|

시장보고서

상품코드

1811763

프린티드 일렉트로닉스 시장(-2030년) : 인쇄 기술별(스크린, 잉크젯, 플렉소 인쇄, 그라비어 인쇄), 재료별(잉크, 기재), 해상도별(100 라인/cm 미만, 100-200 라인/cm, 200 라인/cm 이상), 지역별Printed Electronics Market by Printing Technology (Screen, Inkjet, Flexographic, Gravure Printing), Material (Inks, Substrates), Resolution (Below 100 Lines/CM, 100-200 Lines/CM, Above 200 Lines/CM) and Geography - Global Forecast to 2030 |

||||||

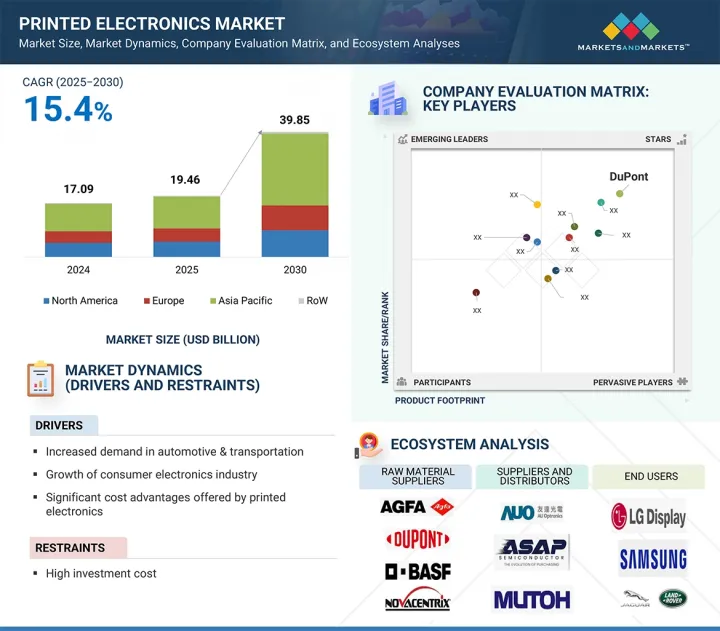

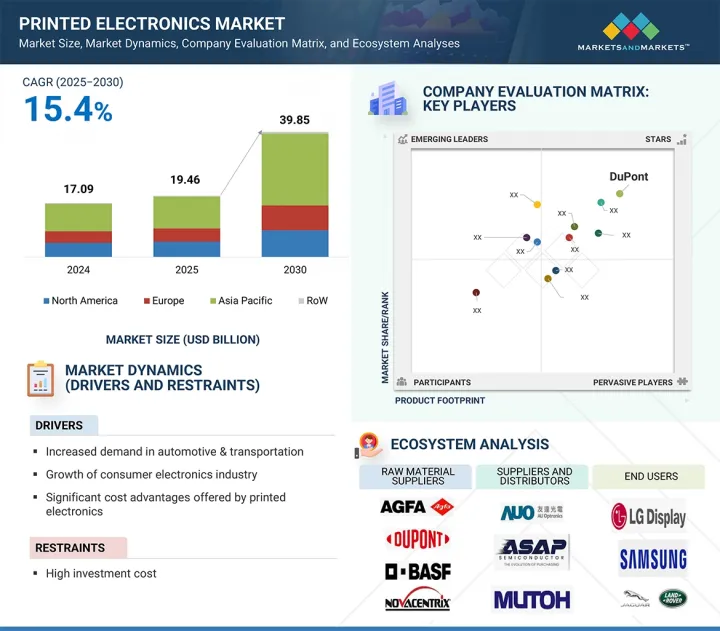

세계의 프린티드 일렉트로닉스 시장 규모는 2025년 194억 6,000만 달러에서 예측 기간 동안 CAGR 15.4%로 증가하여 2030년에는 398억 5,000만 달러로 성장할 것으로 예측됩니다.

이는 산업계 전반에 걸쳐 유연하고 가볍고 비용 효율적인 전자부품에 대한 수요가 증가하고 있기 때문입니다. 프린티드 일렉트로닉스는 기존의 경질 전자제품으로는 구현할 수 없었던 플렉서블 디스플레이, 웨어러블 기기, 스마트 포장, 첨단 센서 등 혁신적인 용도를 가능하게 합니다. 또한, 재료 사용량을 줄이고, 생산 비용을 낮추며, 대규모 맞춤화를 실현할 수 있기 때문에 제조업체에게 매우 매력적인 기술입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문별 | 인쇄 기술, 재료, 해상도, 용도, 최종 이용 산업, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

IoT, 전기자동차, CE 제품의 급속한 성장은 프린티드 일렉트로닉스의 채택을 더욱 가속화하고 있습니다. 또한, 인쇄 기술의 발전으로 성능과 내구성이 향상되어 프린티드 일렉트로닉스가 주류로 자리 잡고 있습니다. 이러한 흐름은 예측 기간 동안 시장 성장을 크게 촉진할 것으로 예상됩니다.

"용도별로는 조명이 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다."

이러한 성장은 주로 자동차, CE 제품, 건축 분야에서 OLED 조명 솔루션의 채택이 확대됨에 따라 주도되고 있습니다. 프린트 조명은 유연성, 경량화, 에너지 절약, 디자인 자유도 등의 이점을 제공하여 현대적이고 지속가능한 용도에 이상적입니다. 스마트홈, 웨어러블 기기, 차세대 자동차의 혁신적인 조명에 대한 수요도 이러한 추세를 더욱 촉진하고 있습니다. 또한, 재료 비용의 하락과 인쇄 기술의 발전으로 인해 인쇄 조명 솔루션의 대규모 보급이 촉진되고 있으며, 이 분야는 시장의 주요 성장 촉진요인으로 자리매김하고 있습니다.

"인쇄 기술별로는 잉크젯이 예측 기간 동안 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다."

잉크젯 인쇄 기술의 성장은 높은 정밀도, 재료 효율성, 마스크나 판 없이도 복잡한 패턴을 인쇄할 수 있는 능력에 기인합니다. 잉크젯 인쇄는 시제품 제작 및 중소규모 생산에 널리 사용되며, 플렉서블 디스플레이, 센서, RFID 태그, 의료기기 등의 용도에 적합합니다. 다양한 기판 및 전도성 잉크와의 호환성 또한 도입을 더욱 촉진하고 있습니다. 또한, CE 제품, 자동차, 헬스케어 산업에서 저비용의 맞춤형 인쇄 방식에 대한 수요가 증가하고 있는 것도 이 분야의 빠른 성장을 촉진하고 있습니다. 잉크 배합 및 프린트 헤드 기술의 지속적인 발전으로 인해 인쇄 전자 제품 시장에서 잉크젯 인쇄의 채택은 앞으로 더욱 가속화될 것으로 예상됩니다.

"지역별로는 중국이 2030년까지 아시아태평양 시장에서 가장 큰 점유율을 차지할 것으로 예상됩니다."

이러한 우위는 강력한 전자제품 제조 기반, 대규모 소비 수요, 산업 전반에 걸친 첨단 기술의 광범위한 채택에 의해 뒷받침됩니다. 이 나라는 CE 제품, 자동차, 반도체 생산의 세계적인 거점이며, 이들은 프린티드 일렉트로닉스의 주요 최종사용자 산업입니다. 또한, 디지털화, 재생에너지, 전기자동차 보급을 지원하는 정부의 노력은 수요를 더욱 촉진하고 있습니다. 중국은 또한 연구개발 및 국내 생산능력에 대한 대규모 투자를 통해 수입 의존도를 낮추고 있으며, IoT 및 스마트 기기 적용 확대와 함께 이 지역의 주요 시장으로 자리매김할 것으로 보입니다.

세계의 프린티드 일렉트로닉스 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 공급망 분석

- 고객의 사업에 영향을 미치는 동향/혼란

- 생태계 분석

- 가격 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 사례 연구

- 관세와 규제 상황

- Porter’s Five Forces 분석

- AI/생성형 AI가 프린티드 일렉트로닉스 시장에 미치는 영향

- 미국 관세가 프린티드 일렉트로닉스 시장에 미치는 영향

제6장 프린티드 일렉트로닉스의 기판 이송 기술

- 롤 투 롤

- 시트 투 시트

- 시트 온 셔틀

제7장 프린티드 일렉트로닉스 시장 : 기술별

- 스크린 인쇄

- 플랫베드 스크린 인쇄

- 로터리 스크린 인쇄

- 잉크젯 인쇄

- 연속식 잉크젯 인쇄

- 드롭 온 디맨드식 잉크젯 인쇄

- 플렉소 인쇄

- 그라비어 인쇄

- 기타 인쇄 기술

- 3D 프린팅

- 오프셋 인쇄

- 릴 투 릴 인쇄

- 에어로졸 제트 인쇄

- 공기압 인쇄

- 나노임프린팅

제8장 프린티드 일렉트로닉스 시장 : 재료별

- 잉크

- 전도성 잉크

- 유전체 잉크

- 기타

- 기질

- 유기 기질

- 무기 기질

제9장 프린티드 일렉트로닉스 시장 : 해상도별

- 100 라인/cm 미만

- 100-200 라인/cm

- 200 라인/cm 이상

제10장 프린티드 일렉트로닉스 시장 : 용도별

- 디스플레이

- 전자종이 디스플레이

- 일렉트로루미네선스 디스플레이

- 태양전지

- RFID 태그

- 조명

- 일렉트로루미네선스 조명

- OLED 조명

- 센서

- 터치 센서

- 가스 센서

- 습도 센서

- 압력 센서

- 이미지 센서

- 온도 센서

- 기타

- 배터리

- 기타 용도

제11장 프린티드 일렉트로닉스 시장 : 최종 이용 산업별

- 자동차·운송

- 가전제품

- 헬스케어

- 소매·포장

- 항공우주 및 방위

- 건설·건축

- 기타

제12장 프린티드 일렉트로닉스 시장 : 지역별

- 북미

- 거시경제 전망

- 유럽

- 거시경제 전망

- 독일

- 프랑스

- 영국

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 호주

- 일본

- 한국

- 기타

- 기타 지역

- 거시경제 전망

- 중동 및 아프리카

- 남미

제13장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제14장 기업 개요

- 주요 기업

- DUPONT

- BASF

- NOVACENTRIX

- AGFA-GEVAERT GROUP

- HENKEL AG & CO. KGAA

- SAMSUNG

- LG DISPLAY CO., LTD.

- MOLEX

- PALO ALTO RESEARCH CENTER INCORPORATED(PARC)

- NISSHA CO., LTD.

- E INK HOLDINGS INC.

- 기타 주요 기업

- SUN CHEMICAL

- TORAY INDUSTRIES, INC.

- YNVISIBLE INTERACTIVE INC.

- JABIL INC.

- OPTOMEC, INC.

- CAMBRIDGE DISPLAY TECHNOLOGY, LTD.

- PRINTED ELECTRONICS LIMITED

- ENFUCELL

- ENSURGE MICROPOWER ASA

- VORBECK MATERIALS CORP.

- GRAPHENICALAB SL

- HERAEUS GROUP

- GENESINK

- ELECTRONINKS

- APPLIED INK SOLUTIONS

제15장 부록

KSM 25.09.25The global printed electronics market is expected to grow from USD 19.46 billion in 2025 to USD 39.85 billion by 2030, at a compound annual growth rate (CAGR) of 15.4% during the forecast period. Due to the rising preference for flexible, lightweight, and cost-efficient electronic components across industries. Printed electronics enable innovative applications such as flexible displays, wearable devices, smart packaging, and advanced sensors that traditional rigid electronics cannot support. Their ability to reduce material usage, lower production costs, and allow large-scale customization makes them highly attractive for manufacturers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Printing Technology, Material, Resolution, Application, End-Use Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rapid growth of the Internet of Things (IoT), electric vehicles, and consumer electronics is further amplifying their adoption. Additionally, advancements in printing technologies are enhancing performance and durability, making printed electronics a mainstream choice. This trend is expected to significantly boost market growth during the forecast period.

"Lighting application to register highest CAGR in printed electronics market during forecast period"

The lighting application segment is expected to grow at the highest CAGR in the printed electronics market during the forecast period. This growth is primarily driven by the increasing adoption of OLED lighting solutions in automotive, consumer electronics, and architectural applications. Printed lighting offers advantages such as flexibility, lightweight design, energy efficiency, and enhanced design freedom, making it ideal for modern, sustainable applications. The demand for innovative lighting in smart homes, wearable devices, and next-generation vehicles is further fueling this trend. Additionally, declining costs of materials and advancements in printing techniques are boosting large-scale deployment of printed lighting solutions, positioning this segment as a major growth driver in the market.

"Inkjet printing technology to grow at highest CAGR in printed electronics market during forecast period"

The growth of the inkjet printing technology is attributed to its high precision, material efficiency, and ability to print complex patterns without requiring masks or plates. Inkjet printing is widely used for prototyping and small-to-medium production runs, making it suitable for applications in flexible displays, sensors, RFID tags, and medical devices. Its compatibility with a wide range of substrates and conductive inks further enhances its adoption. Moreover, the increasing demand for cost-effective and customizable printing methods in consumer electronics, automotive, and healthcare industries is driving the rapid growth of this segment. Continuous advancements in ink formulations and printhead technologies are expected to further accelerate inkjet printing adoption in the printed electronics market.

"China to account for largest share of Asia Pacific printed electronics market by 2030"

China is expected to hold the largest share in the Asia Pacific printed electronics market during the forecast period. This dominance is driven by its strong electronics manufacturing base, large consumer demand, and extensive adoption of advanced technologies across industries. The country is a global hub for consumer electronics, automotive, and semiconductor production, which are key end users of printed electronics. Additionally, government initiatives supporting digitalization, renewable energy, and electric vehicle adoption are further boosting the demand. China also benefits from significant investments in R&D and local production capabilities, reducing reliance on imports. With its vast industrial ecosystem and expanding applications in IoT and smart devices, China is set to remain the leading market in the region.

Extensive primary interviews were conducted with key industry experts in the printed electronics market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 55%, and Tier 3 - 25%

- By Designation: C-level Executives - 50%, Directors - 25%, and Others - 25%

- By Region: North America - 60%, Europe - 20%, Asia Pacific - 10%, and RoW - 10%

Notes: RoW includes the Middle East, Africa, and South America. Other designations include sales & marketing executives and researchers. The three tiers of the companies are defined based on their total revenue as of 2024; Tier 1: revenue more than or equal to USD 500 million, Tier 2: revenue between USD 100 million and USD 500 million, and Tier 3: revenue less than or equal to USD 100 million.

DuPont (US), BASF (Germany), Agfa-Gevaert Group (Belgium), Henkel AG & Co. KGaA (Germany), NovaCentrix (US), SAMSUNG (South Korea), LG DISPLAY CO., LTD. (South Korea), Molex (US), Nissha Co., Ltd (Japan), and E INK HOLDINGS INC. (Taiwan) are some key players in the printed electronics market.

The study includes an in-depth competitive analysis of these key players in the printed electronics market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the printed electronics market based on printing technology (Inkjet printing, screen printing, flexographic printing, gravure printing, and others), material (Ink, substrate), resolution (below 100 lines/CM, 100 to 200 lines/CM, above 200 lines/CM), application (displays, RFID tags, batteries, photovoltaic cells, sensors, lighting, and other applications), End use industry (automotive & transportation, healthcare, consumer electronics, aerospace & defense, construction & architecture, retail & packaging, and other end use industries), and region (North America, Europe, Asia Pacific and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the printed electronics market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the printed electronics ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall printed electronics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased demand for printed electronic products in automotive & transportation, Growth of consumer electronics industry, Increased adoption of IoT by end-use industries, and Significant cost advantages offered by printed electronics) restraints (high investment cost), opportunities (Promising newer applications of printed electronics in healthcare, and smart packaging to create lucrative growth opportunities for printed electronics)and challenges (Inadequate knowledge of appropriate material and design selection for smart building applications) influencing the growth of the printed electronics market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the printed electronics market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the printed electronics market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the printed electronics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as DuPont (US), BASF (Germany), Agfa-Gevaert Group (Belgium), Henkel AG & Co. KGaA (Germany), and NovaCentrix (US) in the printed electronics market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach for obtaining market share using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach for obtaining market share using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.5.1 ASSUMPTIONS

- 2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRINTED ELECTRONICS MARKET

- 4.2 PRINTED ELECTRONICS MARKET, BY REGION AND APPLICATION

- 4.3 PRINTED ELECTRONICS MARKET, BY END-USE INDUSTRY

- 4.4 PRINTED ELECTRONICS MARKET, BY MATERIAL

- 4.5 PRINTED ELECTRONICS MARKET, BY TECHNOLOGY

- 4.6 PRINTED ELECTRONICS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased demand in automotive & transportation

- 5.2.1.2 Growth of consumer electronics industry

- 5.2.1.3 Increased adoption of IoT in various end-use industries

- 5.2.1.4 Significant cost advantages offered by printed electronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High investment cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential applications in healthcare sector

- 5.2.3.2 Increasing adoption of smart packaging

- 5.2.3.3 Use of printed electronics to reduce electromagnetic interference associated with 5G technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate knowledge of appropriate material and design selection for smart building applications

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE ANALYSIS, BY MATERIAL

- 5.6.2 AVERAGE SELLING PRICE (ASP) TREND OF MATERIALS (INK), BY REGION

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Nanomaterials and inks

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Soft lithography

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Active-matrix organic light-emitting diodes (AMOLED)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 853400)

- 5.9.2 EXPORT SCENARIO (HS CODE 853400)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY

- 5.11.1 HUSHBRUSH APPROACHED CENTRE FOR PROCESS INNOVATION LIMITED (CPI) TO MANUFACTURE SENSORY BRUSH THAT SUPPORTS EARLY DEVELOPMENT AND CHILD WELLBEING

- 5.11.2 US DEPARTMENT OF ENERGY'S ADVANCED RESEARCH PROJECTS AGENCY-ENERGY (ARPA-E) PARTNERED WITH PARC TO DEVELOP LOW-COST SYSTEM FOR DETECTING METHANE LEAKS AT NATURAL GAS WELLS

- 5.11.3 CARBON NANOTUBE (CNT) HYBRID MATERIALS FROM CHASM ADVANCED MATERIALS, INC. HELP REDUCE LEAD TIMES AND MANUFACTURING COST

- 5.11.4 NOVARES COLLABORATED WITH FLEXENABLE TO INTEGRATE CURVED DISPLAYS IN ITS DEMO CAR

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFFS

- 5.12.2 REGULATORY COMPLIANCE

- 5.12.3 STANDARDS

- 5.12.4 PRINTED ELECTRONICS ASSOCIATIONS

- 5.13 PORTER FIVE FORCES ANALYSIS

- 5.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 THREAT OF NEW ENTRANTS

- 5.14 IMPACT OF AI/GEN AI ON PRINTED ELECTRONICS MARKET

- 5.14.1 INTRODUCTION

- 5.15 IMPACT OF 2025 US TARIFF ON PRINTED ELECTRONICS MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON APPLICATIONS

6 DIFFERENT SUBSTRATE TRANSPORT TECHNIQUES IN PRINTED ELECTRONICS

- 6.1 INTRODUCTION

- 6.2 ROLL-TO-ROLL

- 6.3 SHEET-TO-SHEET

- 6.4 SHEETS-ON-SHUTTLE

7 PRINTED ELECTRONICS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 SCREEN PRINTING

- 7.2.1 FLATBED SCREEN PRINTING

- 7.2.1.1 Application in development of products that require precise thickness of ink to drive market

- 7.2.2 ROTARY SCREEN PRINTING

- 7.2.2.1 Demand for high-durability printing technology to fuel market growth

- 7.2.1 FLATBED SCREEN PRINTING

- 7.3 INKJET PRINTING

- 7.3.1 CONTINUOUS INKJET PRINTING

- 7.3.1.1 Offers traceability data and complies with increasingly strict industry legislation

- 7.3.2 DROP-ON-DEMAND INKJET PRINTING

- 7.3.2.1 Thermal DoD inkjet printing

- 7.3.2.1.1 Demand for excellent print quality to drive market growth

- 7.3.2.2 Piezo DoD inkjet printing

- 7.3.2.2.1 Offers fast, advanced, and accurate technique for developing printed electronics

- 7.3.2.3 Electrostatic DoD inkjet printing

- 7.3.2.3.1 Growing demand in selected cost-effective applications to support market growth

- 7.3.2.1 Thermal DoD inkjet printing

- 7.3.1 CONTINUOUS INKJET PRINTING

- 7.4 FLEXOGRAPHIC PRINTING

- 7.4.1 DEMAND FOR HIGH-SPEED AND CONTINUOUS PATTERN PRINTING TO FUEL MARKET GROWTH

- 7.5 GRAVURE PRINTING

- 7.5.1 ADOPTION IN LONG-RUN PRINTING PROCESSES TO DRIVE DEMAND

- 7.6 OTHER PRINTING TECHNOLOGIES

- 7.6.1 3D PRINTING

- 7.6.2 OFFSET PRINTING

- 7.6.3 REEL-TO-REEL PRINTING

- 7.6.4 AEROSOL JET PRINTING

- 7.6.5 PNEUMATIC PRINTING

- 7.6.6 NANOIMPRINTING

8 PRINTED ELECTRONICS MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 INKS

- 8.2.1 CONDUCTIVE INKS

- 8.2.1.1 Offers high conductivity and cost-effectiveness

- 8.2.1.2 Conductive silver inks

- 8.2.1.3 Conductive copper inks

- 8.2.1.4 Transparent conductive inks

- 8.2.1.5 Silver copper inks

- 8.2.1.6 Carbon inks

- 8.2.2 DIELECTRIC INKS

- 8.2.2.1 Use of dielectric inks enables circuitry crossover and multilayer applications

- 8.2.3 OTHER INKS

- 8.2.3.1 Carbon nanotubes

- 8.2.3.2 Graphene inks

- 8.2.1 CONDUCTIVE INKS

- 8.3 SUBSTRATES

- 8.3.1 ORGANIC SUBSTRATES

- 8.3.1.1 Polymers

- 8.3.1.1.1 Offers low-cost printing of electronic components on flexible substrates

- 8.3.1.1.2 Polyimides

- 8.3.1.1.3 Polyethylene naphthalate

- 8.3.1.1.4 Polyethylene terephthalate

- 8.3.1.2 Paper

- 8.3.1.2.1 Offers flexibility, cost-effectiveness, and printing sustainability

- 8.3.1.2.2 Polyacrylate

- 8.3.1.2.3 Polystyrene

- 8.3.1.2.4 Polyvinylpyrrolidone

- 8.3.1.2.5 Polyvinyl alcohol

- 8.3.1.3 Other organic substrates

- 8.3.1.1 Polymers

- 8.3.2 INORGANIC SUBSTRATES

- 8.3.2.1 Glass

- 8.3.2.1.1 Increased demand for flexible glass substrates to support market growth

- 8.3.2.2 Other inorganic substrates

- 8.3.2.2.1 Silicon

- 8.3.2.2.2 Metal oxides

- 8.3.2.2.2.1 Silicon dioxide

- 8.3.2.2.2.2 Aluminum oxide

- 8.3.2.2.2.3 Titanium oxide

- 8.3.2.1 Glass

- 8.3.1 ORGANIC SUBSTRATES

9 PRINTED ELECTRONICS MARKET, BY RESOLUTION

- 9.1 INTRODUCTION

- 9.2 BELOW 100 LINES/CM

- 9.2.1 RISING DEMAND FOR COST-EFFECTIVE, SCALABLE MANUFACTURING FUELING ADOPTION

- 9.3 100-200 LINES/CM

- 9.3.1 INKJET PRINTING TO BE MOST WIDELY USED TECHNOLOGY FOR 100-200 LINES/CM SEGMENT

- 9.4 ABOVE 200 LINES/CM

- 9.4.1 NEED FOR HIGH-PERFORMANCE CIRCUIT FUNCTIONALITIES TO DRIVE MARKET GROWTH

10 PRINTED ELECTRONICS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 DISPLAYS

- 10.2.1 E-PAPER DISPLAYS

- 10.2.1.1 Electrochromic displays

- 10.2.1.1.1 Increasing global adoption of electrochromic displays owing to their consistent performance and flexibility

- 10.2.1.2 Electrophoretic displays

- 10.2.1.2.1 Rising use in e-readers contributing to market growth

- 10.2.1.3 Other e-paper displays

- 10.2.1.1 Electrochromic displays

- 10.2.2 ELECTROLUMINESCENT DISPLAYS

- 10.2.2.1 OLED displays

- 10.2.2.1.1 Use of printed electronics increasing for developing thinner, rollable, and more efficient OLED displays

- 10.2.2.2 Flexible OLED displays

- 10.2.2.2.1 Prevailing trend of flexible consumer electronic devices to drive market

- 10.2.2.3 LCDs

- 10.2.2.3.1 Highly suited to television and automotive applications

- 10.2.2.1 OLED displays

- 10.2.1 E-PAPER DISPLAYS

- 10.3 PHOTOVOLTAIC CELLS

- 10.3.1 USE OF PRINTED PV CELLS RISING TO ENHANCE EFFICIENCY OF SOLAR CONVERSION DEVICES

- 10.4 RFID TAGS

- 10.4.1 GROWING ADOPTION OF PRINTED RFID TAGS OVER SILICON CHIPS OWING TO THEIR COST-EFFICIENCY

- 10.5 LIGHTING

- 10.5.1 ELECTROLUMINESCENT LIGHTING

- 10.5.1.1 Offers high flexibility and thin form factor

- 10.5.2 ORGANIC LIGHT-EMITTING DIODE LIGHTING

- 10.5.2.1 Growing awareness of green building to increase demand for printed OLED lighting

- 10.5.1 ELECTROLUMINESCENT LIGHTING

- 10.6 SENSORS

- 10.6.1 TOUCH SENSORS

- 10.6.1.1 Increasing demand for touch-enabled electronic devices to drive market

- 10.6.2 GAS SENSORS

- 10.6.2.1 Growing concern for indoor and outdoor air quality to fuel market growth

- 10.6.3 HUMIDITY SENSORS

- 10.6.3.1 Adoption in environment control systems to drive growth

- 10.6.4 PRESSURE SENSORS

- 10.6.4.1 Technological advancements in printed pressure sensors fueling adoption in healthcare applications

- 10.6.5 IMAGE SENSORS

- 10.6.5.1 Easy scalability into larger areas and high-pixel densities to increase adoption

- 10.6.6 TEMPERATURE SENSORS

- 10.6.6.1 Rising demand for reliable, high-performance, and low-cost temperature sensors fueling market growth

- 10.6.7 OTHER SENSORS

- 10.6.1 TOUCH SENSORS

- 10.7 BATTERIES

- 10.7.1 DEMAND FOR PRINTED BATTERIES IN HEALTHCARE APPLICATIONS TO DRIVE MARKET GROWTH

- 10.8 OTHER APPLICATIONS

11 PRINTED ELECTRONICS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AUTOMOTIVE & TRANSPORTATION

- 11.2.1 INCREASING ADOPTION OF INTERACTIVE DASHBOARDS AND FLEXIBLE PRINTED DISPLAYS TO DRIVE MARKET

- 11.3 CONSUMER ELECTRONICS

- 11.3.1 INCREASED DEMAND FOR COMPACT ELECTRONIC DEVICES FUELING MARKET GROWTH

- 11.4 HEALTHCARE

- 11.4.1 INCREASING ADOPTION OF BIOSENSORS TO DRIVE MARKET GROWTH

- 11.5 RETAIL & PACKAGING

- 11.5.1 EMERGING APPLICATIONS OF PRINTED ELECTRONICS TO PROPEL MARKET GROWTH

- 11.6 AEROSPACE & DEFENSE

- 11.6.1 NEED TO REDUCE SIZE AND WEIGHT OF AEROSPACE & DEFENSE COMMUNICATION SYSTEMS TO DRIVE MARKET

- 11.7 CONSTRUCTION & ARCHITECTURE

- 11.7.1 GROWING TREND OF SMART BUILDINGS TO FUEL MARKET GROWTH

- 11.8 OTHER END-USE INDUSTRIES

12 PRINTED ELECTRONICS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.1.1 US

- 12.2.1.1.1 Presence of major companies to fuel market growth

- 12.2.1.2 Canada

- 12.2.1.2.1 Numerous initiatives taken by government and non-government institutions to support market growth

- 12.2.1.3 Mexico

- 12.2.1.3.1 Increase in automotive production and export to fuel demand for printed electronic devices

- 12.2.1.1 US

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Technological innovations related to automotive industry driving market growth

- 12.3.3 FRANCE

- 12.3.3.1 Surging demand for electric vehicles to spur market growth

- 12.3.4 UK

- 12.3.4.1 Robust economy and significant funding from public and private bodies fueling market growth

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Growth in automotive and consumer electronics industries to propel demand

- 12.4.3 AUSTRALIA

- 12.4.3.1 Increased R&D activities in printed electronics to boost market growth

- 12.4.4 JAPAN

- 12.4.4.1 Presence of numerous printed electronics consumers supporting market growth

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Flourishing consumer electronics industry and presence of key manufacturers of printed electronics fueling market growth

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Increased customer awareness, adoption of innovative technologies, and production of electronic components to fuel growth

- 12.5.2.2 GCC

- 12.5.2.3 Rest of Middle East & Africa

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Increasing demand in automotive and transportation applications to creates market opportunities

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Material footprint

- 13.7.5.4 Application footprint

- 13.7.5.5 End-use industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 DUPONT

- 14.1.1.1 Business overview

- 14.1.1.2 Products/solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BASF

- 14.1.2.1 Business overview

- 14.1.2.2 Products/solutions offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 NOVACENTRIX

- 14.1.3.1 Business overview

- 14.1.3.2 Products/solutions offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 AGFA-GEVAERT GROUP

- 14.1.4.1 Business overview

- 14.1.4.2 Products/solutions offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 HENKEL AG & CO. KGAA

- 14.1.5.1 Business overview

- 14.1.5.2 Products/solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SAMSUNG

- 14.1.6.1 Business overview

- 14.1.6.2 Products/solutions offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.7 LG DISPLAY CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/solutions offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 MOLEX

- 14.1.8.1 Business overview

- 14.1.8.2 Products/solutions offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 PALO ALTO RESEARCH CENTER INCORPORATED (PARC)

- 14.1.9.1 Business overview

- 14.1.9.2 Products/solutions offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 NISSHA CO., LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/solutions offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 E INK HOLDINGS INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/solutions offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Deals

- 14.1.1 DUPONT

- 14.2 OTHER KEY PLAYERS

- 14.2.1 SUN CHEMICAL

- 14.2.2 TORAY INDUSTRIES, INC.

- 14.2.3 YNVISIBLE INTERACTIVE INC.

- 14.2.4 JABIL INC.

- 14.2.5 OPTOMEC, INC.

- 14.2.6 CAMBRIDGE DISPLAY TECHNOLOGY, LTD.

- 14.2.7 PRINTED ELECTRONICS LIMITED

- 14.2.8 ENFUCELL

- 14.2.9 ENSURGE MICROPOWER ASA

- 14.2.10 VORBECK MATERIALS CORP.

- 14.2.11 GRAPHENICALAB SL

- 14.2.12 HERAEUS GROUP

- 14.2.13 GENESINK

- 14.2.14 ELECTRONINKS

- 14.2.15 APPLIED INK SOLUTIONS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS