|

시장보고서

상품코드

1821506

항체 위탁생산 시장 : 업계 동향과 세계 예측(-2035년) - 제조되는 항체 유형별, 사용되는 발현 시스템 유형별, 사업 규모별, 지역별Antibody Contract Manufacturing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Antibody Manufactured, Type of Expression System Used, Scale of Operation, and Geographical Regions |

||||||

항체 위탁생산 시장 : 개요

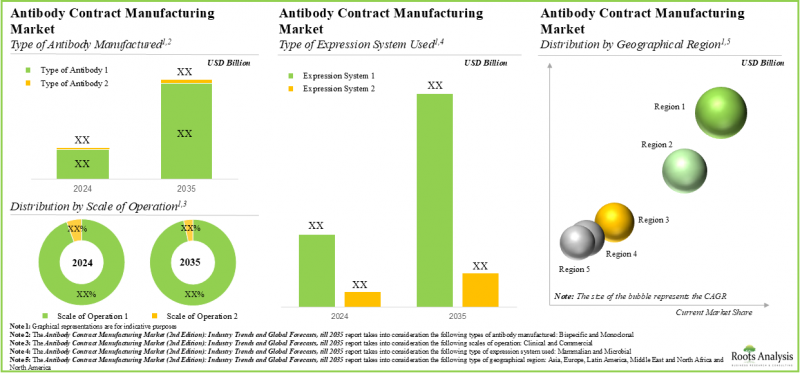

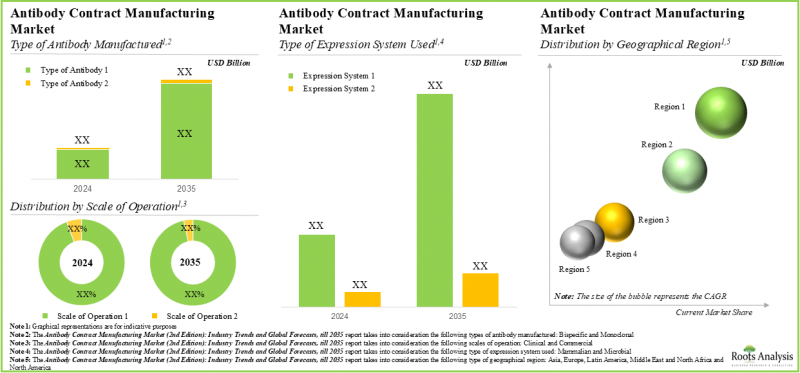

세계 항체 위탁생산 시장 규모는 2035년까지 예측 기간 동안 9.7%의 연평균 복합 성장률(CAGR)로 확대되어 현재 185억 달러에서 2035년까지 468억 달러로 성장할 것으로 예측됩니다.

시장 세분화에서는 시장 규모 및 기회 분석을 다음과 같은 매개 변수로 구분합니다.

생산되는 항체 유형

- 단일클론

- 이중특이성

사용되는 발현 시스템 유형

- 포유류

- 미생물

사업 규모

- 임상

- 상업

지역

- 북미

- 유럽

- 아시아

- 라틴아메리카

- 중동 및 북아프리카

항체 위탁생산 시장 성장 및 동향

항체는 다양한 생물학적 제제 중 가장 빠르게 성장하고 있는 약물군 중 하나입니다. 수년에 걸쳐 개념 및 방법론이 진화하면서 점점 더 복잡하고 효능이 높은 항체 기반 치료제의 개발 및 제조에 있어 몇 가지 혁신적인 발전이 이루어졌습니다. 바이오 의약품은 큰 이익을 가져다주고 수많은 질병 치료에 효과적임이 입증되었음에도 불구하고, 이러한 치료 제품은 일반적으로 개발 비용이 높고 제조 프로토콜이 복잡한 것으로 알려져 있습니다.

최근 몇 년 동안 위탁생산업체는 전체 바이오의약품 시장에서 중요한 역할을 하고 있습니다. 이러한 추세는 항체 제조 시장에서도 확산되고 있으며, 개발업체가 항체 제조 업무를 위탁하는 사례가 늘고 있습니다. 이는 이러한 제3자 서비스 제공업체의 다양한 전문 지식이 전체 제조 비용 절감 등 다양한 이점을 제공하는 결과입니다. 또한, 생물제제를 자체적으로 제조하기 위한 시설의 설계, 건설, 유지관리 등 필요한 전문지식과 능력을 갖추기 위해서는 상당한 설비투자가 필요합니다. 이에 따라 제약업계의 많은 중소기업과 때로는 대형 제약사들도 제조 업무의 아웃소싱을 시작하였습니다.

생물학적 제제 및 항체 제조에 대한 수요 증가, 기술 발전, 연구개발 투자 증가 등 다양한 요인에 힘입어 항체 위탁생산 시장은 향후 몇 년 동안 크게 성장할 것으로 예측됩니다.

항체 위탁생산 시장 주요 인사이트

본 보고서에서는 항체 위탁생산 시장의 현황을 조사하고, 업계의 잠재적인 성장 기회를 파악합니다. 주요 조사 결과는 다음과 같습니다.

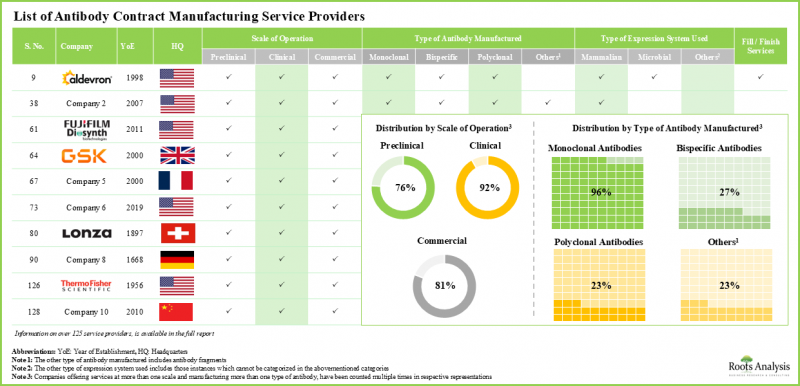

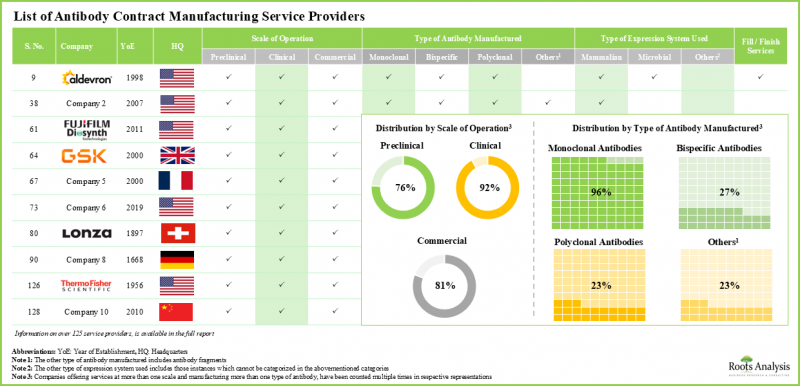

- 현재 125개 이상의 수탁 제조업체가 전 세계적으로 항체 제조 서비스를 제공하고 있다고 주장하고 있으며, 서비스 제공업체의 74%가 상업적 규모로 단일클론항체를 생산하고 있다고 합니다.

- 현재 시장상황은 파편화되어 있고, 대기업과 신규 진입기업이 모두 존재하고 있습니다. 이들 대부분은 북미에 기반을 둔 중견기업(43%)입니다.

- 이 분야에서 경쟁 우위를 확보하기 위해 이해관계자들은 각자의 포트폴리오를 강화하기 위해 기존 역량을 적극적으로 업그레이드하고 새로운 역량을 추가하고 있습니다.

- 역량을 향상시키고 설비를 업그레이드하기 위한 지속적인 노력은 신제품 개발 이니셔티브의 기준이 되는 업계 벤치마크를 확립하는 데 기여하고 있습니다.

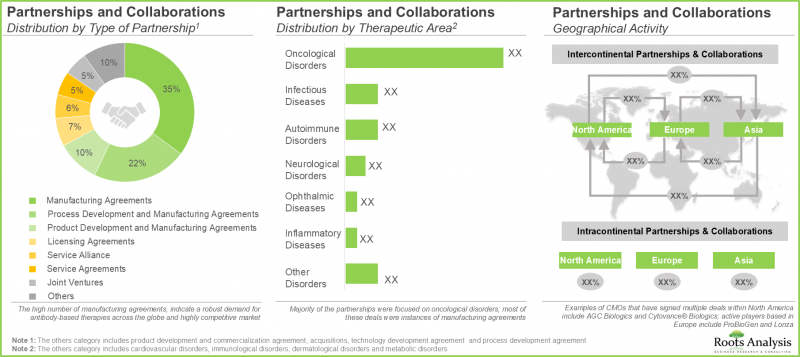

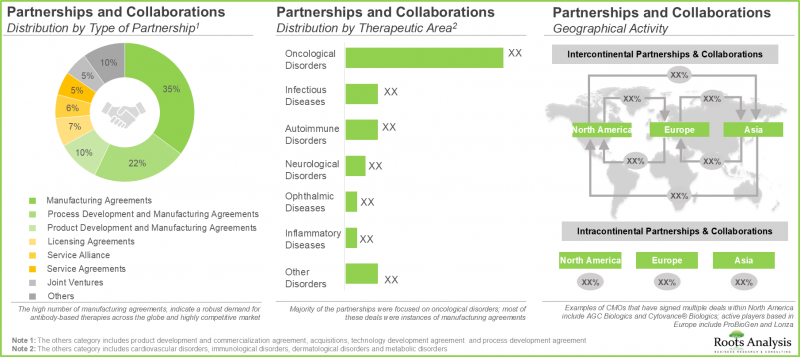

- 이 분야에 대한 이해관계자들의 관심이 높아진 것은 파트너십 활동의 활성화에서도 알 수 있는데, 체결된 파트너십의 대부분은 항체 생산에 초점을 맞춘 것이었습니다.

- 이 연구 분야에 대한 핵심 역량을 강화하기 위해 CMO는 기존 인프라를 업그레이드하고 각 제조 역량을 확대하기 위해 적극적으로 투자하고 있습니다.

- 전 세계 항체 위탁생산 능력은 다양한 지역에 분산되어 있지만, 그 중 55% 이상이 북미 제조시설에 있습니다.

- 다양한 개발 단계에서 여러 항체 기반 의약품 및 치료제 후보물질이 평가되고 있으며, 향후 10년간 이러한 제품에 대한 수요는 크게 증가할 것으로 예측됩니다.

- 항체 제조 시장은 2035년까지 연평균 복합 성장률(CAGR) 10%를 보일 것으로 예측되며, 현재 북미가 시장 점유율의 대부분을 차지하고 유럽이 그 뒤를 잇고 있습니다.

항체 위탁생산 시장 주요 부문

생산되는 항체 유형별로 보면, 시장은 단일클론항체와 이중 특이성 항체로 분산되어 있습니다. 현재, 단일클론항체 부문은 전 세계 항체 위탁생산 시장의 대부분을 차지하고 있습니다. 하지만, 진출기업들은 치료 목적의 이중 특이성 항체 개발에도 힘을 쏟고 있습니다.

사용되는 발현 시스템의 유형로 볼 때, 시장은 포유류 발현 시스템과 미생물 발현 시스템으로 분산되어 있습니다. 현재 포유류 발현 시스템이 세계 항체 위탁생산 시장에서 가장 높은 비율을 차지하는 이유는 포유류 발현 시스템을 통해 항체가 더 높은 생물학적 활성과 결합 친화성을 달성할 수 있기 때문입니다.

사업 규모의 관점에서 볼 때, 시장은 임상 규모와 상업적 규모로 분산되어 있습니다. 현재 항체 위탁생산 시장의 대부분은 항체의 상업적 생산에 대한 수요 증가로 인해 상업적 규모가 차지하고 있습니다.

주요 지역별로 시장은 북미, 유럽, 아시아, 라틴아메리카, 중동 및 북아프리카에 분산되어 있습니다. 북미는 항체 위탁생산 시장을 독점하고 있으며, 올해 가장 큰 매출 점유율을 차지하고 있습니다. 또한, 아시아 시장은 향후 더 높은 CAGR로 성장할 가능성이 높습니다.

항체 위탁생산 시장 진출기업 사례

- AGC Biologics

- Aldevron

- Emergent BioSolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung BioLogics

- Synthon

- Thermo Fisher Scientific

항체 위탁생산 시장 조사 대상

- 시장 규모 및 기회 분석 : 본 보고서는 세계 항체 위탁생산 시장을(A) 생산되는 항체 유형,(B) 사용되는 발현 시스템 유형,(C) 사업 규모,(D) 지역 등 주요 시장 부문별로 상세하게 분석하였습니다.

- 시장 상황:(A)설립연도,(B)기업 규모,(C)본사 소재지,(D)제조시설 소재지,(E)사업 규모,(F)항체 유형,(G)발현 시스템 유형,(H)충전/마무리 작업,(i)규제 당국과의 제휴 등 몇 가지 관련 파라미터를 기반으로 항체 위탁생산 시장 관련 기업들을 상세하게 평가합니다. 을 상세하게 평가.

- 경쟁 분석 : A) 기업의 강점, B) 포트폴리오의 강점, C) 포트폴리오의 다양성 등의 요인을 검토하여 항체의약품 위탁생산 업체들의 종합적인 경쟁 분석을 수행합니다.

- 기업 프로파일: A) 기업 개요, B) 재무 정보(가능한 경우), C) 서비스 포트폴리오, D) 최근 동향 및 미래 전망에 중점을 두었습니다.

- 사례 연구: 고분자 의약품과 저분자 의약품의 주요 특징을 자세히 비교하고, 제조 공정과 제조 과정에서 직면한 과제에 대한 통찰력을 제공합니다.

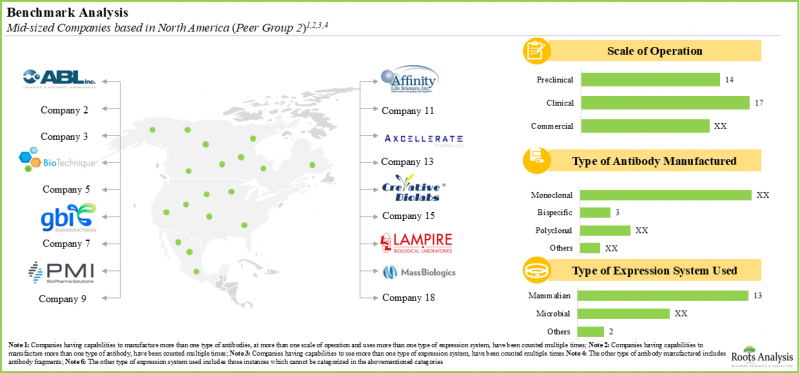

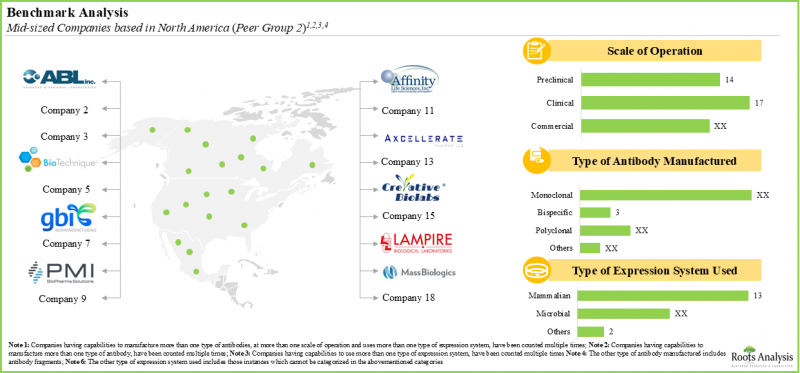

- 벤치마킹 분석 : 중소기업, 대기업, 대기업의 주요 중점 분야에 대해 각 동종업계 그룹 내외의 기존 역량을 비교하여 세부적인 벤치마킹 분석을 수행합니다.

- 역량 분석 :(A) 기업 규모,(B) 주요 지역 분석 등 다양한 매개 변수를 기반으로 항체 제조를 위한 전반적인 시설 역량에 대한 통찰력 있는 분석.

- 수요 분석 :(A) 대상 환자군,(B) 투여 빈도,(C) 투여 강도 등 다양한 관련 파라미터를 기반으로 항체의 연간 상업적 수요와 임상적 수요에 대한 상세한 검토.

- SWOT 분석 : 항체 위탁생산 시장의 발전에 영향을 미칠 수 있는 업계 관련 동향, 기회, 과제 분석.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 및 기타 프로젝트 특유의 고려사항

제4장 주요 요약

제5장 서론

- 본 장의 개요

- 항체 개념

- 항체 구조

- 항체 이소타입

- 항체 작용기전

- 항체 유형

- 계약 제조 개요

- 바이오의약품 업계에서 아웃소싱의 필요성

- 제조 서비스 아웃소싱의 이점

제6장 시장 구도

- 본 장의 개요

- 항체 위탁생산업체 : 시장 구도

제7장 기업 경쟁력 분석

- 본 장의 개요

- 전제와 주요 입력 파라미터

- 조사 방법

- 기업 경쟁력 분석 : 북미의 항체 위탁생산업체

- 기업 경쟁력 분석 : 유럽의 항체 위탁생산업체

- 기업 경쟁력 분석 : 아시아태평양의 항체 위탁생산업체

제8장 상세한 기업 개요

- 본 장의 개요

- AGC Biologics

- Aldeveron

- Emergent Biosolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung Biologics

- Synthon

- Thermo Fisher Scientific

제9장 기업 개요 리스트

- 본 장의 개요

- ABL

- Abzena

- Allele Biotechnology &Pharmaceuticals

- Alvotech

- Antibody Production Services

- Arabio

- Bharat Serums and Vaccines

- Boehringer Ingelheim

- Glenmark Pharmaceuticals

- MilliporeSigma

- Siam Bioscience

제10장 사례 연구 : 저분자 및 고분자(생물제제) 약제/치료법 비교

- 본 장의 개요

- 저분자 화합물 및 생물제제

제11장 벤치마킹 분석

- 본 장의 개요

- 조사 방법

- 항체 위탁생산업체 : 벤치마킹 분석

- 결론

제12장 파트너십 및 협업

- 본 장의 개요

- 파트너십 모델

- 항체 위탁생산 : 제휴처 리스트

제13장 최근 확장

- 본 장의 개요

- 항체 위탁생산업체 : 확장 리스트

제14장 능력 분석

- 본 장의 개요

- 전제와 조사 방법

- 항체 계약 제조 : 세계의 설치 능력

- 결론

제15장 수요 분석

- 본 장의 개요

- 전제와 조사 방법

- 항체 위탁생산 시장 : 연간 총 수요

제16장 시장 영향 분석 : 성장 촉진요인 및 억제요인, 기회, 과제

제17장 세계의 항체 위탁생산 시장

제18장 세계의 항체 위탁생산 시장(제조되는 항체 유형별)

제19장 세계의 항체 위탁생산 시장(사업 규모별)

제20장 세계의 항체 위탁생산 시장(사용되는 발현 시스템 유형별)

제21장 세계의 항체 위탁생산 시장(주요 지역별)

제22장 SWOT 분석

제23장 항체 CMO 시장 전망

- 본 장의 개요

- 아웃소싱 활동 증가

- 단발 계약에서 전략적 파트너십으로의 이동

- 새로운 혁신적인 기술 도입

- 바이오시밀러 시장 성장, 계약 서비스 부문 성장에 기여할 전망

- CMO의 역량 및 전문성 확대, 원스톱 서비스 제공으로 도약

- 수익 극대화 및 기존 역량 확장을 위한 해외 아웃소싱 활동 확대

- 스폰서와 서비스 제공업체 모두 직면한 과제

- 항체 계약 제조 시장의 미래에 영향을 미치는 요소들

- 결론

제24장 경영진 인사이트

제25장 부록 2 : 표 데이터

제26장 부록 3 : 기업 및 단체 리스트

LSH 25.09.30Antibody Contract Manufacturing Market: Overview

As per Roots Analysis, the global antibody contract manufacturing market is estimated to grow from USD 18.5 billion in the current year to USD 46.8 billion by 2035, at a CAGR of 9.7% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Antibody Manufactured

- Monoclonal

- Bispecific

Type of Expression System Used

- Mammalian

- Microbial

Scale of Operation

- Clinical

- Commercial

Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

Antibody Contract Manufacturing Market: Growth and Trends

Antibodies constitute one of the fastest growing drug classes amongst the diverse range of biologics. Over the years, there has been evolution of concepts and methods, which have facilitated several innovative advances in the development and manufacturing of increasingly complex and efficacious antibody-based therapeutics. Despite the fact that biopharmaceuticals offer significant profit margins and have been proven to be effective in treating a myriad of diseases, these therapeutic products are generally known to be associated with high costs of development and complex manufacturing protocols

In the past few years, contract manufacturers have played a critical role in the overall biopharmaceutical market. This trend has also become prevalent in the antibody manufacturing market, as developers are increasingly outsourcing their antibody manufacturing operations to contract service providers. This is a result of the diverse expertise of such third-party service providers in offering various advantages, including reduction in overall production cost. In addition, acquiring the necessary expertise and capabilities, which includes designing, constructing and maintaining a facility for manufacturing biologics in-house, requires significantly high capital investments. Therefore, many of the smaller players in the industry and, at times, certain pharma giants as well, have begun outsourcing their manufacturing operations to contract service providers.

Driven by a range of factors, including the growing demand for biologics and antibody manufacturing, technological advancements, and increasing investment in research and development, the antibody contract manufacturing market is poised to grow significantly over the coming years.

Antibody Contract Manufacturing Market: Key Insights

The report delves into the current state of the antibody contract manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 125 contract manufacturers claim to offer services for antibody manufacturing across the globe; 74% of the service providers manufacture monoclonal antibodies at commercial scale.

- The current market landscape is fragmented, featuring the presence of both large players and new entrants; most of these are mid-sized players (43%) based in North America.

- In pursuit of gaining a competitive edge in this field, stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective portfolios.

- The ongoing efforts to improve capabilities and upgrade facilities have led to the establishment of industry benchmarks, which serve as a standard for new product development initiatives.

- The growing interest of stakeholders in this domain is evident from the rise in partnership activity; most of the partnerships signed were focused on antibody manufacturing.

- In order to enhance core competencies related to this field of research, CMOs are actively investing in upgrading existing infrastructure and expanding their respective manufacturing capacities.

- The global installed antibody contract manufacturing capacity is spread across various regions; over 55% of this capacity is available in manufacturing facilities based in North America.

- Given that several antibody-based drug / therapy candidates being evaluated across various stages of development, the demand for such products is anticipated to rise significantly over the next decade.

- The antibody manufacturing market is likely to grow at a CAGR of 10%, till 2035; presently, majority of the market share is occupied by North America, followed by Europe.

Antibody Contract Manufacturing Market: Key Segments

Monoclonal Antibodies Capture the Largest Market Share

In terms of the type of antibody manufactured, the market is distributed across monoclonal and bispecific antibody. At present, the monoclonal antibody segment constitutes the majority share of the global antibody contract manufacturing market. However, players are also intensely focused on the development of bispecific antibodies for therapeutic purposes.

Microbial Expression System is the Fastest Growing Segment

In terms of the type of expression system used, the market is distributed across mammalian and microbial expression systems. Currently, the mammalian expression system segment captures the highest proportion of the global antibody contract manufacturing market given the fact that mammalian expression systems enable antibodies to achieve greater biological activity and binding affinity.

Commercial Scale Segment Occupies the Largest Share

In terms of the scale of operation, the market is distributed across clinical and commercial scale. In the current year, majority of the antibody contract manufacturing market is held by commercial scale owing to the increasing demand for commercial production of antibodies.

North America is Leading the Global Antibody Contract Manufacturing Market

In terms of key geographical regions, the market is distributed across North America, Europe, Asia, Latin America and Middle East and North Africa. North America dominates the antibody contract manufacturing market and accounts for the largest revenue share in the current year. Further, the market in Asia is likely to grow at a higher CAGR in the coming future.

Example Players in the Antibody Contract Manufacturing Market

- AGC Biologics

- Aldevron

- Emergent BioSolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung BioLogics

- Synthon

- Thermo Fisher Scientific

Antibody Contract Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features a thorough analysis of the global antibody contract manufacturing market, in terms of the key market segments, including [A] type of antibody manufactured, [B] type of expression system used, [C] scale of operation and [D] geographical regions.

- Market Landscape: An in-depth assessment of the companies involved in antibody contract manufacturing market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facilities, [E] scale of operation, [F] type of antibody, [G] type of expression systems used, [H] fill / finish operations and [I] affiliations to regulatory agencies.

- Company Competitiveness Analysis: A comprehensive competitive analysis of antibody contract manufacturers, examining factors, such as [A] company strength and [B] portfolio strength and [C] portfolio diversity.

- Company Profiles: Detailed profiles of key service providers engaged in the antibody contract manufacturing market, emphasizing on [A] overview of the company, [B] financial information (if available), [C] service portfolio, and [D] recent developments and an informed future outlook.

- Case Study: A detailed comparison of the key features of large and small molecule drugs, along with insights into the manufacturing steps and challenges faced during these manufacturing processes.

- Benchmark Analysis: A detailed benchmark analysis of the key focus areas of small, mid-sized, large and very large companies by comparing their existing capabilities within and outside their respective peer groups.

- Capacity Analysis: An insightful analysis of the overall, installed capacity for manufacturing antibodies, based on various parameters, such as [A] company size and [B] key geographical regions.

- Demand Analysis: An in-depth review of the annual commercial and clinical demand for antibodies, based on various relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- SWOT Analysis: An analysis of industry-affiliated trends, opportunities and challenges, which are likely to impact the evolution of antibody contract manufacturing market.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risks

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Concept of an Antibody

- 5.3. Structure of an Antibody

- 5.4. Antibody Isotypes

- 5.5. Mechanism of Action of Antibodies

- 5.6. Types of Antibodies

- 5.6.1. Monoclonal Antibodies

- 5.6.2. Bispecific Antibodies

- 5.6.3. Polyclonal Antibodies

- 5.7. Overview of Contract Manufacturing

- 5.8. Need for Outsourcing in the Biopharmaceutical Industry

- 5.9. Advantages of Outsourcing Manufacturing Services

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Antibody Contract Manufacturers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Location of Antibody Manufacturing Facilities

- 6.2.5. Analysis by Scale of Operation

- 6.2.6. Analysis by Type of Antibody Manufactured

- 6.2.7. Analysis by Expression System Used

- 6.2.8. Analysis by Fill / Finish Services Offered

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Input Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis: Antibody Contract Manufacturers in North America

- 7.5. Company Competitiveness Analysis: Antibody Contract Manufacturers in Europe

- 7.6. Company Competitiveness Analysis: Antibody Contract Manufacturers in Asia-Pacific

8. DETAILED COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. AGC Biologics

- 8.2.1. Company Overview

- 8.2.2. Antibody Contract Manufacturing Service Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Aldeveron

- 8.3.1. Company Overview

- 8.3.2. Antibody Contract Manufacturing Service Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Emergent Biosolutions

- 8.4.1. Company Overview

- 8.4.2. Antibody Contract Manufacturing Service Portfolio

- 8.4.3. Recent Developments and Future Outlook

- 8.5. Eurofins CDMO

- 8.5.1. Company Overview

- 8.5.2. Antibody Contract Manufacturing Service Portfolio

- 8.5.3. Future Outlook

- 8.6. FUJIFILM Diosynth Biotechnologies

- 8.6.1. Company Overview

- 8.6.2. Antibody Contract Manufacturing Service Portfolio

- 8.6.3. Recent Developments and Future Outlook

- 8.7. KBI Biopharma

- 8.7.1. Company Overview

- 8.7.2. Antibody Contract Manufacturing Service Portfolio

- 8.7.3. Recent Developments and Future Outlook

- 8.8. Lonza

- 8.8.1. Company Overview

- 8.8.2. Antibody Contract Manufacturing Service Portfolio

- 8.8.3. Recent Developments and Future Outlook

- 8.9. Nitto Avecia Pharma Services

- 8.9.1. Company Overview

- 8.9.2. Antibody Contract Manufacturing Service Portfolio

- 8.9.3. Recent Developments and Future Outlook

- 8.10. Novasep

- 8.10.1. Company Overview

- 8.10.2. Antibody Contract Manufacturing Service Portfolio

- 8.10.3. Future Outlook

- 8.11. Pierre Fabre

- 8.11.1. Company Overview

- 8.11.2. Antibody Contract Manufacturing Service Portfolio

- 8.11.3. Recent Developments and Future Outlook

- 8.12. Samsung Biologics

- 8.12.1. Company Overview

- 8.12.2. Antibody Contract Manufacturing Service Portfolio

- 8.12.3. Recent Developments and Future Outlook

- 8.13. Synthon

- 8.13.1. Company Overview

- 8.13.2. Antibody Contract Manufacturing Service Portfolio

- 8.13.3. Recent Developments and Future Outlook

- 8.14. Thermo Fisher Scientific

- 8.14.1. Company Overview

- 8.14.2. Antibody Contract Manufacturing Service Portfolio

- 8.14.3. Recent Developments and Future Outlook

9. TABULATED COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. ABL

- 9.2.1. Company Overview

- 9.2.2. Antibody Contract Manufacturing Service Portfolio

- 9.3. Abzena

- 9.3.1. Company Overview

- 9.3.2. Antibody Contract Manufacturing Service Portfolio

- 9.4. Allele Biotechnology & Pharmaceuticals

- 9.4.1. Company Overview

- 9.4.2. Antibody Contract Manufacturing Service Portfolio

- 9.5. Alvotech

- 9.5.1. Company Overview

- 9.5.2. Antibody Contract Manufacturing Service Portfolio

- 9.6. Antibody Production Services

- 9.6.1. Company Overview

- 9.6.2. Antibody Contract Manufacturing Service Portfolio

- 9.7. Arabio

- 9.7.1. Company Overview

- 9.7.2. Antibody Contract Manufacturing Service Portfolio

- 9.8. Bharat Serums and Vaccines

- 9.8.1. Company Overview

- 9.8.2. Antibody Contract Manufacturing Service Portfolio

- 9.9. Boehringer Ingelheim

- 9.9.1. Company Overview

- 9.9.2. Antibody Contract Manufacturing Service Portfolio

- 9.10. Glenmark Pharmaceuticals

- 9.10.1. Company Overview

- 9.10.2. Antibody Contract Manufacturing Service Portfolio

- 9.11. MilliporeSigma

- 9.11.1. Company Overview

- 9.11.2. Antibody Contract Manufacturing Service Portfolio

- 9.12. Siam Bioscience

- 9.12.1. Company Overview

- 9.12.2. Antibody Contract Manufacturing Service Portfolio

10. CASE STUDY: COMPARISON OF SMALL AND LARGE MOLECULES (BIOLOGICS) DRUGS / THERAPIES

- 10.1. Chapter Overview

- 10.2. Small Molecules and Biologics

- 10.2.1. Comparison of Strengths and Weakness of Small Molecules and Biologics

- 10.2.2. Comparison of Key Characteristics

- 10.2.3. Comparison of Manufacturing Processes

- 10.2.4. Comparison of Key Manufacturing related Challenges

11. BENCHMARK ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology

- 11.3. Antibody Contract Manufacturers: Benchmarking Analysis

- 11.3.1. Benchmark Analysis of Small Players Based in North America (Peer Group I)

- 11.3.2. Benchmark Analysis of Mid-Sized Players Based in North America (Peer Group II)

- 11.3.3. Benchmark Analysis of Large Players Based in North America (Peer Group III)

- 11.3.4. Benchmark Analysis of Very Large Players Based in North America (Peer Group IV)

- 11.3.5. Benchmark Analysis of Small Players Based in Europe (Peer Group V)

- 11.3.6. Benchmark Analysis of Mid-Sized Players Based in Europe (Peer Group VI)

- 11.3.7. Benchmark Analysis of Large Players Based in Europe (Peer Group VII)

- 11.3.8. Benchmark Analysis of Very Large Players Based in Europe (Peer Group VIII)

- 11.3.9. Benchmark Analysis of Small Players Based in Asia-Pacific (Peer Group IX)

- 11.3.10. Benchmark Analysis of Mid-Sized Players Based in Asia-Pacific (Peer Group X)

- 11.3.11. Benchmark Analysis of Large Players Based in Asia-Pacific (Peer Group XI)

- 11.3.12. Benchmark Analysis of Very Large Players Based in Asia-Pacific (Peer Group XII)

- 11.4. Concluding Remarks

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnerships Models

- 12.3. Antibody Contract Manufacturing: List of Partnerships

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Antibody Manufactured

- 12.3.5. Analysis by Project Scale

- 12.3.6. Analysis by Focus Therapeutic Area

- 12.3.7. Most Active Players: Analysis by Number of Partnerships and Type of Partnership

- 12.3.8. Geographical Analysis

- 12.3.8.1. Continent-wise Distribution

- 12.3.8.2. Country-wise Distribution

13. RECENT EXPANSIONS

- 13.1. Chapter Overview

- 13.2. Antibody Contract Manufacturers: List of Expansions

- 13.2.1. Analysis by Year of Expansion

- 13.2.2. Analysis by Type of Expansion

- 13.2.3. Analysis by Type of Antibody Manufactured

- 13.2.4. Analysis by Location of Manufacturing Facility

- 13.2.5. Analysis by Location of Manufacturing Facility and Type of Expansion

- 13.2.6. Analysis of Most Active Players by Number of Expansions

- 13.2.7. Geographical Analysis

- 13.2.7.1. Country-wise Distribution

14. CAPACITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Assumptions and Methodology

- 14.3. Antibody Contract Manufacturing: Installed Global Capacity

- 14.3.1. Analysis by Scale of Operation

- 14.3.3. Analysis by Type of Expression System Used

- 14.3.4. Analysis by Location of Manufacturing Facility

- 14.4. Concluding Remarks

15. DEMAND ANALYSIS

- 15.1 Chapter Overview

- 15.2 Assumptions and Methodology

- 15.3 Antibody Contract Manufacturing Market: Overall Annual Demand

- 15.3.1. Analysis by Scale of Operation

- 15.3.2. Analysis by Geography

16 MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17 GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Antibody Contract Manufacturing Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.1 Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1 Scenario Analysis

- 17.4. Key Market Segmentations

18. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY TYPE OF ANTIBODY MANUFCATURED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Antibody Contract Manufacturing Market: Distribution by Type of Antibody Manufactured

- 18.3.1. Antibody Contract Manufacturing Market for Monoclonal Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.2. Antibody Contract Manufacturing Market for Bispecific Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Antibody Contract Manufacturing Market: Distribution by Scale of Operation

- 19.3.1. Antibody Contract Manufacturing Market at Commercial Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2. Antibody Contract Manufacturing Market at Clinical Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY TYPE OF EXPRESSION SYSTEM USED

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Antibody Contract Manufacturing Market: Distribution by Type of Expression System Used

- 20.3.1. Antibody Contract Manufacturing Market for Mammalian Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.3.2. Antibody Contract Manufacturing Market for Microbial Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY KEY GEOGRAPHICAL REGIONS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Antibody Contract Manufacturing Market: Distribution by Key Geographical Regions

- 21.3.1. Antibody Contract Manufacturing Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.2. Antibody Contract Manufacturing Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.1. Antibody Contract Manufacturing Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.2. Antibody Contract Manufacturing Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.1. Antibody Contract Manufacturing Market in Middle East and North Africa: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. SWOT ANALYSIS

- 22.1. Chapter Overview

- 22.2. Strengths

- 22.3. Weaknesses

- 22.4. Opportunities

- 22.5. Threats

- 22.6. Comparison of SWOT Factors

- 22.7. Concluding Remarks

23 FUTURE OF THE ANTIBODY CMO MARKET

- 23.1. Chapter Overview

- 23.2. Rise in Outsourcing Activity

- 23.3. Shift from One-time Contractual Engagements to Strategic Partnerships

- 23.4. Adoption of New and Innovative Technologies

- 23.5. Growing Biosimilars Market to Contribute to the Growth of the Contract Services Segment

- 23.6. Capability and Expertise Expansions by CMOs to become One Stop Shops

- 23.7. Offshoring Outsourcing Activities to Maximize Profits and Expand Existing Capacities

- 23.8. Challenges Faced by both Sponsors and Service Providers

- 23.9. Factors Influencing the Future of Antibody Contract Manufacturing Market

- 23.10. Concluding Remarks

24. EXECUTIVE INSIGHTS

- 24.1. Chapter Overview

- 24.2. Chief Executive Officer, Company A

- 24.3. Assistant Marketing Manager, Company B

- 24.4. Business Development and Marketing Manager, Company C

- 24.5. Business Development Manager, Company D

- 24.6. Business Development Manager, Company E

- 24.7. Business Development Specialist, Company F