|

시장보고서

상품코드

1821511

암호화폐 시장(-2035년) : 기술 유형별, 응용 분야별, 카스토디 솔루션 유형별, 암호화폐 유형별, 컴포넌트 유형별, 경험 레벨 유형별, 지역별 - 산업 동향 및 예측Cryptocurrency Market, Till 2035: Distribution by Type of Technology, Area of Application, Type of Custody Solution, Type of Cryptocurrency, Type of Component, Type of Experience Level, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

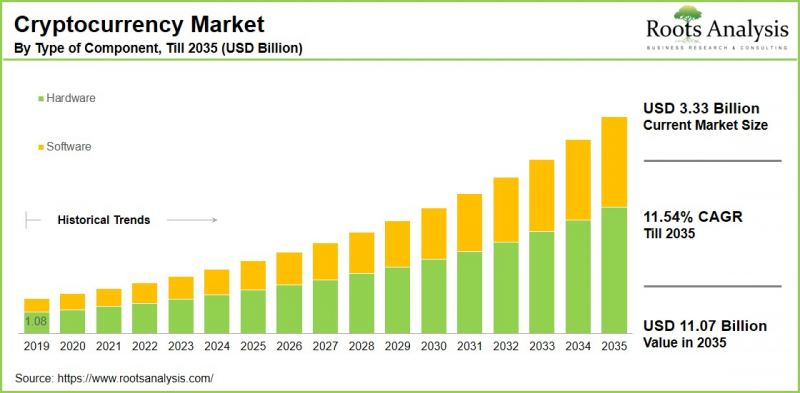

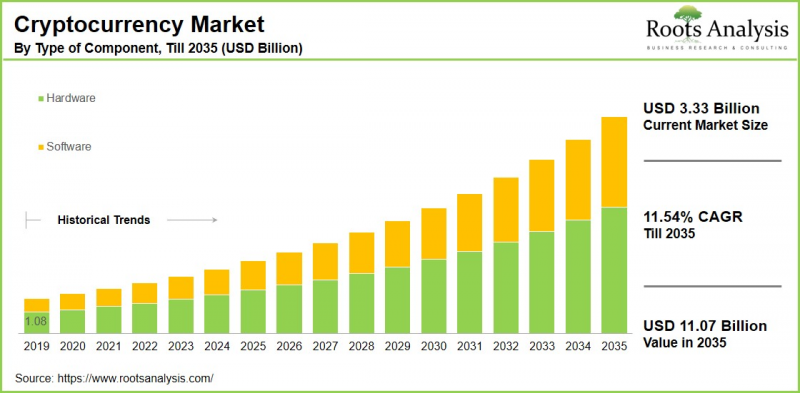

세계 암호화폐 시장 규모는 현재 33억 3,000만 달러에서 2035년까지 110억 7,000만 달러에 달할 것으로 예상되며, 2035년까지 예측 기간 동안 연평균 11.54%의 성장률을 보일 것으로 예측됩니다.

암호화폐 시장 : 성장과 동향

디지털 화폐는 비중앙집권적 특성, 광범위한 접근성, 블록체인 기술의 구현을 통해 현대의 자산 시장을 변화시켰습니다. 2009년 암호화폐의 원조이자 가장 유명한 비트코인(Bitcoin)이 도입된 이후, 암호화폐의 채택률은 급격하게 증가했습니다. 비트코인은 여전히 가장 신뢰할 수 있는 암호화폐이며, 스마트 컨트랙트 기능으로 유명한 이더리움이 근소한 차이로 그 뒤를 잇고 있습니다. 현재 사용 가능한 암호화폐는 1만 개가 넘고, 투자자들은 다양한 디지털 자산을 고려할 수 있습니다.

암호화폐의 등장은 단순한 금융 현상을 넘어 전 세계 투자 활동의 보다 광범위한 기술적 변천을 보여주고 있습니다. 암호화폐를 둘러싼 인프라가 발전함에 따라 개인 투자자와 기관 투자자 모두에게 새로운 물결이 밀려들고 있습니다. 이러한 확장의 대부분은 온라인 거래 플랫폼을 통해 시장에 진입하는 젊은 투자자들이 주도하고 있습니다. 이러한 플랫폼은 직관적인 인터페이스와 통합된 기능을 제공하여 암호화폐 거래를 접근하기 쉽고 전문적으로 만들 수 있습니다. 암호화폐가 풀타임 직업 옵션으로 점점 더 매력적으로 다가오면서 금융권에서 암호화폐 시장을 바라보는 시각도 바뀌고 있습니다.

코로나19가 유행했을 때, 디지털 투자에 대한 움직임이 급속히 증가했습니다. 이러한 채택 증가는 암호화폐 시장의 성숙에 기여했으며, 현재는 개인투자자와 기관투자자 모두에게 환영받는 금융 생태계로 인식되고 있습니다. 결과적으로 위의 요인으로 인해 암호화폐 시장은 예측 기간 동안 크게 성장할 것으로 예측됩니다.

세계의 암호화폐 시장에 대해 조사했으며, 시장 규모 추정과 기회 분석, 경쟁 구도, 기업 프로파일 등의 정보를 전해드립니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 고려사항, 기타 프로젝트 특유의 고려사항

제4장 거시경제 지표

제5장 주요 요약

제6장 서론

제7장 경쟁 구도

제8장 기업 개요

- 본 장의 개요

- Advanced Micro Devices

- Alcheminer

- Binance Holdings

- Bitfinex

- BitFury

- BitGo

- Bitmain

- Bitstamp

- Canaan Creative

- Coinbase

- Coinsecure

- Cryptomove

- Ifinex

- Intel

- Ledger

- Nvidia

- Poloniex

- Ripple

- Xapo

- Xilinx

제9장 밸류체인 분석

제10장 SWOT 분석

제11장 세계의 암호화폐 시장

제12장 시장 기회 : 기술 유형별

제13장 시장 기회 : 응용 분야별

제14장 시장 기회 : 카스토디 솔루션 유형별

제15장 시장 기회 : 암호화폐 유형별

제16장 시장 기회 : 컴포넌트 유형별

제17장 시장 기회 : 프로세스 유형별

제18장 시장 기회 : 경험 레벨 유형별

제19장 북미의 암호화폐 시장 기회

제20장 유럽의 암호화폐 시장 기회

제21장 아시아의 암호화폐 시장 기회

제22장 중동 및 북아프리카(MENA)의 암호화폐 시장 기회

제23장 라틴아메리카의 암호화폐 시장 기회

제24장 기타 지역의 암호화폐 시장 기회

제25장 표 형식 데이터

제26장 기업 및 단체 리스트

제27장 커스터마이즈 기회

제28장 Roots 구독 서비스

제29장 저자 상세

LSH 25.09.30Cryptocurrency Market Overview

As per Roots Analysis, the global cryptocurrency market size is estimated to grow from USD 3.33 billion in the current year to USD 11.07 billion by 2035, at a CAGR of 11.54% during the forecast period, till 2035.

The opportunity for cryptocurrency market has been distributed across the following segments:

Type of Technology

- Blockchain platforms

- Consensus Mechanisms

- Decentralized finance (DeFi)

- Smart contracts

Area of Application

- Gaming and entertainment

- Non-fungible tokens (NFTs)

- Payments and remittances

- Trading and Investments

Type of Custody Solution

- Cold storage

- Custodial services

- Hot wallets

- Multi-signature Wallets

Type of Cryptocurrency

- Bitcoin

- Cash

- Dashcoin

- Ethereum

- Litecoin

- Ripple

- Others

Type of Component

- Hardware

- Software

Type of Process

- Mining

- Transaction

Type of Experience Level

- Beginners

- Intermediate Users

- Experts

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Cryptocurrency Market: Growth and Trends

Digital currencies have transformed the contemporary asset market through their decentralized nature, broad accessibility, and the implementation of blockchain technology. Following the introduction of Bitcoin in 2009, the original and most well-known cryptocurrency, adoption rates for crypto have surged dramatically. Bitcoin remains the most reliable cryptocurrency, with Ethereum following closely, recognized for its smart contract functionalities. Currently, there are more than 10,000 cryptocurrencies available, providing investors with a wide array of digital assets to consider.

The emergence of cryptocurrency signifies more than merely a financial phenomenon; it indicates a wider technological transition in global investment practices. As the infrastructure surrounding crypto advances, it has drawn in a new wave of both retail and institutional investors. A significant part of this expansion is fueled by younger investors who are entering the market via online trading platforms. These platforms provide intuitive interfaces and integrated features that make crypto trading accessible and professional. The growing allure of crypto as a viable full-time career option is also altering the financial sector's perspective on this market.

During the COVID-19 pandemic, the movement towards digital investments experienced a swift increase. This rise in adoption contributed to the maturation of the cryptocurrency market into a well-recognized financial ecosystem that is now welcomed by both retail investors and institutional participants. As a result, owing to the above mentioned factors, the cryptocurrency market is expected to grow significantly during the forecast period.

Cryptocurrency Market: Key Segments

Market Share by Type of Technology

Based on type of technology, the global cryptocurrency market is segmented into blockchain platforms, consensus mechanisms, decentralized finance (DeFi) and smart contracts. According to our estimates, currently, the decentralized finance (DeFi) segment captures the majority of the market share. This growth can be attributed to the extensive use in blockchain-based financial services and peer-to-peer payment networks.

However, the blockchain technology segment is expected to grow at a higher CAGR during the forecast period, driven by the growing acceptance in various industries and the ability to provide secure, transparent, and decentralized transactions.

Market Share by Areas of Application

Based on areas of application, the global cryptocurrency market is segmented into gaming and entertainment, non-fungible tokens (NFTs), payments and remittances, and trading and investments. According to our estimates, currently, the gaming and entertainment segment captures the majority of the market share. This growth is driven by rising awareness of financial diversification, heightened interest from institutional investors, and the emergence of user-friendly trading platforms.

However, the NFTs segment is expected to grow at a relatively higher CAGR during the forecast period. This growth can be attributed to their increasing real-world applications, endorsement from celebrities and global brands, and a wider cultural shift towards digital asset ownership.

Market Share by Type of Custody Solution

Based on type of custody solution, the global cryptocurrency market is segmented into cold storage, custodial services, hot wallets, and multi-signature wallets. According to our estimates, currently, the trading and investment segment captures the majority of the market share. This growth is driven by a rising awareness of financial diversification, increasing interest from institutional investors, and the emergence of user-friendly trading platforms.

However, the NFTs segment is expected to grow at a relatively higher CAGR during the forecast period. This growth is primarily attributed to their increasing real-world applications, endorsement by celebrities and global brands, and a wider cultural shift towards digital asset ownership.

Market Share by Type of Cryptocurrency

Based on type of cryptocurrency, the global cryptocurrency market is segmented into bitcoin, ethereum, litecoin, ripple, dashcoin, and bitcoin cash. According to our estimates, currently, the bitcoin segment captures the majority of the market share due to its established network and relative price stability.

Additionally, the bitcoin is anticipated to sustain robust growth, owing to the recent advancements like the introduction of Bitcoin ETFs, which have expanded institutional access and boosted investor confidence. Ethereum, recognized for its smart contract capabilities, is expected to closely follow, with increasing utility in decentralized applications and finance.

Market Share by Type of Component

Based on type of component, the global cryptocurrency market is segmented into hardware and software. According to our estimates, currently, the hardware segment captures the majority of the market share, due to the rising demand for advanced mining equipment. In particular, the increasing adoption of Application-Specific Integrated Circuits (ASICs) and other specialized mining devices is contributing to the expansion of this segment, especially in regions with growing mining infrastructure and activities.

Market Share by Type of Process

Based on type of process, the global cryptocurrency market is segmented into mining and transaction. According to our estimates, currently, the mining segment captures the majority of the market share, as it is crucial for ensuring the security of cryptocurrency networks and authenticating transactions.

However, the transaction segment is expected to grow at a relatively higher CAGR during the forecast period, owing to the rising acceptance of digital currencies for instantaneous, cross-border payments and the shift away from centralized financial intermediaries.

Market Share by Type of Experience Level

Based on type of experience level, the global cryptocurrency market is segmented into beginners, intermediate users, and expert users. According to our estimates, currently, the intermediate users segment captures the majority of the market share, who have a better understanding of crypto platforms and engage in trading more frequently. However, the beginners segment is expected to grow at a relatively higher CAGR during the forecast period, as platforms with user-friendly designs, built-in tutorials, and expanded educational resources are aiding in welcoming new participants into the digital asset market.

Market Share by Geographical Regions

Based on geographical regions, the cryptocurrency market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Asia captures the majority share of the market. This can be attributed to swift digital transformation, extensive internet accessibility, and growing engagement in nations such as China and India. Additionally, Asia is expected to experience the highest compound annual growth rate (CAGR) during the forecast period, supported by continuous advancements in fintech and an increase in both public and private sector investments in cryptocurrency infrastructure.

Example Players in Cryptocurrency Market

- Advanced Micro Devices

- Alcheminer

- Binance Holdings

- Bitfinex

- BitFury

- BitGo

- Bitmain

- Bitstamp

- Canaan Creative

- Coinbase

- Coinsecure

- Cryptomove

- Ifinex

- Intel

- Ledger

- Nvidia

- Poloniex

- Ripple

- Xapo

- Xilinx

Cryptocurrency Market: Research Coverage

The report on the cryptocurrency market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the cryptocurrency market, focusing on key market segments, including [A] type of technology, [B] area of application, [C] type of custody solution, [D] type of cryptocurrency, [E] type of component, [F] type of experience level, and [G] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the cryptocurrency market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the cryptocurrency market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] cryptocurrency portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the cryptocurrency market.

Key Questions Answered in this Report

- How many companies are currently engaged in cryptocurrency market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Cryptocurrency Market

- 6.2.1. Type of Technology

- 6.2.2. Type of Application

- 6.2.3. Type of Cryptocurrency

- 6.2.4. Type of Custody Solution

- 6.2.5. Type of Cryptocurrency

- 6.2.6. Type of Component

- 6.2.7. Type of Process

- 6.2.8. Type of Experience Level

- 6.2.9. Type of Application

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Interactive Display: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Advanced Micro Devices *

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. Alcheminer

- 8.4. Binance Holdings

- 8.5. Bitfinex

- 8.6. BitFury

- 8.7. BitGo

- 8.8. Bitmain

- 8.9. Bitstamp

- 8.10. Canaan Creative

- 8.11. Coinbase

- 8.12. Coinsecure

- 8.13. Cryptomove

- 8.14. Ifinex

- 8.15. Intel

- 8.16. Ledger

- 8.17. Nvidia

- 8.18. Poloniex

- 8.19. Ripple

- 8.20. Xapo

- 8.21. Xilinx

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL CRYPTOCURRENCY MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Cryptocurrency Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Cryptocurrency Market for Blockchain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Cryptocurrency Market for Consensus Mechanisms: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Cryptocurrency Market for Decentralized Finance: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Cryptocurrency Market for Smart Contracts: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.10. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON AREAS OF APPLICATION

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Cryptocurrency Market for Gaming and Entertainment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Cryptocurrency Market for Non-Fungible tokens (NFT's): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Cryptocurrency Market for Payment and Remittances: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Cryptocurrency Market for Trading and Investments: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF CUSTODY SOLUTION

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Cryptocurrency Market for Hot Wallet: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Cryptocurrency Market for Cold Storage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Cryptocurrency Market for Multi-Signature Wallets: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Cryptocurrency Market for Custodial Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.10. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF CRYPTOCURRENCY

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Cryptocurrency Market for Bitcoin: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Cryptocurrency Market for Cash: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Cryptocurrency Market for Dashcoin: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. Cryptocurrency Market for Ethereum: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. Cryptocurrency Market for Litecoin: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.11. Cryptocurrency Market for Ripple: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.12. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Cryptocurrency Market for Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Cryptocurrency Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF PROCESS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Cryptocurrency Market for Mining: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Cryptocurrency Market for Transaction: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON TYPE OF EXPERIENCE LEVEL

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Cryptocurrency Market for Beginners: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Cryptocurrency Market for Intermediate Users: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Cryptocurrency Market for Experts: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Data Triangulation and Validation

19. MARKET OPPORTUNITIES FOR CRYPTOCURRENCY IN NORTH AMERICA

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Cryptocurrency Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.1. Cryptocurrency Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.2. Cryptocurrency Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.3. Cryptocurrency Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.4. Cryptocurrency Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR CRYPTOCURRENCY IN EUROPE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Cryptocurrency Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.1. Cryptocurrency Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.2. Cryptocurrency Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.3. Cryptocurrency Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.4. Cryptocurrency Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.5. Cryptocurrency Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.6. Cryptocurrency Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.7. Cryptocurrency Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.8. Cryptocurrency Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.9. Cryptocurrency Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.10. Cryptocurrency Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.11. Cryptocurrency Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.12. Cryptocurrency Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.13. Cryptocurrency Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.14. Cryptocurrency Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.15. Cryptocurrency Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR CRYPTOCURRENCY IN ASIA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Cryptocurrency Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Cryptocurrency Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Cryptocurrency Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Cryptocurrency Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Cryptocurrency Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.5. Cryptocurrency Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.6. Cryptocurrency Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR CRYPTOCURRENCY IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Cryptocurrency Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Cryptocurrency Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 22.6.2. Cryptocurrency Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Cryptocurrency Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Cryptocurrency Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Cryptocurrency Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Cryptocurrency Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.7. Cryptocurrency Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.8. Cryptocurrency Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR CRYPTOCURRENCY IN LATIN AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Cryptocurrency Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Cryptocurrency Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Cryptocurrency Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Cryptocurrency Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Cryptocurrency Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Cryptocurrency Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Cryptocurrency Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR CRYPTOCURRENCY IN REST OF THE WORLD

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Cryptocurrency Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Cryptocurrency Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Cryptocurrency Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Cryptocurrency Market in Other Countries

- 24.7. Data Triangulation and Validation