|

시장보고서

상품코드

1794018

스마트 팩토리 시장 예측 : 구성요소별, 솔루션별(-2030년)Smart Factory Market by Component (Industrial Sensors, Industrial Robots, Industrial 3D Printing, Machine Vision Systems), Solution (SCADA, Manufacturing Execution Systems (MES), Plant Asset Management (PAM), Industrial Safety) - Global Forecast to 2030 |

||||||

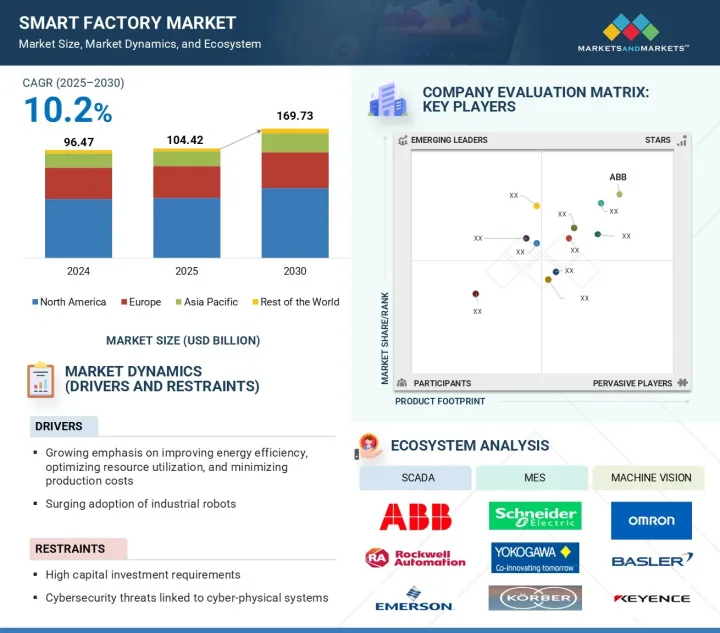

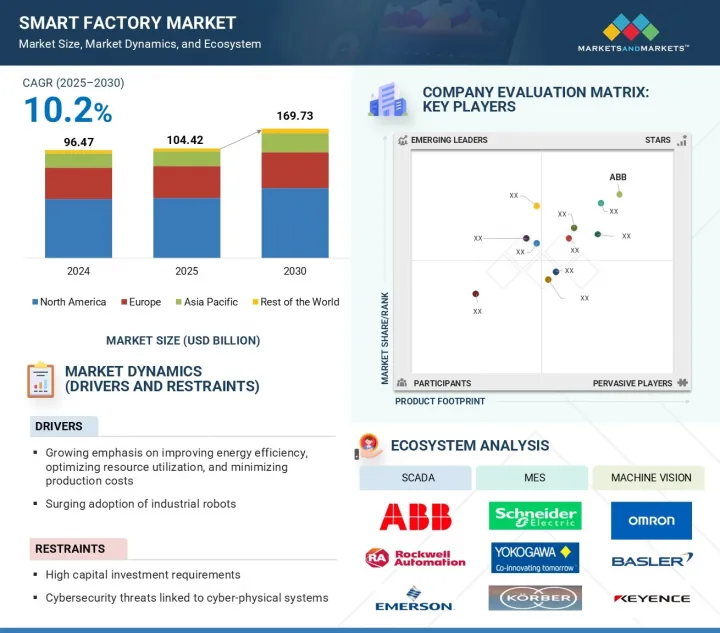

세계 스마트 팩토리 시장 규모는 2025년 1,044억 2,000만 달러, 2030년까지 1,697억 3,000만 달러에 이르고, CAGR 10.2%로 성장할 것으로 예상됩니다.

시장 성장 촉진요인은 인더스트리 4.0 기술 채택 확대, 생산성 향상을 위한 자동화에 대한 수요 증가, 에너지 효율 및 자원 최적화의 중요성입니다. 산업은 비즈니스 효율성을 높이고 다운타임을 줄이기 위해 산업용 센서, 로봇, 3D 프린팅, 머신 비전 시스템 등 스마트 제조 솔루션에 투자하고 있습니다.

| 조사 범위 | |

|---|---|

| 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 구성 요소, 솔루션, 산업, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

MES, SCADA, PAM 시스템의 발전은 공장의 디지털 변환을 지원합니다. 정부의 이니셔티브와 인건비의 상승도 기업에게 제조업무의 현대화를 촉구하고 있습니다. 이러한 요인들이 함께 자동차, 전자, 식품 및 음료, 의약품 등의 부문에서 스마트 팩토리 솔루션 수요를 증가시킵니다.

"MES 부문이 2024년 스마트 팩토리 시장에서 가장 큰 점유율을 차지했습니다."

제조 실행 시스템(MES)은 스마트 팩토리 설정에 매우 중요하며 점유율로 시장을 선도할 것으로 예측됩니다. 이러한 시스템은 기업 수준의 계획과 현장 경영을 가로질러 생산 활동의 실시간 추적, 모니터링 및 제어를 가능하게 합니다. MES의 보급은 생산 효율 향상, 가동 중지 시간 절감, 품질 컴플라이언스 확보 등의 요구에 기인합니다. MES 솔루션은 성능, 재고 및 워크플로우를 시각화하여 데이터 중심의 의사 결정을 지원합니다. 또한 ERP 및 자동화 시스템과의 원활한 통합을 지원하여 복잡한 제조 환경 관리에 이상적입니다. 기업이 Industry 4.0을 채택하고자 하는 가운데, 디지털 전환에서 MES의 역할은 더욱 중요해지고 있습니다. 또한 MES 솔루션은 자동차, 전자, 제약 등의 산업 분야에서 확장성과 적응성으로 인기를 끌고 있습니다. 경영 투명성, 생산 추적성, 실시간 애널리틱스에 대한 주목을 받고 있는 가운데 MES 플랫폼은 스마트하고 연결된 공장을 진화시키는 데 필수적인 도구가 되고 있습니다.

"반도체 및 전자 부문이 예측 기간에 높은 CAGR을 기록"

예측 기간 동안 스마트 팩토리 시장은 반도체 및 전자 부문에서 강력한 성장이 예상됩니다. 이는 주로 칩 및 전자 부품 제조에서의 첨단 자동화, 실시간 모니터링 및 정밀 제조에 대한 수요 증가로 인한 것입니다. 반도체 제조에서는 매우 높은 정밀도, 클린룸에서 작업, 재료의 효율적인 사용이 요구되기 때문에 IoT 센서, 로보틱스, 디지털 트윈, AI에 의한 애널리틱스 등의 스마트 팩토리 기술의 채택에 이상적인 부문이 되고 있습니다. 이러한 도구는 불량품을 줄이고 수율을 향상시키고 전자 장비 생산에서 중요한 일관된 품질을 보장하는 데 도움이 됩니다. 게다가, 생산 사이클의 단축, 커스터마이즈성의 향상, 시장 투입까지의 시간의 단축의 필요성으로부터, 반도체 및 전자 기업은 레거시 시스템을 스마트 팩토리 솔루션으로 업그레이드하는 경향이 있습니다. 장비 연결성과 엣지 컴퓨팅의 지속적인 발전이 이러한 전환을 더욱 강화하고 있습니다. 제조업체가 생산성과 에너지 효율성을 높이려는 가운데 스마트 팩토리 접근 방식은 기세를 늘리고 있습니다. 이러한 추세는 예측 기간의 동일한 부문에서 높은 CAGR을 크게 촉진할 것으로 예측됩니다.

"북미는 2030년까지 스마트 팩토리 시장에서 큰 점유율을 차지할 전망"

북미의 스마트 팩토리 시장은 산업 자동화, 첨단 제조 기술, 강력한 디지털 인프라의 광범위한 채택에 힘입어 2030년에 걸쳐 강력한 지위를 유지할 것으로 예측됩니다. 미국은 Industry 4.0에 대한 조기 투자, 기술 공급자의 강한 존재, 생산성 향상 및 운영 비용 절감에 주력함으로써 크게 기여하는 존재입니다. 자동차, 항공우주, 전자, 식품가공 등의 부문에서 수요가 증가하고 있으며, 모두 업무를 근대화하기 위해 IoT, 로보틱스, 머신러닝, 클라우드 기반 솔루션을 적극적으로 통합하고 있습니다.

이 보고서는 세계의 스마트 팩토리 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 스마트 팩토리 시장의 기업에게 매력적인 기회

- 스마트 팩토리 시장 : 구성요소별

- 스마트 팩토리 시장 : 솔루션별

- 스마트 팩토리 시장 : 프로세스 산업별

- 스마트 팩토리 시장 : 디스크리트 산업별

- 북미의 스마트 팩토리 시장 : 솔루션별, 국가별

- 스마트 팩토리 시장 : 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 가격 설정 분석

- MES의 가격 분석

- 산업용 로봇의 평균 판매 가격

- SCADA의 평균 판매 가격

- 머신 비전 구성요소의 평균 판매 가격

- 참고 가격 : 주요 기업, 구성요소별(2024년)

- 산업용 센서의 평균 판매 가격

- 고객사업에 영향을 주는 동향/혼란

- Porter's Five Forces 분석

- 사례 연구 분석

- ELOPAK, EMERSON AVENTICS의 견고한 공압 시스템을 탑재한 게이블 톱 포장용 완전 무균 충전기를 설치

- MP EQUIPMENT, ROCKWELL AUTOMATION의 안전 컨설턴트와 제휴해, 단백질 포셔닝 머신의 설계를 재평가

- MOLLART ENGINEERING, PROCTER SMART FACTORY의 밀폐형 가드를 자사의 공작기계에 채택

- 주요 자동차 공급업체가 FUJIFILM의 4D 고해상도 머신 비전 렌즈로 검사 효율을 향상

- SIDENOR의 제철소에 있어서, 3D 머신 비전을 이용한 선진의 치수 및 품질 관리

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 주요 이해관계자와 구매 기준

- 무역 분석

- 수입 시나리오(HS 코드 847950)

- 수출 시나리오(HS 코드 847950)

- 특허 분석

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 표준

- 스마트 팩토리 시장에 대한 AI/생성형 AI의 영향

- 소개

- 주요 최종 이용 산업에 대한 AI/생성형 AI의 영향

- 이용 사례

- 스마트 팩토리 에코시스템에 있어서의 AI/생성형 AI의 미래

- 2025년 미국 관세의 영향 - 개요

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 대한 영향

- 최종 이용 산업에 미치는 영향

제6장 스마트 팩토리 시장 : 구성요소별

- 소개

- 산업용 센서

- 산업용 로봇

- 산업용 3D 프린팅

- 머신 비전

제7장 스마트 팩토리 시장 : 솔루션별

- 소개

- 제조 실행 시스템(MES)

- 감시 제어 및 데이터 수집(SCADA)

- 플랜트 자산 관리(PAM)

- 산업안전

제8장 스마트 팩토리 시장 : 산업별

- 소개

- 공정 산업

- 이산 산업

제9장 스마트 팩토리 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 북유럽

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시 경제 전망

- 중동

- 남미

- 아프리카

제10장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점, 2021년 1월-2025년 6월

- 수익 분석(2020년-2024년)

- 주요 5개사의 시장 점유율 분석(2024년)

- 기업 평가 및 재무 지표

- 제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- ABB

- EMERSON ELECTRIC CO.

- SIEMENS

- SCHNEIDER ELECTRIC

- ROCKWELL AUTOMATION, INC.

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- GE VERNOVA

- YOKOGAWA ELECTRIC CORPORATION

- OMRON CORPORATION

- ENDRESS HAUSER GROUP SERVICES AG

- FANUC CORPORATION

- WIKA ALEXANDER WIEGAND SE & CO. KG

- DWYER INSTRUMENTS, LLC

- STRATASYS

- 3D SYSTEMS, INC.

- COGNEX CORPORATION

- BASLER AG

- 기타 주요 기업

- FUJI ELECTRIC CO., LTD.

- HITACHI, LTD.

- KROHNE MESSTECHNIK GMBH

- AZBIL CORPORATION

- VEGA GRIESHABER KG

- DANFOSS

- KUKA AG

- 기타 중소기업

- TRIDITIVE

- ROBOZE

- ZIVID

- INXPECT SPA

- INUITIVE

- FUELICS

- ULTIMAKER

- NANO DIMENSION

- PICK-IT NV

- ONROBOT A/S

제12장 부록

SHW 25.08.25The global smart factory market is projected to grow from USD 104.42 billion in 2025 to USD 169.73 billion by 2030, growing at a CAGR of 10.2%. The market growth is driven by the increasing adoption of Industry 4.0 technologies, rising demand for automation to improve productivity, and growing emphasis on energy efficiency and resource optimization. Industries are investing in smart manufacturing solutions such as industrial sensors, robots, 3D printing, and machine vision systems to improve operational efficiency and reduce downtime.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Solution, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Advancements in MES, SCADA, and PAM systems are also supporting the digital transformation of factories. Government initiatives and rising labor costs also encourage companies to modernize their manufacturing operations. These factors collectively boost the demand for smart factory solutions across sectors such as automotive, electronics, food & beverages, and pharmaceuticals.

"MES segment accounted for largest share of smart factory market in 2024"

Manufacturing execution systems (MES) are crucial in smart factory setups and are expected to lead the market in terms of share. These systems bridge enterprise-level planning and shop-floor operations, enabling real-time tracking, monitoring, and control of manufacturing activities. Their widespread adoption is driven by the need to improve production efficiency, reduce downtime, and ensure quality compliance. MES solutions help manufacturers make data-driven decisions by offering visibility into performance, inventory, and workflows. They also support seamless integration with ERP and automation systems, making them ideal for managing complex manufacturing environments. As companies aim to adopt Industry 4.0 practices, the role of MES in digital transformation becomes even more critical. Additionally, MES solutions are gaining popularity for their scalability and adaptability across industries such as automotive, electronics, and pharmaceuticals. With increasing focus on operational transparency, production traceability, and real-time analytics, MES platforms are becoming essential tools in evolving smart, connected factories.

"Semiconductor & electronics segment to record a significant CAGR during forecast period"

During the forecast period, the smart factory market is expected to experience strong growth in the semiconductor & electronics segment. This is mainly due to rising demand for advanced automation, real-time monitoring, and precision manufacturing in chip and electronic component production. Semiconductor manufacturing requires extremely high accuracy, cleanroom operations, and efficient use of materials, making it an ideal sector for adopting smart factory technologies such as IoT sensors, robotics, digital twins, and AI-driven analytics. These tools help reduce defects, improve yield, and ensure consistent quality, which is critical in electronics production. Additionally, the need for shorter production cycles, greater customization, and faster time-to-market pushes semiconductor and electronics companies to upgrade legacy systems with smart factory solutions. Ongoing advancements in equipment connectivity and edge computing further support this transition. The smart factory approach is gaining momentum as manufacturers aim for better productivity and energy efficiency. These trends are expected to significantly drive the segment's high CAGR during the forecast period.

"North America to hold a significant share in smart factory market by 2030"

The smart factory market in North America is anticipated to maintain a strong position through 2030, supported by widespread adoption of industrial automation, advanced manufacturing technologies, and strong digital infrastructure. The US is a key contributor, driven by its early investment in Industry 4.0 practices, strong presence of technology providers, and a focus on boosting productivity and reducing operational costs. Demand is growing across sectors such as automotive, aerospace, electronics, and food processing, all actively integrating IoT, robotics, machine learning, and cloud-based solutions to modernize operations. The region also benefits from supportive government initiatives promoting smart manufacturing and digital transformation, including funding programs and industry partnerships. Prominent players such as Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), and GE Vernova (US) continuously innovate and offer scalable smart factory solutions. Moreover, the increasing emphasis on real-time monitoring, predictive maintenance, and energy efficiency aligns well with North American manufacturers' goals. With a strong foundation in technology adoption and a clear focus on competitiveness, North America is expected to capture a significant share of the smart factory market during the forecast period.

Extensive primary interviews were conducted with key industry experts in the smart factory market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation - Directors - 48%, C- level Executives - 33%, and Others - 19%

- By Region - Asia Pacific - 40%, Europe - 18%, North America - 35%, and RoW - 7%

The smart factory market is dominated by a few globally established players, such as ABB (Switzerland), Emerson Electric Co.(US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric Corporation (Japan), GE Vernova (US), Rockwell Automation (US), Honeywell International Inc. (US), Yokogawa Electric Corporation (Japan), OMRON Corporation (Japan), WIKA Alexander Wiegand SE & Co. KG (Germany), Endress+Hauser Group Services AG (Switzerland), and FANUC CORPORATION (Japan).

The study includes an in-depth competitive analysis of these key players in the smart factory market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the smart factory market and forecasts its size by component (industrial sensors, industrial robots, industrial 3D printers, machine vision systems), by solution (SCADA, MES, industrial safety, PAM), and by industry [process industries (oil & gas, chemicals, pulp & paper, pharmaceuticals, metals & mining, food & beverages, energy & power, other process industries), discrete industries (automotive, aerospace & defense, semiconductor & electronics, machine manufacturing, medical devices, other discrete industries)]. It also discusses the market's drivers, restraints, opportunities, and challenges. It provides a detailed market analysis across four key regions (North America, Europe, Asia Pacific, and RoW). The report includes a review of the supply chain and competitive landscape of key players operating in the smart factory ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (growing emphasis on improving energy efficiency, optimizing resource utilization, and minimizing production costs; increasing adoption of industrial robots; surging use of IoT and AI technologies across industrial settings), restraints (high capital investment requirements, rising security concerns related to cyber-physical systems), opportunities (adoption of 5G in next-generation smart factories, advancements in wireless sensor technologies and their integration into intelligent manufacturing), challenges (bridging the gap between (IT) and (OT) systems, exposure to cyber threats)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the smart factory market

- Market Development: Comprehensive information about lucrative markets by analyzing the smart factory market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the smart factory market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as ABB (Switzerland), Emerson Electric Co. (US), Honeywell International Inc. (US), Rockwell Automation (US), and Schneider Electric (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART FACTORY MARKET

- 4.2 SMART FACTORY MARKET, BY COMPONENT

- 4.3 SMART FACTORY MARKET, BY SOLUTION

- 4.4 SMART FACTORY MARKET, BY PROCESS INDUSTRIES

- 4.5 SMART FACTORY MARKET, BY DISCRETE INDUSTRIES

- 4.6 SMART FACTORY MARKET IN NORTH AMERICA, BY SOLUTION AND COUNTRY

- 4.7 SMART FACTORY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing emphasis on improving energy efficiency, optimizing resource utilization, and minimizing production costs

- 5.2.1.2 Growing adoption of industrial robots

- 5.2.1.3 Rising interest in technologies like IoT and AI across industrial settings

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investment requirements

- 5.2.2.2 Cybersecurity threats linked to cyber-physical systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of 5G in next-generation smart factories

- 5.2.3.2 Advancements in wireless sensor technologies and their integration into intelligent manufacturing

- 5.2.4 CHALLENGES

- 5.2.4.1 Bridging the gap between IT and OT systems

- 5.2.4.2 Exposure to cyber threats

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 PRICING ANALYSIS OF MES

- 5.6.1.1 Indicative pricing of MES software subscription, by key players, 2024

- 5.6.1.2 Average selling price trend of MES software subscriptions, 2021-2024

- 5.6.1.3 Average selling price trend of MES software subscriptions, by region, 2021-2024

- 5.6.2 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS, 2024 (USD)

- 5.6.3 AVERAGE SELLING PRICE FOR SCADA, BY RTUS, 2024 (USD)

- 5.6.4 AVERAGE SELLING PRICE FOR MACHINE VISION COMPONENTS, 2024 (USD)

- 5.6.5 INDICATIVE PRICING OF KEY PLAYERS, BY COMPONENT, 2024

- 5.6.6 AVERAGE SELLING PRICE FOR INDUSTRIAL SENSORS, 2024 (USD)

- 5.6.1 PRICING ANALYSIS OF MES

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ELOPAK INSTALLS FULLY ASEPTIC FILLING MACHINE FOR GABLE TOP PACKAGING WITH ROBUST PNEUMATICS FROM EMERSON AVENTICS

- 5.9.2 MP EQUIPMENT JOINS HANDS WITH ROCKWELL AUTOMATION SAFETY CONSULTANTS TO RE-EVALUATE DESIGN OF PROTEIN PORTIONING MACHINE

- 5.9.3 MOLLART ENGINEERING SELECTS PROCTER SMART FACTORY'S ENCLOSED GUARDS TO INSTALL IN ITS MACHINE TOOLS

- 5.9.4 LEADING AUTOMOTIVE SUPPLIER IMPROVES INSPECTION EFFICIENCY WITH FUJIFILM'S 4D HIGH RESOLUTION MACHINE VISION LENSES

- 5.9.5 ADVANCED DIMENSIONAL AND QUALITY CONTROL WITH 3D MACHINE VISION AT SIDENOR STEEL MILL

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Artificial intelligence

- 5.10.1.2 Augmented reality

- 5.10.1.3 IoT

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 5G

- 5.10.2.2 Digital twin

- 5.10.2.3 Predictive maintenance

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Blockchain

- 5.10.3.2 Smart energy management

- 5.10.3.3 Edge computing

- 5.10.3.4 Predictive supply chain

- 5.10.3.5 Cybersecurity

- 5.10.1 KEY TECHNOLOGIES

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 847950)

- 5.12.2 EXPORT SCENARIO (HS CODE 847950)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.16 IMPACT OF AI/GEN AI ON SMART FACTORY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GEN AI ON KEY END-USE INDUSTRIES

- 5.16.2.1 Electronics & semiconductors

- 5.16.2.2 Automotive

- 5.16.3 USE CASES

- 5.16.4 FUTURE OF AI/GEN AI IN SMART FACTORY ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 SMART FACTORY MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 INDUSTRIAL SENSORS

- 6.2.1 LEVEL SENSORS

- 6.2.1.1 Requirement to measure liquid, bulk solid, and other fluid levels to drive market

- 6.2.2 TEMPERATURE SENSORS

- 6.2.2.1 Adoption of lean manufacturing and process control technologies to drive market

- 6.2.3 FLOW SENSORS

- 6.2.3.1 Wide use in monitoring flow of various chemicals to foster market growth

- 6.2.4 POSITION SENSORS

- 6.2.4.1 Increasing demand from several applications to drive market

- 6.2.5 PRESSURE SENSORS

- 6.2.5.1 Replacement of pressure transducers with cost-efficient pressure transmitters to drive market

- 6.2.6 FORCE SENSORS

- 6.2.6.1 Demand for force control to improve safety and comfort in robot-human interactions to drive market

- 6.2.7 HUMIDITY & MOISTURE SENSORS

- 6.2.7.1 Extensive use in chemicals, pharmaceuticals, oil & gas, and food & beverage industries to drive demand

- 6.2.8 IMAGE SENSORS

- 6.2.8.1 Wide usage in imaging devices to foster market growth

- 6.2.9 GAS SENSORS

- 6.2.9.1 Rising demand from various end-use industries to drive market

- 6.2.1 LEVEL SENSORS

- 6.3 INDUSTRIAL ROBOTS

- 6.3.1 TRADITIONAL INDUSTRIAL ROBOTS

- 6.3.1.1 Adoption of automated manufacturing techniques to drive market growth

- 6.3.1.2 Articulated robots

- 6.3.1.2.1 Demand for assembly, welding, and machine load and unloads to drive market

- 6.3.1.3 Cartesian robots

- 6.3.1.3.1 Provision of accurate and quick solutions for material handling applications to drive market

- 6.3.1.4 Selective compliance assembly robot arm

- 6.3.1.4.1 Ability to offer precise and flexible horizontal motions while being fixed vertically to drive adoption

- 6.3.1.5 Cylindrical robots

- 6.3.1.5.1 Deployment in various robotic applications to drive market

- 6.3.1.6 Other robots

- 6.3.2 COLLABORATIVE ROBOTS

- 6.3.2.1 High production efficiency through human-robot collaboration to drive market

- 6.3.1 TRADITIONAL INDUSTRIAL ROBOTS

- 6.4 INDUSTRIAL 3D PRINTING

- 6.4.1 ELIMINATION OF ASSEMBLY LINE AND REDUCTION OF LABOR COSTS TO DRIVE MARKET

- 6.4.2 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY OFFERING

- 6.4.2.1 Printers

- 6.4.2.1.1 Primary hardware component used in industrial additive manufacturing

- 6.4.2.2 Material

- 6.4.2.2.1 Investments in R&D for developing new materials for 3D printing to support market growth

- 6.4.2.3 Software

- 6.4.2.3.1 Software programs essential for developing and processing 3D digital models

- 6.4.2.4 Services

- 6.4.2.4.1 Advancements in 3D printing technology increasing demand for services

- 6.4.2.1 Printers

- 6.5 MACHINE VISION

- 6.5.1 INCREASING DEMAND FOR QUALITY FROM MANUFACTURERS AND CUSTOMERS TO DRIVE MARKET

- 6.5.2 MACHINE VISION: SMART FACTORY MARKET, BY COMPONENT

- 6.5.2.1 Cameras

- 6.5.2.1.1 Demand for high-quality images, image processing, and compactness to drive market

- 6.5.2.2 Frame grabbers

- 6.5.2.2.1 Increasing adoption in high-speed and large-scale machine vision systems to drive market

- 6.5.2.3 LED lighting

- 6.5.2.3.1 Increasing adoption of structured lighting solutions to fuel demand

- 6.5.2.4 Optics

- 6.5.2.4.1 Growing integration with camera bodies for object image capture to fuel demand

- 6.5.2.5 Processors

- 6.5.2.5.1 Adoption of advanced vision systems fueling demand for high-performance processors

- 6.5.2.6 Other hardware components

- 6.5.2.6.1 Optimized hardware components to boost system reliability and performance

- 6.5.2.7 Software

- 6.5.2.7.1 AI-based machine vision software

- 6.5.2.1 Cameras

7 SMART FACTORY MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- 7.2 MANUFACTURING EXECUTION SYSTEM (MES)

- 7.2.1 INCREASING PRODUCTIVITY, REDUCING SHIPPING TIME, AND PROCESSING DATA TO DRIVE MARKET

- 7.2.2 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY DEPLOYMENT MODE

- 7.2.2.1 On-premises

- 7.2.2.1.1 Emphasis on enhancing security control through in-house configurations to fuel segmental growth

- 7.2.2.2 Cloud

- 7.2.2.2.1 Cost-efficiency and reliability in terms of data recovery to drive market

- 7.2.2.3 Hybrid

- 7.2.2.3.1 Enhanced operational efficiency through integrated infrastructure to foster segmental growth

- 7.2.2.1 On-premises

- 7.2.3 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY OFFERING

- 7.2.3.1 Software

- 7.2.3.1.1 Ability to limit manual work and reduce errors to accelerate segmental growth

- 7.2.3.2 Services

- 7.2.3.2.1 Need for routine business maintenance and upgradation to contribute to segmental growth

- 7.2.3.1 Software

- 7.2.4 IMPLEMENTATION

- 7.2.5 UPGRADATION

- 7.2.6 TRAINING

- 7.2.7 MAINTENANCE

- 7.3 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

- 7.3.1 CONTROL AND ACQUISITION OF DATA FROM REMOTE DEVICES TO DRIVE MARKET

- 7.3.2 SCADA: SMART FACTORY MARKET, BY OFFERING

- 7.3.2.1 Hardware

- 7.3.2.2 Programmable logic controller

- 7.3.2.2.1 Adoption of PLCs for safe and efficient plant operations to accelerate segment expansion

- 7.3.2.3 Remote terminal unit

- 7.3.2.3.1 Rising demand for real-time data acquisition and remote monitoring to drive segment growth

- 7.3.2.4 Human-machine interface

- 7.3.2.4.1 Growing need for clear graphical representation of critical data to support timely decision-making

- 7.3.2.4.2 Communication systems

- 7.3.2.4.3 Wired communication systems

- 7.3.2.4.4 Wireless communication systems

- 7.3.2.5 Other components

- 7.3.2.6 software

- 7.3.2.6.1 Software deployment modes

- 7.3.2.6.2 On-premises deployment

- 7.3.2.6.3 Cloud deployment

- 7.3.2.7 Services

- 7.3.2.7.1 Professional services

- 7.3.2.7.2 Managed services

- 7.4 PLANT ASSET MANAGEMENT (PAM)

- 7.4.1 REDUCED UNPLANNED DOWNTIME AND OPTIMIZED ASSET UTILIZATION TO FOSTER MARKET GROWTH

- 7.5 INDUSTRIAL SAFETY

- 7.5.1 RISK MITIGATION IN SENSORS, LOGIC CONTROLS, AND ACTING ELEMENTS TO DRIVE MARKET

- 7.5.2 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY TYPE

- 7.5.2.1 Machine safety

- 7.5.2.1.1 Machine safety systems enable safety of plant assets and personnel

- 7.5.2.2 Worker safety

- 7.5.2.2.1 Smart worker safety solutions to drive industrial worker safety market

- 7.5.2.1 Machine safety

8 SMART FACTORY MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- 8.2 PROCESS INDUSTRIES

- 8.2.1 NEED TO DELIVER SUPERIOR PRODUCTS AT COMPETITIVE COSTS TO DRIVE MARKET

- 8.2.2 OIL & GAS

- 8.2.2.1 Reliability in large-scale production, product quality, and accelerated decision-making to drive market

- 8.2.3 CHEMICALS

- 8.2.3.1 Enhancement of production efficiencies and operational excellence in processes to drive market

- 8.2.4 PULP & PAPER

- 8.2.4.1 Workflow management and process optimization to boost market

- 8.2.5 PHARMACEUTICALS

- 8.2.5.1 Need to standardize workflows and enable regulatory compliance to fuel market

- 8.2.6 METALS & MINING

- 8.2.6.1 Cost containment, supply chain visibility, and risk management to drive market

- 8.2.7 FOOD & BEVERAGE

- 8.2.7.1 Cost-efficient and streamlined production processes to foster growth

- 8.2.8 ENERGY & POWER

- 8.2.8.1 Improved plant performance and flexibility in electricity production to drive market

- 8.2.9 OTHER PROCESS INDUSTRIES

- 8.3 DISCRETE INDUSTRIES

- 8.3.1 OPTIMIZATION OF SUPPLY CHAIN MANAGEMENT TO DRIVE MARKET

- 8.3.2 AUTOMOTIVE

- 8.3.2.1 Development and production of high-quality automobiles to drive market

- 8.3.3 AEROSPACE

- 8.3.3.1 Real-time visibility of production processes, equipment conditions, and process defects to drive market

- 8.3.4 SEMICONDUCTOR & ELECTRONICS

- 8.3.4.1 Need to achieve accuracy in designing complex products to drive market

- 8.3.5 MACHINE MANUFACTURING

- 8.3.5.1 Prevention of machine breakdown and unplanned downtime to drive market

- 8.3.6 MEDICAL DEVICES

- 8.3.6.1 Pressing need for manufacturing precision and high profitability to boost demand

- 8.3.7 OTHER DISCRETE INDUSTRIES

9 SMART FACTORY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Operational efficiency, improved product quality, and optimal use of resources to drive market

- 9.2.3 CANADA

- 9.2.3.1 Increasing government support for adopting advanced manufacturing technologies to drive market

- 9.2.4 MEXICO

- 9.2.4.1 Increasing investments and expansions by global market players to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Increasing adoption of smart factory solutions in automotive industry to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Industry 4.0 initiative to automate operations to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Growth of industrial sector to drive market

- 9.3.5 ITALY

- 9.3.5.1 Focus on boosting manufacturing output to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Focus on modernizing manufacturing infrastructure to support smart factory growth

- 9.3.7 POLAND

- 9.3.7.1 Industry 4.0 strategies and EU funding supporting smart factory development

- 9.3.8 NORDICS

- 9.3.8.1 Sustainability-led smart factory adoption across advanced industries

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Increasing adoption of automation solutions due to rising labor costs to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Ongoing developments in smart manufacturing processes to drive market

- 9.4.4 INDIA

- 9.4.4.1 Rapid industrialization, recovering economy, growing government support, and increasing foreign investments to drive market

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Government-led initiatives and technology leadership driving adoption

- 9.4.6 AUSTRALIA

- 9.4.6.1 Focus on reshoring and digital manufacturing to build industrial resilience

- 9.4.7 INDONESIA

- 9.4.7.1 Rising industrialization and government push for Industry 4.0 to fuel demand

- 9.4.8 MALAYSIA

- 9.4.8.1 Government support and smart manufacturing initiatives driving growth

- 9.4.9 THAILAND

- 9.4.9.1 National strategies and foreign investments accelerating smart factory adoption

- 9.4.10 VIETNAM

- 9.4.10.1 Industrial modernization and export-oriented growth fostering smart factory uptake

- 9.4.11 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Bahrain

- 9.5.2.1.1 Digital-first approach in dynamic industrial landscape to support market growth

- 9.5.2.2 Kuwait

- 9.5.2.2.1 Industrial diversification driving digital transformation

- 9.5.2.3 Oman

- 9.5.2.3.1 Strategic investment in industrial modernization and smart production to drive market

- 9.5.2.4 Qatar

- 9.5.2.4.1 Adoption of smart factory increasing to build resilient manufacturing capabilities

- 9.5.2.5 Saudi Arabia

- 9.5.2.5.1 Vision 2030 fueling industrial automation and digital transformation

- 9.5.2.6 UAE

- 9.5.2.6.1 Leading digital industrial transformation through strategic initiatives

- 9.5.2.7 Rest of Middle East

- 9.5.2.1 Bahrain

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Brazil

- 9.5.3.1.1 Focus on industrial modernization and digital adoption to fuel market

- 9.5.3.2 Argentina

- 9.5.3.2.1 Emerging focus on efficiency and technology upgrades supporting market growth

- 9.5.3.3 Other South American countries

- 9.5.3.1 Brazil

- 9.5.4 AFRICA

- 9.5.4.1 South Africa

- 9.5.4.1.1 Government-backed digitization to enhance industrial competitiveness

- 9.5.4.2 Other African countries

- 9.5.4.1 South Africa

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-JUNE 2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS OF KEY FIVE PLAYERS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 MACHINE VISION MARKET: COMPANY FOOTPRINT, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Machine vision market: Region footprint

- 10.7.5.3 Machine vision market: System type footprint

- 10.7.5.4 Machine vision market: Component footprint

- 10.7.5.5 Machine vision market: Industry footprint

- 10.7.6 SCADA MARKET: COMPANY FOOTPRINT, 2024

- 10.7.6.1 SCADA market: Overall footprint

- 10.7.6.2 SCADA market: Region footprint

- 10.7.6.3 SCADA market: Offering footprint

- 10.7.6.4 SCADA market: End user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ABB

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 EMERSON ELECTRIC CO.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & developments

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 SIEMENS

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 SCHNEIDER ELECTRIC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Expansions

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ROCKWELL AUTOMATION, INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & developments

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 HONEYWELL INTERNATIONAL INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & developments

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Right to win

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 MITSUBISHI ELECTRIC CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.3.3 Other developments

- 11.1.8 GE VERNOVA

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & developments

- 11.1.9 YOKOGAWA ELECTRIC CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & developments

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Other developments

- 11.1.10 OMRON CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.11 ENDRESS+HAUSER GROUP SERVICES AG

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & developments

- 11.1.11.3.2 Deals

- 11.1.11.3.3 Expansions

- 11.1.12 FANUC CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & developments

- 11.1.13 WIKA ALEXANDER WIEGAND SE & CO. KG

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.13.3.2 Expansions

- 11.1.14 DWYER INSTRUMENTS, LLC

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches & developments

- 11.1.15 STRATASYS

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches & developments

- 11.1.15.3.2 Deals

- 11.1.16 3D SYSTEMS, INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches & developments

- 11.1.16.3.2 Deals

- 11.1.17 COGNEX CORPORATION

- 11.1.17.1 Business overview

- 11.1.17.2 Products/Solutions/Services offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Product launches

- 11.1.18 BASLER AG

- 11.1.18.1 Business overview

- 11.1.18.2 Products/Solutions/Services offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Product launches

- 11.1.18.3.2 Deals

- 11.1.1 ABB

- 11.2 OTHER KEY PLAYERS

- 11.2.1 FUJI ELECTRIC CO., LTD.

- 11.2.2 HITACHI, LTD.

- 11.2.3 KROHNE MESSTECHNIK GMBH

- 11.2.4 AZBIL CORPORATION

- 11.2.5 VEGA GRIESHABER KG

- 11.2.6 DANFOSS

- 11.2.7 KUKA AG

- 11.3 OTHER SMALL AND MEDIUM-SIZED ENTERPRISES

- 11.3.1 TRIDITIVE

- 11.3.2 ROBOZE

- 11.3.3 ZIVID

- 11.3.4 INXPECT S.P.A.

- 11.3.5 INUITIVE

- 11.3.6 FUELICS

- 11.3.7 ULTIMAKER

- 11.3.8 NANO DIMENSION

- 11.3.9 PICK-IT N.V.

- 11.3.10 ONROBOT A/S

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS