|

시장보고서

상품코드

1910653

성형 섬유 포장 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Molded Fiber Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

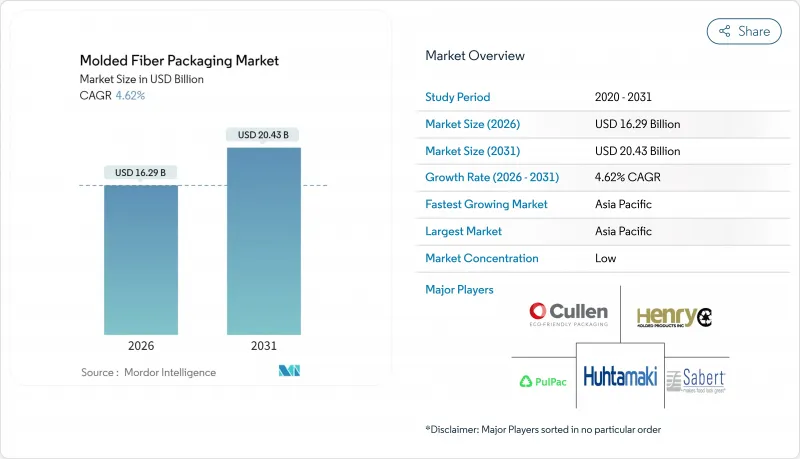

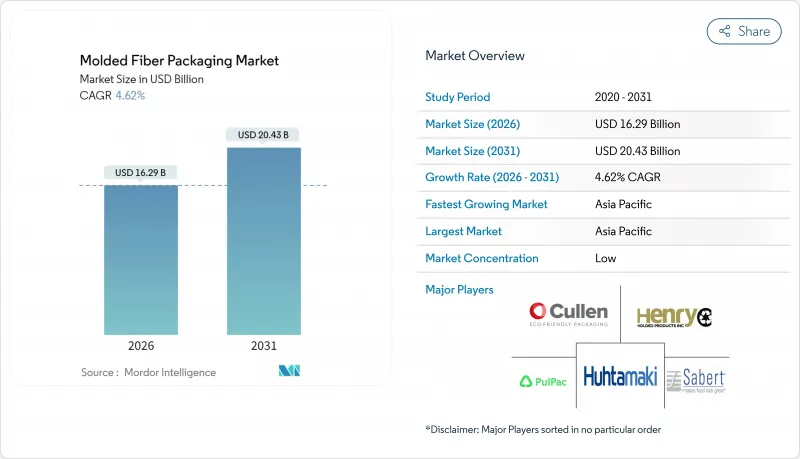

세계의 성형 섬유 포장 시장 규모는 2026년에는 162억 9,000만 달러로 추정되고 있으며, 2025년 155억 7,000만 달러에서 계속 성장하고 있습니다. 2031년까지 204억 3,000만 달러에 이를 것으로 예측되며, 2026년부터 2031년까지 CAGR 4.62%로 확대가 전망됩니다.

일회용 플라스틱 금지 확대, CO2 배출량을 80% 삭감하고 생산량을 10배로 높이는 건식 성형 섬유 기술의 급속한 보급, 그리고 전자상거래량 증가가 함께 수요를 지지하고 있습니다. 생산자는 비용, 기계적 강도 및 지속가능성의 균형을 유지하기 위해 하이브리드 섬유의 연구 개발을 가속화하고 있습니다. 한편, 퀵서비스 레스토랑(QSR)이 퇴비화 가능한 포장 형식에 대한 대처를 확대함으로써 대량 소비의 엔드마켓이 확대되고 있습니다. 합병의 격화로 인해 구매자와 판매자의 역학은 변화하고 있지만, 유럽의 펄프 가격이 2024년 4월에 1톤당 1,380유로(1,496달러)로 최고점에 달했기 때문에 이익률에 대한 압력은 여전히 계속되고 있습니다.

세계의 성형 섬유 포장 시장 동향과 통찰

일회용 플라스틱에 대한 금지 규제

급속한 법규에 따라 컴플라이언스 위험이 성형 섬유 제품의 즉시 주문으로 전환하고 있습니다. 버지니아에서는 2025년 7월에 대규모 식품 공급업체용 발포 스티렌 금지가 시행되었으며, 오레곤 주에서는 2025년 1월에 유사한 규칙이 도입되었습니다. 또한 유럽연합 규칙 2025/40에서는 2040년까지 플라스틱 포장의 65%를 재생재로 하는 것을 의무화하고 있습니다. 호주의 2024년 포장 개혁은 폐기 비용을 내부화하는 확대 생산자 책임을 통합하고 있습니다. 이러한 일관된 규제로 대체가 가속화되고 성형 섬유 포장 시장은 소매업체와 식품 브랜드에 대한 기본 옵션입니다.

전자상거래 및 식품배송 채널 성장

소비자용 밀키트와 식료품 배송 서비스에서는 단열성과 충격 보호가 요구되지만, 경량 플라스틱에서는 지속 가능한 형태로 이것을 실현하기 어렵습니다. TemperPack의 섬유 기반 라이너는 배송량을 줄이고 단일 클라이언트에서 연간 400대의 트럭을 줄일 수 있으므로 재료 가격 프리미엄을 상쇄하는 운송 비용 절감 효과를 보여줍니다. 고객의 백로그가 반복됨으로써 밝혀진 미충족 수요는 성형 섬유 포장 시장에 생산 능력 확대의 인센티브를 가져왔습니다.

럭셔리 재생 섬유의 가격 변동

유럽 펄프의 스팟 가격은 2024년 4월에 톤당 1,380유로(1,496달러)에 달하고, 전년 대비 14% 상승했습니다. 헤지 대책을 취할 수 없었던 가공업자에게는 어려운 상황입니다. 북유럽 공급 혼란과 삼림 벌채 규제의 강화가 제지 공장의 폐쇄를 촉진하여 비용 변동을 확대하고 있습니다. 성형 섬유 포장 업계의 중견 및 중소기업은 운영 자금 압박에 직면하여 제휴 또는 철수를 강요받고 있습니다.

부문 분석

트랜스퍼 성형 섬유는 2025년 49.62%라는 압도적인 점유율을 획득했으며, 설치 기반과 범용성으로 성형 섬유 포장 시장을 지원했습니다. 열 성형품은 규모가 작지만, 배리어 코팅과 미관의 향상에 의해 고급 브랜드를 끌어당겨, 6.45%의 연평균 복합 성장률(CAGR)로 성장이 전망됩니다. 두꺼운 성형은 산업용 완충재로 여전히 중요하며 가공 등급은 장식 마감에 해당합니다. 경도의 탈리그닌 처리에 의해 인장 강도가 22% 향상되어 전자기기 포장에의 적용 가능성이 높아지고 있습니다. 열성형품을 위한 성형 섬유 포장 시장 규모는 3D 드라이 성형에 의한 사이클 타임 단축과 금형 비용 절감으로 꾸준한 확대가 예상됩니다.

기술 혁신의 조류는 전사 부품의 내유성 및 내습성을 높이는 하이브리드 적층 기술로 이행하고 있습니다. 제조업체 각사는 CFD(계산 유체역학)를 활용하여 진공 사이클을 최적화, 섬유 사용량을 최대 12% 삭감하고 있습니다. 경쟁 우위는 독자 개발 성형 스크린과 물 회수 시스템에 의한 운영 비용 절감에 의존하는 상황입니다.

트레이는 2025년 매출액의 34.07%를 차지해 중추 제품이었지만, 퀵서비스 레스토랑 체인이 경첩 강도와 적재 효율을 요구하기 때문에 크램쉘 용기와 컨테이너는 CAGR 5.17%가 전망됩니다. 간편한 간식과 식사 택배 서비스의 성장이 수요를 더욱 가속화하고 있습니다. 엔드 캡과 인서트는 전자기기나 가전제품의 충격 흡수 요구를 충족하고, 폴리에틸렌 프리 배리어재의 등장에 의해 컵 수요도 확대하고 있습니다.

탄산 칼슘과 카올린과 같은 광물계 충전제는 강성과 백색도를 향상시켜 생산 라인의 속도를 상당한 비용 증가없이 향상시킵니다. 그러나, 광물의 과잉 첨가는 내충격성을 감소시키기 때문에 제형 설계자는 충전제 비율을 조심스럽게 조정합니다. 현재의 채용 곡선이 지속되면 클램쉘로 인한 성형 섬유 포장 시장 규모는 10년 후에 10억 달러 대 중반에 이를 수 있습니다.

지역별 분석

아시아태평양은 2025년 성형 섬유 포장 시장에서 38.45%의 점유율을 차지하고 중국과 인도가 재활용하기 어려운 플라스틱 금지 조치를 완화하는 가운데 2031년까지 연평균 6.65%의 성장률로 확대될 것으로 예측됩니다. 지속가능한 소재에 대한 정부 보조금이 국내 기계 구매를 촉진하고, 인건비의 우위성이 투자 회수 기간을 단축하고 있습니다. 견조한 중산계급 소비로 편의식, 전자기기, 의약품 수요량이 증가하고 있습니다.

북미에서는 2032년까지 플라스틱 사용량을 25% 삭감할 것을 의무화하는 캘리포니아주 법안 SB 54 등의 규제가 추진력이 되고 있습니다. 브랜드의 공약이 섬유제 클램쉘의 조기 채용을 촉진하는 한편, 국내 펄프 자원이 원료 가격의 변동을 완화하고 있습니다. 그러나 타이트한 노동 시장과 고에너지 비용으로 대규모 컨버터에게 유리한 자동화에 대한 투자가 촉발되고 있습니다.

유럽에서는 순환형 경제가 중시되고, 규제 2025/40에 의해 재생재 함유율의 기준이 강화됩니다. 오스트리아와 핀란드 제조업체는 고급 섬유 성형 라인을 활용하여 EU 전역 수요에 대응합니다. 일본에서는 2025년 6월 시행의 개정 포지티브 리스트 제도에 의해 엄격한 이행 시험이 의무화되어 규율 있는 공급자가 활용할 수 있는 진입 장벽이 생기고 있습니다. 남미, 중동, 아프리카에서는 도시화와 폐기물 인프라의 정비가 진행되어, 1인당 플라스틱 사용량이 낮다는 미개척의 성장 영역이 존재하고, 성형 섬유의 채용을 향한 경로가 정돈되어 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 소비자의 기호가 재활용 가능하고 환경 친화적인 포장재로 이행

- 일회용 플라스틱에 대한 규제상의 금지 조치

- 전자상거래 및 식품 배달 채널 성장

- 생분해성 크램쉘 용기의 QSR(퀵 서비스 레스토랑) 도입 상황

- 3D 드라이 성형 섬유 기술의 상업화

- 브랜드 레벨에서의 탄소 중립 선언

- 시장 성장 억제요인

- 고품질 재생 섬유의 가격 변동성

- 바이오플라스틱 및 코팅 판지 대체품

- 습윤 식품에 대한 배리어 특성의 제약

- 자본 집약적인 맞춤형 금형 요건

- 업계 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁의 심각성

- 거시경제 요인이 시장에 미치는 영향

제5장 시장 규모와 성장 예측

- 성형 섬유 유형별

- 두꺼운 벽 섬유

- 트랜스퍼 성형

- 열성형

- 처리된 섬유

- 제품 유형별

- 트레이

- 클램쉘 용기 및 컨테이너

- 컵 및 컵 홀더

- 접시 및 그릇

- 기타 제품 유형

- 원재료 조달처별

- 재생지

- 버진 펄프

- 하이브리드 섬유 블렌드

- 최종 사용 산업별

- 식품 및 음료

- 전자기기 및 가전제품

- 헬스케어 및 의료기기

- 산업

- 기타 최종 사용 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 케냐

- 나이지리아

- 기타 아프리카

- 중동

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Huhtamaki Oyj

- Brodrene Hartmann A/S

- Sonoco Products Company

- UFP Technologies Inc.

- Omni-PAC Group UK

- Henry Molded Products Inc.

- Pactiv Evergreen Inc.

- Cullen Packaging Ltd.

- Genpak LLC

- Sabert Corporation

- International Paper Co.

- Enviropak Corporation

- Keiding Inc.

- PulPac AB

- Stora Enso Oyj

- Heracles Packaging SA

- Earthpac(US)

- Fiber Mold A/S

- Fabri-Kal Corporation

- TMP Technologies

제7장 시장 기회와 미래 전망

SHW 26.01.26The molded fiber packaging market size in 2026 is estimated at USD 16.29 billion, growing from 2025 value of USD 15.57 billion with 2031 projections showing USD 20.43 billion, growing at 4.62% CAGR over 2026-2031.

Rising single-use plastic bans, rapid scale-up of dry molded fiber technology that cuts CO2 emissions by 80% and boosts throughput tenfold, and growing e-commerce volumes collectively underpin demand. Producers are accelerating hybrid fiber R&D to balance cost, mechanical strength, and sustainability, while quick service restaurant (QSR) commitments to compostable formats are expanding high-volume end-markets. Intensifying mergers are reshaping buyer-supplier dynamics, yet margin pressure persists because European pulp prices peaked at EUR 1,380 (USD 1,496) per metric ton in April 2024.

Global Molded Fiber Packaging Market Trends and Insights

Regulatory bans on single-use plastics

Fast-moving legislation is converting compliance risk into immediate molded fiber orders. Virginia's expanded polystyrene prohibition for large food vendors takes effect in July 2025, Oregon implemented similar rules in January 2025, and the European Union Regulation 2025/40 mandates 65% recycled content in plastic packaging by 2040. Australia's 2024 packaging reform embeds extended producer responsibility that internalizes disposal costs. These aligned mandates accelerate substitution, making the molded fiber packaging market a default choice for retailers and food brands.

Growth of e-commerce and food-delivery channels

Direct-to-consumer meal kits and grocery delivery require insulation and shock protection that lightweight plastics struggle to provide sustainably. TemperPack's fiber-based liners reduce outbound shipments enough to remove 400 trucks annually for a single client, illustrating freight savings that offset material price premiums. Unmet demand, documented by repeated customer backlogs, is pushing the molded fiber packaging market toward capacity expansion incentives.

Price volatility of high-grade recycled fiber

European pulp spot prices hit EUR 1,380 (USD 1,496) per metric ton in April 2024, a 14% year-over-year jump that squeezed converters unable to hedge. Nordic supply disruptions and stricter deforestation rules spur mill closures, amplifying cost swings. Smaller firms in the molded fiber packaging industry face working-capital strain, prompting alliances or exit.

Other drivers and restraints analyzed in the detailed report include:

- QSR adoption of compostable clamshells

- Commercialization of 3-D dry-molded fiber technology

- Barrier-property limitations for wet foods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transfer-molded fiber captured a commanding 49.62% share in 2025, anchoring the molded fiber packaging market through its installed base and versatility. Thermoformed formats, though smaller, are projected to grow at 6.45% CAGR as improved barrier coatings and aesthetics attract premium brands. Thick wall molding remains vital for industrial cushioning, and processed grades cater to decorative finishes. Light delignification boosts tensile strength by 22%, enhancing viability for electronics packaging. The molded fiber packaging market size for thermoformed items is forecast to increase steadily as 3D dry molding reduces cycle times and tooling costs.

Innovation momentum is shifting toward hybrid laminations that enhance the grease and moisture resistance of transfer parts. Producers leverage computer-aided fluid dynamics to optimize vacuum cycles, trimming fiber usage by up to 12%. Competitive dynamics thus hinge on proprietary forming screens and water-recovery systems that lower operating costs.

Trays remained the backbone with 34.07% of 2025 revenues, yet clamshells and containers are set for 5.17% CAGR because QSR chains require hinge integrity and stacking efficiency. Growth of convenience snacking and meal-delivery services further accelerates demand. End-caps and inserts meet electronics and appliance shock-absorption needs, while cups gain traction as polyethylene-free barriers emerge.

Mineral fillers such as calcium carbonate and kaolin improve rigidity and whiteness, raising line speeds without prohibitive cost increases. However, overdosing minerals can drop impact resistance, so formulators calibrate filler ratios carefully. The molded fiber packaging market size attributable to clamshells could reach a mid-single-digit billion-dollar level by decade-end if current adoption curves sustain.

The Molded Fiber Packaging Market Report is Segmented by Molded Fiber Type (Thick Wall, Transfer Molded, Thermoformed, and Processed), Product Type (Trays, Clamshells and Containers, and More), Raw-Material Source (Recycled Paper, Virgin Pulp, and More), End-User Industry (Food and Beverages, Electronics and Appliances, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region led the molded fiber packaging market with a 38.45% share in 2025 and is projected to compound at a 6.65% rate through 2031, as China and India scale back bans on difficult-to-recycle plastics. Government subsidies for sustainable materials encourage domestic machinery purchases, and labor cost advantages shorten payback periods. Robust middle-class consumption lifts volumes for convenience foods, electronics, and pharmaceuticals.

North America benefits from regulatory catalysts, such as California SB 54, which mandates a 25% reduction in plastic by 2032. Brand pledges drive early adoption of fiber clamshells, while domestic pulp resources cushion raw-material volatility. Nevertheless, tight labor markets and high energy costs compel investments in automation that favor large converters.

Europe emphasizes circularity, with Regulation 2025/40 tightening recycled-content thresholds. Manufacturers in Austria and Finland leverage advanced fiber-forming lines to supply EU-wide demand. Japan's updated positive list regime, effective June 2025, requires rigorous migration testing, creating entry barriers that disciplined suppliers can exploit. South America and the Middle East and Africa offer untapped growth pockets where urbanization and waste infrastructure upgrades converge with lower per-capita plastic use, paving pathways for molded fiber adoption.

- Huhtamaki Oyj

- Brodrene Hartmann A/S

- Sonoco Products Company

- UFP Technologies Inc.

- Omni-PAC Group UK

- Henry Molded Products Inc.

- Pactiv Evergreen Inc.

- Cullen Packaging Ltd.

- Genpak LLC

- Sabert Corporation

- International Paper Co.

- Enviropak Corporation

- Keiding Inc.

- PulPac AB

- Stora Enso Oyj

- Heracles Packaging SA

- Earthpac (US)

- Fiber Mold A/S

- Fabri-Kal Corporation

- TMP Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift in consumer preference toward recyclable and eco-friendly packaging

- 4.2.2 Regulatory bans on single-use plastics

- 4.2.3 Growth of e-commerce and food-delivery channels

- 4.2.4 QSR adoption of compostable clamshells

- 4.2.5 Commercialization of 3-D dry-molded fiber technology

- 4.2.6 Brand-level carbon-neutral pledges

- 4.3 Market Restraints

- 4.3.1 Price volatility of high-grade recycled fiber

- 4.3.2 Bioplastics and coated paperboard substitutes

- 4.3.3 Barrier-property limitations for wet foods

- 4.3.4 Capital-intensive custom tooling requirements

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Molded Fiber Type

- 5.1.1 Thick Wall

- 5.1.2 Transfer Molded

- 5.1.3 Thermoformed

- 5.1.4 Processed

- 5.2 By Product Type

- 5.2.1 Trays

- 5.2.2 Clamshells and Containers

- 5.2.3 Cups and Cup-Carriers

- 5.2.4 Plates and Bowls

- 5.2.5 Other Product Types

- 5.3 By Raw-Material Source

- 5.3.1 Recycled Paper

- 5.3.2 Virgin Pulp

- 5.3.3 Hybrid Fiber Blends

- 5.4 By End-user Industry

- 5.4.1 Food and Beverages

- 5.4.2 Electronics and Appliances

- 5.4.3 Healthcare and Medical Devices

- 5.4.4 Industrial

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huhtamaki Oyj

- 6.4.2 Brodrene Hartmann A/S

- 6.4.3 Sonoco Products Company

- 6.4.4 UFP Technologies Inc.

- 6.4.5 Omni-PAC Group UK

- 6.4.6 Henry Molded Products Inc.

- 6.4.7 Pactiv Evergreen Inc.

- 6.4.8 Cullen Packaging Ltd.

- 6.4.9 Genpak LLC

- 6.4.10 Sabert Corporation

- 6.4.11 International Paper Co.

- 6.4.12 Enviropak Corporation

- 6.4.13 Keiding Inc.

- 6.4.14 PulPac AB

- 6.4.15 Stora Enso Oyj

- 6.4.16 Heracles Packaging SA

- 6.4.17 Earthpac (US)

- 6.4.18 Fiber Mold A/S

- 6.4.19 Fabri-Kal Corporation

- 6.4.20 TMP Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment