|

시장보고서

상품코드

1693718

북미의 민간 항공기 기내 엔터테인먼트 시스템 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)North America Commercial Aircraft In-Flight Entertainment System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

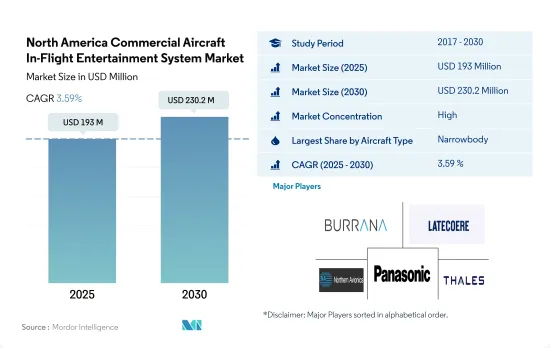

북미의 민간 항공기 기내 엔터테인먼트 시스템 시장 규모는 2025년에는 1억 9,300만 달러, 2030년에는 2억 3,020만 달러에 달할 것으로 예상되며, 예측 기간(2025-2030년) 동안 3.59%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다.

협동체 항공기에 대한 수요 증가와 승객의 전반적인 경험을 중시하는 항공사들이 북미 IFE 수요를 촉진할 것으로 예상되는 요인 중 일부입니다.

- 기내 엔터테인먼트는 기내 인테리어에 필수적인 요소로, 승객의 비행 경험 전체를 결정짓는 요소입니다. 미국에서는 유나이티드 항공, 아메리칸 항공, 사우스웨스트 항공, 델타 항공이 현역 민간 항공기에 기내 엔터테인먼트 시스템을 도입했습니다. 마찬가지로 캐나다에서는 에어캐나다, 웨스트젯, 에어 트랜짓 등이 기내 엔터테인먼트 시스템을 민간 항공기에 도입하고 있습니다.

- 이 지역에서는 파나소닉이 Astrova, NEXT, X 시리즈 등 다양한 버전의 IFE 시스템을 제공하는 주요 OEM 중 하나입니다. 북미의 여러 항공사는 객실 등급에 따라 LED, QLED, 4K HDR 스크린 등 다양한 구성의 12인치에서 18인치까지 다양한 스크린을 사용하고 있습니다.

- 국내 항공 수요 증가에 따라 협동체 항공기 시장은 와이드바디 항공기보다 빠르게 회복될 것으로 예측됩니다. 또한, 737 MAX가 2020년 하반기에 운항을 재개하는 것도 협동체 항공기 부문의 성장을 가속할 수 있습니다.

- 항공기 납품 대수로는 2017-2022년 총 2,049대가 이 지역의 다양한 항공사에 의해 조달되었습니다. 이 2,049대 중 내로우바디 항공기가 92%, 와이드바디 항공기가 8%를 차지했습니다. 신형 민간 여객기 주문이 증가하고 있는 것이 시장 성장을 견인하고 있습니다. 예를 들어, 2021년 7월 유나이티드항공은 Boeing737 Max와 Airbus A320을 270대, 델타항공은 Boeing737-10을 100대 주문하고 30대의 옵션을 추가 주문했다고 발표했습니다. 이러한 주문은 북미 항공기 객실 시장에서 IFE 수요를 창출하여 2023-2030년에 총 2,885대의 항공기가 인도될 것으로 예측됩니다.

협동체 항공기의 부상과 개인화된 여행 경험을 제공하기 위해 승객을 중시하는 항공사가 촉진요인으로 작용

- 민간 항공기 부문은 주로 협동체 항공기에 대한 수요와 북미의 항공 여객 수 증가에 힘입어 큰 성장이 예상됩니다. 항공사의 기체 개발, 연비 효율이 높은 항공기에 대한 수요 증가, 항공업계의 2050년 무공해 목표에 대한 검토가 민간 항공기 수요를 촉진하고 있으며, 2023년 8월 현재 이 지역에는 1,474대의 보잉 항공기와 986대의 에어버스 항공기공급 잔여량이 있습니다. 이 중 미국에서만 2,405대의 주문 잔량이 있습니다. 따라서 미국은 예측 기간 동안 더 큰 성장을 이룰 것으로 예측됩니다.

- 또한, IFE 시스템에 대한 수요는 개인화된 여행 경험을 원하는 승객들에 의해 주도되고 있습니다. IFE 시스템 시장은 새로운 항공기 도입과 항공 승객 증가, 연료 소비 및 유지보수 비용 절감, 항공사 수익성 향상을 위해 기존 유선 IFE 시스템을 무선 IFE 시스템으로 교체해야 할 필요성에 의해 주도되고 있습니다. 무선 IFE 시스템으로 대체할 필요성에 의해서도 견인되고 있습니다. 파나소닉과 탈레스와 같은 OEM들은 기존 IFE 시스템보다 무게가 가벼운 좌석 내 디스플레이와 기내 디스플레이를 개발하고 있습니다.

- 또한 미국에서는 알래스카 항공, 프론티어 항공, 사우스웨스트 항공, 스피릿 항공 등의 항공사가 IFE 시스템을 제공하지 않는 것으로 확인되었습니다. 이들 항공사는 기내 와이파이를 사용하기 위해 약간의 추가 요금을 지불하고 승객 자신의 기기로 엔터테인먼트를 스트리밍하는 옵션을 선택하기 때문입니다. 이러한 시장 개척으로 2023-2030년까지 1.92% 시장 성장이 예상됩니다.

북미 민항기용 기내 엔터테인먼트 시스템 시장 동향

항공사들은 연비가 좋은 신형 항공기를 대량 주문하고 있으며, LCC의 확장은 시장 성장에 기여하고 있습니다.

- 2022년 북미의 항공 여객 수송량은 미국이 전체의 80%를 차지할 것으로 예측됩니다. 따라서 예측 기간 동안 미국은 다른 북미 국가들에 비해 신형 항공기 납품 수요가 가장 높을 것으로 예측됩니다. 항공사들은 증가하는 항공 수요에 대응하기 위해 항공기 규모를 확대하고 있으며, 북미에서는 신규 항공기에 대한 큰 수요가 발생할 수 있습니다.

- 북미에서는 2017-2022년까지 총 1,903대의 신조 여객기가 인도되었고, 2023-2030년까지 2,885대의 신조 제트기가 추가로 인도될 것으로 예측됩니다. 인도된 1,903대의 제트기 중 1,748대가 협동체 항공기, 155대가 와이드바디 항공기였습니다. 저비용 항공사의 확대로 인해 단거리 노선에서 낮은 운항 비용과 높은 연비 등의 장점을 가진 차세대 협동체 항공기에 대한 수요가 크게 증가하고 있습니다. 예측 기간 동안 인도되는 제트기 중 약 2,678대가 협동체 항공기가 될 것으로 예측됩니다. 이는 경제적이고 작은 항공기의 선호, 저가 항공사의 성공, 장거리 협동체 항공기의 도입 등 여러 가지 요인에 기인합니다. 북미의 주요 항공사로는 아메리칸 항공, 델타 항공, 유나이티드 항공, 사우스웨스트 항공, 에어 캐나다, 알래스카 항공 등이 있습니다. 이들 항공사는 총 2,460대 이상의 항공기를 보유하고 있으며, 그 중에는 협동체 및 와이드바디 항공기가 모두 포함되어 있습니다. 했습니다. 항공사는 더 젊은 항공기를 유지하려고 노력하고 있기 때문에 예측 기간 동안 신형 항공기의 대량 주문이 예상됩니다.

경제 성장, 관광 산업 증가, 규제 완화는 북미의 안정적인 항공 여객 수송량 증가의 원동력이 되고 있습니다.

- 광활한 영토와 다양한 목적지를 가진 북미는 국내선 및 국제선을 이용하는 수백만 명의 승객들에게 인기 있는 국가입니다. 경제 성장, 저렴한 항공권 가격, 중산층 증가 등의 요인으로 인해 항공 승객 수가 크게 증가하고 있습니다. 2022년 미국의 항공 여객 수는 10억 4,000만 명으로 2021년 대비 7%, 2019년 대비 12% 증가했으며, 2022년 1월부터 12월까지 미국 항공사가 수송한 여객 수는 8억 5,300만 명으로 2021년 6억 5,800만 명, 2020년 3억 8,800만 명보다 더 많았습니다. 초과했습니다. 캐나다 항공사가 수송한 승객 수는 2022년 1억 7천만 명으로 2021년 대비 6% 증가했고, 2022년 멕시코의 항공 승객 수는 1억 명으로 2021년 대비 7% 성장했습니다. 북미는 다른 많은 국가 및 지역보다 여행 제한이 적고 그 기간도 짧다는 이점을 누리고 있습니다. 이는 대규모 자국 시장의 국내 여행과 해외 여행을 촉진하고 있습니다. 이 지역의 순이익은 2022년 99억 달러에서 2023년 114억 달러로 증가할 것으로 예측됩니다.

- 항공 여객 수송량 증가에 따른 수요에 대응하기 위해 이 지역의 여러 항공사는 새로운 항공기 조달을 계획하고 있습니다. 예를 들어, 2023년 전 세계 항공기의 약 1/3이 북미 항공사에 인도될 것으로 예측됩니다. 이 지역의 항공기 인도량은 2022년에 이미 2019년 수준을 넘어섰으며, 2023년에는 72대가 더 늘어났습니다. 전반적으로 안정적인 항공 여행으로 인해 이 지역의 항공 여객 수송량은 2022년에 기록된 12억 명에 비해 2030년에는 17억 명으로 증가할 것으로 예측됩니다.

북미 민항기 기내 엔터테인먼트 시스템 산업 개요

북미 민항기용 기내 엔터테인먼트 시스템 시장은 상당히 통합되어 있으며, 상위 5개 업체가 71.42%의 점유율을 차지하고 있습니다. 이 시장의 주요 기업은 Burrana, Latecoere, Northern Avionics srl, Panasonic Avionics Corporation, Thales Group 등입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 오퍼

제3장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 항공 여객 운송량

- 신규 항공기 납입수

- 1인당 GDP(현행 가격)

- 항공기 제조업체의 판매량

- 항공기 수주잔고

- 수주 총액

- 공항 건설 지출(지속 중)

- 항공사 연료비

- 규제 프레임워크

- 밸류체인과 유통 채널 분석

제5장 시장 세분화

- 항공기 유형

- 내로우 바디

- 와이드 바디

- 국가별

- 캐나다

- 미국

- 기타 북미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 개요

- Burrana

- Donica Aviation Engineering Co., Ltd

- IMAGIK International Corp.

- Latecoere

- Northern Avionics srl

- Panasonic Avionics Corporation

- Thales Group

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고 문헌

- 도표

- 주요 인사이트

- 데이터 팩

- 용어집

The North America Commercial Aircraft In-Flight Entertainment System Market size is estimated at 193 million USD in 2025, and is expected to reach 230.2 million USD by 2030, growing at a CAGR of 3.59% during the forecast period (2025-2030).

Rising demand for narrowbody aircraft and airlines focusing on passenger's overall experience are some of the factors that expected to drive the demand for IFE in North America

- In-flight entertainment is integral to cabin interiors and defines a passenger's entire flight experience. In the United States, United Airlines, American Airlines, Southwest Airlines, and Delta Air Lines have in-flight entertainment systems in their active fleet of commercial aircraft. Similarly, Air Canada, WestJet, and Air Transat operating in Canada also have in-flight entertainment systems in their active fleet of commercial aircraft.

- In the region, Panasonic is one of the major OEMs that offers many versions of the IFE system, including Astrova, NEXT, and X Series. Various airlines in North America use screens ranging from 12 inches to 18 inches with different configurations, such as LED, QLED, and 4K HDR screens, according to cabin class.

- As the demand for domestic aviation has increased, the market for narrowbody aircraft is anticipated to rebound faster than widebody aircraft. The 737 MAX's return to service in late 2020 may also boost the growth of the narrowbody aircraft segment.

- In terms of deliveries, during 2017-2022, a total of 2,049 aircraft were procured by various airlines in the region. Out of these 2,049 aircraft, narrowbody aircraft accounted for 92%, and widebody aircraft accounted for 8%, respectively. The rising number of aircraft orders of new commercial passenger aircraft has positively driven the growth of the market. For instance, in July 2021, United Airlines announced that it placed a 270-plane order for Boeing 737 Max and Airbus A320s, and Delta Airlines placed orders for 100 Boeing 737-10 aircraft, with an option for 30 more. Such orders are expected to generate demand for IFE in North America's aircraft cabin market, and during 2023-2030, a total of 2,885 aircraft are expected to be delivered.

Rise of narrowbody aircraft, and airlines focusing on passengers to provide personalized travel experiences are the driving factors

- The commercial aircraft segment is expected to experience significant growth, primarily driven by the demand for narrowbody aircraft and the growing number of air passengers in North America. Fleet development of the airlines, increase in demand for fuel-efficient aircraft, and the airline industry's consideration of the zero-emission 2050 goal fuel the demand for commercial aircraft. As of August 2023, the region has a backlog of 1,474 Boeing aircraft and 986 Airbus aircraft. Of these total aircraft, the US alone has 2,405 aircraft in backlog. Hence, the country is expected to witness larger growth during the forecast period.

- Additionally, the demand for IFE systems is driven by passengers as they seek personalized travel experiences. So, airlines are responding by investing in enhanced IFE systems. Besides the procurement of new aircraft and increasing air passenger traffic, the IFE system market is also driven by the need to replace conventional wired IFE systems with wireless IFE systems to reduce fuel consumption and maintenance costs and increase airline profitability. OEMs, such as Panasonic, Thales, and others, are developing in-seat and cabin displays that weigh less than the conventional IFE system.

- Furthermore, it was observed that in the US, airlines such as Alaska Airlines, Frontier Airlines, Southwest Airlines, and Spirit Airlines are not providing any IFE system because these airlines have opted for the option of streaming entertainment on the passenger's own device with some additional cost to use their in-flight Wi-Fi. Overall, with such developments, the market is expected to grow by 1.92% from 2023 to 2030.

North America Commercial Aircraft In-Flight Entertainment System Market Trends

Airlines are placing huge orders for new fuel-efficient aircraft, and the expansion of LCCs is contributing to the growth of the market

- The United States accounted for 80% of the total air passenger traffic in North America in 2022. Therefore, the United States is expected to generate the highest demand for new aircraft deliveries compared to other North American countries over the forecast period. Airlines are looking to expand their fleet size to cater to the growing demand for air travel, which may generate significant demand for new aircraft in North America.

- A total of 1,903 new passenger aircraft were delivered in North America between 2017 and 2022, and a further 2,885 new jets are expected to be delivered to the region during 2023-2030. Of the 1,903 jets delivered, 1,748 were narrowbody aircraft, and 155 were widebody aircraft. The expansion of low-cost carriers has resulted in huge demand for newer generation narrowbody aircraft, which offer advantages such as low operation costs and fuel efficiency in short-haul routes. It is expected that out of all the jets that will be delivered during the forecast period, around 2,678 of them will be narrowbody aircraft. This is due to several factors, including the preference for economical and smaller aircraft, the success of low-cost carriers, and the introduction of long-range narrowbody aircraft. Some of the major airlines in North America are American Airlines, Delta Air Lines, United Airlines, Southwest Airlines, Air Canada, and Alaska Airlines. These airlines together have a backlog of over 2,460 aircraft, including a mix of both narrowbody and widebody aircraft. During the COVID-19 pandemic, most major airlines retired some of their old aircraft models and procured new fuel-efficient aircraft to remain profitable. As the airlines try to maintain a younger fleet, large orders for new aircraft are expected during the forecast period.

Rising economy, increase in tourism industry and ease of restrictions are the driving factors for a consistent air passenger traffic growth in North America

- North America's vast landmass and diverse destinations make it a popular choice for millions of passengers who choose to fly both domestically and internationally. Factors such as a growing economy, increased affordability of air travel, and a rising middle class have contributed to a significant uptick in air passenger traffic. Air passenger traffic in the United States reached 1.04 billion in 2022, up by 7% compared to 2021 and 12% compared to 2019. In 2022, from January through December, US airlines carried 853 million passengers, up from 658 million in 2021 and 388 million in 2020. The total number of passengers carried by airlines in Canada reached 107 million in 2022, surpassing the levels in 2021 by 6%. In 2022, Mexico had 100 million air passenger traffic, representing a 7% growth compared to its 2021 traffic levels. North America has benefitted from fewer and shorter-lasting travel restrictions than many other countries and regions. This has boosted domestic travel in the large home market, as well as international travel. Net profits in the region are expected to rise from USD 9.9 billion in 2022 to USD 11.4 billion in 2023.

- To cater to the demand driven by air passenger traffic, various airlines in the region are planning to procure new aircraft. For instance, around one-third of global aircraft deliveries in 2023 were anticipated to be received by various carriers in North America. Although the region's aircraft deliveries were already above 2019 levels in 2022, they were expected to grow by an additional 72 units in 2023. Overall, with consistent air travel, the region's air passenger traffic is expected to increase by 1.7 billion in 2030 compared to 1.2 billion recorded in 2022.

North America Commercial Aircraft In-Flight Entertainment System Industry Overview

The North America Commercial Aircraft In-Flight Entertainment System Market is fairly consolidated, with the top five companies occupying 71.42%. The major players in this market are Burrana, Latecoere, Northern Avionics srl, Panasonic Avionics Corporation and Thales Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 United States

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Burrana

- 6.4.2 Donica Aviation Engineering Co., Ltd

- 6.4.3 IMAGIK International Corp.

- 6.4.4 Latecoere

- 6.4.5 Northern Avionics srl

- 6.4.6 Panasonic Avionics Corporation

- 6.4.7 Thales Group

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms