|

시장보고서

상품코드

1827027

즉시결제 시장(2025-2030년)Instant Payments Market: 2025-2030 |

||||||

"즉시결제 시장은 2029년까지 세계에서 110조 달러 돌파 전망 : 유럽 규제와 FedNow의 영향이 성장을 가속"

| 주요 통계 | |

|---|---|

| 2025년 즉시결제 거래 총액 : | 60조 달러 |

| 2030년 즉시결제 거래 총액 : | 1억 2900만 달러 |

| 2025-2030년 시장 성장률 : | 115% |

| 예측 기간 : | 2025-2030년 |

개요

이 보고서는 급성장하는 즉시결제 시장을 다각적이고 전략적으로 분석하여 은행, 결제 인프라 사업자, 규제기관, 기업 등 이해관계자들이 향후 시장 성장, 주요 동향, 경쟁 환경을 종합적으로 파악할 수 있도록 돕습니다.

이 보고서는 모두 영어로 제공됩니다.

주요 특징

- 주요 요점 및 전략적 제안:즉시결제 플랫폼, 가맹점, 결제 서비스 프로바이더, 은행 등을 대상으로 주요 시장 기회, 주요 조사결과, 전략적 제안을 상세하게 설명합니다.

- 시장 전망:즉시결제 시장 확대를 촉진하는 새로운 동향과 요인을 분석하고, 사기 위험과 기업 측의 신중한 태도 등 성장을 저해하는 요소도 언급하고 있습니다. 또한 소비자 및 기업 부문에서의 활용 사례를 비교하여 채택률의 차이를 밝힙니다. 국가별 준비지수에서는 61개국의 실시간 결제 분야에서의 위치, 기술 대응력, 미래 성장 가능성을 평가했습니다.

- 업계 예측 벤치마킹:즉시결제 시장 개요를 제시하고, 거래 건수 및 거래금액을 B2B/소비자별, 국내/국제 거래별로 분류하여 예측합니다.

- Juniper Research 경쟁사 리더보드:즉시결제 플랫폼 17개사를 대상으로 시장 역량, 제품 제공력, 경쟁력 등을 종합적으로 평가합니다.

샘플 뷰

시장 데이터 & 예측 리포트

샘플

시장 동향 & 전략 리포트

시장 데이터 & 예측 보고서

이 연구 제품군에는 39개의 표와 24,000개 이상의 데이터 포인트에 대한 예측 데이터세트에 대한 액세스가 포함되어 있습니다.

주요 지표:

- 즉시결제 총 거래 건수

- 즉시결제 총 거래액

주요 시장 분류:

- 소비자 대상 즉시 결제

- 국내 소비자 대상 즉시 결제

- 국제 소비자 대상 즉시 결제

- B2B 즉시 결제

- 국내 B2B 즉시결제

- 국제 B2B 즉시 결제

Juniper Research 인터랙티브 예측(Excel)은 다음과 같은 기능을 제공합니다.

- 통계 분석 :데이터 기간 중 모든 지역과 국가에 대해 표시됩니다. 그래프는 쉽게 수정할 수 있으며, 클립보드로 내보내기도 가능합니다.

- 국가별 데이터 툴:예측 기간 중 모든 지역과 국가의 지표를 볼 수 있습니다. 검색창에서 표시할 지표를 좁힐 수 있습니다.

- 국가별 비교 툴:국가를 선택하여 비교할 수 있습니다. 이 툴에는 그래프 내보내기 기능이 포함되어 있습니다.

- What-if 분석 :5가지 대화형 시나리오를 통해 사용자는 예측의 전제조건과 비교할 수 있습니다.

경쟁사 리더보드 보고서

대상 업체는 아래 17개 업체입니다.

|

|

목차

시장 동향과 전략

제1장 주요 포인트와 전략적 제안

- 주요 포인트

- 전략적 제안

제2장 즉시결제 - 시장 구도

- 서론

- 즉시결제의 작동 방식

- 개요

- 즉시결제 기능

- 즉시결제의 이점

- 즉시결제의 기술층

- 결제 레일

- 과제와 한계

- 배경

- 새로운 동향

- 개요

- 즉시결제를 추진하는 기술 혁신

- 규제의 동향

- 제품 관련 결제 동향

- 소비자용 즉시결제 vs B2B용 즉시결제

- 소비자용 즉시결제

- B2B 즉시결제

제3장 즉시결제 : 부문 분석

- P2P 결제

- 온라인 E-Commerce 결제

- 점포내 즉시결제

- 크로스보더 결제

제4장 즉시결제 : 국가별 준비 지수

- 서론

- 성장 시장

- 포화 시장

- 신흥 시장

경쟁 리더보드

제1장 경쟁 리더보드

제2장 기업 개요

- 벤더 개요

- ACI Worldwide

- Bottomline

- Finastra

- FIS

- Fiserv

- FSS

- Jack Henry

- Mastercard

- Montran Corporation

- Nexi

- Pelican AI

- SWIFT

- Tata Consultancy Services

- Tietoevry

- Visa

- Volante Technologies

- Worldline

- 경쟁 리더보드 평가 방법

- 관련 조사

데이터&예측

제1장 즉시결제 : 서론·조사 방법

제2장 시장 요약

- 총거래 건수

- 총거래액

- 국내 거래

- 크로스보더 거래

제3장 B2B 결제

- 총거래 건수

- 총거래액

- 국내 거래

- 크로스보더 거래

제4장 소비자 결제

- 총거래 건수

- 총거래액

- 국내 거래

- 크로스보더 거래

'Instant Payments to Exceed $110 Trillion by 2029 Globally, Accelerated by European Regulation & FedNow Impact'

| KEY STATISTICS | |

|---|---|

| Total instant payments transaction value in 2025: | $60tn |

| Total instant payments transaction value in 2030: | $129tn |

| 2025 to 2030 market growth: | 115% |

| Forecast period: | 2025-2030 |

Overview

Juniper Research's "Instant Payments" research suite provides a wide-ranging and strategic analysis of this market; enabling stakeholders - from banks, infrastructure providers, regulators, and businesses - to understand future growth, key trends, and the competitive environment.

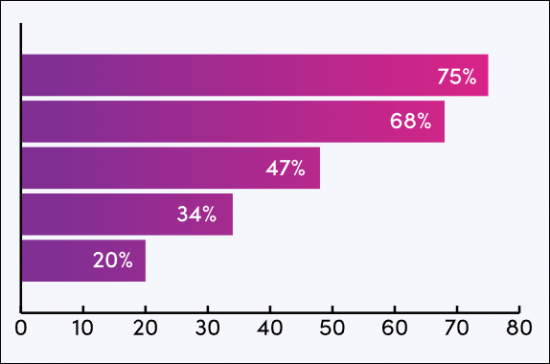

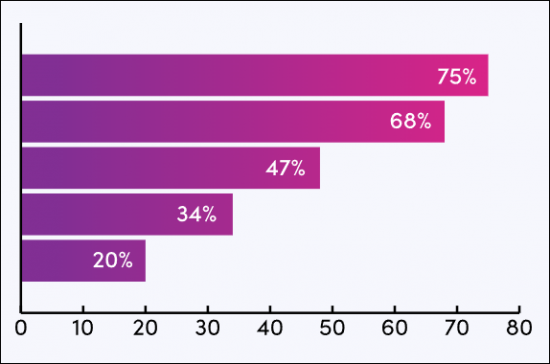

The research suite includes several different options that can be purchased separately. The Market Trends & Strategies element includes an insightful analysis of the key areas of real-time payments' transformation and innovation, including key trends and challenges to market expansion. Additionally, it features Juniper Research's Country Readiness Index, which provides a country-level analysis of the current and future opportunities for instant payments in 61 different geographies.

The Data & Forecasting element includes access to data mapping the adoption and future growth of the instant payments market over the next five years; split by cross-border versus domestic transactions, and B2B versus consumer.

Additionally, the Competitor Leaderboard document features an extensive analysis of the 17 market leaders in the instant payments space; positioning them based on capability and capacity, as well as on their product offering itself; offering a robust analysis of each vendor.

The coverage can also be purchased as a full research suite containing the Market Trends & Strategies, Data & Forecasting, and Competitor Leaderboard, and at a substantial discount.

Collectively, these documents provide a critical tool for understanding this important market. They allow instant payment providers and payments companies to shape their future strategy; capitalising on future growth opportunities. The research suite's extensive coverage makes it a valuable tool for navigating this high-growth market.

All report content is delivered in the English language.

Key Features

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities, key findings, and key strategic recommendations for instant payment platforms, merchants, payment service providers, and banks.

- Market Outlook: Insights into emerging trends and drivers of the expansion of the instant payments market; addressing factors limiting its growth, such as scam risk and business hesitancy. It provides analysis of the different use cases in both the consumer and business sectors; breaking down which have witnessed different adoption rates among instant payment services. Juniper Research's Country Readiness Index positions 61 countries in their relative place in the real-time payments space; their readiness for the technology and their future growth.

- Benchmark Industry Forecasts: This provides an overview of the instant payments market, including the volume and value of instant payments transactions, split by B2B and consumer payments, and by domestic and cross-border payments.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 17 instant payment platforms, via the Juniper Research Competitor Leaderboard.

SAMPLE VIEW

Market Data & Forecasting Report

SAMPLE VIEW

Market Trends & Strategies Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the "Instant Payments" market includes access to the full set of forecast data of 39 tables and over 24,000 datapoints.

Metrics in the research suite include:

- Total Number of Instant Payments

- Total Value of Instant Payments

These metrics are provided for the following key market splits:

- Consumer Instant Payments

- Domestic Consumer Instant Payments

- Cross-border Consumer Instant Payments

- B2B Instant Payments

- Domestic B2B Instant Payments

- Cross-border B2B Instant Payments

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics; displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool enables users to look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios.

Market Trends & Strategies Report

This report examines the Instant Payments market landscape in detail; assessing market trends and factors shaping the evolution of this transforming market. It delivers comprehensive analysis of the strategic opportunities in the instant payments landscape; assessing ways in which the market is changing based on different scheme types and trends, and what this means for overall market growth.

The report also examines key challenges and opportunities, as well as providing an evaluation of key country-level opportunities for instant payments growth via a Country Readiness Index. Combined, the report provides an insightful resource for key stakeholders.

Competitor Leaderboard Report

The Competitor Leaderboard report provides coverage of 17 leading "Instant Payments" vendors; positioning them as established leaders, leading challengers, or disruptors and challengers based on capacity and capability assessments.

The 17 vendors included are:

|

|

The Competitor Leaderboard gives a comprehensive guide to the competitive landscape within instant payments; providing an important resource for stakeholders.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Instant Payments - Market Landscape

- 2.1. Introduction

- 2.1.1. Definition and Core Features of Instant Payments

- 2.1.2. Differentiation: Instant vs Faster Payments

- 2.1.3. Global Adoption

- 2.2. How Instant Payments Work

- 2.2.1. Overview

- i. Main Process

- Figure 2.1: Example Instant Payments System - The Clearing House Real-time Payments (RTP) Network

- ii. Additional Supporting Functions

- i. Main Process

- 2.2.2. Instant Payments Features

- 2.2.3. Benefits of Instant Payment

- 2.2.4. Technological Layer of Instant Payment

- 2.2.5. Payment Rails

- i. Pix (Brazil)

- ii. UPI (India)

- iii. Faster Payments (UK)

- iv. PromptPay (Thailand)

- Figure 2.2: PromptPay Payment Infrastructure

- v. SEPA Instant Credit (EU)

- Figure 2.3: Map of SEPA Member Countries

- 2.2.6. Challenges And Limitations

- i. Overview

- ii. Fraud Prevention

- iii. Ways To Minimise Fraud

- Figure 2.4: Request to Pay Loop

- iv. Other Considerations

- 2.2.1. Overview

- 2.3. Background

- 2.3.1. Historical Background

- 2.3.2. Modern Days

- 2.3.3. Latest Developments

- 2.4. Emerging Trends

- 2.4.1. Overview

- 2.4.2. Technological Innovations Driving Instant Payments

- i. The Rise Of Digital Wallets

- ii. AI's Potential

- iii. Internet of Things (IoT)

- iv. The Integration Of Digital Assets

- v. Decentralised Networks and Blockchain

- vi. Open Banking

- Figure 2.5: Provision of Services in Open Banking

- 2.4.3. Regulatory Trends

- 2.4.4. Product-related Payment Trends

- i. The Use of Data

- ii. Fraud Detection and AML

- 2.5. Consumer vs B2B Instant Payments

- 2.5.1. Consumer Instant Payments

- i. Opportunities

- ii. Adoption

- iii. Use Cases

- 2.5.2. B2B Instant Payments

- i. Opportunities

- ii. Adoption

- iii. Use Cases

- 2.5.1. Consumer Instant Payments

3. Instant Payments: Segment Analysis

- 3.1. P2P Payments

- 3.1.1. Market

- 3.1.2. Opportunities

- 3.1.3. Limitations

- 3.1.4. Future Outlook

- 3.2. Online eCommerce Payments

- 3.2.1. Overview

- 3.2.2. Opportunities

- 3.2.3. Limitations

- 3.2.4. Future Outlook

- 3.3. In-store Instant Payments

- 3.3.1. Market

- 3.3.2. Opportunities

- 3.3.3. Limitations

- 3.3.4. Future Outlook

- 3.4. Cross-border Payments

- 3.4.1. The Latest Progress Within Cross-border Instant Payments

- 3.4.2. Project Nexus

- Figure 3.1: How Payments Are Processed in Nexus

- 3.4.3. Financial Inclusion

- 3.4.4. Barriers to Further Expansion of Cross-border Instant Payments

4. Instant Payments: Country Readiness Index

- 4.1. Introduction

- Figure 4.1: Juniper Research Country Readiness Index: Regional Definitions

- Table 4.2: Juniper Research Country Readiness Index Scoring Criteria: Instant Payments

- Figure 4.3: Juniper Research Country Readiness Index: Instant Payments

- Table 4.4: Instant Payments Country Readiness Index: Market Segments

- 4.1.1. Focus Markets

- 4.1.2. Established Instant Payment Rails

- 4.1.3. Institutional Support

- 4.1.4. Country-level Assessment: The US

- 4.2. Growth Markets

- 4.2.1. Emerging Economies

- 4.2.2. Developed Economies

- 4.2.3. Country-level Assessment: The UAE

- 4.3. Saturated Markets

- 4.3.1. Cross-border Co-operation

- 4.3.2. Additional Services

- 4.3.3. Country-level Assessment: The UK

- 4.3.4. Country-level Assessment: Mexico

- 4.4. Developing Markets

- 4.4.1. Limited Infrastructure

- Table 4.5: Juniper Research Country Readiness Index Heatmap: North America

- Table 4.6: Juniper Research Country Readiness Index Heatmap: Latin America

- Table 4.7: Juniper Research Country Readiness Index Heatmap: West Europe

- Table 4.8: Juniper Research Country Readiness Index Heatmap: Central & East Europe

- Table 4.9: Juniper Research Country Readiness Index Heatmap: Far East & China

- Table 4.10: Juniper Research Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.11: Juniper Research Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.12: Juniper Research Country Readiness Index Heatmap: Africa & Middle East

- 4.4.1. Limited Infrastructure

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Competitor Leaderboard: Instant Payments Vendors Included & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard for Instant Payments

- Table 1.3: Juniper Research Instant Payments Vendors & Positioning

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap - Instant Payments Vendors

2. Company Profiles

- 2.1. Vendor Profiles

- 2.1.1. ACI Worldwide

- i. Corporate

- Figure 2.1: ACI Worldwide's Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.2. Bottomline

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Finastra

- i. Corporate

- ii. Geographical Spread

- iii. iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. FIS

- i. Corporate

- Table 2.2: FIS' Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.5. Fiserv

- i. Corporate

- Table 2.3: Fiserv's Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.6. FSS

- i. Corporate

- Table 2.4: FSS' Rounds of Funding ($m), 2000-2014

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.7. Jack Henry

- i. Corporate

- Table 2.5: Jack Henry's Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.8. Mastercard

- i. Corporate

- Table 2.6: Mastercard's Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.7: Mastercard's Real-time Payments Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.9. Montran Corporation

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. Nexi

- i. Corporate

- Table 2.8: Nexi's Financial Snapshot ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.11. Pelican AI

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. SWIFT

- i. Corporate

- Table 2.9: SWIFT's Financial Snapshot ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.13. Tata Consultancy Services

- i. Corporate

- Table 2.10: Tata Consultancy Services' Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.14. Tietoevry

- i. Corporate

- Table 2.11: Tietoevry's Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.12: Instant Payments for Participants Schematic

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.15. Visa

- i. Corporate

- Table 2.13: Visa's Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.16. Volante Technologies

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.17. Worldline

- i. Corporate

- Table 2.14: Worldline's Financial Snapshot ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.1. ACI Worldwide

- 2.2. Juniper Research Competitor Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

- Table 2.15: Juniper Research Competitor Leaderboard Scoring Criteria - Instant Payments

- 2.2.1. Limitations & Interpretations

- 2.3. Related Research

Data & Forecasting

1. Instant Payments: Introduction & Methodology

- 1.1. Introduction

- 1.2. Methodology & Assumptions

- Figure 1.1: Consumer Instant Payments Methodology

- Figure 1.2: B2B Instant Payments Methodology

2. Market Summary

- 2.1. Total Volume

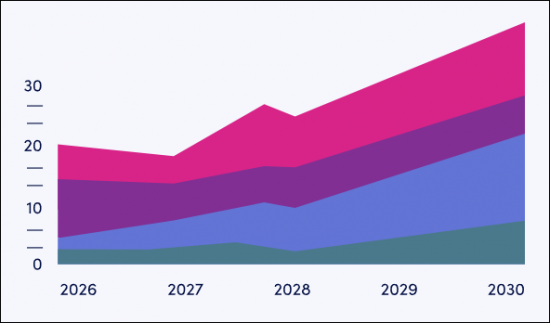

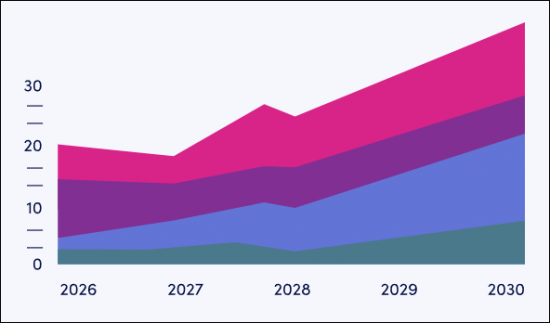

- Figure & Table 2.1: Total Volume of Instant Payments per annum (m), Split by 8 Key Regions, 2025-2030

- 2.2. Total Value

- Figure & Table 2.2: Total Value of Instant Payments per annum ($m), Split by 8 Key Regions, 2025-2030

- 2.3. Domestic Transactions

- Figure & Table 2.3: Total Value of Instant Domestic Payments per annum ($m), Split by 8 Key Regions, 2025-2030

- 2.4. Cross-border Transactions

- Figure & Table 2.4: Total Value of Instant Cross-border Payments per annum ($m), Split by 8 Key Regions, 2025-2030

3. B2B Payments

- 3.1. B2B Volume

- Figure & Table 3.1: Total Number of Instant B2B Transactions per annum (m), Split by 8 Key Regions, 2025-2030

- 3.2. B2B Value

- Figure & Table 3.2: Total Value of Instant Payment B2B Transactions per annum ($m), Split by 8 Key Regions, 2025-2030

- 3.3. Domestic B2B Transactions

- Figure & Table 3.3: Total Value of Instant Payment Domestic B2B Transactions per annum ($m), Split by 8 Key Regions, 2025-2030

- 3.4. Cross-border B2B Transactions

- Figure & Table 3.4: Total Value of Cross-border B2B Payments via Instant Payment per annum ($m), Split by 8 Key Regions, 2025-2030

4. Consumer Payments

- 4.1. Total Volume

- Figure & Table 4.1: Total Number of Instant Payment Consumer Transactions per annum (m), Split by 8 Key Regions, 2025-2030

- 4.2. Total Value

- Figure & Table 4.2: Total Value of Instant Payment Consumer Transactions per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.3. Domestic Consumer Transactions

- Figure & Table 4.3: Total Value of Instant Payment Domestic Consumer Transactions per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.4. Cross-border Consumer Transactions

- Figure & Table 4.4: Total Value of Instant Payment Cross-border Consumer Transactions per annum ($m), Split by 8 Key Regions, 2025-2030