|

시장보고서

상품코드

1793326

UV LED 시장 : UV-A, UV-B, UV-C, UV 경화, 살균, 의료 및 과학, 보안, 리소그래피, 출력 예측(-2030년)UV LED Market by UV-A, UV-B, UV-C, UV Curing (Printing, Adhesives), Disinfection, Medical & Scientific (Equipment Sterilization, Tanning, Teeth Brightening), Security, Lithography, Power Output (Less than 1w, 1W-5W, Above 5W) Global - Forecast to 2030 |

||||||

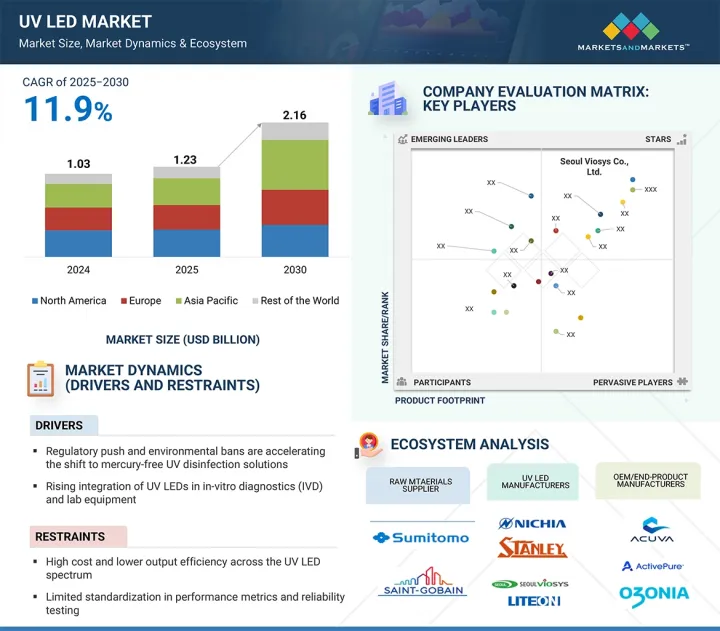

세계의 UV LED 시장 규모는 2025년에 12억 3,000만 달러로 평가되었고, 2030년까지 21억 6,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR 11.9%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 기술, 출력, 용도, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

UV LED에 대한 수요 증가의 주요 원인은 살균, 살균, 경화 과정의 용도 때문입니다. 이러한 LED는 기존 UV 램프에 비해 전력 소비 감소, 수명 연장, 환경 영향 감소 등?著한 장점을 제공합니다.

"기술별로는 UV-C 기술 부문이 예측 기간 동안 UV LED 시장의 상당한 점유율을 차지할 것으로 예상됩니다."

UV-C 기술은 강력한 살균 특성, 화학물질 무사용 살균에 대한 수요 증가, 물 및 공기 정화 시스템의 사용 확대 등으로 인해 예측 기간 동안 UV LED 시장의 상당한 점유율을 차지할 것으로 예상됩니다. 강력한 살균 특성으로 인해 UV-C는 바이러스, 세균, 기타 병원체를 죽이거나 무력화하는 데 매우 효과적이며, 의료, 산업, 주거 분야를 포함한 다양한 분야에서 살균의 선호되는 선택지로 자리 잡았습니다. 화학물질 없는 살균에 대한 수요 증가로 인해 기존 화학 기반 방법(염소 등)보다 안전하고 환경 친화적인 대안으로 UV-C LED로의 전환이 가속화되고 있습니다. 또한 UV-C LED는 소형 크기, 에너지 효율성, 유해 미생물 중화 능력으로 인해 물 필터, HVAC 시스템, 휴대용 살균기 등에의 통합이 증가하고 있습니다. 이러한 특징은 신뢰성 있고 지속 가능한 정화를 보장해 UV-C 기술의 다양한 용도의 채택을 촉진하고 있습니다.

"촉진하고 있습니다. “용도별로는 살균 부문이 예측 기간 동안 UV LED 시장에서 가장 높은 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다."

예측 기간 동안 살균 부문은 위생 및 감염 관리에 대한 인식 향상, 화학물질 무사용 살균 솔루션에 대한 수요 증가, 의료 및 소비자 용도의 UV-C LED 통합 확대 등으로 인해 UV LED 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다. 위생 및 감염 관리에 대한 인식 향상은 공공, 의료, 주거 환경에서 효과적이고 신뢰할 수 있는 살균 솔루션에 대한 수요를 증가시키고 있으며, 특히 전 세계 건강 문제로 인해 이 추세는 더욱 강화되고 있습니다. 화학물질 무사용 살균에 대한 수요 증가로 UV-C LED는 염소나 알코올 기반 화학물질과 같은 기존 살균 방법에 비해 안전하고 환경 친화적이며 잔류물이 없는 대안으로 부상하고 있습니다. 또한 UV-C LED의 의료 및 소비자 제품(공기 청정기, 표면 살균기, 물 처리 시스템 등)에 대한 통합이 확대되면서 용도 범위가 넓어지고 채택 속도가 가속화되어 시장 성장에 크게 기여할 것으로 예상됩니다.

"미국은 예측 기간 동안 가장 높은 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다."

미국은 의료, 수처리, 공기 정화 분야에서 고급 살균 기술에 대한 수요 증가로 인해 예측 기간 동안 북미 지역 UV LED 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다. 위생에 대한 인식 향상은 UV-C LED 솔루션의 채택을 가속화하고 있습니다. 또한, 지속 가능하고 에너지 효율적인 기술에 대한 강력한 정부 지원과 주요 업체들의 지속적인 연구 개발 투자가 시장 성장을 촉진하고 있습니다. 전자 및 인쇄 산업 등에서 UV 경화 기술의 빠른 채택과 주요 제조업체의 존재는 미국 시장을 전 세계 확장 주요 기여자로 자리매김하게 합니다.

본 보고서는 세계의 UV LED 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- UV LED 시장 기업에게 매력적인 성장 기회

- UV LED 시장 : UV 경화별

- UV-A 기술용 UV LED 시장 : 지역별

- 주거 최종 사용자용 UV LED 시장 : 지역별

- 아시아태평양의 UV LED 시장 : 국가별

- UV LED 시장 : 지역별

- UV LED 시장 : 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 주요 기업이 제공하는 UV LED의 평균 판매 가격 : 기술별(2024년)

- UV LED 평균 판매 가격 동향(2021년-2024년)

- UV LED 평균 판매 가격 : 지역별

- UV LED 평균 판매 가격 : 지역별

- 고객사업에 영향을 주는 동향 및 혼란

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- Porter's Five Forces 분석

- 투자 및 자금조달 시나리오

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- PCB 인쇄용 UV LED 경화 솔루션

- 오프 그리드 식수용 UV LED 살균 시스템

- 폴리제트용 UV 경화 시스템

- 무역 분석

- 특허 분석

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 관세 및 규제 상황

- 관세 분석

- 규제기관, 정부기관, 기타 조직

- 표준

- UV LED 시장에 대한 AI/생성형 AI의 영향

- UV LED 시장에 대한 미국 관세의 영향(2025년)

- 소개

- 주요 관세율

- 가격 영향 분석

- 국가 및 지역에 대한 영향

- 산업에 미치는 영향

제6장 UV LED 시장 : 기술별

- 소개

- UV-A

- UV-B

- UV-C

제7장 UV LED 시장 : 출력별

- 소개

- 1W 미만

- 1-5W

- 5W 초과

제8장 UV LED 시장 : 용도별

- 소개

- UV 경화

- 의료 및 과학

- 살균

- 보안

- 리소그래피

- 기타 용도

제9장 UV LED 시장 : 최종 사용자별

- 소개

- 산업

- 상업

- 주거

제10장 UV LED 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 한국

- 대만

- 인도

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시 경제 전망

- 남미

- 중동 및 아프리카

제11장 경쟁 구도

- 개요

- 주요 참가 기업의 전략 및 강점(2021년-2024년)

- 시장 점유율 분석(2024년)

- 수익 분석(2021년-2024년)

- 기업의 평가와 재무지표(2025년)

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- SEOUL VIOSYS CO., LTD.

- NICHIA CORPORATION

- STANLEY ELECTRIC CO., LTD.

- AMS-OSRAM AG

- CRYSTAL IS, INC.

- EVERLIGHT ELECTRONICS CO., LTD.

- BROADCOM

- LITE-ON TECHNOLOGY, INC.

- LUMINUS, INC.

- BOLB INC.

- 기타 기업

- TSLC

- VIOLUMAS

- HOUKEM

- VISHAY INTERTECHNOLOGY, INC.

- INTERNATIONAL LIGHT TECHNOLOGIES INC.

- KRISHNA SMART TECHNOLOGY

- LEDESTAR OPTO-ELECTRONICS TECH. CO., LTD.

- MARKTECH OPTOELECTRONICS INC.

- BOSTON ELECTRONICS CORPORATION

- EPIGAP OSA PHOTONICS GMBH

- SHENZHEN DESHENGXING ELECTRONICS CO., LTD.

- LUMIXTAR

- LUCKYLIGHT ELECTRONICS CO., LTD.

- WURTH ELEKTRONIK EISOS GMBH & CO. KG

- IBT GROUP

제13장 부록

HBR 25.08.22The UV LED Market is projected at USD 1.23 billion in 2025 and is likely to reach USD 2.16 billion by 2030 with a CAGR of 11.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By technology, power output, application, end user, and region |

| Regions covered | North America, Europe, APAC, RoW |

The growing demand for UV LEDs is primarily driven by their application in disinfection, sterilization, and curing processes. These LEDs offer significant advantages over traditional UV lamps, including lower power consumption, longer lifespan, and reduced environmental impact.

"By technology, the UV-C technology segment is expected to hold a significant share of the UV LED market during the forecast period."

UV-C technology is expected to hold a significant share of the UV LED market during the forecast period due to its strong germicidal properties, increasing demand for chemical-free disinfection, and rising use in water and air purification systems. Strong germicidal properties make UV-C highly effective at killing or inactivating viruses, bacteria, and other pathogens, making it the preferred choice for disinfection across healthcare, industrial, and residential sectors. The growing demand for chemical-free disinfection is accelerating the shift toward UV-C LEDs, as they offer a safer and more environmentally friendly alternative to traditional chemical-based methods such as chlorine. Furthermore, the integration of UV-C LEDs into water filters, HVAC systems, and portable sanitizers is rising due to their compact size, energy efficiency, and ability to neutralize harmful microorganisms. These features ensure reliable and sustainable purification, contributing to the growing adoption of UV-C technology in diverse applications.

"By application, disinfection segment is expected to register the highest CAGR in the UV LED market during the forecast period."

During the forecast period, the disinfection segment is expected to register the highest CAGR in the UV LED market due to growing awareness of hygiene and infection control, increasing demand for chemical-free sterilization solutions, and rising integration of UV-C LEDs in healthcare and consumer applications. Growing awareness of hygiene and infection control increases the demand for effective and reliable disinfection solutions in public, healthcare, and residential settings, especially in the wake of global health concerns. The increasing demand for chemical-free sterilization promotes UV-C LEDs as a safe, eco-friendly, and residue-free alternative to traditional disinfection methods such as chlorine or alcohol-based chemicals. Furthermore, the rising integration of UV-C LEDs into healthcare and consumer products such as air purifiers, surface sanitizers, and water treatment systems broadens their application scope and accelerates adoption, significantly contributing to market growth.

"The US is expected to grow at the highest CAGR during the forecast period."

The US is expected to witness the highest CAGR in the UV LED market in North America during the forecast period due to rising demand for advanced disinfection technologies in healthcare, water treatment, and air purification. Increasing awareness of hygiene has accelerated the adoption of UV-C LED solutions. Additionally, strong government support for sustainable and energy-efficient technologies and ongoing R&D investments by key players are driving market growth. The presence of leading manufacturers and rapid adoption of UV curing in industries such as electronics and printing further boost the US market, positioning it as a major contributor to global expansion.

Extensive primary interviews were conducted with key industry experts in the UV LED Market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 45%, Tier 2 - 35%, Tier 3 - 20%

- By Designation- C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region - North America- 20%, Europe - 25%, Asia Pacific - 40%, RoW - 15%

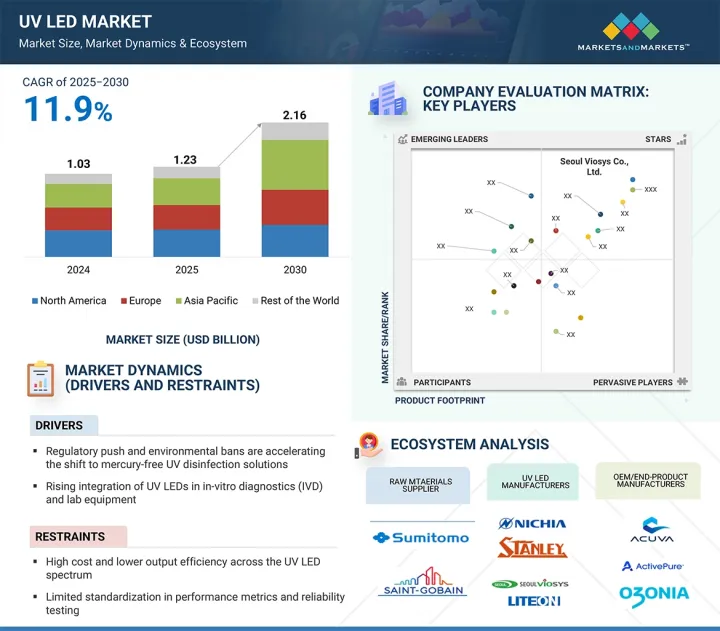

The UV LED market is dominated by a few globally established players, such as Seoul Viosys Co., Ltd. (South Korea), NICHIA CORPORATION (Japan), STANLEY ELECTRIC CO., LTD. (Japan), ams-OSRAM AG (Austria), and Crystal IS, Inc. (US).

The study includes an in-depth competitive analysis of these key players in the UV LED Market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the UV LED Market and forecasts its size by application (UV Curving, Medical & Scientific, Disinfection, Security, Lithography, Other Applications), technology (UV-A, UV-B, UV-C), power output (Less Than 1W, 1-5W, Above 5W), and End User (Industrial, Commercial, Residential). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across regions (North America, Europe, Asia Pacific, RoW). The report includes a supply chain analysis of the key players and their competitive analysis in the UV LED ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Longer operational life of UV LEDs compared with conventional UV lamps, Growing inclination toward eco-friendly products and implementation of stringent regulations regarding use of green products, Growing concern regarding safe drinking water in emerging nations, Higher benefits of UV curing systems than traditional curing systems), restraint (Lower cost of conventional disinfectants compared with UV lights, High cost and lack of awareness associated with UV coatings), opportunities (Increasing demand for ultrapure water, Expanding consumer electronics industry, Emerging applications of UV LEDs in automotive industry), challenges (Limited applications of UV LED technology compared with traditional UV lamps, Strict standards related to UV LED technology)

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product launches in the UV LED Market

- Market Development: Comprehensive information about lucrative markets - the report analyses the UV LED Market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the UV LED Market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Seoul Viosys Co., Ltd. (South Korea), NICHIA CORPORATION (Japan), STANLEY ELECTRIC CO., LTD. (Japan), ams-OSRAM AG (Austria), and Crystal IS, Inc. (US) among others in the UV LED Market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.2 RESEARCH DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Breakdown of primaries

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Approach to arrive at market size using top-down approach (supply side)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN UV LED MARKET

- 4.2 UV LED MARKET, BY UV CURING

- 4.3 UV LED MARKET FOR UV-A TECHNOLOGY, BY REGION

- 4.4 UV LED MARKET IN RESIDENTIAL END USER, BY REGION

- 4.5 UV LED MARKET IN ASIA PACIFIC, BY COUNTRY

- 4.6 UV LED MARKET, BY REGION

- 4.7 UV LED MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Regulatory push and environmental bans accelerating shift to mercury-free UV disinfection solutions

- 5.2.1.2 Rising integration of UV LEDs in in-vitro diagnostics (IVD) and lab equipment

- 5.2.1.3 Advancements in high-power and high-efficiency packaged UV-C LEDs

- 5.2.1.4 Miniaturization of UV LEDs for wearables and smart consumer devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and lower output efficiency across UV LED spectrum

- 5.2.2.2 Limited standardization in performance metrics and reliability testing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased use in robotic and autonomous disinfection systems

- 5.2.3.2 Adoption in compact air and water sterilization modules for appliances

- 5.2.3.3 Development of UV LED-based analytical instruments for food safety testing

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited thermal tolerance and reliability issues in high-density UV LED arrays

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF UV LEDS OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF UV LED, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE OF UV LEDS, BY REGION

- 5.5.4 AVERAGE SELLING PRICE OF UV LED, BY REGION

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 AlGaN epitaxial growth and substrate engineering

- 5.7.1.2 Flip-chip packaging technology

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 UV-LED curing systems

- 5.7.2.2 UV-transparent optical lenses/windows

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Microfluidic lab-on-chip systems

- 5.7.3.2 Deep-UV solid-state & frequency-doubled lasers (DUV, 405-261 nm)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 UV LED CURING SOLUTION FOR PCB PRINTING

- 5.11.2 UV LED DISINFECTION SYSTEM FOR OFF-GRID DRINKING WATER

- 5.11.3 UV CURING SYSTEM FOR POLYJET

- 5.12 TRADE ANALYSIS

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 STANDARDS

- 5.16 IMPACT OF AI/GENERATIVE AI ON UV LED MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON UV LED MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON INDUSTRIES

6 UV LED MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 UV-A

- 6.2.1 RISING ADOPTION IN ELECTRONICS, AUTOMOTIVE, PACKAGING, AND PRINTING INDUSTRIES TO DRIVE DEMAND

- 6.3 UV-B

- 6.3.1 ADOPTION IN TREATMENT OF CHRONIC SKIN CONDITIONS SUCH AS PSORIASIS AND VITILIGO TO DRIVE MARKET

- 6.4 UV-C

- 6.4.1 GROWING DEMAND FOR EFFECTIVE DISINFECTION AND STERILIZATION SOLUTIONS TO DRIVE MARKET

7 UV LED MARKET, BY POWER OUTPUT

- 7.1 INTRODUCTION

- 7.2 LESS THAN 1 W

- 7.2.1 INCREASING DEMAND IN PORTABLE AND COMPACT SYSTEMS TO DRIVE MARKET

- 7.3 1-5 W

- 7.3.1 GROWING USE IN INDUSTRIAL SURFACE CURING, INKJET PRINTING, AND MID-POWER DISINFECTION TO DRIVE MARKET

- 7.4 ABOVE 5 W

- 7.4.1 EXPANDING INDUSTRIAL AND MUNICIPAL ADOPTION OF HIGH-POWER UV-C LEDS FOR STERILIZATION TO FUEL DEMAND

8 UV LED MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 UV CURING

- 8.2.1 GROWING DEMAND FOR ENERGY-EFFICIENT AND ECO-FRIENDLY CURING SOLUTIONS FUELING ADOPTION

- 8.2.2 PRINTING/3D PRINTING

- 8.2.2.1 Demand for instant-cure technology driving adoption in advanced printing solutions

- 8.2.3 COATING

- 8.2.3.1 Growing focus on eco-friendly, low-heat curing boosting demand

- 8.2.4 ADHESIVES

- 8.2.4.1 Increasing need for fast and reliable bonding to drive demand in adhesive curing processes

- 8.3 MEDICAL & SCIENTIFIC

- 8.3.1 RISING USE IN DISINFECTION AND PHOTOTHERAPY FUELING MARKET GROWTH

- 8.3.2 PHOTOTHERAPY

- 8.3.2.1 Growing demand for non-invasive skin treatments fueling segmental growth

- 8.3.3 SENSING

- 8.3.3.1 Offers energy-efficient light sources for sensor applications

- 8.3.4 EQUIPMENT STERILIZATION

- 8.3.4.1 Rising focus on infection control and hygiene driving demand

- 8.3.5 RESEARCH & DEVELOPMENT

- 8.3.5.1 Increasing need for reliable and stable illumination driving adoption in lab equipment

- 8.3.6 TEETH BRIGHTENING

- 8.3.6.1 Growing trend toward fast and safe oral aesthetic treatments driving demand

- 8.3.7 TANNING

- 8.3.7.1 Rising preference for safer UV exposure alternatives fueling demand

- 8.4 DISINFECTION

- 8.4.1 INCREASING NEED FOR COMPACT AND ECO-FRIENDLY DISINFECTION TECHNOLOGIES BOOSTING MARKET GROWTH

- 8.4.2 WATER DISINFECTION

- 8.4.2.1 Rising demand for safe and chemical-free drinking water driving adoption

- 8.4.3 AIR DISINFECTION

- 8.4.3.1 Increasing emphasis on infection prevention in enclosed spaces boosting deployment in HVAC systems

- 8.4.4 SURFACE DISINFECTION

- 8.4.4.1 Shift toward eco-friendly cleaning methods fueling demand

- 8.5 SECURITY

- 8.5.1 INCREASING FOCUS ON PRODUCT TRACEABILITY AND FRAUD PREVENTION FUELING MARKET GROWTH

- 8.5.2 COUNTERFEIT DETECTION (MONEY AND ID)

- 8.5.2.1 Growing need for counterfeit detection and document authentication driving market growth

- 8.5.3 FORENSIC

- 8.5.3.1 Rising demand for non-intrusive forensic tools to increase adoption in law enforcement and investigation

- 8.6 LITHOGRAPHY

- 8.6.1 RISING DEMAND FOR HIGH-PRECISION PATTERNING DRIVING ADOPTION

- 8.7 OTHER APPLICATIONS

9 UV LED MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 INDUSTRIAL

- 9.2.1 INCREASING DEMAND FOR UV TECHNOLOGY IN MANUFACTURING SECTOR TO DRIVE MARKET

- 9.3 COMMERCIAL

- 9.3.1 RISING DEMAND FOR HYGIENE AND STERILIZATION IN HIGH-TRAFFIC COMMERCIAL SPACES DRIVING ADOPTION

- 9.4 RESIDENTIAL

- 9.4.1 RISING DEMAND FOR HYGIENIC LIVING CONDITIONS AND COMPACT DISINFECTION SOLUTIONS DRIVING ADOPTION

10 UV LED MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising focus on sustainable disinfection accelerates market growth

- 10.2.3 CANADA

- 10.2.3.1 Growing demand for clean water and air quality strengthening UV LED deployment

- 10.2.4 MEXICO

- 10.2.4.1 Increasing environmental awareness fueling adoption of UV LEDs

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Rising adoption in public infrastructure and smart sanitation to accelerate market growth

- 10.3.3 GERMANY

- 10.3.3.1 Increasing shift toward UV LED modules in CleanTech landscape to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Rising demand for UV LED packages in healthcare and agriculture sectors to drive market

- 10.3.5 ITALY

- 10.3.5.1 Increasing demand in disinfection and food industries to support market growth

- 10.3.6 SPAIN

- 10.3.6.1 Rising application of UV LED modules in disinfection ecosystem fueling demand

- 10.4 REST OF EUROPE

- 10.5 ASIA PACIFIC

- 10.5.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.5.2 CHINA

- 10.5.2.1 Rising demand in industrial and disinfection applications to fuel market growth

- 10.5.3 JAPAN

- 10.5.3.1 Growing focus on UV LED innovation and exports to drive market

- 10.5.4 SOUTH KOREA

- 10.5.4.1 Growing demand in semiconductor & display sector to propel market

- 10.5.5 TAIWAN

- 10.5.5.1 Expanding UV LED applications in PCB manufacturing and surface treatment to drive market

- 10.5.6 INDIA

- 10.5.6.1 Government push for UV-based sanitation driving market growth

- 10.5.7 REST OF ASIA PACIFIC

- 10.6 ROW

- 10.6.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.6.2 SOUTH AMERICA

- 10.6.2.1 Rising demand in manufacturing and public health infrastructure to drive market

- 10.6.3 MIDDLE EAST & AFRICA

- 10.6.3.1 Clean water and healthcare needs driving adoption

- 10.6.3.2 GCC countries

- 10.6.3.3 Rest of Middle East & Africa

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2021-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 11.6 BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Technology footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SEOUL VIOSYS CO., LTD.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 NICHIA CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 STANLEY ELECTRIC CO., LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 AMS-OSRAM AG

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 CRYSTAL IS, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 EVERLIGHT ELECTRONICS CO., LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.7 BROADCOM

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.8 LITE-ON TECHNOLOGY, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 LUMINUS, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 BOLB INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 SEOUL VIOSYS CO., LTD.

- 12.2 OTHER PLAYERS

- 12.2.1 TSLC

- 12.2.2 VIOLUMAS

- 12.2.3 HOUKEM

- 12.2.4 VISHAY INTERTECHNOLOGY, INC.

- 12.2.5 INTERNATIONAL LIGHT TECHNOLOGIES INC.

- 12.2.6 KRISHNA SMART TECHNOLOGY

- 12.2.7 LEDESTAR OPTO-ELECTRONICS TECH. CO., LTD.

- 12.2.8 MARKTECH OPTOELECTRONICS INC.

- 12.2.9 BOSTON ELECTRONICS CORPORATION

- 12.2.10 EPIGAP OSA PHOTONICS GMBH

- 12.2.11 SHENZHEN DESHENGXING ELECTRONICS CO., LTD.

- 12.2.12 LUMIXTAR

- 12.2.13 LUCKYLIGHT ELECTRONICS CO., LTD.

- 12.2.14 WURTH ELEKTRONIK EISOS GMBH & CO. KG

- 12.2.15 IBT GROUP

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS