

- 1.3.7 DATA CENTER COOLING MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 RESEARCH LIMITATIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 List of participating companies for primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA CENTER COOLING MARKET

- 4.2 DATA CENTER COOLING MARKET, BY DATA CENTER TYPE

- 4.3 NORTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT AND COUNTRY

- 4.4 DATA CENTER COOLING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for improving efficiency in data centers

- 5.2.1.2 Significant growth in number of data centers

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investment

- 5.2.2.2 Requirement of specialized infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of liquid cooling technology

- 5.2.3.2 Growing requirement for modular data center cooling

- 5.2.3.3 Development of innovative cooling techniques

- 5.2.4 CHALLENGES

- 5.2.4.1 Cooling challenges during power outage

- 5.2.4.2 Necessity of reducing carbon emissions

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 DATA CENTER ORIGINAL EQUIPMENT MANUFACTURERS

- 5.4.2 DATA CENTER ORIGINAL DESIGN MANUFACTURERS

- 5.4.3 DATA CENTER COOLING ORIGINAL EQUIPMENT MANUFACTURERS

- 5.4.4 SYSTEM INTEGRATORS

- 5.4.5 VALUE-ADDED SERVICE PROVIDERS

- 5.4.6 END USERS

- 5.5 REGULATORY LANDSCAPE

- 5.5.1 INTRODUCTION

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.3 STANDARDS AND GUIDELINES FOR DATA CENTER COOLING

- 5.5.3.1 American National Standards Institute

- 5.5.3.2 American Society of Heating, Refrigerating and Air-conditioning Engineers

- 5.5.3.3 Joint Research Center of European Commission

- 5.5.3.4 Distributed Management Task Force

- 5.5.3.5 Telecommunication Industry Association

- 5.5.3.6 National Electrical Manufacturers Association

- 5.5.3.7 Canadian Standards Association Group

- 5.5.3.8 Underwriters' Laboratory

- 5.5.3.9 Factory Mutual (FM) Approvals

- 5.5.3.10 United States Department of Energy

- 5.5.3.11 United States Environmental Protection Agency

- 5.5.3.12 Statement on Standards for Attestation Engagements No. 16

- 5.5.3.13 International Standards Compliance

- 5.6 PATENT ANALYSIS

- 5.6.1 MAJOR PATENTS

- 5.7 CASE STUDY

- 5.7.1 CASE STUDY 1: REDUCTION IN DATA CENTER ENERGY SPENDING BY ADOPTING IMMERSION COOLING

- 5.7.2 CASE STUDY 2: BETTER PER RACK POWER DENSITY AND SCALABILITY

- 5.7.3 CASE STUDY 3: IMPROVEMENT IN POWER USAGE EFFECTIVENESS

- 5.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY TECHNOLOGIES

- 5.12.1 AIR COOLING

- 5.12.2 LIQUID COOLING

- 5.13 ADJACENT TECHNOLOGY

- 5.13.1 THERMOELECTRIC COOLING

- 5.13.2 ON-CHIP COOLING/EMBEDDED MICROFLUIDICS

- 5.14 COMPLEMENTARY TECHNOLOGY

- 5.14.1 ADVANCED THERMAL INTERFACE MATERIALS

- 5.14.2 LIQUID LEAK DETECTION & CONTAINMENT SYSTEMS

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.17 IMPACT OF AI ON DATA CENTER COOLING MARKET

- 5.18 AI-DRIVEN COOLING OPTIMIZATION

- 5.19 SHIFT TO ADVANCED LIQUID COOLING TECHNOLOGIES

- 5.20 PREDICTIVE MAINTENANCE AND SYSTEM RELIABILITY

- 5.21 SUSTAINABILITY AND REGULATORY COMPLIANCE

- 5.22 ECONOMIC AND INVESTMENT OPPORTUNITIES

- 5.23 CHALLENGES AND FUTURE OUTLOOK

- 5.24 GLOBAL MACROECONOMIC OUTLOOK

- 5.24.1 GDP

- 5.25 IMPACT OF 2025 US TARIFF ON DATA CENTER COOLING MARKET

- 5.25.1 KEY TARIFF RATES

- 5.25.2 PRICE IMPACT ANALYSIS

- 5.25.3 IMPACT ON MAJOR COUNTRY/REGION

- 5.25.3.1 US

- 5.25.3.2 Europe

- 5.25.3.3 Asia Pacific

6 DATA CENTER COOLING MARKET, BY COMPONENT

- 6.1 INTRODUCTION

7 DATA CENTER COOLING MARKET, DATA CENTER TYPE

- 7.1 INTRODUCTION

- 7.2 MID-SIZED DATA CENTERS

- 7.2.1 WIDE ADOPTION BY SMES TO INCREASE DEMAND

- 7.3 ENTERPRISE DATA CENTERS

- 7.3.1 HIGH POWER CONSUMPTION MANDATES USE OF EFFICIENT COOLING SOLUTIONS

- 7.4 LARGE DATA CENTERS

- 7.4.1 HIGH SERVER DENSITIES AND NEED FOR OPTIMUM COOLING SOLUTIONS TO DRIVE DEMAND

8 DATA CENTER COOLING MARKET, END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 BFSI

- 8.2.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR DATA CENTER COOLING IN BFSI SEGMENT

- 8.3 IT & TELECOM

- 8.3.1 GROWING DEMAND FOR EFFICIENT AND SECURE DATA CENTERS TO DRIVE MARKET

- 8.4 RESEARCH & ACADEMIC

- 8.4.1 INCREASING DEMAND FOR INNOVATIVE COOLING SOLUTIONS TO SUPPORT MARKET

- 8.5 GOVERNMENT & DEFENSE

- 8.5.1 GOVERNMENT INITIATIVES TOWARD DIGITALIZATION TO INCREASE DEMAND

- 8.6 RETAIL

- 8.6.1 INCREASING FOCUS BY RETAIL SECTOR TO ENHANCE IT INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 8.7 ENERGY

- 8.7.1 INCREASING EMPHASIS ON SUSTAINABLE & ENERGY-EFFICIENT DATA CENTER COOLING SOLUTIONS TO DRIVE DEMAND

- 8.8 MANUFACTURING

- 8.8.1 LOWER OPERATIONAL COSTS AND CAPITAL EXPENDITURE TO DRIVE DEMAND

- 8.9 HEALTHCARE

- 8.9.1 GROWING DEMAND FOR CUSTOMIZED DATA SOLUTIONS TO DRIVE MARKET

- 8.10 OTHER END-USE INDUSTRIES

9 DATA CENTER COOLING MARKET, BY SERVICE

- 9.1 INTRODUCTION

- 9.2 CONSULTING

- 9.2.1 NEED TO MINIMIZE RISK AND INCREASE REVENUE TO DRIVE DEMAND

- 9.3 INSTALLATION & DEPLOYMENT

- 9.3.1 INCREASING ADOPTION OF INSTALLATION & DEPLOYMENT SERVICES WITNESSED WORLDWIDE

- 9.4 MAINTENANCE & SUPPORT

- 9.4.1 DOWNTIME RISK ASSOCIATED WITH DATA CENTER FAILURE TO DRIVE ADOPTION OF MAINTENANCE & SUPPORT SERVICES

10 DATA CENTER COOLING MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- 10.2 AIR CONDITIONING

- 10.2.1 LOW INSTALLATION & MAINTENANCE COSTS TO DRIVE DEMAND

- 10.3 CHILLING UNITS

- 10.3.1 LESS COST AND BETTER PERFORMANCE CHARACTERISTICS TO INCREASE ADOPTION

- 10.4 COOLING TOWERS

- 10.4.1 COST-EFFECTIVE COOLING SOLUTIONS TO DRIVE DEMAND

- 10.5 ECONOMIZER SYSTEMS

- 10.5.1 SIGNIFICANT ENERGY SAVING AND INCREASING ADOPTION BY LARGE DATA CENTERS TO SUPPORT GROWTH

- 10.6 LIQUID COOLING SYSTEMS

- 10.6.1 HIGH EFFICIENCY SOLUTIONS TO DRIVE ADOPTION

- 10.7 CONTROL SYSTEMS

- 10.7.1 NECESSITY TO MONITOR & CONTROL COOLING UNITS IN DATA CENTERS LEADING TO DRIVE DEMAND

- 10.8 OTHER SOLUTIONS

11 DATA CENTER COOLING MARKET, BY TYPE OF COOLING

- 11.1 INTRODUCTION

- 11.2 ROOM-BASED COOLING

- 11.2.1 VARIOUS CONSTRAINTS WITH RESPECT TO LAYOUT DESIGN TO LIMIT GROWTH

- 11.3 ROW/RACK-BASED COOLING

- 11.3.1 ADOPTION IN LARGE DATA CENTERS TO DRIVE MARKET

12 DATA CENTER COOLING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Digital transformation to drive data center expansion and data center cooling market

- 12.2.2 INDIA

- 12.2.2.1 Increasing internet users to drive rapid adoption of data center cooling

- 12.2.3 JAPAN

- 12.2.3.1 Presence of large service providers to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Data center infrastructural investments and digital revolution to drive market

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Presence of IT and internet giants to drive market

- 12.3.2 CANADA

- 12.3.2.1 Increased digitization and huge data generation to drive adoption

- 12.3.3 MEXICO

- 12.3.3.1 Exponential growth in data traffic to drive demand

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Growth of data centers in IT and technology sectors to drive market

- 12.4.2 UK

- 12.4.2.1 Surge in data consumption and presence of major hyperscale sites to fuel demand for efficient cooling solutions

- 12.4.3 NETHERLANDS

- 12.4.3.1 Favorable factors, such as tax exemption for green energy usage, to drive market

- 12.4.4 FRANCE

- 12.4.4.1 Growth in ICT sector and focus on environmental sustainability to drive market

- 12.4.5 ITALY

- 12.4.5.1 Rising demand for colocation data centers to boost market

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 UAE

- 12.5.1.1 Increasing adoption of newer technologies to drive market

- 12.5.2 SAUDI ARABIA

- 12.5.2.1 Demand for rugged data center solutions & managed services and digitization to drive market

- 12.5.3 REST OF GCC

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Developed telecommunication infrastructure to fuel market

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.5.1 UAE

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Digital transformation to drive data center cooling market

- 12.6.2 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.4.1 RANKING OF KEY MARKET PLAYERS, 2024

- 13.4.2 MARKET SHARE OF KEY PLAYERS

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX (TIER 1), 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Type of cooling footprint

- 13.6.5.4 Solution footprint

- 13.7 STARTUP/SME EVALUATION MATRIX, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILE

- 14.1 KEY PLAYERS

- 14.1.1 VERTIV GROUP CORP.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 GREEN REVOLUTION COOLING, INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 SUBMER

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.3.4 Others

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 ASPERITAS

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 COOLIT SYSTEMS

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 DCX LIQUID COOLING SYSTEMS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Others

- 14.1.7 ICEOTOPE PRECISION LIQUID COOLING

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 SCHNEIDER ELECTRIC

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Product launches

- 14.1.8.4 MnM view

- 14.1.8.4.1 Key strengths

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 JOHNSON CONTROLS

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.10 CARRIER

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 DAIKIN INDUSTRIES, LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Others

- 14.1.12 MITSUBISHI ELECTRIC CORPORATION

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.13 RITTAL GMBH & CO. KG

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Product launches

- 14.1.14 MIDAS IMMERSION COOLING

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.15 TRANE TECHNOLOGIES PLC

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.16 MUNTERS

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.16.3.2 Others

- 14.1.17 LIQUIDSTACK HOLDING B.V.

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Deals

- 14.1.17.3.2 Others

- 14.1.18 CHILLDYNE, INC.

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Deals

- 14.1.19 DUG TECHNOLOGY

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Deals

- 14.1.20 LIQUIDCOOL SOLUTIONS

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.20.3 Recent developments

- 14.1.20.3.1 Deals

- 14.1.21 STULZ GMBH

- 14.1.21.1 Business overview

- 14.1.21.2 Products/Solutions/Services offered

- 14.1.21.3 Recent developments

- 14.1.21.3.1 Product launches

- 14.1.22 DELTA POWER SOLUTIONS

- 14.1.22.1 Business overview

- 14.1.22.2 Products/Solutions/Services offered

- 14.1.22.3 Recent developments

- 14.1.22.3.1 Deals

- 14.1.23 MODINE MANUFACTURING COMPANY

- 14.1.23.1 Business overview

- 14.1.23.2 Products/Solutions/Services offered

- 14.1.23.3 Recent developments

- 14.1.23.3.1 Product launches

- 14.1.23.3.2 Deals

- 14.1.23.3.3 Expansions

- 14.1.24 BOYD

- 14.1.24.1 Business overview

- 14.1.24.2 Products offered

- 14.1.25 SUPER MICRO COMPUTER, INC.

- 14.1.25.1 Business overview

- 14.1.25.2 Products/Solutions/Services offered

- 14.1.25.3 Recent developments

- 14.1.25.3.1 Deals

- 14.1.25.3.2 Expansions

- 14.1.26 FLEX LTD.

- 14.1.26.1 Business overview

- 14.1.26.2 Products/Solutions/Services offered

- 14.1.26.2.1 Deals

- 14.1.27 BLACK BOX

- 14.1.27.1 Business overview

- 14.1.27.2 Products/Solutions/Services offered

- 14.1.27.3 Recent developments

- 14.1.27.3.1 Deals

- 14.1.28 ALFA LAVAL

- 14.1.28.1 Business overview

- 14.1.28.2 Products/Solutions/Services offered

- 14.1.1 VERTIV GROUP CORP.

- 14.2 OTHER PLAYERS

- 14.2.1 COOLCENTRIC

- 14.2.2 ASETEK

- 14.2.3 GIGA-BYTE TECHNOLOGY CO., LTD.

- 14.2.4 NVENT

- 14.2.5 ACCELSIUS LLC

- 14.2.6 KAORI HEAT TREATMENT CO., LTD.

- 14.2.7 ZUTACORE, INC.

- 14.2.8 NORTEK AIR SOLUTIONS, LLC.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 DATA CENTER COOLING INTERCONNECTED MARKETS

- 15.3.1 DATA CENTER LIQUID COOLING MARKET

- 15.3.1.1 Market definition

- 15.3.1.2 Market overview

- 15.3.1 DATA CENTER LIQUID COOLING MARKET

- 15.4 DATA CENTER LIQUID COOLING MARKET, BY COOLING TYPE

- 15.4.1 COLD PLATE LIQUID COOLING

- 15.4.1.1 Increasing high-density data center installations to drive demand

- 15.4.1 COLD PLATE LIQUID COOLING

- 15.5 IMMERSION LIQUID COOLING

- 15.5.1 ABILITY TO LOWER POWER CONSUMPTION AND CARBON FOOTPRINT TO DRIVE MARKET

- 15.6 SPRAY LIQUID COOLING

- 15.6.1 HIGH ENERGY SAVINGS, EXCELLENT HEAT-DISSIPATION EFFICIENCY, AND SILENT OPERATION TO DRIVE DEMAND

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS