|

시장보고서

상품코드

1812628

배터리용 전해질 시장 : 배터리 유형별, 전해질 유형별, 최종 용도별, 재료별, 지역별 - 예측(-2030년)Battery Electrolyte Market by Battery Type (Lead-Acid and Lithium-Ion), Electrolyte Type (Liquid, Gel, Solid), End Use (EV, Consumer Electronics, Energy Storage), Material (Sulfuric Acid, Lithium Salts, Solvents), and Region - Global Forecast to 2030 |

||||||

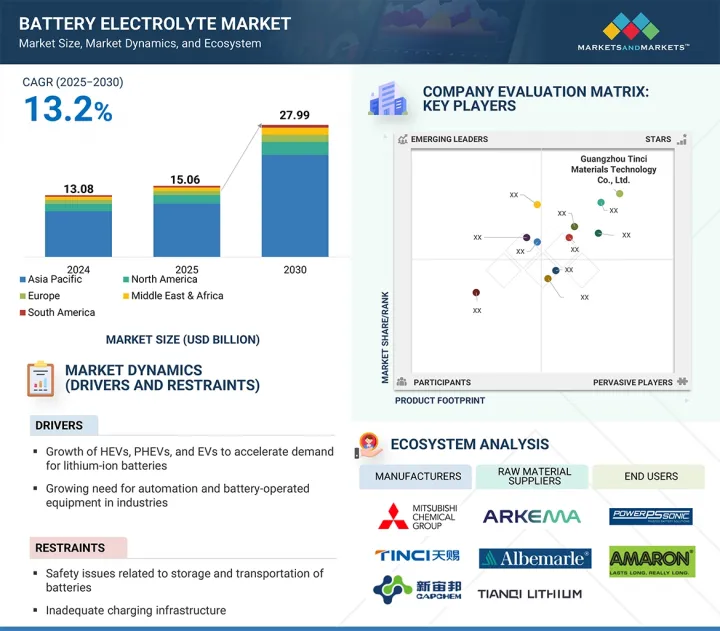

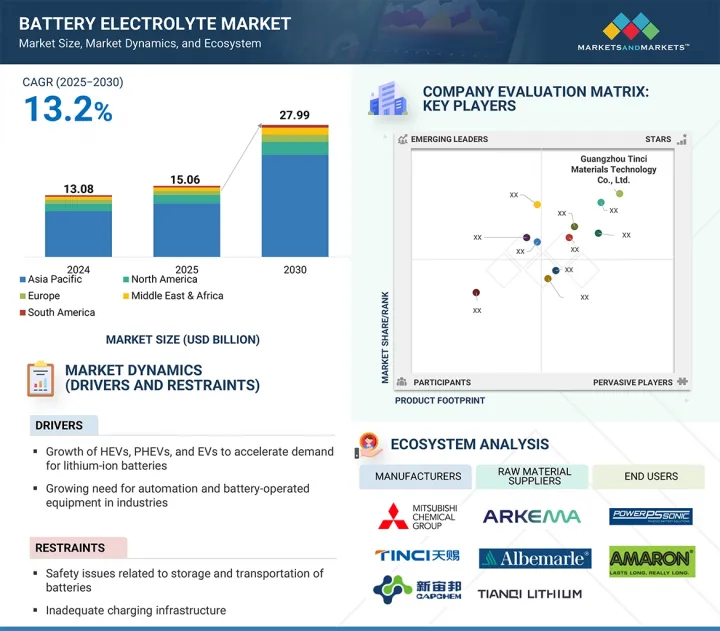

세계의 배터리용 전해질 시장 규모는 2025년 150억 6,000만 달러에서 2030년까지 279억 9,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 13.2%의 성장이 전망됩니다.

전기화, 청정에너지, 디지털 기술로의 전 세계적인 전환으로 인해 시장은 강력한 성장세를 보이고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 전해질 유형, 배터리 유형, 최종 용도 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

전기자동차, 휴대용 전자기기, 에너지 저장 시스템에 대한 수요 증가는 고성능 소재에 대한 수요를 촉진하고 있습니다. 정부와 산업계는 배터리 생산능력, 원자재 조달, 재활용 인프라에 많은 투자를 하고 있습니다.

"납축배터리 부문은 예측 기간 동안 금액 기준으로 두 번째 점유율을 차지할 것으로 추정됩니다."

납축배터리 부문은 자동차, 산업용 백업 전원, 오프그리드 에너지 저장 애플리케이션에 널리 사용됨에 따라 예측 기간 동안 배터리 전해질 시장에서 금액 기준으로 두 번째 점유율을 차지할 것으로 예상됩니다. 납축배터리는 높은 신뢰성과 낮은 비용, 잘 구축된 재활용 인프라로 인해 개발도상국이나 높은 서지 전류가 필요한 응용 분야에서 선호되는 선택이 되고 있습니다. EFB 및 AGM 기술 등 납축배터리 설계의 발전이 시장 성장에 크게 기여하고 있습니다.

"겔 전해질 부문은 예측 기간 동안 금액 기준으로 두 번째 점유율을 차지할 것입니다."

겔 전해질은 백업 전원, 재생에너지 저장, 동력 등의 용도로 사용됩니다. 이러한 전해질은 황산에 실리카를 첨가하여 생성되며, 액체 전해질에 비해 안전성이 향상되고 누출 위험이 감소하며 유지보수가 적습니다. 따라서 가혹한 환경이나 딥사이클 운영에 이상적입니다. 내구성, 내진동성, 넓은 온도 범위에서 작동할 수 있는 능력은 통신, 독립형 태양광발전, 산업용 시스템에서 사용하도록 확립되었습니다.

"최종 용도별로는 에너지 저장 부문이 예측 기간 동안 금액 기준으로 두 번째 점유율을 차지했습니다."

에너지 저장 부문은 재생에너지로의 전환과 효율적인 그리드 밸런싱 솔루션의 필요성에 힘입어 예측 기간 동안 배터리 전해질 시장에서 금액 기준으로 두 번째로 큰 점유율을 차지할 것으로 예상됩니다. 태양광 및 풍력발전의 잉여 전력을 저장하여 안정적인 전력 공급을 확보하고 송전망의 탄력성을 높이기 위해 고성능 전해질을 탑재한 대규모 리튬이온 배터리와 첨단 납축배터리 시스템의 보급이 진행되고 있습니다. 또한, 안전성 향상, 수명 연장, 에너지 밀도 향상 등을 실현하는 전해질 제조 방법의 발전으로 이러한 시스템이 유틸리티 규모 및 상업용 에너지 저장 프로젝트의 엄격한 운영 요건을 충족할 수 있게 되었습니다.

"북미가 예측 기간 동안 물량 기준으로 두 번째 점유율을 차지할 것으로 추정됩니다."

전기자동차 보급률 증가, 재생에너지 수요, 정부 지원으로 북미는 예측 기간 동안 배터리용 전해질 시장에서 물량 기준으로 두 번째 점유율을 차지할 것으로 예상됩니다. 미국은 강력한 정책과 국내 공급망 개발로 주도권을 쥐고 있습니다. 캐나다는 리튬 생산에 투자하고 있으며, 멕시코는 비용 우위를 바탕으로 대규모 배터리 제조를 유치하고 있습니다. 이러한 요인들이 복합적으로 작용하여 이 지역의 배터리 전해질 수요가 증가하고 있으며, 북미는 세계 배터리 생태계의 주요 지역으로 부상하고 있습니다.

세계의 배터리용 전해질 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 배터리용 전해질 시장 기업에서 매력적인 기회

- 배터리용 전해질 시장 : 지역별

- 배터리용 전해질 시장 : 전해질 유형별

- 배터리용 전해질 시장 : 배터리 유형별

- 배터리용 전해질 시장 : 주요 국가별

제5장 시장 개요

- 소개

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

제6장 산업 동향

- 세계의 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 가격 책정 분석

- 배터리용 전해질 가격 동향 : 지역별(2022-2024년)

- 배터리용 전해질 가격대 : 주요 기업별(2024년)

- 관세와 규제 상황

- 관세 분석

- 배터리용 전해질에 관한 관세

- 규제기관, 정부기관, 기타 조직

- 주요 회의와 이벤트

- 특허 분석

- 기술 분석

- 주요 기술

- 인접 기술

- 사례 연구 분석

- PALL CORPORATION : 고에너지 밀도 EV 배터리 생산의 액체 전해질

- PALL CORPORATION : 전기자동차 배터리 생산의 액체 전해질

- 무역 분석

- 수입 시나리오(HS 코드 850650)

- 수출 시나리오(HS 코드 850650)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금 조달 시나리오

- 배터리용 전해질 시장에 대한 생성형 AI의 영향

- 새로운 전해질 화합물 발견

- 복잡한 트레이드 오프의 균형을 맞춤

- 시장 투입까지 시간을 단축

- 강화된 맞춤화

- 자율형 R&D 플랫폼으로의 통합

- 지속가능성과 규제 준수

- 2025년 미국 관세의 영향 - 배터리용 전해질 시장

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 이용 산업에 대한 영향

제7장 배터리용 전해질 시장 : 배터리 유형별

- 소개

- 리튬이온 배터리

- 납축배터리

제8장 배터리용 전해질 시장 : 전해질 유형별

- 소개

- 액체 전해질

- 고체 전해질

- 겔 전해질

제9장 배터리용 전해질 시장 : 용도별

- 소개

- 전기자동차

- 가전제품

- 에너지 저장

- 기타 용도

제10장 배터리용 전해질 시장 : 지역별

- 소개

- 아시아태평양

- 중국

- 한국

- 일본

- 인도

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 네덜란드

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- GCC 국가

- 이스라엘

- 기타 중동 및 아프리카

제11장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품의 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- MITSUBISHI CHEMICAL GROUP CORPORATION

- CAPCHEM

- GUANGZHOU TINCI MATERIALS TECHNOLOGY CO., LTD.

- ENCHEM CO., LTD.

- ZHANGJIAGANG GUOTAI HUARONG NEW CHEMICAL MATERIALS CO., LTD.

- UBE CORPORATION

- NEI CORPORATION

- 3M

- AMERICAN ELEMENTS

- MORITA CHEMICAL INDUSTRIES CO., LTD.

- GS YUASA INTERNATIONAL LTD.

- LG CHEM

- BASF CORPORATION

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- OHARA INC.

- DAIKIN AMERICA, INC.

- STELLA CHEMIFA CORPORATION

- GUANGDONG JINGUANG HIGH-TECH CO., LTD.

- SHANSHAN CO.

- SOULBRAIN CO., LTD.

- ZHUHAI SMOOTHWAY ELECTRONIC MATERIALS CO., LTD

- 기타 기업

- SIONIC ENERGY

- TOMIYAMA PURE CHEMICAL INDUSTRIES, LTD.

- E-LYTE INNOVATIONS GMBH

- ALLEGRO ENERGY PTY LTD

제13장 인접 시장과 관련 시장

- 소개

- 제한사항

- 상호 접속된 시장

- 리튬이온 배터리 시장

- 시장 정의

- 시장 개요

- 리튬이온 배터리 시장 : 유형별

제14장 부록

KSM 25.09.25The global battery electrolyte market is projected to grow from USD 15.06 billion in 2025 to USD 27.99 billion by 2030, at a CAGR of 13.2% during the forecast period. The battery electrolyte market is experiencing strong growth, driven by the global shift toward electrification, clean energy, and digital technology.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Electrolyte Type, Battery Type, and End-Use |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

Rising demand for electric vehicles, portable electronics, and energy storage systems is fueling the need for high-performance materials. Governments and industries are investing heavily in battery production capacity, raw material sourcing, and recycling infrastructure.

"Lead-acid segment is estimated to account for the second-largest share in terms of value during the forecast period."

The lead-acid segment is projected to hold the second-largest share in the battery electrolyte market by value during the forecast period, due to its widespread use in automotive, industrial backup power, and off-grid energy storage applications. Its reliability, low cost, and established recycling infrastructure make it a preferred choice in developing regions and for applications requiring high surge currents. The advancements in lead-acid battery design, such as enhanced flooded and AGM technologies, are contributing significantly to market growth.

"Gel electrolyte segment to account for the second-largest share in terms of value during the forecast period"

The gel electrolyte segment is expected to hold the second-largest share of the battery electrolyte market by value during the forecast period. Gel electrolytes are used in applications such as backup power, renewable energy storage, and motive power. These electrolytes are created by adding silica to sulfuric acid, providing enhanced safety, a reduced risk of leakage, and less maintenance compared to liquid variants. This makes them ideal for harsh environments and deep-cycle operations. Their durability, vibration resistance, and capability to operate across a wide range of temperatures have solidified their use in telecom, off-grid solar, and industrial systems.

"By end use, the energy storage segment accounted for the second-largest share in terms of value during the forecast period."

The energy storage segment is anticipated to hold the second-largest share in terms of value in the battery electrolyte market during the forecast period, propelled by the global transition toward renewable energy and the need for efficient grid balancing solutions. Large-scale lithium-ion and advanced lead-acid battery systems equipped with high-performance electrolytes are increasingly deployed to store surplus solar and wind power, ensuring a stable electricity supply and enhancing grid resilience. Government incentives, renewable integration targets, and falling battery costs are accelerating installations, while advancements in electrolyte formulations offering improved safety, longer cycle life, and higher energy density are enabling these systems to meet the demanding operational requirements of utility-scale and commercial energy storage projects.

"The North American region is estimated to account for the second-largest share in terms of volume during the forecast period."

The North American region is estimated to account for the second-largest share in terms of volume in the battery electrolyte market during the forecast period, driven by rising EV adoption, renewable energy demand, and government support. The US is taking the lead with robust policies and the development of domestic supply chains. Canada is investing in lithium production, while Mexico is attracting significant battery manufacturing due to its cost advantages. Together, these factors are increasing the regional demand for battery electrolytes, positioning North America as a key player in the global battery ecosystem.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors - 25%, Managers - 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, the Middle East & Africa - 7%, and South America - 3%

CAPCHEM (China), ENCHEM Co., Ltd. (South Korea), Guangzhou Tinci Materials Technology Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan), and Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd. (China) are some of the major players in the battery electrolyte market. These players have adopted agreements, expansions, and other strategies to increase their market share and business revenue.

Research Coverage

The report defines segments and projects in the battery electrolyte market based on electrolyte type, battery type, end-use, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles battery electrolyte manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as agreements, joint ventures, expansion, and others.

Reasons to Buy the Report

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the battery electrolyte market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses, and develop suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (growing demand for HEVs, PHEVs, and EVs to accelerate demand for lithium-ion batteries and growing need for automation and battery-operated equipment in industries), restraints (safety issues related to the storage and transportation of batteries and inadequate charging infrastructure), opportunities (increasing demand for grid energy storage systems owing to ongoing grid modernization), and challenges (overheating issues of lithium-ion batteries) influencing the growth of the battery electrolyte market.

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the battery electrolyte market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the battery electrolyte market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the battery electrolyte market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as CAPCHEM (China), ENCHEM Co., Ltd. (South Korea), Guangzhou Tinci Materials Technology Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan), and Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd. (China) in the battery electrolyte market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants (demand and supply sides)

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BATTERY ELECTROLYTE MARKET

- 4.2 BATTERY ELECTROLYTE MARKET, BY REGION

- 4.3 BATTERY ELECTROLYTE MARKET, BY ELECTROLYTE TYPE

- 4.4 BATTERY ELECTROLYTE MARKET, BY BATTERY TYPE

- 4.5 BATTERY ELECTROLYTE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Growing demand for HEVs, PHEVs, and EVs to accelerate demand for lithium-ion batteries

- 5.1.1.2 Growing need for automation and battery-operated equipment in industries

- 5.1.2 RESTRAINTS

- 5.1.2.1 Safety issues related to storage and transportation of batteries

- 5.1.2.2 Inadequate charging infrastructure

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Increasing demand for grid energy storage systems owing to ongoing grid modernization

- 5.1.4 CHALLENGES

- 5.1.4.1 Overheating issues of lithium-ion batteries

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 BARGAINING POWER OF SUPPLIERS

- 6.4.2 BARGAINING POWER OF BUYERS

- 6.4.3 THREAT OF NEW ENTRANTS

- 6.4.4 THREAT OF SUBSTITUTES

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 PRICING TREND OF BATTERY ELECTROLYTE, BY REGION, 2022-2024

- 6.6.2 PRICING RANGE OF BATTERY ELECTROLYTE, BY KEY PLAYER, 2024

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 TARIFF ANALYSIS

- 6.7.2 TARIFF RELATED TO BATTERY ELECTROLYTE

- 6.7.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Acetonitrile-solvent electrolyte system for high-output lithium-ion batteries

