|

시장보고서

상품코드

1811761

FaaS(Fintech as a Service) 시장(-2030년) : 유형별(뱅킹, 결제, 보험, 대출, RegTech, 자산운용, 디지털 자산 및 통화, 사이버 보안), 최종사용자별(소비자, 은행, NBFC, 보험회사, 정부)Fintech as a Service Market by Type (Banking, Payments, Insurance, Lending, RegTech, Wealth Management, Digital Assets & Currencies, Cybersecurity), End User (Consumer, Banks, NBFCs, Insurance Companies, Government) - Global Forecast to 2030 |

||||||

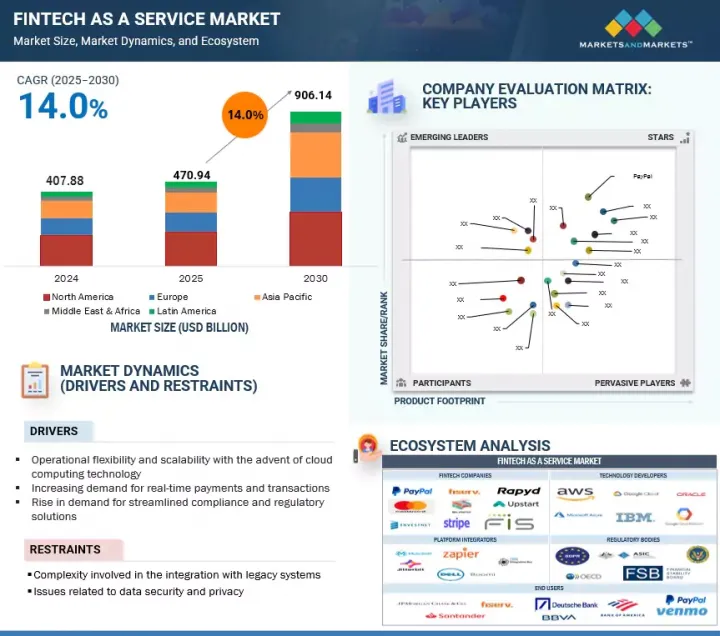

세계의 FaaS(Fintech as a Service) 시장 규모는 2025년 4,709억 4,000만 달러에서 예측 기간 동안 CAGR 14.0%로 증가하여 2030년에는 9,061억 4,000만 달러로 성장할 것으로 예측됩니다.

세계 시장은 임베디드 금융의 급속한 성장에 힘입어 은행, 보험사, 비은행금융회사(NBFC)가 결제, 대출, 카드 발급, 본인확인(KYC) 서비스를 신속하고 저렴한 비용으로 제공하기 위해 API 기반 솔루션을 점점 더 많이 채택하고 있습니다. 또한, 디지털 커머스의 성장, 국제 송금 수요, 규제 준수 필요성, 클라우드 기반 모델의 확장성 등이 도입을 가속화하고 있습니다. 또한, AI와 데이터 분석의 통합으로 부정 방지, 신용 심사, 개인화 기능이 강화되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 유형, 전개 모델, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

또한, 금융 포용(Financial Inclusion), 중소기업의 디지털화, 모듈형 및 컴포저블 금융 서비스로의 전환 등의 움직임이 시장 성장을 더욱 촉진하고 있습니다. 그러나 이 분야는 지역별로 상이한 단편적인 규제, 제3자 리스크 및 컴플라이언스에 대한 엄격한 모니터링, 데이터 프라이버시 및 보안에 대한 우려, 레거시 시스템과의 통합 문제 등의 제약에 직면해 있습니다. 또한, 거래소 수수료 상한으로 인한 수익률 압박, 벤더 락인 가능성, 신뢰성에 대한 기대감 등도 보급을 억제하는 요인으로 작용하고 있습니다. 또한, 자금조달 환경의 엄격화, 위험회피적 운용 관행, 비은행 사업자의 금융서비스 진입에 대한 신뢰의 벽도 여전히 과제로 남아있습니다.

"결제 부문별로는 서비스형 결제(payment processing-as-a-service) 부문이 예측 기간 동안 가장 큰 점유율을 차지할 것으로 예상됩니다."

payment processing-as-a-service는 클라우드 기반 모델로, 기업은 결제 인프라를 아웃소싱하고 API 및 모듈형 플랫폼을 통해 엔드투엔드 거래 기능에 접근할 수 있습니다. 이를 통해 기업은 고가의 자체 시스템을 구축하지 않고도 카드 결제, 디지털 지갑, 은행 송금, 대체 결제 수단을 처리할 수 있으며, 보안, 부정 방지, 컴플라이언스 기능을 통합할 수 있습니다. 이 모델은 EC, 은행, 중소기업, 구독형 서비스, 디지털 마켓플레이스 등에서 널리 사용되고 있으며, 원활한 국제 거래, 정기 결제, 다통화 결제를 지원합니다. 확장성, 빠른 시장 출시, 운영 복잡성 감소를 통해 디지털 금융 서비스의 효율성과 혁신을 촉진하고 FaaS 생태계의 핵심 결제 사용 사례로 자리 잡고 있습니다.

"도입 모델별로는 하이브리드 부문이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예상됩니다."

하이브리드 클라우드는 퍼블릭 클라우드와 프라이빗 클라우드의 장점을 통합하여 금융기관이 확장성, 보안, 컴플라이언스의 균형을 맞출 수 있도록 합니다. 이 모델에서는 고객 데이터, 핵심 은행 시스템, 규제 보고와 같은 민감한 워크로드는 프라이빗 인프라에 보관하고, 디지털 지갑, 결제 API, 로보 어드바이저리 플랫폼과 같은 고객 서비스는 퍼블릭 클라우드의 확장성과 비용 효율성을 활용합니다. 이러한 이중 접근 방식을 통해 기업은 비용 최적화, 컴플라이언스 요건 충족, 새로운 핀테크 기술을 유연하게 도입할 수 있습니다. 금융기관이 디지털 전환을 추진하면서 규제에 대응하는 과정에서 하이브리드 클라우드 도입이 빠르게 확대되고 있습니다. 또한, 서비스별로 다른 클라우드 제공업체를 이용하는 멀티 클라우드 전략을 지원하여 탄력성을 강화하고 벤더 종속성을 줄입니다. FaaS 제공업체에게 하이브리드 도입은 혁신의 속도와 핵심 업무의 안정성 및 컴플라이언스를 모두 충족시킬 수 있는 '두 마리 토끼를 잡을 수 있는' 선택이 될 수 있습니다.

"아시아태평양이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예상됩니다."

아시아태평양 시장은 선진화된 실시간 결제망, 오픈뱅킹으로의 규제 전환, 중소기업 및 플랫폼의 디지털화 확대를 배경으로 빠르게 성장하고 있습니다. 인도, 중국, 일본 등이 계좌간 결제, QR코드 결제, 국제 송금 솔루션에서 시장을 선도하고 있습니다. 싱가포르의 Payment Services Act, 호주의 Consumer Data Right, 일본의 자금결제법 등의 규제 프레임워크는 컴플라이언스-as-a-service 및 데이터 활용형 서비스 형성에 영향을 미치고 있습니다. 또한, 지갑 간 상호운용성과 슈퍼앱 생태계의 확산도 보급을 가속화하고 있습니다. 은행, 비은행금융회사(NBFC), 정부는 FaaS를 활용하여 결제 기반을 현대화하고, 금융 서비스를 통합하고, 규제 부담을 줄이고 있습니다. 또한, Airwallex, Nium, Razorpay와 같은 국제 송금 전문 업체들이 Stripe, Adyen과 같은 세계 기업들과 경쟁하고 있습니다. 규제 파편화, 데이터 현지화, 컴플라이언스 비용 등의 과제가 남아있지만, 시장 전망은 견조하며, 오픈 파이낸스 확대와 함께 멀티레일 오케스트레이션, 임베디드 트레저리, compliance-as-code가 금융 혁신의 핵심이 되는 가운데, 두 자릿수 성장이 기대되고 있습니다.

세계의 FaaS(Fintech as a Service) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 업계 동향

- FaaS(Fintech as a Service)의 역사

- 고객의 사업에 영향을 미치는 동향/혼란

- 공급망 분석

- 생태계 분석

- 가격 분석

- 기술 분석

- 특허 분석

- Porter's Five Forces 분석

- 사례 연구 분석

- 규제 상황

- 주요 이해관계자와 구입 기준

- 2025-2026년의 주요 회의와 이벤트

- FaaS 시장용 기술 로드맵

- FaaS로서 구현하기 위한 베스트 프랙티스

- 현재 비즈니스 모델과 신흥 비즈니스 모델

- FaaS에서 사용되는 도구, 프레임워크, 기법

- AI와 생성형 AI : 소개

- 투자와 자금 조달 시나리오

- 2025년 미국 관세의 영향 : FaaS(Fintech as a Service)

제6장 FaaS(Fintech as a Service) 시장 : 유형별

- 은행

- 고객 온보딩·계좌 관리

- CORE BANKING-AS-A-PLATFORM

- 기타

- 결제

- 국제 송금 플랫폼

- PAYMENT PROCESSING-AS-A-SERVICE

- 기타

- 보험

- 청구 자동화

- 보험계약 관리 플랫폼

- 기타

- RegTech

- 컴플라이언스 및 규제 서포트

- KYC 검증

- 기타

- 대출

- BNPL(후불 서비스)

- 임베디드 대출 API

- 기타

- 자산운용

- 자산 관리

- 고객 온보딩 및 리스크 프로파일링

- 기타

- 디지털 자산·통화

- CRYPTO-AS-A-SERVICE

- 토큰화 플랫폼

- 기타

- 사이버 보안

- 부정행위 검출

- 신원 확인 서비스

- 기타

- 기타

제7장 FaaS(Fintech as a Service) 시장 : 전개 모델별

- 퍼블릭 클라우드

- 프라이빗 클라우드

- 하이브리드 클라우드

제8장 FaaS(Fintech as a Service) 시장 : 최종사용자별

- 소비자

- 은행

- NBFC(비은행계 금융회사)

- 보험회사

- 정부

- 기타

제9장 FaaS(Fintech as a Service) 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 거시경제 전망

- 사우디아라비아

- 아랍에미리트

- 남아프리카공화국

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

제10장 경쟁 구도

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- PAYPAL

- MASTERCARD

- FISERV

- BLOCK, INC.

- STRIPE

- ENVESTNET

- RAPYD

- UPSTART

- FIS

- ADYEN

- 기타 기업

- SOLID FINANCIAL TECHNOLOGIES

- SOFI TECHNOLOGIES

- MARQETA

- SYNCTERA

- DWOLLA

- FINASTRA

- TEMENOS

- POLICYBAZAAR

- RAZORPAY

- 스타트업/SME

- VOLANTE TECHNOLOGIES

- REVOLUT

- FISPAN

- NIUM

- AIRWALLEX

- FINIX

- PLAID

- CURRENCYCLOUD

- MAMBU

- FORM3

- SOLARIS

- CHIME

- M2P FINTECH

- RAILSR

제12장 인접 시장과 부록

제13장 부록

KSM 25.09.25The global Fintech as a Service market will grow from USD 470.94 billion in 2025 to USD 906.14 billion by 2030 at a compounded annual growth rate (CAGR) of 14.0% during the forecast period. The global market is driven by the rapid rise of embedded finance, where banks, insurers, and NBFCs increasingly adopt API-driven solutions to deliver payments, lending, card issuance, and KYC services quickly and cost-effectively. Growth in digital commerce, demand for cross-border remittance, regulatory compliance needs, and the scalability of cloud-based models further accelerate adoption, while the integration of AI and data analytics enhances fraud prevention, underwriting, and personalization.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | Type, Deployment Model, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

Additionally, financial inclusion initiatives, SME digitalization, and the trend toward modular, composable financial services strengthen market momentum. However, the sector faces restraints such as regulatory fragmentation across regions, heightened scrutiny around third-party risk and compliance, data privacy and security concerns, and challenges in integrating with legacy systems. Margin pressures due to interchange caps, potential vendor lock-in, and reliability expectations also weigh on adoption, alongside tighter funding conditions, de-risking practices, and trust barriers for non-bank providers entering financial services.

Based on payment, the payment processing-as-a-service segment is expected to hold the largest market share during the forecast period.

Payment Processing-as-a-Service is a cloud-based model that enables businesses to outsource their payment infrastructure and access end-to-end transaction capabilities through APIs and modular platforms. It allows companies to handle card payments, digital wallets, bank transfers, and alternative payment methods while embedding security, fraud prevention, and compliance features without building costly in-house systems. Widely adopted across e-commerce, banking, SMEs, subscription-based services, and digital marketplaces, Payment Processing-as-a-Service supports seamless global transactions, recurring billing, and multi-currency settlements. By offering scalability, faster go-to-market, and reduced operational complexity, it has become a core payments use case within the Fintech as a Service ecosystem, driving efficiency and innovation in digital financial services.

Based on deployment model, the hybrid segment is expected to grow at the highest CAGR during the forecast period.

Hybrid cloud integrates the benefits of both public and private cloud environments, enabling financial institutions to strike a balance between scalability, security, and compliance. In this model, sensitive workloads such as customer data, core banking systems, and regulatory reporting are kept on private infrastructure, while customer-facing services such as digital wallets, payment APIs, or robo-advisory platforms leverage the public cloud's scalability and cost efficiency. This dual approach allows firms to optimize costs, meet compliance requirements, and remain flexible in adopting new fintech innovations. Hybrid cloud adoption is growing rapidly as financial institutions pursue digital transformation while managing regulatory pressures. It also supports multi-cloud strategies, where different cloud providers are used for specific services, enhancing resilience and reducing vendor lock-in. For FaaS providers, hybrid deployment offers the best of both worlds, enabling innovation at speed while maintaining trust and compliance for core operations.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The Fintech as a Service market in Asia Pacific is expanding rapidly, driven by the region's advanced real-time payment rails, regulatory shifts toward open banking, and growing SME and platform digitalization. Countries such as India, China, and Japan are leading the market with account-to-account, QR-based, and cross-border payment solutions. Regulatory frameworks, including Singapore's Payment Services Act, Australia's Consumer Data Right, and Japan's Payment Services Act, are shaping compliance-as-a-service and data-driven offerings, while wallet interoperability and super-app ecosystems further accelerate adoption. Banks, NBFCs, and governments are leveraging FaaS to modernize payment stacks, embed financial services, and reduce regulatory burdens, while cross-border specialists such as Airwallex, Nium, and Razorpay compete alongside global players such as Stripe and Adyen. Despite challenges of regulatory fragmentation, data localization, and compliance costs, the market outlook remains strong, with double-digit growth expected as open finance expands and multi-rail orchestration, embedded treasury, and compliance-as-code become central to financial innovation in the region.

Breakdown of primaries

We interviewed Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant Fintech as a Service market companies.

- By Company: Tier I: 35%, Tier II: 40%, and Tier III: 25%

- By Designation: C-Level Executives: 35%, Director Level: 25%, and Others: 40%

- By Region: North America: 30%, Europe: 35%, Asia Pacific: 25%, Rest of the World: 10%

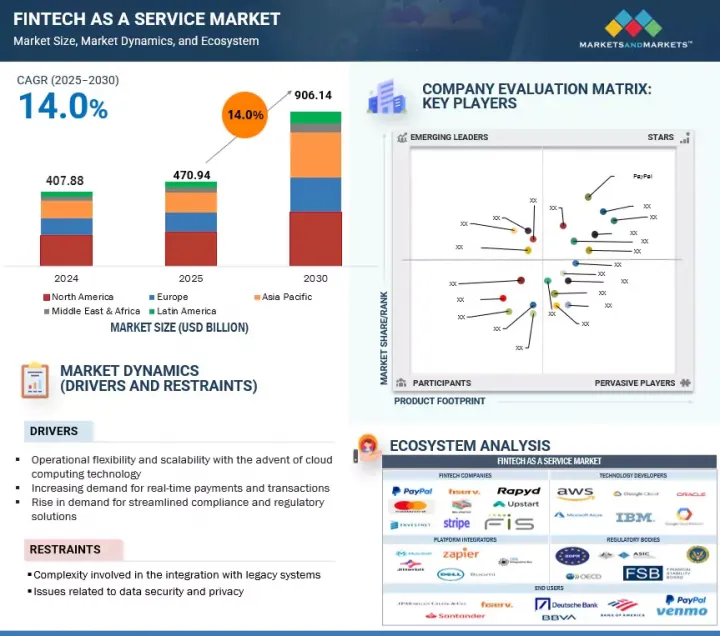

Some of the significant Fintech as a Service vendors are PayPal (US), Mastercard (US), Stripe (US), Fiserv (US), Block Inc. (US), Envestnet (US), Rapyd (UK), Upstart (US), FIS (US), and Adyen (Netherlands).

Research coverage:

The market report covered the Fintech as a Service market across segments. We estimated the market size and growth potential for many segments based on type, deployment model, end user, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product offerings, current trends, and critical market strategies.

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole Fintech as a Service industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report's increased understanding of the competitive environment, which will help them better position their companies and develop go-to-market strategies. The research offers information on the main market drivers, constraints, opportunities, and challenges, as well as aids players in understanding the pulse of the industry.

The report provides insights into the following pointers:

Analysis of key drivers (Operational flexibility and scalability with advent of cloud computing technology, increasing demand for real-time payments and transactions, and rise in demand for streamlined compliance and regulatory solutions), restraints (Complexity involved in integration with legacy systems, and issues related to data security and privacy), opportunities (Transforming financial landscape through digital lending platforms, increased demand for Regulatory Technology (RegTech), expansion of cross-border payments and remittances, and rise in digital assets and currencies), and challenges (Dependency on third-party APIs and infrastructure, and growing competition in fast-moving digital financial landscape).

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and service and product launches in the Fintech as a Service market.

- Market Development: In-depth details regarding profitable markets.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the Fintech as a Service market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, platforms, and service portfolios of the top competitors in the Fintech as a Service industry, such as PayPal (US), Mastercard (US), Stripe (US), Fiserv (US), Block, Inc. (US), Rapyd (UK), Envestnet (US), Upstart (US), Solid Financial Technologies (US), FIS (US), Synctera (US), Adyen (Netherlands), SoFi (US), Marqeta (US), Dwolla (US), Finastra (UK), Temenos (Switzerland), PolicyBazaar (India), Razorpay (India), Revolut (UK), Fispan (Canada), NIUM (SG), Airwallex (AUS), Finix (US), Synapse (US), Volante Technologies (US), Plaid (US), Currencycloud (UK), Mambu (Netherlands), Form3 (UK), Solaris (Germany), Chime (US), M2P Fintech (India), and Railsr (UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Primary sources

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FINTECH AS A SERVICE MARKET

- 4.2 NORTH AMERICA: FINTECH AS A SERVICE MARKET, BY TYPE & COUNTRY, 2025

- 4.3 ASIA PACIFIC: FINTECH AS A SERVICE MARKET, BY TYPE & COUNTRY, 2025

- 4.4 FINTECH AS A SERVICE MARKET, BY END USER, 2025

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Operational flexibility and scalability with advent of cloud computing technology

- 5.2.1.2 Increasing demand for real-time payments and transactions

- 5.2.1.3 Rise in demand for streamlined compliance and regulatory solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity involved in integration with legacy systems

- 5.2.2.2 Issues related to data security and privacy

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Transforming financial landscape through digital lending platforms

- 5.2.3.2 Increased demand for Regulatory Technology (RegTech)

- 5.2.3.3 Expansion of cross-border payments and remittances

- 5.2.3.4 Rise of digital assets & currencies

- 5.2.4 CHALLENGES

- 5.2.4.1 Dependency on third-party APIs and infrastructure

- 5.2.4.2 Growing competition in fast-moving digital financial landscape

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 HISTORY OF FINTECH AS A SERVICE MARKET

- 5.3.1.1 1990-2000

- 5.3.1.2 2000-2010

- 5.3.1.3 2010-2020

- 5.3.1.4 2021-present

- 5.3.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.3 SUPPLY CHAIN ANALYSIS

- 5.3.3.1 Technology infrastructure providers

- 5.3.3.2 Fintech as a service providers

- 5.3.3.3 Application developers

- 5.3.3.4 System integrators

- 5.3.3.5 End-users

- 5.3.4 ECOSYSTEM ANALYSIS

- 5.3.5 PRICING ANALYSIS

- 5.3.5.1 Average selling price trend of fintech as a service among key players, by type

- 5.3.5.2 Indicative pricing analysis, by type

- 5.3.6 TECHNOLOGY ANALYSIS

- 5.3.6.1 Key technologies

- 5.3.6.1.1 Application programming interfaces(APIs)

- 5.3.6.1.2 Cloud computing

- 5.3.6.1.3 Machine learning (ML) & artificial intelligence (AI)

- 5.3.6.2 Adjacent technologies

- 5.3.6.2.1 Blockchain

- 5.3.6.2.2 Robotic process automation (RPA)

- 5.3.6.2.3 Edge computing

- 5.3.6.3 Complementary technologies

- 5.3.6.3.1 Payment gateways and tokenization

- 5.3.6.3.2 Cybersecurity

- 5.3.6.1 Key technologies

- 5.3.7 PATENT ANALYSIS

- 5.3.7.1 METHODOLOGY

- 5.3.8 PORTER'S FIVE FORCES ANALYSIS

- 5.3.8.1 Threat of new entrants

- 5.3.8.2 Threat of substitutes

- 5.3.8.3 Bargaining power of suppliers

- 5.3.8.4 Bargaining power of buyers

- 5.3.8.5 Intensity of competitive rivalry

- 5.3.9 CASE STUDY ANALYSIS

- 5.3.9.1 API portal by Fiserv enhanced consumer experience for veridian credit union

- 5.3.9.2 PayMyTuition expanded global foothold by implementing Rapyd's cross-border and local payments technology

- 5.3.9.3 Home Chef leveraging PayPal checkout button to boost new customer signups and revenue

- 5.3.9.4 FIS helped Zalando by providing seamless payment solution and faster checkout process

- 5.3.9.5 PayPal helped Tradera with payment flexibility and with secure transaction experiences

- 5.3.9.6 Razorpay Optimizer helped craft FabIndia's payments success story

- 5.3.10 REGULATORY LANDSCAPE

- 5.3.10.1 Regulatory bodies, government agencies, and other organizations

- 5.3.10.2 Key regulations

- 5.3.10.2.1 Payment Service Directive/Strong Customer Authentication Compliance

- 5.3.10.2.2 Payment Card Industry Data Security Standard

- 5.3.10.2.3 Information Technology (IT) Act, 2000

- 5.3.10.2.4 General Data Protection Regulation compliance

- 5.3.10.2.5 Anti-money laundering/Combating financing of terrorism compliance

- 5.3.10.2.6 Bank Secrecy Act

- 5.3.10.2.7 Personal Information Protection and Electronic Documents Act

- 5.3.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.11.1 Key stakeholders in buying process

- 5.3.11.2 Buying criteria

- 5.3.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.3.13 TECHNOLOGY ROADMAP FOR FINTECH AS A SERVICE MARKET

- 5.3.13.1 Short-term roadmap (2025-2026)

- 5.3.13.2 Mid-term roadmap (2027-2028)

- 5.3.13.3 Long-term roadmap (2029-2030)

- 5.3.14 BEST PRACTICES TO IMPLEMENT FINTECH AS A SERVICE

- 5.3.15 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.16 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN FINTECH AS A SERVICE

- 5.3.17 INTRODUCTION TO ARTIFICIAL INTELLIGENCE AND GENERATIVE AI

- 5.3.17.1 Impact of generative AI on fintech as a service market

- 5.3.17.2 Use cases of generative AI in fintech as a service market

- 5.3.18 INVESTMENT AND FUNDING SCENARIO

- 5.3.19 IMPACT OF 2025 US TARIFF - FINTECH AS A SERVICE MARKET

- 5.3.19.1 Introduction

- 5.3.19.2 Key tariff rates

- 5.3.19.3 Price impact analysis

- 5.3.19.4 Impact on country/region

- 5.3.19.4.1 US

- 5.3.19.4.2 Europe

- 5.3.19.4.3 Asia Pacific

- 5.3.19.5 Impact on fintech as a service end users

- 5.3.1 HISTORY OF FINTECH AS A SERVICE MARKET

6 FINTECH AS A SERVICE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.1.1 TYPE: MARKET DRIVERS

- 6.2 BANKING

- 6.2.1 FINTECH STARTUPS VYING TO CAPITALIZE ON INTENSE COMPETITION AND MARKET CONSOLIDATION IN BANKING

- 6.2.2 CUSTOMER ONBOARDING AND ACCOUNT MANAGEMENT

- 6.2.3 CORE BANKING-AS-A-PLATFORM

- 6.2.4 OTHER BANKING

- 6.3 PAYMENTS

- 6.3.1 FINTECH AS A SERVICE BRIDGES GAP BETWEEN TRADITIONAL PAYMENT METHODS AND TECHNOLOGY

- 6.3.2 CROSS-BORDER REMITTANCE PLATFORMS

- 6.3.3 PAYMENT PROCESSING-AS-A-SERVICE

- 6.3.4 OTHER PAYMENTS

- 6.4 INSURANCE

- 6.4.1 INCREASE IN CONSUMER DEMAND FOR PERSONALIZED AND CONVENIENT INSURANCE

- 6.4.2 CLAIMS AUTOMATION

- 6.4.3 POLICY MANAGEMENT PLATFORMS

- 6.4.4 OTHER INSURANCE

- 6.5 REGTECH

- 6.5.1 DRIVING COMPLIANCE THROUGH AUTOMATION

- 6.5.2 COMPLIANCE & REGULATORY SUPPORT

- 6.5.3 KYC VERIFICATION

- 6.5.4 OTHER REGTECH

- 6.6 LENDING

- 6.6.1 BORROWERS SEEK STREAMLINED LOAN APPLICATION PROCESSES, FASTER APPROVAL, AND MORE FLEXIBLE LENDING TERMS

- 6.6.2 BNPL (BUY NOW PLAY LATER)

- 6.6.3 EMBEDDED LENDING APIS

- 6.6.4 OTHER LENDING

- 6.7 WEALTH MANAGEMENT

- 6.7.1 CATERING TO SMALL INVESTORS AND COMMUNICATION THROUGH USER APPS

- 6.7.2 MONEY MANAGEMENT

- 6.7.3 CLIENT ONBOARDING & RISK PROFILING

- 6.7.4 OTHER WEALTH MANAGEMENT

- 6.8 DIGITAL ASSETS & CURRENCIES

- 6.8.1 BRIDGING TRADITIONAL FINANCE WITH DIGITAL INNOVATION

- 6.8.2 CRYPTO-AS-A-SERVICE

- 6.8.3 TOKENIZATION PLATFORMS

- 6.8.4 OTHER DIGITAL ASSETS & CURRENCIES

- 6.9 CYBERSECURITY

- 6.9.1 NEED FOR SECURING DIGITAL FINANCIAL ECOSYSTEM

- 6.9.2 FRAUD DETECTION

- 6.9.3 IDENTITY VERIFICATION SERVICES

- 6.9.4 OTHER CYBERSECURITY

- 6.10 OTHER TYPES

7 FINTECH AS A SERVICE MARKET, BY DEPLOYMENT MODEL

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODEL: MARKET DRIVERS

- 7.2 PUBLIC CLOUD

- 7.2.1 DRIVING RAPID INNOVATION THROUGH SCALABLE, COST-EFFICIENT INFRASTRUCTURE

- 7.3 PRIVATE CLOUD

- 7.3.1 ENABLING SECURE, COMPLIANT, AND CUSTOMIZED FINANCIAL SERVICES DELIVERY

- 7.4 HYBRID

- 7.4.1 OPTIMIZING AGILITY AND COMPLIANCE WITH BALANCED CLOUD APPROACH

8 FINTECH AS A SERVICE MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.1.1 END USER: MARKET DRIVERS

- 8.2 CONSUMERS

- 8.2.1 NEED TO ENABLE SEAMLESS AND PERSONALIZED DIGITAL FINANCIAL EXPERIENCES TO DRIVE MARKET

- 8.3 BANKS

- 8.3.1 COMPETITIVE EDGE OFFERED BY FAAS WITH ABILITY TO ADAPT TO CHANGING MARKET TRENDS

- 8.4 NON-BANKING FINANCIAL COMPANIES

- 8.4.1 NEED TO EXPAND DIGITAL LENDING TO UNDERSERVED MARKETS

- 8.5 INSURANCE COMPANIES

- 8.5.1 ENHANCED RISK ASSESSMENT AND PERSONALIZED CUSTOMER SUPPORT

- 8.6 GOVERNMENTS

- 8.6.1 DRIVE FINANCIAL INCLUSION AND TRANSPARENT PUBLIC SERVICES

- 8.7 OTHER END USERS

9 FINTECH AS A SERVICE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Technological advancements with presence of key US vendors offering FaaS solutions

- 9.2.3 CANADA

- 9.2.3.1 Rapid growth of digital transformation measures in Canada

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Thriving fintech startup culture in UK

- 9.3.3 GERMANY

- 9.3.3.1 Advanced infrastructure and robust connectivity in Germany

- 9.3.4 FRANCE

- 9.3.4.1 Innovation and opportunities revolutionizing financial industry in France

- 9.3.5 ITALY

- 9.3.5.1 Young and technology-savvy generation to create significant demand for digital financial services

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Supportive government policies and technologically advanced infrastructure in China

- 9.4.3 JAPAN

- 9.4.3.1 Demand for personalized financial service in Japan

- 9.4.4 INDIA

- 9.4.4.1 Higher adoption of advanced AI and ML-based identity verification solutions

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 KSA

- 9.5.2.1 Vision 2030 driving market growth

- 9.5.3 UAE

- 9.5.3.1 Investments and businesses streamlining growth of fintech

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 South Africa to be attractive market for fintech growth

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Smartphone's penetration to boost digital banking initiatives

- 9.6.3 MEXICO

- 9.6.3.1 Security and regulatory constraints pose challenges

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY FINTECH AS A SERVICE PLAYERS

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Deployment model footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 PAYPAL

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches/developments

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 MASTERCARD

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches/developments

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 FISERV

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches/developments

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 BLOCK, INC.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches/developments

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 STRIPE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches/developments

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 ENVESTNET

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches/developments

- 11.1.6.3.2 Deals

- 11.1.7 RAPYD

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches/developments

- 11.1.7.3.2 Deals

- 11.1.8 UPSTART

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches/developments

- 11.1.8.3.2 Deals

- 11.1.9 FIS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches/developments

- 11.1.9.3.2 Deals

- 11.1.10 ADYEN

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches/developments

- 11.1.10.3.2 Deals

- 11.1.1 PAYPAL

- 11.2 OTHER PLAYERS

- 11.2.1 SOLID FINANCIAL TECHNOLOGIES

- 11.2.2 SOFI TECHNOLOGIES

- 11.2.3 MARQETA

- 11.2.4 SYNCTERA

- 11.2.5 DWOLLA

- 11.2.6 FINASTRA

- 11.2.7 TEMENOS

- 11.2.8 POLICYBAZAAR

- 11.2.9 RAZORPAY

- 11.3 STARTUPS/SMES

- 11.3.1 VOLANTE TECHNOLOGIES

- 11.3.2 REVOLUT

- 11.3.3 FISPAN

- 11.3.4 NIUM

- 11.3.5 AIRWALLEX

- 11.3.6 FINIX

- 11.3.7 PLAID

- 11.3.8 CURRENCYCLOUD

- 11.3.9 MAMBU

- 11.3.10 FORM3

- 11.3.11 SOLARIS

- 11.3.12 CHIME

- 11.3.13 M2P FINTECH

- 11.3.14 RAILSR

12 ADJACENT MARKETS & APPENDIX

- 12.1 INTRODUCTION

- 12.2 B2B DIGITAL PAYMENT MARKET - GLOBAL FORECAST TO 2028

- 12.2.1 MARKET DEFINITION

- 12.3 PAYMENT PROCESSING SOLUTIONS MARKET - GLOBAL FORECAST TO 2028

- 12.3.1 MARKET DEFINITION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS