|

시장보고서

상품코드

1737052

동반진단(CDX) 개발 시장 : 제공 서비스 유형별, 사용 분석 기술별, 대상 치료 영역별, 최종 사용자별, 주요 지역별Companion Diagnostics Development Market Distribution By Type of Services Offered, Analytical Techniques Used, Target Therapeutic Area, End User and Key Geographical Regions |

||||||

세계 동반진단(CDX) 개발 시장 규모는 2035년까지 예측 기간 동안 7.3%의 연평균 복합 성장률(CAGR)로, 8억 9,200만 달러에서 2035년까지 17억 9,600만 달러로 성장할 것으로 예측됩니다.

시장 세분화는 시장 규모와 기회 분석을 다음 매개 변수로 구분합니다.

제공 서비스 유형별

- 피지빌리티 스터디

- 어세이 개발

- 분석 검증

- 임상 밸리데이션

- 제조

사용분석 기술별

- NGS

- PCR

- IHC

- 플로우 사이토메트리

- 기타

대상 치료 영역별

- 종양성 질환

- 비종양성 질환

최종 사용자별

- 업계 진출기업

- 비업계 진출기업

주요 지역별

- 북미

- 유럽

- 아시아태평양

동반진단(CDX) 개발 시장 : 성장과 동향

동반진단은 체외 진단용 의약품(IVD)의 제품 유형으로, 적합한 의약품 및 생물학적 제제를 안전하고 효율적으로 사용하기 위한 중요한 정보를 수집할 수 있습니다. 최근의 동향으로서, 질병의 발병에 관여하는 분자 메커니즘을 이해하는 방향으로 점진적으로 이동하고 있으며, 동반 진단으로부터 수집된 정보는 이러한 질병을 치료하기 위한 표적 요법의 개발에 도움이 되었습니다. 그 결과, 동반진단은 임상의가 치료 계획을 수립하기 위한 환자 고유의 유전자 프로파일에 대한 정보를 제공하기 위해 의료 분야에서 필수적입니다. 2022년부터 FDA는 44개의 CDX 진단제를 승인했습니다. 이 중 3개의 CDX 표적 치료제가 진행 난소암, 유방암, 비소세포폐암의 승인을 얻고 있습니다.

이러한 동반 진단을 사용하여 질병 특이적 정보를 수집하면 표적 특이적 치료의 성공률을 높이고 전체 환자 결과를 개선할 수 있습니다. 그러나, 이러한 검사의 개발은(특정 질환에 특이적인) 적절한 바이오마커의 동정에서 시작하여 생물학적 샘플에서 바이오마커의 존재를 검출하고 정량하는 정확한 방법의 검증까지 긴 과정을 필요로 합니다. 이러한 진단 테스트의 개발은 복잡하기 때문에 의약품 개발 회사는 필요한 전문 지식을 가진 위탁 서비스 제공업체에게이 프로세스를 아웃소싱하는 것을 선호합니다.

현재, 바이오마커의 동정 및 탐색, 바이오마커의 선택과 밸리데이션, 어세이 개발, 분석 밸리데이션, 임상 밸리데이션, 상업화, 제조, 동반진단 키트 관련 서비스, 시약 개발, 규제 지원 등, 진단약 개발을 위한 다양한 서비스를 제공한다고 주장하는 기업이 많이 존재합니다.

동반진단(CDX) 개발 시장 : 주요 고려사항

이 보고서는 동반진단(CDX) 개발 시장의 현재 상태를 조사하고 업계에서 잠재적인 성장 기회를 밝혔습니다.

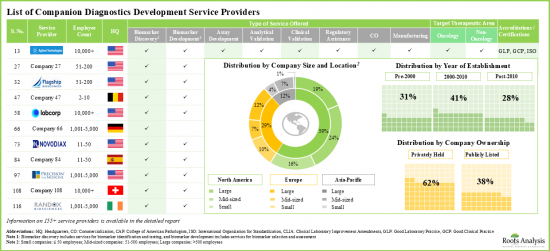

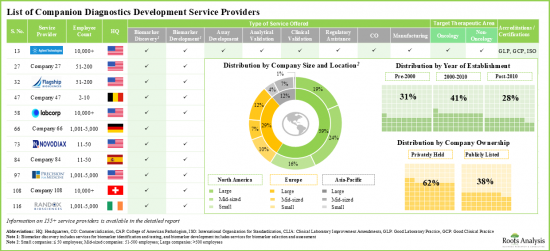

- 현재, 155개 사 이상의 서비스 제공업체가 동반진단(CDX) 개발에 관련되는 복수의 스텝을 서포트하기 위해서 필요한 전문 지식을 가지고 있다고 주장하고 있습니다.

- 각 사는 질환 특이적인 바이오마커를 동정하기 위한 분석 시험을 개발하는 서비스를 제공하고 있으며, 암 영역은 개발자가 개별화 진단 요법을 모색하고 있는 보다 인기가 높은 영역입니다.

- 이 분야에서 경쟁 우위를 확립하기 위해 이해관계자는 각각의 서비스 포트폴리오를 강화하기 위해 기존 능력을 적극적으로 업그레이드하고 새로운 능력을 추가하고 있습니다.

- 다양한 분석 플랫폼을 기반으로 300 가까이 동반진단 제품이 다양한 유형의 생물학적 시료에서 바이오 마커 검출을 촉진하는 데 사용할 수 있으며 개발 중입니다.

- 동반진단의 80% 이상이 암 질환의 치료제으로서 승인되고 있으며, 그 중 95%는 고형암을 타겟으로 한 약제와의 병용이 의도되고 있습니다.

- 이해관계자의 관심의 고조는 제휴 활동의 활성화로부터도 명확합니다.

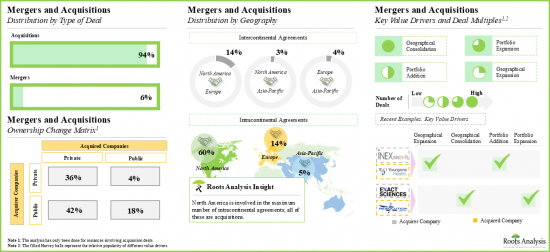

- M&A의 급증은 CDX에 대한 수요 증가에 따른 것으로, 인수계약의 65%는 기존 포트폴리오에 새로운 기능을 통합하기 위해 체결된 것입니다.

- 의약품 개발 기업은 바이오 마커에 기반한 표적 치료제의 견고한 포트폴리오를 구축하고 있으며, CDX 서비스 제공업체와의 파트너십을 적극적으로 모색하고 있습니다.

- 수년 동안 여러 주요 제약 회사는 바이오 마커에 중점을 둔 여러 임상시험을 후원했습니다.

- 바이오인포매틱스와 인공지능 툴의 출현으로 임상 데이터와 진단 데이터를 통합하여 환자에게 개별화된 체험을 제공하는 125개 이상의 소프트웨어 용도이 개발되었습니다.

- 현재 115개가 넘는 기업이 진단, 치료 및 분석을 목적으로 하는 소프트웨어 용도를 제공하고 있으며, 이러한 솔루션은 또한 다양한 치료 영역에서 다양한 데이터 유형을 처리할 수 있습니다.

- 동반진단(CDX) 개발의 밸류 체인에는 복수의 의약품·진단약 개발 기업, 서비스 제공업체, 기타 주된 이해 관계자가 관여하고 있어, 각각이 개별 우선 사항이나 요구 사항을 가지고 있습니다.

- 동반진단(CDX) 개발 서비스 시장은 2035년까지 연평균 복합 성장률(CAGR) 7.3%로 성장할 것으로 예측되고 있으며, 2035년까지 북미가 시장의 대부분(65% 이상)을 차지할 것으로 예측되고 있습니다.

동반진단(CDX) 개발 시장 : 주요 부문

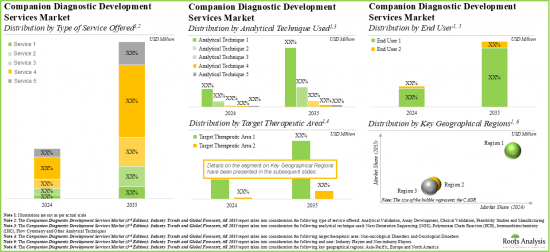

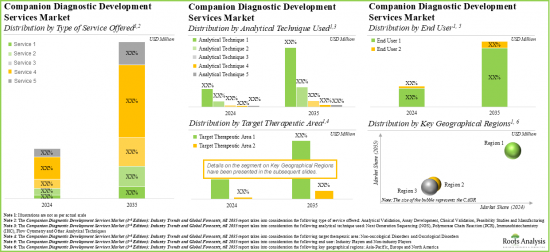

제공 서비스 유형별로, 시장은 피지빌리티 스터디, 분석 개발, 분석 검증, 임상 검증, 제조로 구분됩니다.현재 동반진단(CDX) 개발 세계 시장에서는 임상 검증 서비스가 최대 점유율을 차지하고 있습니다.

사용분석기술별로 시장은 NGS, PCR, IHC, 유동세포계측기 등으로 구분됩니다. 하지만 이것은 이 분석 기술이 제공하는 낮은 샘플 투입량, 높은 스루풋, 고감도 등 다양한 이점에 기인합니다.

대상 치료 영역별로는 시장은 암성 질환과 비암성 질환으로 구분됩니다.

최종 사용자별로 세계 시장은 업계 진출기업과 비업계 진출기업으로 구분됩니다.

주요 지역별로 보면 시장은 북미, 유럽, 아시아태평양으로 구분됩니다. 현재 동반진단(CDX) 개발 세계 시장은 북미가 지배적이며, 최대의 수익 점유율을 차지하고 있습니다.

본 보고서에서는 세계의 동반진단(CDX) 개발 시장에 대해 조사했으며, 시장 개요와 함께, 제공 서비스 유형별, 사용 분석 기술별, 대상 치료 영역별, 최종 사용자별, 주요 지역별 동향, 시장 진출기업프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 및 기타 프로젝트 특유의 고려 사항

제4장 주요 요약

제5장 소개

- 장의 개요

- 맞춤형 의료의 진화

- 동반진단의 개요

- 다양한 치료 영역에서의 동반자 진단의 응용

- 동반진단에 관한 규제 심사 및 승인 프로세스

- 기존의 과제와 아웃소싱의 필요성

- 계약 진단 기관(CDO)을 선택하기 위한 기본 가이드라인

- 장래의 전망

제6장 동반진단(CDX) 개발 서비스 제공업체: 시장 상황

- 장의 개요

- 동반진단(CDX) 개발 서비스 제공업체 : 참가 기업 일람

제7장 기업 경쟁력 분석

제8장 동반진단(CDX) 개발 서비스 제공업체: 상세한 기업 프로파일

- 장의 개요

- 북미의 주요 기업

- Geneuity Clinical Research Services

- Labcorp

- Q2 Solutions

- Quest Diagnostics

- ResearchDx

- 유럽의 주요 기업

- Almac Diagnostic Services

- Eurofins

- QIAGEN

- 아시아태평양의 주요 기업

- BGI Genomics

- MEDICAL &BIOLOGICAL LABORATORIES(MBL)

제9장 동반진단(CDX) 개발 서비스 제공업체: 기업 프로파일

- 장의 개요

- 북미의 주요 기업

- Agilent Technologies

- Creative Biolabs

- ICON Specialty Laboratories

- NeoGenomics Laboratories

- 유럽의 주요 기업

- Cerba Research

- Randox Biosciences

- Roche

- Siemens Healthineers

- Unilabs

- 아시아태평양의 주요 기업

- Abnova

- Celemics

- MEDx Translational Medicine

- Novogene

- Shuwen Biotech

제10장 동반진단 제품: 시장 상황

- 장의 개요

- 동반진단 : 시판/치험약 일람

- 동반자 진단 : 개발자 목록

제11장 파트너십 및 협업

제12장 잠재적인 파트너 분석

- 장의 개요

- 채점 기준과 주요 전제

- 범위와 조사 방법

- 동반진단 서비스 제공업체의 가능성이 있는 파트너 : 알츠하이머병

- 동반진단 서비스 제공업체의 가능한 파트너 : 유방암

- 동반진단 서비스 제공업체의 가능성이 있는 파트너 : 대장암

- 동반진단 서비스 제공업체의 가능한 파트너 : 폐암

- 동반진단 서비스 제공업체의 가능한 파트너 : HIV

- 동반진단 서비스 제공업체의 가능한 파트너 : 난소암

- 동반진단 서비스 제공업체의 가능성이 있는 파트너 : 전립선암

제13장 합병과 인수

제14장 이해관계자 요구 분석

제15장 밸류체인 분석

제16장 암 바이오마커의 임상조사: 주요 제약회사의 대처

제17장 정밀의료 소프트웨어 솔루션의 사례 연구

제18장 시장 영향 분석 : 촉진요인, 제약 요인, 기회, 과제

제19장 세계의 동반진단(CDX) 개발 서비스 시장

제20장 동반진단(CDX) 개발 서비스 시장(제공 서비스 유형별)

제21장 동반진단(CDX) 개발 서비스 시장(사용 분석 기술별)

제22장 동반진단(CDX) 개발 서비스 시장(대상 치료 영역별)

제23장 동반진단(CDX) 개발 서비스 시장(최종사용자별)

제24장 동반진단(CDX) 개발 서비스 시장(주요 지역별)

- 장의 개요

- 주요 전제와 조사 방법

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 벨기에

- 스위스

- 기타

- 아시아태평양

- 중국

- 기타

- 데이터의 삼각측량과 검증

제25장 결론

제26장 주요 인사이트

제27장 부록 1:표 형식 데이터

제28장 부록 2 : 기업 및 단체 일람

SHW 25.06.09COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: OVERVIEW

As per Roots Analysis, the global companion diagnostics (CDx) development market is estimated to grow from USD 892 million in current year to USD 1,796 million by 2035, at a CAGR of 7.3% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Services Offered

- Feasibility Studies

- Assay Development

- Analytical Validation

- Clinical Validation

- Manufacturing

Analytical Techniques Used

- NGS

- PCR

- IHC

- Flow Cytometry

- Others

Target Therapeutic Area

- Oncological Disorders

- Non-oncological Disorders

End User

- Industry Players

- Non-industry Players

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: GROWTH AND TRENDS

A companion diagnostic is a type of in-vitro diagnostic (IVD) device / test that enables researchers to collect crucial information for the safe and efficient use of a compatible drug or biological product. Recently, there has been a gradual shift towards understanding the molecular mechanisms involved in disease pathogenesis, and the information collected from companion diagnostic tools aids in the development of targeted therapies to treat these diseases. As a result, companion diagnostics have become an integral part of the healthcare sector to provide information about the unique genetic profiles of patients that further allow clinicians to develop treatment plans. It is worth noting that, since 2022, the FDA has approved close to 44 CDx diagnostics. Of these, three CDx-targeted therapies have received approval for advanced ovarian cancer, breast cancer, and non-small cell lung cancer.

Using these companion diagnostics to collect disease-specific information helps increase the success rate of target-specific therapies and improve overall patient outcomes. However, the development of such tests is a long process that starts from the identification of a suitable biomarker (specific to a particular disease indication) and extends to validating a precise method for detecting and quantifying its presence in biological samples. Given the complexities involved in the development of such diagnostic tests, drug developers prefer outsourcing this process to contract service providers having the necessary expertise.

Presently, numerous companies claim to offer a variety of services for diagnostic development, including biomarker identification and discovery, biomarker selection and validation, assay development, analytical validation, clinical validation, commercialization, manufacturing, services related to companion diagnostic kits, reagent development and regulatory assistance.

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: KEY INSIGHTS

The report delves into the current state of the companion diagnostics (CDx) development market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Over 155 service providers presently claim to have the required expertise to support multiple steps involved in companion diagnostic development; ~30% of these are established players with more than 500 employees.

- Companies offer services to develop analytical tests to identify disease specific biomarkers; oncology is the more popular area wherein developers are exploring personalized diagnostic regimens.

- In pursuit of building a competitive edge in this field, stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective service portfolios.

- Close to 300 companion diagnostic products, based on various analytical platforms, are available / under development to facilitate biomarker detection from different types of biological specimens.

- More than 80% of the companion diagnostic products have received approval for the treatment of oncological disorders; of these, 95% of the products are currently intended for use with drugs targeting solid tumors.

- The rising interest of stakeholders is evident from the rise in partnership activity; in fact, more than 80 agreements related to companion diagnostic development services were inked in the last two years.

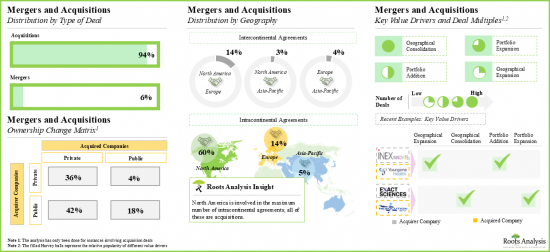

- The surge in mergers and acquisitions is driven by the increasing demand for CDx; 65% of acquisition agreements were signed to incorporate additional capabilities into their existing portfolio offerings.

- As drug developers continue to build a robust portfolio of biomarker-based targeted therapies, they are actively seeking partnerships with CDx service providers, in order to leverage the latter's expertise in this domain.

- Over the years, several big pharma players have sponsored multiple biomarker focused clinical trials; the use of companion diagnostic tests to stratify patient population in these trials offers significant cost reduction (~60%).

- The advent of bioinformatics and artificial intelligence tools has led to the development of over 125 software applications that integrate clinical and diagnostic data to deliver personalized experiences to patients.

- Over 115 players currently offer software applications for diagnostic, therapeutic and analytical purposes; these solutions are also capable of handling variable data types across a range of therapeutic areas.

- The companion diagnostic development value chain involves several drug and diagnostics developers, service providers, along with other key stakeholders, each having a discrete set of priorities and requirements.

- The companion diagnostic development services market is anticipated to grow at a CAGR of 7.3%, till 2035; North America is expected to capture the majority share (over 65%) of the market by 2035.

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: KEY SEGMENTS

Clinical Validation Service Segment Occupies the Largest Share of the Companion Diagnostics (CDx) Development Market

Based on the type of services offered, the market is segmented into feasibility studies, assay development, analytical validation, clinical validation and manufacturing. At present, the clinical validation service segment holds the maximum share of the global companion diagnostics (CDx) development market. Additionally, the analytical validation service segment is likely to grow at a faster pace during the forecasted period.

By Analytical Techniques Used, IHC (Immunohistochemistry) is the Fastest Growing Segment of the Global Companion Diagnostics (CDx) Development Market

Based on the analytical techniques used, the market is segmented into NGS, PCR, IHC, flow cytometry and others. Currently, the next generation sequencing (NGS) segment captures the highest proportion of the global companion diagnostics (CDx) development market owing to the various benefits offered by this analytical technique, such as lower sample input, higher throughput and greater sensitivity. Further, the companion diagnostics (CDx) development market for the IHC segment is likely to grow at a relatively higher CAGR.

Oncological Disorders Segment Occupies the Largest Share of the Companion Diagnostics (CDx) Development Market by Target Therapeutic Area

Based on the target therapeutic area, the market is segmented into oncological disorders and non-oncological disorders. At present, companion diagnostics for oncological disorders hold the maximum share of the companion diagnostics (CDx) development market. This trend is likely to remain the same during the forecasted period. Further, it is worth highlighting that the companion diagnostics (CDx) development market for non-oncological disorders segment is likely to grow at a relatively higher CAGR.

Currently, the Industry Players Segment Holds the Largest Share of the Companion Diagnostics (CDx) Development Market

Based on end user, the global market is segmented into industry players and non-industry players. Currently, the industry players segment holds the largest market share. However, the companion diagnostics (CDx) development market for non-industry players segment is expected to witness substantial growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe and Asia-Pacific. Currently, North America dominates the global companion diagnostics (CDx) development market and accounts for the largest revenue share. However, the market in Europe is expected to grow at a higher CAGR in the coming years.

Example Players in the Companion Diagnostics (CDx) Development Market

- Almac Diagnostics

- BGI Genomics

- Eurofins

- Geneuity Clinical Research Services

- Labcorp

- MEDICAL & BIOLOGICAL LABORATORIES

- Q2 Solutions

- QIAGEN

- Quest Diagnostics

- ResearchDx

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global companion diagnostics (CDx) development market, focusing on key market segments, including [A] type of services offered, [B] analytical techniques used, [C] target therapeutic area, [D] end user and [E] key geographical regions.

- Service Providers Market Landscape: A comprehensive evaluation of the companion diagnostics (CDx) development industry players, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] ownership, [D] geographical location of headquarters, [E] types of services offered, [F] affiliated services, [G] AI support, [H] analytical techniques used, [I] therapeutic areas and [J] regulatory certifications / accreditations.

- Company Competitiveness Analysis: A comprehensive competitive analysis of service providers in the companion diagnostics (CDx) development industry, examining factors, such as [A] developer strength and [B] product portfolio strength.

- Detailed Company Profiles: In-depth profiles of key service providers engaged in the companion diagnostics (CDx) development market, focusing on [A] overview of the company, [B] financial information (if available), [C] service portfolio, and [D] recent developments and [E] an informed future outlook.

- Short Company Profiles: Tabulated profiles of key service providers engaged in the companion diagnostics (CDx) development market, focusing on [A] overview of the company and [B] service portfolio.

- Companion Diagnostic Products Market Landscape: A comprehensive evaluation of the companion diagnostic products, based on several relevant parameters, such as [A] analytical techniques used, [B] target disease indication, [C] therapeutic areas, [D] type of biomarker detected, [E] type of sample used, [F] regulatory authority involved, [G] expediated review designation, [H] leading companion diagnostic developers and [I] most popular companion drugs. Additionally, a comprehensive evaluation of the companion diagnostic developers, based on several relevant parameters, such as [J] year of establishment, [K] company size, [L] ownership and [M] geographical location of headquarters.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the companion diagnostics (CDx) development market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of technology, [D] target therapeutic area, [E] type of partner, [F] most active players (in terms of the number of partnerships signed) and [G] geographical distribution of partnership activity.

- Likely Partner Analysis: An in-depth analysis of 300+ drug developers sponsoring clinical trials of therapies targeting several disease-specific biomarkers, shortlisted based on relevant parameters, such as [A] number of biomarker-focused clinical trials sponsored and [B] time to market their proprietary personalized medicine products.

- Mergers and Acquisitions: An in-depth analysis of various mergers and acquisitions in this domain, based on relevant parameters, such as [A] year of agreement, [B] type of deal, [C] geographical location of headquarters, [D] company size, [E] key value drivers and [F] acquisition deal multiples (based on revenues). Additionally, an ownership change matrix provides a summary of the involvement of private and public sector companies in this domain.

- Stakeholder Needs Analysis: An insightful analysis of the current and long-term needs of different stakeholders, along with the key areas of concern associated with this industry.

- Value Chain Analysis: An in-depth analysis of the companion diagnostics value chain, based on various relevant parameters, such as [A] various steps of development operations and [B] the cost requirements across each step.

- Big Pharma Initiatives: An in-depth analysis of oncology clinical trials sponsored by prominent big pharmaceutical companies in the companion diagnostics domain, based on various relevant parameters, such as [A] trial registration year, [B] phase of development, [C] trial sponsors, [D] recruitment status, [E] therapy design, [F] enrolled patient population, [G] popularity of biomarkers and [H] popularity of target indications.

- Case Study: A detailed discussion on the current market landscape of precision medicine software solutions that offer intelligent insights to diagnostic developers, service providers, patients and healthcare experts, based on [A] type of platform utilized, [B] purpose of software solution, [C] type of data processed, [D] therapeutic area, and [E] types of end users. Additionally, a comprehensive evaluation of software solutions developers, based on several relevant parameters, such as [A] year of establishment, [B] company size, [c] ownership and [D] geographical location of headquarters.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Evolution of Personalized Medicines

- 5.3. An Overview of Companion Diagnostics

- 5.3.1. Development of Companion Diagnostics

- 5.3.2. Analytical Techniques Used in Companion Diagnostic Tests

- 5.3.2.1. Immunohistochemistry

- 5.3.2.2. In-situ Hybridization

- 5.3.2.3. Polymerase Chain Reaction

- 5.3.2.4. DNA Sequencing / Next Generation Sequencing

- 5.3.3. Advantages of Companion Diagnostics

- 5.4. Applications of Companion Diagnostics across Different Therapeutic Areas

- 5.4.1. Oncological Disorders

- 5.4.2. Infectious Diseases

- 5.4.3. Neurological Disorders

- 5.5. Regulatory Review and Approval Process for Companion Diagnostics

- 5.6. Existing Challenges and Need for Outsourcing

- 5.7. Basic Guidelines for Selecting a Contract Diagnostics Organization (CDO)

- 5.8. Future Perspectives

6. COMPANION DIAGNOSTICS DEVELOPMENT SERVICE PROVIDERS: MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Companion Diagnostics Development Service Providers: List of Players

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Company Size and Location of Headquarters (Region)

- 6.2.5. Analysis by Company Ownership

- 6.2.6. Analysis by Type of Services Offered

- 6.2.7. Analysis by Type of Affiliated Service Offered

- 6.2.8. Analysis by AI Support

- 6.2.9. Analysis by Type of Analytical Techniques Used

- 6.2.10. Analysis by Target Therapeutic Area

- 6.2.11. Analysis by Regulatory Accreditation / Certification

- 6.2.12. Analysis by Type of Services Offered, Company Size and Location of Headquarters (Region)

- 6.2.13. Analysis by Analytical Technique Used, Company Size and Location of Headquarters (Region)

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Companion Diagnostics Service Providers: Company Competitiveness Analysis

- 7.4.1. Companion Diagnostics Service Providers based in North America

- 7.4.2. Companion Diagnostics Service Providers based in Europe

- 7.4.3. Companion Diagnostics Service Providers based in Asia-Pacific

8. COMPANION DIAGNOSTICS DEVELOPMENT SERVICE PROVIDERS: DETAILED COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Key Players in North America

- 8.2.1. Geneuity Clinical Research Services

- 8.2.1.1. Company Overview

- 8.2.1.2. Service Portfolio

- 8.2.1.3. Recent Developments and Future Outlook

- 8.2.2. Labcorp

- 8.2.2.1. Company Overview

- 8.2.2.2. Service Portfolio

- 8.2.2.3. Recent Developments and Future Outlook

- 8.2.3. Q2 Solutions

- 8.2.3.1. Company Overview

- 8.2.3.2. Service Portfolio

- 8.2.3.3. Recent Developments and Future Outlook

- 8.2.4. Quest Diagnostics

- 8.2.4.1. Company Overview

- 8.2.4.2. Service Portfolio

- 8.2.4.3. Recent Developments and Future Outlook

- 8.2.5. ResearchDx

- 8.2.5.1. Company Overview

- 8.2.5.2. Service Portfolio

- 8.2.5.3. Recent Developments and Future Outlook

- 8.2.1. Geneuity Clinical Research Services

- 8.3. Key Players in Europe

- 8.3.1. Almac Diagnostic Services

- 8.3.1.1. Company Overview

- 8.3.1.2. Service Portfolio

- 8.3.1.3. Recent Developments and Future Outlook

- 8.3.2. Eurofins

- 8.3.2.1. Company Overview

- 8.3.2.2. Service Portfolio

- 8.3.2.3. Recent Developments and Future Outlook

- 8.3.3. QIAGEN

- 8.3.3.1. Company Overview

- 8.3.3.2. Service Portfolio

- 8.3.3.3. Recent Developments and Future Outlook

- 8.3.1. Almac Diagnostic Services

- 8.4. Key Players in Asia-Pacific

- 8.4.1. BGI Genomics

- 8.4.1.1. Company Overview

- 8.4.1.2. Service Portfolio

- 8.4.1.3. Recent Developments and Future Outlook

- 8.4.2. MEDICAL & BIOLOGICAL LABORATORIES (MBL)

- 8.4.2.1. Company Overview

- 8.4.2.2. Service Portfolio

- 8.4.2.3. Recent Developments and Future Outlook

- 8.4.1. BGI Genomics

9. COMPANION DIAGNOSTICS DEVELOPMENT SERVICE PROVIDERS: SHORT COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Key Players in North America

- 9.2.1. Agilent Technologies

- 9.2.1.1. Company Overview

- 9.2.1.2. Service Portfolio

- 9.2.2. Creative Biolabs

- 9.2.2.1. Company Overview

- 9.2.2.2. Service Portfolio

- 9.2.3. ICON Specialty Laboratories

- 9.2.3.1. Company Overview

- 9.2.3.2. Service Portfolio

- 9.2.4. NeoGenomics Laboratories

- 9.2.4.1. Company Overview

- 9.2.4.2. Service Portfolio

- 9.2.1. Agilent Technologies

- 9.3. Key Players in Europe

- 9.3.1. Cerba Research

- 9.3.1.1. Company Overview

- 9.3.1.2. Service Portfolio

- 9.3.2. Randox Biosciences

- 9.3.2.1. Company Overview

- 9.3.2.2. Service Portfolio

- 9.3.3. Roche

- 9.3.3.1. Company Overview

- 9.3.3.2. Service Portfolio

- 9.3.4. Siemens Healthineers

- 9.3.4.1. Company Overview

- 9.3.4.2. Service Portfolio

- 9.3.5. Unilabs

- 9.3.5.1. Company Overview

- 9.3.5.2. Service Portfolio

- 9.3.1. Cerba Research

- 9.4. Key Players in Asia-Pacific

- 9.4.1. Abnova

- 9.4.1.1. Company Overview

- 9.4.1.2. Service Portfolio

- 9.4.2. Celemics

- 9.4.2.1. Company Overview

- 9.4.2.2. Service Portfolio

- 9.4.3. MEDx Translational Medicine

- 9.4.3.1. Company Overview

- 9.4.3.2. Service Portfolio

- 9.4.4. Novogene

- 9.4.4.1. Company Overview

- 9.4.4.2. Service Portfolio

- 9.4.5. Shuwen Biotech

- 9.4.5.1. Company Overview

- 9.4.5.2. Service Portfolio

- 9.4.1. Abnova

10. COMPANION DIAGNOSTIC PRODUCTS: MARKET LANDSCAPE

- 10.1. Chapter Overview

- 10.2. Companion Diagnostics: List of Marketed / Investigational Products

- 10.2.1. Analysis by Type of Sample Used

- 10.2.2. Analysis by Type of Biomarker Detected

- 10.2.3. Analysis by Analytical Technique Used

- 10.2.4. Analysis by Target Disease Indication

- 10.2.5. Analysis by Target Therapeutic Area

- 10.2.6. Analysis by Commercial Availability and Target Therapeutic Area

- 10.2.7. Marketed Products: Analysis by Year of FDA Approval

- 10.2.8. Marketed Products: Analysis by Year of Other Regulatory Approval

- 10.2.9. Marketed Products: Analysis by Regulatory Authority Involved

- 10.2.10. Most Popular Companion Drugs: Analysis by Number of Companion Diagnostic Products

- 10.3. Companion Diagnostics: List of Developers

- 10.3.1. Analysis by Year of Establishment

- 10.3.2. Analysis by Company Size

- 10.3.3. Analysis by Location of Headquarters

- 10.3.4. Analysis by Company Ownership

- 10.3.5. Most Active Players: Analysis by Number of Marketed Products

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Partnership Models

- 11.3. Companion Diagnostic Development Service Providers: Partnerships and Collaborations

- 11.3.1. Analysis by Year of Partnership

- 11.3.2. Analysis by Type of Partnership

- 11.3.3. Analysis by Year and Type of Partnership

- 11.3.4. Analysis by Type of Technology

- 11.3.5. Analysis by Target Therapeutic Area

- 11.3.6. Analysis by Type of Partner

- 11.3.7. Analysis by Year of Partnership and Type of Partner

- 11.3.8. Most Active Players: Analysis by Number of Partnerships

- 11.3.9. Analysis by Geography

- 11.3.9.1. Local and International Agreements

- 11.3.9.2. Intercontinental and Intracontinental Agreements

12. LIKELY PARTNER ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scoring Criteria and Key Assumptions

- 12.3. Scope and Methodology

- 12.4. Likely Partners for Companion Diagnostics Service Providers: Alzheimer's Disease

- 12.4.1. Industry Players Focused on Amyloid Beta Biomarker

- 12.4.1.1. Regional Distribution of Amyloid Beta Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.4.2. Non-Industry Players Focused on Amyloid Beta Biomarker

- 12.4.2.1. Regional Distribution of Amyloid Beta Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.4.3. Industry Players Focused on Tau Biomarker

- 12.4.3.1. Regional Distribution of Tau Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.4.4. Non-Industry Players Focused on Tau Biomarker

- 12.4.4.1. Regional Distribution of Tau Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.4.1. Industry Players Focused on Amyloid Beta Biomarker

- 12.5. Likely Partners for Companion Diagnostics Service Providers: Breast Cancer

- 12.5.1. Industry Players Focused on BRCA Biomarker

- 12.5.1.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.2. Non-Industry Players Focused on BRCA Biomarker

- 12.5.2.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.3. Industry Players Focused on HER Biomarker

- 12.5.3.1. Regional Distribution of HER Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.4. Non-Industry Players Focused on HER Biomarker

- 12.5.4.1. Regional Distribution of HER Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.5. Industry Players Focused on PD-L1 Biomarker

- 12.5.5.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.6. Non-Industry Players Focused on PD-L1 Biomarker

- 12.5.6.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.7. Industry Players Focused on HR Biomarker

- 12.5.7.1. Regional Distribution of HR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.8. Non-Industry Players Focused on HR Biomarker

- 12.5.8.1. Regional Distribution of HR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.1. Industry Players Focused on BRCA Biomarker

- 12.6. Likely Partners for Companion Diagnostics Service Providers: Colorectal Cancer

- 12.6.1. Industry Players Focused on BRAF Biomarker

- 12.6.1.1. Regional Distribution of BRAF Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.2. Non-Industry Players Focused on BRAF Biomarker

- 12.6.2.1. Regional Distribution of BRAF Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.3. Industry Players Focused on EGFR Biomarker

- 12.6.3.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.4. Non-Industry Players Focused on EGFR Biomarker

- 12.6.4.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.5. Industry Players Focused on KRAS Biomarker

- 12.6.5.1. Regional Distribution of KRAS Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.6. Non-Industry Players Focused on KRAS Biomarker

- 12.6.6.1. Regional Distribution of KRAS Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.7. Industry Players Focused on MSI / dMMR Biomarker

- 12.6.7.1. Regional Distribution of MSI / dMMR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.8. Non-Industry Players Focused on MSI / dMMR Biomarker

- 12.6.8.1. Regional Distribution of MSI / dMMR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.1. Industry Players Focused on BRAF Biomarker

- 12.7. Likely Partners for Companion Diagnostic Service Providers: Lung Cancer

- 12.7.1. Industry Players Focused on ALK Biomarker

- 12.7.1.1. Regional Distribution of ALK Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.2. Non-Industry Players Focused on ALK Biomarker

- 12.7.2.1. Regional Distribution of ALK Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.3. Industry Players Focused on AST Biomarker

- 12.7.3.1. Regional Distribution of AST Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.4. Non-Industry Players Focused on AST Biomarker

- 12.7.4.1. Regional Distribution of AST Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.5. Industry Players Focused on EGFR Biomarker

- 12.7.5.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.6. Non-Industry Players Focused on EGFR Biomarker

- 12.7.6.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.7. Industry Players Focused on PD-L1 Biomarker

- 12.7.7.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.8. Non-Industry Players Focused on PD-L1 Biomarker

- 12.7.8.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.9. Industry Players Focused on RET Biomarker

- 12.7.9.1. Regional Distribution of RET Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.10. Non-Industry Players Focused on RET Biomarker

- 12.7.10.1. Regional Distribution of RET Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.1. Industry Players Focused on ALK Biomarker

- 12.8. Likely Partners for Companion Diagnostics Service Providers: HIV

- 12.8.1. Industry Players Focused on CCR5 Biomarker

- 12.8.1.1. Regional Distribution of CCR5 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.8.2. Non-Industry Players Focused on CCR5 Biomarker

- 12.8.2.1. Regional Distribution of CCR5 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.8.1. Industry Players Focused on CCR5 Biomarker

- 12.9. Likely Partners for Companion Diagnostics Service Providers: Ovarian Cancer

- 12.9.1. Industry Players Focused on BRCA Biomarker

- 12.9.1.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.9.2. Non-Industry Players Focused on BRCA Biomarker

- 12.9.2.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.9.3. Industry Players Focused on CA-125 Biomarker

- 12.9.3.1. Regional Distribution of CA-125 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.9.4. Non-Industry Players Focused on CA-125 Biomarker

- 12.9.4.1. Regional Distribution of CA-125 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.9.1. Industry Players Focused on BRCA Biomarker

- 12.10. Likely Partners for Companion Diagnostics Service Providers: Prostate Cancer

- 12.10.1. Industry Players Focused on AR-V7 Biomarker

- 12.10.1.1. Regional Distribution of AR-V7 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.10.2. Non-Industry Players Focused on AR-V7 Biomarker

- 12.10.2.1. Regional Distribution of AR-V7 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.10.3. Industry Players Focused on PTEN Biomarker

- 12.10.3.1. Regional Distribution of PTEN Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.10.4. Non-Industry Players Focused on PTEN Biomarker

- 12.10.4.1. Regional Distribution of PTEN Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.10.1. Industry Players Focused on AR-V7 Biomarker

13. MERGERS AND ACQUISITONS

- 13.1. Chapter Overview

- 13.2. Merger and Acquisition Models

- 13.3. Companion Diagnostic Development Service Providers: Mergers and Acquisitions

- 13.3.1. Analysis by Year of Deal

- 13.3.2. Analysis by Type of Deal

- 13.3.3. Analysis by Geography

- 13.3.3.1. Local and International Agreements

- 13.3.3.2. Intercontinental and Intracontinental Agreements

- 13.3.4. Ownership Change Matrix

- 13.3.5. Key Value Drivers of Acquisitions

- 13.3.6. Key Players: Analysis by Number of Mergers and Acquisitions

- 13.3.7. Key Acquisitions: Deal Multiples

14. STAKEHOLDER NEEDS ANALYSIS

- 14.1. Chapter Overview

- 14.2. Companion Diagnostics: Interests / Needs of Different Stakeholders

- 14.3. Comparison of Interests / Needs of Various Stakeholders

- 14.3.1. Interests / Needs of Drug Developers

- 14.3.2. Interests / Needs of Companion Diagnostics Developers

- 14.3.3. Interests / Needs of Regulatory Authorities

- 14.3.4. Interests / Needs of Testing Laboratories

- 14.3.5. Interests / Needs of Payers / Insurance Providers

- 14.3.6. Interests / Needs of Physicians

- 14.3.7. Interests / Needs of Patients

- 14.4. Overall Summary

15. VALUE CHAIN ANALYSIS

- 15.1. Chapter Overview

- 15.2. Companion Diagnostics Value Chain

- 15.3. Cost Distribution Across the Value Chain

- 15.3.1. Cost Associated with Research and Product Development

- 15.3.2. Cost Associated with Manufacturing and Assembly

- 15.3.3. Cost Associated with Clinical Trials, FDA Approval and Other Administrative Tasks

- 15.3.4. Cost Associated with Payer Negotiation and KOL Engagement

- 15.3.5. Cost Associated with Marketing and Sales

16. CLINICAL RESEARCH ON CANCER BIOMARKERS: BIG PHARMA INITIATIVES

- 16.1. Chapter Overview

- 16.2. Methodology

- 16.3. Clinical Trial Analysis

- 16.3.1. List of Likely Drug Candidates for IVD Developers

- 16.4. Cumulative Distribution of Biomarker-based Trials by Registration Year, Since 2016

- 16.4.1. Analysis of Biomarker-based Trials of Most Popular Biomarkers

- 16.4.2. Analysis of Biomarker-based Trials of Moderately Popular Biomarkers

- 16.4.3. Analysis of Biomarker-based Trials of Less Popular / Preliminary Stage Biomarkers

- 16.4.4. Word Cloud of Other Emerging Biomarkers

- 16.4.5. Cumulative Distribution of Trials by Registration Year and Most Popular Biomarkers

- 16.4.6. Cumulative Distribution of Trials by Registration Year and Moderately Popular Biomarkers

- 16.4.7. Cumulative Distribution of Trials by Registration Year and Less Popular Biomarkers

- 16.5. Distribution of Biomarker-based Trials by Most Popular Indications

- 16.5.1. Distribution of Biomarker-based Trials by Moderately Popular Indications

- 16.5.2. Distribution of Biomarker-based Trials by Less Popular Other Indications

- 16.5.3. Word Cloud of Other Emerging Indications in Biomarker-based Clinical Trials

- 16.5.4. Cumulative Distribution of Trials by Registration Year and Most Popular Indication

- 16.5.5. Cumulative Distribution of Trials by Registration Year and Moderately Popular Indications

- 16.5.6. Cumulative Distribution of Trials by Registration Year and Less Popular / Preliminary Stage Indications

- 16.6. Analysis of Biomarker-based Trials by Phase of Development

- 16.6.1. Analysis of Biomarker-based Trials by Phase of Development and Most Popular Biomarkers

- 16.6.2. Analysis of Biomarker-based Trials by Phase of Development and Moderately Popular Biomarkers

- 16.6.3. Analysis of Biomarker-based Trials by Phase of Development and Less Popular Other Biomarkers

- 16.6.4. Analysis of Biomarker-based Trials by Phase of Development and Most Popular Indications

- 16.6.5. Analysis of Biomarker-based Trials by Phase of Development and Moderately Popular Indications

- 16.6.6. Analysis of Biomarker-based Trials by Phase of Development and Less Popular Other Indications

- 16.7. Analysis of Biomarker-based Trials by Sponsor

- 16.7.1. Analysis of Biomarker-based Trials by Sponsor and Most Popular Biomarkers

- 16.7.2. Analysis of Biomarker-based Trials by Sponsor and Moderately Popular Biomarkers

- 16.7.3. Analysis of Biomarker-based Trials by Sponsor and Most Popular Indications

- 16.7.4. Analysis of Biomarker-based Trials by Sponsor and Moderately Popular Indications

- 16.8. Analysis of Biomarker-based Trials by Recruitment Status

- 16.9. Analysis of Biomarker-based Trials by Therapy Design

- 16.10. Analysis of Biomarker-based Trials by Geography

- 16.10.1. Analysis of Biomarker-based Trials by Trial Phase and Recruitment Status

- 16.11. Clinical Trials Summary: Analysis by Biomarker and Most Popular Indications

- 16.12. Clinical Trials Summary: Analysis by Biomarker and Moderately Popular Indications

- 16.13. Clinical Trials Summary: Analysis by Biomarker and Preliminary Stage Indications

17. CASE STUDY ON PRECISION MEDICINE SOFTWARE SOLUTIONS

- 17.1. Chapter Overview

- 17.2. Precision Medicine Software Solutions: List of Players

- 17.2.1. Analysis by Year of Establishment

- 17.2.2. Analysis by Company Size

- 17.2.3. Analysis by Location of Headquarters (Region)

- 17.2.4. Analysis by Company Size and Location of Headquarters (Region)

- 17.3. Precision Medicine Software Solutions: List of Software

- 17.3.1. Analysis by Status of Development

- 17.3.2. Analysis by Type of Platform

- 17.3.3. Analysis by Regulatory Accreditation Received

- 17.3.4. Analysis by Target Therapeutic Area

- 17.3.5. Analysis by Type of Data Handled

- 17.3.6. Analysis by Purpose of Software

- 17.3.7. Analysis by End-User

- 17.3.8. Most Active Players: Distribution by Number of Software

18. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 18.1. Chapter Overview

- 18.2. Market Drivers

- 18.3. Market Restraints

- 18.4. Market Opportunities

- 18.5. Market Challenges

- 18.6. Conclusion

19. GLOBAL COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Global Companion Diagnostics Development Services Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.1. Scenario Analysis

- 19.3.1.1. Conservative Scenario

- 19.3.1.2. Optimistic Scenario

- 19.3.1. Scenario Analysis

- 19.4. Key Market Segmentations

20. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY TYPE OF SERVICE OFFERED

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Feasibility Studies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.4. Assay Development: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.5. Analytical Validation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6. Clinical Validation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

21. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY TYPE OF ANALYTICAL TECHNIQUE USED

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. NGS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.4. PCR: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.5. IHC: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6. Flow Cytometry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Other Analytical Techniques: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Data Triangulation and Validation

22. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY TARGET THERAPEUTIC AREA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Oncological Disorders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.4. Non-oncological Disorders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.5. Data Triangulation and Validation

23. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY END USER

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Industry Players: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.4. Non-Industry Players: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.5. Data Triangulation and Validation

24. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY KEY GEOGRAPHICAL REGIONS

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.3.1. US: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.3.2. Canada: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4. Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.4.1. Germany: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.2. UK: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.3. Belgium: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.4. Switzerland: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.5. Other European Countries: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.5. Asia-Pacific: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.5.1. China: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.5.2. Other Asia-Pacific Countries: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.6. Data Triangulation and Validation

25. CONCLUDING REMARKS

26. EXECUTIVE INSIGHTS

- 26.1. Chapter Overview

- 26.2. Apollo Hospital Educational and Research Foundation, and Urvogelbio

- 26.2.1. Company Snapshot

- 26.2.2. Interview Transcript: M.V. Sasidhar, Chief Scientific Officer (Apollo Hospital Educational and Research Foundation) and Founder (Urvogelbio)

- 26.3. MEDICAL & BIOLOGICAL LABORATORIES

- 26.3.1. Company Snapshot

- 26.3.2. Interview Transcript: Keita Takahashi (Manager of Sales and Marketing Division), Kyoko Fukushima (Manager of Companion Diagnostic Development Services) and Kyo Shirai (Sales and Marketing Division)

- 26.4. Genomenon

- 26.4.1. Company Snapshot

- 26.4.2. Interview Transcript: Mike Klein, Chief Executive Officer; Mark Kiel, Founder and Chief Scientific Officer; and Candace Chapman, Vice President of Marketing

- 26.5. Tymora Analytical Operations

- 26.5.1. Company Snapshot

- 26.5.2. Interview Transcript: Anton Iliuk, President and Chief Technology Officer

- 26.6. Novodiax

- 26.6.1. Company Snapshot

- 26.6.2. Interview Transcript: Paul Kortschak, Former Senior Vice President

- 26.7. OWL Metabolomics

- 26.7.1. Company Snapshot

- 26.7.2. Interview Transcript: Pablo Ortiz, Chief Executive Officer

- 26.8. NeoGenomics Laboratories

- 26.8.1. Company Snapshot

- 26.8.2. Interview Transcript: Lawrence M. Weiss, Former Chief Scientific Officer