- 6.10.2 ADJACENT TECHNOLOGIES

- 6.10.2.1 Supercapacitor electrolyte technology

- 6.10.1 KEY TECHNOLOGIES

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 PALL CORPORATION: LIQUID ELECTROLYTES IN HIGH ENERGY DENSITY EV BATTERY PRODUCTION

- 6.11.2 PALL CORPORATION: LIQUID ELECTROLYTES IN ELECTRIC VEHICLE BATTERY PRODUCTION

- 6.12 TRADE ANALYSIS

- 6.12.1 IMPORT SCENARIO (HS CODE 850650)

- 6.12.2 EXPORT SCENARIO (HS CODE 850650)

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 IMPACT OF GENERATIVE AI ON BATTERY ELECTROLYTE MARKET

- 6.15.1 DISCOVERY OF NEW ELECTROLYTE COMPOUNDS

- 6.15.2 BALANCING COMPLEX TRADE-OFFS

- 6.15.3 FASTER TIME-TO-MARKET

- 6.15.4 ENHANCED CUSTOMIZATION

- 6.15.5 INTEGRATION INTO AUTONOMOUS R&D PLATFORMS

- 6.15.6 SUSTAINABILITY AND REGULATORY COMPLIANCE

- 6.16 IMPACT OF 2025 US TARIFF - BATTERY ELECTROLYTE MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON END-USE INDUSTRIES

- 6.16.5.1 Electric vehicles

- 6.16.5.2 Energy storage

- 6.16.5.3 Consumer electronics

- 6.16.5.4 Other end-use industries

7 BATTERY ELECTROLYTE MARKET, BY BATTERY TYPE

- 7.1 INTRODUCTION

- 7.2 LITHIUM-ION BATTERIES

- 7.2.1 GROWING DEMAND FOR ELECTRIC VEHICLES TO PROPEL MARKET

- 7.3 LEAD-ACID BATTERIES

- 7.3.1 USE AS BACK-UP FOR UNINTERRUPTIBLE POWER SUPPLY TO DRIVE DEMAND

8 BATTERY ELECTROLYTE MARKET, BY ELECTROLYTE TYPE

- 8.1 INTRODUCTION

- 8.2 LIQUID ELECTROLYTE

- 8.2.1 FLEXIBILITY AND EFFICIENCY TO SUPPORT USE IN VARIOUS BATTERY TYPES

- 8.3 SOLID ELECTROLYTE

- 8.3.1 RISING DEMAND FOR BATTERIES WITH HIGHER ENERGY DENSITY AND IMPROVED SAFETY TO DRIVE ADOPTION

- 8.4 GEL ELECTROLYTE

- 8.4.1 HIGH SAFETY, LOWER MAINTENANCE, AND DEEP-CYCLE PERFORMANCE-KEY FEATURES DRIVING ADOPTION

9 BATTERY ELECTROLYTE MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 ELECTRIC VEHICLES

- 9.2.1 GROWING DEMAND FOR ELECTRIC VEHICLES TO INCREASE DEMAND FOR BATTERY ELECTROLYTES

- 9.3 CONSUMER ELECTRONICS

- 9.3.1 GROWING MARKET FOR SMARTPHONES AND LAPTOPS TO FUEL MARKET

- 9.4 ENERGY STORAGE

- 9.4.1 GROWING DEMAND FOR CLEAN AND RELIABLE ENERGY STORAGE TO PROPEL MARKET

- 9.5 OTHER END USES

10 BATTERY ELECTROLYTE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Surge in electric vehicle production to boost market

- 10.2.2 SOUTH KOREA

- 10.2.2.1 Government efforts to increase adoption of electric vehicles to fuel market

- 10.2.3 JAPAN

- 10.2.3.1 Boost in domestic production capacity of batteries and growing industries to propel market

- 10.2.4 INDIA

- 10.2.4.1 Expanding EV and clean energy growth to boost market

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Surging EV and renewable energy sectors to fuel market

- 10.3.2 CANADA

- 10.3.2.1 Rise in EVs and energy storage sectors to boost market

- 10.3.3 MEXICO

- 10.3.3.1 Surge in electric vehicles and battery plant investments to propel market

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Rise in automotive sector to fuel market growth

- 10.4.2 FRANCE

- 10.4.2.1 Increasing demand in automotive and marine industries to drive market

- 10.4.3 UK

- 10.4.3.1 Government initiatives for adoption of EVs to boost market

- 10.4.4 ITALY

- 10.4.4.1 Surge in renewable and automotive sectors to drive market

- 10.4.5 NETHERLANDS

- 10.4.5.1 Government initiatives for adoption of lithium-ion batteries to propel market

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Growing automotive sector to drive market

- 10.5.2 ARGENTINA

- 10.5.2.1 Lithium reserves and automotive growth to propel market

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Growth in renewable energy and the automotive industry to drive market

- 10.6.1.2 UAE

- 10.6.1.2.1 Surge in EV adoption to propel market

- 10.6.1.3 Rest of GCC Countries

- 10.6.1.1 Saudi Arabia

- 10.6.2 ISRAEL

- 10.6.2.1 Surge in renewable energy and EVs to propel market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Battery type footprint

- 11.6.5.4 Electrolyte type footprint

- 11.6.5.5 End-use footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- 12.1.1 MITSUBISHI CHEMICAL GROUP CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 CAPCHEM

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 GUANGZHOU TINCI MATERIALS TECHNOLOGY CO., LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 ENCHEM CO., LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 ZHANGJIAGANG GUOTAI HUARONG NEW CHEMICAL MATERIALS CO., LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 UBE CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Expansions

- 12.1.7 NEI CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.8 3M

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 AMERICAN ELEMENTS

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 MORITA CHEMICAL INDUSTRIES CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 GS YUASA INTERNATIONAL LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 LG CHEM

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 BASF CORPORATION

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 TOKYO CHEMICAL INDUSTRY CO., LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 OHARA INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.16 DAIKIN AMERICA, INC.

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.17 STELLA CHEMIFA CORPORATION

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.18 GUANGDONG JINGUANG HIGH-TECH CO., LTD.

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.19 SHANSHAN CO.

- 12.1.19.1 Business overview

- 12.1.19.2 Products offered

- 12.1.20 SOULBRAIN CO., LTD.

- 12.1.20.1 Business overview

- 12.1.20.2 Products offered

- 12.1.21 ZHUHAI SMOOTHWAY ELECTRONIC MATERIALS CO., LTD

- 12.1.21.1 Business overview

- 12.1.21.2 Products offered

- 12.1.1 MITSUBISHI CHEMICAL GROUP CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 SIONIC ENERGY

- 12.2.2 TOMIYAMA PURE CHEMICAL INDUSTRIES, LTD.

- 12.2.3 E-LYTE INNOVATIONS GMBH

- 12.2.3.1 Recent developments

- 12.2.3.1.1 Expansions

- 12.2.3.1 Recent developments

- 12.2.4 ALLEGRO ENERGY PTY LTD

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 INTERCONNECTED MARKETS

- 13.4 LITHIUM-ION BATTERY MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 LITHIUM-ION BATTERY MARKET, BY TYPE

- 13.4.3.1 Lithium nickel manganese cobalt (NMC)

- 13.4.3.1.1 Low self-heating rate to drive adoption

- 13.4.3.2 Lithium iron phosphate (LFP)

- 13.4.3.2.1 Growing deployment in HEVs and PHEVs to boost demand

- 13.4.3.3 Lithium cobalt oxide (LCO)

- 13.4.3.3.1 Increasing deployment as a power source in consumer electronics to drive market

- 13.4.3.4 Lithium titanate oxide (LTO)

- 13.4.3.4.1 High security and stability due to low operating voltage to boost demand

- 13.4.3.5 Lithium manganese oxide (LMO)

- 13.4.3.6 Low internal resistance and high thermal stability to drive growth

- 13.4.3.7 Lithium nickel cobalt aluminum oxide (NCA)

- 13.4.3.8 Power and automotive industries to offer lucrative growth opportunities

- 13.4.3.1 Lithium nickel manganese cobalt (NMC)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS