|

시장보고서

상품코드

1816006

거래 감시 시스템 시장 : 용도별, 최종사용자별 - 예측(-2030년)Trade Surveillance System Market by Application (Surveillance & Analytics, Risk & Compliance, Reports & Monitoring, Case Management) and End User (Financial Institutions, Capital Market, Digital Asset Exchange) - Global Forecast to 2030 |

||||||

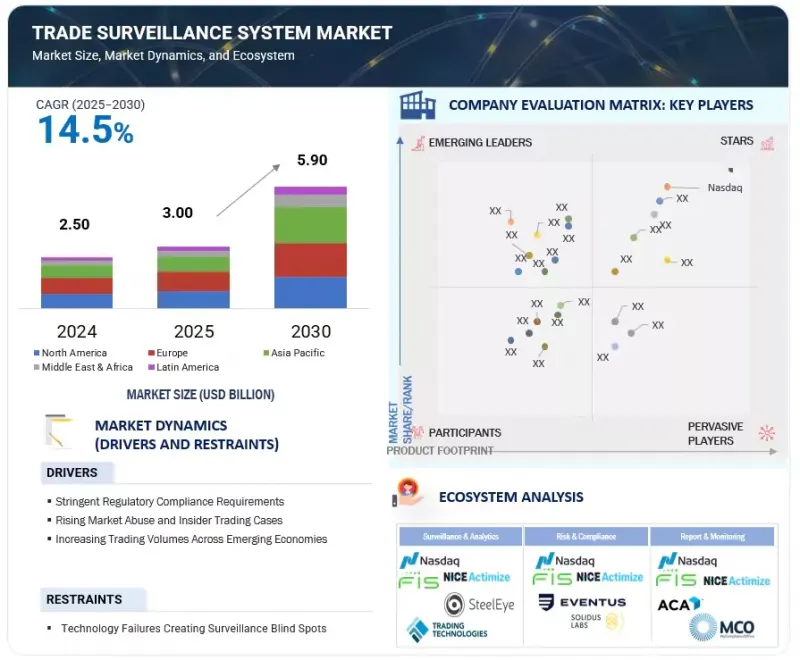

세계의 거래 감시 시스템 시장 규모는 2025년 30억 달러에서 2030년까지 59억 달러에 이를 것으로 예측되며, 예측 기간에 CAGR 14.5%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러 |

| 부문 | 제공, 용도, 전개 유형, 최종사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

규제 당국의 관심 증가와 지원 정책이 전 세계적으로 거래 감시 시스템 채택을 촉진하고 있습니다. 규제 당국은 시장 교란 행위, 내부자 거래, 부정행위를 방지하기 위해 보다 엄격한 컴플라이언스 기준을 부과하고 있으며, 금융기관은 AI 기반 모니터링, 실시간 분석, 클라우드 지원 플랫폼에 대한 투자를 장려하고 있습니다. 이러한 투자는 투명성, 업무 효율성, 리스크 관리를 강화합니다.

그러나 많은 기업들이 여전히 레거시 거래 모니터링 시스템에 의존하고 있으며, 이는 큰 문제를 야기하고 있습니다. 최신 거래 모니터링 플랫폼으로 업그레이드하려면 상당한 시간과 기술적 전문성, 재정적 자원이 필요합니다. 그 결과, 통합의 복잡성과 비용이 거래 모니터링 시스템 시장의 주요 억제요인으로 작용하고 있습니다.

"배포 유형별로는 On-Premise 부문이 예측 기간 동안 가장 큰 시장 규모를 차지할 것으로 예측됩니다. "

On-Premise 거래 모니터링 시스템은 조직이 모니터링 시스템을 직접 소유하고 제어할 수 있도록 하며, 운영, 보안, 컴플라이언스에 대한 특정 요구사항을 충족하는 고급 사용자 정의 기능을 제공합니다. 인프라를 사내에서 호스팅함으로써 기업은 기존 워크플로우, 데이터 관리 정책, 통합 요구사항에 맞게 플랫폼을 설계하고 구성할 수 있습니다. 이러한 통제 수준을 통해 모니터링 규칙, 경고 임계값, 조사 과정를 미세 조정할 수 있으며, 관할권을 넘어선 고유한 거래 패턴과 규제 의무를 반영할 수 있습니다.

기밀성이 높은 거래 데이터는 조직의 네트워크 내에 보관되기 때문에 타사 스토리지 환경에 노출되는 것을 최소화하고, 자체적인 사이버 보안 조치를 적용할 수 있습니다. 이는 데이터 주권이나 프라이버시 규제가 엄격한 감시를 요구하는 민감한 정보나 시장 민감도가 높은 정보를 취급하는 기관에 유리합니다. 또한, On-Premise 구축을 통해 조직은 시스템 유지보수, 업데이트 일정, 재해복구 프로토콜을 자체적으로 결정할 수 있어 외부의 혼란에도 불구하고 업무 연속성을 보장할 수 있습니다.

성능 최적화도 중요한 장점으로, 기업은 외부 대역폭이나 공유 인프라에 의존하지 않고 대량의 거래 데이터를 처리하기 위해 전용 컴퓨팅 리소스를 할당할 수 있습니다. 사내 레거시 시스템과의 통합도 원활하게 이뤄지는 경우가 많으며, 타사와의 연결에 따른 복잡성과 위험을 줄일 수 있습니다. On-Premise 솔루션을 제공하는 벤더는 강력한 설치 지원, 유연한 설정 옵션, 지속적인 기술 지원, 성능 유지 및 컴플라이언스 준수를 보장하는 데 중점을 두고 있습니다. 즉, On-Premise 거래 모니터링은 운영의 독립성과 맞춤형 기능을 결합하여 기업이 기술 환경을 완벽하게 관리하면서 컴플라이언스를 준수할 수 있도록 지원합니다.

"서비스 부문은 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다. "

서비스는 거래 모니터링 솔루션이 최고의 효율성으로 운영되고, 일관된 컴플라이언스 결과를 제공하며, 변화하는 시장 및 규제 환경에 적응하기 위해 필수적입니다. 체계적인 서비스 포트폴리오를 통해 모니터링 투자에서 최대한의 가치를 창출하는 데 필요한 지침, 기술 전문 지식 및 지속적인 지원을 제공합니다.

전문 교육 및 컨설팅 서비스는 컴플라이언스 팀이 감지 방법을 이해하고, 경보 설정을 최적화하며, 시스템 출력을 효과적으로 해석할 수 있도록 지원합니다. 효율적인 구축 및 통합 서비스를 통해 모니터링 플랫폼과 주문 관리 시스템, 데이터 피드, 리포팅 툴 등 기존 인프라와의 원활한 연결성을 보장합니다. 지속적인 지원 및 유지보수 서비스를 통해 시스템의 성능과 안정성을 보호합니다. 정기적인 업데이트를 통해 진화하는 컴플라이언스 요구사항에 대응하고, 감지 기능을 강화하며, 머신러닝 개선과 같은 기술적 진보를 반영합니다. 신속한 기술 지원으로 문제를 신속하게 해결하고 모니터링 범위의 공백을 방지합니다.

세계의 거래 감시 시스템 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 거래 감시 시스템 시장 개요

- 거래 감시 시스템 시장 : 제공별(2025년/2030년)

- 거래 감시 시스템 시장 : 서비스별(2025년/2030년)

- 거래 감시 시스템 시장 : 용도별(2025년/2030년)

- 거래 감시 시스템 시장 : 전개 유형별(2025년/2030년)

- 거래 감시 시스템 시장 : 조직 규모별(2025년/2030년)

- 거래 감시 시스템 시장 : 최종사용자별(2025년/2030년)

- 거래 감시 시스템 시장 : 지역 구성

제5장 시장 개요와 산업 동향

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 사례 연구 분석

- 생태계 분석

- 공급망 분석

- 가격 결정 분석

- 평균 판매 가격 : 지역별(2023년-2025년)

- 참고 가격 : 주요 기업별(2024년)

- 특허 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 주요 규제 : 지역별

- 규제 영향과 산업 표준

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 고객의 비즈니스에 영향을 미치는 동향/파괴적 변화

- 투자 및 자금조달 시나리오

- 거래 감시 시스템 시장에 대한 AI/생성형 AI의 영향

- 사례 연구

- 벤더 대처

- 거래 감시 시스템 시장 : 자산 클래스별

- 주식 감시

- 채권 모니터링

- 파생상품 추적

- 상품

- 외환

- 디지털 자산

제6장 거래 감시 시스템 시장 : 제공별

- 서론

- 솔루션

- 서비스

제7장 거래 감시 시스템 시장 : 용도별

- 서론

- 감시 및 애널리틱스

- 리스크 및 컴플라이언스

- 보고 및 모니터링

- 사례 관리

- 기타 용도

제8장 거래 감시 시스템 시장 : 전개 유형별

- 서론

- 클라우드 기반

- On-Premise

제9장 거래 감시 시스템 시장 : 조직 규모별

- 서론

- 대기업

- 중소기업

제10장 거래 감시 시스템 시장 : 최종사용자별

- 서론

- 금융기관

- 자본시장

- 디지털 자산 거래소

제11장 거래 감시 시스템 시장 : 지역별

- 서론

- 북미

- 북미의 거래 감시 시스템 시장 성장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거래 감시 시스템 시장 성장 촉진요인

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거래 감시 시스템 시장 성장 촉진요인

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 거래 감시 시스템 시장 성장 촉진요인

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카의 거래 감시 시스템 시장 성장 촉진요인

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

제12장 경쟁 구도

- 서론

- 매출 분석(2020년-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 주요 벤더 기업 평가와 재무 지표

- 경쟁 시나리오

제13장 기업 개요

- 서론

- 주요 기업

- NICE

- NASDAQ

- FIS

- IPC SYSTEMS

- ACA GROUP

- CRISIL

- NEXI S.P.A

- ACUITY KNOWLEDGE PARTNERS

- LSEG

- TRADINGHUB

- 기타 기업

- TRADING TECHNOLOGIES

- IONIXX TECHNOLOGIES

- KX

- B-NEXT

- MYCOMPLIANCEOFFICE

- ONEMARKETDATA

- EVENTUS

- BROADPEAK PARTNERS

- STEELEYE

- SOLIDUS LABS

- S3

- TRAPETS

- TRILLIUM SURVEYOR

- SCILA

- AQUIS EXCHANGE

제14장 인접 시장/관련 시장

- 서론

- 관련 시장

- 제한 사항

- 자금세탁 대책(AML) 시장

- 비디오 감시 시장

제15장 부록

LSH 25.09.29The global trade surveillance system market is expected to grow from USD 3.00 billion in 2025 to USD 5.90 billion by 2030 at a compounded annual growth rate (CAGR) of 14.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Offering, Applications, Deployment Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Increased regulatory focus and supportive policies are driving the adoption of trade surveillance systems globally. Regulators enforce stricter compliance standards to prevent market abuse, insider trading, and fraud, prompting financial institutions to invest in AI-driven monitoring, real-time analytics, and cloud-enabled platforms. These investments enhance transparency, operational efficiency, and risk management.

However, many firms still rely on legacy trading and monitoring systems, which pose significant challenges. Upgrading to modern trade surveillance platforms requires substantial time, technical expertise, and financial resources. As a result, the complexity and cost of integration act as key restraints for the trade surveillance system market.

"Based on the deployment mode, the on-premises segment is expected to hold the largest market during forecast period"

On-premises trade surveillance gives organizations direct ownership and control over their monitoring systems, offering a high degree of customization to meet specific operational, security, and compliance needs. By hosting the infrastructure internally, firms can design and configure the platform to align precisely with existing workflows, data management policies, and integration requirements. This level of control allows fine-tuning of surveillance rules, alert thresholds, and investigative processes to reflect unique trading patterns and regulatory obligations across jurisdictions.

Sensitive trading data is retained within the organization's network, minimizing exposure to third-party storage environments and enabling the application of proprietary cybersecurity measures. This proves beneficial for institutions handling highly confidential or market-sensitive information, where data sovereignty and privacy regulations demand strict oversight. On-premises deployment also allows organizations to dictate their own system maintenance, update schedules, and disaster recovery protocols, ensuring operational continuity despite external disruptions.

Performance optimization is another key benefit, as firms can allocate dedicated computing resources to process high volumes of trade data without dependency on external bandwidth or shared infrastructure. Integration with in-house legacy systems is often more seamless, reducing the complexity and risk associated with third-party connectivity. Vendors delivering on-premises solutions emphasize providing robust installation support, flexible configuration options, and ongoing technical assistance to ensure sustained performance and compliance alignment. In essence, on-premises trade surveillance combines operational independence with tailored capability, empowering firms to safeguard compliance while maintaining complete control over their technology environment.

"Based on the offering, the services segment is expected to grow at the highest CAGR during the forecast period"

Services are vital in ensuring trade surveillance solutions operate at peak efficiency, deliver consistent compliance outcomes, and adapt to evolving market and regulatory conditions. A well-structured services portfolio equips institutions with the guidance, technical expertise, and ongoing support necessary to extract maximum value from their surveillance investments.

Specialized training and consulting services help compliance teams understand detection methodologies, optimize alert configurations, and interpret system outputs effectively. Efficient deployment and integration services ensure seamless connectivity between the surveillance platform and existing infrastructure, including order management systems, data feeds, and reporting tools. Ongoing support and maintenance services safeguard system performance and reliability. Regular updates address evolving compliance requirements, enhance detection capabilities, and incorporate technological advancements such as machine learning improvements. Responsive technical support ensures that issues are resolved quickly, preventing gaps in monitoring coverage.

"Europe will account for the largest market share, while Asia Pacific will emerge as the fastest-growing market during the forecast period"

Europe is among the largest markets for trade surveillance systems, driven by stringent regulatory frameworks such as MiFID II, the Markets in Financial Instruments Directive, and ongoing enforcement by national financial authorities. Financial institutions in the United Kingdom, Germany, and France are investing heavily in AI-powered monitoring, real-time analytics, and integrated communication surveillance to ensure compliance and prevent market abuse. Well-established exchanges, advanced technological infrastructure, and strong regulatory oversight contribute to the region's leading position.

In contrast, the Asia Pacific region is the fastest-growing trade surveillance market, with a high CAGR driven by the rapid adoption of electronic trading, derivatives, and digital assets. Singapore, Hong Kong, Australia, and Japan prioritize modern surveillance technologies, including cloud-based platforms, AI-driven anomaly detection, and big data analytics, to address increasing market complexity and regulatory requirements. Expanding fintech ecosystems, rising investor awareness, and government initiatives to enhance market integrity fuel strong demand, making the Asia Pacific a high-potential growth region for trade surveillance solutions.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant trade surveillance system market companies were interviewed to gain insights into this market.

- By Company: Tier I: 40%, Tier II: 25%, and Tier III: 35%

- By Designation: C-Level Executives: 25%, Director Level: 37%, and Others: 38%

- By Region: North America: 34%, Europe: 30%, Asia Pacific: 18%, Rest of World: 18%

Some of the significant trade surveillance system market vendors are NiCE (US), Nasdaq (US), FIS (US), IPC Systems (US), and Nexi S.p.A (Italy), Crisil (India), ACA Group (US), Acuity Knowledge Partners (UK), LSEG (UK), TradingHub (UK), Trading Technologies (US), Ionixx Technologies ((US), KX (US), b-next (Germany), Eventus (US), BroadPeak Partners (US), Solidus Labs (US), SteelEye (US), OneMarketData (US), MyComplianceOffice (US), S3 (US), Trapets (Sweden), Trillium Surveyor (US), Scila (US), and Aquis Exchange (UK).

Research Coverage

The market report covered the trade surveillance system market across segments. We estimated the market size and growth potential for many segments based on solution type, service type, applications, deployment type, end user, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to Buy this Report

This research provides the most accurate revenue estimates for the entire trade surveillance industry and its subsegments, benefiting established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to position their companies better and develop effective go-to-market strategies. The report outlines key market drivers, restraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights into the following pointers:

- Analysis of key drivers (stringent regulatory compliance requirements), restraints (technology failures creating surveillance blind spots), opportunities (integration of AI and machine learning to reduce false favorable rates), and challenges (integration across disparate systems), influencing the growth of the trade surveillance system market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the trade surveillance system market

- Market Development: In-depth details regarding profitable markets, examining the global trade surveillance system market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new software and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the trade surveillance system industry, such as NiCE (US), Nasdaq (US), FIS (US), IPC Systems (US), Nexi S.p.A (Italy), Crisil (India), ACA Group (US), Acuity Knowledge Partners (UK), LSEG (UK), TradingHub (UK), Trading Technologies (US), Ionixx Technologies ((US), KX (US), b-next (Germany), Eventus (US), BroadPeak Partners (US), Solidus Labs (US), SteelEye (US), OneMarketData (US), MyComplianceOffice (US), S3 (US), Trapets (Sweden), Trillium Surveyor (US), Scila (US), and Aquis Exchange (UK)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF TRADE SURVEILLANCE SYSTEM MARKET

- 4.2 TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING (2025 VS 2030)

- 4.3 TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE (2025 VS 2030)

- 4.4 TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION (2025 VS 2030)

- 4.5 TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE (2025 VS 2030)

- 4.6 TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE (2025 VS 2030)

- 4.7 TRADE SURVEILLANCE SYSTEM MARKET, BY END USER (2025 VS 2030)

- 4.8 TRADE SURVEILLANCE SYSTEM MARKET: REGIONAL MIX

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent regulatory compliance requirements

- 5.2.1.2 Rising market abuse and insider trading cases

- 5.2.1.3 Increasing trading volumes across emerging nations

- 5.2.1.4 Increasing demand for 360-degree trade surveillance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technology failures creating surveillance blind spots

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surveillance for crypto and digital assets

- 5.2.3.2 Integration of AI and machine learning to reduce false positive rates

- 5.2.3.3 Growing inclination to adopt cloud-based deployments in trade surveillance

- 5.2.3.4 Demand for low-latency reporting and time-series databases

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration across disparate systems

- 5.2.4.2 Monitoring and mitigating risks from colocation-driven trade manipulation

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 BRINGING RISK INSIGHTS, MONITORING TOOLS, AND GROWTH TO KKPS WITH NASDAQ

- 5.3.2 AUSTRALIAN BANK TACKLES FINANCIAL FRAUD WITH AN INTEGRATED SURVEILLANCE SOLUTION

- 5.3.3 DMA ENHANCES COMPLIANCE CONTROL WITH STEELEYE

- 5.3.4 UPGRADING UK BANK TRADE SURVEILLANCE

- 5.3.5 FALCONX STRENGTHENS INSTITUTIONAL CRYPTO TRADING WITH SOLIDUS LABS PARTNERSHIP

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE, BY REGION, 2023-2025

- 5.6.2 INDICATIVE PRICING, BY KEY PLAYER, 2024

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 AI

- 5.8.1.2 Machine learning

- 5.8.1.3 Real-time processing

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Enterprise integration

- 5.8.2.2 Compliance management

- 5.8.2.3 Data analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Blockchain

- 5.8.3.2 Cloud infrastructure

- 5.8.3.3 Natural language processing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS, BY REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.9.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.9.3.1 General Data Protection Regulation

- 5.9.3.2 SEC Rule 17a-4

- 5.9.3.3 ISO/IEC 27001

- 5.9.3.4 System and Organization Controls 2 Type II

- 5.9.3.5 Financial Industry Regulatory Authority

- 5.9.3.6 Freedom of Information Act

- 5.9.3.7 Health Insurance Portability and Accountability Act

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 IMPACT OF AI/GEN AI ON TRADE SURVEILLANCE SYSTEM MARKET

- 5.15.1 CASE STUDIES

- 5.15.1.1 SIX combats market abuse with AI-based technology

- 5.15.2 VENDOR INITIATIVES

- 5.15.2.1 Revolutionizing Trade Surveillance with AI-Powered Precision and Contextual Intelligence

- 5.15.2.2 Driving Next-Gen Trade Surveillance with AI-Powered Precision and Proactive Risk Management

- 5.15.1 CASE STUDIES

- 5.16 TRADE SURVEILLANCE SYSTEM MARKET, BY ASSET CLASS

- 5.16.1 EQUITY SURVEILLANCE

- 5.16.2 FIXED INCOME MONITORING

- 5.16.3 DERIVATIVES TRACKING

- 5.16.4 COMMODITIES

- 5.16.5 FOREIGN EXCHANGE

- 5.16.6 DIGITAL ASSETS

6 TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 TRANSFORMING TRADE SURVEILLANCE INTO PROACTIVE, HIGH-PRECISION COMPLIANCE FRAMEWORKS

- 6.2.2 REAL-TIME MONITORING

- 6.2.2.1 Instant detection and response through real-time trade monitoring

- 6.2.3 HISTORICAL SURVEILLANCE

- 6.2.3.1 Detecting complex market misconduct through historical surveillance

- 6.3 SERVICES

- 6.3.1 TRAINING & CONSULTING

- 6.3.1.1 Strengthening compliance outcomes through training and consulting

- 6.3.2 DEPLOYMENT & INTEGRATION

- 6.3.2.1 Building a scalable framework for end-to-end trade surveillance

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Proactive performance management for reliable surveillance operations

- 6.3.1 TRAINING & CONSULTING

7 TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 7.2 SURVEILLANCE & ANALYTICS

- 7.2.1 DETECTING RISKS AND PATTERNS WITH INTELLIGENT TRADE SURVEILLANCE ANALYTICS

- 7.2.2 MARKET ABUSE DETECTION

- 7.2.3 ALERT GENERATION & PRIORITIZATION

- 7.2.4 BEHAVIORAL PATTERN DETECTION

- 7.3 RISK & COMPLIANCE

- 7.3.1 ENHANCING COMPLIANCE FRAMEWORKS FOR MARKET TRANSPARENCY

- 7.3.2 RISK SCORING MODELS

- 7.3.3 PRE-TRADE RISK CHECKS

- 7.3.4 TRADE RECONSTRUCTION

- 7.4 REPORTS & MONITORING

- 7.4.1 ENHANCING COMPLIANCE ACCURACY VIA INTELLIGENT ALERTS AND ONGOING RISK TRACKING

- 7.4.2 REGULATORY REPORTING AUTOMATION

- 7.4.3 CUSTOM REPORT GENERATION

- 7.4.4 REAL TIME ALERT & ESCALATION MANAGEMENT

- 7.5 CASE MANAGEMENT

- 7.5.1 STREAMLINING INVESTIGATIONS THROUGH INTELLIGENT CASE MANAGEMENT

- 7.5.2 CASE ASSIGNMENT & TRACKING

- 7.5.3 EVIDENCE ATTACHMENT & ANNOTATION

- 7.6 OTHER APPLICATIONS

8 TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT TYPE: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 8.2 CLOUD-BASED

- 8.2.1 ENHANCING TRADE SURVEILLANCE AGILITY AND COMPLIANCE WITH CLOUD-BASED SOLUTIONS

- 8.3 ON-PREMISES

- 8.3.1 ENSURING CONTROL, CUSTOMIZATION, AND SECURITY WITH ON-PREMISES TRADE SURVEILLANCE

9 TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 9.2 LARGE ENTERPRISES

- 9.2.1 ENABLING SCALABLE, COMPLIANT, AND INSIGHT-DRIVEN SURVEILLANCE FOR LARGE ENTERPRISES

- 9.3 SMES

- 9.3.1 SUPPORTING SMES IN MEETING REGULATORY DEMANDS WITHOUT HEAVY OVERHEADS

10 TRADE SURVEILLANCE SYSTEM MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USERS: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 10.2 FINANCIAL INSTITUTIONS

- 10.2.1 ACCURATE, REAL-TIME OVERSIGHT FOR COMPLEX TRADING ECOSYSTEMS

- 10.2.2 INVESTMENT BANKS

- 10.2.3 INSTITUTIONAL BROKERS

- 10.2.4 OTHER FINANCIAL INSTITUTIONS

- 10.3 CAPITAL MARKETS

- 10.3.1 DRIVING MARKET INTEGRITY THROUGH ADVANCED OVERSIGHT IN CAPITAL MARKETS

- 10.3.2 REGULATORS

- 10.3.3 MARKET CENTERS & STOCK EXCHANGES

- 10.3.4 OTHER CAPITAL MARKET END USERS

- 10.4 DIGITAL ASSET EXCHANGE

- 10.4.1 STRENGTHENING COMPLIANCE AND TRANSPARENCY IN DIGITAL ASSET ECOSYSTEM

- 10.4.2 BLOCKCHAIN

- 10.4.3 CRYPTOCURRENCY EXCHANGES

11 TRADE SURVEILLANCE SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Regulatory reforms drive advanced trade surveillance

- 11.2.4 CANADA

- 11.2.4.1 Optimizing compliance and market integrity through trade surveillance systems

- 11.3 EUROPE

- 11.3.1 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Data-driven regulation accelerates advanced trade surveillance in the UK

- 11.3.4 GERMANY

- 11.3.4.1 AI adoption and regulatory pressure driving trade surveillance transformation

- 11.3.5 FRANCE

- 11.3.5.1 Enhanced data transparency and multi-asset oversight

- 11.3.6 ITALY

- 11.3.6.1 Consob-driven AI and regulatory reforms accelerating Italy's trade surveillance market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Trade market shifts toward algorithmic trading and stricter oversight

- 11.4.4 JAPAN

- 11.4.4.1 Foreign investor dominance and crypto oversight reshaping Japan's trade surveillance

- 11.4.5 INDIA

- 11.4.5.1 Growing retail investor base reshaping India's market and strengthening trade surveillance imperatives

- 11.4.6 AUSTRALIA & NEW ZEALAND

- 11.4.6.1 Regulatory reforms and cross-venue complexity driving need for trade surveillance

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GCC COUNTRIES

- 11.5.3.1 KSA

- 11.5.3.1.1 Regulatory reforms driving market integrity

- 11.5.3.2 UAE

- 11.5.3.2.1 UAE's growth as a trading hub boosts surveillance adoption

- 11.5.3.3 Rest of GCC Countries

- 11.5.3.1 KSA

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Complex and fast-paced environment necessitates oversight

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Brazil reshaping market oversight amid surging complexity

- 11.6.4 MEXICO

- 11.6.4.1 Strengthening market integrity through advanced surveillance systems

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 REVENUE ANALYSIS, 2020-2024

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 BRAND/PRODUCT COMPARISON

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Offering footprint

- 12.5.5.4 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.7.1 COMPANY VALUATION

- 12.7.2 FINANCIAL METRICS

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 12.8.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 NICE

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 NASDAQ

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 FIS

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 IPC SYSTEMS

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 ACA GROUP

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 CRISIL

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Deals

- 13.2.7 NEXI S.P.A

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Deals

- 13.2.8 ACUITY KNOWLEDGE PARTNERS

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Deals

- 13.2.9 LSEG

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 TRADINGHUB

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Deals

- 13.2.1 NICE

- 13.3 OTHER PLAYERS

- 13.3.1 TRADING TECHNOLOGIES

- 13.3.2 IONIXX TECHNOLOGIES

- 13.3.3 KX

- 13.3.4 B-NEXT

- 13.3.5 MYCOMPLIANCEOFFICE

- 13.3.6 ONEMARKETDATA

- 13.3.7 EVENTUS

- 13.3.8 BROADPEAK PARTNERS

- 13.3.9 STEELEYE

- 13.3.10 SOLIDUS LABS

- 13.3.11 S3

- 13.3.12 TRAPETS

- 13.3.13 TRILLIUM SURVEYOR

- 13.3.14 SCILA

- 13.3.15 AQUIS EXCHANGE

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 ANTI-MONEY LAUNDERING (AML) MARKET

- 14.3 VIDEO SURVEILLANCE MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS